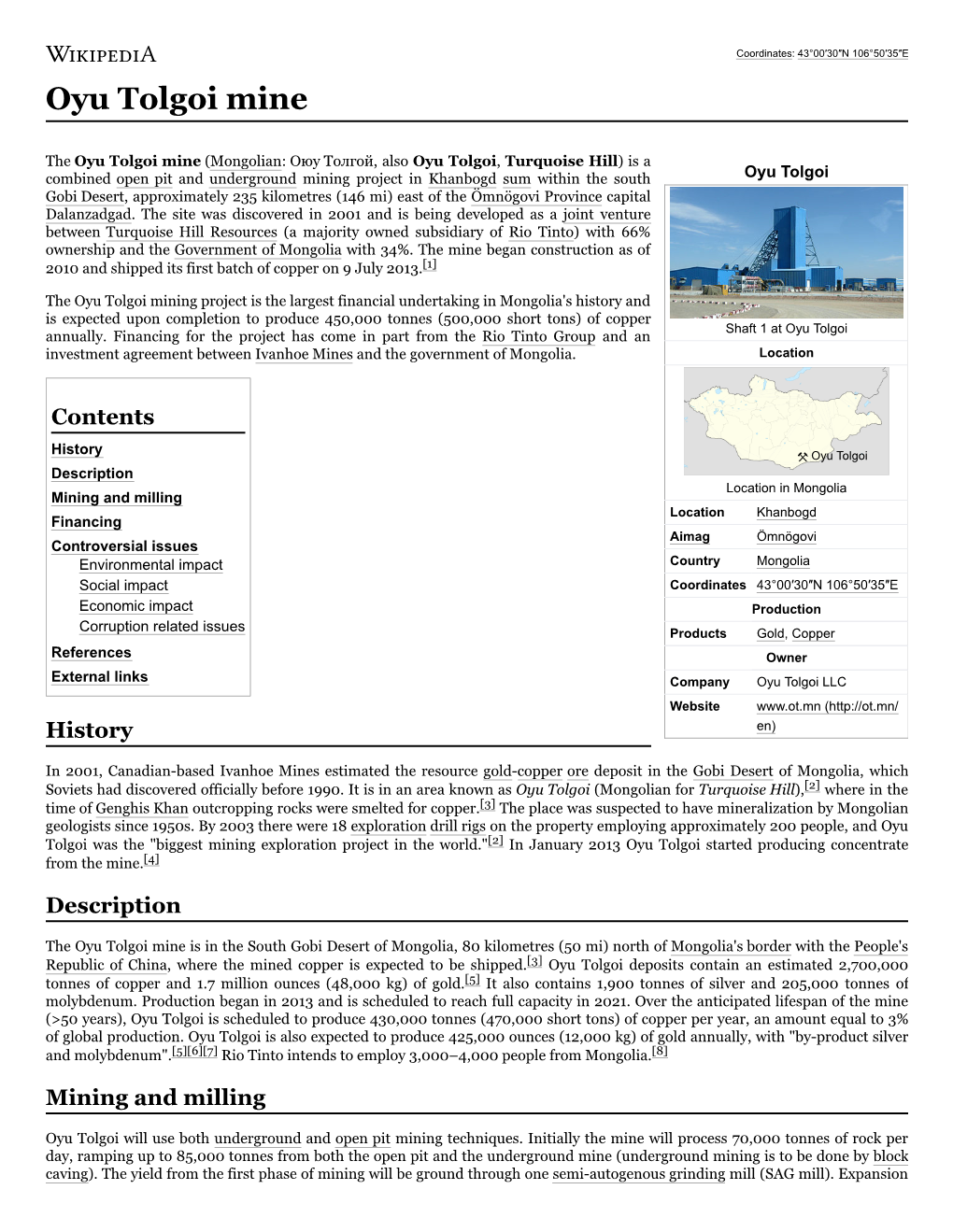

Oyu Tolgoi Mine

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Print This Article

Journal of Law & Commerce Vol. 36, No. 1 (2017) ● ISSN: 2164-7984 (online) DOI 10.5195/jlc.2017.130 ● http://jlc.law.pitt.edu WHAT IS TO BE DONE ABOUT RESOURCE NATIONALISM?: THE CASE OF OYU TOLGOI Batkhuu Dashnyam This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 United States License. This site is published by the University Library System of the University of Pittsburgh as part of its D-Scribe Digital Publishing Program, and is cosponsored by the University of Pittsburgh Press. WHAT IS TO BE DONE ABOUT RESOURCE NATIONALISM?: THE CASE OF OYU TOLGOI Batkhuu Dashnyam* Foreign mining is as important now as ever. As the global population has continued to increase, so has the demand for natural resources. Developing countries richly endowed with natural resources have begun to realize that harnessing them presents a rare opportunity to fuel broader socioeconomic change and may, potentially, catalyze wholesale transformation.1 In this vein, countries have begun to increase their taxes and royalties on mining;2 and, to a greater extent, a “more indirect or insidious form of government intervention referred to as ‘creeping expropriation’”3 has begun to appear, whereby a “foreign investor is substantially deprived of the use or benefit of their investment even though formal title may continue to vest.”4 This emerging tension is encapsulated in what is known as “resource nationalism.” In essence, resource nationalism broadly refers to governmental “dissatisfaction about the distribution of revenues from mining between company shareholders and the host nation.”5 Even after agreeing with foreign investors about the rights, royalties, taxes, and terms for a mining project, governments subsequently will attempt to renegotiate or even possibly breach their bargain in an effort to extract more control and * Batkhuu Dashnyam is a member of the Class of 2018, at the University of Pittsburgh School of Law. -

