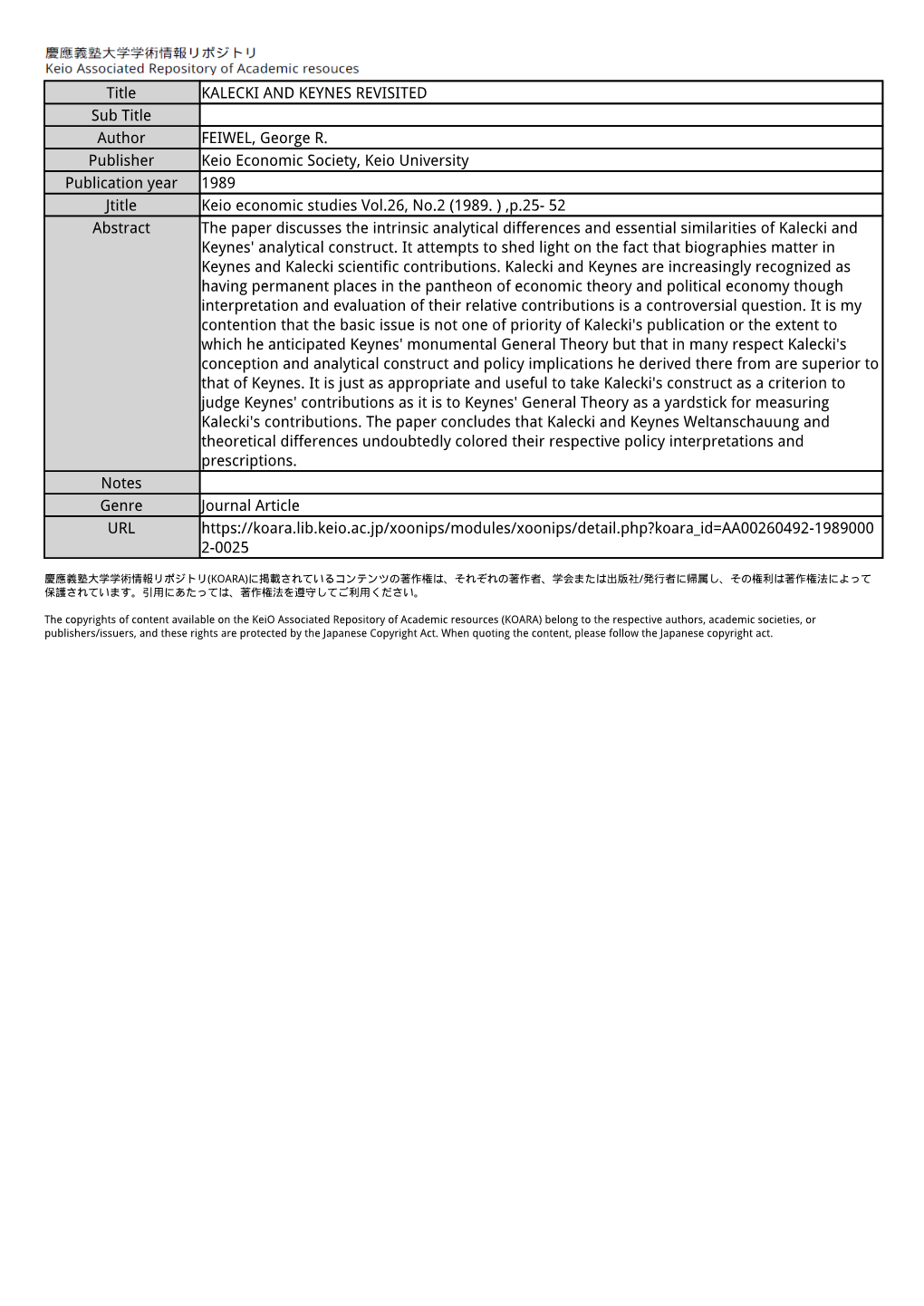

Title KALECKI and KEYNES REVISITED Sub Title Author FEIWEL, George R

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Estimating the Effects of Fiscal Policy in OECD Countries

