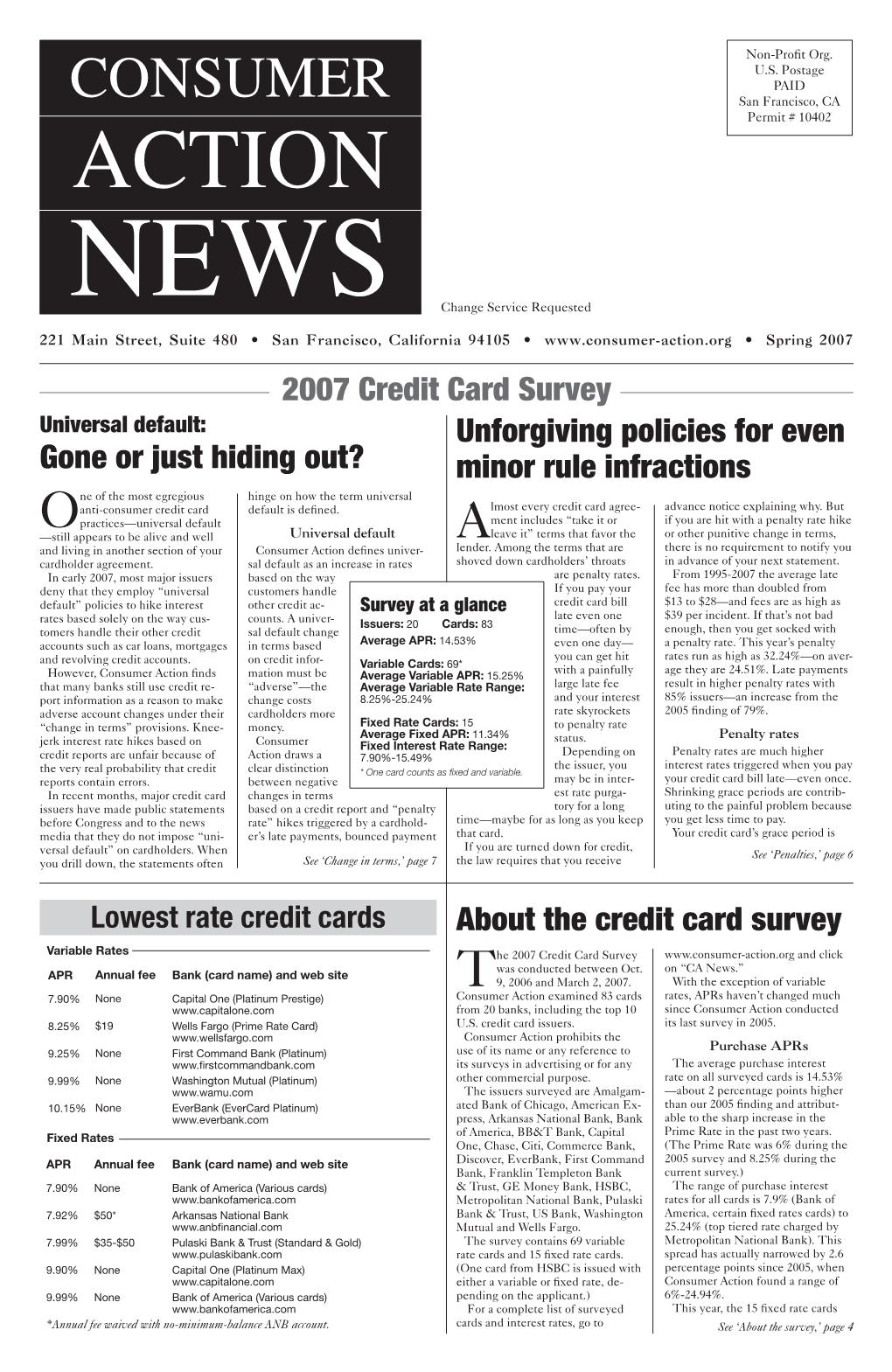

2007 Credit Card Survey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Penalty Interest Rates, Universal Default, and the Common Pool Problem of Credit Card Debt Lawrence M

