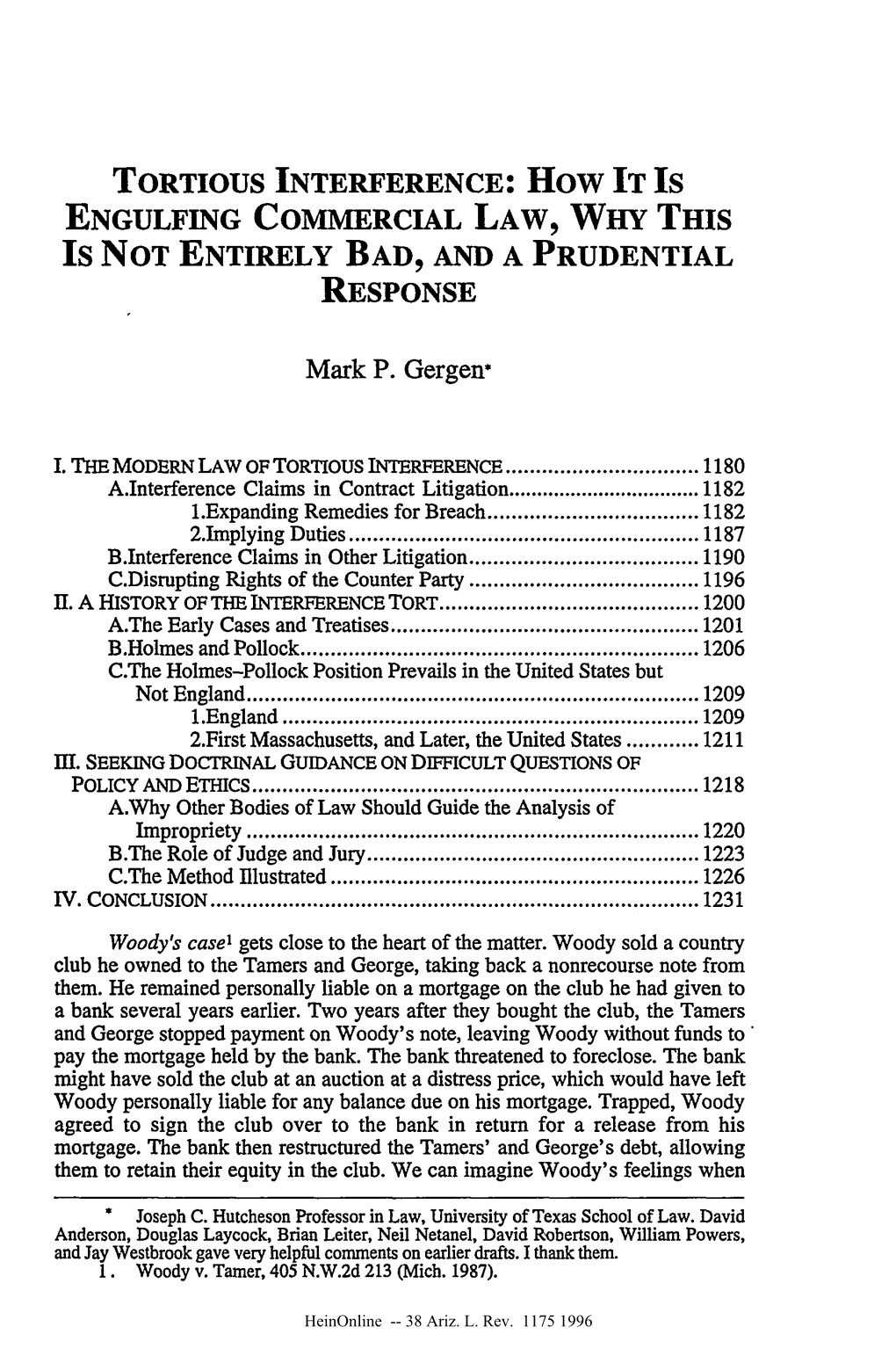

TORTIOUS INTERFERENCE: How IT Is ENGULFING COMMERCIAL LAW, WHY THIS Is NOT ENTIRELY BAD, and a PRUDENTIAL RESPONSE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Plant V. Woods, 176 Mass. 492; Vegelahn V. Guntner, 167 Id. 92, Where an Unbroken Line of Authorities Reiterates the Doctrine That COMMENT

