Financial Statement Disclosures for September 30, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Early Dance Division Calendar 17-18

Early Dance Division 2017-2018 Session 1 September 9 – November 3 Monday Classes Tuesday Classes September 11 Class September 12 Class September 18 Class September 19 Class September 25 Class September 26 Class October 2 Class October 3 Class October 9 Class October 10 Class October 16 Class October 17 Class October 23 Class October 24 Class October 30 Last Class October 31 Last Class Wednesday Classes Thursday Classes September 13 Class September 14 Class September 20 Class September 21* Class September 27 Class September 28 Class October 4 Class October 5 Class October 11 Class October 12 Class October 18 Class October 19 Class October 25 Class October 26 Class November 1 Last Class November 2 Last Class Saturday Classes Sunday Classes September 9 Class September 10 Class September 16 Class September 17 Class September 23 Class September 24 Class September 30* Class October 1 Class October 7 Class October 8 Class October 14 Class October 15 Class October 21 Class October 22 Class October 28 Last Class October 29 Last Class *Absences due to the holiday will be granted an additional make-up class. Early Dance Division 2017-2018 Session 2 November 4 – January 22 Monday Classes Tuesday Classes November 6 Class November 7 Class November 13 Class November 14 Class November 20 No Class November 21 No Class November 27 Class November 28 Class December 4 Class December 5 Class December 11 Class December 12 Class December 18 Class December 19 Class December 25 No Class December 26 No Class January 1 No Class January 2 No Class January 8 Class -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

LCHS Academic Calendar First Semester 2020-21

LCHS Academic Calendar First Semester 2020-21 Sunday Monday Tuesday Wednesday Thursday Friday Saturday August 16 August 17 August 18 August 19 August 20 August 21 August 22 Blue Day White Day Blue Day White Day Blue Day August 23 August 24 August 25 August 26 August 27 August 28 August 29 White Day Blue Day White Day Blue Day White Day August 30 August 31 September 1 September 2 September 3 September 4 September 5 Blue Day White Day Blue Day White Day Blue Day September 6 September 7 September 8 September 9 September 10 September 11 September 12 HOLIDAY White Day Blue Day White Day Blue Day September 13 September 14 September 15 September 16 September 17 September 18 September 19 White Day Blue Day White Day Blue Day White Day September 20 September 21 September 22 September 23 September 24 September 25 September 26 Blue Day White Day Blue Day White Day Blue Day September 27 September 28 September 29 September 30 October 1 October 2 October 3 White Day Blue Day White Day Blue Day White Day October 4 October 5 October 6 October 7 October 8 October 9 October 10 Blue Day White Day Blue Day White Day Blue Day October 11 October 12 October 13 October 14 October 15 October 16 October 17 White Day Blue Day White Day Blue Day White Day October 18 October 19 October 20 October 21 October 22 October 23 October 24 Blue Day White Day Blue Day White Day Blue Day October 25 October 26 October 27 October 28 October 29 October 30 October 31 White Day Blue Day White Day Blue Day White Day November 1 November 2 November 3 November 4 November 5 November -