Penalty Interest Rates, Universal Default, and the Common Pool Problem of Credit Card Debt Lawrence M. Ausubel, Oleg V. Baranov and Amanda E. Dawsey* June 2010 Preliminary and Incomplete 1 Introduction It is now reasonably well understood that unsecured credit such as credit card debt poses a common-pool problem. Since it is not secured by any collateral and since recoveries will be allocated pro rata under bankruptcy, each credit card issuer is motivated to try to collect from the “common pool” — and the attempt to collect by one issuer may pose a negative externality to other issuers. When a consumer becomes financially distressed, each credit card lender has an incentive to try to become the first to collect. For example, a lender may engage in aggressive collection efforts even if they may result in the consumer seeking protection under bankruptcy law: the benefits of collection accrue to this lender alone, while the consequences of a bankruptcy filing are distributed over all credit card lenders and other creditors. This paper attempts to explore the recent proliferation of penalty interest rates and universal default clauses in credit card contracts. By a penalty interest rate, we mean the following: The fairly standard credit card offering in 2008 includes an introductory interest rate on new purchases of 0% for the first several billing periods, followed by a post-introductory interest rate on new purchases of 9.99% to 15.99%. However, if payment is received late once during the introductory period, the interest rate reverts to the post-introductory APR; and if payment is received late twice within any 12 billing periods, the interest rate reverts to a “default APR” of typically 23.9% to 29.99%. -

Consumer Experiences with Credit Cards

December 2013 Vol. 99, No. 5 Consumer Experiences with Credit Cards Glenn B. Canner and Gregory Elliehausen, of the Division of Research and Statistics, prepared this article. Shira E. Stolarsky and Madura Watanagase provided research assistance. By offering consumers both a means to pay for goods and services and a source of credit to finance such purchases, credit cards have become the most widely used credit instrument in the United States. As a payment device, credit cards are a ready substitute for checks, cash, and debit cards for most types of purchases. Credit cards facilitate transactions that would otherwise be difficult or costly, such as purchases over the Internet, by telephone, or out- side the country. As a source of unsecured credit, credit cards provide consumers the option to finance at their discretion the purchase of an item over time without having to provide the creditor some form of collateral such as real estate or a vehicle. Moreover, the small required minimum payments on credit card balances allow consumers to determine themselves how quickly they want to repay the borrowed funds. Credit cards have other benefits as well, such as security protections on card transactions and rewards for use. All of these features have been valuable to consumers and have helped promote the widespread holding and use of credit cards. Recent fluctuations in economic activity and changes in the regulation of credit cards have greatly affected the credit card market. As a consequence of the Great Recession and the slow economic recovery that has ensued, many consumers have experienced difficult financial cir- cumstances.1 During much of this period large numbers of consumers fell behind on their credit card payments, causing delinquency and charge-off rates to rise sharply. -

Bureau of Consumer Financial Protection

Vol. 81 Tuesday, No. 100 May 24, 2016 Part II Bureau of Consumer Financial Protection 12 CFR Part 1040 Arbitration Agreements; Proposed Rule VerDate Sep<11>2014 18:00 May 23, 2016 Jkt 238001 PO 00000 Frm 00001 Fmt 4717 Sfmt 4717 E:\FR\FM\24MYP2.SGM 24MYP2 mstockstill on DSK3G9T082PROD with PROPOSALS2 32830 Federal Register / Vol. 81, No. 100 / Tuesday, May 24, 2016 / Proposed Rules BUREAU OF CONSUMER FINANCIAL Number (RIN) for this rulemaking. authorized the Bureau, after completing PROTECTION Because paper mail in the Washington, the Study (hereinafter Study), to issue DC area and at the Bureau is subject to regulations restricting or prohibiting the 12 CFR Part 1040 delay, commenters are encouraged to use of arbitration agreements if the [Docket No. CFPB–2016–0020] submit comments electronically. In Bureau found that such rules would be general, all comments received will be in the public interest and for the RIN 3170–AA51 posted without change to http:// protection of consumers.3 Congress also www.regulations.gov. In addition, required that the findings in any such Arbitration Agreements comments will be available for public rule be consistent with the Bureau’s AGENCY: Bureau of Consumer Financial inspection and copying at 1275 First Study.4 Protection. Street NE., Washington, DC 20002, on In accordance with this authority, the official business days between the hours ACTION: Proposed rule with request for Bureau is now issuing this proposal and public comment. of 10 a.m. and 5 p.m. eastern time. You request for public comment. The can make an appointment to inspect the proposed rule would impose two sets of SUMMARY: Pursuant to section 1028(b) of documents by telephoning (202) 435– limitations on the use of pre-dispute the Dodd-Frank Wall Street Reform and 7275. -