YALE LAW JOURNAL SUBSCRIPTION PRICE, $2.50 A YEAR. SINGLE COPIES, 35 CENTS EDITORS: JoHN H. SEARs, Chairman. ERNEST T. BAUER, Louis M. ROSENBLUTH, COGSwELL BENTLEY, ROBERT H. STRAHAN, JOHN J. FISHER, KiNsLEY TWINING. Associate Editors: JAMES L LooMIs, CH.maLES C. Russ. WnIJtAi M. MALTBIL CAMERON B. WATERMAN, Business Manager. CHARLES DRIvER FRANCIS, Assistant Business Manager. FRANK KENNA, Assistant Business Manager. Published monthly during the Academic year. by students of the Yale Law School. P. 0. Address, Box 835, Yale Station, New Haven, Conn. If a subscriber wishes his copy of the JOURNAL discontinued at the expiration of his subscription, notice to that effect should be sent; otherwise it is assumed that a con- tinuation of the subscription is desired. COMPETITION AS JUSTIFICATION FOR INTERFERENCE WITH EMPLOY- PLOYMENT OF FELLOW WORKMAN. That, in the absence of justification, it is actionable to induce an employer by a strike or a threatened strike to discharge or refuse to employ a workman, has been repeatedly held. But notwith- standing many such cases in recent years presenting the question as to within what limits a strike, involving no acts tortious per se, may be justified by labor as legitimate competition, the boundary lines remain unmarked. In a large and increasing proportion of these cases the presence or absence of justification must depend upon the object of conduct. The question. has recently arisen in Pennsylvania in the case of Erdman v. Mitchell, 56 Atl. 334, which was an action by one labor union against another to enjoin the latter from attempting by strikes or threatened strikes to prevent members of the former from securing or continuing in employment because of their refusal to join the latter union. -

United States District Court Eastern District of New York

Case 2:06-cv-04746-JFB-GRB Document 624 Filed 07/26/13 Page 1 of 35 PageID #: <pageID> UNITED STATES DISTRICT COURT EASTERN DISTRICT OF NEW YORK _____________________ No 06-CV-4746 (JFB)(ETB) _____________________ ANTHONY CONTE, Plaintiff, VERSUS COUNTY OF NASSAU, ET AL., Defendants. ___________________ MEMORANDUM AND ORDER July 26, 2013 ___________________ Joseph F. Bianco, District Judge: review of the record and submissions of the parties, the Court issued a Memorandum and Pro se plaintiff Anthony Conte Order dated September 30, 2010, granting in (“plaintiff” or “Conte”) filed the instant part and denying in part defendants’ motions action against the County of Nassau (“the for summary judgment and denying County”), Robert Emmons (“Emmons”), plaintiff’s motion for summary judgment in Philip Wasilausky (“Wasilausky”), William its entirety. Pursuant to that Order, the Wallace (“Wallace”), Christina Sardo following claims survived summary (“Sardo”), Michael Falzarano (“Falzarano”) judgment: (1) plaintiff’s false arrest claim (collectively, the “County defendants”), against Wasilausky; (2) plaintiff’s abuse of Tefta Shaska (“Shaska”), and Larry Guerra process claim against all of the County (“Guerra”) (collectively, “defendants”), defendants except Sardo; (3) plaintiff’s alleging federal claims under 42 U.S.C. Monell claim against the County; and (4) § 1983 for false arrest, malicious plaintiff’s tortious interference with contract prosecution, abuse of process, violation of claim against all of the County defendants the First Amendment, conspiracy, and except Sardo and Shaska. Monell liability against the County. Plaintiff also asserted various state-law claims. The matter was then tried before a jury, which found that (1) Wasilausky subjected Following discovery, both plaintiff and plaintiff to an unlawful arrest; (2) none of defendants filed motions for summary the County defendants maliciously abused judgment with the Court. -

