Press Release Key Rating Drivers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ambattur Falling Waters

https://www.propertywala.com/ambattur-falling-waters-chennai Ambattur Falling Waters - Perungudi, Chennai 2, 3 & 4 BHK apartments available at Falling Waters The Flying Elephant Corp presents Falling Waters with 2, 3 & 4 BHK apartments available at Perungudi, Chennai Project ID : J300120119 Builder: The Flying Elephant Corp Properties: Apartments / Flats, Residential Plots / Lands Location: Ambattur Falling Waters, Perungudi, Chennai - 600096 (Tamil Nadu) Completion Date: Oct, 2015 Status: Started Description The Flying Elephant comes with a exclusive project that is Ambattur Falling Waters at Perungudi. The project embodies the concept of organic architecture, interior spaces and blending exterior seamlessly to create a sense of harmony with nature and to give you the best possible living experience. The project comprises of 186 tastefully laid out apartments ranging from 2 bedroom units at 1434 sq. ft. to 4 bedroom penthouses at 3365 sq.ft. Falling Waters is begin made by handpicked marble, oversize windows, to international fittings, to the thoughtful placement of the switches. The project promises to deliver on the commitment of quality and comfort in every aspect. Amenities Clubhouse Infinity Swimming Pool Mini Theater Fully Equipped Gymnasium Ample Lobby Space Optimized Unit Layout Video Door Phone International Fittings Over-sized Windows Visitors Car Parking Facilities The Flying Elephant Corp is the real estate arm of the Ambattur Clothing Group of Companies. It is the creators of landmark projects like AMBIT IT Park and Park Hyatt Chennai, brings you Falling Water. In all its endeavors, The flying Elephant Corp seeks to channel the power of design as a means of transforming your living environment through thought and execution. -

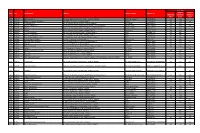

Pp Approval - B - Channel - Special Buildings 2012

PP APPROVAL - B - CHANNEL - SPECIAL BUILDINGS 2012 SL. P.P. SBC DATE OF NAME OF THE APPLICANT DATE OF SITE ADDRESS VILLAGE PROPOSED CONSTRUCTION FILE NO. NO. NO. NO. SUBMISSION (Thiruvalargal) APPROVAL 1 Rajiv Gandhi Salai (OMR) in S.No.216/5 as per Patta MILL STORES (MADRAS) PVT. Okkiam Stilt + 4 Floors Residential Building 6929 790 05-08-2011 S.No.216/21A & 21B of Okkiam Thoraipakkam B2/11244/2011 10-01-2012 LTD., Thoraipakkam with 40 Dwelling Units. village. 2 JAYASWATHY CONSTRUCTIONS Plot No.A-32, Jawahar Nagar 6th Main Road, Chennai (P) LTD., REP BY J.MUTHULAKSHMI Stilt + 4 Floors Residential Building 6930 965 22-09-2011 comprised in T.S.No.71, Block No.42 of Peravallur Peravallur B3/13811/2011 10-01-2012 DIRECTOR (GPA) (GPA HOLDER with 16 Dwelling Units Premium FSI Village. OF JEGAN MOHAN & OTHERS) 3 Old Door No.192, New Door No.38 & 40, Vellalar Stilt + 4 Floors Residential Building 6931 789 05-08-2011 R.SETHURAMAN & OTHERS Street, Purasawalkam in T.S.No.109, Block No.5 of Purasawalkam with 8 Dwelling Units With Premium B3/11243/2011 10-01-2012 Purasawalkam Village, Chennai-84 FSI 4 Old Door No.14, New Door No.21, Barnabi Road, Stilt + 3 Floors Residential Building 6932 832 28-08-2011 K.DEVARAJAN Kilpauk in T.S.No.3122/44, Block No.51 of Purasawalkam with 3 Dwelling Units available with B3/12188/2011 10-01-2012 Purasawalkam Village, Chennai. Premium FSI 5 Stilt + 3Floors Cottage Industry Plot No.1157, New Door No.137, 6th Avenue, Anna (Garment Industry for Cutting & 6933 1053 12-10-2011 V.RAJKUMAR Nagar in Old R.S.No.127Part & 128Part, T.S.No.4, Villivakkam B3/14430/2011 10-01-2012 Parking) cum Residential Building with Block No.48 of Villivakkam Village, Chennai-40 4 Dwelling Units 6 Block No.D-107, Sangeetha Colony, Ashok Pillar Stilt Floor + 4 Floors Residential 6934 522 18-05-2011 S.GOVINDARAJAN & 5 OTHERS Road, K.K.Nagar, Chennai-78 in R.S.No.416Part, Kodambakkam Building with 12 Dwelling Units availing BC1/7000/2011 10-01-2012 T.S.No.116/4, Block No.139 Kodambakkam Village. -

