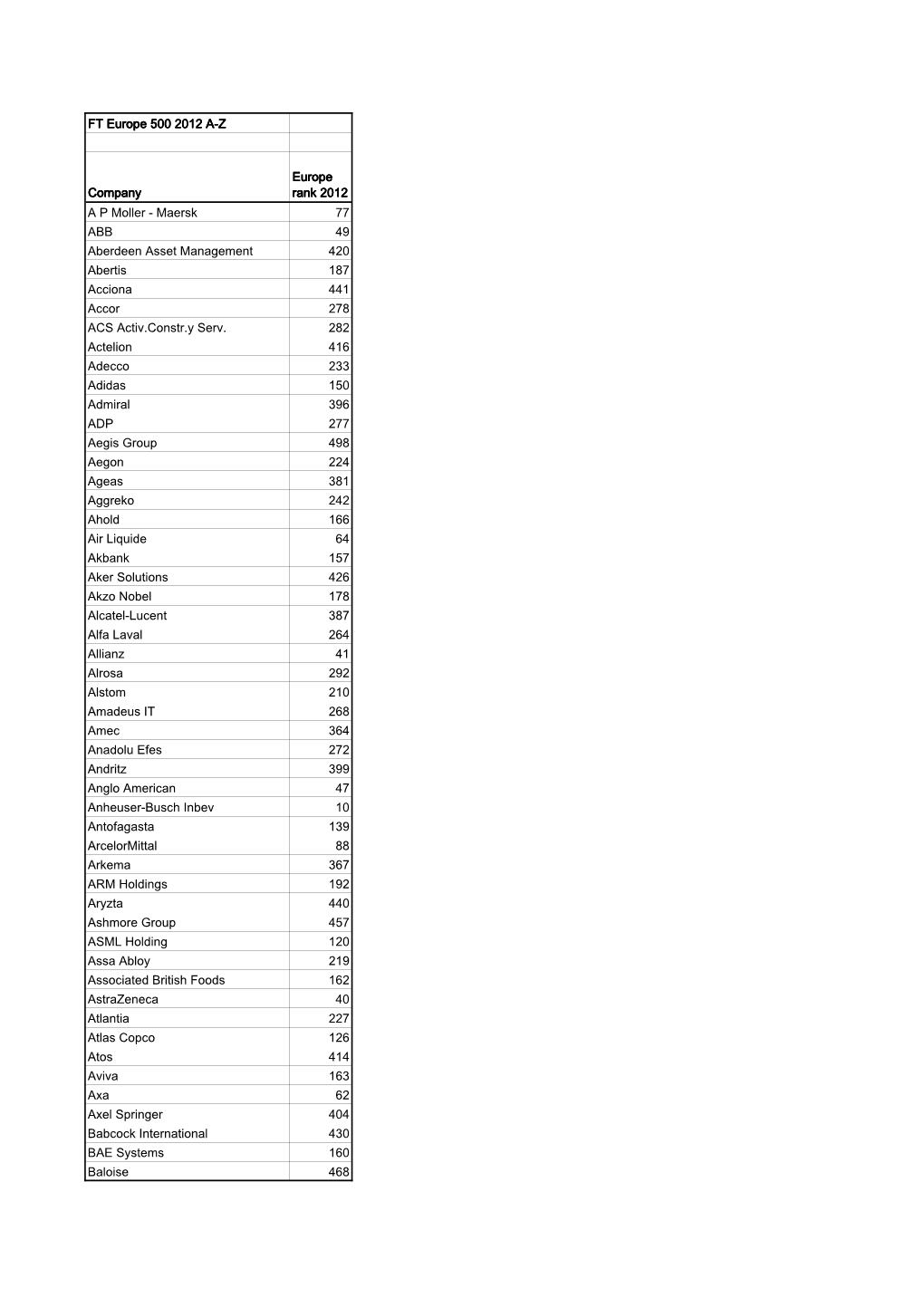

Europe 500 2012 A-Z

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

FCF Valuation Monitor German Small- / Midcap Companies – Q2 2020 AGENDA Executive Summary I

