Federal Communications Commission Washington, D.C. 20554

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

P85959 the E. W. Scripps Company 10K 2017 V1

2016 ANNUAL REPORT FINANCIAL HIGHLIGHTS Operating Revenues Operating Revenues By Segment Continuing Operations Continuing Operations (Dollars in millions) $1000 Syndication and other Digital 1% Radio 7% $750 7% $500 $250 $716 $943 $499 85% Television $0 2014 2015 2016 2016 Operating Results – Continuing Operations 2014 2015 2016 (Dollars in millions) Consolidated Operating revenues............................................. $499 $716 $943 Operating income....................................................... 26 (83) 127 Net income (loss)................................................ 9.5 (67) 67 Television Segment operating revenues............................... 467 610 802 [ Radio Segment operating revenues............................... – 59 71 [ M Digital Segment operating revenues............................... 23 39 62 Segment loss....................................................... (23) (17) (16) Syndication and other Segment operating revenues............................... 9 8 8 Segment loss....................................................... (1.5) (1.1) (0.8) LETTER TO SHAREHOLDERS To our shareholders: From the vantage point of spring 2017, I can see behind us a year when our television division delivered record revenue, driven by more than $100 million of political advertising revenue and a 50 percent increase in fees we receive from cable and satellite operators who include our TV stations in their packages. From this same vantage point, I can see ahead to a year when local broadcasters’ optimism already has been lifted by the promised tailwinds of the advancement of next-gen television transmission standard ATSC 3.0 as well as further increases in the value of our content as represented by rising rates for the retransmission of our stations. At Scripps, 2017 also brings the promise of new leadership. After nearly 18 years as a member of the senior leadership team here at Scripps — including nine as CEO — I will retire from the role of president and CEO later this year, retaining the job of chairman of the board. -

Community Involvement Plan

Miracle Mile Water Quality Assurance Revolving Fund Site Tucson, Arizona Community Involvement Plan Flowing Wells Irrigation District Water Treatment System February 2020 ADEQ Document No. EQR-20-03 Table of Contents Community Involvement Plan – Introduction ........................................................................... 1 A. WQARF Process ........................................................................................................... 2 B. Designated Spokesperson ............................................................................................ iv C. Information Repository and Website ........................................................................... iv Chapter 1 – Site Overview ........................................................................................................... 5 Chapter 2 – Community Profile .................................................................................................. 7 A. Community Involvement Area ..................................................................................... 7 B. Community Demographics ........................................................................................... 8 Chapter 3 – Community Issues and Concerns ......................................................................... 11 A. Environmental and Health Concerns .......................................................................... 11 B. Outreach and Other Concerns .................................................................................... -

Licensing and Management System

Approved by OMB (Office of Management and Budget) 3060-0010 September 2019 (REFERENCE COPY - Not for submission) Commercial Broadcast Stations Non-Biennial Ownership Report (FCC Form 323) File Number: 0000066906 Submit Date: 2019-01-11 FRN: 0022406706 Purpose: Commercial Broadcast Stations Non-Biennial Ownership Report Status: Superceded Status Date: 01/15/2019 Filing Status: InActive Section I - General Information 1. Respondent FRN Entity Name 0022406706 SummitMedia, LLC Street City (and Country if non U. State ("NA" if non-U. Zip Address S. address) S. address) Code Phone Email 2700 Birmingham AL 35242 +1 (205) darryl. Corporate 322-2987 grondines@summitmediacorp. Drive com Suite 115 2. Contact Name Organization Representative Francisco R. Montero, Esq. Fletcher Heald & Hildreth, PLC Zip Street Address City (and Country if non U.S. address) State Code Phone Email 1300 North Arlington VA 22209 +1 (703) 812-0400 [email protected] 17th Street 11th Floor Not Applicable 3. Application Filing Fee 4. Nature of (a) Provide the following information about the Respondent: Respondent Relationship to stations/permits Entity required to file a Form 323 because it holds an attributable interest in one or more Licensees Nature of Respondent Limited liability company (b) Provide the following information about this report: Purpose Transfer of control or assignment of license/permit "As of" date 11/01/2018 When filing a biennial ownership report or validating and resubmitting a prior biennial ownership report, this date must be Oct. 1 of the year in which this report is filed. 5. Licensee(s) /Permittees(s) Respondent is filing this report to cover the following Licensee(s)/Permittee(s) and station(s)/permit(s): and Station(s) Licensee/Permittee Name FRN /Permit(s) SM-KQCH, LLC 0027762020 Fac. -

