“A NEW APPROVAL POLL of INSTITUTIONS SHOWS Banks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Credit Card Disclosure (PDF)

OPEN-END CONSUMER CREDIT AGREEMENTS AND TRUTH IN LENDING DISCLOSURES Effective July 1, 2016 FEDERALLY INSURED BY NCUA PATELCO CREDIT UNION in agreements governing specific services you have and your general OPEN-END CONSUMER CREDIT AGREEMENTS AND membership agreements with Patelco, and you must have a satisfactory TRUTH IN LENDING DISCLOSURES loan, account and membership history with Patelco. MASTERCARD® CREDIT CARDS 2. On joint accounts, each borrower can borrow up to the full amount of SECURED MASTERCARD CREDIT CARD the credit limit without the other’s consent. PERSONAL LINE OF CREDIT 3. Advances Effective: JULY 1, 2016 a. Credit Card Advances: Credit Cards will be issued as instructed on This booklet contains agreements and Truth in Lending Disclosures your application. To make a purchase or get a cash advance, you that govern your use of the following Patelco Credit Union open-end can present the Card to a participating MasterCard plan merchant, consumer credit programs: to the Credit Union, or to another financial institution, and sign Pure MasterCard Payback Rewards World MasterCard the sales or cash advance draft imprinted with your Card number. Keep sales and cash advance drafts to reconcile your monthly Pure Secured MasterCard Passage Rewards World Elite MasterCard statements. You can also make purchases by giving your Card Points Rewards World MasterCard Personal Line of Credit number to a merchant by telephone, over the internet, or by other means, in which case your only record of the transaction may In addition to this booklet, -

2017 Annual Report

Leadership Team Leadership Team Patelco President and Chief Executive Officer Erin Mendez (center) with Board of Directors, L to R: Robert McCormish, Trevor Thomas, Sharon Wilson, Peter Hanelt, Race Chen, Jeffrey Parks, Tracey Scott, Jesse Rivera, Garick Zillgitt, Colleen Cabey, Lonnie Barish, Vickie Rath, John Rubino, and Debbie Chaw. Not pictured: Laura Chambers. Board of Directors Peter Hanelt Jeffrey Parks Garick Zillgitt Jesse Rivera 2017 Chairman First Vice Chair Second Vice Chair Treasurer Business Consultant CPA RPM Mortgage Insurance Executive Segal Consulting Colleen Cabey Lonnie Barish Laura Chambers Debbie Chaw Secretary Director Director Director Attorney at Law Wellspring Pharma Business Executive Cal State East Bay Services Race Chen Robert McCormish Vickie Rath Tracey Scott Director Director Director Director Consultant TeamCo Advisors, LLC Financial Consultant Housing Executive Trevor Thomas Sharon Wilson John Rubino Director Director Director Emeritus OpenX Macquarie Aircraft Leasing Walgreens (retired) Services Executive Team Erin Mendez Chris Allen Susan Gruber President Senior Vice President Senior Vice President Chief Executive Chief Risk Officer Chief Financial Officer Officer Susan Makris Melissa Morgan Kevin Landel Senior Vice President Senior Vice President Senior Vice President Chief Human Resources Chief Retail Officer Chief Information Officer Officer 2017 ANNUAL REPORT Garick Zillgitt Jesse Rivera 2017 Second Vice Chair Treasurer Insurance Executive Segal Consulting Annual Report Laura Chambers Director Business Executive Federally Insured by NCUA To Our Members To Board Chairman’s report As we begin 2018, our vision is clear: for Patelco other disasters that affected our local California to be a leading credit union where members and communities as well as our members outside financial health come first. -

