Metso Outotec Corporation 12 April 2021 Update Following Ratings Affirmation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ofleiden, Germany, 30Th August to the 2Nd September

201703 www.advanced-mining.com ADVERTISEMENT 03 2017 TRANSFEREDUCATION OF TECHNOLOGY Mawsons and Pipeline Plant Hire take the first E-series: ADTs ‚Down Under‘ Bell Equipment Africa Africaa Bell Equipment United Kingdom Kelston Sparkes brings tally of Bell B50Es to 10 United Kingdom EX1200BE-5 hydraulic backhoe at MacDougall Mining’s coal mine Hitachi Construction Machinery Oosterhout | The Netherlands EX3500/1800 - Over 91% Availability after 88,765 Operating Hours Hitachi Construction Machinery Oosterhout | The Netherlands EX2500, EH3500 and EH1700 are chosen for the Friendsvilla mine project Hitachi Construction Machinery Oosterhout | The Netherlands Hitachi Construction Machinery New ZX350LC-6 Excavators Working on Multi-Million Dollar Views Oosterhout | The Netherlands First Volvo for Burnside Plant & Piling Contractors Volvo Construction Equipment International Volvo Construction Equipment LPM Plant Hire Sales Ltd steps up a gear with larger Volvo excavators International Volvo Construction Equipment Another Volvo loader for Skene Group International Volvo Construction Equipment The legacy that shaped Volvo‘s world-class excavators International Volvo Construction Equipment New Venture - New Volvo International Volvo Construction Equipment Taking Articulated Dump Truck Safety Levels to Zero Defect International Volvo Construction Equipment Prestigious package for Hall Construction International Caterpillar and Fortescue Moving Forward with Expansion of Autonomous Truck Fleet in Australia CATERPILLAR INC. International Metso makes screening media change-outs safer and faster with a new attachment system Metso Corporation International Metso welcomes HOLT CAT to Texas distributor network Metso Corporation International Metso presented latest innovations for the mining industry at Perumin 2017 Metso Corporation International Compact versatility with excellent references – both above and below ground Sandvik Mining and Construction Essen | Germany Sandvik Mining and Construction Vogelsberger Basaltwerk GmbH & Co. -

Metso Outotec Assigned 'BBB-' Rating; Outlook Negative on Uncertain COVID-19 Fallout and Integration Challenges

