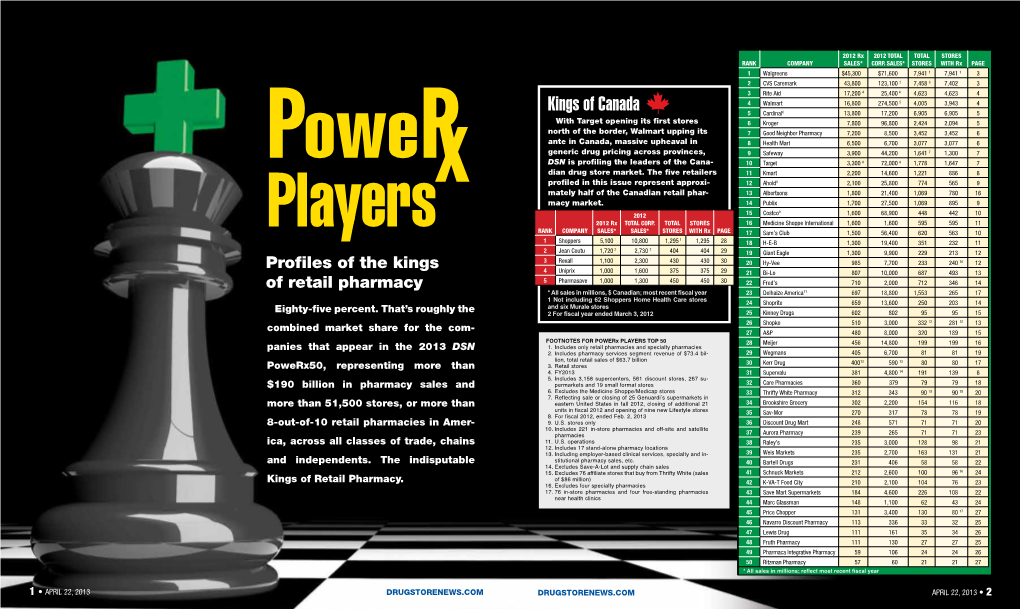

Kings of Canada

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2015 South Central

Eastern North Central Northwest South Central Southwest WDA WDA WDA WDA WDA (41 towns) (37 towns) (41 towns) (30 towns) (20 towns) Ashford Andover Barkhamsted Bethany Ansonia Bozrah Avon Bethel Branford Beacon Falls Brooklyn Berlin Bethlehem Chester Bridgeport Canterbury Bloomfield Bridgewater Clinton Darien Chaplin Bolton Brookfield Cromwell Derby Colchester Bristol Canaan Deep River Easton Columbia Burlington Cheshire Durham Fairfield Coventry Canton Colebrook East Haddam Greenwich Eastford East Granby Cornwall East Hampton Monroe East Lyme East Hartford Danbury East Haven New Canaan Franklin East Windsor Goshen Essex Norwalk Griswold Ellington Hartland Guilford Oxford Groton Enfield Harwinton Haddam Seymour Hampton Farmington Kent Hamden Shelton Killingly Glastonbury Litchfield Killingworth Stamford Lebanon Granby Middlebury Madison Stratford Ledyard Hartford Morris Meriden Trumbull Lisbon Hebron Naugatuck Middlefield Weston Lyme Manchester New Fairfield Middletown Westport Mansfield Marlborough New Hartford Milford Wilton Montville New Britain New Milford New Haven New London Newington Newtown North Branford North Stonington Plainville Norfolk North Haven Norwich Plymouth North Canaan Old Saybrook Old Lyme Rocky Hill Prospect Orange Plainfield Simsbury Redding Portland Pomfret Somers Ridgefield Wallingford Preston Southington Roxbury Westbrook Putnam South Windsor Salisbury West Haven Salem Stafford Sharon Woodbridge Scotland Suffield Sherman Sprague Tolland Southbury Sterling Vernon Thomaston Stonington West Hartford Torrington Thompson Wethersfield Warren Union Windsor Washington Voluntown Windsor Locks Waterbury Waterford Watertown Willington Winchester Windham Wolcott Woodstock Woodbury 2015 Informaon for Workforce Investment Planning Conneccut Department of Labor ‐ www.ct.gov/dol ‐ Labor Market InformaƟon PREFACE The Conneccut Department of Labor’s Office of Research is the state’s leading producer of informaon and stascs on the economy, workforce, occupaons, and careers. -