Estimating the e®ects of ¯scal policy in OECD countries Roberto Perotti¤ This version: November 2004 Abstract This paper studies the e®ects of ¯scal policy on GDP, in°ation and interest rates in 5 OECD countries, using a structural Vector Autoregression approach. Its main results can be summarized as follows: 1) The e®ects of ¯scal policy on GDP tend to be small: government spending multipliers larger than 1 can be estimated only in the US in the pre-1980 period. 2) There is no evidence that tax cuts work faster or more e®ectively than spending increases. 3) The e®ects of government spending shocks and tax cuts on GDP and its components have become substantially weaker over time; in the post-1980 period these e®ects are mostly negative, particularly on private investment. 4) Only in the post-1980 period is there evidence of positive e®ects of government spending on long interest rates. In fact, when the real interest rate is held constant in the impulse responses, much of the decline in the response of GDP in the post-1980 period in the US and UK disappears. 5) Under plausible values of its price elasticity, government spending typically has small e®ects on in°ation. 6) Both the decline in the variance of the ¯scal shocks and the change in their transmission mechanism contribute to the decline in the variance of GDP after 1980. ¤IGIER - Universitµa Bocconi and Centre for Economic Policy Research. I thank Alberto Alesina, Olivier Blanchard, Fabio Canova, Zvi Eckstein, Jon Faust, Carlo Favero, Jordi Gal¶³, Daniel Gros, Bruce Hansen, Fumio Hayashi, Ilian Mihov, Chris Sims, Jim Stock and Mark Watson for helpful comments and suggestions. -

Introduction to Macroeconomics Lecture Notes

Introduction to Macroeconomics Lecture Notes Robert M. Kunst March 2006 1 Macroeconomics Macroeconomics (Greek makro = ‘big’) describes and explains economic processes that concern aggregates. An aggregate is a multitude of economic subjects that share some common features. By contrast, microeconomics treats economic processes that concern individuals. Example: The decision of a firm to purchase a new office chair from com- pany X is not a macroeconomic problem. The reaction of Austrian house- holds to an increased rate of capital taxation is a macroeconomic problem. Why macroeconomics and not only microeconomics? The whole is more complex than the sum of independent parts. It is not possible to de- scribe an economy by forming models for all firms and persons and all their cross-effects. Macroeconomics investigates aggregate behavior by imposing simplifying assumptions (“assume there are many identical firms that pro- duce the same good”) but without abstracting from the essential features. These assumptions are used in order to build macroeconomic models.Typi- cally, such models have three aspects: the ‘story’, the mathematical model, and a graphical representation. Macroeconomics is ‘non-experimental’: like, e.g., history, macro- economics cannot conduct controlled scientific experiments (people would complain about such experiments, and with a good reason) and focuses on pure observation. Because historical episodes allow diverse interpretations, many conclusions of macroeconomics are not coercive. Classical motivation of macroeconomics: politicians should be ad- vised how to control the economy, such that specified targets can be met optimally. policy targets: traditionally, the ‘magical pentagon’ of good economic growth, stable prices, full employment, external equilibrium, just distribution 1 of income; according to the EMU criteria, focus on inflation (around 2%), public debt, and a balanced budget; according to Blanchard,focusonlow unemployment (around 5%), good economic growth, and inflation (0—3%). -

