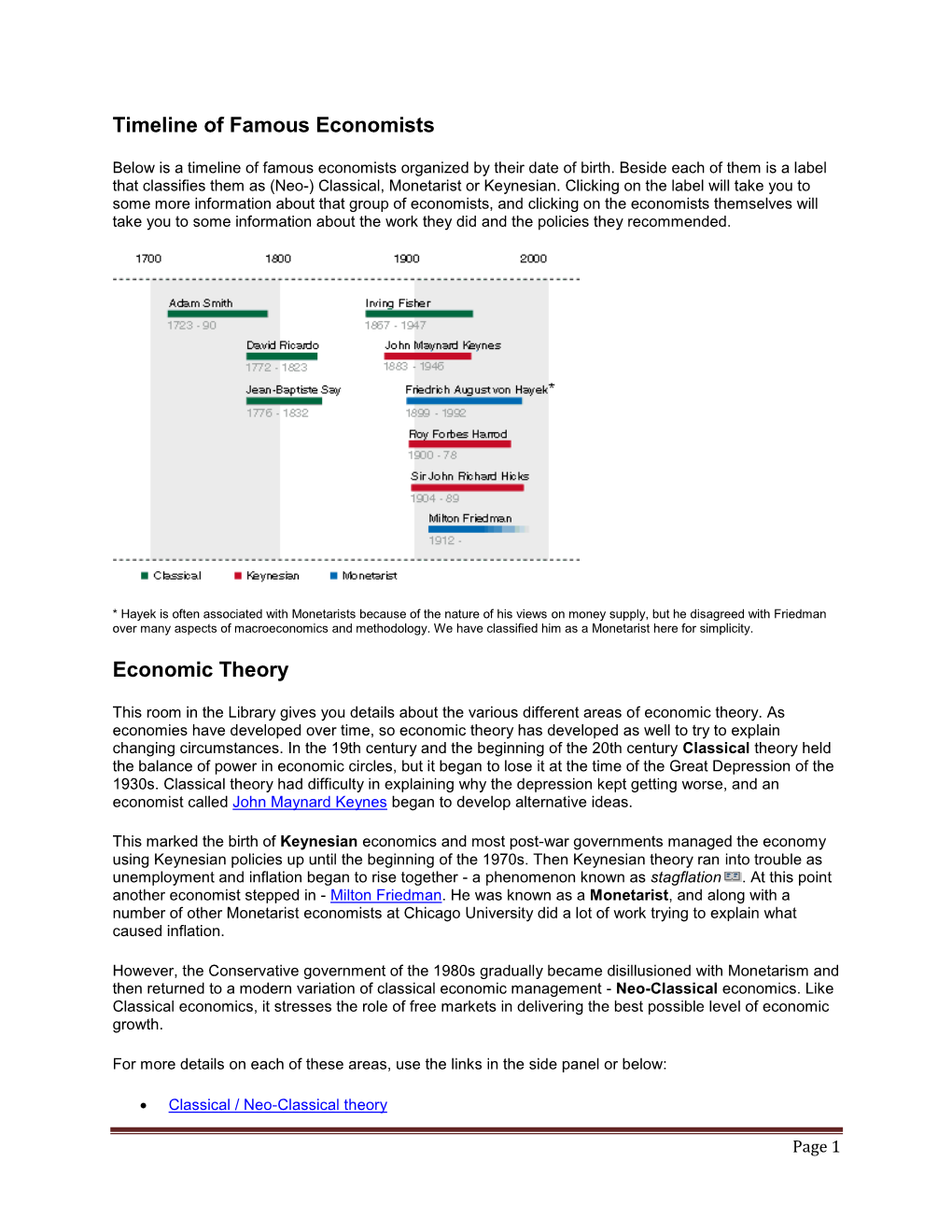

Timeline of Famous Economists Economic Theory

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BIS Working Papers No 136 the Price Level, Relative Prices and Economic Stability: Aspects of the Interwar Debate by David Laidler* Monetary and Economic Department