OFFICIAL RULES for SUMMITMEDIA RADIO KYQQ La Autentica De Jerez Giveaways Wk 8.30 5X

OFFICIAL RULES FOR SUMMITMEDIA RADIO KYQQ La Autentica de Jerez Giveaways_Wk 8.30_5x The following are the official rules of SummitMedia, LLC (“Sponsor”) for the KYQQ La Autentica de Jerez Giveaways_Wk 8.30_5x contest (“Contest”). By participating, each participant agrees as follows: 1. NO PURCHASE IS NECESSARY. Void where prohibited by law. All federal, state, and local regulations apply. 2. ELIGIBILITY. This Contest is open only to legal U.S. residents age eighteen (18) years or older at the time of entry with a valid Social Security number and who reside in the KYQQ-FM listening area. Individuals age 13 to 17 may be eligible to participate in Contests with the approval of a parent or legal guardian, provided that the parent or legal guardian is a legal U.S. resident at least 18 years of age at the time of entry with a valid Social Security number and resides in the sponsoring SummitMedia radio station’s listening area, but Sponsor reserves the right to refuse to award certain prizes to or on behalf of any minor. Employees of SummitMedia, its parent company, affiliates, related entities and subsidiaries, promotional sponsors, prize providers, advertising agencies, other radio stations serving the SummitMedia radio station’s listening area, and the immediate family members and household members of all such employees are not eligible to participate. The term “immediate f amily members” includes spouses, parents and stepparents, siblings and step-siblings, and children and stepchildren. The term “household members” refers to people who share the same residence at least three (3) months out of the year. -

Why Larry Wilson Stepped Down As Alpha Media Chairman. After Founding Alpha Media with Six of West-Central Missouri

Inside Radio Weekly August 6-10, 2018 Inside Story: Why Larry Wilson Stepped Down As Alpha Media Chairman. After founding Alpha Media with six of west-central Missouri. Alpha Media for a change and didn’t elaborate further. stations in 1999 and growing it into one president/CEO Bob Proffitt told Inside “As with every company, there comes of the largest privately held radio groups, Radio in a recent interview that some a time for transitions in the leadership stepping down as chairman is likely portfolio trimming is possible. “It depends positions,” VP of marketing Randi P’Pool bittersweet for Larry Wilson. While neither on how our board and investors feel, but told Inside Radio. “Bob and his team Wilson nor the company has offered a right now we’d like to de-lever a little bit,” have worked closely with Larry for many public explanation for the abrupt change he said. years, and there comes a time when announced last week, sources say it has many factors come into play when the to do with differences of opinion between But as an independent-minded, lifelong founder changes roles.” Wilson and Alpha’s board of directors broadcaster who built the company over the future direction of the company. from scratch, those who know Wilson P’Pool noted that Wilson remains a well say it’s not hard to imagine him board member, adding, “We value his being a reluctant seller and not wanting past contributions and look forward to to let go of some of the radio empire he his continued contributions in the future.” weaved together, especially with the As for selling – or buying – the company potential for the FCC to loosen its radio is keeping its options open. -

Public Notice >> Licensing and Management System Admin >>

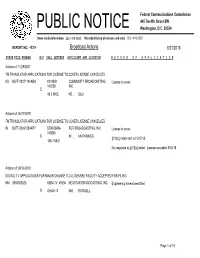

REPORT NO. PN-1-210201-01 | PUBLISH DATE: 02/01/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000133623 Renewal of FX K298AG 155267 107.5 NORFOLK, NE FLOOD 01/28/2021 Accepted License COMMUNICATIONS, For Filing L.L.C. From: To: 0000133486 License To FX W223DC 201383 92.5 BERLIN, NH WHITE MOUNTAINS 01/28/2021 Accepted Cover BROADCASTING, LLC For Filing From: To: 0000133665 Renewal of FL KYTF-LP 196817 94.7 BLAIR, NE BLAIR HEALING 01/28/2021 Accepted License ROOMS INC For Filing From: To: 0000133558 Minor FM KRSH 16257 Main 95.9 HEALDSBURG, SINCLAIR 01/28/2021 Accepted Modification CA TELECABLE, INC. D/B For Filing /A SINCLAIR COMMUNICATIONS From: To: 0000133401 Renewal of FM KKNL 122329 Main 89.3 VALENTINE, NE COMMUNITY PUBLIC 01/28/2021 Accepted License MEDIA For Filing From: To: 0000133247 Renewal of FM KXBL 68331 Main 99.5 HENRYETTA, GRIFFIN LICENSING, 01/27/2021 Accepted License OK L.L.C. For Filing From: To: Page 1 of 17 REPORT NO. PN-1-210201-01 | PUBLISH DATE: 02/01/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000132803 Renewal of DTV KEMV 2777 Main 210.0 MOUNTAIN Arkansas Educational 01/27/2021 Accepted License VIEW, AR Television Commission For Filing From: To: 0000133528 Renewal of AM KSCB 59803 Main 1270.0 LIBERAL, KS Seward County 01/28/2021 Accepted License Broadcasting Co., Inc. -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM -

