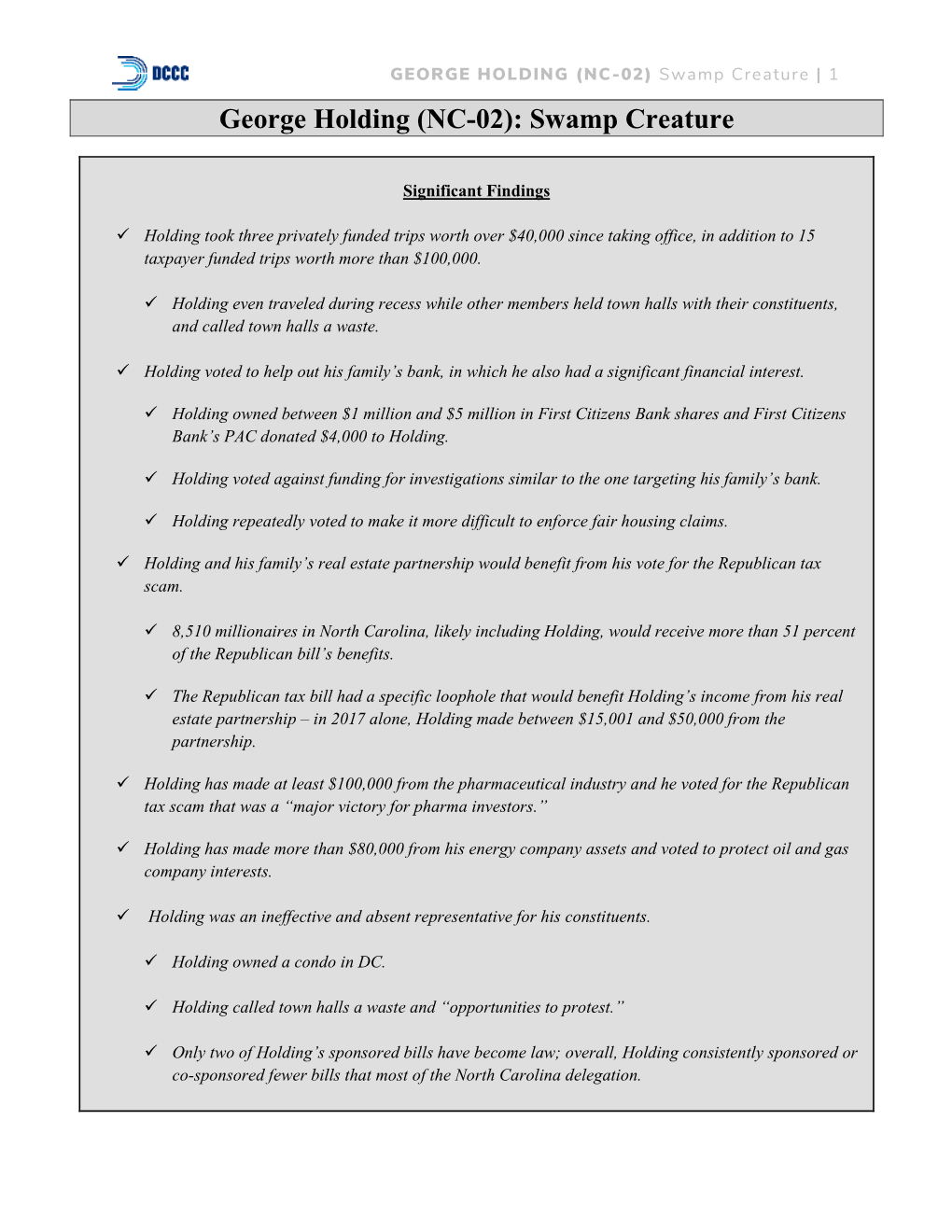

George Holding (NC-02): Swamp Creature

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Congressional Report Card

Congressional Report Card NOTE FROM BRIAN DIXON Senior Vice President for Media POPULATION CONNECTION and Government Relations ACTION FUND 2120 L St NW, Suite 500 Washington, DC 20037 ou’ll notice that this year’s (202) 332–2200 Y Congressional Report Card (800) 767–1956 has a new format. We’ve grouped [email protected] legislators together based on their popconnectaction.org scores. In recent years, it became twitter.com/popconnect apparent that nearly everyone in facebook.com/popconnectaction Congress had either a 100 percent instagram.com/popconnectaction record, or a zero. That’s what you’ll popconnectaction.org/116thCongress see here, with a tiny number of U.S. Capitol switchboard: (202) 224-3121 exceptions in each house. Calling this number will allow you to We’ve also included information connect directly to the offices of your about some of the candidates senators and representative. that we’ve endorsed in this COVER CARTOON year’s election. It’s a small sample of the truly impressive people we’re Nick Anderson editorial cartoon used with supporting. You can find the entire list at popconnectaction.org/2020- the permission of Nick Anderson, the endorsements. Washington Post Writers Group, and the Cartoonist Group. All rights reserved. One of the candidates you’ll read about is Joe Biden, whom we endorsed prior to his naming Sen. Kamala Harris his running mate. They say that BOARD OF DIRECTORS the first important decision a president makes is choosing a vice president, Donna Crane (Secretary) and in his choice of Sen. Harris, Joe Biden struck gold. Carol Ann Kell (Treasurer) Robert K. -

Health Care June 22, 2016 Better.Gop

Health Care June 22, 2016 better.gop A BETTER WAY | 2 Table of Contents High-Quality Health Care for All ............................................................................................................. 5 Obamacare Has Not Worked ................................................................................................................... 9 More Choices, Lower Costs, Greater Flexibility ........................................................................................ 12 Protecting and Strengthening Coverage Options for All Americans .............................................................. 20 Medicaid Reform: Empowering States and Increasing Flexibility ................................................................. 23 Promoting Innovation in Health Care ..................................................................................................... 