Annual Report 2015-2016 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Siriusxm-Schedule.Pdf

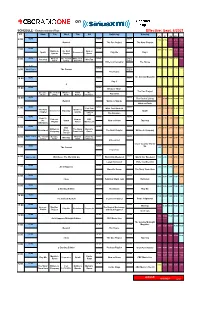

on SCHEDULE - Eastern Standard Time - Effective: Sept. 6/2021 ET Mon Tue Wed Thu Fri Saturday Sunday ATL ET CEN MTN PAC NEWS NEWS NEWS 6:00 7:00 6:00 5:00 4:00 3:00 Rewind The Doc Project The Next Chapter NEWS NEWS NEWS 7:00 8:00 7:00 6:00 5:00 4:00 Quirks & The Next Now or Spark Unreserved Play Me Day 6 Quarks Chapter Never NEWS What on The Cost of White Coat NEWS World 9:00 8:00 7:00 6:00 5:00 8:00 Pop Chat WireTap Earth Living Black Art Report Writers & Company The House 8:37 NEWS World 10:00 9:00 8:00 7:00 6:00 9:00 World Report The Current Report The House The Sunday Magazine 10:00 NEWS NEWS NEWS 11:00 10:00 9:00 8:00 7:00 Day 6 q NEWS NEWS NEWS 12:00 11:00 10:00 9:00 8:00 11:00 Because News The Doc Project Because The Cost of What on Front The Pop Chat News Living Earth Burner Debaters NEWS NEWS NEWS 1:00 12:00 The Cost of Living 12:00 11:00 10:00 9:00 Rewind Quirks & Quarks What on Earth NEWS NEWS NEWS 1:00 Pop Chat White Coat Black Art 2:00 1:00 12:00 11:00 10:00 The Next Quirks & Unreserved Tapestry Spark Chapter Quarks Laugh Out Loud The Debaters NEWS NEWS NEWS 2:00 Ideas in 3:00 2:00 1:00 12:00 11:00 Podcast Now or CBC the Spark Now or Never Tapestry Playlist Never Music Live Afternoon NEWS NEWS NEWS 3:00 CBC 4:00 3:00 2:00 1:00 12:00 Writers & The Story Marvin's Reclaimed Music The Next Chapter Writers & Company Company From Here Room Top 20 World This Hr The Cost of Because What on Under the NEWS NEWS 4:00 WireTap 5:00 4:00 3:00 2:00 1:00 Living News Earth Influence Unreserved Cross Country Check- NEWS NEWS Up 5:00 The Current -

Canada's Public Space

CBC/Radio-Canada: Canada’s Public Space Where we’re going At CBC/Radio-Canada, we have been transforming the way we engage with Canadians. In June 2014, we launched Strategy 2020: A Space for Us All, a plan to make the public broadcaster more local, more digital, and financially sustainable. We’ve come a long way since then, and Canadians are seeing the difference. Many are engaging with us, and with each other, in ways they could not have imagined a few years ago. Our connection with the people we serve can be more personal, more relevant, more vibrant. Our commitment to Canadians is that by 2020, CBC/Radio-Canada will be Canada’s public space where these conversations live. Digital is here Last October 19, Canadians showed us that their future is already digital. On that election night, almost 9 million Canadians followed the election results on our CBC.ca and Radio-Canada.ca digital sites. More precisely, they engaged with us and with each other, posting comments, tweeting our content, holding digital conversations. CBC/Radio-Canada already reaches more than 50% of all online millennials in Canada every month. We must move fast enough to stay relevant to them, while making sure we don’t leave behind those Canadians who depend on our traditional services. It’s a challenge every public broadcaster in the world is facing, and CBC/Radio-Canada is further ahead than many. Our Goal The goal of our strategy is to double our digital reach so that 18 million Canadians, one out of two, will be using our digital services each month by 2020. -