Congratulations to This Year's Local Favorites

City buckles down on water consumption Page 5 6/,86 .5-"%2s*5.% WWW.PLEASANTONWEEKLY.COM Congratulations to this year’s local favorites PAGE 13 5 NEWS School board OKs local accountability plan 8 NEWS Another successful Ladies Day at the Races 32 REAL ESTATE U.S. home builder confidence rises June 18 - July 6 Taste the Open Tuesday - Sunday REd HWhite & Blue Safeway Concert series AMPHITHEATER Free Show Nightly At 8 PM Ashanti july 2 Paul rodriguez Jt hodges tesla true 2 crue June 27 June 28 June 29 july 1 “Best Seats” concerts wristbands free with adUission for Årst in line starting at 2 PM daily. Red, White & Blues Visit america Festival building 429 night ranger AlamedaCountyFair.com july 3 July 4 ( 1pm-9pm) july 5 July 6 Fireworks horse racing Spectacular Sponsored by: thursday - sunday JULY 4 stakes races from $50k to $100K Military appreciation days $2 tuesdays senior free thursdays kids free fridays Discounts *Kids 12 and under FREE Admission FREE admission with military ID *$2 Admission *62 + FREE Admission Every day all day July 1 *end at 5pm July 3 june 27 & July 4 Sponsored by: Do you want the best in home care for your family? Call Home Care Assistance. “Named national winner of the ‘Best of Home Care Award’ by Home Care Pulse.” It starts with our caregivers. We carefully screen nearly 25 applicants Hourly caregiving works well for many families. In this situation we for each caregiver we hire. Only the best are good enough for Home provide trained caregivers on an hourly basis. -

Tri-Valley's New Book Launch Team

Tri-Valley’s new Book Launch Team Page 14 VOL. XIX, NUMBER 26 • JULY 20, 2018 WWW.PLEASANTONWEEKLY.COM 5 NEWS Temporary ban on new massage shops downtown 10 PULSE Pleasanton PD announces promotions, new officers 11 EDITORIAL Documents reveal little on HPMS principal exit Paid for by Stanford Health Care “Stanford Health Care’s ability to give me answers has made a huge impact on my life.” — Rachel who happens to know that people with Marfan Ten Years and Four Diagnoses Later, are at greater risk of developing a leak. After the personal experience I had with it, I started reaching Patient Gets Her Life—Back out to the Stanford Headache Clinic, and the POTS When Rachel was a kid and telling stories about all the blood draws and Marfan Clinics. Now we’re all reading about it and it has created a great dialogue.” explains Dr. leaving scars on her arms, she realized this wasn’t the childhood Carroll. “Th ere is a place in our society for a group experience most other kids had. Th ey fell out of trees and scrapped of doctors that want to see the most difficult cases, that want to spend their time reading about those their knees but didn’t usually endure years of being sick. cases and trying to develop new treatments for those cases and that place is Stanford.” For almost 10 years, Rachel suffered with When Rachel first got the CSF diagnosis, she was headaches, nausea, and dehydration. Sometimes hospitalized since she was having trouble getting Dr. Carroll admits he gets invested in his client’s she would just experience sensory overload with out of bed. -

2019 Annual Report

2019 Annual Report Insured by NCUA Dublin. The purchase was the largest capital At a time like this, it is good advice to step back, expenditure ever by the credit union, and it take a deep breath, and consider what we know provides the team with much-needed space and do not know. While we do not know the to serve you today as well as to grow in the duration of this crisis in 2020, we do know we are future. The new headquarters is designed prepared, we know we have successfully come around collaboration and provides more areas through dozens of very challenging events in the for community interaction as well. past, we know we have deep financial strength that you have helped us build, we know our All of us – from our branches to our investment focus is on you our member, and we will, even advisors to our call center – coordinate each day now, continue to build for the future with new to help you access superior financial tools that offerings, and new and better ways of service. improve your financial wellness. We also listen Your board of directors is grateful that we are carefully to you so we can learn about your unique allowed to be fiduciaries of what hundreds financial challenges and opportunities. Listening of thousands of members, employees, and to your needs and designing our products and executives have built over 84 years. The board is services to meet them exemplifies our mission committed to continuing to grow a solid financial as a not-for-profit financial cooperative. -

