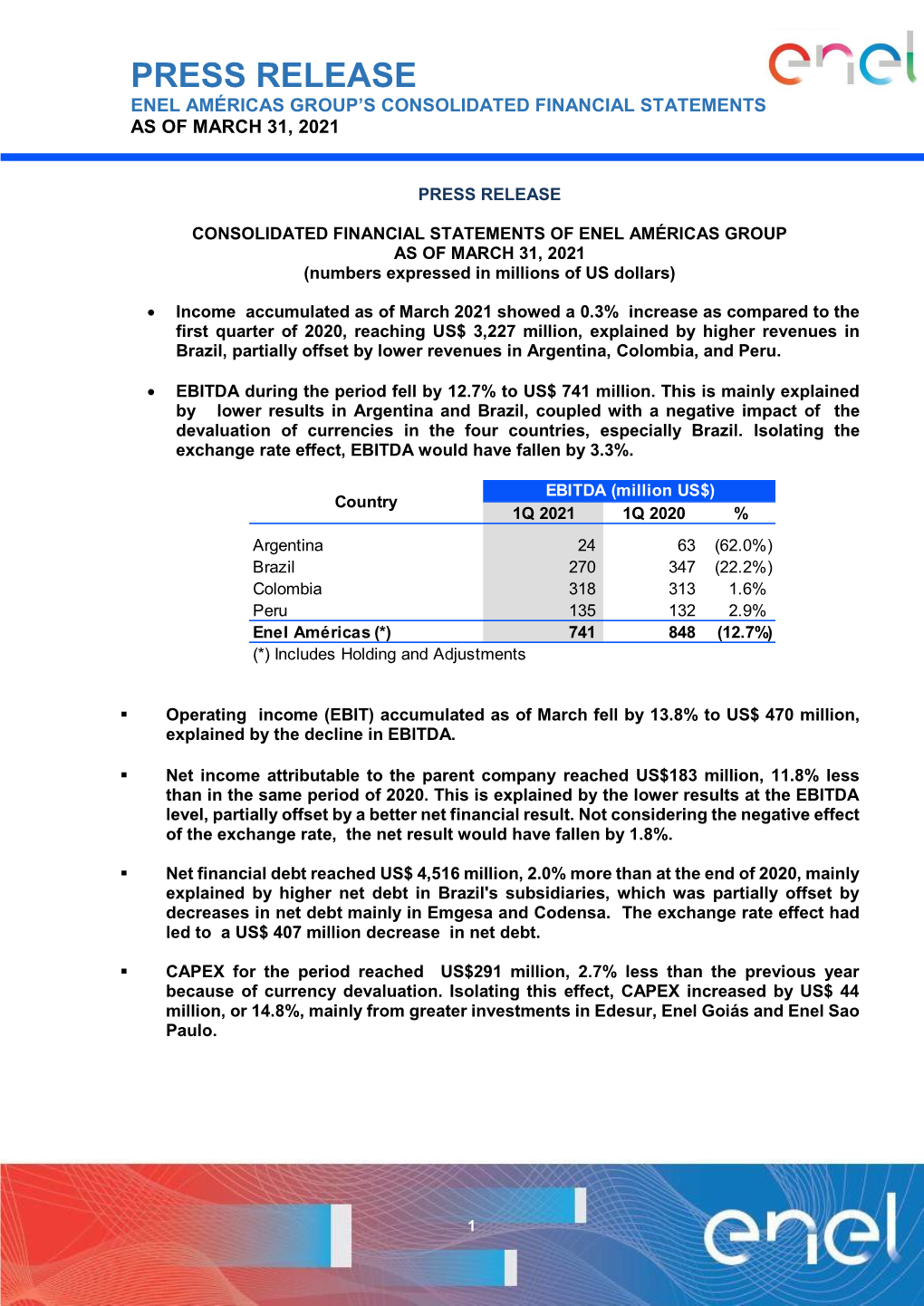

Enel Américas Financial Statements Analysis March 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Food Processing Ingredients

