Liontrust Special Situations Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

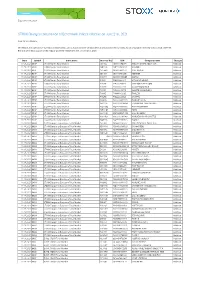

Stoxx® Europe Ipo (60 Months) Index

STOXX® EUROPE IPO (60 MONTHS) INDEX Components1 Company Supersector Country Weight (%) CELLNEX TELECOM Telecommunications ES 6.13 DELIVERY HERO Retail DE 5.29 JUST EAT TAKEAWAY.COM NV Retail NL 5.21 SCOUT24 Technology DE 3.41 COVESTRO Chemicals DE 2.72 AUTO TRADER GROUP Media GB 2.50 HELLOFRESH AG Retail DE 2.18 AMUNDI Financial Services FR 2.08 KOJAMO OYJ Real Estate FI 2.00 GALENICA SANTE AG Retail CH 1.92 VAT GROUP AG Industrial Goods & Services CH 1.91 ASR NEDERLAND NV Insurance NL 1.79 SIG COMBIBLOC GROUP AG Industrial Goods & Services CH 1.72 CONVATEC PLC Health Care GB 1.70 SIGNIFY Industrial Goods & Services NL 1.54 NEXI SPA Industrial Goods & Services IT 1.50 TEAMVIEWER AG Technology DE 1.49 INWIT Telecommunications IT 1.43 AVAST PLC Technology GB 1.41 LA FRANCAISE DES JEUX Travel & Leisure FR 1.28 STADLER RAIL AG Industrial Goods & Services CH 1.19 BAWAG GROUP AG Banks AT 1.05 NETCOMPANY GROUP AS Technology DK 1.03 SOFTCAT Technology GB 0.89 PIRELLI & C. S.P.A. Automobiles & Parts IT 0.89 COUNTRYSIDE PROPERTIES PLC Personal & Household Goods GB 0.88 LANDIS GYR GROUP AG Industrial Goods & Services CH 0.86 INTEGRAFIN HOLDINGS PLC Financial Services GB 0.81 DOMETIC GROUP AB Personal & Household Goods SE 0.77 BRAVIDA HOLDING AB Industrial Goods & Services SE 0.72 SILTRONIC Technology DE 0.69 TRAINLINE PLC Travel & Leisure GB 0.68 SPIE Industrial Goods & Services FR 0.68 INTERTRUST NV Financial Services NL 0.68 ZUR ROSE GROUP Retail CH 0.66 ASCENTIAL PLC Media GB 0.64 SINCH Technology SE 0.64 Virgin Money UK Banks GB 0.62 HASTINGS -