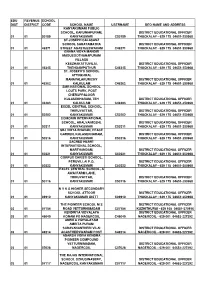

Deo &Ceo Address List

EDU REVENUE SCHOOL DIST DISTRICT CODE SCHOOL NAME USERNAME DEO NAME AND ADDRESS KANYAKUMARI PUBLIC SCHOOL, KARUNIAPURAM, DISTRICT EDUCATIONAL OFFICER 01 01 50189 KANYAKUMARI C50189 THUCKALAY - 629 175 04651-250968 ST.JOSEPH CALASANZ SCHOOL SAHAYAMATHA DISTRICT EDUCATIONAL OFFICER 01 01 46271 STREET AGASTEESWARAM C46271 THUCKALAY - 629 175 04651-250968 GNANA VIDYA MANDIR MADUSOOTHANAPURAM VILLAGE KEEZHAKATTUVILAI, DISTRICT EDUCATIONAL OFFICER 01 01 46345 THENGAMPUTHUR C46345 THUCKALAY - 629 175 04651-250968 ST. JOSEPH'S SCHOOL ATTINKARAI, MANAVALAKURICHY DISTRICT EDUCATIONAL OFFICER 01 01 46362 KALKULAM C46362 THUCKALAY - 629 175 04651-250968 SMR NATIONAL SCHOOL LOUTS PARK, POST CHERUPPALOOR KULASEKHARAM, TEH DISTRICT EDUCATIONAL OFFICER 01 01 46383 KALKULAM C46383 THUCKALAY - 629 175 04651-250968 EXCEL CENTRAL SCHOOL, THIRUVATTAR, DISTRICT EDUCATIONAL OFFICER 01 01 50202 KANYAKUMARI C50202 THUCKALAY - 629 175 04651-250968 COMORIN INTERNATIONAL SCHOOL, ARALVAIMOZHI, DISTRICT EDUCATIONAL OFFICER 01 01 50211 KANYAKUMARI C50211 THUCKALAY - 629 175 04651-250968 SBJ VIDYA BHAVAN, PEACE GARDEN, KULASEKHARAM, DISTRICT EDUCATIONAL OFFICER 01 01 50216 KANYAKUMARI C50216 THUCKALAY - 629 175 04651-250968 SACRED HEART INTERNATIONAL SCHOOL, MARTHANDAM, DISTRICT EDUCATIONAL OFFICER 01 01 50221 KANYAKUMARI C50221 THUCKALAY - 629 175 04651-250968 CORPUS CHRISTI SCHOOL, PERUVILLAI P.O, DISTRICT EDUCATIONAL OFFICER 01 01 50222 KANYAKUMARI C50222 THUCKALAY - 629 175 04651-250968 EXCEL CENTRAL SCHOOL, A AWAI FARM LANE, THIRUVATTAR, DISTRICT EDUCATIONAL OFFICER -

