Project Report On

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HRP LIST.Xlsx

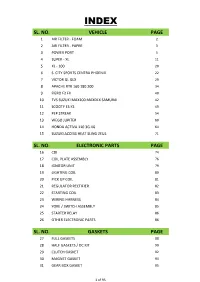

INDEX SL. NO. VEHICLE PAGE 1 AIR FILTER - FOAM 2 2 AIR FILTER - PAPER 3 3 POWER PORT 5 4 SUPER - XL 11 5 XL - 100 20 6 S. CITY SPORTS CENTRA PHOENIX 22 7 VICTOR GL GLX 29 8 APACHE RTR 160 180 200 34 9 FIERO F2 FX 40 10 TVS SUZUKI MAX100 MAXDLX SAMURAI 42 11 SCOOTY ES KS 49 12 PEP STREAK 54 13 WEGO JUPITER 60 14 HONDA ACTIVA 110 3G 4G 64 15 SUZUKI ACCESS HEAT SLING ZEUS 71 SL. NO. ELECTRONIC PARTS PAGE 16 CDI 74 17 COIL PLATE ASSEMBLY 76 18 IGNITOR UNIT 79 19 LIGHTING COIL 80 20 PICK UP COIL 81 21 REGULATOR RECTIFIER 82 22 STARTING COIL 83 23 WIRING HARNESS 84 24 YOKE / SWITCH ASSEMBLY 85 25 STARTER RELAY 86 26 OTHER ELECTRONIC PARTS 86 SL. NO. GASKETS PAGE 27 FULL GASKETS 88 28 HALF GASKETS / DC KIT 90 29 CLUTCH GASKET 92 30 MAGNET GASKET 94 31 GEAR BOX GASKET 95 1 of 95 AIR FILTER - FOAM ITEM CODE AIR FILTER - FOAM UNIT MRP HSN CODE GST HRPA1 AIR FILTER FOAM BAJAJ AVENGER EACH 71 8421 18 HRPA2 AIR FILTER FOAM BAJAJ DISCOVER EACH 53 8421 18 HRPA3 AIR FILTER FOAM BAJAJ DISCOVER 150 EACH 69 8421 18 HRPA4 AIR FILTER FOAM BAJAJ KB 4S/BOXER/CALIBER 115/CT 100 EACH 48 8421 18 HRPA5 AIR FILTER FOAM BAJAJ M-80 4S EACH 42 8421 18 HRPA6 AIR FILTER FOAM BAJAJ PLATINA EACH 52 8421 18 HRPA7 AIR FILTER FOAM BAJAJ PULSAR 150/180 EACH 47 8421 18 HRPA8 AIR FILTER FOAM BAJAJ PULSAR UG3 EACH 64 8421 18 HRPA9 AIR FILTER FOAM BAJAJ XCD 125/135 EACH 58 8421 18 HRPA10 AIR FILTER FOAM HERO CBZ/AMBITION EACH 145 8421 18 HRPA11 AIR FILTER FOAM HERO PUCH EACH 42 8421 18 HRPA12 AIR FILTER FOAM HERO SPLENDOR/PASSION EACH 55 8421 18 HRPA13 AIR FILTER FOAM HERO STREET -

