Valuatum Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

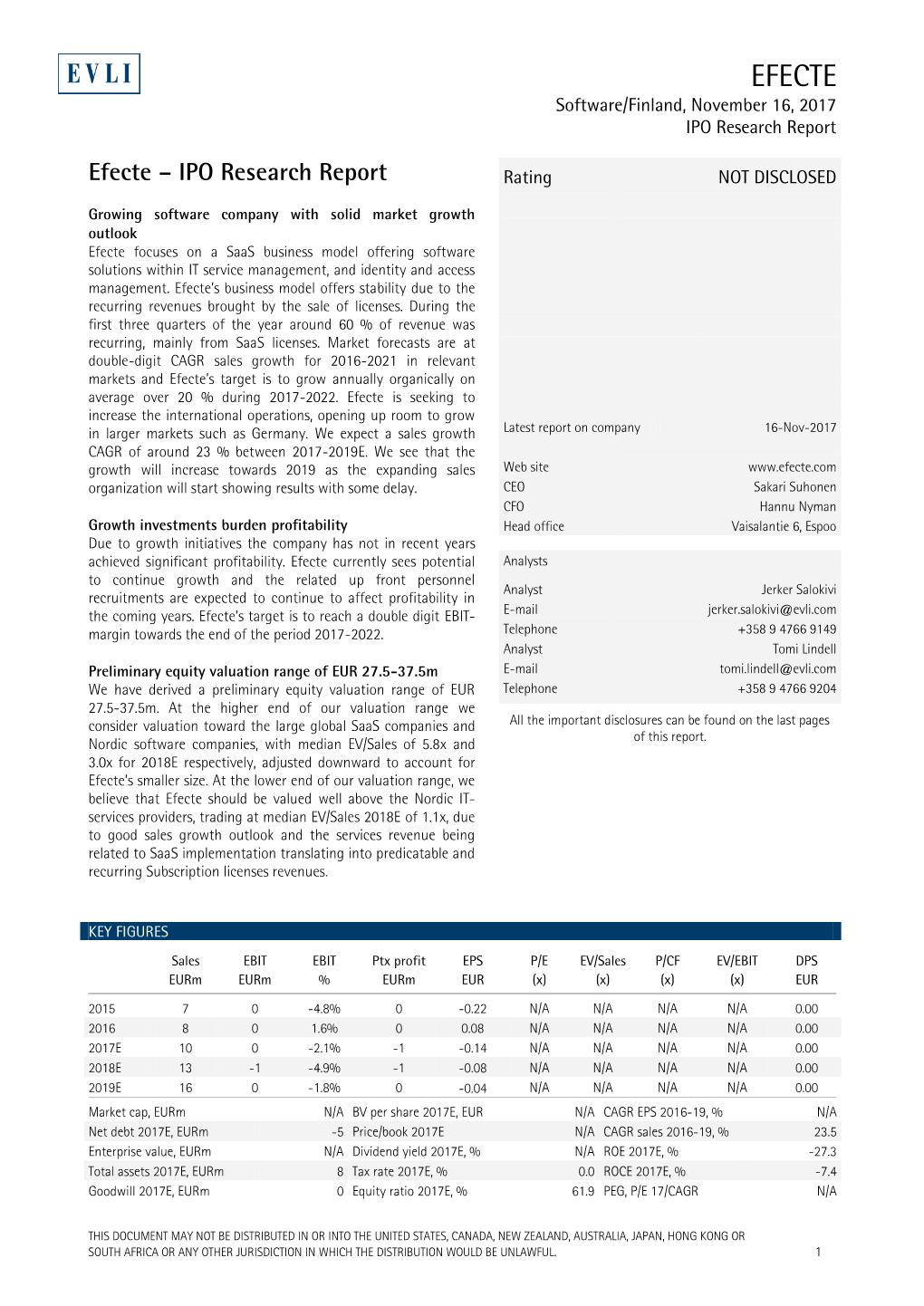

Recommended publications

-

Software As a Service (Saas) Report 2020

Software as a Service (SaaS) Report 2020 REDEYE - AI/MACHINE LEARNING 1 AGENDA 08:30 Introduction Redeye and summary of SaaS-report BLOCK 1 CRM/MARKETING 08:40 Younium 08:55 Lime 09:10 Agillic 09:25 Panel Q&A, Fredrik Nilsson and Johan Crona* BLOCK 2 ERP 09:40 24SevenOffice 09:55 Briox 10:10 Carasent 10:25 Panel Q&A, Mark Siöstedt and Johan Crona* BLOCK 3 RETAIL/E-COMMERCE 10:40 Bambuser 10:55 Litium 11:10 Vertiseit 11:25 ZetaDisplay 11:40 Panel Q&A, Forbes Goldman och Johan Crona* BLOCK 4 VARYING SAAS 11:55 Formpipe 12:10 BIMobject 12:25 Qbank 12:40 Irisity 12:55 Pexip 13:10 Panel Q&A, Fredrik Nilsson and Johan Crona* 13:30 Summary and thank you – Redeye *Johan Crona is the founder of Cloud Capital, a company specializing in financing SaaS companies in the size of SEK 10-50 million in sales. Cloud Capital was started to offer financing solutions so that SaaS entrepreneurs can retain more ownership in their company and avoid unnecessary dilution during a growth journey. He also runs a SaaS network with 700 members and since the summer of 2019 a SaaS podcast where he interviews entrepreneurs and experts in the sector. The video link to the SaaS-event: https://www.redeye.se/events/793615/redeye-software-as-a-service-saas-seminar-autumn-2020 REDEYE - SAAS REPORT 2020 2 SAAS REPORT 2020 Table of contents About Redeye 4 Redeye Technology Team 5 Transactions 8 Why invest in SaaS & the Cloud 10 The BIG one: The shift to the Cloud 11 Consumerization of IT 11 The rise of subscription economy 11 Investors and recurring revenue 11 Software Overview -