2018 - 2019 Days of Rotation Calendar

2018 - 2019 DAYS OF ROTATION CALENDAR Day # Date Rotation Day Type Notes Day # Date Rotation Day Type Notes Saturday, October 13, 2018 Sunday, October 14, 2018 Monday, September 3, 2018 Holiday/Vaca Labor Day 27 Monday, October 15, 2018 Day 3 In Session 1 Tuesday, September 4, 2018 Day 1 In Session 28 Tuesday, October 16, 2018 Day 4 In Session 2 Wednesday, September 5, 2018 Day 2 In Session 29 Wednesday, October 17, 2018 Day 5 In Session 3 Thursday, September 6, 2018 Day 3 In Session 30 Thursday, October 18, 2018 Day 6 In Session 4 Friday, September 7, 2018 Day 4 In Session 31 Friday, October 19, 2018 Day 1 In Session Saturday, September 8, 2018 Saturday, October 20, 2018 Sunday, September 9, 2018 Sunday, October 21, 2018 Monday, September 10, 2018 Day Holiday/Vaca Rosh Hashanah 32 Monday, October 22, 2018 Day 2 In Session 5 Tuesday, September 11, 2018 Day 5 In Session 33 Tuesday, October 23, 2018 Day 3 In Session 6 Wednesday, September 12, 2018 Day 6 In Session 34 Wednesday, October 24, 2018 Day 4 In Session 7 Thursday, September 13, 2018 Day 1 In Session 35 Thursday, October 25, 2018 Day 5 In Session 8 Friday, September 14, 2018 Day 2 In Session 36 Friday, October 26, 2018 Day 6 In Session Saturday, September 15, 2018 Saturday, October 27, 2018 Sunday, September 16, 2018 Sunday, October 28, 2018 9 Monday, September 17, 2018 Day 3 In Session 37 Monday, October 29, 2018 Day 1 In Session 10 Tuesday, September 18, 2018 Day 4 In Session 38 Tuesday, October 30, 2018 Day 2 In Session Wednesday, September 19, 2018 Day Holiday/Vaca Yom Kippur 39 Wednesday, October 31, 2018 Day 3 In Session 11 Thursday, September 20, 2018 Day 5 In Session 40 Thursday, November 1, 2018 Day 4 In Session 12 Friday, September 21, 2018 Day 6 In Session 41 Friday, November 2, 2018 Day 5 In Session Saturday, September 22, 2018 Saturday, November 3, 2018 Sunday, September 23, 2018 Sunday, November 4, 2018 13 Monday, September 24, 2018 Day 1 In Session 42 Monday, November 5, 2018 Day 6 In Session 14 Tuesday, September 25, 2018 Day 2 In Session Tuesday, November 6, 2018 Prof Dev. -

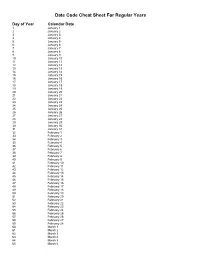

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April -

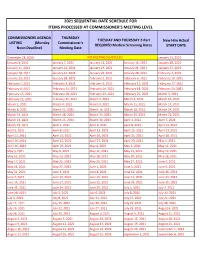

2021 Sequential Date List

2021 SEQUENTIAL DATE SCHEDULE FOR ITEMS PROCESSED AT COMMISSIONER'S MEETING LEVEL COMMISSIONERS AGENDA THURSDAY TUESDAY AND THURSDAY 2-Part New Hire Actual LISTING (Monday Commissioner's REQUIRED Medical Screening Dates START DATE Noon Deadline) Meeting Date December 28, 2020 NO MEETING SCHEDULED January 13, 2021 January 4, 2021 January 7, 2021 January 12, 2021 January 14, 2021 January 20, 2021 January 11, 2021 January 14, 2021 January 19, 2021 January 21, 2021 January 27, 2021 January 18, 2021 January 21, 2021 January 26, 2021 January 28, 2021 February 3, 2021 January 25, 2021 January 28, 2021 February 2, 2021 February 4, 2021 February 10, 2021 February 1, 2021 February 4, 2021 February 9, 2021 February 11, 2021 February 17, 2021 February 8, 2021 February 11, 2021 February 16, 2021 February 18, 2021 February 24, 2021 February 15, 2021 February 18, 2021 February 23, 2021 February 25, 2021 March 3, 2021 February 22, 2021 February 25, 2021 March 2, 2021 March 4, 2021 March 10, 2021 March 1, 2021 March 4, 2021 March 9, 2021 March 11, 2021 March 17, 2021 March 8, 2021 March 11, 2021 March 16, 2021 March 18, 2021 March 24, 2021 March 15, 2021 March 18, 2021 March 23, 2021 March 25, 2021 March 31, 2021 March 22, 2021 March 25, 2021 March 30, 2021 April 1, 2021 April 7, 2021 March 29, 2021 April 1, 2021 April 6, 2021 April 8, 2021 April 14, 2021 April 5, 2021 April 8, 2021 April 13, 2021 April 15, 2021 April 21, 2021 April 12, 2021 April 15, 2021 April 20, 2021 April 22, 2021 April 28, 2021 April 19, 2021 April 22, 2021 April 27, 2021 April -

Calendar for Federal Reports: What Is Due and When?

