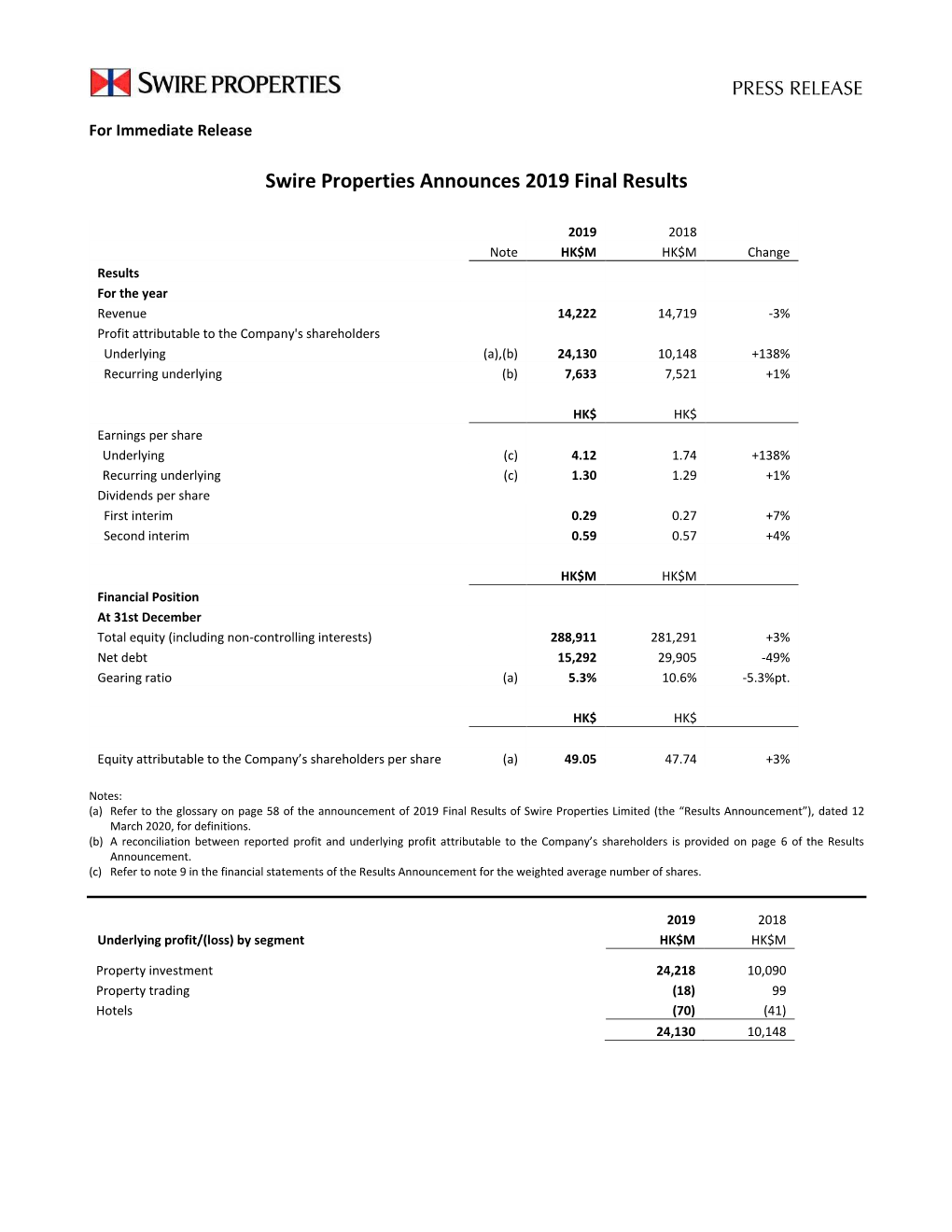

Swire Properties Announces 2019 Final Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Antonio Corsaro Chef De Cuisine, La Scala at the Sukhothai Shanghai