U. S. Radio Stations As of June 30, 1922 the Following List of U. S. Radio

U. S. Radio Stations as of June 30, 1922 The following list of U. S. radio stations was taken from the official Department of Commerce publication of June, 1922. Stations generally operated on 360 meters (833 kHz) at this time. Thanks to Barry Mishkind for supplying the original document. Call City State Licensee KDKA East Pittsburgh PA Westinghouse Electric & Manufacturing Co. KDN San Francisco CA Leo J. Meyberg Co. KDPT San Diego CA Southern Electrical Co. KDYL Salt Lake City UT Telegram Publishing Co. KDYM San Diego CA Savoy Theater KDYN Redwood City CA Great Western Radio Corp. KDYO San Diego CA Carlson & Simpson KDYQ Portland OR Oregon Institute of Technology KDYR Pasadena CA Pasadena Star-News Publishing Co. KDYS Great Falls MT The Tribune KDYU Klamath Falls OR Herald Publishing Co. KDYV Salt Lake City UT Cope & Cornwell Co. KDYW Phoenix AZ Smith Hughes & Co. KDYX Honolulu HI Star Bulletin KDYY Denver CO Rocky Mountain Radio Corp. KDZA Tucson AZ Arizona Daily Star KDZB Bakersfield CA Frank E. Siefert KDZD Los Angeles CA W. R. Mitchell KDZE Seattle WA The Rhodes Co. KDZF Los Angeles CA Automobile Club of Southern California KDZG San Francisco CA Cyrus Peirce & Co. KDZH Fresno CA Fresno Evening Herald KDZI Wenatchee WA Electric Supply Co. KDZJ Eugene OR Excelsior Radio Co. KDZK Reno NV Nevada Machinery & Electric Co. KDZL Ogden UT Rocky Mountain Radio Corp. KDZM Centralia WA E. A. Hollingworth KDZP Los Angeles CA Newbery Electric Corp. KDZQ Denver CO Motor Generator Co. KDZR Bellingham WA Bellingham Publishing Co. KDZW San Francisco CA Claude W. -

Broadcast Actions 8/21/2018

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 49304 Broadcast Actions 8/21/2018 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 11/29/2007 FM TRANSLATOR APPLICATIONS FOR LICENSE TO COVER LICENSE CANCELLED KS BLFT-20071101ABO K242BM COMMUNITY BROADCASTING, License to cover. 142058 INC. E 96.3 MHZ KS ,IOLA Actions of: 05/17/2018 FM TRANSLATOR APPLICATIONS FOR LICENSE TO COVER LICENSE CANCELLED IN BLFT-20061030APY DDW294BA FCR BROADCASTING, INC. License to cover. 143860 E IN ,VALPARAISO §312(g) letter sent on 5/17/18. 106.7 MHZ No response to §312(g) letter. License cancelled 8/16/18. Actions of: 08/16/2018 DIGITAL TV APPLICATIONS FOR MINOR CHANGE TO A LICENSED FACILITY ACCEPTED FOR FILING NM 0000002625 KBIM-TV 48556 NEXSTAR BROADCASTING, INC. Engineering Amendment filed E CHAN-10 NM ,ROSWELL Page 1 of 16 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 49304 Broadcast Actions 8/21/2018 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 08/16/2018 AM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE GRANTED UT BAL-20180625ABN KRRF 58303 RADIO LICENSE HOLDING CBC, Voluntary Assignment of License LLC From: RADIO LICENSE HOLDING CBC, LLC E 1230 KHZ To: KONA COAST RADIO, LLC UT , MURRAY Form 314 IA BAL-20180702AAZ KWPC 47085 WPW BROADCASTING, INC. -