Required Report: Required - Public Distribution Date: March 31, 2021 Report Number: BR2021-0011 Report Name: Food Processing Ingredients Country: Brazil Post: Sao Paulo ATO Report Category: Food Processing Ingredients Prepared By: Alexandre Vendemiatti Approved By: Nicolas Rubio Report Highlights: Brazil continues to present opportunities for U.S. exporters of ingredients, with its food processing industry market estimated in 2020 at $152 billion, an increase of 12.7 percent compared to the previous year. High-performance ingredients that add value to products will continue to show good market potential in the country. Although Brazil's economic situation was heavily affected by the COVID-19 social distance measures, the country's food industry kept its resilience and is expected to grow in 2021. THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Executive Summary Food Retail Industry Brazil is the largest economy in Latin America and The Brazilian Supermarket Association (ABRAS) one of the largest in the world. Brazil’s Gross reported supermarket revenues of $73.3 billion Domestic Product (GDP) closed out 2020 with a (R$378.3 billion) in 2019, an increase of 6.4 percent record contraction of 4.1 percent compared to the in nominal terms. Brazil’s retail sector includes previous year. This is the most significant drop in the 89,806 stores. The sector is expected to grow by 4.5 historical series with the current methodology, percent in 2021. The final 2020 numbers have not surpassing the retraction of 3.5 percent registered in been released as of the release of this GAIN report 2015. -

Applying SEIR Model Without Vaccination for COVID-19 in Case Of

Epidemiol. Methods 2021; 10(s1): 20200036 Marwan Al-Raeei*, Moustafa Sayem El-Daher and Oliya Solieva Applying SEIR model without vaccination for COVID-19 in case of the United States, Russia, the United Kingdom, Brazil, France, and India https://doi.org/10.1515/em-2020-0036 Received September 2, 2020; accepted May 11, 2021; published online May 28, 2021 Abstract Objectives: Compartmental models are helpful tools to simulate and predict the spread of infectious diseases. In this work we use the SEIR model to discuss the spreading of COVID-19 pandemic for countries with the most confirmed cases up to the end of 2020, i.e. the United States, Russia, the United Kingdom, France, Brazil, and India. The simulation considers the susceptible, exposed, infective, and the recovered cases of the disease. Method: We employ the order Runge–Kutta method to solve the SIER model equations-for modelling and forecasting the spread of the new coronavirus disease. The parameters used in this work are based on the confirmed cases from the real data available for the countries reporting most cases up to December 29,2020. Results: We extracted the coefficients of the exposed, infected, recovered and mortality rate of the SEIRmodel by fitting the collected real data of the new coronavirus disease up to December 29, 2020 in the countries with the most cases. We predict the dates of the peak of the infection and the basic reproduction number for the countries studied here. We foresee COVID-19 peaks in January-February 2021 in Brazil and the United Kingdom, and in February-March 2021 in France, Russia, and India, and in March-April 2021 in the United States. -

Leadership Crisis Led Healthcare Debacle and Economic Turmoil in Brazil

International Journal of Research in Engineering, Science and Management 73 Volume 4, Issue 5, May 2021 https://www.ijresm.com | ISSN (Online): 2581-5792 Leadership Crisis Led Healthcare Debacle and Economic Turmoil in Brazil Subhendu Bhattacharya1*, Y. Nisha2 1,2Amity Global Business School, Mumbai, India Abstract: The world was deeply impacted with the outbreak of service sectors. It had been top notch coffee producer of the corona virus in early 2020, Brazil was no different. In fact, Brazil world for long. People across the globe poured down to Brazil was the worst affected among all the Latin American countries. every year as it acted as favourite tourist destination but that More than three million people died till March 2021 due to COVID 19 infection. Healthcare service was stressed out and completely tourist flow thinned out and virtually reduced to nil as COVID overwhelmed with daily rise in cases. President of Brazil, Jair M sparked a disaster beyond imagination. Although economy Bolsonaro received criticism from all corners of the world when progressed remarkably in the first decade of 21st century but it his erroneous leadership pushed nation to an unprecedented slowed down substantially later on and unsettled issues like health emergency and economic distress. He downplayed novel poverty, unemployment, government apathy and corrupt corona virus since the early phase of the spread, antagonized practices in nation’s social, economic and political institutions quarantine necessity and opposed lockdown measures in fear of economic loss. Vaccination drive remained abysmally low as surfaced repeatedly. There was environment crisis due to miniscule 2 percent people were inoculated till March end of 2021. -