Press Release

November 6, 2014 Press release Turquoise Hill announces board and management changes VANCOUVER, CANADA – Turquoise Hill Resources today announced the retirement of Chair Dr. David Klingner, effective January 1, 2015, and Chief Executive Officer Kay Priestly, effective December 1, 2014. Current directors Jill Gardiner and Jeff Tygesen have been appointed Chair and Chief Executive Officer, respectively. Ms. Priestly will remain on the Turquoise Hill board until December 31, 2014. The appointments are the result of an extensive succession planning program that has been underway for several months. Dr. Klingner said, “It has been an honour to serve Turquoise Hill shareholders particularly during a period of significant transition for the Company. I am confident Jill will successfully lead the board as the Company and Oyu Tolgoi prepare for the next phase of growth and development, and her tenure as a director will allow for continuity in overall strategy.” During his time as Chair, Dr. Klingner led the board transition that followed the 2012 Memorandum of Agreement with Rio Tinto and execution of a long-term funding strategy that included two major capital raising programs that led to completion of Oyu Tolgoi’s initial development. Ms. Priestly was appointed Chief Executive Officer of the Company on May 1, 2012 leading Turquoise Hill during the final phase of Oyu Tolgoi’s initial development and operational ramp up. Dr. Klingner said, “I have thoroughly enjoyed working with Kay and am pleased with Turquoise Hill’s development during her tenure. Under her leadership, the Company emerged debt free in January 2014 following a successful rights offering, significantly reduced corporate costs due to streamlined corporate functions and divested multiple non-core assets.” Mr. -