GLOSSARY of LEGAL TERMS Ad Damnum

GLOSSARY OF LEGAL TERMS Ad damnum: The technical name of the clause in the complaint that contains a statement by the plaintiff of the amount of the damages he/she is claiming. Additur: The opposite of Remittitur. An increase in an award by the Judge done in the Court's discretion if he or she feel the Jury's judgment is inadequate. Adjudicate: To settle in the exercise of judicial authority; to determine finality. Admissions: Confessions, concessions, or voluntary acknowledgment made by a party of the existence of certain facts. Affiant: The person who makes and subscribes an affidavit. Affidavit: Sworn statement of a witness, which is verified by a Notary Public. Affirmative Defense: A defense that must be specifically pled by the defendant to be asserted at trial. If such a defense is not raised in the answer, it is waived. An example of an affirmative defense is contributory negligence, assumption of the risk, etc. Appellant: The party who takes an appeal from one court or jurisdiction to another in the interest of setting aside or reversing the judgment. Appellee: The party in a case against whom an appeal is taken, that is, the party who has an interest adverse to setting aside or reversing the judgment (some times called the respondent). Arbitration: Alternative dispute resolution in which the case is decided by an arbitrator or panel of arbitrators, usually experienced attorneys, former judges, or administrative law judges. The case is decided after an informal hearing. Arbitration is almost always binding. Assumption of the Risk: This is an affirmative defense. -

Interference with Contract and Other Economic Expectancies: a Clash of Tort and Contract Doctrine Harvey S

Interference with Contract and Other Economic Expectancies: A Clash of Tort and Contract Doctrine Harvey S. Perlmant A has a contract with B. TP interferes with its performance, to A's economic detriment. A might recover from B for breach of con- tract, but prior to 1853, in most circumstances, he could not re- cover against TP. In that year, Lumley v. Gye1 established a gen- eral principle of tort liability for intentionally interfering with a contract. Since Lumley, the interference tort has been applied evenwhere the interference is directed at an unenforceable con- tract or a relationship involving only an expectancy not yet formal- ized into a contract.2 Today, courts impose liability under the ru- bric of the interference tort in a variety of contexts, but they have failed to develop common or consistent doctrines. The absence of a coherent doctrine is understandable. The idea that a person should not interfere with another's economic relationships is easier to expound in the abstract than to apply in the particular. The expectations of the parties and, therefore, the acceptability of an interference differ radically depending on the context, terms, and subject matter of the relationship-whether it t Professor, University of Virginia Law School. Several persons commented on earlier drafts, including Tyler Baker, Thomas Bergin, Edmund Kitch, Jeffrey O'Connell, George Rutherglen, Stephen Saltzburg, and participants in the University of Virginia and Univer- sity of Iowa Faculty Workshops. I am particularly indebted to Robert Scott and Charles Goetz for their assistance. Linda Williams, Virginia class of 1982, and David Rosengren, class of 1981, provided valuable research support. -