Geneva, November 07, 2019 MSCI GLOBAL SMALL CAP INDEXES

Geneva, November 07, 2019 MSCI GLOBAL SMALL CAP INDEXES The following are changes in constituents for the MSCI Global Small Cap Indexes which will take place as of the close of November 26, 2019. SUMMARY PER COUNTRY and PER REGION: Nb of Nb of Securities Securities Region Country Added Deleted Asia Pacific PAKISTAN 0 3 AUSTRALIA 12 5 JAPAN 22 7 HONG KONG 7 4 SINGAPORE 4 1 NEW ZEALAND 0 1 MALAYSIA 9 4 INDONESIA 6 4 PHILIPPINES 1 0 TAIWAN 16 2 KOREA 20 13 THAILAND 7 3 INDIA 13 21 CHINA 27 23 Nb of Nb of Securities Securities Region Country Added Deleted Europe, Middle East and Africa UNITED ARAB EMIRATES1 0 BELGIUM 0 1 SWITZERLAND 3 1 DENMARK 1 1 SPAIN 0 1 FRANCE 3 2 GERMANY 5 5 NETHERLANDS 0 2 ITALY 2 1 NORWAY 2 4 SWEDEN 8 4 UNITED KINGDOM 10 9 FINLAND 0 3 TURKEY 0 3 IRELAND 0 1 ISRAEL 3 0 SOUTH AFRICA 6 6 POLAND 2 0 RUSSIA 1 2 EGYPT 0 2 SAUDI ARABIA 1 1 Nb of Nb of Securities Securities Region Country Added Deleted Americas USA 87 78 CANADA 16 12 MEXICO 3 2 BRAZIL 9 2 COLOMBIA 1 0 ARGENTINA 3 0 ASIA PACIFIC MSCI PAKISTAN INDEX Page 1 MSCI Global Small Cap Indexes - November 07, 2019 © MSCI 2019, All rights reserved Additions Deletions None KHAN (DG) CEMENT CO KOT ADDU POWER COMPANY THAL LTD MSCI AUSTRALIA INDEX Additions Deletions AUSTAL OFX GROUP AVITA MEDICAL SPEEDCAST INTERNATIONAL BANK OF QUEENSLAND SYRAH RESOURCES CENTURIA METROPOLITAN WAGNERS HOLDING CO ECOFIBRE WISETECH GLOBAL EML PAYMENTS IMF BENTHAM INGENIA COMMUNITIES GRP ISIGNTHIS PERSEUS MINING POLYNOVO RAMELIUS RESOURCES MSCI JAPAN INDEX Additions Deletions FIXSTARS CORP LINICAL CO G-7 HOLDINGS MTG INSOURCE NIPPON SHINYAKU CO IR JAPAN HOLDINGS ORIX JREIT JAPAN MED. -

Your Guide Directors' Remuneration in FTSE 250 Companies

Your guide Directors’ remuneration in FTSE 250 companies The Deloitte Academy: Promoting excellence in the boardroom October 2018 Contents Overview from Mitul Shah 1 1. Introduction 4 2. Main findings 8 3. The current environment 12 4. Salary 32 5. Annual bonus plans 40 6. Long term incentive plans 52 7. Total compensation 66 8. Malus and clawback 70 9. Pensions 74 10. Exit and recruitment policy 78 11. Shareholding 82 12. Non-executive directors’ fees 88 Appendix 1 – Useful websites 96 Appendix 2 – Sample composition 97 Appendix 3 – Methodology 100 Your guide | Directors’ remuneration in FTSE 250 companies Overview from Mitul Shah It has been a year since the Government announced its intention to implement a package of corporate governance reforms designed to “maintain the UK’s reputation for being a ‘dependable and confident place in which to do business’1, and in recent months we have seen details of how these will be effected. The new UK Corporate Governance Code, to take effect for accounting periods beginning on or after 1 January 2019, includes some far reaching changes, and the year ahead will be a period of review and change for many companies. Remuneration committees must look at how best to adapt to an expanded remit around workforce remuneration, as well as a greater focus on how judgment is used to ensure that pay outcomes are justified and supported by performance. Against this backdrop, 2018 has been a mixed year in the FTSE 250 executive pay environment. In terms of pay outcomes, the picture is relatively stable. Overall pay levels have fallen for FTSE 250 chief executives and we have seen continued momentum in companies adopting executive alignment features such as holding periods, as well as strengthening shareholding guidelines for executives. -

Phoenix Unit Trust Managers Manager's Interim Report

PHOENIX UNIT TRUST MANAGERS MANAGER’S INTERIM REPORT For the half year: 2 May 2018 to 1 November 2018 PUTM UK STOCK MARKET FUND (SERIES 3) Contents Investment review 2-3 Portfolio of investments 4-10 Top ten purchases and sales 11 Statistical information 12-14 Statements of total return & change in unitholders’ funds 15 Balance sheet 16 Distribution table 17 Corporate information 18-19 1 Investment review Dear Investor Performance Review Welcome to the PUTM Stock Market Series 3 Unit Trust Over the review period, the accumulation units in the interim report for the six months to 1 November 2018. PUTM Stock Market Series 3 Unit Trust returned -6.8%. Over the same period, the FTSE 250 Mid ex IT Index returned -6.7% (Source: Standard Life Investments for the six months to 01/11/18). In the table below, you can see how the Fund performed against the FTSE 250 Mid ex IT Index over the last five discrete one-year periods. Standardised Past Performance Nov 17-18 Nov 16-17 Nov 15-16 Nov 14-15 Nov 13-14 % growth % growth % growth % growth % growth PUTM Stock Market Series 3 Unit Trust -5.1 18.8 3.2 14.2 2.2 FTSE 250 Mid ex IT Index -5.1 19.0 3.5 14.5 2.3 Source: Standard Life Investments to 1 November for each year. Past performance is not a guide to future performance. The value of units and the income from them can go down as well as up and is not guaranteed. You may not get back the full amount invested. -