BIS Working Papers No 136 The price level, relative prices and economic stability: aspects of the interwar debate by David Laidler* Monetary and Economic Department September 2003 * University of Western Ontario Abstract Recent financial instability has called into question the sufficiency of low inflation as a goal for monetary policy. This paper discusses interwar literature bearing on this question. It begins with theories of the cycle based on the quantity theory, and their policy prescription of price stability supported by lender of last resort activities in the event of crises, arguing that their neglect of fluctuations in investment was a weakness. Other approaches are then taken up, particularly Austrian theory, which stressed the banking system’s capacity to generate relative price distortions and forced saving. This theory was discredited by its association with nihilistic policy prescriptions during the Great Depression. Nevertheless, its core insights were worthwhile, and also played an important part in Robertson’s more eclectic account of the cycle. The latter, however, yielded activist policy prescriptions of a sort that were discredited in the postwar period. Whether these now need re-examination, or whether a low-inflation regime, in which the authorities stand ready to resort to vigorous monetary expansion in the aftermath of asset market problems, is adequate to maintain economic stability is still an open question. BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and from time to time by other economists, and are published by the Bank. The views expressed in them are those of their authors and not necessarily the views of the BIS. -

New Monetarist Economics: Methods∗

Federal Reserve Bank of Minneapolis Research Department Staff Report 442 April 2010 New Monetarist Economics: Methods∗ Stephen Williamson Washington University in St. Louis and Federal Reserve Banks of Richmond and St. Louis Randall Wright University of Wisconsin — Madison and Federal Reserve Banks of Minneapolis and Philadelphia ABSTRACT This essay articulates the principles and practices of New Monetarism, our label for a recent body of work on money, banking, payments, and asset markets. We first discuss methodological issues distinguishing our approach from others: New Monetarism has something in common with Old Monetarism, but there are also important differences; it has little in common with Keynesianism. We describe the principles of these schools and contrast them with our approach. To show how it works, in practice, we build a benchmark New Monetarist model, and use it to study several issues, including the cost of inflation, liquidity and asset trading. We also develop a new model of banking. ∗We thank many friends and colleagues for useful discussions and comments, including Neil Wallace, Fernando Alvarez, Robert Lucas, Guillaume Rocheteau, and Lucy Liu. We thank the NSF for financial support. Wright also thanks for support the Ray Zemon Chair in Liquid Assets at the Wisconsin Business School. The views expressed herein are those of the authors and not necessarily those of the Federal Reserve Banks of Richmond, St. Louis, Philadelphia, and Minneapolis, or the Federal Reserve System. 1Introduction The purpose of this essay is to articulate the principles and practices of a school of thought we call New Monetarist Economics. It is a companion piece to Williamson and Wright (2010), which provides more of a survey of the models used in this literature, and focuses on technical issues to the neglect of methodology or history of thought. -

Three Dimensions of Classical Utilitarian Economic Thought ––Bentham, J.S

July 2012 Three Dimensions of Classical Utilitarian Economic Thought ––Bentham, J.S. Mill, and Sidgwick–– Daisuke Nakai∗ 1. Utilitarianism in the History of Economic Ideas Utilitarianism is a many-sided conception, in which we can discern various aspects: hedonistic, consequentialistic, aggregation or maximization-oriented, and so forth.1 While we see its impact in several academic fields, such as ethics, economics, and political philosophy, it is often dragged out as a problematic or negative idea. Aside from its essential and imperative nature, one reason might be in the fact that utilitarianism has been only vaguely understood, and has been given different roles, “on the one hand as a theory of personal morality, and on the other as a theory of public choice, or of the criteria applicable to public policy” (Sen and Williams 1982, 1-2). In this context, if we turn our eyes on economics, we can find intimate but subtle connections with utilitarian ideas. In 1938, Samuelson described the formulation of utility analysis in economic theory since Jevons, Menger, and Walras, and the controversies following upon it, as follows: First, there has been a steady tendency toward the removal of moral, utilitarian, welfare connotations from the concept. Secondly, there has been a progressive movement toward the rejection of hedonistic, introspective, psychological elements. These tendencies are evidenced by the names suggested to replace utility and satisfaction––ophélimité, desirability, wantability, etc. (Samuelson 1938) Thus, Samuelson felt the need of “squeezing out of the utility analysis its empirical implications”. In any case, it is somewhat unusual for economists to regard themselves as utilitarians, even if their theories are relying on utility analysis. -

