Form 8-K Meredith Corporation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TITLE GENRE LANGUAGE Architectural Digest

TITLE GENRE LANGUAGE Architectural Digest Architecture English American Art Collector Art & Photo English Digital Photo Art & Photo English Harper's Magazine Art & Photo English Writer's Digest Art & Photo English Car and Driver Automotive English Motor Trend Automotive English Road & Track Automotive English Brides Bridal English Economist Business & Finance English Entrepreneur Magazine Business & Finance English Fast Company Business & Finance English Forbes Russia Business & Finance Russian Inc. Magazine Business & Finance English Kiplinger's Personal Finance Business & Finance English Newsweek Business & Finance English CQ Amateur Radio Computers & Technology English Discover Computers & Technology English Macworld Computers & Technology English Computers & Technology PC Magazine English Popular Mechanics Computers & Technology English Popular Science Computers & Technology English WIRED Computers & Technology English American Craft Crafts English American Patchwork & Quilting Crafts English Knitscene Crafts English Counselor Current Affairs English Mother Jones Current Affairs English New Yorker Current Affairs English New York Magazine Current Affairs English Bicycling Cycling English Reader's Digest Entertainment English Us Weekly Entertainment English Vanity Fair Entertainment English PEOPLE Bookazines Entertainment - Bookazine English FamilyFun Family & Parenting English Allrecipes Food & Cooking English Better Nutrition Food & Cooking English Bon Appetit Food & Cooking English Clean Eating Food & Cooking English Cook's Country -

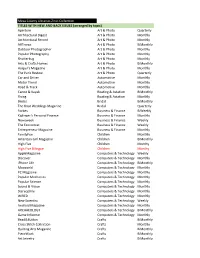

Mesa County Libraries Zinio Collection TITLES with NEW AND

Mesa County Libraries Zinio Collection TITLES WITH NEW AND BACK ISSUES (arranged by topic) Aperture Art & Photo Quarterly Architectural Digest Art & Photo Monthly Architectural Record Art & Photo Monthly ARTnews Art & Photo BiMonthly Outdoor Photographer Art & Photo Monthly Popular Photography Art & Photo Monthly Shutterbug Art & Photo Monthly Arts & Crafts Homes Art & Photo BiMonthly Harper's Magazine Art & Photo Monthly The Paris Review Art & Photo Quarterly Car and Driver Automotive Monthly Motor Trend Automotive Monthly Road & Track Automotive Monthly Canoe & Kayak Boating & Aviation BiMonthly Flying Boating & Aviation Monthly Brides Bridal BiMonthly The Knot Weddings Magazine Bridal Quarterly Forbes Business & Finance BiWeekly Kiplinger's Personal Finance Business & Finance Monthly Newsweek Business & Finance Weekly The Economist Business & Finance Weekly Entrepreneur Magazine Business & Finance Monthly FamilyFun Children Monthly American Girl Magazine Children BiMonthly High Five Children Monthy High Five Bilingue Children Monthy AppleMagazine Computers & Technology Weekly Discover Computers & Technology Monthly iPhone Life Computers & Technology BiMonthly Macworld Computers & Technology Monthly PC Magazine Computers & Technology Monthly Popular Mechanics Computers & Technology Monthly Popular Science Computers & Technology Monthly Sound & Vision Computers & Technology Monthly Stereophile Computers & Technology Monthly WIRED Computers & Technology Monthly New Scientist Computers & Technology Weekly Android Magazine Computers & Technology -

Cooking up Healthy Habits: a Guide to CACFP Meals

Cooking Up Healthy Habits: A Guide to CACFP Meals i In accordance with Federal civil rights law and U.S. Department of Agriculture (USDA) civil rights regulations and policies, the USDA, its Agencies, offices, and employees, and institutions participating in or administering USDA programs are prohibited from discriminating based on race, color, national origin, sex, disability, age, or reprisal or retaliation for prior civil rights activity in any program or activity conducted or funded by USDA. Persons with disabilities who require alternative means of communication for program information (e.g. Braille, large print, audiotape, American Sign Language, etc.), should contact the Agency (State or local) where they applied for benefits. Individuals who are deaf, hard of hearing or have speech disabilities may contact USDA through the Federal Relay Service at (800) 877-8339. Additionally, program information may be made available in languages other than English. To file a program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, (AD-3027) found online at: https://www.ascr.usda.gov/node/119,and at any USDA office, or write a letter addressed to USDA and provide in the letter all of the information requested in the form. To request a copy of the complaint form, call (866) 632-9992. Submit your completed form or letter to USDA by: (1) mail: U.S. Department of Agriculture Office of the Assistant Secretary for Civil Rights 1400 Independence Avenue, SW Washington, D.C. 20250-9410; (2) fax: (202) 690-7442; or (3) email: [email protected]; This institution is an equal opportunity provider. -