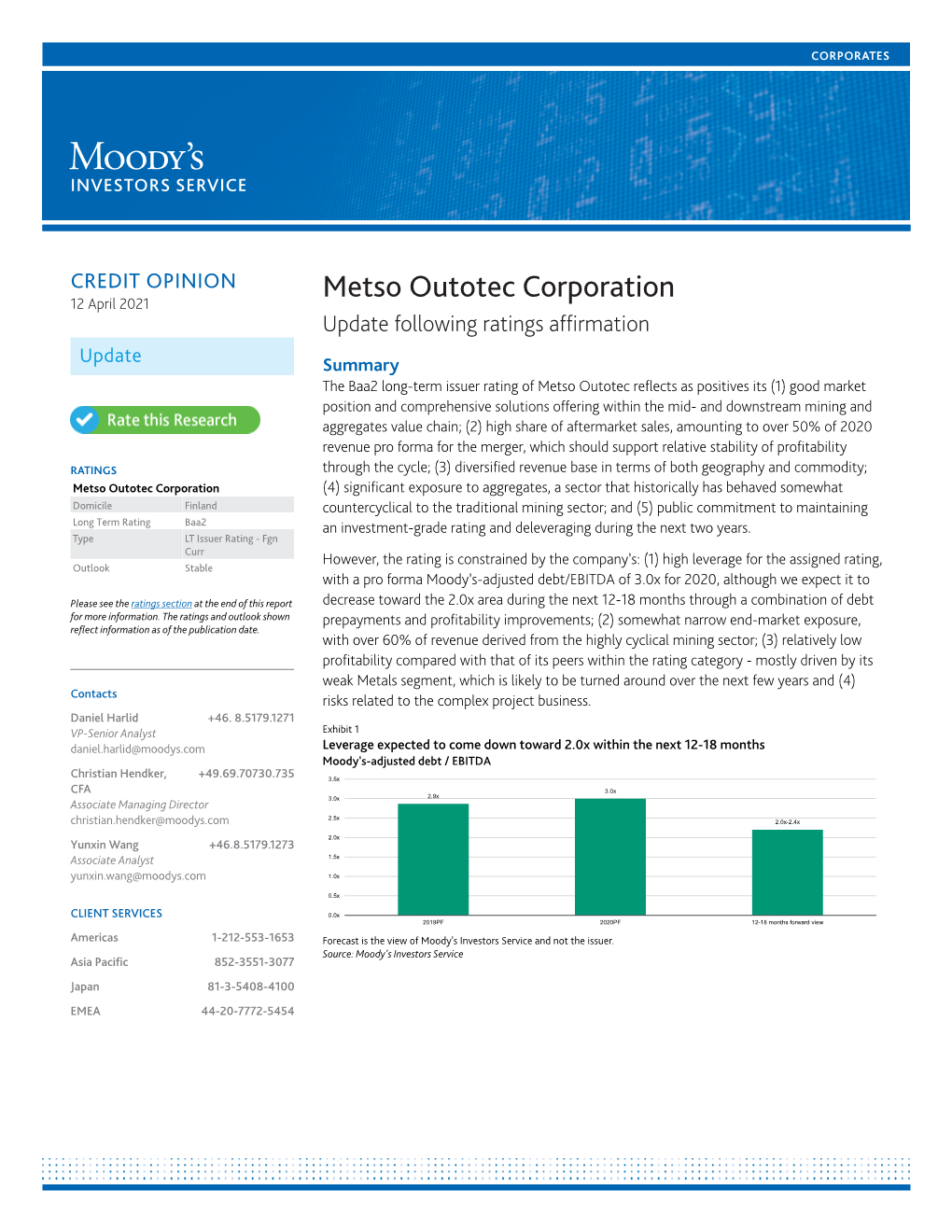

Research Update: Metso Outotec Assigned 'BBB-' Rating; Outlook Negative On Uncertain COVID-19 Fallout And Integration Challenges August 27, 2020 Rating Action Overview PRIMARY CREDIT ANALYST - Metso Minerals' merger with Outotec took place on June 30, 2020, and the combined group, Marta Bevilacqua Metso Outotec Corp., recently reported its first set of pro-forma statements. Milan - Metso Minerals' showed solid results despite the pandemic, and its management has + (39)0272111298 marta.bevilacqua increased and shortened its cost-synergies target for Metso Outotec to €120 million by @spglobal.com end-2021. SECONDARY CONTACT - However, the recessionary environment has hit Outotec hard and we therefore expect overall Mikaela Hillman pro-forma weaker results for the combined group in 2020 compared with 2019. Stockholm + 46 84 40 5917 - We continue to see the combined group's adjusted pro-forma funds from operations mikaela.hillman (FFO)-to-debt ratio declining to about 30% in 2020, but improving to about 35% in 2021. @spglobal.com - We are assigning our 'BBB-' issuer credit rating to Metso Outotec. ADDITIONAL CONTACT - At the same time, we are affirming our 'BBB-' issue rating on the €400 million senior unsecured Industrial Ratings Europe Corporate_Admin_London notes that were transferred from Metso Corp. to the newly formed Metso Outotec on the merger @spglobal.com date. - The negative outlook reflects the potential for a one-notch downgrade if the group's pro-forma adjusted FFO to debt falls below 30% with no prospects for short-term recovery in 2021. Rating Action Rationale The rating on Metso Outotec reflects the company's position as a leading provider of process technology, equipment, and services in the minerals, metals, and aggregates industries. -

