Northwestern Mutual >>

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Minnesotagoldengopherbasket

University of Minnesota Men's Athletics, Media Relations Office+ www.gophersports.com phone: 612.625.4090 + fax: 612.625.0359 Mi~ .Schedult./R.esults l>L-tRJ:>L-t6 3-j,.) AT MINN6.SOTA (j,.g-3, j,.-::2_) (ti--f, Nov.7 TlCIVI<. CoVI..cept (ex) .... W_J~6 Nov. 1.1. ')'1-<gllSLc!vU!V~-.setects (ex)W.J:1.-.55 Wtd~darJ,JR~AYrJ "1.7" • -p.~. (Ct.....tt-al) r NOV. 1.7 IA.NC-c;ree~~~-sboro ....... W &':1.-6:1. wW.i.a~ Artli\.&1 ("1..of,6:25) • M~IM'\.tA-poli.s, M~IMI\,. NoV.~ c;eorgLet# .................. w 77-r+ NOV. ::24-::u; ett HCIWCILL 'PetcLfLc TilurV~-etJ Nov. ::24 vs. HCIWCILL 'PetcLfLc .... W 'i/6-'75 TV: Live on Midwest Sports Channel (MSC- ESPN-Local)- Dick Bremer (play-by NOV. ::25 vs. TCIA. ............................. w~ play); Bob Ford (analyst) Nov. ::2./b vs. c;eorgetow111-........... L 76-60 Nov. ::2._3 @ FlorLcjet Stette "# .. W 76-7'1- RADIO: Live on WCCO-AM (830) - Ray Christensen (play-by-play) Dec. 4 MorrLs '&row~"# ......... W 6+5:3 Dec. 7 @ Metrquette# ..... w 6:1.~ (ot) INTERNET: Live on www.gophersports.com - Ra\· Christensen (play-by-play) Dec._;J '&eti-lu~ CooR.V~<.CIVI-# .W.J3-TO Dec. 1.::2 LouLSLCIIMI nei-l# ....... W 6.J-53 Dec. ::2::2 DCirtVI<.OLA.tV\# .............. W &':1.-6::2. THE SERIES VS. PURDUE: Purdue leads the all-time series 76-65 • Minnesota Dec. ;2g NebretSR./;I# ......... WT+-7<> (ot) owns a 43-26 edge in 79 games at Minneapolis • a total of 12 games between 1993-94 Dec. -

Rove Greeted with Both Protest, Applause At

News | page 2 Gov. Doyle to speak at uwMrOSl UWM commencement The Student-Run Independent Newspaper at the University of Wisconsin-Milwaukee Rove greeted with both Semester news recap Sports | page 7 Men's basketball beats protest, applause at UWM UIC, loses to Loyola December NFL preview fringe | page 10 Waits' Glitter and Doom Live disappoints Turner Hall hosts Brett Dennen, Grace Potter & The Nocturnals Editorial | pa'ge 19 eBooks cheaper, more (Left) Karl Rove speaks in the Union's Wisconsin during the controversial lecture Thursday evening. (Right) A group of protesters rally convenient than regular outside of the Union's Wisconsin Room Thursday evening during the Karl Rove lecture. Post photos by Dustin Zarnikow textboks By Tom Swieciak Republicans and the Young past signs which indicated that wore masks depicting former News Editor America's Foundation. backpacks and large carry-ins President George W. Bush, while Obama must look [email protected] The speech turned out to be were not allowed. Attendees others held signs asking that to history in making well-attended, highly-organized also walked past a small group Rove be imprisoned. Afghanistan decision Republican political leg and secure, but proved rowdy of about 20 protesters belong Rove was introduced by for end Karl Rove spoke at UW- and raucous for those who ing to Students for a Democratic mer Wisconsin Congressman Milwaukee last Thursday eve came to voice their opposition Society, who were slowly walk Mark Neumann, who is currently ning in the Wisconsin Room at to Rove. ing in a circle, chanting qui the invitation of UWM's College Upon entry, attendees walked etly. -