Causality and Interdependence in Pasinetti's Works and in the Modern

Causality and interdependence in Pasinetti’s works and in the modern classical approach Enrico Bellino and Sebastiano Nerozzi Centro Sraffa Working Papers n. 10 January 2015 ISSN: 2284 -2845 Centro Sraffa working papers [online] Causality and interdependence in Pasinetti’s works and in the modern classical approach* Enrico Bellinoa and Sebastiano Nerozzib a Università Cattolica del Sacro Cuore, Milano b Università degli studi di Palermo One of the items that Pasinetti rightfully emphasizes in characterizing the Cambridge school, and differentiating it from mainstream neoclassicism, is causality versus interdependence. (Leijonhufvud, 2008, 537) Abstract. The formal representation of economic theories normally takes the shape of a model, that is, a system of equations which connect the endogenous variables with the values of the parameters which are taken as given. Sometimes, it is possible to identify one or more equations which are able to determine a subset of endogenous variables priory and independently of the other equations and of the value taken by the remaining variables of the system. The first group of equations and variables are thus said to causally determine the remaining variables. In Pasinetti’s works, this notion of causality has often been emphasized as a formal property having the burden of conveying a profound economic meaning. In this paper, we will go through those works of Pasinetti where the notion of causality plays a central role, with the purpose of contextualizing it within the econometric debate of the Sixties, enucleate its economic meaning, and show its connections with other fields of the modern classical approach. Keywords: causality, interdependence, modern classical approach, Ricardo distribution theory, Keynes’s analysis, ‘given quantities’, surplus approach, structural dynamics, vertical integration. -

Long-Term Unemployment and the 99Ers

Long-Term Unemployment and the 99ers An Emerging Issues Report from the January 2012 Long-Term Unemployment and the 99ers The Issue Long-term unemployment has been the most stubborn consequence of the Great Recession. In October 2011, more than two years after the Great Recession officially ended, the national unemployment rate stood at 9.0%, with Connecticut’s unemployment rate at 8.7%.1 Americans have been taught to connect the economic condition of the country or their state to the unemployment Millions of Americans— rate, but the national or state unemployment rate does not tell known as 99ers—have the real story. Concealed in those statistics is evidence of a exhausted their UI benefits, substantial and challenging structural change in the labor and their numbers grow market. Nationally, in July 2011, 31.8% of unemployed people every month. had been out of work for at least 52 weeks. In Connecticut, data shows 37% of the unemployed had been jobless for a year or more. By August 2011, the national average length of unemployment was a record 40 weeks.2 Many have been out of work far longer, with serious consequences. Even with federal extensions to Unemployment Insurance (UI), payments are available for a maximum of 99 weeks in some states; other states provide fewer (60-79) weeks. Millions of Americans—known as 99ers— have exhausted their UI benefits, and their numbers grow every month. By October 2011, approximately 2.9 million nationally had done so. Projections show that five million people will be 99ers, exhausting their benefits, by October 2012. -

National Income Per Capita

HOUSEHOLD INCOME AND WEALTH • INCOME AND SAVINGS NATIONALIncome and savings INCOME PER CAPITA While per capita gross domestic product is the indicator residents (and vice versa). In this respect, it is important to most commonly used to compare national income levels, note that retained earnings of foreign enterprises owned by two other measures are preferred by many analysts. These residents do not actually return to the residents concerned. are per capita Gross National Income (GNI) and Net Nevertheless, the retained earnings are recorded as a National Income (NNI). Whereas GDP refers to the income receipt. generated by production activities on the economic territory of the country, GNI measures the income Comparability generated by the residents of a country, whether earned in the domestic territory or abroad. NNI is the aggregate value All countries compile data according to the 2008 SNA of the balances of net primary incomes summed over all “System of National Accounts, 2008” with the exception of sectors. Chile, Japan, and Turkey, where data are compiled according to the 1993 SNA. When changes in international standards are implemented countries often take the Definition opportunity to implement improved compilation methods; GNI is defined as GDP plus receipts from abroad less therefore also implementing various improvements in payments to abroad of wages and salaries and of property sources and estimation methodologies. In some countries income plus net taxes and subsidies receivable from the impact of the ‘statistical benchmark revision’ could be abroad. NNI is equal to GNI net of depreciation. higher than the impact of the changeover in standards. As Wages and salaries from abroad are those that are earned a consequence the GDP level for the OECD total increased by residents who essentially live and consume inside the by 3.8% in 2010 based on the available countries. -

How Does Fiscal Policy Affect the American Worker?