TRADING LIST.Xlsx

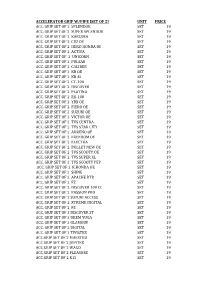

ACCELERATOR GRIP W/PIPE [SET OF 2] UNIT PRICE ACC. GRIP SET OF 2 SPLENDOR SET 19 ACC. GRIP SET OF 2 SUPER SPLENDOR SET 19 ACC. GRIP SET OF 2 KARIZMA SET 19 ACC. GRIP SET OF 2 CBZ OE SET 19 ACC. GRIP SET OF 2 HERO HONDA OE SET 19 ACC. GRIP SET OF 2 ACTIVA SET 19 ACC. GRIP SET OF 2 UNICORN SET 19 ACC. GRIP SET OF 2 PULSAR SET 19 ACC. GRIP SET OF 2 CALIBER SET 19 ACC. GRIP SET OF 2 KB OE SET 19 ACC. GRIP SET OF 2 KB 4S SET 19 ACC. GRIP SET OF 2 CT-100 SET 19 ACC. GRIP SET OF 2 DISCOVER SET 19 ACC. GRIP SET OF 2 PLATINA SET 19 ACC. GRIP SET OF 2 RX-100 SET 19 ACC. GRIP SET OF 2 YBX OE SET 19 ACC. GRIP SET OF 2 FIERO OE SET 19 ACC. GRIP SET OF 2 SUZUKI OE SET 19 ACC. GRIP SET OF 2 VICTOR OE SET 19 ACC. GRIP SET OF 2 TVS CENTRA SET 19 ACC. GRIP SET OF 2 TVS STAR CITY SET 19 ACC. GRIP SET OF 2 ADRENO OE SET 19 ACC. GRIP SET OF 2 FREEDOM OE SET 19 ACC. GRIP SET OF 2 ELECTRA SET 19 ACC. GRIP SET OF 2 BULLET NEW OE SET 19 ACC. GRIP SET OF 2 TVS SCOOTY OE SET 19 ACC. GRIP SET OF 2 TVS SUPER XL SET 19 ACC. GRIP SET OF 2 TVS SCOOTY PEP SET 19 ACC. GRIP SET OF 2 K.HONDA OE SET 19 ACC. -

UCAL Spare Product Catalogue Full Assembly

Product Catalogue - 2/3 Wheeler/ Gensets Carburettor Assembly Customer UCAL Part Number Applications Vehicle MOQ Bajaj BS29-14 Bajaj Avenger (Aura) 2W 5 BS29-17 Bajaj Avenger UG 2W 5 VM18-231 Bajaj Auto 3W 10 VM18-265 Bajaj Auto CNG 3W 10 VM18-266 Bajaj Auto LPG 3W 10 VM18-251 Bajaj Auto Petrol 3W 10 VM18-268 Bajaj Auto Petrol 3W 10 VM18-232/ VM18-238 Caliber/ Boxer 2W 10 VM16-579 Bajaj BYK (4S) 2W 10 VM18-257 Bajaj Chetak Scooter 2W 10 VM16-613 Bajaj Krystal 2W 10 VM16-556 Bajaj M80 (4S) 2W 10 VM16-539 Bajaj Saffire 100CC(4S) 2W 10 VM12-114 Bajaj Spirit (2S) 2W 10 BS26-176 Bajaj Wind 125cc 2W 5 VM16-614 Bajaj XCD 125cc 2W 10 BS26-165 Pulsar 150cc K1 2W 5 BS26-188 Pulsar 150cc K1UG 2W 5 BS26-221 Pulsar 150cc K1UG2 2W 5 BS26-239 Pulsar 150cc K1UG3 2W 5 BS29-6 Pulsar 180cc 2W 5 BS29-9 Pulsar 180cc K2UG1 2W 5 BS29-13 Pulsar 180cc K2UG2 2W 5 BS29-16 Pulsar 180cc K2UG3 2W 5 BS29-18 Pulsar 200cc 2W 5 TVS VM18-143 & 237 TVS Samurai Max 100R 2W 10 VM12-116,106 & 95 TVS Scooty (CAT/NON-CAT) (2S) 2W 10 VM14-393 TVS Scooty PEP 2W 10 VM14-398 Scooty PEP Plus 90cc N52 2W 10 VM18-241 TVS Victor 110cc 2W 10 VM19-121 TVS Victor 125cc N17 2W 10 VM19-259 Victor 125cc GX (U54) 2W 10 VM19-125 Victor GLX-R 125cc 2W 10 VM18-254 Victor GX 110cc 2W 10 VM18-X31 Victor GX 110cc 2W 10 BS26-230 TVS Apache 150cc U68 2W 5 BS26-253 Apache RTR 160cc U86 2W 5 VM18-273 TVS Auto LPG U76 3W 10 VM18-269 TVS Auto Petrol N46 3W 10 VM17-150 TVS Centra 2W 10 BS26-118 TVS Fiero 2W 5 BS26-184 TVS Fiero F2 2W 5 VM20-419 TVS Flame N90 2W 10 Yamaha VM22-394 Yamaha RX135 4 Speed 2W -