28272676, [email protected] 28276652

1 Website: mca.gov.in Telephone No: 28276685, Email: 28272676, [email protected] 28276652 Fax: 28280436 1-117ff -Ncr)k GOVERNMENT OF INDIA cwq 4-1:lleio MINISTRY OF CORPORATE AFFAIRS comidq, & itcrcp, OFFICE OF THE REGISTRAR OF COMPANIES, TAMILNADU, ANDAMAN & NICOBAR ISLANDS, II Trf'--a-, 26, — 600 006. "SHASTRI BHAVAN", II FLOOR, 26, HADDOWS ROAD, CHENNAI - 600 006. ROC/CHN/S.20/8/PVT.PUB.ACT.DOR/STK-5 Dated: 10-07-2017 Form No. STK 5 Notice by Registrar for removal of name of a company from the register of companies [Pursuant to sub-section (1) of section 248 of the Companies Act, 2013 and rule 3 of the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016] Reference: In the matter of striking off of companies under section 248 (1) of the Companies Act, 2013, in respect of the following companies in table "A." Notice is hereby given that the Registrar of Companies has a reasonable cause to believe that — (1) The following companies in table" A " (List of 8822 Nos. of Companies) have not been carrying on any business or operation for a period of two immediately preceding financial years and have not made any application within such period for obtaining the status of dormant company under section 455. And, therefore, proposes to remove/strike off the names of the above mentioned companies from the register of companies and dissolve them unless a cause is shown to the contrary, within thirty days from the date of this notice. (2) Any person objecting to the proposed removal/striking off of name of the companies from the register of companies may send his/her objection to the office address mentioned here above within thirty days from the date of publication of this notice. -

Rating Rationale for JKCL

Rating Rationale Brickwork Ratings assigns ‘BWR BB-’ for the Bank Loan facilities aggregating ₹ 12.50 Cr of Chennai Leisure Private Ltd. Brickwork Ratings has assigned the following Rating1 for Bank Credit facilities of Chennai Leisure Private Ltd. (CLPL). Limit Facility Tenure Rating (₹ Cr) BWR BB- Fund Based (BWR Double B minus) 12.50 Long Term Term Loan (Outlook-Stable) Total 12.50 INR Twelve Crores & Fifty Lakhs only The rating factors, inter alia, the experience of the promoters and established credentials of the promoters in the entertainment industry, established market for VGP Universal Kingdom, increasing trend in spending pattern of customers for amusement parks and high growth potential of amusement/theme park However, the rating is constrained by project implementation risks given the nascent stage of the project, risk of not able to achieve the projected revenues and profitability and competition from other theme parks in Chennai. Background: Chennai Leisure Private Limited (CLPL) is a private limited company having its registered office in Hyderabad – Andhra Pradesh, promoted in April 2013 to establish an Indoor Snow Theme Park in Chennai, Tamil Nadu. CLPL has entered into a License Agreement with VGP Housing Private Limited (VGPHPL) on the basis of revenue share model (85%: 15%) for 10-years for establishing and operating an indoor snow theme park independently in the name and style of VGP Snow City. CLPL has been allotted about an acre of land situated in the already very popular destination, VGP Universal Kingdom situated on East Coast Road, Injambakkam, Chennai, Tamil Nadu. Management Profile: The company is private limited company and has 4 appointed directors Mr. -

