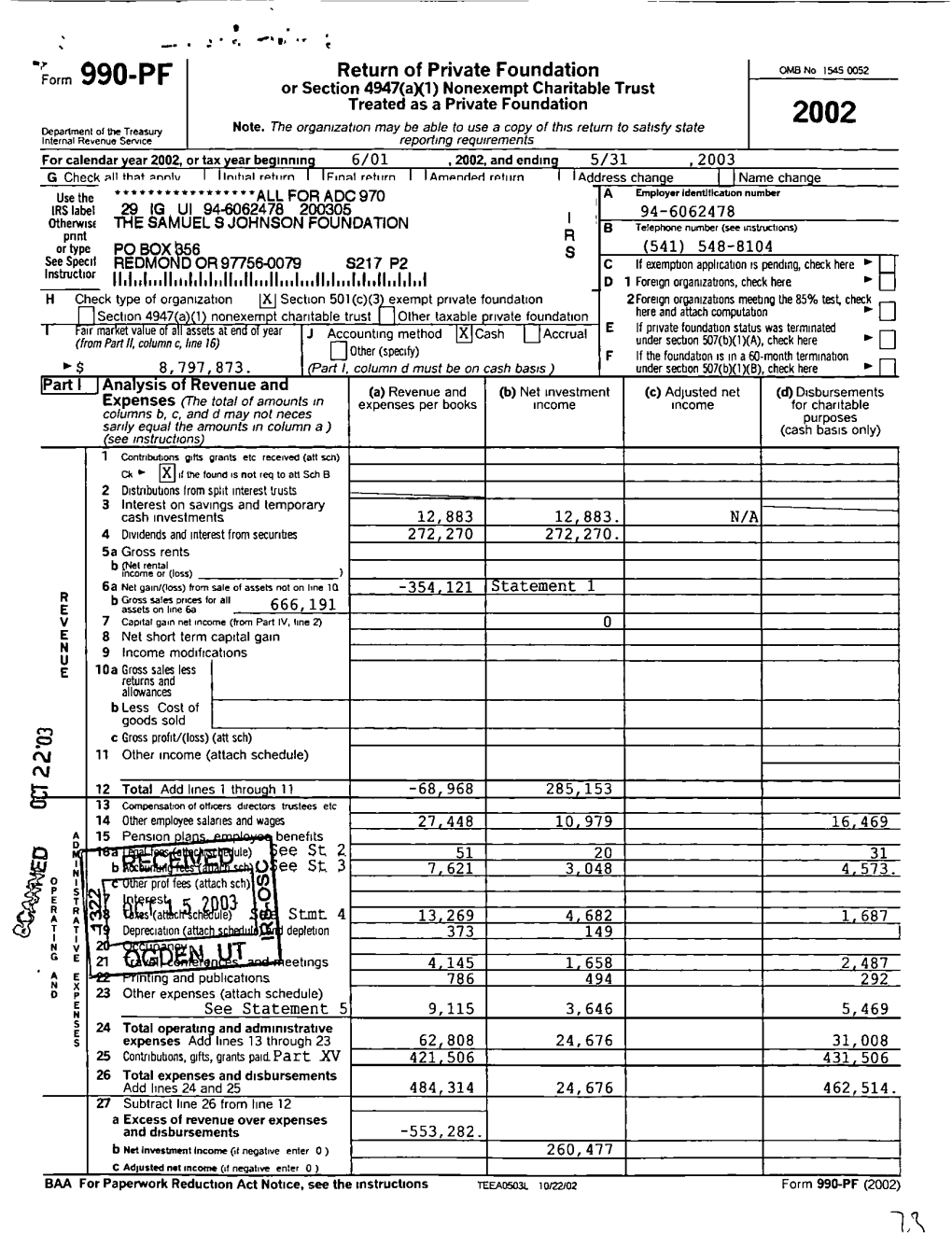

Return of Private Foundation PF Or Section 4947(Ax1) Nonexempt Charitable Trust Treated As a Private Foundation 2002 Department of the Treasury Note

