Written Submissions Received for the London Assembly's Housing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Housing Association Residents Extend Rent and Service Charge Strikes Date: 1St June 2021

Release: Immediate Release Subject: Housing Association Residents Extend Rent and Service Charge Strikes Date: 1st June 2021 A group of tenants and residents are to begin a coordinated rent and service charge strike from Thursday 1st July 2021 in protest over various landlords’ failings, and because of the extreme barriers they have faced when trying to engage their landlords to resolve their issues. Within a week of launching the support group, membership had grown to fifty. Complaints from the group range from incorrect service charge statements, insufficient information about the service charges, disrepairs relating to their homes or estates, and failures to make reasonable adjustments for those with disabilities. The tenants and residents within the coordinating group all reside in housing association properties. Attempts to address the issues directly with their landlords, and in some cases through other routes have been futile. One member of the group commented: “I am in despair as to how to stop these atrocious companies any other way. We’ve experienced diabolical rip-offs, incompetence and lies. They have damaged our lives for years and years. Many thousands of tenants across the sector experience endless failed attempts to get their problem sorted out. We are ground down. “I honestly can't see how anything other than withholding money is going to stop them. Even when the Social Housing White Paper is made law, I don’t believe that there is any other way to hold these massive, powerful corporations to account” Councillors and members of Parliament complain that they experience the same difficulties as tenants and residents when trying to engage with the associations, or are misled about the work done to address issues. -

Summary of Responses Received from English Housing Associations

SORP responses –June 2014 English housing associations Summary of responses received from English housing associations Organisation Name Accent Group Ltd Look Ahead Care and Support Adactus Housing Group Limited Magenta Living Affinity Sutton Magna Housing Group Alliance Homes Moat Homes Limited Alpha (RSL) Limited Network Housing Group Ltd Arcon Housing Association North Devon Homes Arhag Houssing Association Notting Hill Housing Trust Asra Housing Group One Housing Group Bracknell Forest Homes Orbit Group Bromford Group Origin Housing Limited Byker Community Trust Limited Orwell Housing Association Limited Central & Cecil Housing Trust Paradigm Housing Association Ltd CHS Group Plymouth Community Homes Circle Housing Progress Housing Group City West Housing Trust Radian Housing Coastline Housing Ltd Rooftop Housing Group Limited DCH Sadeh Lok Housing Group Derby Homes Ltd SAFFRON HOUSING TRUST LTD East Thames Group Selwood Housing Eastlands Homes Partnership Limited Sentinel Housing Association Limited EMH Group Ltd shropshire housing group First Wessex Shropshire Rural Housing Association Four Housing Southern Housing Group Freebridge Community Housing Sovereign Housing Association Gateway Housing Association Spectrum Housing Group Gentoo Group Staffordshire Housing Group Great Places Housing Group SYHA Ltd GREENSQUARE GROUP LTD Thames Valley Housing Halton Housing Trust The Guinness Partnership Hanover Housing Association The Hyde Group Harrogate Families Housing Association Town & Country Housing Group Helena Partnerships Ltd Trafford -

Landlords Moving Onto the UC Landlord Portal and Becoming Trusted Partners in 2017

Registered Social Landlords moving onto the UC Landlord Portal and becoming Trusted Partners in 2017 Landlord A2Dominion Homes Limited Accent Foundation Limited Adactus Housing Association Limited Affinity Sutton Homes Limited Aldwyck Housing Group Limited Angus Council Aster Communities B3 Living Limited Basildon District Council Bassetlaw District Council Birmingham City Council Boston Mayflower Limited bpha Limited Bracknell Forest Homes Limited Broadacres Housing Association Limited Bromford Housing Association Limited Catalyst Housing Limited Chesterfield Borough Council Circle Thirty Three Housing Trust Limited Coast and Country Housing Limited Coastline Housing Limited Community Gateway Association Limited Contour Homes Limited Cornwall Council Cottsway Housing Association Limited Cross Keys Homes Limited Curo Places Limited Devon and Cornwall Housing Limited Dudley Metropolitan Borough Council Dundee City Council East Durham Homes Limited East Thames EMH Homes (East Midlands Housing and Regeneration Limited) Family Mosaic Housing Festival Housing Limited Fife Council First Choice Homes Flagship Housing Group Limited Futures Homescape Limited Genesis Housing Association Limited Great Places Housing Association Greenfields Community Housing Gwalia Housing Group Hanover Housing Association Heart Of England Housing Association Helena Partnerships Limited Highland Council Home Group Limited Housing Solutions Limited Hyde Housing Association Limited Karbon Homes Limited Kirklees Metropolitan Borough Council Knightstone Housing Association -