The Mineral Industry of Mongolia in 2013

2013 Minerals Yearbook MONGOLIA U.S. Department of the Interior November 2016 U.S. Geological Survey THE MINERAL INDUSTRY OF MONGOLIA By Lin Shi Mongolia is a landlocked country located between China The Mineral Resources Authority of Mongolia (MRAM) and Russia. The country has large proven reserves of coal, issued the Mining Sector’s Policy of the Government of Mongolia copper, and fluorspar. Mineralized systems with copper, gold, Program 2008–2012, which included developing strategic molybdenum, tin, and tungsten are common in Mongolia. deposits; conducting research on geologic formations and mineral Mongolia depends on imported finished petroleum products distribution; providing general evaluations and geologic mapping; and has been trying to develop its domestic petroleum sector and improving the legal environment of the geology and mining by attracting foreign investors through revisions of the nation’s sectors (Mineral Resources Authority of Mongolia, 2014, p. 28). legal framework and by offering tax incentives to oil refiners On February 7, 2013, the Petroleum Products Law was (U.S. Central Intelligence Agency, 2014; Woolley and Odkhuu, amended to require an additional license to trade petroleum 2014, p. 1). products. The Petroleum Products Law, which was enacted on In 2013, Mongolia’s real gross domestic product (GDP) rate July 1, 2005, defined petroleum products as “all types of fuel of growth was 11.7%, the nominal GDP amounted to about products” and provided five subclassifications of activities $11.5 billion, and the inflation rate was 13%. The country’s in relation to petroleum products: import, production, trade, economy has grown by about 10% per year since 2010 because transportation, and storage. -

Turquoise Hill Resources Ltd

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 __________________ FORM 40-F __________________ ☐ Registration Statement pursuant to Section 12 of the Securities Exchange Act of 1934 or ☒ Annual Report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2019 Commission File Number: 001-32403 __________________ TURQUOISE HILL RESOURCES LTD. (Exact name of Registrant as specified in its charter) __________________ Yukon, Canada 1000 Not Applicable (Province or other jurisdiction of (Primary Standard Industrial (I.R.S. Employer Identification incorporation or organization) Classification Code Number) Number) Suite 3680 – 1 Place Ville Marie, Montreal, Quebec H3B 3P2, Canada, (514) 848-1567 (Address and telephone number of Registrant’s principal executive offices) CT Corporation System 28 Liberty St 42nd Floor New York, New York 10005 (212) 894-8700 (Name, address (including zip code) and telephone number (including area code) of agent for service in the United States) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Shares without par value TRQ New York Stock Exchange Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None For annual reports, indicate by check mark the information filed with this Form: ☒ Annual Information -

Turquoise Hill Resources Ltd

TURQUOISE HILL RESOURCES LTD. Third Quarter Report September 30, 2020 Financial Statements and MD&A Turquoise Hill Resources Ltd. Condensed Interim Consolidated Financial Statements (Unaudited) September 30, 2020 TURQUOISE HILL RESOURCES LTD. Consolidated Statements of Income (Loss) (Stated in thousands of U.S. dollars) (Unaudited) Three Months Ended Nine Months Ended September 30, September 30, Note 2020 2019 2020 2019 Revenue 4 $ 264,520 $ 209,189 $ 673,146 $ 944,617 Cost of sales 5 (167,991) (174,188) (495,871) (567,978) Gross margin 96,529 35,001 177,275 376,639 Operating expenses 6 (49,909) (40,835) (144,713) (169,078) Corporate administration expenses (6,496) (3,640) (21,068) (13,943) Other income (expenses) (250) (1,751) 1,550 771 Impairment charges 10 - - - (596,906) Income (loss) before finance items and taxes 39,874 (11,225) 13,044 (402,517) Finance items Finance income 7 1,590 25,693 16,214 87,584 Finance costs 7 (1,503) (3,987) (4,828) (7,714) 87 21,706 11,386 79,870 Income (loss) from operations before taxes $ 39,961 $ 10,481 $ 24,430 $ (322,647) Income and other taxes 121,803 34,591 228,608 (263,763) Income (loss) for the period $ 161,764 $ 45,072 $ 253,038 $ (586,410) Attributable to owners of Turquoise Hill Resources Ltd. 128,612 71,730 246,380 (263,548) Attributable to owner of non-controlling interest 33,152 (26,658) 6,658 (322,862) Income (loss) for the period $ 161,764 $ 45,072 $ 253,038 $ (586,410) Basic and diluted earnings (loss) per share attributable to Turquoise Hill Resources Ltd. -