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Newsletter 07-6

VOL XXIX #2 1 July 2007 I n t e r n a t i o n a l F l e e t C l u b N E W S L E T T E R Editor / Publisher From the Editor mailing well over 400 hard copies Jim Catalano world wide. Last issue we sent out over 200 requests for updated info to 8 Westlin Lane Wildly optimistic, I started the open those we hadn’t heard from since Cornwall NY 12518 cockpit season off on April 1 with two 1999 – and received only about 10 great flights in 60-degreee weather, responses. We have no idea whether E-Mail clear skies – then it dropped to 35 these 200 folks are receiving the [email protected] degrees and snowed on and off for 2 newsletter, or are enjoying it or weeks. I thought for about a minute couldn’t care less – but it’s almost like Telephone about putting on the old MacKenzie throwing leaflets overboard on a fly-by 845 - 534 - 3947 Airservice wooden skis, then thought and not knowing what impact we’re better of it. having. Fleet Web Site Ninety de- web.mac.com/fleetclub grees here If you’re one of this today, great Silent Half, we would for warming Fleet Net love to hear from you. up 2 gallons Don’t just sit there on groups.yahoo.com/ of oil, short- your er …ah… seat group/fleetnet ening up my pack, send news, pre-flight by several minutes so I can send photos and con- Cover Photo quickly get up in the sky and go no- sider sending a dona- Mike O’Neil’s 1930 where fast in 615S! tion of at least $10 a Model 7 Fleet - N756V year to keep us ahead Club membership now hovers around of the financial power Designer 450 strong; 5% receive the newsletter curve. -

OEHR Director Markisha Smith Wed, Jan 1

January 2020 Calendar – OEHR Director Markisha Smith Wed, Jan 1 – Fri, Jan 3 All Day Vacation Mon, Jan 6 8:00 AM – 9:30 AM Stipends Taskforce Meeting Pettygrove Room, City Hall, Tjaden, Ashley 9:30 AM – 10:30 AM 1:1 Markisha Smith and Kapua Foster Smith, Markisha 11:00 AM – 11:30 AM HRC agenda, Telephone, Elejalde, Tatiana Tue, Jan 7 9:00 AM – 10:00 AM Check-in: Markisha Smith and Theo Latta, Markisha's Office 10:00 AM – 11:30 AM Office of Equity Staff Meeting, PHB Broadway, Labrador-Hallett, Grace 11:30 AM – 12:30 PM CAAN Always Eat Together lunch, Congress Center Building - Brannon, Jay 2:00 PM – 3:00 PM Dr. Markisha Smith, Office of Equity & Human Rights (OEHR) Director, weekly (Claire), Commissioner Fritz's office, Fritz, Amanda 3:30 PM – 4:00 PM COEP IGA Presentation to Council Executives, Conference Call Spitler, Lester Wed, Jan 8 9:00 AM – 10:00 AM Danielle Brooks 1:1 Check-in Markisha's Office 10:30 AM – 11:30 AM Budget Markisha's Office, Smith, Markisha 1:30 PM – 2:30 PM Yolanda 1:1 check-in Markisha's office, Smith, Markisha 4:30 PM – 7:00 PM HRC Meeting 5:00 PM – 6:30 PM Hold for DEI HH KEX, 100 NE Martin Luther King Jr Blvd, Portland, OR Raahi Reddy Thu, Jan 9 9:00 AM – 10:00 AM COEP leadership check in Prosper Portland, Masterman, Morgan 10:30 AM – 12:00 PM P&D Directors Meeting Steel Room, Portland Housing Bureau Commonwealth Building, Lamb, Tony 1:30 PM – 2:30 PM Tatiana Elejalde 1:1 Markisha’s Office, Smith, Markisha 2:00 PM – 4:00 PM Performance Drop-in Session #1, The Portland Building Carney, Shannon Fri, Jan 10 11:10 AM – 12:00 PM COEP IGA Presentation to Council Execs Mayor's Conference Rm. -