Trade Marks Journal No: 1849 , 14/05/2018 Class 7 1721888 14/08

Trade Marks Journal No: 1849 , 14/05/2018 Class 7 Priority claimed from 30/04/2008; Application No. : 77462153 ;United States of America 1721888 14/08/2008 EATON CORPORATION 1000 EATON BOULEVARD CLEVELAND OHIO 44122 USA . AN COMPANY INCORPORATED UNDER THE LAWS OF UNITED STATES OF AMERICA Address for service in India/Attorney address: DUBEY & PARTNERS 601 DLF TOWER, TOWER-A, PLOT NO. 10-11 DDA DISTT. CENTRE JASOLA NEW DELHI-110044 Proposed to be Used DELHI HYDRAULIC PUMPS, HYDRAULIC MOTORS, VALVES, HYDRAULIC CYLINDERS, ELECTROHYDRAULIC VALVES, ACTUATORS, ACCUMULATORS, AND CONNECTORS. 1052 Trade Marks Journal No: 1849 , 14/05/2018 Class 7 4DX 2149826 25/05/2011 CJ 4DPLEX CO., LTD 164-1 JEUNGSAN-DONG, EUNPYEONG-GU, SEOUL, REPUBLIC OF KOREA MANUFACTURER AND MERCHANT A KOREAN CORPORATION Address for service in India/Attorney address: SHARDUL AMARCHAND MANGALDAS & CO. AMARCHAND TOWERS, 216, OKHLA INDUSTRIAL ESTATE-PHASE III, NEW DELHI 110020 Proposed to be Used To be associated with: 2022627 DELHI MACHINES FOR USE IN CREATING MOVIES AUDIENCE EFFECTS; AIR BLOWERS; BLOWING MACHINES FOR THE COMPRESSION, EXHAUSTION AND TRANSPORT OF GASES; ELECTRIC MOTORS FOR MACHINES, OTHER THAN FOR VEHICLES; AUTOMATIC HANDLING MACHINES; ROBOTS 1053 Trade Marks Journal No: 1849 , 14/05/2018 Class 7 Priority claimed from 11/07/2011; Application No. : 010113124 ;Germany 2254102 21/12/2011 SM MOTORENTEILE GMBH ALLEENSTR. 70, 71679 ASPERG, GERMANY MANUFACTURERS AND MERCHANTS/TRADERS A COMPANY INCORPORATED UNDER THE LAWS OF GERMANY Address for service in India/Agents -

Uthandi, Chennai 2BHK, 3BHK Residential Apartment Uthandi, Chennai

https://www.propertywala.com/star-dazzle-chennai Star Dazzle - Uthandi, Chennai 2BHK, 3BHK Residential Apartment Uthandi, Chennai. Star Property Developers brings luxurious 2BHK and 3BHK Residential Apartments in Star Dazzle In Uthandi, Chennai. Project ID : J305232119 Builder: Star Property Developers Properties: Residential Plots / Lands Location: Star Dazzle, Uthandi, Chennai - 600119 (Tamil Nadu) Completion Date: Dec, 2017 Status: Started Description Star Dazzle is the brand new ultra luxury project of Star Property Developers in the arm of Chennai City, that is offering beautiful 2BHK and 3BHK residential apartments in different sizes staring from 1403 Sq. Ft. to 2037 Sq. Ft. in very reasonable cost that can be affordable by any common man. This is project is having two different blocks that is Block-A and Block-B. Each block is having Ground Floor, First Floor and Second Floor. Star Dazzle is located in one of the most prime and in-demanded location of the Chennai City, the project is surrounded by beautiful geenland where you can find the real taste of true nature. You will find the beautiful and very clean as well as pollution free environment around this project, not only this you will also find the all modern amenities and necessary features in this project. Location - Uthandi, Chennai. Type - 2BHK and 3BHK Residential Apartments. Size - 1403 Sq. Ft. to 2037 Sq. Ft. Price - On Request. Features Designed wardrobes and lift will be provided for all apartments 2 covered car park for 3 bedrooms 1 Covered car park for 2 bedrooms Security Room and Toilets. CCTV security systems with intercom facility Lift with Semi autometic. -