Come Exhibit with Us

Store Brands Got The Power Come Exhibit With Us 2011 2010 26.0% 2009 25.0% 2008 23.7% 2007 22.3% 21.2% November 14-16 Chicago Presented by the Private Label Manufacturers Association Store Brands ll across the country, store brands power is driving big increases in store brands sales. A New categories. New merchandising ideas. New package designs. New shelf allocation. Store brands are reaching unheard of levels of consumer popularity and retailer commitment. For manufacturers, store brands power is the power to compete with big national brands in category after category without big advertising budgets and promotion allowances. It’s the power to make a small and medium-size company important to retailers. It’s the power to market your products to millions of consumers. It means new opportunities for your business. Store brands power is growing, too. According to GfK Roper, 57% of all shoppers now say that they purchase store brands frequently, up from 36% ten years ago. Moreover, 9 out of 10 consumers say that store brands are now as good as or better than national brands and one-third of all shoppers expect to buy more store brands in the year ahead. November Got The Power THE SHOW FOR STORE BRANDS MORE THAN PRODUCTS PLMA gives you the chance to show your power. For PLMA’s annual show is more than just products, though. nearly 30 years, PLMA’s Private Label Trade Show has PLMA’s Innovation Hall features the latest software and been the place where retailers and suppliers meet to technology to make business more efficient. -

Eleven Points Logistics Begins Servicing Target Stores Cornwall's Economy Offers Opportunities 2012 Was a Great Year, and 2013 Is Continuing That Positive Trend

Eleven Points Logistics Begins Servicing Target Stores Cornwall's Economy Offers Opportunities 2012 was a great year, and 2013 is continuing that positive trend Cornwall is a busy place these days. It Activity has been consistent over time the City’s wastewater treatment facility. may come as a surprise to some, but to and across all sectors. While some major Work has been completed at the hospital, those who have been following what is projects have dominated the headlines, and the other two projects are on happening in Eastern Ontario, it is a story small to medium sized investments have schedule for completion by 2016. that began a few years ago and shows also been strong. little sign of abating. Investments by Cornwall has also welcomed new private and public organizations are One key project has been the completion commercial development, with new adding to a level of development activity of the 1.4 million sq.ft. Eleven Points restaurants opening in the heart of the not seen in the region in decades, and Logistics distribution centre that will city and new retail plazas being built in it bodes well for the future. begin servicing Target stores in Eastern multiple areas. Construction activity has Canada. This project required the been equally split between big box retail Let’s take a look at some of the numbers. construction of a new road, which has in complexes and smaller, local entrepre- turn opened up another 200 acres for neurial efforts, and taken as a whole, In 2005, the 10-year rolling average of development in the Cornwall Business activity in this sector has been building permits issued by the City was Park. -

The Jean Coutu Group (Pjc) Inc

THE JEAN COUTU GROUP (PJC) INC. ANNUAL INFORMATION FORM Financial year ended May 31, 2002 October 18, 2002 TABLE OF CONTENTS ITEM 1 - INCORPORATION................................................................................................................................... 3 1.1 INCORPORATION OF THE ISSUER ................................................................................................................... 3 1.2 CAPITAL STRUCTURE.................................................................................................................................... 3 1.3 SUBSIDIARIES................................................................................................................................................ 4 ITEM 2 - GENERAL DEVELOPMENT OF THE BUSINESS.............................................................................. 4 2.1 HISTORY AND PROFILE ................................................................................................................................. 4 2.2 PRINCIPAL DEVELOPMENT AND ACQUISITIONS OF THE LAST FIVE YEARS ................................................... 5 ITEM 3 - DESCRIPTION OF ACTIVITIES ........................................................................................................... 6 3.1 FRANCHISING................................................................................................................................................ 6 3.1.1 Franchising Business .................................................................................................................... -