Cbc Radio One, Today

Stratégies gagnantes Auditoires et positionnement Effective strategies Audiences and positioning Barrera, Lilian; MacKinnon, Emily; Sauvé, Martin 6509619; 5944927; 6374185 [email protected]; [email protected]; [email protected] Rapport remis au professeur Pierre C. Bélanger dans le cadre du cours CMN 4515 – Médias et radiodiffusion publique 14 juin 2014 TABLE OF CONTENT ABSTRACT ......................................................................................... 2 INTRODUCTION .................................................................................. 3 CBC RADIO ONE, TODAY ...................................................................... 4 Podcasting the CBC Radio One Channel ............................................... 6 The Mobile App for CBC Radio One ...................................................... 7 Engaging with Audiences, Attracting New Listeners ............................... 9 CBC RADIO ONE, TOMORROW ............................................................. 11 Tomorrow’s Audience: Millennials ...................................................... 11 Fishing for Generation Y ................................................................... 14 Strengthening Market-Share among the Middle-aged ............................ 16 Favouring CBC Radio One in Institutional Settings ................................ 19 CONCLUSION .................................................................................... 21 REFERENCES .................................................................................... -

News Deserts and Ghost Newspapers: Will Local News Survive?

NEWS DESERTS AND GHOST NEWSPAPERS: WILL LOCAL NEWS SURVIVE? PENELOPE MUSE ABERNATHY Knight Chair in Journalism and Digital Media Economics Will Local News Survive? | 1 NEWS DESERTS AND GHOST NEWSPAPERS: WILL LOCAL NEWS SURVIVE? By Penelope Muse Abernathy Knight Chair in Journalism and Digital Media Economics The Center for Innovation and Sustainability in Local Media School of Media and Journalism University of North Carolina at Chapel Hill 2 | Will Local News Survive? Published by the Center for Innovation and Sustainability in Local Media with funding from the John S. and James L. Knight Foundation and the University of North Carolina at Chapel Hill Office of the Provost. Distributed by the University of North Carolina Press 11 South Boundary Street Chapel Hill, NC 27514-3808 uncpress.org Will Local News Survive? | 3 TABLE OF CONTENTS Preface 5 The News Landscape in 2020: Transformed and Diminished 7 Vanishing Newspapers 11 Vanishing Readers and Journalists 21 The New Media Giants 31 Entrepreneurial Stalwarts and Start-Ups 40 The News Landscape of the Future: Transformed...and Renewed? 55 Journalistic Mission: The Challenges and Opportunities for Ethnic Media 58 Emblems of Change in a Southern City 63 Business Model: A Bigger Role for Public Broadcasting 67 Technological Capabilities: The Algorithm as Editor 72 Policies and Regulations: The State of Play 77 The Path Forward: Reinventing Local News 90 Rate Your Local News 93 Citations 95 Methodology 114 Additional Resources 120 Contributors 121 4 | Will Local News Survive? PREFACE he paradox of the coronavirus pandemic and the ensuing economic shutdown is that it has exposed the deep Tfissures that have stealthily undermined the health of local journalism in recent years, while also reminding us of how important timely and credible local news and information are to our health and that of our community. -

Mass-Mediated Canadian Politics: CBC News in Comparative Perspective

Mass-Mediated Canadian Politics: CBC News in Comparative Perspective Blake Andrew Department of Political Science McGill University Leacock Building, Room 414 855 Sherbrooke Street West Montreal, QC H3A 2T7 blake.andrew at mcgill.ca *Paper prepared for the Annual General Meeting of the Canadian Political Science Association, Ottawa, Canada, May 27-29, 2009. Questions about news media bias are recurring themes of mainstream debate and academic inquiry. Allegations of unfair treatment are normally based on perceptions of inequality – an unfair playing field. News is dismissed as biased if people think that a political group or candidate is systemically advantaged (or disadvantaged) by coverage. When allegations of this nature surface, the perpetrator is usually one of three usual suspects: the media (writ large), a newsroom, or a medium (e.g. Adkins Covert and Wasburn 2007; D'Alessio and Allen 2000; Groeling and Kernell 1998; Niven 2002; Shoemaker and Cohen 2006). Headlines and stories are marshaled for evidence; yet the integrity of headlines as proxies for their stories is rarely considered as an avenue for testing and conceptualizing claims of media bias. It is common knowledge that headlines are supposed to reflect, at least to some degree in the space they have, the content that follows. Yet this myth has thus far received only sparse attention in social science (Althaus, Edy and Phalen 2001; Andrew 2007). It is a surprising oversight, partly because news headlines are clearly not just summaries. They also signal the importance of, and attempt to sell the news story that follows. The interplay of these imperatives is what makes a test of the relationship between headline news and story news particularly intriguing. -