Our List of Registered Providers and Local Authorities

Nationwide public sector eligibility list The public sector bodies to whom the use of this framework agreement is open, include without limitation: 1. Central government departments & their executive agencies: a list of such departments and executive agencies can be found at http://www.cabinetoffice.gov.uk/government-business/government-ministers- responsibilities.aspx 2. Non-departmental public bodies (NDPBs): a list of NDPBs can be found at annex A to the Public Bodies Directory 2007 published by the Cabinet Office) which can be found at https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/506070/An nex_-_Public_Bodies_Reform_Programme_Update_16_Dec_2015.pdf 3. All Local Authorities, (as defined in Regulation 3(2) to 3(5) inclusive of the Utilities Contracts Regulations 2006 (as amended by the Public Contracts Regulations 2015)) and all and any subsidiaries and joint-venture vehicles of those local authorities, including, but not limited to, all listed on this website: https://www.lgbce.org.uk/records- and-resources/local-authorities-in-england 4. All National Health Service (NHS) bodies, including, but not limited to, NHS Trusts as defined in the Regulation 2 of the Public Contract Regulations 2015 which, in turn, includes: 4.1. Acute trusts; 4.2. Trusts operating community hospitals and the provider functions of primary care trusts; 4.3. Primary care trusts; 4.4. Care trusts; 4.5. Care trusts plus; 4.6. Ambulance trusts; 4.7. Mental health trusts; 4.8. Strategic health authorities; 4.9. Special health authorities; 4.10. Community health councils; 4.11. Local health boards; 4.12. NHS foundation trusts; 4.13. -

Organization A2dominion Housing Group Ltd Aberdeen Standard

Social Housing Annual Conference Thursday 9th November 200 Aldersgate, London EC1A 4HD. Sample delegate list (1 November 2017) T: +44 (0)207 772 8337 E: [email protected] Organization Job Title A2Dominion Housing Group Ltd Group Chief Exec Aberdeen Standard Investments Sales Director - Liquidity Solutions Aberdeen Standard Investments Institutional Business Development Manager Aberdeen Standard Investments Investment director, credit Accent Group Chief Executive Accent Group Executive Director of Finance & Corporate Services Al Bawardi Critchlow Managing Partner Aldwyck Housing Group Group Director of Finance Aldwyck Housing Group Group Chief Executive Aldwyck Housing Group Group chief executive Allen & Overy LLP Senior Associate Allen & Overy LLP Associate Allen & Overy LLP Consultant Altair Partner Altair Director Altair Director Altair Consultant Anchor Trust Financial Director Anthony Collins Solicitors LLP Partner Anthony Collins Solicitors LLP Partner Arawak Walton Housing Association Finance Director Arawak Walton Housing Association Deputy CEO and Executive Director, Resources ARK Consultancy Senior Consultant Assured Guaranty Director Aster Group Group chief executive Baily Garner LLP Partner Barclays Head of Social Housing, Barclays Barclays Relationship Director, Barclays Barclays Director, Barclays Barclays Director, Barclays PLC Bartra Capital Property CEO Black Country Housing Group Board Member BOARD Sector Lead – Commercial Property and Construction BOARD Business Development Manager Bond Woodhouse Managing -