Clinique Now More Accessible Than Ever Famous Brand Arriving at Jean Coutu

Press Release For Immediate Release Clinique now more accessible than ever Famous brand arriving at Jean Coutu Varennes, Quebec, May 12, 2017 – The Jean Coutu Group (PJC) Inc. (the "Corporation" or the "Jean Coutu Group") announces the arrival of the famous Clinique brand in several of its affiliated stores in Quebec and New Brunswick. From the outset, Clinique has set itself apart through products adapted for every skin concern. In order to reach a wider clientele, of both women and men, the products are now available in most areas of the province (see list). As of now, all the products can also be purchased online at cliniqueproducts.jeancoutu.com. "We are pleased to offer Clinique products, previously available only in large centres, over a wider territory. The implementation will be staggered over three years. 54 stores will carry the brand by August 2017," said Christian Comtois, Senior Manager, Cosmetics at Jean Coutu Group. "As the high end skincare brand in Canada, Clinique is pleased to partner with Jean Coutu, the most admired and respected retailer in Quebec. We are convinced that Clinique’s beauty vision, based on simple routines that give astonishing results, is completely in line with Jean Coutu’s customers throughout the province. We look forward to the future and this important association between two iconic brands," said Artur Klepacz, Brand General Manager at Clinique Canada and LAB SERIES Skincare For Men. A wide range of products Jean Coutu will carry the popular skincare lines such as the famous 3-Step system, Acne Solutions products, the men’s line, the Smart franchise, anti-aging skincare and several recent products. -

2017 Annual Report

2017 ANNUAL REPORT TABLE OF CONTENTS MESSAGE TO SHAREHOLDERS ................................................................................................................................. 2 CORPORATE PROFILE ............................................................................................................................................. 3 MANAGEMENT'S DISCUSSION AND ANALYSIS ........................................................................................................... 8 1. GENERAL INFORMATION ...................................................................................................................... 8 2. DEFINITIONS ....................................................................................................................................... 8 3. SELECTED ANNUAL INFORMATION FOR FISCAL YEARS 2017, 2016 AND 2015 ......................................... 9 4. OPERATING SEGMENTS PERFORMANCE FOR FISCAL YEARS 2017 AND 2016 ........................................ 11 5. QUARTERLY RESULTS ....................................................................................................................... 12 6. INFORMATION ON THE PJC NETWORK OF FRANCHISED STORES ........................................................... 14 7. LIQUIDITY AND CAPITAL RESOURCES .................................................................................................. 15 8. FINANCIAL INSTRUMENTS AND OFF-BALANCE SHEET ARRANGEMENTS .................................................. 18 9. RELATED PARTY TRANSACTIONS -

1 CANADA (Class Action) SUPERIOR COURT PROVINCE of QUEBEC DISTRICT of MONTREAL M. HÉBER

1 CANADA (Class Action) SUPERIOR COURT PROVINCE OF QUEBEC ____________________________________ DISTRICT OF MONTREAL M. HÉBERT NO: 500-06-001085-204 Petitioner -vs.- ANGITA PHARMA INC., legal person duly incorporated, having its head office at 504- 1570 rue Ampère, City of Boucherville, Province of Quebec, J4B 5Z5 and THE JEAN COUTU GROUP (PJC) INC., legal person duly incorporated, having its head office at 11011 boul. Maurice-Duplessis, City of Montreal, Province of Quebec, H1C 1V6 Respondents ____________________________________ ____________________________________________________________________ APPLICATION TO AUTHORIZE THE BRINGING OF A CLASS ACTION & TO APPOINT THE PETITIONER AS REPRESENTATIVE (Art. 574 C.C.P. and following) ____________________________________________________________________ TO ONE OF THE HONOURABLE JUSTICE OF THE SUPERIOR COURT, SITTING IN AND FOR THE DISTRICT OF MONTREAL, YOUR PETITIONER STATE AS FOLLOWS: I. GENERAL PRESENTATION A) The Action 1. Petitioner wishes to institute a class action on behalf of the following class, of which she is a member, namely: • All persons who have a pharmacy record that was accessed by Angita Pharma or any other group to be determined by the Court; 2. This is a case of the intentional violation of Class Members’ privacy rights; Respondent Angita Pharma was given access to customers’ confidential pharmacy 2 records for profit. This access was unauthorized and illegal; Respondent Jean Coutu was reckless or grossly negligent for failing to put in place safeguards that would prevent this type of conduct from being able to take place; 3. Over 200 pharmacists (73 of which are affiliated with Jean Coutu) have been accused by their professional order, the Ordre des pharmaciens du Québec, of allowing Respondent Angita Pharma access to their clients’ confidential files; 4. -