100 Popular Titles for Elementary Schools

WT Cox Information Services 100 Popular Titles For Elementary Schools For personalized pricing contact WT Cox Information Services. American Girl Animal Tales ChopChop Magazine Arts & Activities Ask Magazine (Arts & Sciences for Kids) Inspire and teach kids and Bazoof! families to cook real food Beanz Magazine together with the award- Best Friends Magazine winning ChopChop Magazine. Blaze Magazine Each ad-free issue is filled Booklist (Password) with beautiful photography, Boys Life ethnically diverse, kid-tested Brainspace Magazine recipes, kitchen how to’s, fun Car & Driver food facts, engaging puzzles, Catster and games to keep kids moving. Published in English ChickaDEE and Spanish. Pre K-Grade 8. chickaDEE is the magazine for kids 6 to 9! Each issue is Click jam-packed with activities, Cobblestone (Discover American History) comics, animal photos and Consumer Reports (With Buying Guide) facts, crafts, easy science Cricket experiments, and engaging Dig stories, all in a bright, colorful Dirt Bike format that kids in the early Dirt Wheels grades will love. Discover Disney Junior Disney Princess Dogster Educational Leadership ESPN Magazine Chirp Faces: People Places & Cultures FamilyFun Chirp is a unique magazine Field & Stream designed for beginning Food Network Magazine readers ages 3 to 6. Each Fun For Kidz issue contains fun activities, Girls Life age-appropriate puzzles, easy Girls' World rhymes, tools to help with Great Activities Newspaper letter and number recognition, Highlights for Children and read-out-loud stories for Highlights High Five pre-schoolers and their Highlights High Five Bilingue parents to enjoy. Horn Book Magazine Horse & Rider Horse Illustrated Hot Rod Build your quote request online at Humpty Dumpty's Magazine Ingredient Magazine www.wtcox.com/catalog J-14: Just for Teens Call WT Cox For Any Title Not Listed at 1-800-571-9554 or visit www.wtcox.com. -

2015 Annual Report Report Annual 2015

Our Mission We are Meredith Corporation, a publicly held deliver the messages of advertisers and extend Corporation Meredith media and marketing company founded upon our brand franchises and expertise to related service to our customers and committed to markets. building value for our shareholders. Our products and services distinguish Our cornerstone is a commitment to service themselves on the basis of quality, customer journalism. From that, we have built businesses service and value that can be trusted. that serve well-defned readers and viewers, Annual Report 2015 Annual Report Meredith Corporation • 1716 Locust Street 2015 Annual Report Des Moines, IA 50309-3023 515-284-3000 • meredith.com Corporate Information Financial Highlights MEREDITH CORPORATION REGISTRAR AND TRANSFER AGENT Meredith Corporation (NYSE: MDP; meredith.com) has Wells Fargo Bank, N.A., PO Box 64854, St. Paul, MN been committed to service journalism for more than 55164-0854 or 1110 Centre Pointe Curve, Suite 101, 110 years. Today, Meredith uses multiple distribution Mendota Heights, MN 55120-4100, 800-468-9716 or Years Ended June 30 (In millions except per share data) platforms – including broadcast television, print, digital, 651-450-4064, email: [email protected] mobile, tablets and video – to provide consumers with content they desire and to deliver the messages of its DIVIDEND REINVESTMENT 2014 2013 2012 2011 GAAP Results 2015 advertising and marketing partners. Meredith Corporation ofers a dividend reinvestment Revenues $ 1,594 $ 1,469 $ 1,471 $ 1,377 $ 1,400 plan that automatically reinvests shareholder dividends ANNUAL MEETING for the purchase of additional shares of stock. To obtain Income from operations 242 187 211 186 225 Holders of Meredith Corporation stock are invited to more information or to join the plan, contact Wells Fargo Net earnings 137 114 124 104 127 attend the annual meeting of shareholders at 10 a.m. -