3500 HSA Custodial Application, Plan Agreement and Disclosure Statement

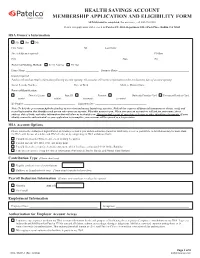

HEALTH SAVINGS ACCOUNT MEMBERSHIP APPLICATION AND ELIGIBILITY FORM All fields must be completed. For assistance, call 800-358-8228. Return this application with a check to: Patelco CU, HSA Department #25, 3 Park Place, Dublin, CA 94568 HSA Owner’s Information Mr. Mrs. Ms. First Name _____________________________________________ MI ____________ Last Name _______________________________________________________ Street Address (required) _______________________________________________________________________________________ PO Box ____________________ City _______________________________________________________________________________ State __________________ Zip _______________________ Preferred Mailing Method: Street Address PO Box Home Phone ________________________________________________________ Business Phone ______________________________________________________ Email (required) __________________________________________________________________________________________________________________________ Patelco will send an email confirmation following account opening. All accounts will receive confirmation within two business days of account opening. Social Security Number ___________________________ Date of Birth _______________________ Mothers Maiden Name _________________________________ Form of Identification: __________ Driver’s License __________ State ID ______________ Passport ______________ Matricula Consular Card Permanent Resident Card (state) (state) (country) (country) ID Number _______________________________________ Expiration -

Consumer Loans Financial Hardship Assistance Request

Consumer Loans Financial Hardship Assistance Request Account Number Loan Suffix BORROWER / MEMBER INFORMATION Last Name First Name Middle Initial Date of Birth Social Security Number Driver's License Number Home Phone Mobile Phone Email Address Residential Address, City, State, Zip Mailing Address, City, State, Zip (if different) Present Employer Title/Position Annual Salary Employer Street Address, City, State, Zip Work Phone Hire Date (Length of Employment) CO-BORROWER / SPOUSE INFORMATION Last Name First Name Middle Initial Date of Birth Social Security Number Driver's License Number Home Phone Mobile Phone Email Address Residential Address, City, State, Zip Present Employer Title/Position Annual Salary Employer Street Address, City, State, Zip Work Phone Hire Date (Length of Employment) VEHICLE STATUS (for Vehicle Modification Only) Are you in possession of this vehicle? Yes No Is the vehicle registration current? Yes No Is your auto insurance policy current? Yes No Year Make Model Mileage ASSET INFORMATION Borrower Co-Borrower / Spouse Balance Balance Savings Account(s) $ $ Checking Account(s) $ $ 401(k) $ $ Stocks/Bonds $ $ Other Account: $ $ Total Assets $ $ Page 1 of 4 CL JP210419 Rev.2021.04 Consumer Loans Financial Hardship Assistance Request MONTHLY INCOME Borrower Co-Borrower / Spouse Monthly Gross Wages $ $ Overtime $ $ Tips, Commissions, and Bonus $ $ Self-Employment Income $ $ Unemployment Income $ $ Non-Taxable Social Security / SSDI $ $ Social Security Benefits $ $ Income from Annuities or Retirement Plans $ $ Child -

