Annual Information Form for the Transition Year (Six Months) Ended December 31, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DRAFT L Catterton Notco Series C Press Release CLEAN (01225446

NotCo Closes $85 Million Series C Round and Announces U.S. Expansion The Leading Food-Tech Company in Latin America Announces the Closing of a Series C Round Co-Led by Future Positive and L Catterton, Joining Bezos Expeditions Among the Startup Investors CHILE – September 9, 2020 – Today, NotCo, a leading food-tech company in Latin America, is announcing the closing of an $85 million Series C investment round, co-led by Future Positive, the investment vehicle of Fred Blackford and Biz Stone, and L Catterton, the largest and most global consumer-focused private equity firm. NotCo is an industry pioneer built using a proprietary technology that can match animal protein to its ideal replacement among thousands of plant-based ingredients. NotCo is the only global company to launch products disrupting massive food and beverage segments, including dairy, eggs, and meat simultaneously. The company has launched NotMilk, NotBurger, NotIceCream, and NotMayo in Brazil, Argentina, and Chile, and in less than three years has become the largest and fastest-growing food-tech company in Latin America. The new funding comes as the company announces scaled up operations and marks plans for international expansion leading with an entry into the United States, a promising market for its portfolio of products of plant- based food that taste as delicious and cook just like animal-based products. The company will evaluate both food service and retail partners as part of this expansion, building on successful NotBurger and NotMeat partnerships with Burger King and Papa John’s in Chile. "We have the absolute best partners to embark with us on this journey: Fred Blackford from Future Positive joins us bringing a collaborative approach, experience with the plant-based food revolution, and a deep knowledge of the tech environment," says Matias Muchnick, co-founder and CEO of NotCo. -

How to Catch a Unicorn

How to Catch a Unicorn An exploration of the universe of tech companies with high market capitalisation Author: Jean Paul Simon Editor: Marc Bogdanowicz 2016 EUR 27822 EN How to Catch a Unicorn An exploration of the universe of tech companies with high market capitalisation This publication is a Technical report by the Joint Research Centre, the European Commission’s in-house science service. It aims to provide evidence-based scientific support to the European policy-making process. The scientific output expressed does not imply a policy position of the European Commission. Neither the European Commission nor any person acting on behalf of the Commission is responsible for the use which might be made of this publication. JRC Science Hub https://ec.europa.eu/jrc JRC100719 EUR 27822 EN ISBN 978-92-79-57601-0 (PDF) ISSN 1831-9424 (online) doi:10.2791/893975 (online) © European Union, 2016 Reproduction is authorised provided the source is acknowledged. All images © European Union 2016 How to cite: Jean Paul Simon (2016) ‘How to catch a unicorn. An exploration of the universe of tech companies with high market capitalisation’. Institute for Prospective Technological Studies. JRC Technical Report. EUR 27822 EN. doi:10.2791/893975 Table of Contents Preface .............................................................................................................. 2 Abstract ............................................................................................................. 3 Executive Summary .......................................................................................... -

Family Offices: Global Landscape and Key Trends

Family Offices: Global Landscape and Key Trends Final report 22/04/2020 Provide a macro overview of Family Offices and global trends within the industry Scope and objectives Offer key learnings from selected best in class family offices 1 Agenda A Overview of the family offices landscape B Global Trends for Single Family Offices C Key Learnings from selected SFOs 2 Agenda A Overview of the family offices landscape Global Trends for Single Family Offices Key Learnings from selected SFOs 3 Scope: We focus on single family offices, which represent 80% of total family offices Share of Single Family Offices in the family office space Four key areas to be covered in this 9% chapter 11% 1• General overview of global wealth 2• Background and history of family offices 80% 3• Dominant investment strategies 4• Overview of enablers (governance and operations) Single family offices Commercial multi family offices Private multi family offices Note: Based on 360 family offices participating in The UBS / Campden Wealth Global Family Office Survey 2019 4 Source: The Global Family Office Report, 2019, UBS and Campden Research 1 General overview of global wealth As of 2018, global wealth stood at around $206 trillion, with almost half of it in North America Wealth distribution across geographies, 2018, in $ trillions 90 $206 44 trillion 37 16 5 4 4 3 2 North Western Asia Japan Latin Oceania Middle Eastern Africa America Europe America East Europe and Central Asia 5 Source: The Global Family Office Report, 2019, UBS and Campden Research 2 Background and history -