Antonio Corsaro Chef de Cuisine, La Scala at The Sukhothai Shanghai Exceptional culinary delights are intrinsic part of a hotel experience. In the two years since its opening, The Sukhothai Shanghai has established itself as one of Shanghai’s lifestyle landmarks and a must-visit culinary destination. A stylish highlight of the hotel is the casual upscale Italian restaurant, La Scala. As the new chef de cuisine of the hotel’s signature, award-winning restaurant, Chef Antonio Corsaro leads the culinary team to take La Scala’s epicurean offerings to new heights, crafting memorable gourmet experience for guests and discerning gastronomes alike. With over 17 years of experience honing his skills at some of Europe’s most elite establishments, including various Michelin-starred restaurants by Alain Ducasse, Chef Corsaro is known for his culinary finesse and uncompromising commitment to seasonality and freshness. The Italy native upholds the virtues of Italian food – simplicity with an emphasis on quality ingredients, which continues to underscore La Scala’s food philosophy. Originally from Naples, Italy, Chef Corsaro’s discovered a lifelong culinary passion from his mom's home cooking and his travels across the continent. Fascinated by the richness of food cultures in his own country and abroad, Antonio embarked on a journey to create his career success. He began his career in Unico, a one-star Michelin restaurant in Milan as chef de partie, working alongside celebrity chef Fabio Baldassarre, before moving to Tuscany to join L’Andana, a one-star Michelin restaurant under DUCASSE Paris. His relentless pursuit of culinary excellence has taken him to multiple DUCASSE Paris’ restaurants in Paris and London from 2013 to 2018. -

HKR International Ltd Version 1 | Bloomberg: 480 HK Equity | Reuters: 0480.HK Refer to Important Disclosures at the End of This Report

China / Hong Kong Company Guide HKR International Ltd Version 1 | Bloomberg: 480 HK Equity | Reuters: 0480.HK Refer to important disclosures at the end of this report DBS Group Research . Equity 4 Jun 2020 BUY(Initiating Coverage) Rediscovering a hidden gem. Last Traded Price ( 2 Jun 2020):HK$3.12(HSI : 23,996) • HKRI Taikoo Hui in Shanghai is a crown jewel, supporting its Price Target 12-mth:HK$4.09 (31.1% upside) long-term share price appreciation • Low-cost land reserve in Discovery Bay, a well-regarded Analyst residential community, provides good investment returns Jeff YAU CFA,+852 36684180, [email protected] • The stock is undervalued, trading at 82% discount to our assessed current NAV Price Relative • Initiating coverage with BUY rating and TP of HK$4.09 HK$ Relative Index 3.7 209 Initiating coverage with BUY rating and target price of HK$4.09. HKR 3.5 189 International is trading at 82% discount to our appraised current 3.3 169 3.1 149 NAV, slightly wider than those for other small-to-mid cap property 2.9 129 developers. The stock is undervalued in view of its asset quality and 2.7 109 financial strength. The realisation of the value of its upmarket 2.5 89 Dec-19 Mar-20 residential developments in Hong Kong should provide upside on HKR International Ltd (LHS) Relative HSI (RHS) stock. Steadily growing contributions from HKRI Taikoo Hui in Forecasts and Valuation Shanghai and CDW Building in Hong Kong should underpin its long- FY Mar (HK$ m) 2019A 2020F 2021F 2022F term share price appreciation. -

0 Swire Pacific Annual Report 2009 Quality in Every Detail Swire Properties Believes That the Quality of Its Planning and Design Creates Long-Term Value

0 Swire Pacific Annual Report 009 Quality in Every Detail Swire Properties believes that the quality of its planning and design creates long-term value. Swire Pacific Annual Report 009 Review of Operations Property Division Swire Properties’ property investment portfolio in Hong Kong comprises office and retail premises in prime locations, as well as hotel interests, serviced apartments and other luxury residential accommodation. The completed portfolio in Hong Kong totals 4.9 million square feet of gross floor area. In Mainland China, Swire Properties has interests in major commercial mixed-use developments in Beijing, Shanghai and Guangzhou, which will total 8.0 million square feet on completion, of which .6 million square feet has already been completed. In the United States, Swire Properties owns a 75% interest in the Mandarin Oriental Hotel in Miami, Florida. In the United Kingdom, Swire Properties owns four small hotels. Swire Properties’ trading portfolio comprises land and residential apartments under development in Hong Kong and Florida, as well as the remaining units for sale at the Island Lodge and Asia residential developments in Hong Kong and Miami respectively. Particulars of the Group’s key properties are set out on pages 79 to 89. 2009 008 HK$M HK$M Turnover Gross rental income derived from Offices 4,115 3,63 Retail 3,060 ,90 Residential 268 9 Other revenue * 83 74 Property investment 7,526 6,907 Property trading 643 889 Hotels 172 56 Total turnover 8,341 7,95 Operating profit derived from Property investment 5,607 5,012 Valuation gains on investment properties 14,383 84 Property trading 70 98 Hotels (474) (86) Total operating profit 19,586 5,308 Share of post-tax profits from jointly controlled and associated companies 163 83 Attributable profit 15,390 4,93 * Other revenue is mainly estate management fees. -