Power Report

Industrial© 2007 Caterpillar EnginePOWER REPORT Vol. No. 9 1 IN THIS ISSUE OEM Spotlight: 4 The Cat® C6.6 ACERT engine is an excellent choice for Link-Belt cranes — now and in the future. Engine Technology: 6 Cat® engines with ACERT™ PAGE 2: COVER STORY Technology — the innovative spirit continues. Published on behalf of Caterpillar Inc. and your Caterpillar Dealer by Cygnus Business Media Inc., P.O. Box 803, Fort Atkinson, WI 53538-0803. Spring 2007, Vol. 9, No. 1. CAT, CATERPILLAR, their respec- tive logos, "Caterpillar Yellow" and the Power Edge trade dress, as well as corporate and product identity used herein, are trade- marks of Caterpillar and may not be used without permission. Form Number: LEPH 4078-00 OEM SPOTLIGHT CATERPILLAR® ENGINES POWER METSO MINERALS CRUSHERS WORLDWIDE. ustomers all around the globe are relying on Metso Minerals for solu- C tions, equipment and services to their rock and minerals processing needs. Tampere, Finland-based Metso Minerals is a key subsidiary of parent company Metso Corporation. You’ll find Metso Minerals’ cus- tomers crushing, feeding, screening and wash- ing aggregate in more than 150 countries. “Our contractor and quarry customers count on our crushers, every day,” explains Jussi Sjoblom, global source manager for Metso Minerals. “Our machines have to be reliable. They have to work.” Sjoblom is currently located in Columbia, Metso Minerals’ Lokotrack LT3054 jaw crusher is equipped with a Cat® C13 ACERT S.C., where the company has just completed engine rated at 310 bkW (415 bhp) at 1,800 to 2,100 rpm. a manufacturing facility for the LT200HP mobile crushing plant, powered by a RELY ON THE PROVEN strong working relationship,” notes Markus ® Cat C13 ACERT engine. -

PRESS RELEASE Public Joint Stock Company «Mining and Metallurgical Company «NORILSK NICKEL» (PJSC “MMC “Norilsk Nickel”, “Nornickel” Or the “Company”)

PRESS RELEASE Public Joint Stock Company «Mining and Metallurgical Company «NORILSK NICKEL» (PJSC “MMC “Norilsk Nickel”, “Nornickel” or the “Company”) NORNICKEL AWARDS MAJOR CONTRACT FOR PROCESSING EQUIPMENT SUPPLY TO METSO OUTOTEC Moscow, August 10, 2021 - Nornickel, the world’s largest producer of palladium and high- grade nickel and a major producer of platinum and copper, has awarded a major contract for the supply of some of the key industry-leading equipment used in mining operations to Metso Outotec, further extending the partnership with Finland’s technology solutions provider. Nornickel and Metso Outotec have signed an agreement to deliver industry-leading dewatering, flotation and automation equipment for Nornickel’s Talnakh concentrator expansion project in Russia’s Arctic city of Norilsk. The contract value is a commercially sensitive matter and therefore may not be disclosed publicly. Metso Outotec’s delivery scope consists of modernization of three existing thickeners and delivery of over 100 TankCell® flotation machines and an automation system for the new Talnakh concentrator Line 3 flotation area. In addition, the contract covers the supply of spare parts and consumables. Metso Outotec will also provide a metallurgical performance guarantee as well as advisory services for the installation and commissioning of the equipment. The delivery is scheduled for 2022-23. Sergey Dubovitsky, Nornickel Senior Vice President Strategy, Strategic Projects, Logistics & Procurement, commented: “The new contract further develops the collaboration with our longstanding partner Metso Outotec, which has supplied technology to us for many years. We have an excellent track record of using the Metso Outotec machinery across the entire geography of our operations. -

Financial Statements Review 2019

2019 Financial Statements Review Metso’s Financial Statements Review January 1 – December 31, 2019 Metso has classified its Minerals segment as discontinued operations from October 29, 2019, in accordance with IFRS. This was based on the decision taken by Metso’s Extraordinary General Meeting on October 29, 2019, to approve the partial demerger of the company. As a result, the depreciation and amortization of the Minerals segment is calculated only for the period of January-October 2019 according to IFRS. Metso has also prepared consolidated financial information, where the depreciation and amortization of Minerals is calculated for the full- year 2019, and these figures are comparable to the year 2018. Analysis of the fourth-quarter 2019 and January-December 2019 in this Financial Statements Review is based on the comparable figures unless otherwise noted. Figures in brackets refer to the corresponding period in 2018, unless otherwise stated. Fourth-quarter 2019 in brief • Market activity continued to be good • Orders received increased 1% to EUR 914 million (902 million) • Sales grew 7%, totaling EUR 963 million (897 million) • Adjusted EBITA improved to EUR 117 million, or 12.2% of sales (98 million, or 10.9%) • Operating profit improved to EUR 96 million, or 10.0% of sales (93 million, or 10.4%) • Earnings per share were EUR 0.41 (0.42) • Free cash flow was EUR 18 million (57 million) • Acquisition of the Canadian mobile aggregates equipment supplier McCloskey was completed • Shareholders approved Metso’s partial demerger to create -