US Venture Capital Market in 2013 January 2014 Page 1 of 2

US Venture Capital Market in 2013 January 2014 Page 1 of 2 Fig. 1: Number and Aggregate Value of US Venture Capital Deals Fig. 2: Number and Aggregate Value of US Venture Capital Exits Fig. 3: Breakdown of the Number of US Venture Capital Deals by by Year, 2007 - 2013* by Year, 2007 - 2013 State and Industry in 2013* 4,500 40 600 60 37.4 100% 10% 11% 8% 9% 10% Aggregate Deal Value ($bn) Aggregate Deal Value 51.4 16% 4,000 ($bn) Aggregate Exit Value 90% 35 3% 2% 4% 2% 2% 31.8 500 47.4 50 30.9 30.4 46.0 8% 12% 11% Other 3,500 30.1 80% 14% 16% 4% 30 9% 26.2 11% 11% 8% Business Services 3,000 400 38.1 40 70% 6% 25 11% 9% 21.8 32.3 2,500 60% Telecoms 23% 20% 25% 20 300 30 27% 560 543 50% Other IT 2,000 4,022 No. of Exits 23.5 27% No. of Deals 503 486 32% 3,494 3,508 15 5% 1,500 3,052 200 408 18.1 20 40% Software 2,800 2,766 2,613 353 13% 10 331 30% 29% 27% 1,000 Proportion of Deals 14% Healthcare 100 10 42% 14% 500 5 20% Internet 27% 10% 21% 0 0 0 0 16% 15% 17% 2007 2008 2009 2010 2011 2012 2013 2007 2008 2009 2010 2011 2012 2013 0% No. of Deals Aggregate Deal Value ($bn) No. of Exits Aggregate Exit Value ($bn) CA MA NY TX WA Other State Fig. -

Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 3/19/2018 – 3/23/2018 (Transactions in Excess of $20 Million)

Private Capital Group Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 3/19/2018 – 3/23/2018 (Transactions in excess of $20 million) Trends & Commentary ▪ This week, 15 U.S. private placement deals between $20 million and $50 million closed, accounting for $452 million in total proceeds, compared to last week’s 13 U.S. deals leading to $421 million in total U.S. Corporate VC Activity $ in Billions proceeds. This week also had 6 U.S. deals between $50 million and $100 million yielding $365 million, $50 compared to last week’s 5 deals resulting in $341 million in total proceeds. 1,379 ▪ U.S. corporate venture capital deal volume has grown over the past decade from $10.0 billion in 2008 to $45 1,283 1,268 $37.4 billion in 2017. The number of deals has increased as well, from 674 in 2008 to 1,268 in 2017. (see 1,231 $40 figure) ▪ Dropbox priced its IPO at $21 per share and traded up 40% on its opening to close at $28.48 a share. The $35 1,045 Company raised $756 million and had an initial market cap of more than $8.0 billion. Dropbox previously raised $350 million in Series C funding at a $9.7 billion pre-money valuation from BlackRock in 2014. $30 829 713 ▪ Zscaler, a provider of a global cloud security platform, priced its IPO last week at $27.50 per share, raising $25 674 $192 million. The Company had originally planned to sell 10 million shares between $10 and $12 a share. -

Gedi Book V4.Indd

Forget the Glass Ceiling: Build Your Business Without One Geri Stengel Copyright © 2014 by Geri Stengel All rights reserved. Dedication To my mother and the other mothers who inspire their daughters by showing the way. My mother, Mickey, went back to work before it was acceptable — in the ‘60s. First as a bookkeeper in my grandfather’s hardware, houseware and toy store. Then as the owner, when she and my father opened their own store. When I graduated from college, I opted for the corporate world instead of running the family business. My mother would be delighted that I have since started my own business. She would be even more pleased that my business gives me the opportunity to write about the successes of women entrepreneurs to inspire the next generation. Thank you, Dell, for the opportunity to write about 10 awe-inspiring women who didn’t need to break glass, because they’re building businesses without ceilings. Contents Foreword i Introduction 1 Erika Bliss 5 Mandy Cabot 8 Luan Cox 11 Liz Elting 14 Kara Goldin 17 Lili Hall 20 Paula Long 23 Kourtney Ratliff 26 Danae Ringelmann 29 Nina Vaca 32 Networks fuel business growth 35 Ingredients for creating more high-potential women entrepreneurs 43 Financing: It is the best of times, it is the worst of times 51 Crowdfunding: A game-changer for women entrepreneurs 62 Innovation and growth aren’t just for the technology companies 67 Challenges to high-potential entrepreneurship and how to 73 overcome them Setting the stage for high-potential women entrepreneurs 80 No one “has it all” but you can have a lot 84 What’s needed to increase the trajectory of women-led businesses? 89 “You’ve come a long way, baby” 93 Foreword | i Foreword by Jennifer Jones “JJ” Davis Entrepreneurship is a key driver of a country’s prosperity and competitiveness. -