2019-2020 China Health and Fitness Market White Paper

2019-2020 China Health and Fitness Market White Paper Public version Technology, Media & Telecommunications Industry Foreword From Deloitte Partner 5 Foreword From Founder of CHINAFIT 9 Overview of the report 11 Methodology and implications of this report 12 Disclaimer 12 Chapter 1: Overview of China Health and Fitness Industry 13 Chapter 2: Trend of China Health and Fitness Industry 17 Chapter 3: The Impact of COVID-19 Pandemic 28 Chapter 4: Overview of Health and Fitness Market in Cities 41 Chapter 5: Operation of Leading Gyms 43 LeFit 45 LuckyBird 48 Will's 51 简介 Tera Wellness 54 Kuaikuai 57 Physical 59 Sinofit 61 Ingym 63 Good Feeling 65 Liking Fit 68 Mirako Fitness 70 SunPig 72 Powerhouse 74 The One Fitness 76 Super Monkey 78 Golden Times Fitness 81 Total Fitness 83 Pure 85 Renma Fitness 88 WHYTEWOOLF 90 Oxygym 92 SpaceCycle 94 Zhongtian Fitness 97 Chapter 6: Interview with Leading Industry Experts 99 (No Particular Order) Mr. Han Ke (MFT) 100 Mr. Xu Chaoqin (MATRIX) 102 Mr. Yao Ning (3HFIT) 103 Mr. Wu Chenghan, Ms. Sun Tongtong (GYMLUXE) 105 Mr. Jin Yuqing (Tera Wellness) 109 Mr. Li Liang (Oxygym) 111 Mr. Huo Ming (Good Feeling) 113 Mr. Zhou Rong (LuckyBird) 118 Ms. Cao Yan (Powerhouse) 120 Mr. Han Wei, Mr. Xia Dong (LeFit) 122 Foreword From Deloitte Partner 2019-2020 China Health and Fitness Market White Paper Foreword From Deloitte Partner As China's economy and disposable penetration rates of 10- 20% in income continues to grow, its Europe and North America. people are increasingly interested – The industry is transitioning in improving their quality of life, to customer-centric service. -

2017 Final Results | Analyst Briefing

EASTWOOD2011\Roadshow presentation\Eastwood Roadshow Presentation_FINAL.ppt 2017 Final Results | Analyst Briefing 15th March 2018 © Swire Properties Limited EASTWOOD2011\Roadshow presentation\Eastwood Roadshow Presentation_FINAL.ppt Agenda Speakers : Guy Bradley, Chief Executive and Fanny Lung, Finance Director 1. Financial Highlights 2. Investment Portfolio 3. Trading Portfolio 4. Financing 5. Prospects 6. Q&A EASTWOOD2011\Roadshow presentation\Eastwood Roadshow Presentation_FINAL.ppt Highlights Solid performance in 2017 underpinned by higher rental income from Hong Kong, Mainland China and Miami, U.S.A. Well-placed for growth in investment property income with key projects - One Taikoo Place, South Island Place and Tung Chung Town Lot No. 11, scheduled for completion in 2018. Building project pipeline with new investments in Hong Kong, Shanghai and Beijing.Highlights 14.2% y-y 10.2% y-y 8.5% y-y Equity Attributable Underlying Profit Dividend per Share to Shareholders (2017 Full Year) HK$ 44.00 per share HK$ 7,834 M HK$ 0.77 (2016 Dec: HK$ 38.52 per share) (2016: HK$ 7,112 M) (2016: HK$ 0.71) 3 EASTWOOD2011\Roadshow presentation\Eastwood Roadshow Presentation_FINAL.ppt Key Developments Feb 2018 Qiantan Project, Shanghai ~ 1.3M sq ft GFA Entered into a conditional equity transfer agreement for the acquisition of a 50% interest Jan 2018 One Taikoo Place ~ 1.0M sq ft GFA Topped out Qiantan Project Artist Impression Jan 2018 First Green Bond Issued for US$500M Dec 2017 Po Wah Building, 1-11 Landale Street and 2-12 One Taikoo Place Anton -