28 Protecting and Preserving Medicare ...................................................................................................... 30 Conclusion ....................................................................................................................................... 37 A BETTER WAY | 3 A BETTER WAY | 4 High-Quality Health Care for All Americans deserve an accessible and affordable health care system that promotes quality care and peace of mind. It should empower patients and support innovation. Sadly, that is not the system we have today. Obamacare has limited choices for patients, driven up costs for consumers, and buried employers -

Legislative Hearing on the Social Security 2100 Act

1 Legislative Hearing on the Social Security 2100 Act ________________________________________ HEARING BEFORE THE COMMITTEE ON WAYS AND MEANS U.S. HOUSE OF REPRESENTATIVES ONE HUNDRED SIXTEENTH CONGRESS FIRST SESSION ________________________ July 25, 2019 __________________ Serial No. 116-31 _________________ 2 COMMITTEE ON WAYS AND MEANS RICHARD E. NEAL, Massachusetts, Chairman JOHN LEWIS, Georgia KEVIN BRADY, Texas, Ranking Member LLOYD DOGGETT, Texas DEVIN NUNES, California MIKE THOMPSON, California VERN BUCHANAN, Florida JOHN B. LARSON, Connecticut ADRIAN SMITH, Nebraska EARL BLUMENAUER, Oregon KENNY MARCHANT, Texas RON KIND, Wisconsin TOM REED, New York BILL PASCRELL, JR., New Jersey MIKE KELLY, Pennsylvania JOSEPH CROWLEY, New York GEORGE HOLDING, North Carolina DANNY K. DAVIS, Illinois JASON SMITH, Missouri LINDA SÁNCHEZ, California TOM RICE, South Carolina BRIAN HIGGINS, New York DAVID SCHWEIKERT, Arizona TERRI A. SEWELL, Alabama JACKIE WALORSKI, Indiana SUZAN DELBENE, Washington DARIN LAHOOD, Illinois JUDY CHU, California BRAD R. WENSTRUP, Ohio GWEN MOORE, Wisconsin JODEY ARRINGTON, Texas DAN KILDEE, Michigan DREW FERGUSON, Georgia BRENDAN BOYLE, Pennsylvania RON ESTES, Kansas DON BEYER, Virginia DWIGHT EVANS, Pennsylvania BRAD SCHNEIDER, Illinois TOM SUOZZI, New York JIMMY PANETTA, California STEPHANIE MURPHY, Florida JIMMY GOMEZ, California STEVEN HORSFORD, Nevada BRANDON CASEY, Staff Director GARY ANDRES, Minority Staff Director 3 Legislative Hearing on the Social Security 2100 Act U.S. House of Representatives, Committee on Ways and Means, Washington, D.C _________________________ WITNESSES Stephen C. Goss Chief Actuary Social Security Administration Nancy J. Altman President Social Security Works Kelly Brozyna Member Job Creators Network’s National Women’s Coalition Shaun Castle Deputy Executive Director Paralyzed Veterans of America Abigail Zapote Executive Director Latinos for a Secure Retirement 4 ADVISORY FROM THE COMMITTEE ON WAYS AND MEANS FOR IMMEDIATE RELEASE CONTACT: (202) 225-3625 July 18, 2019 No. -