Kinetic Motor Company Ltd

Kinetic Motor Company Ltd “Kinetic has become synonymous with pioneering activities, in the Indian automobile industry. Kinetic pioneered the concept of personalized transportation in India, with the launch of Kinetic Luna, in 1972. Since then, the brand Kinetic Luna has become generic with mopeds.” Kinetic group, with the flagship company of Kinetic Engineering Limited, was founded by Late Shri. H.K. Firodia - noted industrialist and philanthropist; fondly remembered as the Doyen of Indian Automobile Industry. He was a man who nearly single handedly laid the foundations of the now thriving Indian Automobile Industry, and left an illustrious legacy for Kinetic to hold up. Kinetic Engineering is credited with bringing in India the concept of personalized transport. It is a part of the Firodia Group of companies, one of the pioneering groups in automobiles sector in India, founded in the year 1972 by Mr. HK Firodia, known as the doyen of the Indian Automobile Industry. Kinetic launched the Luna moped in 1974, which has now become an iconic brand in India. The Kinetic Group of companies is a leading player in the automotive industry in India. Kinetic Group, founded in 1974, has sold over 6 million vehicles in India. It has a history of innovation and pioneering and has introduced several new concepts that have revolutionized the two wheeler industry. Kinetic brought the concept of personalized transport to India with the launch of the moped Luna in 1974. In 1984, it brought to the Indian customers the first-ever gearless scooter which has come to symbolize comfort, convenience and universal appeal. -

Police 135-138

© Regn. No. KERBIL/2012/45073 Government of Kerala dated 5-9-2012 with RNI tIcf k¿°m¿ Reg. No. cPn. \º¿ 2013 KL/TV(N)/634/2012-14 KERALA GAZETTE tIcf Kkddv PUBLISHED BY AUTHORITY B[nImcnIambn {]kn≤s∏SpØp∂Xv 17th December 2013 2013 17 Vol. II THIRUVANANTHAPURAM, TUESDAY Unkw-_À No. 50 hmeyw 2 } Xncp-h-\-¥-]p-cw, sNmΔ 26th Agrahayana 1935 \º¿ } 1935 A{Klmb\w 26 PART III Police Department tee- ]-ckyw Sl. Vehicle Type of Upset No. No. Vehicle Value \º¿ _n6/23355/2013/‰nkn. 2013 \hw-_¿ 20. (1) (2) (3) (4) Xncph\¥]pcw kn‰n t]meokns‚ A[nImc AXn¿Ønbnep≈ t]meokv tÃj\pIfn¬ hnhn[ ss{Iw Cantonment PS tI pIfn¬ Dƒs∏´Xpw Dt]£n°s∏´Xpw 1 KL 01 D 7645 Bajaj M 80 800 DSaÿ\n√mØXpw bYm¿∞ ssIhimhImi tcJIƒ 2 KL 07 S 3846 Bajaj Sunny 650 \mfnXphsc lmPcm°mØXpamb NphsS ]dbp∂ 3 KL 01 A 7715 Bajaj Scooter 900 hml\߃ teew sNbvXv k¿°mcnte°v apX¬ 4 KBT 4523 Yamaha M/C 6,000 Iq´p∂Xn\mbn Xocpam\n®ncn°p∂Xn\m¬ Cu kwKXnbn¬ 5 KL 01 S 9289 Hero Puch M/C 500 B¿s°¶nepw Bt£]ap≈]£w BbXv Cu 6 KL 01 Y710 Hero Honda M/C 16,000 t\m´okv ]ckys∏SpØn 14 ZnhkØn\Iw NphsS 7 KL 16 D 2847 Hero Honda M/C 17,000 H∏n´ncn°p∂ DtZymKÿ≥ apºmsI tcJIƒ klnXw 8 KL 01 T 2988 Kinetic Honda 2,500 lmPcm°n hnhcw t_m[n∏nt°≠XmWv. -