Evidence of the Standing Committee On

43rd PARLIAMENT, 2nd SESSION Standing Committee on Environment and Sustainable Development EVIDENCE NUMBER 032 Monday, May 17, 2021 Chair: Mr. Francis Scarpaleggia 1 Standing Committee on Environment and Sustainable Development Monday, May 17, 2021 ● (1430) [Translation] [English] The Chair (Mr. Francis Scarpaleggia (Lac-Saint-Louis, In December of last year, we published Canada's strengthened Lib.)): I will call the meeting to order. climate plan. This plan is one of the most detailed GHG reduction plans in the world. Welcome to the 32nd meeting of the House of Commons Stand‐ ing Committee on Environment and Sustainable Development, for Recognizing the scientific imperative for early and ambitious ac‐ the first meeting of our clause-by-clause study of Bill C-12. tion, we announced a new 2030 target of a 40% to 45% reduction in I think everyone here is experienced with the modus operandi of GHG emissions at the Leaders Summit on Climate in April. committees, especially in virtual space, so I won't go over that. [English] We have with us again today, with great pleasure, Minister Wilkinson. Joining him, from the Department of Finance is Mr. Measures announced in budget 2021, along with ongoing work Samuel Millar, director general, corporate finance, natural re‐ with our American colleagues on issues including transportation sources and environment, economic development and corporate fi‐ and methane, will support that new target. We know more action nance branch. We also have, from the Department of the Environ‐ will be required. This continued ambition is what Canadians ex‐ ment, John Moffet, who was with us as well last week, assistant pect—that we will continue to prioritize climate action, and that we deputy minister, environmental protection branch; and Douglas will work to achieve targets that are aligned with science. -

Rite Aid Corporation and the Jean Coutu Group

Federal Register / Vol. 72, No. 111 / Monday, June 11, 2007 / Notices 32099 April 1, 2004 respectively. On March • FCSIC Financial Report. ACTION: Proposed Consent Agreement. 31, 2005, EPA approved Louisiana’s • Report on Insured Obligations. 2002 listing of 442 water body-pollutant • Quarterly Report on Annual SUMMARY: The consent agreement in this combinations and associated priority Performance Plan. matter settles alleged violations of federal law prohibiting unfair or rankings and Louisiana’s 2004 listing of C. New Business 444 water body-pollutant combinations deceptive acts or practices or unfair • and associated priority rankings. EPA Mid-year Review of Insurance methods of competition. The attached disapproved Louisiana’s 2002 listing Premium Rates. Analysis to Aid Public Comment decisions not to list 44 water quality describes both the allegations in the Closed Session draft complaint and the terms of the limited segments and associated • pollutants (or 69 water body-pollutant FCSIC Report on System consent order -- embodied in the consent agreement -- that would settle combinations) and Louisiana’s 2004 Performance. these allegations. listing decisions not to list 14 water Dated: June 5, 2007. quality limited segments and associated Roland E. Smith, DATES: Comments must be received on pollutants (or 17 water body-pollutant Secretary, Farm Credit System Insurance or before July 9, 2007. combinations). EPA identified these Corporation Board. ADDRESSES: Interested parties are additional waters and pollutants along [FR Doc. E7–11168 Filed 6–8–07; 8:45 am] invited to submit written comments. Comments should refer to ‘‘Rite Aid and with priority rankings for inclusion on BILLING CODE 6710–01–P the 2002 and 2004 Section 303(d) Lists. -