Oyu Tolgoi Mine

Oyu Tolgoi Mine Optimizing the efficient use of scarce water resources a Rio Tinto case study September 2017 Company details Rio Tinto is a leading global mining and metals group that focuses on finding, mining, processing and marketing the earth’s mineral resources. Their major products are aluminium, copper, diamonds, gold, industrial minerals, iron ore, thermal and metallurgical coal and uranium. Rio Tinto has been in business for more than 140 years with a current workforce of about 50,000 in around 35 countries. http://www.riotinto.com/ Oyu Tolgoi Copper and Gold Mine, Mongolia Situated in the southern Gobi desert of Mongolia, approximately 550 kilometres south of the capital, Ulaanbaatar, and 80 kilometres north of the Mongolia-China border, Oyu Tolgoi is jointly owned by the Government of Mongolia (34 per cent) and Turquoise Hill Resources (66 per cent, of which Rio Tinto owns 51 per cent). Since 2010, Rio Tinto has also been the manager of the Oyu Tolgoi project. Summary of action Mongolia’s mining sector is a significant contributor to the economy as well as a key water user. The Rio Tinto managed Oyo Tolgoi copper and gold mine located in the water scarce South province has recognised the importance of optimizing the use of the scarce water resources and taking a stewardship approach in order to ensure the long-term future of mine, natural environmental systems and local herder livelihoods. In response to the situation, Oyu Tolgoi surveyed the area seeking a suitable underground water supply and identified the Gunii Hooloi aquifer, a 150 meter deep resource holding around 6.8 billion cubic metres of non-drinkable saline water. -

Undermining Mongolia

Undermining Mongolia Corporate hold over development trajectory Rhodante Ahlers & Vincent Kiezebrink & Sukhgerel Dugersuren February 2020 Colophon Undermining Mongolia Corporate hold over development trajectory February 2020 Authors: Rhodante Ahlers, Vincent This publication is made possible with Kiezebrink, Sukhgerel Dugersuren financial assistance from The Dutch Ministry Layout: Frans Schupp of Foreign Affairs. The content of this Cover photo: Tserenjav Demberel publication is the sole responsibility of SOMO and can in no way be taken to reflect the views of The Dutch Ministry of Foreign Affairs. Oyu Tolgoi Watch Stichting Onderzoek Multinationale Ondernemingen Ulaanbaatar, 46A Mongolia Centre for Research on Multinational T: 976-98905828 Corporations Oyu Tolgoi Watch is a non-profit, non- Sarphatistraat 30, 1018 GL Amsterdam governmental organization established in The Netherlands 2009 to monitor Oyu Tolgoi project’s T: +31 (0)20 639 12 91 compliance with the international [email protected] – www.somo.nl environmental and human rights norms and standards. OT Watch was established The Centre for Research on Multinational by a group of CSOs which have actively Corporations (SOMO) is a critical, engaged with govern-ment and protested independent, not-for-profit knowledge against signing the unfair investment centre on multinationals. Since 1973 we agreement. Since its establishment OT have investigated multinational corporations Watch is working in partnership with and the impact of their activities on people national, international civil society and the environment. We provide custom- networks in advocating for fair and made services (research, consulting accountable mining and investment and training) to non-profit organisations practices respectful of human rights and the public sector. We strengthen in the development process. -