Institutional and Sustainability Report 2020/2021 Siemens.Com.Br Institutional and Sustainability Report | Siemens 2020/2021 Dear Reader

Institutional and Sustainability Report 2020/2021 siemens.com.br Institutional and Sustainability Report | Siemens 2020/2021 Dear reader, It is a pleasure to present our Institutional and Sustainability 2020 was also a year that marked the creation of two new Report 2020-2021. In Brazil and throughout the world, Siemens independent companies globally: Siemens and Siemens Energy. The works to make plants more efficient, buildings more intelligent, decision consolidated one of the pillars of the Vision 2020+ strategy: transportation cleaner and more comfortable and healthcare more to address markets in a more targeted and agile manner. With this, affordable and advanced. In a nutshell, we work with the objective Siemens is now focused on the digital transformation, serving of helping our customers shape a more sustainable world. This Industry and Infrastructure, while Siemens Energy is dedicated to the report shows what we do to accomplish this purpose. energy transformation. Siemens Healthineers and Siemens Mobility make up the Siemens Group and their activities are also described in For the second consecutive year, we chose to demonstrate the this Report. impacts of our actions in society through the United Nations’ 17 Sustainable Development Goals (SDGs). In conjunction with these Besides the impressive sales and new-order figures, we also obtained criteria, we are signatories of the Global Pact, an initiative that important achievements in terms of customer satisfaction. In the Net comprises companies from around the world to structure actions in Promoter Score (NPS), which evaluates how willing customers are the pursuit of these goals. to recommend our company to peers, our average score was 85, a milestone in our history and well above our industry average. -

Indirect Impact on Number of Admitted Children with COVID-19 in the First Three Months of Emergency Use of Two Vaccines, in Rio De Janeiro, Brazil

medRxiv preprint doi: https://doi.org/10.1101/2021.07.01.21259330; this version posted July 6, 2021. The copyright holder for this preprint (which was not certified by peer review) is the author/funder, who has granted medRxiv a license to display the preprint in perpetuity. All rights reserved. No reuse allowed without permission. Indirect impact on number of admitted children with COVID-19 in the first three months of emergency use of two vaccines, in Rio de Janeiro, Brazil Authors: Fonseca CGB 1, Costa ALTG 1, Esteves MDM 1, de Carvalho BRR 1, Souza CV 2 , Teixeira CH 2, Araujo da Silva, AR 1,2 1- Universidade Federal Fluminense 2- Infection Control Committee- Prontobaby-Group Abstract: Introduction: Since January 19, 2021, two vaccines against SARS-COV-2 are available in Brazil for emergency use for selected groups, not including children. Aim: To describe indirect impact on the number of hospitalized children with COVID- 19 in the first three months after beginning of emergency use of two vaccines. Methods: A retrospective study was conducted in children (0-18 years), admitted in two pediatric hospitals of Rio de Janeiro city, between January and April 2021 with confirmed COVID-19 by reverse transcription polymerase chain reaction or serological tests. Number of cases, clinical signs, symptoms and outcomes were compared with the first wave of disease (April- June 2020). A p value of less than .05 were considered was significant. Results: The number of total admitted patients (with all diseases) were 1097 in 2020 period, being 46 (4.2%) of them with confirmed COVID-19, and 2187 in the 2021 period, with 47 (2.1%) cases (p=0.006). -