` United States District Court Eastern District Of

Case: 4:16-cv-01866-CDP Doc. #: 5 Filed: 12/15/16 Page: 1 of 5 PageID #: <pageID> UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MISSOURI EASTERN DISTRICT CHARMANE SMITH, ) ) Plaintiff, ) ) v. ) No. 4:16CV1866 CDP ) MASTERCARD INTERNATIONAL, ) ) Defendant. ) MEMORANDUM AND ORDER This matter is before the Court upon the motion of plaintiff Charmane Smith for leave to proceed in forma pauperis. (Docket No. 2). Upon review of the financial affidavit plaintiff submitted in support of the motion, the Court has determined that plaintiff is unable to pay the filing fee. 28 U.S.C. § 1915. The motion will therefore be granted. In addition, plaintiff will be allowed the opportunity to submit an amended complaint. Standard of Review Under 28 U.S.C. § 1915(e), the Court is required to dismiss a complaint filed in forma pauperis if it is frivolous, malicious, or fails to state a claim upon which relief can be granted. To state a claim for relief, a complaint must plead more than “legal conclusions” and “[t]hreadbare recitals of the elements of a cause of action [that are] supported by mere conclusory statements.” Ashcroft v. Iqbal, 556 U.S. 662, 678 (2009). A plaintiff must demonstrate a plausible claim for relief, which is more than a “mere possibility of misconduct.” Id. at 679. “A claim has facial plausibility when the plaintiff pleads factual content that allows the court to draw the reasonable inference that the defendant is liable for the misconduct alleged.” Id. at 678. Determining whether a complaint states a plausible claim for relief is a ` Case: 4:16-cv-01866-CDP Doc. -

Retiring Workplace Tortious Interference Claims Donn C

Hofstra Labor & Employment Law Journal Volume 34 | Issue 1 Article 4 9-1-2016 Retiring Workplace Tortious Interference Claims Donn C. Meindertsma Follow this and additional works at: http://scholarlycommons.law.hofstra.edu/hlelj Part of the Labor and Employment Law Commons Recommended Citation Meindertsma, Donn C. (2016) "Retiring Workplace Tortious Interference Claims," Hofstra Labor & Employment Law Journal: Vol. 34 : Iss. 1 , Article 4. Available at: http://scholarlycommons.law.hofstra.edu/hlelj/vol34/iss1/4 This document is brought to you for free and open access by Scholarly Commons at Hofstra Law. It has been accepted for inclusion in Hofstra Labor & Employment Law Journal by an authorized administrator of Scholarly Commons at Hofstra Law. For more information, please contact [email protected]. Meindertsma: Retiring Workplace Tortious Interference Claims PRACTITIONERS' NOTES RETIRING WORKPLACE TORTIOUS INTERFERENCE CLAIMS Donn C. Meindertsma Are you a rung or two lower on the corporate ladder than you expected to be at this point in your career? Sue your boss. Suits by unhappy employees against supervisors or cubicle-mates are nothing new. In at least one manifestation, however, the right to sue coworkers over workplace disputes has developed in an ad hoc manner based on an all-purpose tort theory, tortious interference. As a result of this organic development, the law is unclear and in many respects confounded by inconsistencies. The lack of clarity leaves employers and employees guessing about the legal duties coworkers owe to each other in the workplace.' Courts should freshly examine the viability of claims that a coworker tortiously interfered with the plaintiffs job. -

San Diego Law Review November-December 2003

40 SANDLR 1315 Page 1 (Cite as: 40 San Diego L. Rev. 1315) San Diego Law Review November-December 2003 Symposium Baselines and Counterfactuals in the Theory of Compensatory Damages: What Do Compensatory Damages Compensate? *1315 RETHINKING INJURY AND PROXIMATE CAUSE John C.P. Goldberg [FNa1] Copyright © 2003 San Diego Law Review Association; John C.P. Goldberg Table of Contents I. Introduction ............................................... 1315 II. Perry on Harm ............................................. 1316 III. Harm Versus Injury ....................................... 1321 A. Injury, Harms, Rights Violations, and Lost Expectancies .. 1321 B. Harm and Damages ......................................... 1330 IV. Harms, Wrongings, and a Rationale for Proximate Cause ..... 1332 V. Conclusion ................................................. 1343 I. Introduction Injury and proximate cause form two components of a plaintiff's prima facie negligence case. [FN1] Although equals in this sense, they have received starkly different treatment at the hands of judges and scholars. Proximate cause has long attracted attention, yet has also managed to defy repeated efforts at characterization and explanation. [FN2] Injury, by *1316 contrast, seems to have been largely ignored. [FN3] One of the many virtues of Professor Perry's paper [FN4] is that it prompts reconsideration of this disparate treatment from both ends. By offering a subtle and rich account of the related concept of "harm," Perry permits us to see that the concept of "injury" is normative, contestable, and therefore laden with interesting questions. Likewise, his analysis provides a springboard from which to launch an inquiry into proximate cause. In this Commentary, I will undertake both of these projects, first, by reviewing and elaborating Professor Perry's thoughtful analysis of harm, then by analyzing the distinction between the concepts of harm and injury, and finally by sketching an account of proximate cause that can help explain why it has a legitimate role to play in negligence law. -