Mongolia: the Oyu Tolgoi Copper & Gold Mine Project

Mongolia: The Oyu Tolgoi Copper & Gold Mine Project Comments on Chapter D1 of the ESIA: “Environmental and Social Management Plan Framework” 32 pages, dated 31st July 2012 Prepared by Robert Goodland October 2012 1. The ESIA is about one decade overdue Oyu Tolgoi mine exploration began in 1997. This chapter and elsewhere states that construction is on line to be completed by December 2012 and operations will begin in January 2013. This means construction is 94% complete so practically all the decisions have been taken without having the benefit of the mandatory ESIA. The 2012 ESIA is about one decade late. The ESIA is a design tool process that needs to run in parallel with the Feasibility Study and to feed into the Feasibility Study throughout its often 24 month duration. The ESIA is dated 31st July 2012, which means it could not have fed into the Feasibility Study. The ESIA cannot run retroactively. In some ways even more serious is that not only is the ESIA late in terms of the construction having already taken place, but it also doesn’t include the final information on implementation of operational impacts/management plans, and therefore the operational phase ESIA will also be late. Making the ESIA into a useless sham is consistent with Ivanhoe CEO Robert Friedland’s knowledge of OT’s environment in his claim: "The nice thing about (Oyu Tolgoi) is that there are no people around, the land is flat, there's no tropical jungle, there are no NGOs." (Jan. 21st 2012, The Economist) IFC’s PS1 Para 6 states: The environmental assessment process may recommend alternative (higher or lower) levels or measures, which, if acceptable to IFC, become project- or site-specific requirements. -

2021 Technical Report

Entrée/Oyu Tolgoi Joint Venture Project Mongolia NI 43-101 Technical Report Prepared for: Effective Date: Entrée Resources Ltd. 17 May, 2021 Prepared by: Mr Kirk Hanson, P.E. Project Number: Mr Christopher Wright, P.Geo. 247026 Mr. Piers Wendlandt, P.E.. Mr. Dean David, FAusIMM Dr. Haiming (Peter) Yuan, P.E. CERTIFICATE OF QUALIFIED PERSON Kirk Hanson, P.E. Wood USA Mining Consulting SLC Engineering 10876 S River Front Pkwy #250 South Jordan, UT 84095 United States Tel: (775) 997-6559 I, Kirk Hanson, P.E., am employed as a Technical Director, Open Pit Mining with Wood USA Mining Consulting SLC Engineering. This certificate applies to the technical report entitled “Entrée/Oyu Tolgoi Joint Venture Project, Mongolia, NI 43-101 Technical Report” that has an effective date of 17 May, 2021 (the “technical report”). I am registered as a Professional Engineer in the State of Idaho (#11063). I graduated with a B.Sc. degree from Montana Tech of the University of Montana, Butte, Montana in 1989 and from Boise State University, Boise, Idaho with an MBA degree in 2004. I have practiced my profession for 32 years. I was Engineering Superintendent at Barrick’s Goldstrike operation, where I was responsible for all aspects of open-pit mining, mine designs, mine expansions and strategic planning. After earning an MBA in 2004, I was assistant manager of operations and maintenance for the largest road department in Idaho. In 2007, I joined AMEC (now Wood) as a principal mining consultant. Over the past 14 years, I have been the mining lead for multiple scoping, pre-feasibility, and feasibility studies. -

Can Mongolian Copper Power the Green Revolution? | Financial Times 13/8/18, 7(35 Am

Can Mongolian copper power the green revolution? | Financial Times 13/8/18, 7(35 am Subscribe to the FT The Big Read Mongolia Can Mongolian copper power the green revolution? To meet demand miners will have to operate in countries difficult to navigate Neil Hume in Oyu Tolgoi YESTERDAY After a four-minute descent in a dark, two-storey lift, the latest shift of workers arrives at Mongolia’s largest ever construction project — a huge underground copper mine called Oyu Tolgoi 1.3km below the Gobi desert. Along one of the tunnels, a minibus makes its way slowly to a huge cavern. This, a young Australian engineer explains, will house one of the mine’s biggest pieces of equipment — a 300 tonne crushing machine, which will pulverise copper bearing rocks blasted from an ore body the size of central Manhattan. Capable of processing 4,000 tonnes of copper-bearing rock per hour, the machine is a key part of a near $7bn expansion project that will see Oyu Tolgoi emerge as the world’s third largest source of copper by 2027, producing more than 500,000 tonnes a year. Once finished Oyu Tolgoi will help supply a metal that will be in ever-greater demand as the green energy revolution takes hold. It will also become a mainstay of the Mongolian economy, which has veered between boom and bust since the end of the Soviet satellite regime in the early 1990s. https://www.ft.com/content/1a39210c-91cc-11e8-bb8f-a6a2f7bca546 Page 1 of 13 Can Mongolian copper power the green revolution? | Financial Times 13/8/18, 7(35 am Oyu Tolgoi mining map The development of Oyu Tolgoi, controlled and operated by Anglo-Australian group Rio Tinto, provides a unique insight into the modern mining industry and its quest to find the raw materials that will make the shift to renewable energy possible. -