NTS NOV 2017 Page 2 of 221

NTS NOV 2017 Page 1 of 221 REVENUE CODE : 01 KANYAKUMARI CENTRE 0101 GOVT HR SEC SCHOOL, THUCKALAY KANYAKUMARI DIST 372 46383 SMR NATIONAL SCHOOL LOUTS PARK, POST CHERUPPALOOR KULASEKHARAM, TEH KALKULAM 19 50202 EXCEL CENTRAL SCHOOL, THIRUVATTAR, KANYAKUMARI 56 TKY006 GOVT HR SEC SCHOOL, KATTATHURAI KANYAKUMARI DIST 29 TKY008 GOVT HR SEC SCHOOL, THIRUVITHANCODE KANYAKUMARI DIST 26 TKY009 GOVT HR SEC SCHOOL, THUCKALAY KANYAKUMARI DIST 14 TKY010 GOVT HR SEC SCHOOL, KALKULAM KANYAKUMARI DIST 21 TKY034 GOVT HIGH SCHOOL, MOOLACHI KANYAKUMARI DIST 8 TKY036 GOVT HIGH SCHOOL, VADHYARKONAM KANYAKUMARI DIST 10 TKY045 GOVT HIGH SCHOOL, ERAVIPUTHOORKADAI KANYAKUMARI DIST 9 TKY048 GOVT HIGH SCHOOL, CHERUKOLE KANYAKUMARI DIST 8 TKY052 GOVT HIGH SCHOOL, KESAVAPURAM KANYAKUMARI DIST 6 TKY404 CHRISTUCOIL LMS HR SEC SCHOOL, PALLIYADI KANYAKUMARI DIST 8 TKY408 L.M.S HR SEC SCHOOL, KADAMALAIKUNTU KANYAKUMARI DIST 10 TKY416 ST. JOSEPH'S HR SEC SCHOOL, MULAGUMOODU KANYAKUMARI DIST 18 TKY417 ST.MARY GORETTY HR SEC SCHOOL, MANALIKARAI KANYAKUMARI DIST 90 TKY423 CARMEL (G) HR SEC SCHOOL, MANALIKARAI KANYAKUMARI DIST 17 TKY456 VICTORY MATRIC HR SEC SCHOOL, MYLODE KANYAKUMARI DIST 23 CENTRE 0102 AMALA CONVENT (G) HR SEC SCHOOL, THUCKALAY KANYAKUMARI DIST 368 46362 ST. JOSEPH'S SCHOOL ATTINKARAI, MANAVALAKURICHY KALKULAM 29 TKY422 AMALA CONVENT (G) HR SEC SCHOOL, THUCKALAY KANYAKUMARI DIST 54 TKY454 ST. JOSEPH'S MATRIC HR SEC SCHOOL, MULAGUMOODU KANYAKUMARI DIST 15 TKY459 INFANT JESUS (G) HIGH SCHOOL, MULAGUMOODU KANYAKUMARI DIST 23 TKY463 -

Name Address City State

Name Address City State RELIANCE DIGITAL - 6505 6505 VILLAGE CHAMPAHATI MAIN ROAD PO CHAMPAHATI PS & SD BARUIPUR DISTRICT SOUTH 0 0 24 PARGANHAS WEST BENGAL POORVIKA MOBILES PVT LTD SHOP NO : 63 BY-PASS ROAD VELLORE DISTRICT 0 0 AAMBUR TAMIL NADU RELIANCE DIGITAL 6571 SHOP NO 23 ABOVE BANK OF BARODA TERNING POINT ACHALPUR ROD PLOT NO 10/2 ACHALPUR 0 0 ACHALPUR MAHARASHTRA UNIVERCELL ADILABAD 4-3-6/ 4-3-6/7 HAMEEDPURA 0 0 ADILABAD ANDHRA PRADESH LOT MOBILES PVT LTD-ADILABAD DISTRICT SHOP NO 4-3-8/4/6/1 CINEMA OPP INDIAN OVERSEAS BANK ADILABAD 0 0 ADILABAD ANDHRA PRADESH RELIANCE DIGITAL-6904 6904 H NO 4-4-75/2 HAMEED PURA NEAR NETAJI CHOWK ADILABAD 0 0 ADILABAD TELANGANA RELIANCE DIGITAL-3670 3670 H NO 1 2 69/2 GR FLRCHINNA GATE OPP BUS DEPT NIRMALADILABAD DIST 0 0 0 ADILABAD ANDHRA PRADESH RELIANCE DIGITAL 6024 6024, D NO:18/157 -1 PRABHAKAR TALKIES ROAD ADONI 0 0 ADONI ANDHRA PRADESH RELIANCE DIGITAL 9177 PRASUN GHOSH L N BARI ROAD DAG NO 11447 KHATIAN NO 4297 AGARTALA TO MOUZA SADAR DIST WEST AGARTALA 0 0 AGARTALA TRIPURA RELIANCE DIGITAL - 6475 6475 GF 6/230 JAGAN PLAZA BHARION PARK BELANGANJ 0 0 0 AGRA UTTAR PRADESH RELIANCE DIGITAL-7448 7448 SHOP AT UGF 9 LAXMAN NAGAR ARJUN NAGAR 0 0 AGRA UTTAR PRADESH RELIANCE DIGITAL-7460 7460 SHOP NO B5 GF 20/ 213 B SILKY MANDI JAIPUR HOUSE 0 0 AGRA UTTAR PRADESH RELIANCE DIGITAL-7997 7997 SHOP NOG1ONGF B 504 SANGAM PALACE KAMLA NAGAR 0 0 AGRA UTTAR PRADESH RELIANCE DIGITAL-7449 7449 SHOP NO 7 AT LGF KARIM COMPLEX FATEHABAD RD 0 0 AGRA UTTAR PRADESH RELIANCE DIGITAL-7447 7447 SHOP NO 9 &10 AT -

