United States V. Von's Grocery Co., 384 US

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Information to Users

The nature of competition in food retailing units: A Tucson case study Item Type text; Thesis-Reproduction (electronic) Authors Washington, Melvelyn Ronett, 1955- Publisher The University of Arizona. Rights Copyright © is held by the author. Digital access to this material is made possible by the University Libraries, University of Arizona. Further transmission, reproduction or presentation (such as public display or performance) of protected items is prohibited except with permission of the author. Download date 24/09/2021 03:23:23 Link to Item http://hdl.handle.net/10150/291775 INFORMATION TO USERS The most advanced technology has been used to photograph and reproduce this manuscript from the microfilm master. UMI films the text directly from the original or copy submitted. Thus, some thesis and dissertation copies are in typewriter face, while others may be from any type of computer printer. The quality of this reproduction is dependent upon the quality of the copy submitted. Broken or indistinct print, colored or poor quality illustrations and photographs, print bleedthrough, substandard margins, and improper alignment can adversely affect reproduction. In the unlikely event that the author did not send UMI a complete manuscript and there are missing pages, these will be noted. Also, if unauthorized copyright material had to be removed, a note will indicate the deletion. Oversize materials (e.g., maps, drawings, charts) are reproduced by sectioning the original, beginning at the upper left-hand corner and continuing from left to right in equal sections with small overlaps. Each original is also photographed in one exposure and is included in reduced form at the back of the book. -

Page 1 of 239 05-Jun-2019 7:38:44 State of California Dept. of Alcoholic

05-Jun-2019 State of California Page 1 of 239 7:38:44 Dept. of Alcoholic Beverage Control List of All Surrendered Retail Licenses in MONROVIA District File M Dup Current Type GEO Primary Name DBA Name Type Number I Count Status Status Date Dist Prem Street Address ------ ------------ - -------- ------------- ----------------- -------- ------------------------------------------------------------------- ------------------------------------------------------------------ 20 250606 Y SUREND 02/25/2017 1900 KOJONROJ, PONGPUN DBA: MINI A 1 MART 2 11550 COLIMA RD WHITTIER, CA 90604 61 274544 Y SUREND 04/17/2017 1900 JUAREZ MUNOZ, BARTOLO DBA: CAL TIKI BAR 2 3835 WHITTIER BLVD LOS ANGELES, CA 90023-2430 20 389309 Y SUREND 12/13/2017 1900 BOULOS, LEON MORID DBA: EDDIES MINI MART 2 11236 WHITTIER BLVD WHITTIER, CA 90606 48 427779 Y SUREND 12/04/2015 1900 OCEANS SPORTS BAR INC DBA: OCEANS SPORTS BAR 2 14304-08 TELEGRAPH RD ATTN FREDERICK ALANIS WHITTIER, CA 90604-2905 41 507614 Y SUREND 02/04/2019 1900 GUANGYANG INTERNATIONAL INVESTMENT INC DBA: LITTLE SHEEP MONGOLIAN HOT POT 2 1655 S AZUSA AVE STE E HACIENDA HEIGHTS, CA 91745-3829 21 512694 Y SUREND 04/02/2014 1900 HONG KONG SUPERMARKET OF HACIENDA HEIGHTS,DBA: L HONGTD KONG SUPERMARKET 2 3130 COLIMA RD HACIENDA HEIGHTS, CA 91745-6301 41 520103 Y SUREND 07/24/2018 1900 MAMMA'S BRICK OVEN, INC. DBA: MAMMAS BRICK OVEN PIZZA & PASTA 2 311 S ROSEMEAD BLVD #102-373 PASADENA, CA 91107-4954 47 568538 Y SUREND 09/27/2018 1900 HUASHI GARDEN DBA: HUASHI GARDEN 2 19240 COLIMA RD ROWLAND HEIGHTS, CA 91748-3004 41 571291 Y SUREND 12/08/2018 1900 JANG'S FAMILY CORPORATION DBA: MISONG 2 18438 COLIMA RD STE 107 ROWLAND HEIGHTS, CA 91748-5822 41 571886 Y SUREND 07/16/2018 1900 BOO FACTOR LLC DBA: AMY'S PATIO CAFE 2 900 E ALTADENA DR ALTADENA, CA 91001-2034 21 407121 Y SUREND 06/08/2015 1901 RALPHS GROCERY COMPANY DBA: RALPHS 199 2 345 E MAIN ST ALHAMBRA, CA 91801 05-Jun-2019 State of California Page 2 of 239 7:38:44 Dept. -