Mergers and Acquisitions in Brazil: Projections for 2021

Mergers and Acquisitions in Brazil: Projections for 2021 FEBRUARY 2021 PREPARED BY: Denise Debiasi [email protected] +55.11.99102.9552 INTELLIGENCE THAT WORKS Copyright ©2021 by Berkeley Research Group, LLC. Except as may be expressly provided elsewhere in this publication, permission is hereby granted to produce and distribute copies of individual works from this publication for nonprofit educational purposes, provided that the author, source, and copyright notice are included on each copy. This permission is in addition to rights of reproduction granted under Sections 107, 108, and other provisions of the US Copyright Act and its amendments. Disclaimer: The opinions expressed in this publication are those of the individual authors and do not represent the opinions of BRG or its other employees and affiliates. The information provided in the publication is not intended to and does not render legal, accounting, tax, or other professional advice or services, and no client relationship is established with BRG by making any information available in this publication, or from you transmitting an email or other message to us. None of the information contained herein should be used as a substitute for consultation with competent advisors. In 2019, the so-called M&As (mergers and acquisitions) hit a record in Brazil, and the expectation was that, in 2020 alone, such operations would reach 1,3501. However, during the COVID-19 pandemic, the great majority of potential M&A operations remained suspended, gradually resuming from the second half of the year, both as a solution for some companies to maintain their operations; and for others, well capitalized, to take advantage of acquisition opportunities at lower prices, expanding their lines of business and increasing their market shares. -

Drivers of and Barriers to Capital Market Investments in Low-Carbon Infrastructure in Brazil

SNAPFI CASE STUDY Drivers of and barriers to capital market investments in low- carbon infrastructure Brazil in Brazil JULY 2021 About this report Published in July 2021 Project Strengthen National Climate Policy Implementation: Comparative Empirical Learning & Creating Linkage to Climate Finance – SNAPFI Website: https://www.diw.de/snapfi Financial support This project is part of the International Climate Initiative (IKI). The Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU) supports this initiative on the basis of a decision adopted at the German Bundestag. www.international-climate-initiative.com Study conducted by Center for Sustainability Studies (FGVces), São Paulo School of Business Administration (FGV EAESP), Fundação Getulio Vargas (FGV) Reference FGVces (Fundação Getulio Vargas Center for Sustainability Studies (2021). Drivers of and barriers to capital market investments in low-carbon infrastructure in Brazil. São Paulo. 102 p. Report design by Wilf Lytton [email protected] Cover illustration by Daniele Simonelli [email protected] SNAPFI CASE STUDY Drivers of and barriers to capital market investments in low- carbon infrastructure in Brazil Brazil JULY 2021 AUTHORS (in alphabetical order) Annelise Vendramini Camila Yamahaki Gustavo Velloso Breviglieri Victoria Kang Contents Executive Summary x Introduction 1 1.1 Brazil’s Nationally Determined Contribution and low-carbon infrastructure 5 Literature review 7 2.1 Drivers of and barriers to institutional 8 investments in transport infrastructure -