Dealing with Data: Cybersecurity in the COVID-19 Era Working Smarter and Safer Has Become an Industry Creed for Employee Welfare

EEMJ_991MJ_991 FC.inddFC.indd 991991 88/7/20/7/20 33:43:43 PPMM Improves productivity Eliminates unplanned stops Increases employee safety — Condition monitoring For mechanical components The ABB AbilityTM Smart Sensor for mechanical products is an easy-to-use, wireless sensor which monitors the health of mounted bearings and gear reducers. The sensor provides warnings when health status declines, reducing the risk of unplanned downtime. In addition, connectivity and trend data allow maintenance to be planned proactively instead of reactively, and remote monitoring capabilities keep employees away from areas that are difficult or dangerous to access. Operate safely. Reduce downtime. Improve reliability. new.abb.com AEEMJ_992BMBJ_E99_2M IFC.inddIJF_CC.oinndddit i o 9992n9 M2 onitoring for Mechanical Components_0320.indd 1 788/3/20/1/3//20 99:542::5149 AAMPM AUGUST 2020 • VOL 221 • NUMBER 8 FEATURES Machines That Help Reduce Dilution The top narrow vein mining solutions on the market offer an increased power-to-weight ratio, lower ownership costs and higher productivity ...........28 Mineral Processing Titans Merge Stephan Kirsch, president of Metso Outotec’s new Minerals Business Area, discusses the next steps for the business and new opportunities ..................34 Refining Gold Processing E&MJ looks at designs and technologies that are making gold flowsheets more efficient and economic .........................................................................36 Dealing With Data: Cybersecurity in the COVID-19 Era Working smarter and safer -

Metso Neles Flow Control Products

Mead O'Brien | (800) 892-2769 | www.meadobrien.com Neles Flow control solutions A solution for each and every process challenge Mead O'Brien | (800) 892-2769 | www.meadobrien.com Neles Flow control solutions To help you optimize your performance for the verification of every for the whole valve assembly, including process performance and delivered valve unit. Basic testing includes valve, actuator, positioner and one to several hydrostatic, seat leakage and functional pneumatic components when needed. reliability, Metso approaches testing. Advanced computer-based test rigs each process and application have been provided for these valve testing Ensuring process safety and reliability as a specific challenge. Our activities. A special feature in Metso test In addition to our robust and reliable valves, control, on-off and ESD valves, facilities is our high-pressure gas test and we offer a range of products and services top-of-range industrial cryogenic laboratory. designed to ensure the desired performance accessories, intelligent devices of critical valves across their entire life cycle. and software products are Simplifying service solutions For instance, the Neles ValvGuard intelligent engineered to meet these We are committed to helping energy and safety solenoid and PST system helps challenges. They provide hydrocarbon, and pulp and paper customers monitor and ensure the full functionality of improve process performance and critical, yet often idle, emergency shutdown innovative, fundamentally simple reduce operating costs. Our leading edge (ESD) and venting valves. construction, operation and technological solutions and skilled customer maintenance features to optimize support personnel get the job done with a Valve Controls process performance at the goal of making your work life easier. -