Trade Marks Journal No: 1895 , 01/04/2019 Class 37

Trade Marks Journal No: 1895 , 01/04/2019 Class 37 2281254 10/02/2012 LANDT METRO RAIL (HYDERABAD) LIMITED trading as ;LANDT METRO RAIL (HYDERABAD) LIMITED 4TH FLOOR, CYBER TOWERS, HITEC CITY, MADHAPUR,HYDERABAD - 500 081 A. P. SERVICE PROVIDER A REGISTERED INDIAN COMPANY INCORPORATED UNDER THE COMPANIES ACT, 1956 Address for service in India/Attorney address: ADVOCATE SANGEETA PAL C/310, ANTOPHILL WAREHOUSING COMPANY LTD., V.I.T COLLEGE ROAD, WADALA (E), MUMBAI - 400 037 Used Since :06/01/2011 CHENNAI CONSTRUCTION SERVICES, INSTALLATION, REPAIR SERVICES IN RELATION TO PLATFORM, BUILDING OF RAILWAYS, CONSTRUCTION OF RAILWAY ROADBEDS, CONSTRUCTION OF RAILWAYS, MAINTENANCE OF RAILWAY TRACK, REFURBISHMENT OF RAILWAY ELECTRIC ENGINES, REFURBISHMENT OF RAILWAY FREIGHT WAGONS, REFURBISHMENT OF RAILWAY ROLLING STOCK, The mark as a label should be used in whole as a composite mark and there is no exclusive right over the descriptive words in the logo.. 5731 Trade Marks Journal No: 1895 , 01/04/2019 Class 37 2284074 16/02/2012 M/S THRISSUR BUILDERS PRIVATE LIMITED trading as ;THRISSUR BUILDERS PVT LTD DOOR NO.25/1160/1, MACHINGAL LANE NORTH END, THRISSUR - 680001 BUILDING CONSTRUCTION AND REPAIR Address for service in India/Attorney address: ADV.TONY CHACKO MASJID ROAD, KOKKALAI THRISSUR Used Since :17/09/1997 CHENNAI BUILDING CONSTRUCTION AND REPAIR 5732 Trade Marks Journal No: 1895 , 01/04/2019 Class 37 2403970 01/10/2012 KESTREL REALTY PVT. LTD. KESTREL PRIDE, HIRA GHAT, ULHASNAGAR 421 003 (MAHARASHTRA) INDIA. SERVICE PROVIDER A PVT. LTD. COMPANY INCORPORATED UNDER THE INDIAN COMPANIES ACT Used Since :17/09/2012 MUMBAI BUILDING CONSTRUCTIONS, REPAIR, INSTALLATION SERVICES. -

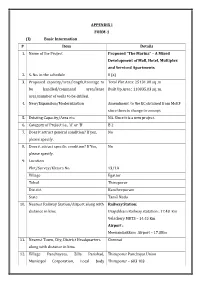

APPENDIX I FORM-1 (I) Basic Information # Item Details Proposed “The Marina” – a Mixed