1 Financial Statements Bulletin 2018 Efecte

1 FINANCIAL STATEMENTS BULLETIN 2018 EFECTE PLC -- FINANCIAL STATEMENTS BULLETIN -- 7 MARCH 2019 at 14.00 Efecte Plc's Financial Statements Bulletin 2018 - SaaS grew by 24% - Order intake in Germany exceeded one million euro • Net sales grew by 15% to 12.2 million euro. (17% growth without perpetual licenses) • SaaS grew by 24% and was 47% of total net sales • Services grew by 20% and was 38% of total net sales • Investments into accelerating international growth decreased profitability, as anticipated. EBITDA was -2.0 million euro and operating profit -2.4 million euro • Growth accelerated in Germany toward year-end and order intake exceeded one million euro • Guidance: In 2019 SaaS net sales is expected to grow by over 20% and profitability to improve from the comparison period Group key figures 1000 EUR 7-12/2018 7-12/2018 2018 2017 Net sales 6 240 5 577 12 224 10 615 EBITDA -950 208 -1 988 305 EBITA -1 134 68 -2 339 41 Operating profit -1 143 -11 -2 382 -110 Profit for the period -1 163 -730 -2 419 -841 Profit for the period (adjusted for -1 163 -16 -2 419 -122 listing cost) Earnings per share, eur -0.20 -0.16 -0.42 -0.19 Adjusted earnings per share, eur -0.20 0.00 -0.42 -0.03 Equity per share, eur 0.59 1.02 0.59 1.02 SaaS MRR 523 425 523 425 CEO Niilo Fredrikson: In 1-12/2018 Efecte's net sales grew by 15% to 12.2 MEUR (10.6 MEUR in 2017). -