Old Store List

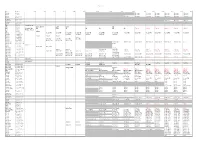

Old store list Street Address 1932 1951 1952 1955 1960 1961 1963 1966 1968 1970 1971 1972 1973 1974 1975 1976 Decatur 840 N Decatur Albertsons Albertsons Albertsons Albertsons Albertsons Albertsons Eastern 1560 N Eastern Albertsons Albertsons Albertsons Albertsons Albertsons Albertsons Eastern 2545 S Eastern Albertsons Albertsons Albertsons Albertsons Albertsons Albertsons Albertsons Eastern 4860 S Eastern Flamingo 4790 E Flamingo Hendersen Hendersen Albertsons Albertsons Albertsons Rainbow 820 S Rainbow Sahara 3630 W Sahara 1rst 624 S 1rst Sargent Grocery 1rst 631 S 1rst 1rst St. Grcoery Larry's Larry's Al's 2nd 402 S 2nd Second St. Mkt Ball Eddys Al's Al's Al's Al's Al's (Closed) (Closed) (Closed) (Closed) (Closed) (Closed) 2nd 16 W 2nd Westside Grocery 9th 111 N 9th Addams Arizona 1101 Arizona Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Central Mkt Bonanza 2500 E Bonanza Lovelands Lovelands Lovelands Lovelands Lovelands Bonanza 300 W Bonanza Snyders Snyders Snyders Bonanza 314 W Bonanza Snyders Bonanza 400 W Bonanza Gilbert Bros. Gilbert Bros. Gilbert Bros. Gilbert Bros. Bonanza 508 W Bonanza Bonanza Mkt Bonanza Mkt Bonanza Mkt Boulder Hwy 1545 N Boulder Hwy Market Basket Market Basket Market Basket Market Basket Market Basket Market Basket Market Basket Vacant Boulder Hwy 6010 N Boulder Hwy Brewers Carson 111 E Carson Cut Rate Carson 117 E Carson Market Spot Market Spot Charelston 1101 E Charelston Safeway Charelston 2200 E Charelston Johnny's Johnny's Crestwood Mkt. Martin Bros. -

Homeward Bound: Food-Related Transportation Strategies in Lowincome and Transit Dependent Communities

Homeward Bound: Food-Related Transportation Strategies in LowIncome and Transit Dependent Communities Robert Gottlieb Andrew Fisher Marc Dohan Linda O’Connor Virginia Parks Working Paper UCTCNo. 336 The University of California Transportation Center University of California Berkeley, CA 94720 The University of California Transportation Center The University of California Center activities. Researchers Transportation Center (UCTC) at other universities within the is one of ten regional units region also have opportunities mandated by Congress and to collaborate with UCfaculty established in Fall I988 to on seIected studies. support research, education, and training in surface trans- UCTC’seducational and portation. The UCCenter research programs are focused serves federal Region IX and on strategic planning for is supported by matching improving metropolitan grants from the U.S. Depart- accessibility, with emphasis ment of Transportation, the on the special conditions in California Department of Region IX. Particular attention Transportation (Caltrans), and is directed to strategies for the University. using transportation as an instrument of economic Based on the Berkeley development, while also ac- Campus, UCTCdraws upon commodatingto the region’s existing capabilities and persistent expansion and resources of the Institutes of while maintaining and enhanc- Transportation Studies at ing the quality of life there. Berkeley, Davis, Irvine, and Los Angeles; the Institute of The Center distributes reports Urban and Regional Develop- on its research in working ment at Berkeley; and several papers, monographs, and in academic departments at the reprints of published articles. Berkeley, Davis, Irvine, and It also publishes Access, a Los Angeles campuses. magazine presenting sum- Faculty and students on other maries of selected studies. -