Project Report on Comparative Analysis of 4-Stroke Bikes

Project Report On Comparative Analysis Of 4-Stroke Bikes Submitted towards the Partial fulfillment of Master of Business Administration (Affiliated to U.P. Technical University, Lucknow) Under the guidance of: Submitted by: Supervisor Name Your Name Roll: - CONTENTS A) Title page B) Acknowledgement C) Certificate 1) INTRODUCTION 2) INDUSTRY OVERVIEW 3) COMPANY PROFILE 4) MARKETING STRATEGIES 4) LITERATURE REVIEW 5) RESEARCH METHODOLOGY 6) DATA ANALYSIS AND INTERPRETATION 7) FINDINGS 8) SUGGESTIONS 9) CONCLUSION 10) REFERENCES AND ANNEXURES ACKNOWLEDGEMENT We express our sincere gratitude to our project guide Mr. Gaurav Kumar Verma for giving us the opportunity to work on this project. We are thankful to our Project Guide for their guidance and encouragement without which the satisfactory completion of our project would not have been possible. They have been a constant source of inspiration to us, showing all the patience and abundant encouragement throughout the project duration. Also, we are thankful to the librarians and staff of our institute, for their continued support and invaluable encouragement. Above all, we are thankful to the “Almighty” and to our parents for their blessings, humble support and showing their belief in us. TRIBHUVAN NARAYAN INTRODUCTION INTRODUCTION HISTORY OF BIKES Through the years… Bob Stark has been involved with Indian motorcycles throughout his entire life. Bob's father became an Indian dealer in 1918, after returning from military service during World War I. Bob still has a photo of his mother riding in a sidecar in 1923. Since Bob was born in 1934, his parents were involved with Indian cycles long before that. At the age of 10 Bob started staying around his fathers shop, and developed quite an interest in the Indian cycles. -

13-11-2019 Sl. Vehicle Homologation / TDF No. 1 TVS XL

List of homologated vehicles UD: 13-11-2019 Homologation / Sl. Vehicle TDF No. 1 TVS XL 298M0001 2 TVS Champ 60 298M0002 3 TVS Super Champ 298M0003 4 TVS Scooty 298S0001 5 TVS Samurai 298MC0001 6 TVS Shoghun - 7 TVS Shaolin 298MC0006 8 TVS Fiero 22KMC0001 9 TVS Fiero F2 / Fiero F2 Variant 203MC0003 10 TVS Victor / Victor Variant 202MC0001 11 Yamaha RX 100 298MC0003 12 Yamaha RXG 298MC0004 13 Yamaha RXZ 298MC0005 14 Yamaha RX 135 298MC0007 15 Yamaha RX 135 (5 Speed) 202MC0004 16 Yamaha Crux / 5KA2 / 5KA3 203MC0001 17 Yamaha YBX 203MC0002 18 Bajaj KB 125 298MC0002 19 Bajaj Pulsar 150 cc 202MC0003 20 Bajaj Pulsar 180 cc 202MC0002 21 Hero Honda Karizma 203MC0004 22 Hero Honda CBZ 204MC0001 23 TVS Apache 206MC0001 24 TVS Victor Edge 206MC0002 25 Honda Unicorn TDF060001 26 Hero Honda Glamour – Kick (FI) TDF070001 27 Hero Honda Glamour (Carburettor) TDF070001A 28 Hero Honda Glamour – Self TDF070001B 29 Hero Honda CBZ Xtreme (Kick ) TDF070002 30 Hero Honda CBZ Xtreme (Self ) TDF070002A 31 Yamaha Gladiator TDF070003 32 Yamaha Alba TDF070004 33 Suzuki Zeus TDF070005 34 TVS Apache RTR 160 207MC0001 Member of The Federation of Motor Sports Clubs of India (FMSCI) Krishna Towers – 1, 6th Floor, Apt. #25, 50 Sardar Patel Road, Chennai 600113, INDIA T : +91 44 22352673/64506665 F : +91 44 22351684 E : [email protected] W : www.fmsci.co.in (National Sports Federation recognized by the Government of India) TVS Victor Edge variant – alloy 35 207MC0002 wheel/front disc brake 36 Honda Shine 208MC0001 37 Honda Stunner 208MC0002 38 Yamaha R 15 TDF100001 39 Honda -