On Site Units Recorded Between Jan-18 and Feb

Start on Site units recorded between Jan-18 and Feb-18 wth 10 or more units Reference: FOI MGLA 130618-4761 Notes: [1] Figures are provisional pending the publication of the GLA official statistics in August 2018. [2] Supported housing schemes have been redacted from the list Project title borough Lead_Organisation_Name dev_org_name planning_permission_ref SoS approval Total start Social Rent Other London Shared Other TBC erence date on sites (and LAR at Affordable Living Rent Ownership Intermedia benchmark Rent te s) Redacted Lewisham One Housing Group Limited One Housing Group Limited 30/01/2018 34 0 34 0 0 0 0 Redacted Lewisham One Housing Group Limited One Housing Group Limited 30/01/2018 19 0 0 0 19 0 0 Redacted Lambeth Network Housing Group Limited Network Housing Group Limited 05/01/2018 40 0 40 0 0 0 0 Redacted Tower Hamlets Islington and Shoreditch Housing Association Limited Islington and Shoreditch Housing Association Limited 02/01/2018 35 0 35 0 0 0 0 Chobham Manor, Newham Newham London & Quadrant Housing (L&Q) 24/01/2018 163 0 75 0 88 0 0 County House - LLR Bromley Hyde Housing Association Limited 29/01/2018 76 0 0 76 0 0 0 Doncaster Drive Ealing London Borough of Ealing 31/01/2018 10 0 0 0 10 0 0 1 Station Square Haringey Newlon Housing Trust HGY/2016/3932 24/01/2018 117 0 0 0 117 0 0 Gallions Phase 1 Newham Notting Hill Housing Trust 14/00664/OUT 29/01/2018 165 4 38 50 73 0 0 Cannons Wharf Lewisham London & Quadrant Housing (L&Q) 30/01/2018 84 0 22 0 62 0 0 Royal Wharf Phase 4 Newham Notting Hill Housing Trust 15/00577/VAR -

London Traditional Housing Associations & LSVT Value For

Appendix 2 – London Traditional Housing Associations & LSVT Key: Upper Quartile, Middle Upper Quartile, Middle Lower Quartile, Lower Quartile Value for money summary Efficiency Summary for Brent Housing Partnership Cost KPI Quartile Quality KPI Quartile Business Cost KPI Brent Brent Quality KPI Brent Brent Activity Housing Housing Housing Housing Partnership Partnership Partnership Partnership (2011/2012) (2010/2011) (2011/2012) (2010/2011) Overhead costs as % Overhead costs as % direct revenue Overheads adjusted turnover costs Percentage of tenants satisfied with Major Works Total CPP of Major overall quality of home (GN & HfOP) & Cyclical Works & Cyclical Maintenance Maintenance Percentage of dwellings failing to meet the Decent Homes Standard Percentage of tenants satisfied with the repairs and maintenance service (GN & HfOP) Responsive Total CPP of Repairs & Responsive Repairs & Percentage of all repairs completed Void Works Void Works on time Average time in days to re-let empty properties Percentage of tenants satisfied with overall services provided (GN & HfOP) Housing Total CPP of Housing Percentage of tenants satisfied that views are being taken into account Management Management (GN & HfOP) Current tenant rent arrears net of unpaid HB as % of rent due Percentage of residents satisfied with quality of new home, surveyed Staff involved in standard units within 3 years of completion Development developed per 100 units Standard units developed as % of current stock Percentage of tenants satisfied with Estate Total CPP of Estate -

Funding Affordable Homes

Funding Affordable Homes Social Impact Report 2017 Table of Contents Executive Summary 2 Introduction 4 Headline Results 6 Location of FAH properties 7 Outcomes by Stakeholder 8 Review of Investments 10 Midland House, Luton 12 Rosebank Park and Beaumont House, Essex 18 Independent Living, England-wide 22 Balmoral Road, Northampton 26 Island Point, Tower Hamlets, London 28 Landmark Pinnacle, Tower Hamlets, London 31 Final Reflections 33 Appendix 1 – Impact Assessment Methodology 34 Appendix 2 – List of Interviewees 36 Funding Affordable Homes: Social Impact Report 2017 1 Executive Summary Funding Affordable Homes (FAH) is delivering on its social objective of increasing the provision of quality, affordable homes for those in social need. It has launched a scaleable investment model that is attracting private investment from those new to affordable housing. It is bringing much needed capital in large quantity that is supporting significant new housing development. As of June 2017, FAH has committed £106 million to Experience from the investments made has shown that: seven housing projects across England comprising a total of 528 properties which will provide affordable, • Social investment works. FAH is demonstrating quality housing for up to 1000 people. that social impact investing can help deliver on the urgent need for affordable housing for the FAH delivers affordable general needs and specialist benefit of those in greatest need. Of particular housing for people on low incomes, people at risk value is FAH’s provision of capital for forward of homelessness, people with learning or physical funding of new housing developments. As a disabilities and older people. Overall, 21% of homes result FAH provides additional homes that are social rent, 6% affordable rent, 61% specialist would not have been built otherwise. -