Swire Properties Delivers Solid Results in First Half of 2021

For Immediate Release Swire Properties Delivers Solid Results in First Half of 2021 Strong fundamentals, combined with a balanced portfolio and strategic capital management fuelling Company’s future growth Summary of 2021 Interim Results • Increase in attributable underlying profit to HK$4,513 million, driven by the sale of car parking spaces at Taikoo Shing in Hong Kong. • Strong fundamentals delivering sustainable dividend growth of 3% year-on-year. • Resilient Hong Kong office portfolio with high occupancies and stable rents. • Robust Chinese Mainland retail portfolio with 38% year-on-year increase in attributable gross rental income. • Gradual recovery in Hong Kong retail portfolio with high occupancy and an increase in retail sales. • Strong balance sheet to scale up our investments in Hong Kong and the Chinese Mainland. Six months ended 30th June 2021 2020 Note HK$M HK$M Change Results Revenue 9,068 6,551 +38% Profit attributable to the Company's shareholders Underlying (a), (b) 4,513 3,753 +20% Recurring underlying (b) 3,716 3,702 0% Reported 1,984 1,029 +93% HK$ HK$ Earnings per share Underlying (c), (d) 0.77 0.64 +20% Recurring underlying (c), (d) 0.64 0.63 0% Reported (c), (d) 0.34 0.18 +93% Dividend per share First interim 0.31 0.30 +3% 30th June 31st December 2021 2020 HK$ HK$ Change Financial Position Equity attributable to the Company’s shareholders per share (a) 49.21 49.36 0% Gearing ratio (a) 3.1% 2.3% +0.8%pt. Notes: (a) Refer to the glossary on page 66 of the announcement of 2021 Interim Results of Swire Properties Limited (the “Results Announcement”), dated 12 August 2021, for definition. -

Baroque Group Opens Its 200Th Store in Mainland China

July 11, 2017 Press Release Baroque Japan Limited (Tokyo Stock Exchange First Section 3548) Baroque Group Opens its 200th Store in Mainland China HKRI Taikoo Hui MOUSSY & SLY General Store opens on July 8 in Shanghai Baroque Japan Limited (Head Office: Meguro-ku, Tokyo, Japan; Representative Director and CEO: Hiroyuki Murai, hereinafter “our company”), a specialty retailer of private label apparel, opened a MOUSSY & SLY general store in HKRI Taikoo Hui, a new commercial facility in the center of Shanghai on Saturday, July 8, 2017, through its joint venture with BELLE INTERNATIONAL HOLDINGS LIMITED (Head Office: Shenzhen City, Guangdong Province, China; hereinafter “Belle”). This store is our 200th in mainland China. Staff of MOUSSY & SLY general store celebrating the success of the 200th store at HKRI Taikoo Hui in Shanghai 21 The MOUSSY & SLY general store at HKRI Taikoo Hui (1) Overview of the commercial facility HKRI Taikoo Hui and the new store HKRI Taikoo Hui is a new complex which opened in May 2017. Large in size and with appealing store designs, it is attracting much attention in the Puxi district, which is the center of commercial activity. It comprises a shopping mall (approx 100,000 m2), a hotel and serviced apartments (approx 50,000 m2), and offices (approx 170,000 m2). It is conveniently located with access from three subway lines. Baroque Group, with the establishment of a large-scale 285 square-meter store in HKRI Taikoo Hui, is confident in the ability of its MOUSSY and SLY brands to attract customers amidst competition with other retail clothing lines. -