The UK Private Equity IPO Report

THE UK PRIVATE EQUITY IPO REPORT Private equity-backed IPOs: 1 January 2009 – 31 December 2017 IN ASSOCIATION WITH 2 | THE UK PRIVATE EQUITY IPO REPORT CONTENTS FOREWORD 03 HISTORIC ANALYSIS OF PRIVATE EQUITY-BACKED IPOS IN THE UK 04 BETWEEN 1 JANUARY 2009 AND 31 DECEMBER 2017 VOLUME AND VALUE OF PRIVATE EQUITY-BACKED IPOS LISTING IN THE UK 05 TOP 10 PRIVATE EQUITY-BACKED IPOS 06 INDUSTRIES 07 FREE FLOAT 12 USE OF PROCEEDS 13 PRICING 14 PERFORMANCE 15 ANALYSIS OF ACTIVE PRIVATE EQUITY HOUSES BY SIZE 17 LOCK-UP PERIODS 18 HOLDING PERIODS 20 PRIVATE EQUITY-BACKED IPO ACTIVITY IN 2017 21 APPENDIX 23 PRIVATE EQUITY-BACKED IPOS 1 JANUARY 2009 - 31 DECEMBER 2017 23 METHODOLOGY 31 CONTACTS 32 3 | THE UK PRIVATE EQUITY IPO REPORT FOREWORD Public markets have long been an important exit route for private equity houses selling their stakes into the companies they have backed, yet little research has been conducted into how these businesses perform after they have floated. This report, published by the BVCA and PwC, provides an historic analysis of private equity-backed IPOs in the UK between 1 January 2009 and 31 December 2017. It looks at a number of metrics including the use of proceeds, pricing and performance to build a picture of the IPO market and the key trends with the market. The performance numbers are particularly revealing as they show that private equity-backed IPOs are trading on average 43.9% higher than their offer price for the period from IPO to 31 December 2017 compared to the non-private equity-backed IPOs of the same period which are trading at an average of 26.6% higher. -

STOXX Changes Composition of Benchmark Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Benchmark Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Benchmark Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXP STOXX Nordic Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. SDR Addition 11.06.2021 BDXP STOXX Nordic Total Market NO112F NO0010823131 KAHOOT! Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10W3 SE0015483276 CINT GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10X4 SE0015671995 HEMNET Addition 11.06.2021 BDXP STOXX Nordic Total Market DK3011 DK0060497295 MATAS Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10JH FI4000480215 SITOWISE GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10HF FI4000049812 VERKKOKAUPPA COM Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10FD FI0009001127 ALANDSBANKEN B Addition 11.06.2021 BDXP STOXX Nordic Total Market FI6036 FI4000048418 AHLSTROM-MUNKSJO Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10IG FI4000062195 TAALERI Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10GE FI4000029905 SCANFIL Addition 11.06.2021 BDXP STOXX Nordic Total Market NO90I2 NO0010861115 NORSKE SKOG Addition 11.06.2021 BDXP STOXX Nordic Total Market NO111E NO0010029804 SPAREBANK 1 HELGELAND Addition 11.06.2021 BDXP STOXX Nordic Total Market NO113G NO0010886625 AKER BIOMARINE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO114H NO0010936792 FROY Addition 11.06.2021 BDXP STOXX Nordic Total Market NO110D BMG9156K1018 2020 BULKERS Addition 11.06.2021 BDXP STOXX Nordic Total Market NO10R3 NO0010196140 NORWEGIAN AIR SHUTTLE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO809S NO0010792625 FJORD1 Deletion 11.06.2021 BKXA STOXX Europe ex Eurozone Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. -