HOW DOES FISCAL POLICY AFFECT THE AMERICAN WORKER? JOHN D. MUELLER* OVERVIEW American policymakers have begun to prepare the public for fiscal policy changes, such as comprehensive reforms of the Federal income tax and Social Security retirement systems, which would profoundly alter the lives of American workers and their families. Projected fiscal imbalances are clearly unsustainable, and Europe’s economic and demographic crisis, characterized by high unemployment and falling fertility rates, illustrates the grave dangers of policy mistakes. But no American consensus has emerged, partly because there is no generally accepted and empirically grounded theory explaining how fiscal policy affects employment and fertility. This paper lays out a simple but com- prehensive framework for analyzing such questions, by proceed- ing from the homey example of a children’s lemonade stand to describe how Augustine’s theory of personal love and Aristotle’s theory of distributive justice were originally integrated within economic analysis. The second section applies the analysis to describe and update “Rueff’s Law,” which explains how employ- ment and unemployment are determined by the cost of labor (measured as workers’ share of total labor and property income after government taxes and benefits). The analysis shows that funding social benefits either by borrowing or with income taxes raises the cost of labor and unemployment, while funding such benefits with payroll taxes does not increase unemployment but may lower labor market participation. The third section extends the analysis to fill a crucial gap in the economic theory of fertility and shows that most variation in the Total Fertility Rate (TFR) among the fifty countries for which data are available (compris- * John D. -

Understanding the Postwar Decline in U.S. Saving: a Cohort Analysis

JAGADEESH GOKHALE Federal Reserve Bank of Cleveland LAURENCE J. KOTLIKOFF Boston University JOHN SABELHAUS Congressional Budget Office Understandingthe Postwar Decline in U.S. Saving: A CohortAnalysis IN 1950 THE RATE of net national saving in the United States was 12.3 percent. In 1994 it was only 3.5 percent. ' The difference in these saving rates is illustrative of a dramatic long-term decline in U.S. saving. The U.S. saving rate averaged 9. 1 percent per year in the 1950s and 1960s, 8.5 percent in the 1970s, 4.7 percent in the 1980s, and just 2.7 percent in the first five years of the 1990s.2 The decline in saving in the United States has been associated with an equally dramatic decline in domestic investment. Since 1990, net We thank the Office of Management and Budget and the Social Security Administra- tion for providing long-term fiscal and population projections, and Jonathan Skinner for providing health expenditure data. We also thank Orazio Attanasio, Barry Bosworth, Robert Haveman, Andrew Samwick, Jonathan Skinner, and numerous seminar partici- pants for helpful comments. The opinions expressed in this paper are those of the authors and are not necessarily shared by the Federal Reserve Bank of Cleveland or the Congres- sional Budget Office. 1. The net national saving rate is defined as net national product less national con- sumption (household consumption plus government purchases), divided by net national product. The National Income and Product Account (NIPA) data used in the body of this paper do not incorporate recently revised NIPA data for the years starting in 1959. -

Ole Jonny Klakegg Governance of Major Public Investment Projects in Pursuit of Relevance and Sustainability