Efecte Plc: Notice to the Annual General Meeting

EFECTE PLC -- COMPANY ANNOUNCEMENT -- 8 March 2018 at 14.00 Efecte Plc: Notice to the Annual General Meeting Notice is given to the shareholders of Efecte Plc to the Annual General Meeting to be held on Thursday 5 April 2018 starting at 12:30 p.m. EET at Innopoli 2, seminar room Edison, at the address Tekniikantie 14, Espoo, Finland. The reception of persons who have registered for the meeting and the distribution of voting tickets will commence at 12:00 EET. A. MATTERS ON THE AGENDA OF THE ANNUAL GENERAL MEETING At the Annual General Meeting, the following matters will be considered: 1. Opening of the meeting 2. Calling the meeting to order 3. Election of persons to scrutinise the minutes and to supervise the counting of votes 4. Recording the legality of the meeting 5. Recording the attendance at the meeting and adoption of the list of votes 6. Presentation of the Annual Accounts, consolidated financial statements, the report of the Board of Directors and the Auditor’s Report for the year 2017 - Review by the CEO 7. Adoption of the Annual Accounts and the consolidated financial statements 8. Resolution on the use of the profit shown on the balance sheet and the payment of dividend The Board of Directors proposes to the Annual General Meeting that no dividend be distributed for the financial year that ended on 31 December 2017. 9. Resolution on the discharge of the members of the Board of Directors and the CEO from liability 10. Resolution on the remuneration of the members of the Board of Directors Efecte Plc’s shareholders who in total represent more than 40 % of all of Efecte Plc’s shares and votes have proposed that the members of the Board of Directors be paid the following fees for their term of office: the Chairman of the Board be paid EUR 3,000 per month and the other members of the Board of Directors be paid EUR 1,500 per month each. -

Efecte Company Report

Efecte Company report 3/10/2019 Inderes Corporate Customer Efecte company report 3/10/2019 08:30, translation published 23/12/2019 Successful internationalisation is the decisive factor Analysts We reiterate accumulate recommendation and target price of EUR 5.2 for Efecte. After the IPO, Efecte’s progress has remained weaker than expected as the acceleration of the growth of international operations has taken more time Petri Aho than estimated and the benefits from the considerable growth investments have not been at the expected level. +358 50 340 2986 However, with the new management and clarified strategy, the company’s development is stabilising, and our [email protected] opinion is that the valuation of the share is moderate considering the strong growth outlook of the SaaS business. Efecte’s software solutions are used to develop and digitalise the services of organisations Efecte’s software solutions help organisations manage, measure, develop and automate, for example, enterprise services provided by IT, finance and HR. In the 2010s, the company has successfully transformed to adopt the SaaS business model and it has commercialised and verified the functioning of its technology to good effect in the market Recommendation and target price for large and medium-sized companies in Finland, all of which is reflected in its leading market position in Finland and a 20% average growth of revenue since 2012. With the IPO that took place towards the end of 2017, the company Accumulate entered a new strategic phase, the objective of which is to increase the company’s business significantly in the (previously Accumulate) Central Europe and Scandinavian markets and to utilise the value creation potential of the scalable SaaS model. -

The Finnish Financial Supervisory Authority Has Approved Efecte Plc's Finnish Language Prospectus