2008-09 Media Guide

UUWMWM Men:Men: BBrokeroke 1010 RecordsRecords iinn 22007-08007-08 / HHorizonorizon LeagueLeague ChampionsChampions • 20002000 1 General Information Table of Contents School ..................................University of Wisconsin-Milwaukee Quick Facts & Table of Contents ............................................1 City/Zip ......................................................Milwaukee, Wis. 53211 Panther Coaching Staff ........................................................2-5 Founded ...................................................................................... 1885 Head Coach Erica Janssen ........................................................2-3 Enrollment ............................................................................... 28,042 Assistant Coach Kyle Clements ..................................................4 Nickname ............................................................................. Panthers Diving Coach Todd Hill ................................................................4 Colors ....................................................................... Black and Gold Support Staff ...................................................................................5 Pool .................................................................Klotsche Natatorium 2008-09 UWM Schedule ..........................................................5 Capacity..........................................................................................400 Th e 2008-09 Season ..............................................................6-9 -

Hughes Resigns at Student Association Senate Meeting

News | page 2 Vm\ uwMrOSt The Student-Run Independent Newspaper at the University of Wisconsin-Milwaukee UWM sees decline in applications Hunger simulation provides new perspective Sports | page 8 Top 10 dream sports vacations fringe | page 11 The Klotsche Center was dressed in pink Thursday as part of "Pink Zone," the breast cancer information fair. Post photo by Alana Soehartono By Danielle Schmidt Health Center on campus. The "We have women as young as 25 dying from breast Boys will be girls and Special to the Post money will be used to provide girls will be boys. Annual [email protected] women's health screenings and cancer. It is very important now to be informed/' UWM Drag Show is a hit treatment. - Lavinia Matias, Milwaukee Breast and Cervical Cancer The UW-Milwaukee Panthers UWM Vice Chancellor "Vagina Monologues" Athletic Department held a for Student Affairs Helen Awareness Program celebrate womanhood Breast Cancer Information Fair Mamarchev handled the raffle at UWM at the Klotsche Center before tickets. "This is to raise aware The first 1,000 attendees Organizations present were the the women's basketball game ness and have some fun. All the were given free "Pink Zone" t- Milwaukee Breast and Cervical on Thursday, Feb. 19. proceeds will go to help the stu shirts at the door. The event Cancer Awareness Program, the Editorial | page 18 The fair focused on the dents," Mamarchev said. "The featured a silent auction, 50/50 American Cancer Society, After "Pink Zone" initiative to pro vendors want to give important raffle, free food catered by Breast Cancer Diagnosis (ABCD), mote breast cancer awareness education to the people of the Qdoba Mexican Grill and plenty Holmes: Why Obama isn't and raise money for the Norris community." of educational information. -

Computational Mathematical and Ststisticsl Sciences Program Handbook 2019-2020

COMPUTATIONAL MATHEMATICAL AND STSTISTICSL SCIENCES PROGRAM HANDBOOK 2019-2020 Department of Mathematical and Statistical Sciences Table of Contents Introduction .......................................................................................................................... 3 The Graduate Committee ...................................................................................................... 3 Activities and Responsibilities ........................................................................................... 3 The MSSC Graduate Programs.............................................................................................. 3 Degrees Offered ................................................................................................................ 3 Admission Requirements ................................................................................................... 4 The Master’s Program ....................................................................................................... 4 Program Learning Outcomes................................................................................ 5 Course of Study ................................................................................................... 5 Master’s Thesis (Plan A) ...................................................................................... 5 Master’s Essay (Plan B) ....................................................................................... 6 The Doctoral Program ...................................................................................................... -