13000817.Pdf

AS Nr 0616 AN OKF III I/NO NI.FLF NN hi FF066 LI/F 06 ON IN Yb OK lit rIco KKV FL 15 rn hp WIK Mynr NW WALK IN P1 \/ LP1n 10 KNN FW WFV VNF 06 11 AL viE06 1FF NO ry Inc or 110 TH IN OIL KY Fl ci 6K ott or CC 016 hOC Cl 1ok ry 0/ 34 ILtitAt is KY IF Ic ntr/ Fit irtry hr KFFF cC FV ORoi 6\ CC FMK 06 606 CXLIII it 0/0 Id WI IF Kr ij WKFFF ro ni Fl Vi crv WOO Mi Ic flOV Kcv s/F nO FOcI FIn ilv OK ws IC V/Fl it Or Fir 01 nO Cs iNFi oUorr it NAP nFl it ii lill cfl0S rsrr tO /F LIALS w5 FINANCIAL HIGHLIGHTS MLIIONS 2012 2011 Ai S1tc 3% ib iOO $356 Revenue $600 $398 Operating irnings $3.3 $12.2 Net earnings Bsharc $061 $0.3 DultLed arningspcr ClauAad $62S.8 $41/I lotal issels $246.0 Li tot debt 1205S $.06 lotal oquity lass 43/SOS 431/83 Cmmon sin es outstanding it itt 1t is ystcc Class 636.0 14 Class 3640 2012 2011 co 18 High $b.8t Class common stot.k price per nr Low $3.94 $1 fl Clnc $51/ Journal ommurixations seeks to giow our oral mar ket business through relevant and differentiated content across 12 states 15 tE rvcson statio is 34 radio statons nd daly community newspapers and inteiactiv prop ci ties We improved our rum etitive position in 2012 three ways th the acqu don of WI VF Nc wshannel 51M in Nashvillc iN the 29th largcst DMA wo added so ncr stone asset and the leading stat in stiong iarket Ow continur to mat re with our new Fox In Wiscnr sin we arqu opwaV under multi year par trierk.h Network which gai es as well as oths In Radio we BOB chase Wh ii thess remain the Milwau extciideo our ft no strnd ng hereM our with to receive this -

Emergency Alert System Plan

State Emergency Alert System Plan 2013 i i ii Record of Changes Change Location of Change Date of Date Entered Person Making Number Change Change iii Contents Promulgation Letter ....................................................................................................................................... i Concurrence Signatures…………………………………………………………………………………….ii Record of Changes…...…………………………………………………………………………………….iii Purpose .......................................................................................................................................................... 1 Authority ....................................................................................................................................................... 1 Introduction ................................................................................................................................................... 1 General Considerations ................................................................................................................................. 1 Definitions..................................................................................................................................................... 2 Concept of Operation .................................................................................................................................... 3 Methods of Access for System Activation .................................................................................................... 3 A. State Activation -

KRVB, KTHI and KJOT Compassion Awards Official Rules No Purchase

KRVB, KTHI and KJOT Compassion Awards Official Rules No purchase or obligation necessary to enter or win. PROMOTION DATES These rules (the “Official Rules”) govern the Compassion Awards (“Promotion”), which will begin on April 8, 2019 and end on May 12, 2019. CONTEST DESCRIPTION: Requirements: Must be 18 years of age or older and have a valid Idaho Driver’s License or Government Issued Identification Card. Grand Prize: One (1) grand prize winner will win $500 cash as a gesture of appreciation and a produced segment for air (and as a keepsake) proudly recognizing their achievement. The award is sponsored by Saint Alphonsus Regional Medical Center, Ennis Fine Furniture and Butler Heating and Cooling. HOW TO ENTER/WIN: Listeners of KRVB, KTHI and KJOT can submit nominee stories on the station websites. www.riverboise.com, www.khitsboise.com and www.j105.com. ELIGIBILITY RESTRICTIONS: 1. The KRVB, KTHI AND KJOT’s Compassion Award is open to listeners of KRVB, KTHI AND KJOT who are 18 years of age and older and are legal residents of the 48 contiguous United States residing with the, Boise metropolitan area. 2. Employees of KRVB, KTHI AND KJOT, and KQXR, Boise Lotus Corp, and its subsidiaries, affiliates, general sponsors, advertisers, competitors, promotional partners, other radio stations in the Boise metropolitan area, and members of the immediate families or those living in the same households (whether related or not) of any of the above are NOT eligible to participate or win in this KRVB, KTHI AND KJOT’s Compassion Award. For purposes of this contest, immediate family members mean spouses, parents, grandparents, children, and siblings and their respective spouses are not eligible.