Modern Monetary Theory: Cautionary Tales from Latin America

Modern Monetary Theory: Cautionary Tales from Latin America Sebastian Edwards* Economics Working Paper 19106 HOOVER INSTITUTION 434 GALVEZ MALL STANFORD UNIVERSITY STANFORD, CA 94305-6010 April 25, 2019 According to Modern Monetary Theory (MMT) it is possible to use expansive monetary policy – money creation by the central bank (i.e. the Federal Reserve) – to finance large fiscal deficits that will ensure full employment and good jobs for everyone, through a “jobs guarantee” program. In this paper I analyze some of Latin America’s historical episodes with MMT-type policies (Chile, Peru. Argentina, and Venezuela). The analysis uses the framework developed by Dornbusch and Edwards (1990, 1991) for studying macroeconomic populism. The four experiments studied in this paper ended up badly, with runaway inflation, huge currency devaluations, and precipitous real wage declines. These experiences offer a cautionary tale for MMT enthusiasts.† JEL Nos: E12, E42, E61, F31 Keywords: Modern Monetary Theory, central bank, inflation, Latin America, hyperinflation The Hoover Institution Economics Working Paper Series allows authors to distribute research for discussion and comment among other researchers. Working papers reflect the views of the author and not the views of the Hoover Institution. * Henry Ford II Distinguished Professor, Anderson Graduate School of Management, UCLA † I have benefited from discussions with Ed Leamer, José De Gregorio, Scott Sumner, and Alejandra Cox. I thank Doug Irwin and John Taylor for their support. 1 1. Introduction During the last few years an apparently new and revolutionary idea has emerged in economic policy circles in the United States: Modern Monetary Theory (MMT). The central tenet of this view is that it is possible to use expansive monetary policy – money creation by the central bank (i.e. -

How Would Modern Macroeconomic Schools of Thought Respond to the Recent Economic Crisis?

® Economic Information Newsletter Liber8 Brought to You by the Research Library of the Federal Reserve Bank of St. Louis November 2009 How Would Modern Macroeconomic Schools of Thought Respond to the Recent Economic Crisis? “Would financial markets and the economy have been better off if the Fed pursued a policy of quantitative easing sooner?” —Daniel L. Thornton, Vice President and Economic Adviser, Federal Reserve Bank of St. Louis, Economic Synopses The government and the Federal Reserve’s response to the current recession continues to be hotly de bated. Several questions arise: Was a $780 billion economic stimulus bill appropriate? Was the Troubled Asset Re lief Program (TARP) beneficial? Should the Fed have increased the money supply sooner? Should Lehman Brothers have been allowed to fail? Some answers to these questions lie in economic theory, and whether prudent decisions were made depends on whom you ask. This article examines three modern schools of economic thought and how each school would advise was the best way to respond to the most recent crisis. The New Keynesian Approach New Keynesian economics, the “new” version of the school based on the works of the early twentieth- century economist John Maynard Keynes, is founded on two major assumptions. First, people are forward looking; that is, they use available information today (interest rates, stock prices, gas prices, and so on) to form expectations about the future. Second, prices and wages are “sticky,” meaning they adjust gradually. One example of “stickiness” is a union-negotiated contract, which is fixed for a definite period of time. Menus are also an example of price stickiness: The cost associated with reprinting menus causes a restaurant owner to be reluctant about replacing them. -

Three Revolutions in Macroeconomics: Their Nature and Influence

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Laidler, David Working Paper Three revolutions in macroeconomics: Their nature and influence EPRI Working Paper, No. 2013-4 Provided in Cooperation with: Economic Policy Research Institute (EPRI), Department of Economics, University of Western Ontario Suggested Citation: Laidler, David (2013) : Three revolutions in macroeconomics: Their nature and influence, EPRI Working Paper, No. 2013-4, The University of Western Ontario, Economic Policy Research Institute (EPRI), London (Ontario) This Version is available at: http://hdl.handle.net/10419/123484 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen -

Nber Working Paper Series David Laidler On

NBER WORKING PAPER SERIES DAVID LAIDLER ON MONETARISM Michael Bordo Anna J. Schwartz Working Paper 12593 http://www.nber.org/papers/w12593 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 October 2006 This paper has been prepared for the Festschrift in Honor of David Laidler, University of Western Ontario, August 18-20, 2006. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research. © 2006 by Michael Bordo and Anna J. Schwartz. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. David Laidler on Monetarism Michael Bordo and Anna J. Schwartz NBER Working Paper No. 12593 October 2006 JEL No. E00,E50 ABSTRACT David Laidler has been a major player in the development of the monetarist tradition. As the monetarist approach lost influence on policy makers he kept defending the importance of many of its principles. In this paper we survey and assess the impact on monetary economics of Laidler's work on the demand for money and the quantity theory of money; the transmission mechanism on the link between money and nominal income; the Phillips Curve; the monetary approach to the balance of payments; and monetary policy. Michael Bordo Faculty of Economics Cambridge University Austin Robinson Building Siegwick Avenue Cambridge ENGLAND CD3, 9DD and NBER [email protected] Anna J. Schwartz NBER 365 Fifth Ave, 5th Floor New York, NY 10016-4309 and NBER [email protected] 1. -

Neo-Classical Economics: a Trail of Economic Destruction Since the 1970S Erik S

real-world economics review, issue no. 60 Neo-classical economics: A trail of economic destruction since the 1970s Erik S. Reinert [The Other Canon Foundation, Norway] Copyright: Erik S. Reinert, 2012 You may post comments on this paper at http://rwer.wordpress.com/2012/06/20/rwer-issue-60/ ‘...soon or late, it is ideas, not vested interests, which are dangerous for good or evil’. John Maynard Keynes, closing words of The General Theory (1936). Abstract This paper argues that the international financial crisis is just the last in a series of economic calamities produced by a type of theory that converted the economics profession from a study of real world phenomena into what in the end became mathematized ideology. While the crises themselves started by halving real wages in many countries in the economic periphery, in Latin America in the late 1970s, their origins are found in economic theory in the 1950s when empirical reality became academically unfashionable. About half way in the destructive path of this theoretical tsunami – from its origins in the world periphery in the 1970s until today’s financial meltdowns – we find the destruction of the productive capacity of the Second World, the former Soviet Union. Now the chickens are coming home to roost: wealth and welfare destruction is increasingly hitting the First World itself: Europe and the United States. This paper argues that it is necessary to see these developments as one continuous process over more than three decades of applying neoclassical economics and neo-liberal economic policies that destroyed, rather than created, real wages and wealth. -

The Applied-Ethical Structural Synthesis of International Development 1

Problemas del desarrollo ISSN: 0301-7036 Universidad Nacional Autónoma de México, Instituto de Investigaciones Económicas The Applied-Ethical Structural Synthesis of International Development 1 Astroulakis, Nikos 1 The Applied-Ethical Structural Synthesis of International Development Problemas del desarrollo, vol. 50, no. 197, 2019 Universidad Nacional Autónoma de México, Instituto de Investigaciones Económicas Available in: http://www.redalyc.org/articulo.oa?id=11860882004 DOI: 10.22201/iiec.20078951e.2019.197.65856 PDF generated from XML JATS4R by Redalyc Project academic non-profit, developed under the open access initiative Artícles e Applied-Ethical Structural Synthesis of International Development 1 La síntesis estructural ética-aplicada del desarrollo internacional Nikos Astroulakis b [email protected] Hellenic Open University, Greece Abstract: e paper challenges the mainstream stance in the study of applied ethics in international development. Applied ethics is positioned at the macro-social level of global ethics while a specific codification is attempted by formulating international development based on its structural synthesis, in a threefold level: First, the structural synthesis -associated with the framework of existing international development policy- can be found in the 'market relations'. Second, the analysis specifies the policies applied at the national level and the role of nation-state policy. ird, the paper criticizes the Problemas del desarrollo, vol. 50, no. 197, international development institutions' policies. In each of the levels mentioned above, 2019 the analysis reveals the fundamental policy theory issues of neoclassical economics, as the Universidad Nacional Autónoma de intellectual defender of free market economics. México, Instituto de Investigaciones Key Words: applied ethics, international development, neo-classical economics, Económicas freemarket economy, Nation-State policy, neo-liberal institutionalism. -