Design Engineering Process from Content- Based Point of View

INTERNATIONAL DESIGN CONFERENCE - DESIGN 2006 Dubrovnik - Croatia, May 15 - 18, 2006. DESIGN ENGINEERING PROCESS FROM CONTENT- BASED POINT OF VIEW K. Nevala, P. Saariluoma and M. Karvinen Keywords: design engineering process, content-based design analysis, reconstruction, empirical design research, task definition window 1. Introduction Design is a multifaceted process and therefore design research must be multidisciplinary. Design is, essentially, an organizational activity in which both group work and individual thinking are involved. Design consists of various types of engineering activities, which can be investigated and explored, and is studied under various labels such as Applied Engineering Design Sciences, for example. During last decades to this engineering research tradition has been added a human-centered perspective. Naturally, these two fields of research, traditional design analysis and human-oriented investigations to design are not without connections. In fact, they must closely interact in order to recognize the decisive role of individual engineers in the actual design processes (Nevala 2004, 2005a,b, Nevala and Karhunen 2004, Saariluoma 2003, Saariluoma, Nevala and Karvinen 2005 a,b, Simon 1969). This paper emphasizes the applied engineering design science perspective. A new way of looking human role is offered by content-based approach, in which explaining real-life design processes is based on the analysis of designers’ mental contents (Saariluoma 2003, Saariluoma and Maarttola 2003). Recently, this approach has been developed from theoretical beginnings to an analysis of industrial scale design engineering processes (Saariluoma, Nevala and Karvinen 2005, Nevala 2005a,b). The fundamental idea is that in order to understand design process properly it is essential to approach it through the thought processes of individual engineers engaged in the process. -

Automation – Taking Customers' Performance Forward

Automation – taking customers’ performance forward Tampere site visit November 26, 2015 Sakari Ruotsalainen, Business Line President, Automation History of Automation in Tampere 1920’s An aircraft repair 1936 1944 1968 Workshop Division is opened in Tampere Measurement and control instruments Valmet Oy Instrument founded in for the process industry begin to develop Works established in Helsinki to repair Rantaperkiö aircraft instrumentation 1940’s 1953 The first black box ”Mata Hari” invented Precision mechanics division established, and produced in the State aircraft factory introduction of pneumatic measurement and in Tampere control system 2 November 26, 2015 © Valmet | Sakari Ruotsalainen, Business Line President, Automation History of Automation in Tampere 1980’s 2000’s Damatic, the first Distributed Control IQInsight IQProfilers (IQSteam Pro) 2015 1960 System (DCS) The Airmatic, a IQCaliper-L Metso Process Automation PaperIQ Plus Systems to Valmet pneumatic Acquisition of Sentrol Systems (QCS) Multivariable Model Predictive measurement and Controls (MPC) Valmet DNA control system Damatic XD, modular second generation metsoDNA CR DCS 24/7 ProCenter for DCS 24/7 ProCenter for QCS PaperIQ Select IQCaliper-L IQFiber 2015 Valmet IQ 2010’s 1990’s Metso PQV, web inspection system PaperIQ, QualityControl System (QCS) Metso DNA 1970 Metso IQ Elmatic-100 Metso Incorporated (the merger of Valmet Metso IQ for corrugators system, electronic Automation Inc. and Neles Controls) Metso condition analysis services instrumentation Vapo, peat and water -

IQSI IQ Candriam ESG International Equity ETF Q1 Holdings

Schedule of Investments ─ IQ Candriam ESG International Equity ETF July 31, 2020 (unaudited) Shares Value Shares Value Common Stocks — 99.4% Common Stocks (continued) Australia - 8.0% Belgium (continued) Alumina Ltd. 26,705 $ 29,110 Umicore SA .................... 1,980 $ 93,514 .................... * AMP Ltd. ...................... 34,617 36,370 Total Belgium 597,926 Ampol Ltd. ..................... 2,466 46,476 APA Group..................... 12,077 95,271 Chile - 0.0%(a) ASX Ltd. ...................... 1,960 116,174 Antofagasta PLC ................. 3,609 48,671 AusNet Services ................. 18,374 23,455 Australia & New Zealand Banking Group China - 0.9% Ltd. 27,245 350,916 ...................... Alibaba Health Information Technology Ltd.* 40,385 111,512 BHP Group Ltd. 30,113 793,636 .................. China Gas Holdings Ltd. 19,166 57,620 BHP Group PLC 21,055 457,354 ............ ................. CSPC Pharmaceutical Group Ltd. ...... 49,090 102,991 BlueScope Steel Ltd. 5,121 41,096 .............. Fosun International Ltd. 25,389 28,926 Boral Ltd. 12,274 31,600 ............. ...................... Geely Automobile Holdings Ltd. 52,544 110,509 Brambles Ltd. 15,570 120,370 ........ ................... Haier Electronics Group Co., Ltd.(b) ...... 12,540 43,444 Coca-Cola Amatil Ltd. 5,239 30,734 .............. Prosus NV* ..................... 4,077 395,809 Cochlear Ltd. 652 88,943 ................... Shimao Group Holdings Ltd. 11,833 50,155 Computershare Ltd. 4,730 45,556 .......... ............... Sun Art Retail Group Ltd. ............ 17,990 24,977 CSL Ltd. ...................... 4,635 897,810 Dexus ........................ 11,127 67,908 Total China 925,943 Fortescue Metals Group Ltd. ......... 17,329 216,363 Goodman Group ................. 18,522 224,882 Colombia - 0.0%(a) GPT Group (The) 19,916 55,417 Millicom International Cellular SA ...... -