Doctoral theses at NTNU, 2010:15 Ole Jonny Klakegg Ole Jonny Klakegg Governance of Major Public Investment Projects In Pursuit of Relevance and Sustainability ISBN 978-82-471-1985-3 (printed ver.) ISBN 978-82-471-1986-0 (electronic ver.) ISSN 1503-8181 Doctoral theses at NTNU, NTNU philosophiae doctor Thesis for the degree of Norwegian University of Science and Technology 2010: 15 Department of Civil and Transport Engineering Faculty of Engineering Science and Technology Ole Jonny Klakegg Governance of Major Public Investment Projects In Pursuit of Relevance and Sustainability Thesis for the degree of philosophiae doctor Trondheim, February 2010 Norwegian University of Science and Technology Faculty of Engineering Science and Technology Department of Civil and Transport Engineering NTNU Norwegian University of Science and Technology Thesis for the degree of philosophiae doctor Faculty of Engineering Science and Technology Department of Civil and Transport Engineering ©Ole Jonny Klakegg ISBN 978-82-471-1985-3 (printed ver.) ISBN 978-82-471-1986-0 (electronic ver.) ISSN 1503-8181 Doctoral Theses at NTNU, 15 Printed by Tapir Uttrykk Preface and Acknowledgements In the year 2000 the Norwegian Ministry of Finance initiated a new quality assurance scheme under which all major public investment projects financed by the State were to be appraised and analysed by external QA-consultants. In 2002 the Ministry initiated the Concept research programme to support and follow up the QA scheme. The main task of the programme is to perform trailing research, gathering and analysing empirical data from these projects and develop new knowledge that could help to improve the front-end governance of major public projects. -

National Income Per Capita

PRODUCTION AND INCOME • INCOME, SAVINGS AND INVESTMENTS NATIONALPRODUCTIONIncome, savings AND and INCOME investments INCOME PER CAPITA While per capita gross domestic product is the indicator Depreciation, which is deducted from GNI to obtain NNI, is most commonly used to compare living standards across the decline in the market value of fixed capital assets – countries, two other measures are preferred by many dwellings, buildings, machinery, transport equipment such analysts. These are per capita gross national income (GNI) as physical infrastructure, software, etc. – through wear and and net national income (NNI). tear and obsolescence. Definition Comparability GNI is defined as GDP plus net receipts from abroad of Both income measures are compiled according to the wages and salaries and property income. definitions of the 1993 System of National Accounts. There are, Wages and salaries from abroad are those that are earned by however, practical difficulties in measuring international residents, i.e. by persons who essentially live and consume flows of wages and salaries and property income and inside the economic territory of a country but work abroad depreciation. Because of these difficulties, GDP per capita is (this happens in border areas on a regular basis) or by the most widely used indicator of income despite being persons that live and work abroad for only short periods theoretically inferior to either GNI or NNI. (seasonal workers). Guest-workers and other migrant Note that data for Australian and New Zealand refer to fiscal workers who live abroad for one year or more are considered years. to be resident in the country where they are working. -

Concepts of National Income

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Studies in Income and Wealth, Volume 1 Volume Author/Editor: The Conference on Research in Income and Wealth Volume Publisher: NBER Volume ISBN: 0-870-14156-2 Volume URL: http://www.nber.org/books/unkn37-1 Publication Date: 1937 Chapter Title: Concepts of National Income Chapter Author: M. A. Copeland Chapter URL: http://www.nber.org/chapters/c8136 Chapter pages in book: (p. 3 - 63) Part One CONCEPTS OF NATIONAL INCOME M. A. COPELAND CI<."NTlI.AL STATI STICAL BOARD Discussion SIMON KUZNETS NATIONAL IWREAU OF ECONOMIC RESEA RCH CLARK WARBURTON FEIlEJtAL DEPOSIT INSURANCE (X)RPOR:ATION M. A . COPELAND • CONCEPTS OF NATIONAL INCOME M. A. COPELAND I National Income and Social Income THE PURPOSES of this memorandum are first, to indicate the pres ent status of concepts of national or other social income, and to outline the most useful types of income breakdown; second, to consider some of the questions that are now particularly moot with respect to concepts of national income, and to suggest pos sible answers' It should be fully recognized that this procedure involves taking sides on issues that are necessarily conrroversial and that may well continue to be controversial for some time. In the fOllowing discussion references will be made to social income and social wealth. For the world as a whole and for parts of it either smaller or larger than an entire nation there may be need for measures corresponding to those designated as national wealth and national income. -