Helicopter Ben, Monetarism, the New Keynesian Credit View and Loanable Funds

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Fiebinger, Brett; Lavoie, Marc Working Paper Helicopter Ben, monetarism, the New Keynesian credit view and loanable funds FMM Working Paper, No. 20 Provided in Cooperation with: Macroeconomic Policy Institute (IMK) at the Hans Boeckler Foundation Suggested Citation: Fiebinger, Brett; Lavoie, Marc (2018) : Helicopter Ben, monetarism, the New Keynesian credit view and loanable funds, FMM Working Paper, No. 20, Hans-Böckler- Stiftung, Macroeconomic Policy Institute (IMK), Forum for Macroeconomics and Macroeconomic Policies (FFM), Düsseldorf This Version is available at: http://hdl.handle.net/10419/181478 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available -

A Quantum Theory of Money and Value*

A quantum theory of money and value* David Orrell [email protected] Abstract The answer to the question ‘what is money?’ has changed throughout history. During the gold standard era, money was seen as gold or silver (the theory known as bullionism). In the early 20th century, the alternative theory known as chartalism proposed that money was a token chosen by the state for payment of taxes. Today, many economists take an agnostic line, and argue that money is best defined in terms of its function, e.g. as a neutral medium of exchange. This paper argues that none of these approaches adequately describe the nature of money, and proposes a new theory, inspired by non-Newtonian physics, which takes into account the dualistic real/virtual properties and complex nature of money. The theory is applied to the example of the emergence of cybercurrencies. Keywords: money, history, cybercurrencies 1. Introduction According to the definition used by most economists, money is anything that serves as a medium of exchange, a store of value, and a unit of account (Ragan & Lipsey, 2011, p. 609). But what special quality is it that gives money these properties? In other words, what makes money, money? Answers to the question are tied up with ideas about value, and have typically fallen into one of three camps. The first, known as metallism or bullionism, holds that the special ingredient is precious metal. Money should ideally be made of the stuff, or at least be backed by it. The second camp is chartalism (from the Latin charta for a record) which holds that coins and other money objects are just tokens, that the state agrees to accept as currency (Knapp, 1924, p. -

Nominality of Money: Theory of Credit Money and Chartalism Atsushi Naito

Review of Keynesian Studies Vol.2 Atsushi Naito Nominality of Money: Theory of Credit Money and Chartalism Atsushi Naito Abstract This paper focuses on the unit of account function of money that is emphasized by Keynes in his book A Treatise on Money (1930) and recently in post-Keynesian endogenous money theory and modern Chartalism, or in other words Modern Monetary Theory. These theories consider the nominality of money as an important characteristic because the unit of account and the corresponding money as a substance could be anything, and this aspect highlights the nominal nature of money; however, although these theories are closely associated, they are different. The three objectives of this paper are to investigate the nominality of money common to both the theories, examine the relationship and differences between the two theories with a focus on Chartalism, and elucidate the significance and policy implications of Chartalism. Keywords: Chartalism; Credit Money; Nominality of Money; Keynes JEL Classification Number: B22; B52; E42; E52; E62 122 Review of Keynesian Studies Vol.2 Atsushi Naito I. Introduction Recent years have seen the development of Modern Monetary Theory or Chartalism and it now holds a certain prestige in the field. This theory primarily deals with state money or fiat money; however, in Post Keynesian economics, the endogenous money theory and theory of monetary circuit place the stress on bank money or credit money. Although Chartalism and the theory of credit money are clearly opposed to each other, there exists another axis of conflict in the field of monetary theory. According to the textbooks, this axis concerns the functions of money, such as means of exchange, means of account, and store of value.