National Register of Historic Places Registration Form

NPS FornI 11).900 (MIB No. 10u0018 (FWI.8-86) United States Department of the Interior or r:, ( I. A \. National Park Service National Register of Historic Places Registration Form . nOmin~ting req~esti~g d~t~~minations This form is for use -in" or 'of eligibility for individual properties or districts. See insiruCtlons in Gulde/ines I lor Completing National Register Forms (National Register Bulletin 16). Complete each item by marking "x" in the appropriate box or by entering the requested infonnation. If an item does not apply to the property ~ing documented, enter uN/A" for "not applicable." For functions, styles, materials. I and areas of significance, enter only the categories and subcategories listed in the instructions. For additionjil.space use continuation sheets (Form 10-9OOa). Type all entries.. I 1. Name of Pro e historic name Portland New Chinatown Japantown Historic illstrict other nameslsite number Chinatown National Register Historic District 2. Location street & number Multi Ie rties N not for pUblication cit, town Portland vicinity state Oregon code OR county Multnornah code 051 zip code 97209 3. Classification Ownership of Property Category of Property Number of Resources within Property [ji] priv~te o building(s) Contributing Noncontributing [Xl pUblic-local [li] district -3 C· 29 ".,' 16 buildings o public-State o site ___ sites o public-Federal o structure _-;;-- structures Dobject -,-7;2:-objects 1 ._/ 29 / / 18 Total Name of related multiple property listing: Number of contributing resources previously N/A listed in the National Register -<RL. _ 4. State/Federal Aaencv Certification I As the designated authority under the National Hip ;, P eservation·' ~ct of 1966, as amended, I hereby certify that this IKJ nomination 0 request for determination of er~i i . -

China Council Quarterly 127 NW 3Rd Avenue, Portland, OR 97209

July-September 2011 - Issue 119 China Council Quarterly 127 NW 3rd Avenue, Portland, OR 97209 www.nwchina.org this year of the 100th anniversary of the 1911 Chinese LETTER FROM OUR PRESIDENT Revolution led by Dr. Sun Yat-sen that brought about the beginning of modern China, we plan to offer program- Now that our lovely Oregon summer ming to commemorate the special historic event. We is finally upon us, I hope you are would also like to recognize the contributions by earlier enjoying the sunny weather as much generations of Americans and Chinese Americans. If you as I am. This has been a busy time have knowledge of any local residents that contributed to at the Northwest China Council. In Dr. Sun's efforts, please contact us at the Northwest China addition to our normal program- Council. We are most interested in collecting histories of ming, we have devoted much time to the Pacific NW and Oregon involvements. strategic planning and thinking care- - Cathy Chinn, President fully about the organization's future. The Board recently adopted a new strategic plan, following our February retreat and many CHINA BUSINESS CULTURE WORKSHOP thoughtful discussions. If you would like to receive a copy or to share your ideas, please contact me at The Northwest China Council is now offering an inten- [email protected]. sive and practical 4-hour business and cultural intelli- gence workshop, specially designed for busy profession- I would like to share with you our updated mission state- als engaging in business trips and delegation tours to ment, adopted along with the strategic plan. -