Chapter -3 National Income and Related Aggregates 3.1

Chapter -3 National Income And Related Aggregates 3.1 Background : Performance of an economy depends on the amount of goods and services produced in that economy. In monetary terms its measure is the Gross Domestic Product (GDP), Gross National Income (GNI), and Net National Income (NNI). Apart from these macro-economic aggregates, the other important indicators to measure health of economy are capital formation and savings. Thus, measurement of these macro- economic indicators is an extremely important exercise, which requires collection and analysis of large volume of data. The conceptual framework guiding such an exercise has to be robust and evolve with the time to keep pace with the dynamics of the manifested world. 3.2 System of National Accounts (SNA): The System of National accounts (SNA) was developed by United Nations with an aim to provide a comprehensive conceptual and accounting framework for compiling and reporting macroeconomic statistics for analysing and evaluating the performance of an economy. The origins of the SNA trace back to the 1947 Report of the Sub-Committee on National Income Statistics of the League of Nations Committee of Statistical Experts. The 1953 SNA was published under the auspices of the UNSC. It consisted of a set of six standard accounts and a set of 12 standard tables presenting detail and alternative classifications of the flows in the economy. The concepts and definitions of the accounts were widely applicable for most countries, including developing countries. Two slightly modified editions of the 1953 SNA were published. SNA was revised in 1960, 1964 and 1968 in view of country experiences in implementing SNA 1953, to improve consistency with IMFs Balance of Payments manual and to extend the scope by adding input output tables, balance sheets and to bring it closer to Material Product System (MPS) respectively . -

KEYNESIAN ECONOMICS and UNDERDEVELOPED COUNTRIES a MASTER's REPORT MASTER of ARTS KANSAS STATE UNIVERSITY Manhattan, Kansas Appr

KEYNESIAN ECONOMICS AND UNDERDEVELOPED COUNTRIES by J, SENT CHATURANTABUTARA B. A., Thammasat University, Bangkok, Thailand, 1963 A MASTER'S REPORT submitted in partial fulfillment of the requirements for the degree MASTER OF ARTS Department of Economics KANSAS STATE UNIVERSITY Manhattan, Kansas 1968 Approved by: Major Professor TABLE OF CONTENTS Chapter Page I INTRODUCTION 1 II WHAT IS AN UNDERDEVELOPED COUNTRY? 4 Basic Characteristics 4 Meaning 4 III KEYNESIAN FULL EMPLOYMENT AND ECONOMIC DEVELOPMENT 8 Full Employment and Effective Demand 8 The Process of Economic Development 10 IV CONCEPT OF UNEMPLOYMENT 14 Keynesian Unemployment 14 Non-Keynesian Unemployment 1)4 Application to Underdeveloped Countries 15 V CONSUMPTION, INVESTMENT, INCOME AND THE MULTIPLIER 18 The Basic Keynesian Theory of Employment 18 Patterns of Consumption 19 Multiplier Principle . 20 Application to Underdeveloped Countries 21 VI CAPITAL FORMATION 24 The Role of Capital Formation 24 Vicious Circle of Poverty 24 Keynes and Capital Formation 26 VII EPILOGUE ON POST-KEYNESIAN GROWTH THEORIES 29 Harrod's Growth Model 30 Domar's Growth Model 30 Singer's Growth Model 31 Balanced versus Unbalanced Growth 34 VIII CONCLUSIONS 38 A CK NO4LEDGEMENT 140 BIBLIOGRAPHY 41 CHAPTER I INTRODUCTION In recent years the process and problems of economic development of the underdeveloped countries have drawn widespread interest of economists and policy-makers of nations of the modern world. In recent years there have also been significant developments in economic thought growing out of and building on the ideas of J. N. Keynes.1 Keynesian economics is a method of economic analysis which focuses attention on the operation of the economic system as a whole utilizing the so-called aggregative approach (commonly known as the macroeconomic approach).