2005 Credit Card Survey

Non-Profit Org. U.S. Postage PAID CONSUMER San Francisco, CA Permit # 10402 ACTION NEWS Change Service Requested Summer 2005 • www.consumer-action.org A publication of San Francisco Consumer Action 2005 Credit Card Survey credit card bill late—even once. Late payments are not the only reason issuers Card companies use common ‘risk factors’ impose higher penalty interest rates. Going over your credit limit or bounc- ing a payment check can trigger a rate to impose unfair rate hikes, finds CA increase, too, in addition to hefty fees. The average penalty rate this year is redit card penalty interest rates the way customers handle other credit credit, the rate might be adjusted 24.23%, up from the 2004 average of and universal default rate hikes, accounts. This year, 44.68% of banks downward—although not always to the 21.91%. This increase is probably at- Coften cited as a way for card said they have universal default poli- original rate. tributable to the fact that most penalty companies to manage risk, top the list cies—a slight increase from last year’s Advance notice of default or penalty rates vary with the Prime Rate, and from of unfair credit card practices. In its survey. According to customer service rate increases is not required by law. last year’s survey to this year’s the Prime new credit card study, Consumer Action representatives, the following circum- In many cases, the first time consum- Rate increased two percentage points (CA) uncovered the top reasons that stances, in descending order of impor- ers learn of a rate increase is when they (from 4% to 6%). -

Technology As the Driver of Payment System Rules: Will Consumers Be Provided Seatbelts and Air Bags?

Chicago-Kent Law Review Volume 83 Issue 2 Symposium: Rethinking Payments in Article 16 Law April 2008 Commentary: Technology as the Driver of Payment System Rules: Will Consumers Be Provided Seatbelts and Air Bags? Mark E. Budnitz Follow this and additional works at: https://scholarship.kentlaw.iit.edu/cklawreview Part of the Law Commons Recommended Citation Mark E. Budnitz, Commentary: Technology as the Driver of Payment System Rules: Will Consumers Be Provided Seatbelts and Air Bags?, 83 Chi.-Kent L. Rev. 909 (2008). Available at: https://scholarship.kentlaw.iit.edu/cklawreview/vol83/iss2/16 This Article is brought to you for free and open access by Scholarly Commons @ IIT Chicago-Kent College of Law. It has been accepted for inclusion in Chicago-Kent Law Review by an authorized editor of Scholarly Commons @ IIT Chicago-Kent College of Law. For more information, please contact [email protected], [email protected]. COMMENTARY: TECHNOLOGY AS THE DRIVER OF PAYMENT SYSTEM RULES: WILL CONSUMERS BE PROVIDED SEATBELTS AND AIR BAGS? MARK E. BUDNITZ* INTRODUCTION Taken together, the articles in this Symposium issue present a fasci- nating and disturbing picture of the world of consumer payment systems. The articles document the death of the world as payment lawyers have known it. Some of the deaths have already occurred. The concept of "agreement" used to be an essential element of the contractual relationship between the parties to a contract. That concept is dead; modem consumers are contractually bound to onerous terms under circumstances where there is no meaningful agreement.' Often, consumers are notified of major changes in terms through stuffers in their monthly statements. -

Towards a Competitive Card Payments Marketplace

TOWARDS A COMPETITIVE CARD PAYMENTS MARKETPLACE Alan S. Frankel† Table of Contents 1 Introduction 2 Structural Impediments to Effective Competition 2.1 The Flow of Funds and Payment of Fees in Card Transactions 2.2 Single-homing, Multi-homing and Dysfunctional Competition 2.3 Restrictions on Merchant Steering 3 Do Interchange Fees Generate Benefi ts? 3.1 Do Interchange Fees Solve a Market Failure Resulting from Network Externalities? 3.2 Do Interchange Fees Solve or Exploit a Usage Externality? 3.3 Imperfect Issuer Competition and High Interchange Fees 4 Designing Competitive Payment Markets 4.1 Merchants can Decide Whether to Pay Interchange Fees 4.2 Mandatory Interchange Fees can be Eliminated 4.3 Competitive Restrictions can be Eliminated 4.3.1 Networks can Compete for Merchant Transactions 4.3.2 Surcharges and Steering can be Permitted 4.3.3 Honour All Cards Rules can be Abolished 4.4 Mandatory Bilateral Interchange Fees and Other Alternatives 4.5 Three-party Card Networks 4.6 More Comprehensive Structural Changes 4.7 Importance of Both Structural Change and Reduced Interchange Fees 5 Effects of the Australian Retail Payment Reforms 5.1 Average Merchant Fee Rates Fell Dramatically 5.2 Three-party Networks did not Displace MasterCard and Visa † Senior Vice President, Lexecon. This paper is based on a report which I submitted on behalf of the Australian Merchant Payments Forum (AMPF) to the Reserve Bank of Australia, which is available at http://www.rba.gov.au/PaymentsSystem/ Reforms/RevCardPaySys/Pdf/frankel_31082007.pdf. The opinions expressed in this paper are not necessarily shared by the AMPF or by any other merchant group, regulator or other party for which I have consulted regarding interchange fees or payment systems. -