June 2019 Home & Relocation Guide Issue

WOMEN OF CHINA WOMEN June 2019 PRICE: RMB¥10.00 US$10 N 《中国妇女》 Beijing’s essential international family resource resource family international essential Beijing’s 国际标准刊号:ISSN 1000-9388 国内统一刊号:CN 11-1704/C June 2019 June WOMEN OF CHINA English Monthly Editorial Consultant 编辑顾问 Program 项目 《中 国 妇 女》英 文 月 刊 ROBERT MILLER(Canada) ZHANG GUANFANG 张冠芳 罗 伯 特·米 勒( 加 拿 大) Sponsored and administrated by Layout 设计 All-China Women's Federation Deputy Director of Reporting Department FANG HAIBING 方海兵 中华全国妇女联合会主管/主办 信息采集部(记者部)副主任 Published by LI WENJIE 李文杰 ACWF Internet Information and Legal Adviser 法律顾问 Reporters 记者 Communication Center (Women's Foreign HUANG XIANYONG 黄显勇 ZHANG JIAMIN 张佳敏 Language Publications of China) YE SHAN 叶珊 全国妇联网络信息传播中心(中国妇女外文期刊社) FAN WENJUN 樊文军 International Distribution 国外发行 Publishing Date: June 15, 2019 China International Book Trading Corporation 本 期 出 版 时 间 :2 0 1 9 年 6 月 1 5 日 中国国际图书贸易总公司 Director of Website Department 网络部主任 ZHU HONG 朱鸿 Deputy Director of Website Department Address 本刊地址 网络部副主任 Advisers 顾问 WOMEN OF CHINA English Monthly PENG PEIYUN 彭 云 CHENG XINA 成熙娜 《中 国 妇 女》英 文 月刊 Former Vice-Chairperson of the NPC Standing 15 Jianguomennei Dajie, Dongcheng District, Committee 全国人大常委会前副委员长 Director of New Media Department Beijing 100730, China GU XIULIAN 顾秀莲 新媒体部主任 中国北京东城区建国门内大街15号 Former Vice-Chairperson of the NPC Standing HUANG JUAN 黄娟 邮编:100730 Committee 全国人大常委会前副委员长 Deputy Director of New Media Department Tel电话/Fax传真:(86)10-85112105 新媒体部副主任 E-mail 电子邮箱:[email protected] Director General 主 任·社 长 ZHANG YUAN 张媛 Website 网址 http://www.womenofchina.cn ZHANG HUI 张慧 Director of Marketing Department Printing 印刷 Deputy Director General & Deputy Editor-in-Chief 战略推广部主任 Toppan Leefung Changcheng Printing (Beijing) Co., 副 主 任·副 总 编 辑·副 社 长 CHEN XIAO 陈潇 Ltd. -

David Zhao Joins Burson-Marsteller As Executive Vice President

Contact: Brad Burgess +86-10-5816-2566 [email protected] NEWS RELEASE Swire Properties Taps Burson-Marsteller For Brand Building In China Beijing, August 21, 2012 – Burson-Marsteller, a leading public relations and communications consulting company, was awarded a one-year corporate retainer to elevate the reputation of Swire Properties in Mainland China and to increase awareness of its brand among potential partners and customers. A Guangzhou-led team of property branding professionals at Burson-Marsteller China will develop corporate communications and media strategies for Swire Properties’ corporate brand and its innovative mixed-use developments, positioning them as unique places to live, work and play. “Swire Properties is strongly positioned in Hong Kong as a leading developer and owner of large-scale mixed-use properties,” said Chris Deri, Burson-Marsteller China’s CEO. “This year marks Swire Properties’ listing on the Main Board of the Hong Kong Stock Exchange and its 40th anniversary. We are proud and excited to be its communications partner in Mainland China at this significant moment and are eager to support its branding campaigns within China.” Swire Properties has significant investments on the mainland, including Sanlitun Village and INDIGO in Beijing, TaiKoo Hui in Guangzhou, Daci Temple project in Chengdu and Dazhongli project in Shanghai. The company also has representative offices in Beijing, Shanghai, Guangzhou and Chengdu to explore new business opportunities. “Swire Properties has spent the past 40 years developing transformational projects which create lasting value for our stakeholders and the community at large,” said Vivian Lo, Swire Properties’ Assistant Director of Public Affairs, Mainland China. -