The Mineral Industry of Mongolia in 2015

2015 Minerals Yearbook MONGOLIA [ADVANCE RELEASE] U.S. Department of the Interior November 2018 U.S. Geological Survey The Mineral Industry of Mongolia By Meralis Plaza-Toledo Mongolia, a country located in northeast Asia, is bordered Production on the north by Russia and on the south by China. Historically, Mongolia’s economy relied on herding and agriculture, but in In 2015, production of molybdenum (mine output) increased recent times, it has become increasingly reliant on the mining by 28%; gold (mine output), by 27%; copper, by 25%; and sector. In 2015, Mongolia accounted for 3% of the world’s crude petroleum, by 18%. Production of fluorspar decreased by fluorspar production. In addition, the country has extensive 38%, and that of crude steel, by 32%, owing to lower demand deposits of coal, copper, gold, petroleum, and uranium. As of (table 1; Industrials Minerals, 2015; National Statistical Office 2015, the Government was actively taking action to increase of Mongolia, 2016). foreign direct investment (FDI) to stabilize the economy Structure of the Mineral Industry (Mungunzul and Chang, 2016, p. 1; McRae, 2017; World Bank, The, 2017). Table 2 lists Mongolia’s major mineral industry facilities. Most of the producing mining companies in Mongolia were Minerals in the National Economy owned by the state or by joint ventures between international In 2015, the mineral industry in Mongolia contributed companies and the Government of Mongolia, although a few approximately 20% to the country’s gross domestic product companies were wholly owned by foreign investors. (GDP). The mining sector accounted for 78.8% of total exports, Mineral Trade of which coal, copper concentrate, iron ore and concentrate, and crude petroleum constituted about 74% of total exports and 85% In 2015, trade between Mongolia and Russia decreased by of mineral commodity exports. -

Turquoise Hill Resources Ltd. 2020 Annual Report Drill and Blasting Area of the Open Pit Mine, Oyu Tolgoi

2020 Annual Report Turquoise Hill is an international mining company focused on the operation and further development of the world class Oyu Tolgoi copper-gold mine in Southern Mongolia. Underground Mine Shaft Facilities and Chandmani Operations and Service Centre Table of contents 4 Letter from the Chairman 6 Company Profile 8 Operational Performance 10 2020 in Review 12 Mine Design 14 ESG Commitments 16 Copper Mark Award 18 Strong Sustainability 20 Safety 22 Water 24 Biodiversity 26 Land Management 27 Greenhouse Gas Emission 28 Sustainability Commitments 32 Environmental and Social impact Assessment Management 33 Board of Directors / Senior Leadership Team 35 MD&A & Financial Statements Table of contents Table 2 Turquoise Hill Resources Ltd. 2020 Annual Report Drill and blasting area of the open pit mine, Oyu Tolgoi. The Oyut open pit is mined using conventional drill, blast load and haul methods. Camel herd belonging to a nomadic family in Khanbogd soum in which the Oyu Tolgoi Mine site is located, within the Umnogovi aimag Turquoise Hill Resources Ltd. 2020 Annual Report 3 Letter from the Chairman 2020 was a year in which, despite the challenges presented by the COVID-19 pandemic, we delivered on many milestones and continued to operate the open pit uninterrupted, while keeping the underground development on the critical path to sustainable production. Of note, our achievements in 2020 were accomplished during a year in which the All Injury Frequency Rate, the global measurement of safety performance, registered a record low. The key milestone of 2020 was the completion of the updated mine design for the underground development.