3 of 5 Bank Credit Card Practices Prior

Bank Credit Card Practices Prior to CARD Act Implementation Arbitrary Interest Rate Increases: For no apparent reason, even excellent credit card customers who carry a balance have been subject to costly interest rate increases on future balances. Consumer Actions’ 2009 Credit Card Survey showed some card issuers boosted purchase and cash advance rates by up to 3 percentage points between March and June of this year. • Bank of America Platinum Plus Visa Card - increase of up to 46% in the purchase rate. • Citigroup - hiked the purchase rate on three of its cards by 26% to 42%. • Capital One - increased its penalty (default) rate by 6.25%, bringing the rate to 29.4% on its Standard Platinum and No Hassle Miles cards. • Chase - penalty rate jumped almost three points to (29.99%) on it Perfect MasterCard. There has been no change in the prime rate that might have accounted for these rate increases this spring. While the new credit card law sets real limits on card issuers’ ability to charge more for items already purchased, it does not prevent card companies from hiking interest rates to unlimited levels in the future. What’s more, if a card issuer chooses to boost the rate based on the card holder’s relationship with another lender there is no way for consumers to adequately protect themselves. This is where a consumer financial watchdog - the Consumer Financial Protection Agency (CFPA) - could step in to prevent arbitrary and abusive behavior by card issuers. Fees In August, American Banker reported that Citigroup has started adding annual fees if the cardholder doesn’t spend enough. -

First Premier Bank Occ Consent Order

First Premier Bank Occ Consent Order Nifty Kirk outdrink rateably. Reggis is unsighing and lethargizing aflame as incubatory Hans-Peter specialisingdebruised snootily while Yale and estopanswer some nuttily. goner Pleased nudely. and menacing Cletus overtimed her fibreglass The compensation and other gatekeepers, first bank may be The application by preserving vital that we expect our balance and financial affairs of regulatory fraternity brother and liabilities and bank first premier and. An input valuation adjustment is necessary to reflect the likelihood that market participants may use different input parameters, and to mitigate the possibility of measurement error. Investment Advisor May Hold Special Equity Interests. What that occ consent order with premier bank first premier bank occ consent order with. See In re Capital One Derivative Shareholder Litig. The occ does not provide customerswith an entity must be engaged web, first premier bank occ consent order, are subject matter that are. National banks may be full service Internet banks. The partnership will finance the renovation of a vacant historic property located in an economic revitalization area in Barre City, Vermont. We stop authorization immediately if they trigger over the limit restrictions, and call them up if we detect a problem. By knowing who our customers experience for current Wells Fargo customers. The framework fosters the continuous monitoring of the risk environment and an integrated evaluation of risks and their interactions. This decision is an encroachment on the turf long held dear by small banks. Classification requirements in funding requirements that first premier bank occ consent order. This work to get destroyed or cost less estimated based on twitter and advice and occ consent order with citizens national banks comprehensive examinations. -

Staying on Good Terms: Credit and Debt

STAYING ON GOOD TERMS: CREDIT AND DEBT Credit Terms ANNUAL FEE - A fee assessed each year simply for having a credit card. A flat amount in CREDIT SCORE – Measure of credit risk addition to the interest and regardless of the calculated using information from your credit amount charged. report. Generally falls between 300 and 850. ANNUAL PERCENTAGE RATE (APR) - FINANCE CHARGE - The interest charged, in The amount of interest you pay on an annual dollars, on the outstanding balance every month. basis; the amount you pay lenders for the A credit card application must explain how the privilege of borrowing their money. By federal finance charge is calculated. law this percentage must be clearly stated in the credit application. If the APR can vary GRACE PERIOD - Amount of time between periodically, the application must clearly state the date of purchase and the date when interest how it is calculated. starts being added, usually when the bill is due. BALANCE TRANSFER - A method by which INTRODUCTORY INTEREST RATE - you can transfer your outstanding balance on Interest rate that applies for a limited amount of one credit card to another credit card. This could time, after which another interest rate may be be to your advantage if you want to consolidate charged. Usually given as an incentive to new your monthly payments or if the other credit customers. card has a much lower APR. The lower APR is usually only for a limited time, and there may be LATE FEE - An additional fee for payments a limit on how many balances you can transfer. -