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a feeder fund in a master-feeder structure and the holdings listed below are the investment holdings of the corresponding master fund. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of use in the Legal Notices. -

ACZH Avantis International Small Cap Value

American Century Investments® Quarterly Portfolio Holdings Avantis® International Small Cap Value Fund May 28, 2021 Avantis International Small Cap Value Fund - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 98.5% Australia — 8.0% Adairs Ltd. 10,087 36,395 Adbri Ltd. 41,613 106,901 Aeris Resources Ltd.(1) 194,638 25,413 Alkane Resources Ltd.(1)(2) 23,444 15,852 Alliance Aviation Services Ltd.(1) 9,551 32,478 Asaleo Care Ltd. 55,544 60,172 Aurelia Metals Ltd. 117,534 40,228 Austal Ltd. 40,665 74,694 Australian Finance Group Ltd. 27,184 58,450 Australian Pharmaceutical Industries Ltd. 57,039 50,799 Bank of Queensland Ltd. 50,470 351,413 Beach Energy Ltd. 256,312 252,041 Bega Cheese Ltd. 10,686 47,626 Bendigo & Adelaide Bank Ltd. 28,090 227,274 Boral Ltd.(1) 23,590 124,899 Brickworks Ltd. 3,303 53,477 Byron Energy Ltd.(1) 7,834 635 Calix Ltd.(1) 13,271 28,120 Champion Iron Ltd.(1) 59,052 300,176 Class Ltd. 1,392 1,856 Coronado Global Resources, Inc.(1) 116,275 62,270 CSR Ltd. 61,819 265,781 Dacian Gold Ltd.(1) 57,096 12,508 Eclipx Group Ltd.(1) 40,478 66,477 Emeco Holdings Ltd.(1) 64,744 45,199 EML Payments Ltd.(1) 32,108 84,701 Fleetwood Ltd. 1,403 2,649 Galaxy Resources Ltd.(1) 50,126 148,165 Genworth Mortgage Insurance Australia Ltd.(1) 23,355 49,881 Gold Road Resources Ltd. 119,473 138,134 GrainCorp Ltd., A Shares 46,105 178,302 Grange Resources Ltd. -

Liontrust Special Situations Fund

LIONTRUST SPECIAL SITUATIONS FUND Interim Report & Financial Statements (unaudited) For the period: 1 June 2018 to 30 November 2018 Managed in accordance with The Liontrust Economic Advantage LIONTRUST FUND PARTNERS LLP LIONTRUST SPECIAL SITUATIONS FUND Table of contents Management and Administration* 1 Investment Profile* 2 Manager´s Investment Report* 3 Authorised Status* 9 Certification of Financial Statements by Directors of the Manager* 9 Comparative Tables 10 Portfolio Statement* 11 Financial Statements: Statement of Total Return 14 Statement of Change in Net Assets Attributable to Unitholders 14 Balance Sheet 15 Securities Financing Transactions 16 Additional Information 17 * Collectively, these comprise the Authorised Managers Report (from herein referred to as the Managers Report). LIONTRUST SPECIAL SITUATIONS FUND Management and Administration Authorised Fund Manager ( "Manager ") Liontrust Fund Partners LLP 2 Savoy Court London WC2R 0EZ Administration and Dealing enquiries 0330 123 3822 Administration and Dealing facsimile 0330 123 3720 Email [email protected] Website www.liontrust.co.uk Authorised and regulated by the Financial Conduct Authority. Investment Adviser Liontrust Investment Partners LLP 2 Savoy Court London WC2R 0EZ Authorised and regulated by the Financial Conduct Authority. Trustee* The Bank of New York Mellon (International) Limited One Canada Square London E14 5AL Authorised by Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registrar DST Financial Services Europe Limited DST House St. Nicholas Lane Basildon Essex SS15 5FS Authorised and regulated by the Financial Conduct Authority. Independent Auditors PricewaterhouseCoopers LLP Atria One 144 Morrison Street Edinburgh EH3 8EX * Please refer to page 18 for details of the change. -