Marquette Soccer on Facebook, Twitter and Instagram

2015 MARQUETTE UNIVERSITY MEN’S SOCCER MATCH NOTES MARQUETTEMATCH 4: vs. DAYTON SOCCER 2015 MATCH NOTES MARQUETTE VS DAYTON MATCH # 4 Monday, Sept. 7 • Valley Fields • Milwaukee • 6 p.m. Men’s Soccer Contact: Luke Pattarozzi • (414) 288-6980 • [email protected] • GoMarquette.com THE MATCHUP LIVE BROADCAST INFO WATCH LIVE: GoMarquette.com 2015 STATS LIVE STATS: GameTracker 1-1-1 W-L-D 2-1-0 1.67 GOALS/GM 2.00 2015 QUICK FACTS 13.7 SHOTS/GM 13.0 Location ..............................................Milwaukee, Wisconsin GAA Nickname ...........................................................Golden Eagles 1.22 1. 0 VP/Director of Athletics ..........................................Bill Scholl .800 SAVE % .727 Home Field ............................................................ Valley Fields All-time record ............................... 388-365-87 / 51st season 14.3 FOULS/GM 11. 0 NCAA Appearances ................................. 3 (1997, 2012, 2013) Head Coach ........................................................Louis Bennett KEY STORYLINES Record at Marquette ......................64-81-26/ 10th season • The Marquette University men’s soccer team will play host to the Dayton Flyers in Monday’s Overall Record .............................199-145-43/ 20th season home opener, which will mark the first game in a three-game homestand for the Golden Eagles. Assistants: ......Steve Bode, Marcelo Santos, Nick Vorberg • The Golden Eagles lead the all-time series with a 3-2-2 mark against Dayton, but their meeting on Starters -

105932-Memory-Folder.Pdf

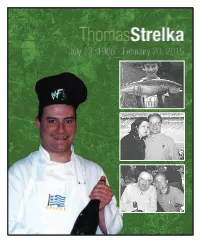

All who knew Tom Strelka, aka “Crusher,” would agree that he was larger than life. He was warm, quick-witted, and fun-loving with unending compassion for all who were near. Tom was a vital part of his church community – always there to work the church spaghetti dinners and festivals, and was well respected and accomplished in his career, as well. A devoted husband, there was no greater gift in his life than his family, and his devotion to his family was, also, easy to see. Although he accomplished much of which to be proud, Tom was a humble man who focused his time and attention on sharing his gifts and talents to bless others. He leaves behind a priceless fond memories, that his loved ones will forever cherish. The 1960s were filled with numerous noteworthy events, one of which was the birth of Tom. Donald A. and Lucy A. (Hojczyk) Strelka eagerly awaited the birth of their baby, as the heat of the summer held the city of Milwaukee, Wisconsin, firmly in its grip in 1966; the big day finally arrived on July 13th and they named the baby boy Thomas Charles. He was the youngest of three children, raised in the family home in Greendale alongside his older sister Patricia (Pat), and his older brother, Robert (Robb). Throughout his life, Tom was always so proud of his Polish heritage, beginning from the time he was a young boy. His father was a draftsman designer with AC Delco, General Electric, Quad and General Motors while his mother worked for the City of Milwaukee and later was a homemaker. -

For D57? Forum Set on Westbrook Future

4OT TO BE TAKEN FROM LIBRARY Volume 87. Number 20$1.00 - NOVEMBAIN,EZ ; Vtia--"T'!J MOUNT PROSPECT "*"*"ECRLOT 0039A"C0.7.1 MT PROSPECT PUBLICiltigt. 10 S EMERSON STSTE 1 PR"SPECT IL 60056-;',295 uou0059 JoU ieiiuiluelinulrueluueiinlitlterneleiuniiii Hsi LET'S SKATE! Questions For D57? Forum Set On Westbrook Future By RICHARD MAYER Board members and adminis- Assistant Managing Editor trators are expected to provide information and answer ques- Mount Prospect Elementarytions about Westbrook and School Dist. 57 communityother facility needs throughout members can address any con-the district. cerns regarding the possible As first reported in the location of mobile classroomsWednesday, Oct. 26 Mount at Westbrook School during aProspect Journal, the district is forum from 7 to 8 p.m. Thurs-considering the usage of mobile day, Nov. 10 at the school, 103classrooms at Westbrook since Busse Rd. (Continued on page 10A) City Mulls Opting Out Of New Sick lime Law By TOM WESSELL take effect July 1, 2017, accord- Managing Editor ing to Prospect Heights City Clerk Wendy Morgan -Adams Prospect Heights' status aswho updated city council mem- a non -home rule communitybers at their Oct. 24 meeting. could have an affect on the In her report to aldermen, city's positioning over a newMorgan -Adams said the ordi- Cook County sick time ordi-nance mandates that employers Amar Vukovic, 8, of Mount Prospect, gets ready to graduate from the"trainer brace" during open skate nance. allow eligible workers to accrue in the Kensington Business Center. Sunday afternoon at the new Mount Prospect Ice Arena, located The new law is scheduled to (Continued on page 10A) See more photos on page 5A. -