Reuters Institute Digital News Report 2020

Reuters Institute Digital News Report 2020 Reuters Institute Digital News Report 2020 Nic Newman with Richard Fletcher, Anne Schulz, Simge Andı, and Rasmus Kleis Nielsen Supported by Surveyed by © Reuters Institute for the Study of Journalism Reuters Institute for the Study of Journalism / Digital News Report 2020 4 Contents Foreword by Rasmus Kleis Nielsen 5 3.15 Netherlands 76 Methodology 6 3.16 Norway 77 Authorship and Research Acknowledgements 7 3.17 Poland 78 3.18 Portugal 79 SECTION 1 3.19 Romania 80 Executive Summary and Key Findings by Nic Newman 9 3.20 Slovakia 81 3.21 Spain 82 SECTION 2 3.22 Sweden 83 Further Analysis and International Comparison 33 3.23 Switzerland 84 2.1 How and Why People are Paying for Online News 34 3.24 Turkey 85 2.2 The Resurgence and Importance of Email Newsletters 38 AMERICAS 2.3 How Do People Want the Media to Cover Politics? 42 3.25 United States 88 2.4 Global Turmoil in the Neighbourhood: 3.26 Argentina 89 Problems Mount for Regional and Local News 47 3.27 Brazil 90 2.5 How People Access News about Climate Change 52 3.28 Canada 91 3.29 Chile 92 SECTION 3 3.30 Mexico 93 Country and Market Data 59 ASIA PACIFIC EUROPE 3.31 Australia 96 3.01 United Kingdom 62 3.32 Hong Kong 97 3.02 Austria 63 3.33 Japan 98 3.03 Belgium 64 3.34 Malaysia 99 3.04 Bulgaria 65 3.35 Philippines 100 3.05 Croatia 66 3.36 Singapore 101 3.06 Czech Republic 67 3.37 South Korea 102 3.07 Denmark 68 3.38 Taiwan 103 3.08 Finland 69 AFRICA 3.09 France 70 3.39 Kenya 106 3.10 Germany 71 3.40 South Africa 107 3.11 Greece 72 3.12 Hungary 73 SECTION 4 3.13 Ireland 74 References and Selected Publications 109 3.14 Italy 75 4 / 5 Foreword Professor Rasmus Kleis Nielsen Director, Reuters Institute for the Study of Journalism (RISJ) The coronavirus crisis is having a profound impact not just on Our main survey this year covered respondents in 40 markets, our health and our communities, but also on the news media. -

Solo News Box, Kevin Posted the Drawing I Gave Him on His Instagram This Month

With my proofreader on holiday in China and Liam touring America with Steven Page, I’m writing solo this issue; all typos are therefore my fault and you can shout at me for them. Lots of Steve news this issue. It’s nice now the uncertainty between them has cleared and I no longer have to feel awkward about including Steve news in here. As for his new album, I’d describe it as a Beatles-inspired soundtrack to a Broadway musical about the current political climate; your mileage will vary depending on how appealing that idea sounds to you. And since this is kind of my solo news box, Kevin posted the drawing I gave him on his Instagram this month. Considering it took 9 months to draw, I’m really glad he and so many others like it. Test your Kevin knowledge: On the wall are songs and on the floor bands he’s played with - Mil NEWS Announced late this month, ‘Not a Retrospective’ is a new mini-documentary filmed during the Canadian Fake Nudes tour last year coming soon for BNL fans everywhere! Steve’s new album Discipline: Heal Thyself, Pt. II was released this month – All the release coverage on page 2. BNL played a few shows this month with more soon, including the annual Dream Serenade concert for charity. A round-up of this month’s on page 2 and dates on the final page. BSolo News Ed Kevin Ed’s been up to his usual, namely playing far too ♪ Kevin joined friends the Violent Femmes on-stage this month with much pinball and snuggling with his awesomely his accordion – What song isn’t improved with more accordion cute dogs this month – No News after all? – during their show at the Fiserv Forum in Milwaukee. -