Congressional Directory NORTH CAROLINA

192 Congressional Directory NORTH CAROLINA NORTH CAROLINA (Population 2010, 9,535,483) SENATORS RICHARD BURR, Republican, of Winston-Salem, NC; born in Charlottesville, VA, November 30, 1955; education: R.J. Reynolds High School, Winston-Salem, NC, 1974; B.A., communications, Wake Forest University, Winston-Salem, NC, 1978; professional: sales man- ager, Carswell Distributing; member: Reynolds Rotary Club; board member, Brenner Children’s Hospital; public service: U.S. House of Representatives, 1995–2005; served as vice-chairman of the Energy and Commerce Committee; married: Brooke Fauth, 1984; children: two sons; committees: ranking member, Veterans’ Affairs; Finance; Health, Education, Labor, and Pen- sions; Select Committee on Intelligence; elected to the U.S. Senate on November 2, 2004; re- elected to the U.S. Senate on November 2, 2010. Office Listings http://burr.senate.gov 217 Russell Senate Office Building, Washington, DC 20510 .................................... (202) 224–3154 Chief of Staff.—Chris Joyner. FAX: 228–2981 Legislative Director.—Natasha Hickman. 2000 West First Street, Suite 508, Winston-Salem, NC 27104 .................................. (336) 631–5125 State Director.—Dean Myers. 100 Coast Line Street, Room 210, Rocky Mount, NC 27804 .................................... (252) 977–9522 201 North Front Street, Suite 809, Wilmington, NC 28401 ....................................... (910) 251–1058 *** KAY R. HAGAN, Democrat, of Greensboro, NC; born in Shelby, NC, May 26, 1953; edu- cation: B.A., Florida State University, 1975; J.D., Wake Forest University School of Law, 1978; professional: attorney and vice president of the Estate and Trust Division, NCNB, 1978–88; public service: North Carolina State Senator, 1999–2009; religion: Presbyterian; married: Chip Hagan; children: two daughters, one son; committees: Armed Services; Banking, Housing, and Urban Affairs; Health, Education, Labor, and Pensions; Small Business and Entrepreneurship; elected to the U.S. -

2016 Lilly Report of Political Financial Support

16 2016 Lilly Report of Political Financial Support 1 16 2016 Lilly Report of Political Financial Support Lilly employees are dedicated to innovation and the discovery of medicines to help people live longer, healthier and more active lives, and more importantly, doing their work with integrity. LillyPAC was established to work to ensure that this vision is also shared by lawmakers, who make policy decisions that impact our company and the patients we serve. In a new political environment where policies can change with a “tweet,” we must be even more vigilant about supporting those who believe in our story, and our PAC is an effective way to support those who share our views. We also want to ensure that you know the story of LillyPAC. Transparency is an important element of our integrity promise, and so we are pleased to share this 2016 LillyPAC annual report with you. LillyPAC raised $949,267 through the generous, voluntary contributions of 3,682 Lilly employees in 2016. Those contributions allowed LillyPAC to invest in 187 federal candidates and more than 500 state candidates who understand the importance of what we do. You will find a full financial accounting in the following pages, as well as complete lists of candidates and political committees that received LillyPAC support and the permissible corporate contributions made by the company. In addition, this report is a helpful guide to understanding how our PAC operates and makes its contribution decisions. On behalf of the LillyPAC Governing Board, I want to thank everyone who has made the decision to support this vital program. -