FCF Valuation Monitor German Small- / Midcap Companies – Q2 2020 AGENDA Executive Summary I. FCF Overview II. Market Overview III. Sector Overview IV. Sector Analysis A p p e n d i x Executive Summary The FCF Valuation FCF Valuation Monitor Recipients Monitor is a standardized report is a comprehensive valuation analysis for the German small / midcap The FCF Valuation Monitor targets the following recipients: on valuations in the market segment and is published by FCF on a quarterly basis German small / ■ Institutional investors ■ Family Offices / High Net- midcap segment and ■ Private equity investors Worth Individuals is a quick reference ■ Venture capital investors ■ Corporates Selection of Companies for investors, ■ Advisors corporates and professionals The selection of companies is primarily based on the regulated market of the Deutsche Börse: Data ■ Large cap DAX 30 companies are excluded All input data is provided by S&P Capital IQ and is not independently More advanced, verified by FCF. Ratio and multiple calculations are driven based on ■ Certain sectors which are dominated by large cap companies detailed and / or the input data available. For additional information and disclaimer, or which are of limited relevance for a small / midcap analysis please refer to the last page customized reports have been excluded (e.g. financials, utilities, automotive are available upon manufacturers and specialty sectors such as biotech and request healthcare services / hospitals) Availability ■ The allocation of companies into a specific sector -

FACTSHEET - AS of 28-Sep-2021 Solactive Mittelstand & Midcap Deutschland Index (TRN)

FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) DESCRIPTION The Index reflects the net total return performance of 70 medium/smaller capitalisation companies incorporated in Germany. Weights are based on free float market capitalisation and are increased if significant holdings in a company can be attributed to currentmgmtor company founders. HISTORICAL PERFORMANCE 350 300 250 200 150 100 50 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive Mittelstand & MidCap Deutschland Index (TRN) CHARACTERISTICS ISIN / WKN DE000SLA1MN9 / SLA1MN Base Value / Base Date 100 Points / 19.09.2008 Bloomberg / Reuters MTTLSTRN Index / .MTTLSTRN Last Price 342.52 Index Calculator Solactive AG Dividends Included (Performance Index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 19.09.2008 Index Members 70 FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.69% 3.12% 7.26% 27.72% 12.73% 242.52% Performance (p.a.) - - - - - 9.91% Volatility (p.a.) 13.05% 12.12% 12.48% 13.60% 12.90% 21.43% High 357.49 357.49 357.49 357.49 357.49 357.49 Low 342.52 329.86 315.93 251.01 305.77 52.12 Sharpe Ratio -2.77 1.14 1.27 2.11 1.40 0.49 Max. Drawdown -4.19% -4.19% -4.19% -9.62% -5.56% -47.88% VaR 95 \ 99 -21.5% \ -35.8% -34.5% \ -64.0% CVaR 95 \ 99 -31.5% \ -46.8% -53.5% \ -89.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

MFS® Research International Fund (Class R6 Shares) Second Quarter 2021 Investment Report

MFS® Research International Fund (Class R6 Shares) Second quarter 2021 investment report NOT FDIC INSURED MAY LOSE VALUE NOT A DEPOSIT Before investing, consider the fund's investment objectives, risks, charges, and expenses. For a prospectus, or summary prospectus, containing this and other information, contact MFS or view online at mfs.com. Please read it carefully. ©2021 MFS Fund Distributors, Inc., 111 Huntington Avenue, Boston, MA 02199. FOR DEALER AND INSTITUTIONAL USE ONLY. Not to be shown, quoted, or distributed to the public. PRPEQ-RIF-30-Jun-21 34135 Table of Contents Contents Page Fund Risks 1 Disciplined Investment Approach 2 Market Overview 3 Executive Summary 4 Performance 5 Attribution 6 Significant Transactions 10 Portfolio Positioning 11 Characteristics 13 Portfolio Outlook 14 Portfolio Holdings 18 Additional Disclosures 21 Country and region information contained in this report is based upon MFS classification methodology which may differ from the methodology used by individual benchmark providers. Performance and attribution results are for the fund or share class depicted and do not reflect the impact of your contributions and withdrawals. Your personal performance results may differ. Portfolio characteristics are based on equivalent exposure, which measures how a portfolio's value would change due to price changes in an asset held either directly or, in the case of a derivative contract, indirectly. The market value of the holding may differ. 0 FOR DEALER AND INSTITUTIONAL USE ONLY. - MFS Research International Fund PRPEQ-RIF-30-Jun-21 Fund Risks The fund may not achieve its objective and/or you could lose money on your investment in the fund. -