The Future of Work Growthenabler Report 2020

Private & Confidential 2020 The Future of Work GrowthEnabler Report 2020 The growing adoption of digital technologies is fueling a new paradigm - Remote Working.The enormous power of data combined with AI in the workplace has created new business and economic models - On/Off balance sheet talent management. What changes could be in store for the workplace, the workforce, and the nature of work itself? CONFIDENTIAL AND PROPRIETARY This presentation, including any supporting materials, is owned by GrowthEnabler™ and/or its affiliates and is for the sole use of the intended GrowthEnabler™ audience or other intended recipients. This presentation may contain information that is confidential, proprietary or otherwise legally protected, and it may not be further copied, distributed or publicly displayed without the express written permission of GrowthEnabler™ or its affiliates. ©2020 GrowthEnabler™ and/or its affiliates. All rights reserved. Private & Confidential An AI-powered digital insights-engine & solution sourcing marketplace GrowthEnabler is an AI powered insights and solutions sourcing platform with strategic advisory arm that enables Global Enterprises to rapidly source digital solutions, and engage new and innovative vendors from the digital economy We create strategic insights on the digital economy and provide real-time analysis on over 500 thousand global digital vendors. Our clients rely on us to save them time and money using AI, to enhance their digital innovation and decision making capabilities. Partner, Invest and Procure. -

Read the Full Report

Summary This paper assesses the commercial viability of the Affordable, Robust, Compact (ARC) fusion reactor under development by Commonwealth Fusion Systems (CFS) via the scaled-down, experimental SPARC reactor. The assessment begins with an analysis of CFS’ history, investors, and goals. ARC’s innovative design is then evaluated using some notable critiques on the commercial and technological viability of fusion reactors as a guide on the necessary challenges to overcome. To provide situational awareness, the paper investigates other firms pursuing fusion. Indirect competitors in the broader renewable space are also analyzed to distill a necessary Levelized Cost of Energy (LCOE) that ARC must achieve to be competitive in the energy market of the 2030s and beyond. Combining the technological assessment with an understanding of the scalability factors that face ARC, the paper arrives at the conclusion that although CFS will likely achieve net positive energy production with the SPARC reactor by 2030, it is unlikely that ARC fusion reactors will be commercially viable before 2040. 1 “Many people in fusion get down from time to time because of the big problems they face, but the benefits are so huge that it is irresponsible not to try.” -Dr. Scott Hsu, ARPA-E Fusion Energy Program Director1 Introduction Nuclear fusion is a natural process which powers stellar cores by fusing the atomic nuclei of lighter elements into heavier ones, releasing massive amounts of thermal energy in the process. With the exception of antimatter-matter interactions, fusion is the most energy dense 2 physical interaction known to humanity. There are many types of fusion reactions, stellar cores can fuse every element up to iron before they collapse, but the most useful variants typically involve lighter atomic nuclei like hydrogen and helium. -

Tech Economics Organizations -- a Running List Organizations That Generate And/Or Analyze Large Volumes of Transactions and Records in Important Dimensions of U.S

Tech Economics Organizations -- A Running List Organizations that generate and/or analyze large volumes of transactions and records in important dimensions of U.S. economic activity Current as of: 8/16/2018 Sector Organization Description Corporate Finances Perfect Information Perfect Information provides a set of productivity tools which enable investment banks, corporate lawyers and other professional advisers involved in all aspects of corporate finance to operate efficiently and accurately. Perfect Information was set up in 1991 to provide workflow solutions and global financial information for the leading investment banks, corporate lawyers and other professional advisers involved in corporate finance worldwide. Right Networks Right Networks gets all your critical accounting and business applications into the cloud so your team can work from anywhere, making it that much easier to collaborate, onboard teammates, and even expand your business into new geographies. Consensus Metrix The most complete and detailed consensus estimates product in the market, with up to 100 operational and financial metrics for each covered company. Financial Services Cerulli Associates Cerulli Associates specializes in worldwide asset management and distribution analytics and guidance. Since 1992 we have blended original research and data analysis to bring perspective to current market conditions and forecasts for future developments. With a suite of research publications, an interactive data platform, and custom consulting services, we provide financial services firms with unparalleled guidance in strategic positioning and new business development. Beyond our Boston headquarters, we have fully staffed offices in London and Singapore. Our clients include virtually all of the top 50 global asset management firms, as well as banks, broker/dealers, insurance companies, consulting firms, and private equity firms. -