PRESS RELEASE 24 November 2017 at 18.00 The Finnish Financial Supervisory Authority has approved Efecte Plc’s Finnish language prospectus The Finnish Financial Supervisory Authority has today approved Efecte Plc’s (“Efecte” or the “Company”) Finnish language prospectus. The prospectus relates to the Company’s contemplated listing on the First North Finland marketplace operated by Nasdaq Helsinki Ltd and the related initial public offering (“IPO”). The prospectus is available as an electronic document on Efecte's website at www.efecte.com/listautuminen and on Evli Bank Plc’s website at www.evli.com/efecte. The prospectus will also be available as a printed version on or about 27 November 2017 at Efecte's headquarters at the address Vaisalantie 6, 02130 Espoo, Finland, from Evli Bank Plc’s office at the address Aleksanterinkatu 19 A, 4th floor, 00100 Helsinki, Finland, and from the service desk of Nasdaq Helsinki Ltd at the address Fabianinkatu 14, 00100 Helsinki, Finland. The terms and conditions of the IPO are appended to this release in their entirety. The subscription period of the IPO will commence on 27 November 2017. Further enquiries: Sakari Suhonen CEO Efecte Plc [email protected] +358 50 384 3576 Hannu Nyman CFO Efecte Plc [email protected] +358 50 306 9913 Efecte Plc Efecte is a Finnish software company that provides cloud-based service and identity management software solutions, as well as related consultancy services. They simplify and improve the efficiency of managing the services, IT systems and infrastructure in an organization. Measured by number of customers, Efecte is one of the leading software vendors in its field to large, medium- sized and public organizations in Finland and the Nordic countries. -

Ey-Finland-Transparency-Report-2020

Message from the Country Managing Partner and the EY Finland Welcome to the Transparency Report 2020 of EY Finland. We believe that how we advance sustainable audit quality, manage risk and maintain our independence, Assurance Leader as auditors should be transparent to our stakeholders. We value regular dialogue, and this report is one of the ways in which we update our stakeholders on what we are doing in each of these areas. Executing high-quality audits continues to be our top priority and is at the heart of our commitment to serve the public interest. It enables us to grow the global EY network successfully and responsibly, while achieving our purpose of building a better working world. Auditors play a vital role in the functioning of capital markets by promoting transparency and supporting investor confidence. Companies, regulators and other stakeholders count on us to deliver excellence in every engagement. We are focused on investing in tools to improve what we do, creating the highest- performing teams, and building trust and confidence through the audits we perform. EY Finland’s reputation is based on and grounded in providing high-quality professional audit services objectively and ethically to every company we audit. We embrace the transparency objectives of the European Union’s Regulation 537/2014 and the EU audit regulation and the Finnish Auditing Legislation, which require Finnish statutory auditors of public interest entities (PIEs) to publish annual transparency reports. TheEY Finland Transparency Report 2020 complies with the Regulation and the Finnish Auditing Legislation, and covers the fiscal year ending 30 June 2020 and any more recent relevant events. -

F-Secure ANNUAL REPORT 2018

F-SECURE ANNUAL REPORT 2018 CONTENTS F-SECURE 2018 Key figures . 01 Why invest in F-Secure? . 02 Products and services . .03. Nobody knows cyber security like F-Secure. For three decades, CEO letter . 04 F-Secure has driven innovations in cyber security, defending over BOARD OF DIRECTORS’ REPORT 100,000 companies and millions of people. With unsurpassed Board of Directors’ Report . .06 experience in endpoint protection as well as detection and Key figures . 13 response, F-Secure shields enterprises and consumers against Calculation of key ratios . 14. everything from advanced cyber attacks and data breaches to widespread ransomware infections. FINANCIAL STATEMENTS F-SECURE CONSOLIDATED . 16 Statement of comprehensive income . 16 Statement of financial position . 17 Statement of cash flows . 18 WE ARE Statement of changes in equity . 19 Notes to the Financial Statements . 20 F-SECURE CORPORATION . 41 F-SECURE Income statement . 41. Balance sheet . 42 Cash flow statement . 43 F-Secure’s sophisticated technology combines the power of Notes to the machine learning with the human expertise of its world-renowned parent company Financial Statements . 44 security labs. F-Secure’s security experts perform incident Auditor’s Report . 55 response and forensic investigations on four continents, and its products are sold all over the world by around 200 broadband and NON-FINANCIAL INFORMATION mobile operators and thousands of resellers. Statement of non-financial information . 59 CORPORATE GOVERNANCE Founded in 1988, F-Secure is listed on the Nasdaq Helsinki. F-Secure’s Corporate Governance Statement . 67 Board of directors . 71 Leadership team . 73 Remuneration statement . 76. INFORMATION FOR SHAREHOLDERS Information for shareholders . -