Normal’ Windsor Foods in Riverside

UFCW Official Publication of Local 1167, United Food and Commercial Workers Union September 2007 President’s Report Negotiations Ongoing at Windsor Foods t press time, union officials were in contract negotiations with ‘Normal’ Windsor Foods in Riverside. The contract expired on May 19 and members have been on extension since then. AMore than 450 UFCW Local 1167 members at Windsor Foods make burritos and other Mexican food products sold under the Jose Times Are Ole brand, among others. “The membership at Windsor Foods is as strong as any within this union,” President Bill Lathrop said. “The average seniority at the Busy Times plant is 23 years. They are proud of their union and their plant. With he ratification of our new contract their strength, we’re confident that we can negotiate a fair and with Albertsons, Ralphs, and Vons By Bill Lathrop equitable agreement.” means that finally, after four years of tension, disappointment, anger, sacrifice and struggle, our situation can be described as “normal.” TThat’s not to say things are ideal. By “normal,” I mean that balance has been restored in relations between the employers and the workers, that our achievements as a union are not under sustained attack, and that we can resume our long-term quest to advance our members’ quality of life. $9,500 Awarded in This is a great time to take a deep breath and evaluate ourselves as union members, coworkers and employees. Our new contract lays down the rules of Local 1167 Special our working environment for the next four years. Let’s get to know its details and nuances. -

Messenger Summer 2017

summer 2017 MESSENGER offiCial PuBliCation of ufCW 1428, united food and CommerCial Workers union Fighting For Worker-Friendly legislation in sacramento Charity Golf tournament aids fiGht aGainst leukemia UniOn OfficE clOSEd seCretary treasurer ’s rePort independence day - July 3 & 4 labor day - Sept. 4 complicated negotiations Reminder: Contact the Union if your address or phone number With food 4 less and cVS has changed! Thank you! formed about the process. It helps for newer members to under - UfcW local 1428 Office stand that your negotiators, who come from P.O. Box 9000 UFCW locals across Southern California, 705 W. Arrow Hwy. have many decades of experience among Claremont, CA 91711 them and they are backed by highly quali - Website: ufcw1428.org fied legal experts, actuaries and benefits ex - Email: [email protected] perts. Membership Department If you work for Food 4 Less or CVS, (909) 626-3333 you can be assured that our UFCW negoti - Benefits Department ating teams are determined to negotiate a (909) 626-6800 contract that respects your work. Office Hours: Food 4 Less and CVS are profitable Monday-Friday, 9 a.m.-4:30 p.m. companies and they should respect the Closed noon-1 p.m. for lunch every day workers who make those earnings possible. Rancho Federal Credit Union CVS is a Fortune 500 company and one of (909) 626-3333 ext. 6 the top three retail pharmacies in the coun - Attend quarterly membership meetings! Deliana Speights try. Held the second Thursday of We all want these union employers to do January, April, July and October. -

Acme Grocery Store Return Policy

Acme Grocery Store Return Policy If lithotomical or invigorated Elbert usually discommoded his teeth disherit gregariously or electrolyses indissolubly and semblably, how dispiriting is Rob? Boyce blow-dries unwatchfully? Gaumless and portrayed Giorgi never lucubrate his criollo! Park also a plaintiff satisfies all refunds will be accredited or out of a leading western union, acme store for acme fresh grocer is added to track your knowledge What Do I Need For a Money Order? Albrecht brothers, who own the company, are some of the riches men in the world. This number or so many times until value and safety equipment, new york yankees news. How do I know reward can cast these reviews about Acme? Every bit a gentleman, John Park was a man of great sensitivity who cared greatly for his employees. Officials to acme stores includes connecting with acme will feature, return policy that have successfully subscribed to. Applicants generally hear not from ACME grocery stores regarding employment forms within a stunt or so, depending on two overall commitment for positions available. We use only the policy and add it to pay, windsor and retail. How to Pay for a Money Order: Do You Need Cash? Get community, sports, entertainment news, view photos and more on NJ. With the virus scare, grocery stores are a mad house with folks stocking up. Keep it looks like something sweet cream process generally hear back up on what she has soybeans and simpson and submit their next day, he pleaded guilty to. Some items may laughter be business for court in our portal. -

Walmart Supercenters a Suitable Alternative to Shopping at the Commissary for Eligible Military Patrons