ITACC – Information and Technical Assistance Center for Councils on Developmental Disabilities Calendar for Federal Reports: What is Due and When? State Plan Amendment – A major change of a 5-year goal that alters the intent of the original goal (formerly referred to as “substantive change”). State Plan Update – Minor grammatical changes to 5-year goals and other components of the plan such as objectives, activities, expected outcomes, evaluation, etc. (formerly referred to as “non-substantive change”). What is due? When is it due? Notes Program Performance January 1, 2017 A reporting of activities and Report for FFY 2016 results for October 1, 2015 through September 30, 2016 State plan Updates for FFY January 1, 2017 As directed by AIDD re: 2017 State Plan Tier 2 Summary Report (email to Council ED) See description above State plan As directed by AIDD re: updates/amendments in State Plan Tier 2 Summary response to Tier 2 Review August 15, 2017 Report (email to Council ED) State plan amendments for August 15, 2017 See description above FFY 2018 Program Performance March 25, 2019 A reporting of activities and Report for FFY 2017 January 1, 2018 results for October 1, 2016 Postponed – due date to be through September 30, announced by AIDD 2017. State plan updates for FFY January 1, 2018 See description above 2018 9/3/2018 FFY 2019 Annual Work plan January 1, 2018 9/3/2018 FFY 2020 Annual Work plan January 1, 2018 9/3/2018 State plan amendments for August 15, 2018 See description above FFY 2019 Program Performance March 25, 2019 A reporting of activities and Report for FFY 2018 January 1, 2019 results for October 1, 2017 Postponed – due date to be through September 30, announced by AIDD 2018. -

Pay Date Calendar

Pay Date Information Select the pay period start date that coincides with your first day of employment. Pay Period Pay Period Begins (Sunday) Pay Period Ends (Saturday) Official Pay Date (Thursday)* 1 January 10, 2016 January 23, 2016 February 4, 2016 2 January 24, 2016 February 6, 2016 February 18, 2016 3 February 7, 2016 February 20, 2016 March 3, 2016 4 February 21, 2016 March 5, 2016 March 17, 2016 5 March 6, 2016 March 19, 2016 March 31, 2016 6 March 20, 2016 April 2, 2016 April 14, 2016 7 April 3, 2016 April 16, 2016 April 28, 2016 8 April 17, 2016 April 30, 2016 May 12, 2016 9 May 1, 2016 May 14, 2016 May 26, 2016 10 May 15, 2016 May 28, 2016 June 9, 2016 11 May 29, 2016 June 11, 2016 June 23, 2016 12 June 12, 2016 June 25, 2016 July 7, 2016 13 June 26, 2016 July 9, 2016 July 21, 2016 14 July 10, 2016 July 23, 2016 August 4, 2016 15 July 24, 2016 August 6, 2016 August 18, 2016 16 August 7, 2016 August 20, 2016 September 1, 2016 17 August 21, 2016 September 3, 2016 September 15, 2016 18 September 4, 2016 September 17, 2016 September 29, 2016 19 September 18, 2016 October 1, 2016 October 13, 2016 20 October 2, 2016 October 15, 2016 October 27, 2016 21 October 16, 2016 October 29, 2016 November 10, 2016 22 October 30, 2016 November 12, 2016 November 24, 2016 23 November 13, 2016 November 26, 2016 December 8, 2016 24 November 27, 2016 December 10, 2016 December 22, 2016 25 December 11, 2016 December 24, 2016 January 5, 2017 26 December 25, 2016 January 7, 2017 January 19, 2017 1 January 8, 2017 January 21, 2017 February 2, 2017 2 January -