Efecte Plc Launches Initial Public Offering on First North and Plans to Apply for Admittance of Its Shares to Trading on the First North Marketplace

PRESS RELEASE 24 November 2017 at 10:30 Efecte Plc launches initial public offering on First North and plans to apply for admittance of its shares to trading on the First North marketplace NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, NEW ZEALAND, AUSTRALIA, HONG KONG, SOUTH AFRICA, SINGAPORE OR JAPAN OR ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL. On 15 November 2017, Efecte Plc (“Efecte” or the “Company”) announced that it is planning a listing on the First North Finland marketplace (“First North”) operated by Nasdaq Helsinki Ltd. The Company’s board of directors has today made a preliminary decision concerning the issuance of a maximum of 1,035,000 new shares (“New Shares”) in the Company by offering New Shares for subscription in an institutional offering, a public offering and a personnel offering (“Share Issue”). In addition, some of the Company’s current shareholders are offering a maximum of 1,027,623 shares in the Company for purchase (“Sale Shares”, and together with the New Shares the “Offer Shares”) (together with the Share Issue the “IPO”). The subscription price in the institutional offering and the public offering is EUR 5.50 per Offer Share (“Subscription Price”). The subscription price in the personnel offering is 10% lower than the Subscription Price, i.e. EUR 4.95 per Offer Share. Preliminarily, a maximum of 2 062 623 shares in the Company are being offered in the Share Issue and in the Share Sale. Provided that the IPO is realised in full, the size of the IPO is thus approximately MEUR 11.3, consisting of the Share Issue of MEUR 5.7 and the Share Sale of MEUR 5.7. -

F-Secure Corporation Annual General Meeting

PROPOSED BOARD MEMBERS FOR 2017-2018 F-Secure Corporation Annual General Meeting Proposed Board members for 2017-2018 Pertti Ervi Currently Chairman of the Audit Committee Born 1957 Pertti Ervi is a management consultant and serves in board of directors in several companies. He has served on the Board of F-Secure since 2003 and is the Chairman of the Audit Committee. Mr Ervi is a Chairman of the Boards of Efecte Oy and Comptel Corporation. He is also a member of the Board of Teleste Corporation. Mr Ervi co- founded Computer 2000 Finland Oy and served as a MD for the company until 1995. After that he worked as Co-President for Computer 2000 AG international headquarters in Munich, Germany. He has worked closely at international management level with major IT vendors such as Cisco, IBM, Intel, HP and Microsoft. Mr Ervi holds a B.Sc/Electronics degree from Tekniska Läroverket (Swedish Institute of Technology) in Helsinki. He has also completed several financial and management studies. Matti Heikkonen Currently Member of the Board Born 1976 Matti Heikkonen has served as a member of the Board of F‑Secure since 2013. He is an associate and COO of Questback AS. Previously he has served as entrepreneur and CEO of Digium Oy, Head of Nokia- Cisco Systems global alliance, 2004-2007, entrepreneur of Triple Check Oy, 2002-2004, associate and business unit manager of Done Solutions Oyj, 2000-2002 and entrepreneur of Identia Oy, 1998-2000. He is the Chairman of the Board of Directors of Finnish Software Entrepreneurs Association and a board member in Mobile Wellness MWS Oy. -