Interference with Business and Contractual Relations

The IDC Monograph Mark J. McClenathan Heyl, Royster, Voelker & Allen, P.C., Rockford Crossing the Line: Interference with Business and Contractual Relations I. Introduction A prospective client approaches you and asks if you are willing to represent her in a real estate case that has been pending for some time. She explains that she fired her attorney and is filing an ARDC complaint against him. You immediately turn down the assignment, and, at her request, give her the names of three local attorneys who specialize in real estate law and are respected litigators. The meeting lasted 20 minutes. Several months later, the client’s discharged attorney serves you with a summons and complaint charging you and the client’s new attorney with tortious interference with business relations. What did you do to deserve this lawsuit? What did you do wrong? Did you “interfere” with another attorney’s relationship with his client? Was your act “intentional”? In today’s litigious society, common law causes of action are being stretched to the limit to give anyone a forum to seek redress for their alleged injuries, damages, failures, and disappointments, especially when something does not go their way. Losing a client or customer happens every day; there are no guarantees. But what if the competitor is not playing “fair”? There are plenty of attempts by business owners to protect what is “theirs.” For instance, employers may ask their employees to sign restrictive covenants, such as covenants not to compete and confidentiality agreements. If employees leave and either start their own business or work for a competitor, we often see employers filing petitions for injunctions to enforce said “contracts” against former employees and their new employers to protect market share and proprietary information. -

Malice in Tort

Washington University Law Review Volume 4 Issue 1 January 1919 Malice in Tort William C. Eliot Washington University School of Law Follow this and additional works at: https://openscholarship.wustl.edu/law_lawreview Part of the Law Commons Recommended Citation William C. Eliot, Malice in Tort, 4 ST. LOUIS L. REV. 050 (1919). Available at: https://openscholarship.wustl.edu/law_lawreview/vol4/iss1/5 This Note is brought to you for free and open access by the Law School at Washington University Open Scholarship. It has been accepted for inclusion in Washington University Law Review by an authorized administrator of Washington University Open Scholarship. For more information, please contact [email protected]. MALICE IN TORT As a general rule it may be stated that malice is of no conse- quence in an action of tort other than to increase the amount of damages,if a cause of action is found and that whatever is not otherwise actionable will not be rendered so by a malicious motive. In the case of Allen v. Flood, which is perhaps the leading one on the subject, the plaintiffs were shipwrights who did either iron or wooden work as the job demanded. They were put on the same piece of work with the members of a union, which objected to shipwrights doing both kinds of work. When the iron men found that the plaintiffs also did wooden work they called in Allen, a delegate of their union, and informed him of their intention to stop work unless the plaintiffs were discharged. As a result of Allen's conference with the employers plaintiffs were discharged. -