Europe 500 2011 A-Z

FT Europe 500 2011 A-Z FT Europe 500 2011 A-Z Europe Company rank 2011 3i group 473 A P Moller - Maersk 73 A2A 445 ABB 50 Abertis 176 Acciona 355 Accor 253 Acerinox 453 ACS Activ.Constr.y Serv. 189 Actelion 330 Adecco 220 Adidas 211 Admiral 363 ADP 281 Aegon 197 Ageas 350 Aggreko 353 Ahold 177 Air France-KLM 448 Air Liquide 77 Aixtron 492 Akbank 142 Aker Solutions 377 Akzo Nobel 178 Alcatel-Lucent 208 Alfa Laval 280 Allianz 39 Alstom 163 Amadeus IT 295 Amec 376 Anadolu Efes 375 Andritz 459 Anglo American 36 Anheuser-Busch Inbev 19 Antofagasta 126 ArcelorMittal 48 Arkema 410 ARM Holdings 223 Aslan Cimento 327 ASML Holding 146 Assa Abloy 261 Associated British Foods 219 AstraZeneca 40 Atlantia 202 Atlas Copco 90 Autonomy 381 Aviva 140 Axa 61 Axel Springer 425 Page 1 of 10 FT Europe 500 2011 A-Z Europe Company rank 2011 BAE Systems 157 Baloise 450 Baltika Breweries 347 Banca Monte Dei Paschi 354 Banco de Sabadell 384 Banco Espirito Santo 461 Banco Popolare 433 Banco Popular Espanol 309 Banco Santander 15 Bank Zachodni WBK 398 Banque Cantonale Vaudoise 456 Barclays 53 Basf 27 Bashneft 232 Bayer 38 BBVA 52 Beiersdorf 183 Bekaert 357 Belgacom 213 BG Group 24 BHP Billiton 23 Bic 499 BIM Birlesik Magazalar 442 BMW 54 BNP Paribas 21 Boliden 392 Bollore 403 Boskalis Westminster 424 Boss (Hugo) 408 Bouygues 160 BP 8 BRE Bank 444 Brenntag 404 British American Tobacco 26 British Land 316 British Sky Broadcasting 120 BT Group 122 Bulgari 434 Burberry 307 Bureau Veritas 293 Cairn Energy 250 Cap Gemini 283 Capita Group 340 Capital Shopping Centres 430 -

FTSE Publications

2 FTSE Russell Publications FTSE EDHEC-Risk Efficient 19 August 2021 Eurozone Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.12 GERMANY Continental 0.79 GERMANY Henkel KG Pref 0.21 GERMANY A2A 0.25 ITALY Covestro AG 0.22 GERMANY Henkel Kgaa ORD 0.1 GERMANY Aalberts NV 0.31 NETHERLANDS Covivio 0.24 FRANCE Hera 0.19 ITALY ABN AMRO Bank NV 0.45 NETHERLANDS Credit Agricole 0.18 FRANCE Hermes International S.C.A. 0.86 FRANCE Acciona S.A. 0.33 SPAIN Cts Eventim 0.22 GERMANY Hochtief 0.15 GERMANY Accor 0.15 FRANCE Daimler AG 0.17 GERMANY Huhtamaki 0.2 FINLAND Ackermans & Van Haaren 0.66 BELGIUM Danone 0.64 FRANCE Iberdrola 0.1 SPAIN ACS Actividades Cons y Serv 0.13 SPAIN Dassault Aviation S.A. 0.14 FRANCE Icade 0.42 FRANCE Adidas 0.11 GERMANY Dassault Systemes 0.15 FRANCE Iliad 0.39 FRANCE Adyen 0.46 NETHERLANDS Delivery Hero SE 0.35 GERMANY IMCD NV 0.23 NETHERLANDS Aegon NV 0.18 NETHERLANDS Deutsche Bank 0.16 GERMANY Imerys 0.24 FRANCE Aena SME SA 0.23 SPAIN Deutsche Boerse 0.25 GERMANY Inditex 0.14 SPAIN Aeroports de Paris 0.28 FRANCE Deutsche Lufthansa AG 0.53 GERMANY Infineon Technologies AG 0.36 GERMANY Ageas 0.43 BELGIUM Deutsche Post 0.14 GERMANY ING Group CVA 0.18 NETHERLANDS Ahold Delhaize 0.36 NETHERLANDS Deutsche Telekom 0.12 GERMANY Inmobiliaria Colonial S.A. -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