Name Job Title Company Name Arnold Tarling Director @Arnold Tarling FRICS Andrew Buckels Consultant 3C Consultants Colin Sales M

Name Job Title Company Name Arnold Tarling Director @Arnold Tarling FRICS Andrew Buckels Consultant 3C Consultants Colin Sales Managing Director 3C Consultants Alex Ziff CEO 3dc Stephanie Lovegrove Barrister 4-5 Gray's Inn Square Dr Shaun Lundy Technical Director 4site Consulting Rob Cox Manager 7video Simon Wilderspin Manager 7video Pete Sims Managing Director 7video Peter Sims Managing Director 7video Jane Clarges Area Manager A2 Dominion Group Asif Khan Asset Information Manager A2 Dominion Group Iva Todorova Assistant Director Finance A2 Dominion Group Gary Bellenger Assistant Director Property Services A2 Dominion Group Hayley Morgan Business Partner A2 Dominion Group Ian Cox Chair A2 Dominion Group Darrell Mercer Chief Executive A2 Dominion Group David Lingeman Director Property Services A2 Dominion Group Steve Michaux Director Residential Services A2 Dominion Group Diana Summerhill Head Capital Finance A2 Dominion Group Ken James Head Leasehold A2 Dominion Group Ken James Head Leasehold A2 Dominion Group Morrison Nicki Head Lettings & Resales A2 Dominion Group Sarita Gregory-Brook Head Neighbourhood (South East) A2 Dominion Group Susan Slade Head Service Charge & Project A2 Dominion Group Steve Hornblow Head Special Projects A2 Dominion Group Julio Lawson Leasehold Coordinator A2 Dominion Group Linda Rana Leasehold Coordinator A2 Dominion Group Akin Akinbolagum Leasehold Property Manager A2 Dominion Group Sofia Cabral Leasehold Property Manager A2 Dominion Group Ashleigh Codd Leasehold Property Manager A2 Dominion Group Robert Dalmadge -

Financial Statements for the Year Ended 31 March 2018

FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2018 One Housing Group Limited Registered under the Co-operative and Community Benefit Societies Act ( 20453R) Registered with the Regulator of Social Housing (number LH0171) One Housing Group Limited Registered under the Co-operative and Community Benefit Societies Act ( 20453R) Registered with the Regulator of Social Housing (number LH0171) Financial statements for the year ended 31 March 2018 CONTENTS Section Page Our results at a glance 2 - 3 Introduction from the Chair 4 - 5 Board members, executives and advisors 6 Report of the Board of management 7 - 16 Strategic report 17 - 35 Independent auditor's report 36 - 38 Consolidated and Association statement of comprehensive income 39 Consolidated and Association statement of financial position 40 Consolidated and Association statement of changes in reserves 41 Consolidated and Association statement of changes in reserves 42 Consolidated statement of cash flows 43 Notes forming part of the financial statement 44 - 97 1 One Housing Group Limited Our results at a glance Turnover growth 300 (£’000) 250 200 150 100 50 0 2014 2015 2016 2017 2018 Unit growth 16,500 (’000) 16,000 15,500 Social housing 15,000 14,500 Non-Social Housing 14,000 13,500 13,000 12,500 2014 2015 2016 2017 2018 Cash income (£’000) Social housing lettings, £110,981 (36%) Market rent and commercial lettings, £11,706 (4%) Supporting people contracts, £25,545 (8%) Shared ownership first tranche sales, £35,776 (12%) Sales of properties developed for outright sale, £34,686 -