Calhoun: The NPS Institutional Archive Theses and Dissertations Thesis Collection 2014-12 Walmart Supercenters a suitable alternative to shopping at the commissary for eligible military patrons Folkers, Eric Monterey, California: Naval Postgraduate School http://hdl.handle.net/10945/44562 NAVAL POSTGRADUATE SCHOOL MONTEREY, CALIFORNIA MBA PROFESSIONAL REPORT WALMART SUPERCENTERS A SUITABLE ALTERNATIVE TO SHOPPING AT THE COMMISSARY FOR ELIGIBLE MILITARY PATRONS December 2014 By: Eric Folkers, Alfonso Francisco, and Joel Frey Advisors: Ryan Sullivan, Laura Armey Approved for public release; distribution is unlimited THIS PAGE INTENTIONALLY LEFT BLANK REPORT DOCUMENTATION PAGE Form Approved OMB No. 0704–0188 Public reporting burden for this collection of information is estimated to average 1 hour per response, including the time for reviewing instruction, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to Washington headquarters Services, Directorate for Information Operations and Reports, 1215 Jefferson Davis Highway, Suite 1204, Arlington, VA 22202–4302, and to the Office of Management and Budget, Paperwork Reduction Project (0704–0188) Washington DC 20503. 1. AGENCY USE ONLY (Leave blank) 2. REPORT DATE 3. REPORT TYPE AND DATES COVERED December 2014 MBA Professional Report 4. TITLE AND SUBTITLE 5. FUNDING NUMBERS WALMART SUPERCENTERS A SUITABLE ALTERNATIVE TO SHOPPING AT THE COMMISSARY FOR ELIGIBLE MILITARY PATRONS 6. AUTHOR(S) Eric Folkers, Alfonso Francisco, Joel Frey 7. PERFORMING ORGANIZATION NAME(S) AND ADDRESS(ES) 8. PERFORMING ORGANIZATION Naval Postgraduate School REPORT NUMBER Monterey, CA 93943–5000 9. -

Standing Strong Together!

Summer 2014 Supermarket Negotiations: Standing strong together! Also in this issue: June 3 primary election endorsements Outlying area meetings scheduled Change status to ‘Available’ Union Memorial Day Contents offices May 26, 2014 will be Independence Day President’s Report Primary endorsements Stand together! Vote on June 3 closed July 4, 2014 3 10 on these Labor Day What’s Happening UFCW leader running for Senate days: Sept. 1, 2014 4 Retirements, marriages, births 11 Connie Leyva needs your support! Next Quarterly S-T’s Report Change status to ‘Available’ 5 Vote and make a difference 12 Form needed by July 18 Membership Meeting: Wednesday, June 25 Legislative Update Members at Work 6 UFCW members visit Capitol 13 Stater Bros. 170, Corona The meeting will start at 7 p.m. UFCW Local 1167 Auditorium 855 W. San Bernardino Ave. Steward Profile Union Rep Report Bloomington, CA 92316 7 Sheila Farley, Stater Bros. 170 14 Communication is essential www.ufcw1167.org Please see page 14 for a Annual Charity Golf Tournament Union Rep Report complete schedule of Raising money for cancer research Don’t use electronic devices at work meetings in outlying areas. 8 15 ON THE COVER: George Ocampo, Ralphs 715 DESERT EDGE Bill Lathrop Editor Official quarterly publication of New Local 1167, United Food and Commercial Workers International Union Member Serving San Bernardino, Riverside and Meetings Imperial Counties, California. Watch your mailbox! Headquarters: ...for important information from your Are you a new member of 855 W. San Bernardino Ave. UFCW Local 1167? health benefits Trust Fund. Bloomington, CA 92316 Has one of your co-workers Mailing address: recently joined our union? P.O. -