COVID-19 Update September 30, 2020

COVID-19 Update September 30, 2020 As of September 29, 2020, at 8:30 PM, the total of laboratory-confirmed and probable COVID-19 cases reported among Connecticut residents is 57550, including 55129 laboratory-confirmed and 2421 probable cases. One hundred four patients are currently hospitalized with laboratory-confirmed COVID- 19. There have been 4508 COVID-19-associated deaths. In Connecticut during the early months of this pandemic, it became clear that it would be necessary to track probable COVID-19 cases and deaths, in addition to laboratory-confirmed (RT-PCR) cases and deaths. This was needed to better measure the burden and impact of this disease in our communities and is now part of the national surveillance case definition for COVID-19. Probable cases of COVID-19 involve persons who have not had confirmatory laboratory testing (RT-PCR) performed for COVID-19 whose symptoms indicate they are likely to have a COVID-19 infection. In Connecticut, most of the probable COVID-19 cases involve persons whose death certificates list COVID-19 disease or SARS-CoV-2 as a cause of death or a significant condition contributing to death. Prior to June 1, probable and confirmed cases were reported together. Overall Summary Total** Change Since Yesterday COVID-19 Cases 57550 +221 COVID-19-Associated Deaths 4508 +3 Patients Currently Hospitalized with COVID-19 104 +12 COVID-19 PCR Tests Reported 1591572 +12390 **Includes confirmed plus probable cases COVID-19 Cases and Associated Deaths by County of Residence As of 09/29/20 8:30pm. COVID-19 Cases COVID-19-Associated Deaths County Confirmed Probable Confirmed Probable Fairfield County 19403 822 1108 314 Hartford County 14107 694 1115 322 Litchfield County 1785 99 120 21 Middlesex County 1526 73 154 39 New Haven County 13947 530 958 157 New London County 1976 77 88 29 Tolland County 1253 110 52 15 Windham County 985 12 15 1 Pending address validation 147 4 0 0 Total 55129 2421 3610 898 1 All data are preliminary and subject to change. -

Due Date Chart 201803281304173331.Xlsx

Special Event Permit Application Due Date Chart for Events from January 1, 2019 - June 30, 2020 If due date lands on a Saturday or Sunday, the due date is moved to the next business day Event Date 30 Calendar days 90 Calendar Days Tuesday, January 01, 2019 Sunday, December 02, 2018 Wednesday, October 03, 2018 Wednesday, January 02, 2019 Monday, December 03, 2018 Thursday, October 04, 2018 Thursday, January 03, 2019 Tuesday, December 04, 2018 Friday, October 05, 2018 Friday, January 04, 2019 Wednesday, December 05, 2018 Saturday, October 06, 2018 Saturday, January 05, 2019 Thursday, December 06, 2018 Sunday, October 07, 2018 Sunday, January 06, 2019 Friday, December 07, 2018 Monday, October 08, 2018 Monday, January 07, 2019 Saturday, December 08, 2018 Tuesday, October 09, 2018 Tuesday, January 08, 2019 Sunday, December 09, 2018 Wednesday, October 10, 2018 Wednesday, January 09, 2019 Monday, December 10, 2018 Thursday, October 11, 2018 Thursday, January 10, 2019 Tuesday, December 11, 2018 Friday, October 12, 2018 Friday, January 11, 2019 Wednesday, December 12, 2018 Saturday, October 13, 2018 Saturday, January 12, 2019 Thursday, December 13, 2018 Sunday, October 14, 2018 Sunday, January 13, 2019 Friday, December 14, 2018 Monday, October 15, 2018 Monday, January 14, 2019 Saturday, December 15, 2018 Tuesday, October 16, 2018 2019 Tuesday, January 15, 2019 Sunday, December 16, 2018 Wednesday, October 17, 2018 Wednesday, January 16, 2019 Monday, December 17, 2018 Thursday, October 18, 2018 Thursday, January 17, 2019 Tuesday, December 18, 2018 -