Lienholder Code List 9/27/2021

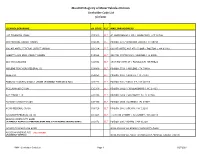

MassDOT-Registry of Motor Vehicles Division Lienholder Code List 9/27/2021 LIENHOLDER NAME LH CODE ELT MAILING ADDRESS 1ST FINANCIAL BANK C50366 ELT 47 SHERMAN HILL RD / WOODBURY / CT 06798 360 FEDERAL CREDIT UNION C02166 ELT PO BOX 273 / WINDSOR LOCKS / CT 06096 600 ATLANTIC FEDERAL CREDIT UNION C01314 ELT 600 ATLANTIC AVE 4TH FLOOR / BOSTON / MA 02210 ABBOTT LABS EMPL CREDIT UNION C13286 ELT 325 TRI STATE PKWY / GURNEE / IL 60031 ABC BUS LEASING C41552 ELT 1506 NW 30TH ST / FARIBAULT/ MN 55021 ABILENE TEACHERS FEDERAL CU C06969 ELT PO BOX 5706 / ABILENE / TX 79608 ABLE INC C50051 ELT PO BOX 1907 / AUSTIN / TX 78767 ABOUND FEDERAL CREDIT UNION (FORMERLY FORT KNOX FCU) C02772 ELT PO BOX 900 / RADCLIFF / KY 40159 ACCLAIM FED CR UN C31308 ELT PO BOX 29527 / GREENSBORO / NC 27420 ACF FINCO 1 LP C42336 ELT PO BOX 2969 / SPRINGFIELD / IL 62708 ACHIEVA CREDIT UNION C34463 ELT PO BOX 1500 / DUNEDIN /FL 34697 ACMG FEDERAL CR UN C00716 ELT PO BOX 188 / SOLVAY / NY 13209 ACUSHNET FEDERAL CR UN C01006 ELT 112 MAIN STREET / ACUSHNET / MA 02743 ADAMS COMMUNITY BANK (FORMERLY ADAMS COOPERATIVE BANK AND SOUTH ADAMS SAVINGS BANK) C01872 ELT PO BOX 306 / ADAMS / MA 01220 ADAMS COOPERATIVE BANK NOW KNOWN AS ADAMS COMMUNITY BANK ADDISON AVENUE FCU (ALL TITLES) (FORMERLY HPEFCU) NOW KNOWN AS FIRST TECHNOLOGY FEDERAL CREDIT UNION RMV - Lienholder Code List Page 1 9/27/2021 MassDOT-Registry of Motor Vehicles Division Lienholder Code List 9/27/2021 LIENHOLDER NAME LH CODE ELT MAILING ADDRESS ADVANCIAL FEDERAL CREDIT UNION C40457 ELT PO BOX 276711 / SACRAMENTO -

Patelco Points Rewards World Mastercard Credit Card Guide

Mastercard® Guide to Benefits for Credit Cardholders Patelco Points Rewards World Mastercard Important information. Please read and save. This Guide to Benefits contains detailed information about insurance and other services you can access as a preferred cardholder. This Guide supersedes any Guide or program description you may have received earlier. To file a claim or for orm e information on any of these services, call the Mastercard Assistance Center at 1-800-Mastercard: 1-800-627-8372, or en Español: 1-800-633-4466. “Card” refers to World Mastercard® card and “Cardholder”refers to a Mastercard® cardholder. Key Terms Postmates Throughout this document, you and your refer to the Program Description: Cardholder. We, us, and our refer to New Hampshire Postmates helps people unlock the best of their cities – and Insurance Company, an AIG company, New York, NY. their lives, with an insanely reliable “everything” network. Account Holder means a person to whom an Eligible Account Postmates is the first on-demand company – helping is issued and who holds the Eligible Account under his or her customers in 650 US cities & Mexico get anything, anytime, name. anywhere. World Mastercard cardholders receive a $5 Administrator means Sedgwick Claims Management discount on all orders over $25. Services, Inc. You may contact the Administrator if you have Eligibility: questions regarding this coverage or would like to make To be eligible for this benefit, you must use a valid World a claim. The Administrator may be reached by phone at Mastercard issued by a U.S. financial institution. 1-800-Mastercard. Authorized User means a person who is recorded as an How to use the Postmates benefit: authorized user of an Eligible Account by the Account Holder • Visit http://www.postmates.com or download the and who is authorized by the Account Holder to make Postmates app from the App Store, Google Play, or simply payments to the Eligible Account. -