Legislative Update Presented By: David Barnes, Electricities of N.C

Legislative Update Presented by: David Barnes, ElectriCities of N.C. Drew Elliot, ElectriCities of N.C. Federal Legislative Update Key players and key issues An Influential Delegation • Democrats • David Price: Chair, Transportation Appropriations Subcommittee • G.K. Butterfield: House Energy and Commerce Committee • Republicans • Richard Burr: Chair, Senate Intelligence Committee • Patrick McHenry: Republican Leader, House Financial Services Committee • Mark Walker: Founder, Republican Study Committee • Virginia Foxx: Republican Leader, House Education and Labor Committee • Mark Meadows: Chair, House Freedom Caucus • Richard Hudson: House Energy and Commerce Committee • David Rouzer, House Transportation and Infrastructure Committee • George Holding: House Ways and Means Committee Special Elections • US House District 3 (Jones seat) • State Rep. Dr. Greg Murphy won July 9 runoff • General election pits Murphy against Democrat Allen Thomas on September 10 • Winner will be seated in Congress immediately to serve 3 until Jan. 2021 • US House District 9 (Pittenger seat) • “Battle of the Dans” • Entrepreneur and retired Marine officer Dan McCready is the Democratic candidate 9 • State Sen. Dan Bishop, a lawyer, is the GOP candidate • General election will occur on September 10 • Winner will be seated in Congress immediately to serve until Jan. 2021 Energy Policy Senate Approach • Senate floor time and political messaging • Green New Deal vote • Murkowski (R-AK) continues to press energy legislation House Approach • Leadership agenda and climate -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 114 CONGRESS, FIRST SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 114 CONGRESS, FIRST SESSION Vol. 161 WASHINGTON, WEDNESDAY, OCTOBER 7, 2015 No. 147 House of Representatives The House met at 10 a.m. and was One from the Fiscal Times, Sep- The little girls beside me, Mr. Speak- called to order by the Speaker pro tem- tember 23, ‘‘U.S. Wasted Billions of er, Eden and Stephanie Balduf, their pore (Mr. STEWART). Dollars Rebuilding Afghanistan.’’ daddy was training Afghanistan citi- The second headline from the New f zens to be policemen, and they were York Times, October 1, ‘‘Afghan Forces shot and killed by the man they were DESIGNATION OF SPEAKER PRO on the Run.’’ training. Poor little girls represent so TEMPORE The third headline, ‘‘U.S. Soldiers many families whose loved ones have The SPEAKER pro tempore laid be- Told to Ignore Sexual Abuse of Boys by died in Afghanistan for nothing but a fore the House the following commu- Afghan Military Leaders.’’ waste. I am so outraged about the third nication from the Speaker: With that, Mr. Speaker, I ask God to headline story that I am demanding please bless our men and women in uni- WASHINGTON, DC. answers on the Pentagon’s policy of October 7, 2015. form, please bless America, and, God, permitting Afghan men to rape young I hereby appoint the Honorable CHRIS please wake up the Congress before it boys on U.S. military bases. I have STEWART to act as Speaker pro tempore on is too late on Afghanistan. -

2020 Election Recap

2020 Election Recap Below NACCHO summarizes election results and changes expected for 2021. Democrats will continue to lead the House of Representatives…but with a smaller majority. This means that many of the key committees for public health will continue to be chaired by the same members, with notable exceptions of the Appropriations Committee, where Chair Nita Lowey (D-NY) did not run for reelection; the Agriculture Committee, which has some jurisdiction around food safety and nutrition, whose Chair, Colin Peterson (D-MN) lost, as well as the Ranking Member for the Energy and Commerce Committee, Rep. Greg Walden, (R-OR) who did not run for reelection. After the 117th Congress convenes in January, internal leadership elections will determine who heads these and other committees. The following new Representatives and Senators are confirmed as of January 7. House of Representatives Note: All House of Representative seats were up for re-election. We list only those where a new member will be coming to Congress below. AL-1: Republican Jerry Carl beat Democrat James Averhart (open seat) Carl has served a member of the Mobile County Commission since 2012. He lists veterans’ health care and border security as policy priorities. Rep. Bradley Byrne (R-AL) vacated the seat to run for Senate. AL-2: Republican Barry Moore beat Democrat Phyllis Harvey-Hall (open seat) Moore served in the Alabama House of Representatives from 2010 to 2018. The seat was vacated by Rep. Martha Roby (R-AL) who retired. CA-8 Republican Jay Obernolte beat Democrat Christine Bubser (open seat) Jay Obsernolte served in the California State Assembly since 2014. -

GUIDE to the 117Th CONGRESS

GUIDE TO THE 117th CONGRESS Table of Contents Health Professionals Serving in the 117th Congress ................................................................ 2 Congressional Schedule ......................................................................................................... 3 Office of Personnel Management (OPM) 2021 Federal Holidays ............................................. 4 Senate Balance of Power ....................................................................................................... 5 Senate Leadership ................................................................................................................. 6 Senate Committee Leadership ............................................................................................... 7 Senate Health-Related Committee Rosters ............................................................................. 8 House Balance of Power ...................................................................................................... 11 House Committee Leadership .............................................................................................. 12 House Leadership ................................................................................................................ 13 House Health-Related Committee Rosters ............................................................................ 14 Caucus Leadership and Membership .................................................................................... 18 New Members of the 117th -