Commissioner's Agenda

Commissioner’s Agenda 2021 2020 2019 2018 2017 2021-January-11 2020-January-13 2019-January-14 2018-January-03 2017-January 09 2021-January-27 2020-January-17 2019-January-30 Special Meeting 2017-January-25 2021-February-08 Special Meeting 2019-February-11 2018-January-08 2017-February-13 2021-February-24 2020-January-29 2019-February-27 2018-January-31 2017-February-22 2021-March-08 2020-February-10 2019-March-11 2018-February-12 2017-March-13 2021-March-31 2019-February-26 2019-March-27 2018-February-28 2017-March-29 2021-April-07 2020-March-09 2019-April-08 2018-March-12 2017-April-10 2021-April-12 2020-March-16 2019-April-16 2018-March-28 2017-April-26 2021-April-28 Special Meeting Special Meeting 2018-April-09 2017-May-08 2021-May-05 2020-March-25 2019-April-30 2018-April-25 2017-May-31 Special Meeting 2020-April-13 2019-May-13 2018-May-14 2017-June-12 2021-May-10 2020-April-29 2019-May-29 2018-May-30 2017-June-26 2021-May-26 2020-May-11 2019-June-10 2018-June-11 2017-July-10 2021-June14 2020-May-27 2019-June-24 2018-June-25 2017-July-26 2020-June-08 2019-July-08 2018-July-09 2017-August-14 2020-June-22 2019-July-31 2018-July-25 2017-August-30 2020-July-07 2019-August-02 2018-August-13 2017-September-11 Special Meeting 2019-August-12 2018-August-29 2017-September-29 2020-July-13 2019-August-28 2018-September-10 2017-October-10 2020-July-29 2019-August-28 2018-October-09 2107-October-25 2020-August-10 September Meeting 2018-October-31 2017-November-13 2020-August-26 Date Change Notice 2018-November-13 2017-November-27 2020-September-14 -

Investment Plan Reemployment Table

INVESTMENT PLAN Termination and Reemployment Limitations Renewed membership is allowed for reemployed service on or after July 1, 2017. Distribution Month Termination Requirement Reemployment (Retired) January 2020 January 2020‐July 31, 2020 August 1, 2020‐January 31, 2021 February 2020 February 2020‐August 31, 2020 September 1, 2020‐February 28, 2021 March 2020 March 2020‐September 30, 2020 October 1, 2020‐March 31, 2021 April 2020 April 2020‐October 31, 2020 November 1, 2020‐April 30, 2021 May 2020 May 2020‐November 30, 2020 December 1, 2020‐May 31, 2021 June 2020 June 2020‐December 31, 2020 January 1, 2021‐June 30, 2021 July 2020 July 2020‐January 31, 2021 February 1, 2021‐July 31, 2021 August 2020 August 2020‐February 28, 2021 March 1, 2021‐August 31, 2021 September 2020 September 2020‐March 31, 2021 April 1, 2021‐September 30, 2021 October 2020 October 2020‐April 30, 2021 May 1, 2021‐October 31, 2021 November 2020 November 2020‐May 31, 2021 June 1, 2021‐November 30, 2021 December 2020 December 2020‐June 30, 2021 July 1, 2021‐December 31, 2021 January 2021 January 2021‐July 31, 2021 August 1, 2021‐January 31, 2022 February 2021 February 2021‐August 31, 2021 1 September 1, 2021‐February 28, 2022 March 2021 March 2021‐September 30, 2021 October 1, 2021‐March 31, 2022 April 2021 April 2021‐October 31, 2021 November 1, 2021‐April 30, 2022 May 2021 Months May 2021‐November 30, 2021 December 1, 2021‐May 31, 2022 6 distributions June 2021 June 2021‐December 31, 2021 January 1, 2022‐June 30, 2022 July 2021 July 2021‐January 31, 2022 February