Metso Corporation (Finland): Transaction with Outotec Oyj (Finland) Changes in Russell RAFI™ Index Series

Metso Corporation (Finland): Transaction with Outotec Oyj (Finland) Changes in Russell RAFI™ Index Series 24 June 2020 Further to the FTSE Russell Notice on 09 June 2020 and subject to the completion of the all-share combination of Metso Corporation's (Finland, constituent) minerals business with Outotec Oyj (non constituent), alongside the remaining component of Metso Corporation retaining its listing under the new name of Neles, please see details of affected indexes and effective dates below: Effective From Index Start of Trading Russell RAFI Global Index 01 July 2020 03 July 2020 Russell RAFI Global Large Company 01 July 2020 Index Effective From Index Start of Trading 03 July 2020 Russell RAFI Developed Index 01 July 2020 03 July 2020 Russell RAFI Developed Large 01 July 2020 Company Index 03 July 2020 Russell RAFI Global ex US Index 01 July 2020 03 July 2020 Russell RAFI Global ex US Large 01 July 2020 Company Index 03 July 2020 Russell RAFI Developed ex US 01 July 2020 Index Effective From Index Start of Trading 03 July 2020 Russell RAFI Developed ex US 01 July 2020 Large Company Index 03 July 2020 Russell RAFI Europe Index 01 July 2020 03 July 2020 Russell RAFI Europe Large 01 July 2020 Company Index 03 July 2020 *The number of shares is based on the demerger consideration terms of 4.3 new Outotec shares for every Metso Corporation share held. **The shares in issue and investability weight increase for Outotec Distribution Shares (now Metso Outotec) is based on the 1:1 combination with Outotec Oyj. -

Metso Financial Statements Review 2007

Financial Statements Review 2007 Metso Corporation’s Financial Statements Release 2007 Strong growth and record profits Highlights of 2007 • Operating profi t (EBIT) was EUR 179.7 million, i.e. 9.5 percent • New orders worth EUR 6,965 million were received in 2007, of net sales (EUR 125.0 million and 8.1%). i.e. 22 percent more than in the previous year (EUR 5,705 • Earnings per share were EUR 0.85 (EUR 0.86, adjusted EPS: million in 2006).*) EUR 0.65). • At year’s end, the order backlog was EUR 4,341 million (EUR *) The acquisition of the Pulping and Power businesses at the end of 2006 con- 3,737 million at December 31, 2006). tributed to the increase in 2007. • Net sales increased by 26 percent and totaled EUR 6,250 “2007 was again the best year ever for Metso. Our net sales million (EUR 4,955 million).*) grew by 26 percent, our EBITA margin exceeded 10 percent, • Earnings before interest, tax and amortization (EBITA) were and we are also proposing a record-breaking dividend. Our EUR 635.4 million, i.e. 10.2 percent of net sales (EUR 481.1 strong growth was driven by good demand in emerging mar- million and 9.7%). kets and the mining and energy industry. About one half of • Operating profi t (EBIT) was EUR 579.8 million, i.e. 9.3 percent the net sales growth derived from the successful Pulping and of net sales (EUR 457.2 million and 9.2%). Power acquisition”, says Jorma Eloranta, President and CEO of • Earnings per share were EUR 2.69 (EUR 2.89, adjusted EPS: Metso Corporation.