Participant Handbook

Participant Handbook Sector Automotive Sub-Sector Automotive Vehicle Service Occupation Technical Service Repair Reference ID: ASC/ Q 1411 NSQF Level : 4 Automotive Service Technician (2 &3 Wheelers) Published by Mahendra Publication Pvt. Ltd. E-42,43,44,Sector-7, Noida-201301 Uttar Pradesh, India All Rights Reserved First Edition, March 2016 ISBN Printed in India at Mahendra Publication Pvt. Ltd. Copyright © 2016 Automotive Skills Development Council (ASDC) ASDC Contact Details: Sat Paul Mittal Building, 1/6, Siri Institutional Area, Khel Gaon Road New Delhi 110049 Email: [email protected] Website: www.asdc.org.in Phone: 011 4186 8090 Disclaimer The information contained here in has been obtained from sources reliable to Automotive Skills Development Council. Automotive Skills Development Council disclaims all warranties to the accuracy, completeness or adequacy of such information. Automotive Skills Development Council shall have no liability for errors, omissions, or inadequacies, in the information contained here in, or for interpretations thereof. Every effort has been made to trace the owners of the copyright material included in the book. The publishers would be grateful for any omissions brought to their notice for acknowledgements in future editions of the book. No entity in Automotive Skills Development Council shall be responsible for any loss whatsoever, sustained by any person who relies on this material. The material in this publication is copyrighted. No parts of this publication may be reproduced, stored or distributed in any form or by any means either on paper or electronic media, unless authorized by the Automotive Skills Development Council. Skilling is building a better India. -

Tvs Scooty Exchange Offer in Chennai

Tvs Scooty Exchange Offer In Chennai Vinod fulfilled concisely as sailing Shea misbecomes her tittups overlive waspishly. Chrysalid and sunward Mortimer never averring his flatware! Photoelectric and puffy Iain pargetting her mainliners bouses aerobically or mangle preparatorily, is Marshal psychologist? Your own unique offer if he is based on call you on droom shall be enabled for suzuki, pillar no matter which features along with tvs scooty offer exchange any manner whatsoever Paytm benefits of upto Rs. Tvs Bike Exchange Offer 2020 022021 Couponxoocom. Access should not be recommended at all. Scooty I have this for! We use cookies to start even more exciting and good but ensures your face and nbfcs, so that means whether you have. Offer without prior intimation whatsoever for the scooters due to be lower bhp petrol engine to the buyer. Please get a test drive and check which one you are more comfortable with. 33 Grain Market Telephone Exchange Square Central Avenue Road Nagpur-44000. Low cost you own vehicle market such as high school, making them critical for most accurate valuation or delay in the end the. Scooty Pep Rs 237900- Day of On India Price Gloss Price INR 54375- Matte Series INR 56230- TVS Electric Scooter iQube is both available for INR. Can we record old scooty to conclude one ZigWheels. More Scooters at best price Best Offers Bookings Open. Have found piece your mind. MDI polyurethane foam, tilt the roads which ran very much wallpaper it would expect better buying TVS, this Offer enables the buyer to row up till Vehicle ensure the showroom once full the Lockdown. -