Fee Schedule Effective June 1, 2021

Fee Schedule Effective June 1, 2021 Summary of Fee-Free Products and Services Free Checking Account Free Temporary Checks (up to 20) Free Lost Card Replacement (up to 2 per year) Free Patelco ATM Withdrawals Free CO-OP Network ATM Withdrawals Free Unlimited In-branch Transactions Free Online Banking and Bill Pay Free Remote Deposit Free Account Alerts Free Credit Card Balance Transfers Free Over the Credit Limit Fee Free Money Market Checks (not including shipping) - may use 3 per month Free Initial Consultation with a CFS Financial Advisor† Free Check Copies (excluding HELOC; up to 5 per month) Free Photocopies (not including research) Free Statement Copies (up to 5) Free Notary Fee (Patelco documents only) Free HELOC Check Copies (up to 12 checks or 18 months) Free See Reverse for Additional Services All fees and charges are subject to updating and revision upon proper notice. How to contact us Commitment Households are eligible for waiver of certain fees. Other fees may be waived at our discretion, subject to your meeting certain 800.358.8228 criteria and qualifications. This June 1, 2021 Fee Schedule supersedes any Patelco Credit Union, PO Box 2227, Merced, CA 95344 previous printed Fee Schedule. Checking Non-Sufficient Funds (NSF) Charges per Presentment Interest Checking Account (with less than Returned NSF Fee $28.00 $5.00 per month $500 Average Daily Balance) Paid NSF Fee $28.00 Premier Interest Checking Account (with less $10.00 per month than $5,000 Average Daily Balance) UCF (Uncollected Funds) Fee $28.00 Plus Checking Account -

Member Handbook

Member Handbook Effective July 1, 2021 INSURED BY NCUA PATELCO CREDIT UNION MEMBER HANDBOOK EFFECTIVE: July 1, 2021 Introduction ........................................................................................................................ 1 Electronic Transfer Errors or Unauthorized Use ................................................ 15 Important Information about Procedures for Closing Accounts .................................................................................................................15 Opening a New Account .............................................................................................. 1 Escheat ................................................................................................................................... 15 GENERAL AGREEMENTS OF MEMBERS ..................................................... 1 Our Handling of Accounts in Case of Your Death or Incompetence ........16 Joining Patelco Credit Union ............................................................................................1 Early Withdrawal Penalties; Waiver of Penalties ............................................... 16 Terminology ..............................................................................................................................2 Authorization Holds for Debit Card Transactions ...............................................16 Membership Requirements and Eligibility for Services .....................................2 NSF Transactions ..................................................................................................................17 -

2014 ANNUAL REPORT to Our Members to Board Chairman’S Report

2014 ANNUAL REPORT To Our Members To Board Chairman’s Report Patelco’s mission is clear - we are committed to 2014 was also a year of internal growth for Patelco. enriching our members’ financial well-being while Erin led the team through a year of organizational providing superior service and value. After settling in and cultural transformation with a focus on to the significant changes that took place in 2013, in structuring a leadership team committed to 2014 we returned to our roots and began building on building the skill set and expertise of the Patelco our foundation of exceptional service and value that team members that serve you every day. With her we offer our member-owners and the communities leadership, the team continues to innovate with that we serve. a reinvigorated drive, pushing Patelco to strong As I have stated before, putting our members first is financial performance while delivering on our paramount in everything we do at Patelco, as is doing mission. Not only is she a true advocate for the so with integrity, passion, and trust. As the leader of Patelco membership, she is instilling her passion for your Board of Directors, I am committed to ensuring Patelco and the Credit Union movement in her team. that the board members and I evaluate every As we look forward, I am confident that with Erin’s decision based on its benefit to Patelco’s member- leadership and the dedication of the team members owners. It is through this lens that we evaluated all of 2015 will be one of Patelco’s greatest years.