National Register of Historic Places Registration Form

NPS Form 10-900 0MB No. 10244018 (Rev. 8-86) United States Department of the Interior National Park Service National Register of Historic Places Registration Form This form is for use in nominating or requesting determinations of eligibility for individual properties or districts. See instructions in Guidelines for Completing National Register Forms (National Register Bulletin 16). Complete each item by marking "x" in the appropriate box or by entering the requested information. If an item does not apply to the property being documented, enter "N/A" for "not applicable." For functions, styles, materials, and areas of significance, enter only the categories and subcategories listed in the instructions. For additional space use continuation sheets (Form 10-900a). Type all entries. 1 . Name of Property historic name Portland New Chinatown/Japantown Historic District other names/site number Chinatown National Register Historic District 2. Location street & number Multiple Properties N ?A not f°r publication city, town Portland N ^A, vicinity state Oregon code OR county Multnomah code 051 zip code Q790Q 3. Classification Ownership of Property Category of Property Number of Resources within Property l~x] private I I building(s) Contributing Noncontributing [~xl public-local pxl district 29 16 buildings r~l public-State I [site sites r~| public-Federal d structure structures d object 2 objects 29 18 Total Name of related multiple property listing: Number of contributing resources previously N/A_______________ listed in the National Register __S______ 4. State/Federal Agency Certification -f- As the designated authority under the National Hi es ervation of 1966, as amended, I hereby certify that this |X~1 nomination I I request for determination of el. -

123-2012-July

July - September 2012 - Issue 123 China Council Quarterly 221 NW 2nd Ave, Ste 210-J, Portland, OR 97209 www.nwchina.org affairs, and we have more exciting events coming up in LETTER FROM OUR PRESIDENT the fall. This has been an exciting year The Flying Tigers series of exhibits and programs that we for the Northwest China Council. have been working hard on for the past year is almost We have been busy creating upon us, and we look forward to welcoming the veterans mechanisms for growth, effi- to Portland. For more, see page 2. ciency and sustainability within the structure of the organization, Please also save the date for the Northwest China Council and are ready to take the North- annual meeting and dinner Saturday September 8, west China Council to a new 2012, at Wong’s King Restaurant. We will be voting in level of engagement with our new board directors and officers, and the meeting will be membership and the community highlighted by a keynote speech by Dr. K. Scott Wong. at large. We look forward to seeing you there. - David W. Kohl, President During the last few months we have re-assessed our mission and approach; we have cre- ated internal documentation regarding organizational pro- CHINA BUSINESS EVENTS cedure and protocol; and have reached out to our member- ship, as well as other aligned organizations, to assist us in On July 26, Amy Sommers presented a talk titled fulfilling our mission to provide non-biased, accessible “Murder, Sex, and Scandal in China: Why Businesses and timely information regarding all aspects of the greater Should Care About Compliance in China.” Amy, a part- China region to the community. -

44, October - December, 1991 the Opening to China

China Coune 1 #44, October - December, 1991 The Opening to China The following are excerpts from the speech by Alfred trips to China negotiating with Premier Zhou Enlai Jenkins, retired foreign service officer in China, made at leading up to a Nixon visit. the China Council's annual dinner on September 11. My office was charged with preparing the talking Editor's note. papers for those negotiations, on every conceivable subject. The project was so secret I could only get y first and last assignments in diplomatic ser- two members of my staff cleared for it. We could Mvice were to Beijing, with a quarter century hia- draw on any resource in Washington as needed, if tus between, when we had no diplomatic we camouflaged the request. representation in the mainland of China. Virtually the whole world paid attention when repre- sentatives of two great nations that had been in inim- As early as the summer of 1954I began to wonder ical, at times actively hostile, confrontation for 23 about the Sino-Soviet alleged fraternal collusion. I years, sat down together to try to find common was negotiating with the Chinese in Geneva, ground on which to build trust and mutual respect. attempting to get Americans released who were held It had to be one of the great shows of the 20th cen- against their will in China. My opposite number tury to see Henry Alfred Kissinger and Zhou Enlai was the Chinese official who had maintained an sparring across the table during three pre-Nixon unsullied record of anti-American vituperation and negotiating visits to China, each of a week's dura- bombast in the Panmunjam talks in Korea, and here tion. -