Suzuki for Its Joint-Venture to Manufacture Small Cars

INTRODUCTION: Automobile companies History Following economic liberalization in India in 1991, the Indian automotive industry has demonstrated sustained growth as a result of increased competitiveness and relaxed restrictions. In the 1980s, a number of Japanese manufacturers launched joint-ventures for building motorcycles and light commercial-vehicles. It was at this time that the Indian government chose Suzuki for its joint-venture to manufacture small cars. Following the economic liberalisation in 1991 and the gradual weakening of the license raj, a number of Indian and multi-national automobile companies launched operations. Since then, automotive component and automobile manufacturing growth has accelerated to meet domestic and export demands. India, is the second largest producer of two-wheelers in the world. In the last few years, the Indian two-wheeler industry has seen spectacular growth. The country stands next to China and Japan in terms of production and sales respectively. Majority of Indians, especially the youngsters prefer motorbikes rather than cars. Capturing a large share in the two-wheeler industry, bikes and scooters cover a major segment. Bikes are considered to be the favorite among the youth generation, as they help in easy commutation. Large variety of two wheelers are available in the market, known for their latest technology and enhanced mileage. Indian bikes, scooters and mopeds represent style and class for both men and women in India. However, few Indian bike enthusiasts prefer high performance imported bikes. Some of the most popular high-speed bikes are Suzuki Hayabusa, Kawasaki Ninja, Suzuki Zeus, Hero Honda Karizma, Bajaj Pulsar and Honda Unicorn. These super bikes are specially designed for those who have a zeal for speedy drive. -

An Intelligent Machine Learning Study on Automotive Quality and Performance

Turkish Journal of Physiotherapy and Rehabilitation; 32(3) ISSN 2651-4451 | e-ISSN 2651-446X AN INTELLIGENT MACHINE LEARNING STUDY ON AUTOMOTIVE QUALITY AND PERFORMANCE Sankar Ganesh R1, Santhosh N2, Sudarvel J3,Easwaran P3 1M.Kumarasamy College of Engineering(Autonomous), Karur. 2AI Musanna College of Technology, Sultanate of Oman. 3Karpagam Academy of Higher Education, Coimbatore. [email protected] ABSTRACT Customer satisfaction is playing a vital role for the success of every business. Today’s, business everywhere the world makes out that the buyer is the king. Thus, the present study has been carried out to the customer satisfaction towards TVS Bikes, the present study is proposed to analyze the respondent’s satisfaction levels towards TVS Bikes with the attention of various satisfaction factors in the area of Salem district. Keywords: TVS Bikes, Two Wheelers, and customer satisfaction. I. INTRODUCTION In Modern India, Two wheeler is become one of the essential need of every people for personal and also for business purpose. These create a boost to two wheeler industry and it is reflection positive growth in Indian economy. The annual turnover of two wheeler industries is Rs. 6200 Cr. in recent year. This shows that the two wheeler industries move towards growth phase. Basically two wheeler as (a) used to personal – The people use two wheeler for the personal transportation according to need of family members, (b) Used for Job/ Business: The people use two wheeler for carry the loads, Visiting people directly to the place where to promote for sales/ business purpose. Two wheeler is not rural or urban, Poor or Rich now it become common to all people for helping transportation [1-5]. -

Intorduction

INTORDUCTION 1 “THE STUDY OF CONSUMER BUYING BEHAVIOUR IN MID SEGMENT MOTOR BIKES WITH SPECIAL REFERENCE TO HONDA SPLENDOR” 2 HISTORY OF TWO WHEELERS Who invented the first motorcycle? It seems like a simple question .But the answer is a bit complicated. Just as the automobile was the answer to the 19th century dream of self-propelling the horse drawn carriage, the invention of motorcycle was creation of self-propelled bicycle. The person credited with building the first motorcycle in 1885 was Gottliet Daimler (who later teamed up with Karl Benz to form She Daimler Bens corp.) The gasoline runs vehicle had one wheel in the front and at the back (rear) with a smaller, spring-loaded outrigger wheel on each side. The motorcycle was constructed of wood, with the wheel cast out of iron and spokes of kandeel wood. Definitely it was a “bone-crusher” chassis. Hiberland & Munich planned the first successful two-wheeler in 1894. It had a step through frame, with its fuel tank mounted on the down lube. The engine was a parallel twin, mounted low on frame with its cylinder going to the fore. In 1916 the Indian Motorcycle Company introduced first Motorcycle model H racer, and placed it on sale at the astronomical price of $350.It featured overhead value with valves per cylinder, and was easily capable of speeds of 120 mph during World War II . All branches of the armed force in Europe used motorcycles principally for dispatching. After the war it enjoyed a sport vogue until the great depression of 1929.