GEA Group Aktiengesellschaft Annual Report 2008 GEA Group: Key IFRS fi Gures

GEA Group Aktiengesellschaft Annual Report 2008 GEA Group: Key IFRS fi gures Change (EUR million) 2008 2007 (%) Results of operations Order intake Energy and Farm Technology 1 1,645.6 1,991.2 -17.4 Order intake Process Technology 3,346.6 3,432.1 -2.5 Order intake GEA Group 1 4,983.9 5,417.0 -8.0 Revenue Energy and Farm Technology 1,818.6 1,648.3 10.3 Revenue Process Technology 3,338.1 3,159.0 5.7 Revenue GEA Group 5,179.0 4,856.0 6.7 Order backlog 2,450.7 2,698.7 -9.2 EBITDA 585.9 480.7 21.9 EBIT Energy and Farm Technology 165.5 139.8 18.4 EBIT Process Technology 369.7 301.7 22.5 EBIT core segments 535.2 441.5 21.2 in percent of revenue 10.4 9.2 - EBIT GEA Group 504.2 401.1 25.7 in percent of revenue 9.7 8.3 - Earnings before tax 458.8 351.6 30.5 Net income/loss on continued operations 349.0 237.2 47.1 Net income/loss on discontinued operations -248.0 46.3 - Net income/loss 101.0 283.5 -64.4 Net assets Total assets 5,128.3 4,748.0 8.0 Equity 1,455.4 1,413.7 3.0 in percent of total assets 28.4 29.8 - Working Capital (balance sheet date) 2 790.4 625.2 26.4 Net position 3/4 -60.2 61.3 - Gearing (percent) 3/5 4.1 -4.3 - Financial position Cash fl ow from operating activities 388.9 181.1 114.8 Cash fl ow from operating activities (adjusted) 6 373.6 273.2 36.8 1) Including large order contracts from South Africa totalling approximately EUR 340 million in 2007 7 Investment (balance sheet date) 2,884.5 2,559.1 12.7 2) Working capital = inventories + trade receivables - trade liabilities - prepayments received ROCE (percent) 8 17.5 15.7 - 3) Including -

Dienstwagen Börsennotierter Und Mittelständischer Unternehmen 2015 10-12 Punkte 4-9 Punkte 0-3 Punkte Bewertungskriterien Zur Punktevergabe Siehe Seite 6