The Expansion of the CBC Northern Service and Community Radio

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by YorkSpace Cultural imperialism of the North? The expansion of the CBC Northern Service and community radio Anne F. MacLennan York University Abstract Radio broadcasting spread quickly across southern Canada in the 1920s and 1930s through the licensing of private independent stations, supplemented from 1932 by the Canadian Radio Broadcasting Commission and by its successor, the Canadian Broadcasting Corporation, from 1936. Broadcasting in the Canadian North did not follow the same trajectory of development. The North was first served by the Royal Canadian Corps of Signals that operated the Northwest Territories and Yukon Radio System from 1923 until 1959. The northern Canadian radio stations then became part of the CBC. This work explores the resistance to the CBC Northern Broadcasting Plan of 1974, which envisaged a physical expansion of the network. Southern programming was extended to the North; however, indigenous culture and language made local northern programmes more popular. Efforts to reinforce local programming and stations were resisted by the network, while community groups in turn rebuffed the network’s efforts to expand and establish its programming in the North, by persisting in attempts to establish a larger base for community radio. Keywords Canadian radio CBC Northern Service community radio indigenous culture broadcasting Inuktitut Fears of American cultural domination and imperialism partially guided the creation of the Canadian Radio Broadcasting Commission in 1932 and its successor the Canadian Broadcasting Corporation (CBC) in 1936. However, the possibility of the CBC assuming the role of cultural imperialist when it introduced and extended its service to the North is rarely considered. -

Cloudfront.Net

Canadian Broadcasting Corporation Societe Radio-Canada ••• CBC est!' Radio-Canada Mr. Jason Plotz 2-44 Clarey Avenue Ottawa, Ontario KI S 2R 7 Our file: A-2015-00 I 02 I YJP Dear Mr. Plotz, This is in response to your request under the Access to Information Act (Act) dated March 21, 2016, received by our office on March 24, 2016, for the following: ""Provide copies of all documents, including memos, briefingnotes, e-mails, correspondence, etc. regarding any discussions about sponsorships or coverage to mark David Suzuki's 80th Birthday, since Janua,y 1, 2016. "" Attached are copies of all the accessible documents which you requested under the Act. Please note that certain information has been severed from them pursuant to sections 16(2), l 8(b ), 19( I) and 21( I)(b) of the Act. Some of the requested infom1ationrelates also to our programming activities, and is excluded from t e application of the Act pursuant to section 68.1, which states: "68.1 This Act does not apply to any information that is under the contr I of th� a adian Broadcasting Corporation that relates to its journalistic, creative or programming acti 'ties other than information that relates to its general administration." Please note that CBC reserves the right to claim exemptions pursuant to the Act. Please be advised that you are entitled to complain to the Information Commissioner concerning the processing of your request within sixty days of the receipt of this notice. In the event you decide to avail yourself of this right, your notice of complaint should be addressed to: Office of the Information Commissioner of Canada 30 Victoria Street Gatineau, Quebec KI A I H3 Should you have any questions concerning the processing of your request, please contact Yves Lapierre at 613-288-6248. -