Chinatown National Register Historic District

NPS Form 10-900 0MB No. 10244018 (Rev. 8-86) United States Department of the Interior National Park Service National Register of Historic Places Registration Form This form is for use in nominating or requesting determinations of eligibility for individual properties or districts. See instructions in Guidelines for Completing National Register Forms (National Register Bulletin 16). Complete each item by marking "x" in the appropriate box or by entering the requested information. If an item does not apply to the property being documented, enter "N/A" for "not applicable." For functions, styles, materials, and areas of significance, enter only the categories and subcategories listed in the instructions. For additional space use continuation sheets (Form 10-900a). Type all entries. 1 . Name of Property historic name Portland New Chinatown/Japantown Historic District other names/site number Chinatown National Register Historic District 2. Location street & number Multiple Properties N ?A not f°r publication city, town Portland N ^A, vicinity state Oregon code OR county Multnomah code 051 zip code Q790Q 3. Classification Ownership of Property Category of Property Number of Resources within Property l~x] private I I building(s) Contributing Noncontributing [~xl public-local pxl district 29 16 buildings r~l public-State I [site sites r~| public-Federal d structure structures d object 2 objects 29 18 Total Name of related multiple property listing: Number of contributing resources previously N/A_______________ listed in the National Register __S______ 4. State/Federal Agency Certification -f- As the designated authority under the National Hi es ervation of 1966, as amended, I hereby certify that this |X~1 nomination I I request for determination of el. -

Ninety- Nines News Letter

PRESIDENT'S COLUMN Greetings of the New Year to you all. I hope it has NINETY- many opportunities and happy landings in store for each and everyone of you. Thanks for the many Xmas cards and NINES personal notes sent me. I did so enjoy every one of them. I ’m sure you enjoyed hearing in our December News Letter from our secretary, Melba Beard. Next month, you’ll hear from another of the national officers, but this month I had several things I wanted to talk over with you, so here I am. First, I’d like to quote from an interesting letter I received from a NINETY NINE of many years standing. TP "Could we have published in the News Letter, far in advance, not so that you receive it too late to attend, or after it’s over, dates of meetings and parties? So many of the women pilots travel everywhere, and would be happy to attend if they but knew in time. For instance, in the last few years, I ’ve been in 42 of the 48 states, and in Alaska. For periods of one week to six months NEWS in each. I have attended exactly 2 Ninety Nine meetings. LETTER That was entirely due to a Chinese member, Leah Hing, who learned I was ^n Portland, Oregon each time and notified me. My suggestion would bes (l) Let each chapter decide on a date for regular January 15, 1948 meeting. (2) Block the name of the chapter in the news notes, and directly under it, date, time, and address of meeting. -

Riptide on the Columbia: a Military Community

Part III, Riptide on the Columbia: A Military Community Between the Wars, Vancouver, Washington and the Vancouver National Historic Reserve, 1920-1942, with suggestions for further research written by Donna L. Sinclair Center for Columbia River History with research assistance from Joshua Binus This document is the third in a research partnership between the Center for Columbia River History (CCRH) and the Department of the Interior National Park Service at Fort Vancouver National Historic Site in Vancouver, Washington. The National Park Service contracts with CCRH to encourage and support professional historical research, study, lectures and development in higher education programs related to the Fort Vancouver National Historic Site and the Vancouver National Historic Reserve (VNHR). The Center for Columbia River History is a consortium of the Washington State Historical Society, Portland State University, and Washington State University Vancouver. The mission of the Center for Columbia River History (www.ccrh.org) is to promote the study of the history of the Columbia River Basin. CCRH is dedicated to examining “hidden histories” in the Basin and to helping people think about the historical record from different perspectives. Funded by the National Park Service, Department of the Interior Fort Vancouver National Historic Site, Vancouver National Historic Reserve Printed, Vancouver, Washington, January 2005 Preface The site of the Vancouver National Historic Reserve has been strategically important for centuries. First, native people occupied the region, living along a trade route that was among the most populated areas in North America. Then in 1825, the Hudson’s Bay Company (HBC) established a fur trade post at the site along the Columbia River.