In the United States District Court for the District Of

8:11-cv-00270-LES-FG3 Doc # 64 Filed: 06/07/12 Page 1 of 5 - Page ID # <pageID> IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEBRASKA AMERICAN HOME ASSURANCE ) COMPANY and CARGILL MEAT ) SOLUTIONS CORPORATION, ) ) Plaintiffs, ) 8:11CV270 ) v. ) ) GREATER OMAHA PACKING COMPANY,) MEMORANDUM AND ORDER INC., ) ) Defendant. ) ______________________________) This matter is before the Court upon plaintiffs’ motion to dismiss defendant’s counterclaim (Filing No. 46) and defendant’s motion for oral argument regarding motion to dismiss (Filing No. 54) and motion in limine and request for oral argument (Filing No. 55). After reviewing the motions, briefs, and relevant law, the Court will deny plaintiffs’ motion to dismiss and deny defendant’s motion for oral argument and motion in limine and request for oral argument. I. Background This lawsuit arises out of the sale of some raw beef trim by defendant to Cargill Meat Solutions Corporation (“Cargill”), which plaintiffs claim was contaminated with the bacterium known as “E. coli 0157:H7.” On February 1, 2012, defendant filed an amended answer to plaintiffs’ complaint that asserted a counterclaim against Cargill for tortious interference with business relationships and expectancies (Filing No. 40). 8:11-cv-00270-LES-FG3 Doc # 64 Filed: 06/07/12 Page 2 of 5 - Page ID # <pageID> Defendant’s counterclaim arises from a New York Times article that allegedly contained false information supplied by Cargill’s representatives. Id. Defendant claims that one or more of its existing and potential business customers learned about the false information, leading them to terminate their business and/or refuse to do business with defendant. -

In the United States District Court for the Northern District of Iowa Cedar Rapids Division

IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF IOWA CEDAR RAPIDS DIVISION CRST EXPEDITED, INC, Plaintiff, No. 17-cv-25-CJW-KEM vs. MEMORANDUM OPINION SWIFT TRANSPORTATION CO OF AND ORDER ARIZONA, LLC, Defendant. ____________________ TABLE OF CONTENTS I. FACTUAL BACKGROUND ............................................................. 2 II. APPLICABLE LAW ....................................................................... 5 III. NATURE OF CLAIMS AND CONTRACTS .......................................... 8 IV. CRST v. TransAm .........................................................................12 V. DISCUSSION OF CLAIMS ..............................................................14 A. Intentional Interference with Contract ..........................................14 1. Contract Validity and Enforceability ...................................14 a. Lack of Protectable Interest ......................................18 b. Violation of Public Policy ........................................26 2. Knowledge ..................................................................31 3. Intentional and Improper Conduct ......................................33 Case 1:17-cv-00025-CJW-KEM Document 169 Filed 06/04/19 Page 1 of 58 4. Causation ....................................................................36 5. Damages .....................................................................39 B. Intentional Interference with Prospective Economic Advantage ...........41 C. Unjust Enrichment .................................................................45 -

Rethinking Injury and Proximate Cause

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by University of San Diego San Diego Law Review Volume 40 Issue 4 Symposium: Baselines and Counterfactuals in the Theory of Compensatory Article 9 Damages: What Do Compensatory Damages Compensate? 12-1-2003 Rethinking Injury and Proximate Cause John C.P. Goldberg Follow this and additional works at: https://digital.sandiego.edu/sdlr Part of the Law Commons Recommended Citation John C. Goldberg, Rethinking Injury and Proximate Cause, 40 SAN DIEGO L. REV. 1315 (2003). Available at: https://digital.sandiego.edu/sdlr/vol40/iss4/9 This Symposium Article is brought to you for free and open access by the Law School Journals at Digital USD. It has been accepted for inclusion in San Diego Law Review by an authorized editor of Digital USD. For more information, please contact [email protected]. GOLDBERG.DOC 9/24/2019 1:12 PM Rethinking Injury and Proximate Cause JOHN C.P. GOLDBERG* TABLE OF CONTENTS I. INTRODUCTION ................................................................................................ 1315 II. PERRY ON HARM .............................................................................................. 1316 III. HARM VERSUS INJURY ..................................................................................... 1321 A. Injury, Harms, Rights Violations, and Lost Expectancies ...................... 1321 B. Harm and Damages ............................................................................... 1330 IV. HARMS, WRONGINGS, AND