Essays on Technology-Driven Marketing

ESSAYS ON TECHNOLOGY-DRIVEN MARKETING Zijun (June) Shi Submitted to the Tepper School of Business in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY Dissertation Committee Kannan Srinivasan (Chair) Hui Li Xiao Liu Alan Montgomery Kaifu Zhang April, 2019 I © Coypyright by Zijun (June) Shi, 2019 All rights reserved. II Abstract: With the development of technology in business applications, new marketing problems emerge, creating challenges for both practitioners and researchers. In this dissertation, I investigate marketing issues that involve new technology or require research methodologies enabled by new technology. I take an interdisciplinary approach, combining structural modeling, analytical modeling, machine learning, and causal inference, to study problems on pricing, media hype, and branding in three essays. In the first essay, we examine the optimality of the freemium pricing strategy. Despite its immense popularity, the freemium business model remains a complex strategy to master and often a topic of heated debate. Adopting a generalized version of the screening framework à la Mussa and Rosen (1978), we ask when and why a firm should endogenously offer a zero price on its low-end product when users' product usages generate network externalities on each other. Our analysis indicates freemium can only emerge if the high- and low-end products provide asymmetric marginal network effects. In other words, the firm would set a zero price for its low- end product only if the high-end product provided larger utility gain from an expansion of the firm's user base. In contrast to conventional beliefs, a firm pursuing the freemium strategy might increase the baseline quality on its low-end product above the “efficient” level, which seemingly reduces differentiation. -

Economic Benefits of Architectural Conservation for the Tourism and Film and Television Industries Architectural Conservancy Ontario 2 in Ontario

Graphic Standards Manual 2.0 The New Brand Architectural Conservancy Ontario’s (ACO) new brand has been designed to increase overall public awareness of the organization and to help consolidate a network of branches. The focal point of the logo is the acronym (ACO) within a square shape. Structurally, a plus sign divides the shape into four quadrants – the letter A occupies one half of the square and the letters C and O the other half. The letterforms, like the structure, are very simple. The terracotta colour was chosen to reflect the colour of brick often found in historical Ontario buildings. The new logo becomes a unifying symbol for the organization – enabling each branch office to attach to the ACO logo an image that is relevant to their community. And finally, the logo will provide a striking and memorable image of ACO when it appears on project site signage throughout the province. ARCHITECTURAL CONSERVANCY Old Logo ONTARIO Economic Benefits of Architectural Conservation for the Tourism and Film and Television Industries Architectural Conservancy Ontario 2 in Ontario by Stephanie Mah for Architectural Conservancy Ontario February 18 th, 2015 Economic Benefits of Architectural Conservation for the Tourism Industry Tourism is a source of substantial economic benefits in Ontario and one of it most potent attractions, is architectural heritage. According to Statistics Canada, historic sites in Ontario had approximately 3,750,800 person visits in 2011, placing built heritage in the top five most popular tourist attractions in the Province. Toronto, one of the most popular tourist destinations, also uses built heritage as a pull factor. -

By: the Canadian Association of Stand-Up Comedians, (CASC)

Written Submission for the Pre-Budget Consultations in Advance of the 2020 Budget By: The Canadian Association of Stand-up Comedians, (CASC) LIST OF RECOMMENDATIONS Recommendation 1: That the government fulfill and make permanent its current commitment of a $16 million increase in budget over two years to The Canada Arts Presentation Fund (CAPF), to promote the talents of Canadian artists across the country. Recommendation 2: That the government sustain current levels of federal tax credit incentives and funding for CBC/Radio-Canada, as well as Canada Media Fund (CMF) contributions, including the stabilization allocation, to strengthen the creation of original Canadian audio-visual content. Recommendation 3: That the government maintain and continue investments made in Budget 2016 and 2018 for Canada’s Creative Export Strategy, ensuring that Canadian comedians can access funding for export activities through an appropriate funding channel. 2 BACKGROUND The Canadian Association of Stand-up Comedians (CASC) is an association for aspiring and established professional Canadian comedians, including stand- up, sketch, and improv artists. Since July 2017, CASC’s mission has been to build a thriving, dynamic comedy industry in Canada, by: engaging Canadian comedians through advocacy, career opportunity, and support for programming; plus, professional development, improved labour mobility across international borders, and industry education. Canadian comedy artists are world leaders in entertaining and innovating through humour. CASC champions the fact that Comedians bring unique voices and perspectives to challenging issues that are relevant to other Canadians and citizens around the world. In April 2019, CASC helped facilitate the forming of The Foundation for Canadian Comedy (CANCOM), a foundation established to help create a funding infrastructure to strengthen the profitability and competitiveness of the Canadian comedy industry domestically and abroad.