Epcot® International Food & Wine Festival

OCTOBER 1 - NOVEMBER 14, 2010 ® Welcome to the Annual Epcot International Food & Wine Festival. We’re so glad you’re here! In honor of this, our 15th milestone year, we’re celebrating the return of many of our festival favorites, along with brand new (and delicious) discoveries, including those from new Marketplaces like Belgium, Charcuterie & Cheese, and South Korea. Whether you’ve visited before or are here for the first time, you are in for a treat! There’s so much to explore and enjoy, including special taste seminars, book and bottle signings, meet-and-greets, beverage and culinary programs, and the Eat to the Beat concert series every evening at the America Gardens Theatre. There’s also a new “can’t miss” event – the “3D” Disney’s Dessert Discovery. During this dessert lover’s dream on select Thursday & Friday evenings, you’ll experience a variety of desserts, samplings of cordials, and the grand finale V.I.P. viewing of IllumiNations: Reflections of Earth. Give the folks back home a little “taste” of the festival by sharing a treasure from any of the shops and festival experiences around World Showcase. To help expedite your shopping or dining experience throughout the festival, be sure to purchase a festival-themed, wearable mini Disney Gift Card! In closing, a toast: Here’s to you and your entire festival experience of sights, smells, sounds, and tastes becoming one of the most enjoyable and memorable events of the year. Bon appétit! Dan Cockerell Vice President, Epcot® Table of Contents INTERNATIONAL MARKETPLACES . .2 SPECIAL FESTIVAL EXPERIENCES . -

FY18 Q4 Form 10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30, 2018 Commission file number 1-5128 MEREDITH CORPORATION (Exact name of registrant as specified in its charter) Iowa 42-0410230 (I.R.S. Employer Identification No.) (State or other jurisdiction of incorporation or organization) 50309-3023 1716 Locust Street, Des Moines, Iowa (Address of principal executive offices) (ZIP Code) Registrant’s telephone number, including area code: (515) 284-3000 Securities registered pursuant to Section 12(b) of the Act: Name of each exchange on which registered Title of each class Common Stock, par value $1 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: Title of class Class B Common Stock, par value $1 Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

Free Digital Samples

For personalized pricing contact WT Cox Information Services. All You Bead & Button Allure Better Homes & Gardens American Artist Better Homes & Gardens Wood American Girl Bicycling American History Billboard American Patchwork & Quilting Birds & Blooms Antique Trader Black Enterprise Archaeology Bloomberg BusinessWeek Architectural Digest BMX Plus Art in America Bon Appetit Arthritis Today Booklist Artist's Magazine, The Bookmarks Magazine ArtNews Boys Life Ask Magazine (Arts & Sciences for Kids) Calliope (Exploring World History) Astronomy Magazine Car & Driver Atlantic, The Cat Fancy Audubon Chickadee Aviation Week & Space Technology Chief: Civil Service Leader, The Babybug Christian Century Backpacker Christian Science Monitor Barrons Christianity Today Civil War Times Click Cobblestone (Discover American History) Coin World Commentary Conde Nast Traveler Consumer Reports Consumer Reports Money Adviser Consumer Reports on Health Cooking Light Cooking with Paula Deen Cooks Country Cooks Illustrated Cosmopolitan Free Digital Samples Cosmopolitan en Espanol (Mexico) Country Browse By Topic Country Gardens Magazine Country Living Try Unlimited Titles Country Sampler Free of Charge Country Woman Crafts n Things www.wtcox.com Creating Keepsakes: Scrapbook Magazine Cricket Crochet World Cuisine at Home Cycle World Details Call WT Cox For Any Title Not Listed at 1-800-571-9554 (Title information is subject to change per publisher discretion.) Diabetic Cooking Field & Stream Diabetic Living Fine Cooking Dig Fine Gardening Discover Fine Homebuilding -

Familyfun Magazine Families That Volunteer Together

For Immediate Release Melanie Scharler 212.633.5957 [email protected] FAMILYFUN MAGAZINE CELEBRATES FAMILIES THAT VOLUNTEER TOGETHER WITH THE THIRD ANNUAL FAMILYFUN VOLUNTEERS CONTEST -Winning Families Featured in the October Issue; Received $50,000 in Cash Grants for Charities of Choice- Northampton, MA, September 10, 2007 – Celebrating the difference that families can make in their community and around the world, FamilyFun magazine’s third annual FAMILYFUN VOLUNTEERS program honors families that volunteer together. In conjunction with parent company The Walt Disney Company (TWDC) and the Points of Light Foundation, FamilyFun magazine is offering cash grants totaling $50,000 to winning families for donation to charities of their choice. Disney will be donating $5,000 to the charity choices of the five grand-prize winning families and $1,000 to the chosen charity of each of the twenty-five first-prize families for a total of $50,000. The winners and the charities of their choice are featured in the October 2007 issue of FamilyFun magazine and at www.familyfun.com. “Today’s parents and grandparents are looking for ways to teach children the importance of giving back to their communities and those less fortunate,” notes Alexandra Kennedy, vice president and editorial director, FamilyFun magazine. ”We are proud to share thirty wonderful acts of volunteering taken on by FamilyFun readers across the country, and hope to inspire others to take action.” Families can apply for the fourth annual FamilyFun Volunteers Program online at FamilyFun.com (www.familyfun.com/volunteers). The Points of Light Foundation, a non-profit organization dedicated to promoting volunteerism, will assist FamilyFun’s editors in judging the entries. -