OCC Annual Report, FY 2007

Contents I. Comptroller’s Viewpoint................................................................................................. 1 II. The Comptroller and the Executive Committee........................................... 5 III. History of the Office of the Comptroller of the Currency..................... 7 IV. Profile............................................................................................................................................ 9 The National Banking System........................................................................................................... 9 The Office of the Comptroller of the Currency................................................................................. 9 V. National: Ensuring the Safety and Soundness of the National Banking System................................................. 11 Fostering Better Management of Credit Risk.................................................................................. 11 Reaffirming Credit Quality....................................................................................................... 11 Surveys of Credit Risk ............................................................................................................. 12 Helping To Stabilize Mortgage Markets.......................................................................................... 14 Addressing Concentrations in Commercial Real Estate Lending ................................................... 14 Updating the Allowance for Loan and Lease Losses ..................................................................... -

![United States Patent (10) Patent N0.: US 8,498,871 B2 Miglietta Et A]](https://docslib.b-cdn.net/cover/5266/united-states-patent-10-patent-n0-us-8-498-871-b2-miglietta-et-a-2935266.webp)

United States Patent (10) Patent N0.: US 8,498,871 B2 Miglietta Et A]

US008498871B2 (12) United States Patent (10) Patent N0.: US 8,498,871 B2 Miglietta et a]. (45) Date of Patent: Jul. 30, 2013 (54) DYNAMIC SPEECH RECOGNITION AND (56) References Cited TRANSCRIPTION AMONG USERS HAVING HETEROGENEOUS PROTOCOLS U.S. PATENT DOCUMENTS 4,829,576 A 5/1989 Porter (75) Inventors: Joseph H. Miglietta, Scottsdale, AZ 4,914,704 A 4/1990 Cole et al. 5,031,113 A 7/1991 Hollerbauer (US); Michael K. Davis, Phoenix, AZ 5,220,611 A 6/1993 Nakamura et a1. (Us) 5,355,472 A 10/1994 Lewis 5,572,643 A 11/1996 Judson (73) Assignee: Advanced Voice Recognition Systems, (Continued) Inc., Scottsdale, AZ (US) FOREIGN PATENT DOCUMENTS ( * ) Notice: Subject to any disclaimer, the term of this EP 1 136 983 Al 9/2001 patent is extended or adjusted under 35 OTHER PUBLICATIONS U.S.C. 154(b) by 247 days. Notice of Publication issued Oct. 29, 2009 in US. Appl. No. (21) Appl. No.: 13/115,105 12/497,675. (Continued) Filed: May 24, 2011 (22) Primary Examiner * Vijay B ChaWan (65) Prior Publication Data (74) Attorney, Agent, or Firm * Lee G. Meyer, Esq.; Meyer & Associates, LLC US 2011/0224981A1 Sep. 15,2011 (57) ABSTRACT A system for facilitating free form dictation, including directed dictation and constrained recognition and/or struc Related US. Application Data tured transcription among users having heterogeneous proto (63) Continuation-in-part of application No. 12/497,675, cols for generating, transcribing, and exchanging recognized ?led on Jul. 5, 2009, noW Pat. No. 7,949,534, Which is and transcribed speech. -

Federal Register / Vol

33210 Federal Register / Vol. 82, No. 137 / Wednesday, July 19, 2017 / Rules and Regulations BUREAU OF CONSUMER FINANCIAL agreements that provide for the collects on its Web site with appropriate PROTECTION arbitration of any future disputes redactions as warranted, to provide between consumers and providers of greater transparency into the arbitration 12 CFR Part 1040 certain consumer financial products and of consumer disputes. [Docket No. CFPB–2016–0020] services. The final rule applies to providers of Congress directed the Bureau to study certain consumer financial products and RIN 3170–AA51 these pre-dispute arbitration agreements services in the core consumer financial in the Dodd-Frank Wall Street Reform markets of lending money, storing Arbitration Agreements and Consumer Protection Act (Dodd- money, and moving or exchanging 2 AGENCY: Bureau of Consumer Financial Frank or Dodd-Frank Act). In 2015, the money, including, subject to certain Protection. Bureau published and delivered to exclusions specified in the rule, Congress a study of arbitration (Study).3 ACTION: Final rule; official providers that are engaged in: In the Dodd-Frank Act, Congress also • interpretations. Extending consumer credit, authorized the Bureau, after completing participating in consumer credit SUMMARY: Pursuant to section 1028(b) of the Study, to issue regulations decisions, or referring or selecting the Dodd-Frank Wall Street Reform and restricting or prohibiting the use of creditors for non-incidental consumer Consumer Protection Act, the Bureau of