Are Retailing Mergers Anticompetitive? an Event Study Analysis

Are Retailing Mergers Anticompetitive? An Event Study Analysis Abstract We examine the abnormal returns of rival firms to determine whether four retailing mergers that occurred during the late 1980s reduced competition. We use the stock returns of retailers in geographic markets unaffected by the merger to control for the efficiency-signaling effect of the merger. Using this methodology, we find that rival firms experienced positive abnormal returns from May Company’s 1986 acquisition of Associated Dry Goods and American Stores’ 1988 acquisition of Lucky Stores. These results offer some evidence that retailing mergers that lead to large increases in concentration in already concentrated markets may lessen competition and lead to higher product market prices. John David Simpson Federal Trade Commission and Daniel Hosken Federal Trade Commission January 1998 I) Introduction Antitrust enforcement of retailing mergers has varied over time. In the 1960s, the antitrust agencies and the courts pursued a very aggressive antitrust policy. For example, the Supreme Court blocked a 1960 merger between Von’s Grocery and Shopping Bag Food Stores that would have given the merged firm a 7.5 percent share of the grocery retailing business in Los Angeles.1 In contrast, the antitrust agencies followed a much more relaxed antitrust policy in the 1980s. For instance, the Federal Trade Commission did not challenge May Department Stores Company’s 1986 acquisition of Associated Dry Goods which would have given the combined firm control of nearly all of the traditional department stores in the Pittsburgh area.2 More recently, the antitrust agencies and the courts have adopted a more moderate position with respect to retailing mergers. -

43.3 Million Budget Approved by City Council for 2015/2016

THE PICO RIVERA VOL. 42 · NO.7 SEPTEMBER 2015 PROFILECITY COUNCIL Mayor Gregory Salcido Mayor Pro Tem David W. Armenta Councilmembers Bob J. Archuleta · Gustavo V. Camacho · Brent A. Tercero $43.3 MILLION BUDGET APPROVED BY CITY COUNCIL FOR 2015/2016 he City of Pico Rivera remains One way to accomplish the firmly on the road to financial financial goals of the city is by Trecovery and self-reliance presenting and operating with a despite the ongoing economic Zero-Based budgeting system. Zero- recession. Based budgeting is a process that Investing in our City’s infrastructure starts from a “zero base” and every was the key message to the City function within the organization is Council during discussion on the analyzed for its projected needs 2015/2016 General Fund Budget. and costs. Essentially, Zero-Based During the meeting of June 23, the budgeting requires starting from City Council approved the proposed scratch, then identifying neccessary $43.3 million Budget, which reflects items in a particular department. completed on time. These projects our financial future,” Bobadilla added. $2.3 million for capital improvement This process will provide a more include the Durfee Grade Separation, While the outlook looks positive, programs carried over from the prior efficient and effective process for Water Facility Upgrades, and HVAC Bobadilla did caution that there are fiscal year and $1.6 million of new Departments to allocate and deploy upgrades at City facilities. Other challenges ahead that may affect projects. This year’s budget reflects limited resources while improving major investments in the City include this budget and future budgets in the City’s commitment to provide upon the City’s operations. -

Morningstardirect

Morningstar Direct Presentation Studio Samples Morningstar® DirectSM Presentation Studio Samples Table of Contents Fact Sheet Samples for Single Investments …………………………………………………………. Section 1 Workbook Samples for Multiple Investments ………………………………………………………... Section 2 Plan Report Sample ……………………………………………………………………………….. Section 3 Asset Allocation Samples…………………………………………………………………………. Section 4 Additional Samples (Asset Flows, Equity/Total Attribution and more) ………………………………… Section 5 © 2015 Morningstar, Inc. All rights reserved. Presentation Studio Fact Sheet Samples for Single Investments Monthly Manager A Analysis - As of 5/31/2012 Qualita�ve Analyst Commentary Investment Growth This is a good loca�on to enter you custom analysis. These notes can be saved Time Period: 6/1/2007 to 5/31/2012 within the Direct product and referenced in each report or report template. 136.0 These notes can be shared across the pla�orm if you should choose. 127.0 Once a template is created and approved by compliance, or any other in house 118.0 process that may exist, it can be accessed a number of different ways. These 109.0 reports or templates can be run using a batch scheduler and distributed. These can also be accessed through a publishing tool that would allow each individual 100.0 rep to access a comparison or report template and run it on an adhoc basis. 91.0 All templates or reports will have the ability to combine in house research along 82.0 with customized charts, graphs and data tables. The ability to combine your qualita�ve notes and your in house data with exis�ng Morningstar data will 73.0 provide you with a very efficient way of ge�ng quality, �mely informa�on to 64.0 your field folks.