Fast Facts 2021

BEVERAGES & MARINE SHIPPING LINES FOOD CHAIN SERVICES THE CHINA NAVIGATION BEVERAGES COMPANY (CNCo) OFFSHORE SUPPORT SERVICES SWIRE COCA-COLA Swire Shipping, CNCo’s liner shipping division, offers multipurpose liner services for transporting containerised, A strategic partner of The Coca-Cola Company breakbulk and project cargoes, connecting North America since the 1960s. to the Pacific Islands and Oceania. Through Swire Projects, CNCo offers project parcelling and transport engineering Holds the franchise to manufacture, market and services to the energy, resource and infrastructure sectors. distribute products of The Coca-Cola Company in an extensive area of the western USA, the Hong Kong SAR, Taiwan region, and 11 provinces and the Shanghai Municipality in the Chinese Mainland. SWIRE BULK In business since 1978, Swire Coca-Cola, USA is one of the largest independent Coca-Cola bottlers in the United States, operating in 13 states. SWIRE ENERGY SERVICES (SES) UNITED STATES Operates across strategic locations in North America, including Mexico and the Caribbean. Offers offshore Leading vessel owner and operator specialising in container solutions, equipment rentals and sales, transporting cargoes in the dry bulk segment. Has Franchise population Sales volume integrity services, aviation services and chemical presence in the Atlantic and opens its Atlantic Americas plants 6 million handling services. desk in Miami. in 13 states 30.3 million 317 unit cases* * A unit case comprises 24 8-ounce servings. @2021 The Coca-Cola Company FAST FACTS -

FAST FACTS 2021 Swire Is a Highly Diversified Global Business Group, Which Has Been in Turnover US$23,830M Operation for Over 200 Years

GF210715e FAST FACTS 2021 FACTS FAST Swire is a highly diversified global business group, which has been in Turnover US$23,830M operation for over 200 years. Within Asia, Swire’s activities principally come Turnover | 2016-2020 Turnover by Region | 2020 Turnover by Division | 2020 US$M US$M US$M under the group’s publicly quoted arm, Swire Pacific Ltd. Elsewhere in the 35,000 Hong Kong SAR Property 30,000 Chinese Mainland Aviation world, businesses are held by parent company, John Swire & Sons Ltd. 25,000 Other Asia Beverages & 20,000 SW Pacific Food Chain Marine Services 15,000 Americas Trading & Industrial 10,000 Europe Head Office Africa & Middle East 5,000 Marine Global# 0 16 17 18 19 20 Capital Employed US$75,803M Capital Employed | 2016-2020 Capital Employed by Region | 2020 Capital Employed by Division | 2020 US$M US$M US$M 80,000 Hong Kong SAR Property 70,000 Chinese Mainland Aviation 60,000 Other Asia Beverages & 50,000 SW Pacific Food Chain 40,000 Marine Services Americas 30,000 Trading & Industrial ABOUT JOHN SWIRE & SONS LTD Europe 20,000 Head Office & Africa & Middle East 10,000 Swire Investments Marine Global# 0 • Established in 1816 and headquartered in London. 16 17 18 19 20 • Responsible for formulating and directing overall group strategy. Provides a range of services within the group, including recruitment, employment and training of staff. Employees 121,211 Employees | 2016-2020 Employees by Region | 2020 Employees by Division | 2020 • Holds a 58% shareholding in Swire Pacific in the Hong Kong Special Administrative Region (“Hong Kong SAR”). -

Relocating to Guangzhou

The British School of Guangzhou Relocating to Guangzhou Welcome to one of the most populous, energetic and rapidly growing places in China. Estimated to have a population of about 16 million, Guangzhou is a thriving hub where people from all corners of the world converge for everything from business to pleasure. Under the flashy surface of this modern metropolis, lies a rich cultural tradition and a history that spans more than 2200 years. With so much on offer, it is no wonder that families are now choosing to call this city home. Many of our families say that moving to Guangzhou has been one of the most rewarding and fascinating decisions that they have made. If you’re in the midst of considering the big move, here is some handy information that will help you with your decision. Residential Options The majority of expats reside in Tianhe, the most developed downtown area. Several commercial buildings such as Center Plaza (P&G Headquarters), Teem Tower, Citic Plaza and China Shine are located here. This eastern district is also convenient for its proximity to bus, subway and rail links to Guangzhou and the rest of China. Grandview Mall and Teem Mall provide endless shopping options for families. Tianhe is home to several expat-friendly compounds such as Fraser Suites, Regal Court, Hilton Sunshine, Greenery, Favorview Palace, Concordia, Castle Peak and Citic Apartments, and luxury five star hotels like the Sheraton, Sofitel and Westin. Zhujiang New Town, a newer and pricier area that is also part of Tianhe District, is home to the city’s tallest buildings and several shopping malls such as GT Land and Happy Valley.