APPENDIX I FORM-1 (I) Basic Information # Item Details Proposed “The Marina” – A Mixed 1. Name of the Project Development of Mall, Hotel, Multiplex and Serviced Apartments 2. S. No. in the schedule 8 (a) 3. Proposed capacity/area/length/tonnage to Total Plot Area: 25131.08 sq .m be handled/command area/lease Built Up Area : 110835.03 sq. m. area/number of wells to be drilled. 4. New/Expansion/Modernization Amendment to the EC obtained from MoEF since there is change in concept 5. Existing Capacity/Area etc. NA. Since it is a new project. 6. Category of Project i.e., ‘A’ or ‘B’ B 2 7. Does it attract general condition? If yes, No please specify. 8. Does it attract specific condition? If Yes, No please specify. 9. Location Plot/Survey/Khasra No. 13/1A Village Egattur Tehsil Thiruporur District Kancheepuram State TamilRailway Nadu Station: 10. Nearest Railway Station/Airport along with distance in kms. Urapakkam Railway statation : 17.43 Km VelacheryAirport : MRTS – 14.45 Km Meenambakkam Airport – 17.3Km 11. Nearest Town, City, District Headquarters Chennai along with distance in kms. 12. Village Panchayats, Zilla Parishad, Thiruporur Panchayat Union Municipal Corporation, Local body Thiruporur – 603 103 (complete postal addresses with telephone nos. to be given) 13. Name of Applicant Allied Majestic Promoters and OMR Mall Developers Pvt. Ltd. th 14. Registered Address 5 Floor, CITI Tower, #117, Thiyagaraya Road T.Nagar, Chennai – 600017 th 15. Address for correspondence: 5 Floor, CITI Tower, #117, Thiyagaraya Road T.Nagar, Chennai – 600017 Name Mr. A. Abdul Wadood Designation (Owner/Partner/CEO) Director th Address 5 Floor, CITI Tower, #117, Thiyagaraya Road T.Nagar, Pin Code [email protected], [email protected] E – mail Telephone No. -

USB Flash Drive Mobile Memory Cards Camera Memory Cards

Sale Type Mobile Camera Zone City Outlet Name Address Contact Person Contact No USB Flash Memory Memory Drive Cards Cards East Kolkata K B Computers No-1/1A, Biplabi Anukul Ch. Street , Kolkata-700072 Nilesh Kr. Bagaria 9433086664 Yes Yes East Kolkata Super Computech Solutions No-6,GF, C R Avenue , Kolkata-700072 Pathak 9163904062 Yes Yes Yes East Kolkata H S Computers No-3C, Madan Street, Chandni , Kolkata-700072 Md. Habib 9836070610 Yes Yes East Kolkata Pratima Electronics No-20,GF, 3/C Madan Street, Madan Street , Kolkata-700072 Chulbul Singh 9831508208 Yes Yes Yes East Kolkata G H G No-6,FF, C.R Avenue-Emall, C R Avenue , Kolkata-700072 Rajeev Gupta 9903380143 Yes Yes East Kolkata Savera No-4, Chandni Chowk Street , Kolkata-700072 Dhiraj Jain 9830259200 Yes Yes East Kolkata Tirumala Infotech No.16A, Chandni Chowk Street , Kolkata-700072 Vijay 9830887191 Yes Yes East Kolkata Fashion Computers No.1, Chandni Chowk Street , Kolkata-700072 Amit 9830105102 Yes Yes East Kolkata Arya Computech pvt. Ltd. 6 C.R Avenue-E mall, C R Avenue , Kolkata-700072 Amit 9830105101 Yes Yes East Kolkata Easten Logica Infoway No-16, G C Avenue , Kolkata-700013 Gaurav Goel 2225918 Yes Yes East Kolkata National Radio Products No-1, Biplabi Anukul Ch. Street , Kolkata-700072 Mukesh 9831074006 Yes Yes Yes East Kolkata Laptopia No-6,FF, C R Avenue , Kolkata-700072 Jay 9874777661 Yes Yes East Kolkata Neha Electronics No-3, 3C,Madan Street, Madan Street , Kolkata-700072 K. Reddy 9831020962 Yes Yes Yes East Kolkata Nikky`S 14, C R Avenue, C R Avenue , Kolkata-700072 Mr Vinay 9830015151 Yes East Kolkata Galaxy Computech Pvt.