Oxford Instruments Plc Report and Financial Statements 2020 D E V O R P

tanding nders c u ntif cie n s s i ap Le y om n o c e r e n e e r G Oxford Instruments plc Instruments Oxford Report and Financial Statements 2020 Statements Report Financial and h t l a e h y d t i e v v i t o r c p e n m I n o c d e v o r p m I Oxford Instruments plc Report and Financial Statements 2020 Our Purpose Our core purpose is to support our customers in addressing some of the world’s most pressing challenges, enabling a greener economy, increased connectivity, improved health, and leaps in scientifc understanding. We provide high technology products and services to the world’s leading industrial companies and scientifc research communities, exploiting our world-class ability to image, analyse and manipulate materials down to the atomic and molecular level. Employee Pride Respect Reputation in working for us and being inclusive and for positive making a difference valuing our employees contribution to society Being Oxford FTSE 250 constituent Instruments Accountability Health and Safety Trust for our actions ensuring everyone is safe our people to deliver Strategic Report Governance Financial Statements Company Information Contents How we make a in this section Strategic Report difference We discuss the progress we Performance Highlights 2 have made over the past year Our Business 4 Investment Case 7 pages 2 to 67 Leaps in How We Make a Difference 8 scientific Chair’s Statement 12 understanding Chief Executive’s Review 14 Market Context 20 Business Model 22 Engaging with Stakeholders 24 Our Strategy 28 Key Performance Indicators -

Acs Sub Fund Investments September 2019

ACS Investments 30TH SEPTEMBER 2019 LGPS Central UK Equity Passive Fund Portfolio Statement as at 30 September 2019 (Unaudited) HOLDING/ MARKET VALUE % OF NET NOMINAL VALUE INVESTMENT £'000 ASSETS UK Collective Investment Scheme 3.43% (3.62%) Non-equity Investment Instruments 3.43% (3.62%) 176,000 iShares MSCI UK Small Cap UCITS ETF GBP Acc 37,814 3.43 UK Equities 94.63% (94.97%) Aerospace & Defense 1.90% (1.80%) 1,504,000 BAE Systems 8,570 0.78 1,122,000 Cobham 1,760 0.16 364,000 Meggitt 2,311 0.21 254,000 QinetiQ 734 0.07 799,000 Rolls-Royce 6,331 0.57 220,000 Senior 413 0.04 38,000 Ultra Electronics 768 0.07 20,887 1.90 Automobiles & Parts 0.04% (0.04%) 30,000 Aston Martin Lagonda Global 158 0.01 122,000 TI Fluid Systems 235 0.03 393 0.04 Banks 9.54% (10.09%) 20,000 Bank of Georgia 267 0.02 8,114,000 Barclays 12,203 1.11 71,000 Close Brothers 1,000 0.09 562,000 CYBG 645 0.06 9,580,000 HSBC 59,837 5.43 33,408,000 Lloyds Banking 18,080 1.64 2,146,000 Royal Bank of Scotland 4,455 0.40 1,244,000 Standard Chartered 8,509 0.77 18,000 TBC Bank 222 0.02 105,218 9.54 Beverages 3.70% (3.64%) 45,000 A.G. Barr 261 0.02 121,000 Britvic 1,189 0.11 92,000 Coca-Cola HBC 2,441 0.22 1,105,000 Diageo 36,829 3.35 40,720 3.70 Chemicals 0.68% (0.75%) 58,000 Croda International 2,817 0.26 300,000 Elementis 444 0.04 89,000 Johnson Matthey 2,720 0.25 2,610,000 Sirius Minerals 103 0.01 178,750 Synthomer 578 0.05 37,000 Victrex 798 0.07 7,460 0.68 11 LGPS Central UK Equity Passive Fund Portfolio Statement (continued) as at 30 September 2019 (Unaudited) HOLDING/