2020 Corporate Responsibility Report

Corporate Responsibility Report 2020 fiscal year Corporate profile Table of contents METRO is a food and pharmacy leader in Québec and Ontario Messages 2 - President and Chief Executive Officer - Vice President, Public Affairs and Communications Corporate responsibility at METRO 3 Sales of Network of Nearly Founded in 2019 Highlights 4 close to $18 1,601 90,000 Delighted customers 5 billion stores colleagues 1947 Respect for the environment 8 Strengthened communities 11 Empowered employees 14 Food Pharmacy About this report This corporate responsibility report covers the 2020 fiscal year: the 52-week period ending on September 26, 2020. The significant events that occurred between the end of the fiscal year and late December 2020 are also included. In this report, METRO refers to the corporation and Metro refers to the store banner. The report was reviewed by internal auditors but was not audited externally. Forward-looking information Throughout this report, we used statements that may constitute forward-looking 953 food stores 648 drugstores information. In general, any statement in this report that does not constitute Québec historical fact may be considered a forward-looking statement. The forward- Discount Neighbourhood Specialized 377 looking statements that may be set out in this report refer to hypotheses on the PJC Jean Coutu Supermarkets stores stores stores 537 Canadian food and pharmacy industries, targets, the economy in general and our PJC Santé 2016–2020 corporate responsibility plan. PJC Santé Beauté Québec 196 98 53 22 These forward-looking statements do not provide any guarantees as to the Metro Super C Marché Richelieu Première 160 future performance of the Corporation and are subject to known and unknown 680 Brunet Metro Plus Moisson risks and uncertainties that could cause the outcome to differ significantly. -

Annual Information Form

ANNUAL INFORMATION FORM Year Ended May 7, 2016 July 20, 2016 TABLE OF CONTENTS FORWARD-LOOKING STATEMENTS ..................................................................................................... 1 CORPORATE STRUCTURE .................................................................................................................... 3 Name and Incorporation ................................................................................................................ 3 Intercorporate Relationships ......................................................................................................... 3 DESCRIPTION OF THE BUSINESS ........................................................................................................ 4 Food Retailing ............................................................................................................................... 4 Investments and Other Operations ............................................................................................... 7 Competition ................................................................................................................................... 7 Other Information .......................................................................................................................... 8 GENERAL DEVELOPMENT OF THE BUSINESS ................................................................................... 9 Focus on Food Retailing .............................................................................................................. -

Could Aldi Succeed in Canada? Sonia Boyer [email protected]

Bucknell University Bucknell Digital Commons Global Manager Abroad Global Management Spring 2018 Could Aldi Succeed in Canada? Sonia Boyer [email protected] Justin Carr [email protected] Sam Loomis [email protected] Maria Prothero [email protected] Quentin Street [email protected] See next page for additional authors Follow this and additional works at: https://digitalcommons.bucknell.edu/glbm400 Recommended Citation Boyer, Sonia; Carr, Justin; Loomis, Sam; Prothero, Maria; Street, Quentin; and Chen, Jimmy, "Could Aldi Succeed in Canada?" (2018). Global Manager Abroad. 7. https://digitalcommons.bucknell.edu/glbm400/7 This Article is brought to you for free and open access by the Global Management at Bucknell Digital Commons. It has been accepted for inclusion in Global Manager Abroad by an authorized administrator of Bucknell Digital Commons. For more information, please contact [email protected]. Authors Sonia Boyer, Justin Carr, Sam Loomis, Maria Prothero, Quentin Street, and Jimmy Chen This article is available at Bucknell Digital Commons: https://digitalcommons.bucknell.edu/glbm400/7 Could Aldi Succeed in Canada? GLBM 400 Professor Chen Sonia Boyer, Justin Carr, Sam Loomis, Maria Prothero, and Quentin Street TABLE OF CONTENTS Contextual Information 2 History of Aldi 2 Research Questions 5 Competitive Landscape 6 United States 7 Canada 8 Comprehensive Venture Analysis 11 Cultural and Social Aspects 12 Political Aspects 14 Economic Aspects 14 Recommendations 15 References 18 Appendices 20 1 1. CONTEXTUAL INFORMATION AND RESEARCH QUESTIONS 1.1 History of Aldi Initial Growth In 1946 a pair of brothers named Karl and Theo Albrecht founded the supermarket chain Aldi in Essen, Germany. The storefront, a local grocery store, had been in operation since 1913 when the Albrecht’s mother began the business (“Company Profile”, 2018).