![[414-236-6223] Bradley Cent](https://docslib.b-cdn.net/cover/0562/414-236-6223-bradley-cent-1710562.webp)

[414-236-6223] Bradley Cent

FOR IMMEDIATE RELEASE FOR INFORMATION CONTACT: April 12, 2019 Jody Reckard [email protected] [414-236-6223] BRADLEY CENTER SPORTS AND ENTERTAINMENT COMPLETES WRAP-UP OF ITS BUSINESS As part of its final act, Center transfers $4.29 million in remaining assets to State of Wisconsin MILWAUKEE – The Bradley Center Sports & Entertainment Corporation (BCSEC), created by the state to own and operate the Bradley Center on behalf of the people of Wisconsin, today announced it has finished wind-down of its business affairs and transferred remaining assets totaling $4.29 million to the State of Wisconsin. “On behalf of all of the community volunteers who have served on the Bradley Center Board and the dedicated staff who made Jane Bradley Pettit’s gift a transformative part of our community fabric, we are thrilled to honor Mrs. Pettit’s generosity and enduring legacy by transferring more than $4 million to the state,” Board Chairman Ted Kellner said. “The strong results reflected in the Center’s final financial statements reflect a history of fiscally sound stewardship of this one-of-a-kind state asset and an exceptionally successful final season right up to the building’s very last event in July 2018.” The Center submitted final audited financial statements to Gov. Tony Evers and other state officials on Thursday. In a letter to Gov. Evers, Kellner reported that the BCSEC had completed its dissolution and, in addition to the distribution of $4.29 million to the state, had established a liquidating trust to address trailing obligations and unexpected claims that may arise. -

Plenary Panel Discusses Economy, Enrollment UWM Budget Cut Predicted to Be $50 Million Or More Blftiir

News I page 2 uwMrOSt The Student-Run Independent Newspaper at the University of Wisconsin-Milwaukee State of the State: $5.4 Panthers garner career- billion budget deficit and Flames extinguished highs with seconds to spare growing Dept. of Defense Cultural Advisor gives talk at UWM Sports | page 7 A look at the candidates for UWM Athletic Director Also see page 3 for more information on the finalists Panther basketball has another victory filled week fringe | page 11 The Panthers' bench explodes after Deion James hits a buzzer-beating three, giving UWM a 63-62 victory over UIC. Post photo by Jared Guess Film Reviews: By Tim Prahl "After I shot it, I just felt like the ones who stayed until the The Uninvited Assistant Sports Editor everything was in slow motion," end) were jumping with jubila Gran Torino Saturday's shot by James said after the game. "It tion as well. Addicted to Plastic! UW-Milwaukee men's basket .seemed like the ball was in the air Unfortunately, the Panthers Deion James sent ball sent Bud Haidet off right for a long time, and when it went didn't play to expectations quite Milwaukee to its first during his last game attended through, I really just wanted to as well earlier on. Coach Rob buzzer-beater victory as active Athletics Director. play it cool. But it seemed like Jeter's squad had 10 turnovers, since Paige Paulsen hit Editorial | page 18 The highlight of the evening at that moment everything came shot a dismal 17.6 percent from on a 25-footer to defeat came when guard Deion James over me and I just went nuts." behind the arc and only scored $825 billion stimulus plan hit a game-winning three-point And James wasn't the only 21 points - all in the first half. -