Investor Day February 14, 2012

Investor Day February 14, 2012 1 Safe Harbor This presentation and management’s public commentary contain certain forward-looking statements that are subject to risks and uncertainties. These statements are based on management’s current knowledge and estimates of factors affecting the Company’s operations. Statements in this presentation that are forward- looking include, but are not limited to, the statements regarding broadcast and publishing advertising revenues, as well as any guidance related to the Company’s financial performance. Actual results may differ materially from those currently anticipated. Factors that could adversely affect future results include, but are not limited to, downturns in national and/or local economies; a softening of the domestic advertising market; world, national, or local events that could disrupt broadcast television; increased consolidation among major advertisers or other events depressing the level of advertising spending; the unexpected loss or insolvency of one or more major clients; the integration of acquired businesses; changes in consumer reading, purchasing and/or television viewing patterns; increases in paper, postage, printing, or syndicated programming costs; changes in television network affiliation agreements; technological developments affecting products or the methods of distribution; changes in government regulations affecting the Company’s industries; unexpected changes in interest rates; and the consequences of any acquisitions and/or dispositions. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. 2 Today’s Agenda Meredith Vision Steve Lacy, Chairman and CEO National Media Group Growth Strategies Tom Harty, President Digital Growth Strategies Liz Schimel, Chief Digital Officer, National Media National Media Group Meredith Xcelerated Mktg. -

Magazines at WLA Updated As of 11/19/2010

Magazines at WLA Updated as of 11/19/2010 Note that Titles beginning with "The" are listed alphabetically under "T." Title AARP the magazine. Air & space Smithsonian. Allure. American artist. American craft. American girl. American heritage. American photo. American spirit. Antiques & collecting magazine. Archaeology's dig. Architectural digest. Art in America. ARTnews. Audubon Bead style. Better homes and gardens. Bicycling. Bloomberg Businessweek. Bon appetit. Bookmarks. Boys' life. Bride's / Car and driver. Cat fancy. Click. Coastal living. Cobblestone. Commentary. Conde Nast's traveler. Connecticut explored. Connecticut magazine. Connecticut muse. Connecticut student-athlete magazine. Consumer reports buying guide issue. Consumer reports. Cook's illustrated. Cooking light. Cosmopolitan. Cricket. Cross-stitch & needlework Dance magazine. Der Spiegel Digital photo. Discover. Disney adventures. Dog fancy E : the environmental magazine. Eating well. Ebony. Edible Nutmeg. Entertainment weekly. Entrepreneur : the small business authority. ESPN. Esquire. Everyday food. Faces. Fairfield County business journal. Familyfun. Fine cooking. Focus. Forbes. Foreign affairs. Fortune. Gamepro. Gardens illustrated. Girls' life. Glamour. Golf digest. Good housekeeping. GQ Granta. Harper's magazine. Harvard business review. Harvard health letter / Harvard women's health watch. Health. Highlights for children. Hog River journal. Horticulture. House beautiful. Inc. Junior baseball. Kids discover. Kiplinger's personal finance magazine. Knitters. Living without. Macworld : the Macintosh magazine. Mad. Martha Stewart living. Martha Stewart weddings Men's health. Money. More. Motor trend / Muse. National affairs. National geographic kids. National geographic traveler. National geographic. Natural history. New Canaan Darien & Rowayton / New moon New scientist. New York. Newsweek. O : the Oprah magazine. Odyssey. Opera news. Organic gardening. Orion. Out. Outdoor life. Outside. Parabola. -

How to Help with Homework: 7 Common Parent Questions from Familyfun.Com

How to help with Homework: 7 Common Parent Questions from FamilyFun.com As a parent, you may already be hearing these lines . I forgot I’m too busy You’re nagging me I want a reward I can’t find it It’s too hard I need books Here are some helpful reminders of what’s been valuable from other parents. 1. "I Forgot" How can I keep my child from forgetting (or "losing") the assignment? As any parent knows, many strange things can befall homework between school and home. Assignments may be left on the bus or copied from the blackboard in ancient Egyptian hieroglyphics. Your child may tell you she has no homework, then panic later in the evening as she remembers she has an essay on Abraham Lincoln due in the morning. What's needed? Constant parental vigilance. •Equip a forgetful child with a special notebook or folder for transporting homework between school and home. You might buy a cheap, lightweight cardboard folder with fasteners and pockets to which you can attach a plastic pouch filled with pens, pencils, and other supplies. Current assignments can go on top or in the front pocket. • Keep a class list with phone numbers and names in a prominent place. When a homework assignment is forgotten or misplaced, your child can telephone another student for it. • Enlist the teacher as your ally. Have your child write homework in a special notebook and have the teacher read it and sign off on it every day. • Work with the teacher to develop a contingency plan in case a key assignment disappears.