E484K As an Innovative Phylogenetic Event for Viral Evolution: Genomic

bioRxiv preprint doi: https://doi.org/10.1101/2021.01.27.426895; this version posted March 24, 2021. The copyright holder for this preprint (which was not certified by peer review) is the author/funder. All rights reserved. No reuse allowed without permission. E484K as an innovative phylogenetic event for viral evolution: Genomic analysis of the E484K spike mutation in SARS-CoV-2 lineages from Brazil Patrícia Aline Gröhs Ferrareze1, Vinícius Bonetti Franceschi2, Amanda de Menezes Mayer2, Gabriel Dickin Caldana1, Ricardo Ariel Zimerman3, Claudia Elizabeth Thompson1,2,4* 1 Graduate Program in Health Sciences, Universidade Federal de Ciências da Saúde de Porto Alegre (UFCSPA), Porto Alegre, RS, Brazil 2 Center of Biotechnology, Graduate Program in Cell and Molecular Biology (PPGBCM), Universidade Federal do Rio Grande do Sul (UFRGS), Porto Alegre, RS, Brazil 3 Irmandade Santa Casa de Misericórdia de Porto Alegre, Porto Alegre, RS, Brazil 4 Department of Pharmacosciences, Universidade Federal de Ciências da Saúde de Porto Alegre (UFCSPA), Porto Alegre, RS, Brazil * Corresponding author Address for correspondence: Claudia Elizabeth Thompson Department of Pharmacosciences, Universidade Federal de Ciências da Saúde de Porto Alegre (UFCSPA), 245/200C Sarmento Leite St, Porto Alegre, RS, Brazil. ZIP code: 90050-170. Phone: +55 (51) 3303 8889. E-mail: [email protected], [email protected] Running title: Genomic Analysis of the E484K spike mutation in Brazil Keywords: COVID-19, E484K, Severe acute respiratory syndrome coronavirus 2, Infectious Diseases, Viral evolution 1 bioRxiv preprint doi: https://doi.org/10.1101/2021.01.27.426895; this version posted March 24, 2021. The copyright holder for this preprint (which was not certified by peer review) is the author/funder. -

2020 I 2021 Annual Sustainability About This Message from Our Unique Metrics and Indicators 2 Report 2020 | 2021 Report the Ceo Model Results (Gri and Sasb)

ANNUAL SUSTAINABILITY REPORT 2020 I 2021 ANNUAL SUSTAINABILITY ABOUT THIS MESSAGE FROM OUR UNIQUE METRICS AND INDICATORS 2 REPORT 2020 | 2021 REPORT THE CEO MODEL RESULTS (GRI AND SASB) Menu Strong culture Value partnerships People management Safety Corporate governance Ethics and compliance ABOUT THIS REPORT Risk management Discussing priorities Social performance • Relationship with neighboring communities MESSAGE FROM THE CEO • Agile and precise actions during the pandemic • Creando Vínculos OUR UNIQUE MODEL • Raízen Foundation Integrated ecosystem Fronts of operation METRICS AND RESULTS • Renewables • Marketing & Services INDICATORS (GRI AND SASB) • Proximity • Sugar CONTENT INDEX (GRI AND SASB) Advanced technologies LETTER OF ASSURANCE Effectiveness and efficiency New energy solutions CREDITS Digitalization Advanced analytical solutions PREVIOUS REPORTS ANNUAL SUSTAINABILITY ABOUT THIS MESSAGE FROM OUR UNIQUE METRICS AND INDICATORS 3 REPORT 2020 | 2021 REPORT THE CEO MODEL RESULTS (GRI AND SASB) DISCUSSING PRIORITIES GRI 102-46, 102-47 An important part of our 10-year history is our About this Report active consultation with stakeholders through the materiality process, which consists of a survey of the most relevant topics for our business and We have published annual sustainability reports since the begin- stakeholders, based on the impacts—both posi- ning of our activities as a demonstration of our commitment to tive and negative—caused by our operations. transparency and accountability with equity, timeliness, and corpo- rate responsibility. GRI 102-52 The process includes analysis of internal and external documents, engagement of senior man- This tenth edition includes the performance of our operations1, in agement, and consultations with our stakehold- Brazil and Argentina, between April 1, 2020 and March 31, 2021 ers, which are accessed through interviews (pri- (2020/2021 crop year). -