Biospace Is Delighted to Present Its Nextgen

By Mark Terry, BioSpace.com Breaking News Staff ioSpace is delighted to present its NextGen Bio “Class of 2015.” This list contains 30 life Bscience companies that were launched no earlier than in 2011 and are headquartered in the United States. Once the companies were sorted into that group, they were then weighted by a number of different categories and ranked in a cumulative fashion based on the points awarded each category. Those categories are: Finance, Collaborations, Pipeline, Sales and Editorial (view methodology). The NextGen Bio Class of 2015 is filled with a stellar group of companies that are making enormous impact on the industry now and in the future. Congratulations! “This recognition is testament to how hard we are working to bring transformative cancer therapies to market. Being named the most promising biopharma startup speaks to the milestones we have achieved in less than a year, including two funding rounds and significant progress in clinical development. It has been an exciting year, but we are even more excited about the progress still to come,” Hans Bishop, chief executive officer ofJuno Therapeutics, Inc., told BioSpace. Methodology: How We Ranked the “NextGen Bio Class of 2015” • Finance: One (1) point was awarded for each $10 million in seed financing or seed money that was raised. • Collaborations: Two (2) points were awarded if the company was a spinout from a well-known company or institution, had signed developmental or commercial agreements or partnerships. Two points for each collaboration. • Pipeline: Two (2) points were given if the company had a compound or device in an ongoing clinical trial. -

Greater Seattle Innovation Ecosystem Report

2018 GREATER SEATTLE INNOVATION ECOSYSTEM REPORT R. Joe Ottinger Iinnovate Leadership Network [email protected] Denis Trapido Faculty Coordinator Jessica Partnow and Ella Stefoglo University of Washington Bothell, School of Business 1 February 2019 2018 Seattle Technology Ecosystem Study Dear Readers, Now in our fourth year, the Puget Sound Innovation Ecosystem Report is published in conjunction with the University of Washington. The initial impetus for the report was to help entrepreneurs in the Puget Sound Region (Greater Seattle) understand the resources available to them as tech start-ups and scale-ups. Over time, we have expanded the report with the belief that a healthy innovation economy can improve companies, communities, and lives. We are happy to share our insights with you as we continue to explore building a healthy innovation economy. This 2018 report is our most ambitious to date, and includes the networks of investors, professionals, service providers and other resources supporting tech, health & life sciences, women in tech, commercial real estate, and Government elements of our Greater Seattle innovation ecosystem. A big thank you is due to the University of Washington Bothell, and the Greater Seattle innovation community of leaders, investors, service providers, and professionals for making this year’s report possible. We hope find it to be a valuable resource, and look forward to receiving your feedback at info@ innovatenetwork.com so we can improve future reports. Best wishes for a great 2019! R. Joe Ottinger CEO of Iinnovate Leadership Network P.S. Please Note that most everything that is underlined in the report is a Hyperlink to make it easier to contact the resources that could be helpful to you! 2018 Seattle Technology Ecosystem Study 2 ABOUT THE AUTHORS Iinnovate Leadership Network (pronounced “I innovate”) is an advisory firm and leadership network helping companies succeed in today’s innovation economy. -

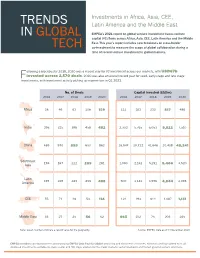

Trends in Global Tech

Investments in Africa, Asia, CEE, TRENDS Latin America and the Middle East IN GLOBAL EMPEA’s 2021 report on global venture investment traces venture capital (VC) flows across Africa, Asia, CEE, Latin America and the Middle East. This year’s report includes new breakouts on cross-border TECH co-investment to measure the scope of global collaboration during a time of record venture investment in global markets. ollowing a blockbuster 2019, 2020 was a record year for VC investment across our markets, with USD67b F invested across 2,570 deals. 2020 was also an overall record year for seed, early-stage and late stage investments, with investment activity picking up momentum in Q1 2021. No. of Deals Capital Invested (USDm) 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 Africa 28 46 63 108 159 111 163 232 817 486 India 298 315 398 458 482 2,332 5,765 6,053 9,822 7,510 China 489 570 899 630 862 15,547 29,722 41,646 20,438 48,241 Southeast 158 167 222 281 1,083 2,161 5,251 3,520 Asia 289 5,406 Latin 197 249 463 433 500 1,141 1,976 4,093 America 488 4,844 CEE 55 71 48 53 114 124 193 614 1,087 1,131 Middle East 33 27 25 56 52 663 102 75 203 245 Note: Green numbers indicate a record value for the geography. Source: EMPEA. Data as of 31 December 2020. Note: Green highlights contain a record high value for the geography.