– 1/6 – Grüne Karte: Gelbe Karte: Rote Karte: Dienstwagen börsennotierter und mittelständischer Unternehmen 2015 10-12 Punkte 4-9 Punkte 0-3 Punkte Bewertungskriterien zur Punktevergabe siehe Seite 6 Unternehmen Name Fahrzeug Ø CO2-Ausstoß Ø CO2-Ausstoß Ø CO2-Ausstoß Punkte Gesamt- Bewer- Vorsitzender Vorstand / Vorsitzender Vorstand / Fahrzeug Vorstands- Unternehmens- Mobilitäts- punkt- tung Vorsitzender flotte flotte strategie Geschäftsführung Geschäftsführung zahl [g/km] [g/km] [g/km] Tengelmann Warenhandels- Karl-Erivan W. Haub Tesla Model S Performance (Elektro) 1031) 99 124 4 12 gesellschaft KG Audi A6 Avant 3.0 TDI clean diesel quattro Allianz Deutschland AG Dr. Manfred Knof 138 112 117 4 11 (Diesel) Coca-Cola Deutschland GmbH Bianca Bourbon Mercedes Benz E300 BlueTEC Hybrid (Diesel) 119 124 120 3 11 FRoSTA AG Felix Ahlers VW up! 1.0 BMT (Benzin) 98 135 124 4 11 IKEA Deutschland GmbH & Co. KG Peter Betzel VW Passat 2,0 TDI BlueMotion (Diesel) 119 119 113 3 11 Tchibo GmbH Dr. Markus Conrad BMW i3 Range Extender (Benzin/Elektro) 902) 146 118 4 11 Deutsche Telekom AG Timotheus Höttges Mercedes Benz S350 BlueTEC 4MATIC (Diesel) 156 140 117 4 10 Drägerwerk AG & Co. KGaA Stefan Dräger Tesla Model S Performance (Elektro) 1031) 79 115 2 10 DuPont de Nemours (Deutschland) Christian Beers Mercedes Benz E300 BlueTEC Hybrid (Diesel) 116 123 127 2 10 GmbH Kaiser’s Tengelmann GmbH Raimund Luig Audi A6 Avant 3.0 TDI (Diesel) 156 148 118 4 10 Mercedes Benz E300 BlueTEC Hybrid Kombi Pfeiffer Vacuum GmbH Manfred Bender 116 133 119 3 10 (Diesel) Mercedes Benz CLS Shooting Brake 350 CDI SMA Solar Technology AG Pierre-Pascal Urbon 159 117 128 4 10 (Diesel) 1) 2) CO2-Ausstoß des Tesla Model S: Stromverbrauch von 18,1 kWh/100km (103g CO2/km) unter Berücksichtigung der spezifischen CO2-Emissionen des deutschen Strommix 2014 von 569 g/kWh (Quelle: Umweltbundesamt). -

Eurex Clearing Circular 129/15

eurex clearing circular 129/15 Date: 4 November 2015 Recipients: All Clearing Members of Eurex Clearing AG and Vendors Authorized by: Thomas Laux Action required High priority Composition of GC Pooling® Equity Basket and acceptance of equity collaterals for margining by Eurex Clearing Related Eurex Clearing circular: 114/15 Contact: Risk Control, T +49-69-211-1 24 52, F +49-69-211-1 84 40, [email protected] Content may be most important for: Attachment: Overview of composition of GC Pooling® Equity Basket Ü Middle + Backoffice and acceptance of equity collaterals for margining by Ü Auditing/Security Coordination Eurex Clearing, effective 16 November 2015 Please find attached the list of admitted equities for collateralization of trades in the GC Pooling® Equity Basket, effective 16 November 2015. At the same time, these equities will be admitted as collaterals for margining by Eurex Clearing. Additionally, all equities which are part of the DAX®, EURO STOXX 50® or SMI® remain eligible as collaterals. The attachment contains an overview of admissible equity collaterals and the concentration limit per ISIN for trades in the GC Pooling® Equity Basket. Eurex Clearing AG T +49-69-211-1 24 52 Chairman of the Executive Board: Aktiengesellschaft mit Mergenthalerallee 61 F +49-69-211-1 84 40 Supervisory Board: Thomas Book (CEO), Sitz in Frankfurt/Main 65760 Eschborn [email protected] Hugo Bänziger Heike Eckert, Matthias Graulich HRB Nr. 44828 Mailing address: Internet: Thomas Laux, Erik Tim Müller USt-IdNr. 60485 Frankfurt/Main www.eurexclearing.com DE194821553 Germany Amtsgericht Anhang zu/Attachment to Eurex Clearing circular 129/15 ISIN Instrument Name Nbr Of Eligible Shares DE000A1EWWW0 ADIDAS AG NA O.N.