1 in the Shadow of Trump: How the 2016 Presidential Contest Affected

In the Shadow of Trump: How the 2016 Presidential Contest Affected House and Senate Primaries Prepared for the 2017 State of the Parties Conference, Akron, Ohio Robert G. Boatright, Clark University [email protected] The presidential race did not quite monopolize all of the uncivil or bizarre moments of the summer of 2016. One of the more interesting exchanges took place in Arizona in August of 2016, during the weeks before the state’s Senate primary election. Senator John McCain, always a somewhat unpredictable politician, has had difficulties in his last two primaries. Perhaps because he was perceived as having strayed too far toward the political center, or perhaps simply because his presidential bid had created some distance between McCain and Arizonans, he faced a vigorous challenge in 2010 from conservative talk show host and former Congressman J. D. Hayworth. McCain ultimately beat back Hayworth’s challenge, 56 percent to 32 percent, but only after a bitter campaign in which McCain spent a total of over $21 million and abandoned much of his “maverick” positioning and presented himself as a staunch conservative and a fierce opponent of illegal immigration (Steinhauer 2010). His task was made easier by his ability to attack Hayworth’s own checkered career in Congress. In 2016, McCain again faced a competitive primary opponent, physician, Tea Party activist, and two-term State Senator Kelli Ward. Ward, like Hayworth, argued that McCain was not conservative enough for Arizona. Ward was (and is), however, a decade younger than Hayworth, and her shorter tenure in political office made it harder for McCain to attack her. -

GUIDE to the 116Th CONGRESS

th GUIDE TO THE 116 CONGRESS - SECOND SESSION Table of Contents Click on the below links to jump directly to the page • Health Professionals in the 116th Congress……….1 • 2020 Congressional Calendar.……………………..……2 • 2020 OPM Federal Holidays………………………..……3 • U.S. Senate.……….…….…….…………………………..…...3 o Leadership…...……..…………………….………..4 o Committee Leadership….…..……….………..5 o Committee Rosters……….………………..……6 • U.S. House..……….…….…….…………………………...…...8 o Leadership…...……………………….……………..9 o Committee Leadership……………..….…….10 o Committee Rosters…………..…..……..…….11 • Freshman Member Biographies……….…………..…16 o Senate………………………………..…………..….16 o House……………………………..………..………..18 Prepared by Hart Health Strategies Inc. www.hhs.com, updated 7/17/20 Health Professionals Serving in the 116th Congress The number of healthcare professionals serving in Congress increased for the 116th Congress. Below is a list of Members of Congress and their area of health care. Member of Congress Profession UNITED STATES SENATE Sen. John Barrasso, MD (R-WY) Orthopaedic Surgeon Sen. John Boozman, OD (R-AR) Optometrist Sen. Bill Cassidy, MD (R-LA) Gastroenterologist/Heptalogist Sen. Rand Paul, MD (R-KY) Ophthalmologist HOUSE OF REPRESENTATIVES Rep. Ralph Abraham, MD (R-LA-05)† Family Physician/Veterinarian Rep. Brian Babin, DDS (R-TX-36) Dentist Rep. Karen Bass, PA, MSW (D-CA-37) Nurse/Physician Assistant Rep. Ami Bera, MD (D-CA-07) Internal Medicine Physician Rep. Larry Bucshon, MD (R-IN-08) Cardiothoracic Surgeon Rep. Michael Burgess, MD (R-TX-26) Obstetrician Rep. Buddy Carter, BSPharm (R-GA-01) Pharmacist Rep. Scott DesJarlais, MD (R-TN-04) General Medicine Rep. Neal Dunn, MD (R-FL-02) Urologist Rep. Drew Ferguson, IV, DMD, PC (R-GA-03) Dentist Rep. Paul Gosar, DDS (R-AZ-04) Dentist Rep. -

1 Redistricting and Congressional Control Following the 2012 Election

Redistricting and Congressional Control Following the 2012 Election By Sundeep Iyer On Election Day, Republicans maintained control of the House of Representatives. While two Congressional races remain undecided as of November 20, it appears that Democrats may have picked up about eight seats during the 2012 election,1 falling well short of the 25 seats Democrats needed to take back control of the House. Before the election, the Brennan Center estimated that redistricting would allow Republicans to maintain long-term control of 11 more seats in the House than they would have under the previous district lines.2 Now that the election is complete, it is worth re-examining the influence of redistricting on the results of the 2012 election. This brief assesses how the new district lines affected the partisan balance of power in the House. The report is the prologue to more extensive analyses, which will examine other aspects of redistricting, including the fairness of the process and its effect on minority representation, among others. Based on our initial analysis of the 2012 election, several important trends emerge: • Redistricting may have changed which party won the election in at least 25 House districts. Because of redistricting, it is likely that the GOP won about six more seats overall in 2012 than they would have under the old district lines. • Where Republicans controlled redistricting, the GOP likely won 11 more seats than they would have under the old district lines, including five seats previously held by Democrats. Democrats also used redistricting to their advantage, but Republicans redrew the lines for four times as many districts as Democrats.