Employment in Crisis the Path to Better Jobs in a Post-COVID-19 Latin America

WORLD BANK LATIN AMERICAN AND CARIBBEAN STUDIES Employment in Crisis The Path to Better Jobs in a Post-COVID-19 Latin America Joana Silva, Liliana D. Sousa, Truman G. Packard, and Raymond Robertson Employment in Crisis WORLD BANK LATIN AMERICAN AND CARIBBEAN STUDIES Employment in Crisis The Path to Better Jobs in a Post-COVID-19 Latin America Joana Silva, Liliana D. Sousa, Truman G. Packard, and Raymond Robertson © 2021 International Bank for Reconstruction and Development / The World Bank 1818 H Street NW, Washington, DC 20433 Telephone: 202-473-1000; Internet: www.worldbank.org Some rights reserved 1 2 3 4 24 23 22 21 This work is a product of the staff of The World Bank with external contributions. The findings, inter- pretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Nothing herein shall constitute or be considered to be a limitation upon or waiver of the privileges and immunities of The World Bank, all of which are specifically reserved. Rights and Permissions This work is available under the Creative Commons Attribution 3.0 IGO license (CC BY 3.0 IGO) http://creativecommons.org/licenses/by/3.0/igo. -

Improving the Creation of Hot Spot Policing Patrol Routes: Comparing Cognitive Heuristic Performance to an Automated Spatial Computation Approach

International Journal of Geo-Information Article Improving the Creation of Hot Spot Policing Patrol Routes: Comparing Cognitive Heuristic Performance to an Automated Spatial Computation Approach Spencer P. Chainey 1,* , Jhonata A. S. Matias 2 , Francisco Carlos F. Nunes Junior 2 , Ticiana L. Coelho da Silva 2, José Antônio F. de Macêdo 2, Regis P. Magalhães 2, José F. de Queiroz Neto 2 and Wellington C. P. Silva 3 1 Jill Dando Institute of Security and Crime Science, University College London, 35 Tavistock Square, London WC1H 9EZ, UK 2 Insight Data Science Lab, Department of Computing, Federal University of Ceará, Pici Campus, Block 952, Science Center, Pici, Fortaleza 60440-900, CE, Brazil; [email protected] (J.A.S.M.); [email protected] (F.C.F.N.J.); [email protected] (T.L.C.d.S.); [email protected] (J.A.F.d.M.); [email protected] (R.P.M.); fl[email protected] (J.F.d.Q.N.) 3 Federal Police of Brazil, National Police Academy, Rodovia DF 001 KM—02 Setor Habitacional Taquari, Lago Norte, CEP, Brasília 71559-900, DF, Brazil; [email protected] * Correspondence: [email protected] Abstract: Hot spot policing involves the deployment of police patrols to places where high levels of crime have previously concentrated. The creation of patrol routes in these hot spots is mainly Citation: Chainey, S.P.; Matias, J.A.S.; a manual process that involves using the results from an analysis of spatial patterns of crime to Nunes Junior, F.C.F.; Coelho da Silva, identify the areas and draw the routes that police officers are required to patrol. -

Tracking and Analysis September/2020

Tracking and Analysis September/2020 1 - Introduction 2 – Number of actions 3 - Actions by type and by theme 4 - Analysis 5 - Trends 6 – Terms of usage and contact information 1 - Introduction The Politica Por Inteiro tracks policy signals that affect the environment and climate change in Brazil by using data science and policy analysis to understand government’s actions and strategies. Through monthly outlooks like this one, we aim at differentiating signals from noise and capture relevant trends to economic and civic actors. The current edition summarizes relevant Brazilian government's signals from SEPTEMBER 2020, quantifying the number of actions by theme (from energy to conservation) and by type (according to our own classification), as well as the most important trends for October. 2 – Number of actions1 In September, our Government Actions Tracker identified 112 measures relevant to environmental policy and climate change in the Federal Official Gazette. The three most frequent governmental signals detected were signals of: "regulation" (33 actions), "response" (17 actions, mainly due to the large number of declarations of emergency because of the dry season, drought, forest fires and floods in various municipalities) and “Law consolidation" (12 actions, due to expiry). 1 For further information regarding this work’s methodology, refer to our website. September/2020 The number of "flexibilization" signals was also noteworthy (8 actions, a few of which addressing extensions due to the Covid-19 pandemic). We also identified 7 actions resulting in changes in structures in federal institutions, here listed under “institutional reform”; 3 “deregulation” actions, 1 "privatization" action and 1 "retreat" from federal government regarding prior deregulation.