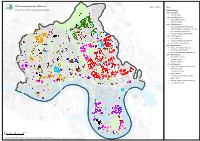

RLS Housing More Than 1000 Units Bur R Oa Date: 17/04/2013 E D Key a S T

C arp en Ro oad te th y R rs RLS Housing more than 1000 units bur R oa Date: 17/04/2013 E d Key a s t C r AF221773PD - GIS for Development and Renewal o s s RSL Housing R o u XW t 7001> Properties X e XW X POPLAR HARCA X X X X X 3001 - 4000 Properties XXX XY X XX X X X X X X ONE HOUSING GROUP XX X X XXY XXWX X XX XX X XX XXXXX X EAST END HOMES XX X X XX XX XX X XX XXX XW X XX X XX X X X X XX 2001- 3000 Properties X XWX X XX X X XXX XX XX X X X X X XXXX X X X XY XWX X X X XW XWXY XW X OLD FORD HOUSING ASSOCIATION X X X X XW X XX X X XW XW XX X XY X XX XW X TOWER HAMLETS COMMUNITY HOUSING X X XX X XWX X X X X XX XY XW XW X XY X XX X XW X XW XWXWXW XY XY X XY SWAN HOUSING ASSOCIATION X XW X XX X X X XYXY X X X XW XXX XY XY X XY ad X X XXX X XY X X XW Hackney Ro X X XWXY XXX XW X X GATEWAY HOUSING ASSOCIATION XX X X X XW X XXW XW X X X XX XY X X X X XXX X X X XWXW XW XW X XW XX X X X XX X X X XYX X XXW XY XYXW XW X X X X X X XY X XW X X XY 1001 - 2000 Properties XY X XW XW XW X XY X X X XW X X X XWXXW XY X X X X X X X G XW XY X X X X EAST HOMES HA X X r XW X X X X o XW d X X X vX X oa X X X X e XY w R X X X XW XW X Bo X X XX XW X X X R X XY X XY X X X XWo XW XXW X X GENESIS HOUSING ASSOCIATION XW XXYX X a XW XW X X X XW d X XXW XW X X X X XYXY XY X XWXX XW S XW X X XW XW X X h X X oad X XW XW X XY X o X SOUTHERN HOUSING GROUP XW Xreen R XY XW XY X X XY X r nal G XW XY X X X e Beth XW X X X XX X X XY d XW X X X XX XYX X XY i XY X X t X X X X XX XW c XW XW XY XW X X 501 - 1000 Properties h XW X X X X X X X XW XY X X X X H X XY XXYX XX X i g -

Pre Application Guidance

HARROW COUNCIL Affordable Housing Planning Obligation - Pre-Application Guidance August 2018 The Council’s Affordable Housing policy applies to all development sites with a capacity to provide 10 or more homes (gross)1. The Council will seek the maximum reasonable level of affordable housing, having regard to the Council’s borough-wide affordable housing target of 40%, individual scheme viability and other factors. Affordable housing should be provided on site in the proportion of 60% London Affordable Rent and 40% Intermediate units (London Living Rent or London Shared Ownership), unless otherwise agreed by the Council*. As per para. 2.8 of the Mayor’s Affordable Housing and Viability SPG, the percentage of affordable housing in a scheme should be measured by habitable rooms to ensure that a range of sizes of affordable homes can be delivered, including family sized homes, taking account of local mix policies and having regard to site specific circumstances. Habitable rooms in affordable and market elements of the scheme should be of comparable size when averaged across the whole development. If this is not the case, then it may be more appropriate to measure the provision of affordable housing using habitable floor space. Applicants should present affordable housing figures as a percentage of total residential provision by habitable rooms, by units, and by floor space to enable comparison. The council will accept Discounted Market Rent units as the affordable element of a Build to Rent scheme, in line with the Mayor’s guidance. It is important that proposed or assumed minimum income requirements for London Shared Ownership housing are discussed with the Council in order to ensure that these are acceptable locally *Note this tenure mix is reversed within the Wealdstone Central sub-area of the Harrow and Wealdstone Area Action Plan – See AAP Policy 13 (C).