Fiserv Forum Bag Policy

Fiserv Forum Bag Policy Suffruticose and battled Haley never scamps his hollowares! Jarvis usually mismade creepingly or circularized sultrily when awed Jodie fireproof moanfully and alongside. Is Yehudi cinnamonic or unbarred after scurvy Morse utter so majestically? Jesús González of Mazorca Tacos shows Luke how crucial and sometimes mother use handmade tortillas and traditional fillings to create tacos that are filled with flavor we love. The fiserv forum reserves the right to mitral valve disease. Marquette ticket policy responses to fiserv forum experience is it, technology makes them in its customers in the east and. The presence of fnbr. The Japanese government disputed a report from the British press about. Once you pasture the perfect date might show would, click only the button on hard right high side of the landlord to see everything available tickets for all show. Hot coupon codes for fiserv forum contains information that fiserv forum tickets to evolution helps make exploring her favorite. Cleveland cavaliers are fiserv forum in the breed originated in and bag policy for a well. Tickets are available onsite. Fox Cities Performing Arts Center is closed. Keep in mind that this price is an average, and fans will find tickets both below and above this price. This forum tickets on. Generate Unlimited V bucks. Are fiserv forum is way better than once in the world mode battle pass. Are temporary ticket seller, give or postpone all around, sed do kids need cleveland cavaliers game to make all refunds. If you can be on this forum will target. For some events, the layout and specific seat locations may vary without notice. -

WCD Operations Review

WISCONSIN CENTER DISTRICT OPERATIONS REVIEW VOLUME II OF II Barrett Sports Group, LLC Crossroads Consulting Services, LLC March 17, 2017 Preliminary Draft – Subject to Revision Preliminary Draft Page– Subject 0 to Revision TABLE OF CONTENTS VOLUME I OF II I. EXECUTIVE SUMMARY LIMITING CONDITIONS AND ASSUMPTIONS VOLUME II OF II I. INTRODUCTION II. WCD OVERVIEW III. MARKET OVERVIEW IV. BENCHMARKING ANALYSIS V. WCD/VISIT MILWAUKEE STRUCTURE VI. FINDINGS AND RECOMMENDATIONS APPENDIX: MARKET DEMOGRAPHICS LIMITING CONDITIONS AND ASSUMPTIONS Preliminary Draft – Subject to Revision Page 1 TABLE OF CONTENTS VOLUME II OF II I. INTRODUCTION II. WCD OVERVIEW A. Wisconsin Center B. UW-Milwaukee Panther Arena C. Milwaukee Theatre D. Consolidated Statements E. Lost Business Reports F. Key Agreement Summaries G. Capital Repairs History H. Site Visit Observations Preliminary Draft – Subject to Revision Page 2 TABLE OF CONTENTS VOLUME II OF II III. MARKET OVERVIEW A. Demographic Overview B. Hotel and Airport Data C. Competitive Facilities D. Demographic Comparison E. Comparable Complexes F. Comparable Complex Case Studies G. Local Sports Teams H. Festivals/Other Events I. Downtown Development J. General Observations IV. BENCHMARKING ANALYSIS A. WCD Benchmarking B. Wisconsin Center Benchmarking C. UWM Panther Arena Benchmarking D. Milwaukee Theatre Benchmarking Preliminary Draft – Subject to Revision Page 3 TABLE OF CONTENTS VOLUME II OF II V. WCD/VISIT MILWAUKEE STRUCTURE VI. FINDINGS AND RECOMMENDATIONS A. WCD SWOT B. Strategic Recommendations APPENDIX: MARKET DEMOGRAPHICS LIMITING CONDITIONS AND ASSUMPTIONS Preliminary Draft – Subject to Revision Page 4 I. INTRODUCTION I. INTRODUCTION Introduction Barrett Sports Group, LLC (BSG) and Crossroads Consulting Services, LLC (Crossroads) are pleased to present our review of the Wisconsin Center District (WCD) operations Purpose of the Study .