Financial Review 2019

FINANCIAL REVIEW 2019 Financial Review 2019 ALMA MEDIA CORPORATION FINANCIAL REVIEW 2019 2 CONTENT REPORT BY THE BOARD OF DIRECTORS CORPORATE GOVERNANCE STATEMENT Report by the Board of Directors. .....................................................3 Corporate Governance Statement of Alma Media Corporation ����������������������������������������� 105 Key figures describing economic development. .....................................28 Alma Media Group ������������������������������������������������������������������������������������������������������������������������������������� 106 Calculation of key figures ............................................................ 31 Board of Directors of Alma Media Corporation ����������������������������������������������������������������������������107 The Shareholders’ Nomination Committee . .114 CONSOLIDATED FINANCIAL STATEMENTS President & CEO and Group Executive Team of Alma Media Corporation ���������������������115 Consolidated comprehensive income statement ....................................32 Insider Management ���������������������������������������������������������������������������������������������������������������������������������119 Consolidated balance sheet .........................................................33 Internal control and risk management systems in financial reporting . 120 Consolidated cash flow statement ...................................................34 Auditing . 122 Consolidated statement of changes in equity .......................................36 -

Year 2011 1 YEAR 20 11

Enabling Digital Evolution Year 2011 1 YEAR 2011 CONTENT TELESTE BUSINESS AREAS Year 2011 in brief 1 Business areas in brief 10 Teleste in brief 2 Video and Broadband Solutions 12 CEO´s letter 4 Network Services 16 Research and Technology Development 6 Customer Projects 18 Strategy 8 RESPONSIBILITY Personnel 22 Social Responsibility and Sustainable Development 24 MANAGEMENT Board of Directors 28 Management Group 30 Information for Shareholders 32 Enabling Digital Evolution Digital networks allow households to enjoy better image quality, a wider provision of services to a range of terminal equipment, interactivity, and higher data rates. Similarly, video surveillance systems are increasingly moving towards fully digital network technology and more advanced au- tomatic control applications. Digitization of services and networks began already in the late 1990s and is still continuing strong. It is progressing deeper into the network infrastructure and, simultaneously, spreading wider geographically; in Teleste’s main market areas in Europe, digitiza- tion will still continue strong for many years and elsewhere in the world in many places it is only just beginning. Teleste contributes to this digitization of networks by providing its customers with both equipment and services. We can either make available complete product solutions or develop them together with our customers to make them better meet the changing demand. This, combined with our strong offering of network design and maintenance services, allows us to offer our unique overall expertise in the promotion of digital expansion among our operator customers. Year 2011 in Brief TELESTE MANAGED to exceed the FUTURE YEARS for Teleste set growth target while significantly appears equally bright. -

Ipo Underpricing in the Helsinki Stock Exchange

TALLINN UNIVERSITY OF TECHNOLOGY School of Business and Governance Department of Economics and Finance Stella Mylläri IPO UNDERPRICING IN THE HELSINKI STOCK EXCHANGE - AN EMPIRICAL STUDY OF IPOs DURING 2013-2018 Bachelor’s thesis Programme International Business Administration, specialisation Finance and Accounting Supervisor: Karin Jõeveer, PhD Tallinn 2018 I hereby declare that I have compiled the paper independently and all works, important standpoints and data by other authors has been properly referenced and the same paper has not been previously presented for grading. The document length is 8,384 words from the introduction to the end of conclusion. Stella Mylläri …………………………… (signature, date) Student code: 166310TVTB Student e-mail address: [email protected] Supervisor: Karin Jõeveer, PhD: The paper conforms to requirements in force …………………………………………… (signature, date) Chairman of the Defence Committee: Permitted to the defence ………………………………… (name, signature, date) ABSTRACT This thesis presents the dynamic phenomenon of IPO underpricing by examining 38 initial public offerings that took place in the Helsinki Stock Exchange (HSE) between January 2013 and November 2018. Empirical findings of IPO underpricing is presented, supported by company specific reasoning and regression analyses. Three hypotheses are presented in respect to the regression analyses, therein the EBITDA multiple, the offering size and the percentage of primary shares issued. Additionally, prior art and prominent literature is conferred. It was found that investors who chose to invest in IPOs during the sample period were “rewarded” by underpricing with a median of 2.97%. Factors that resulted a higher underpricing included the listing venue and the company’s dominant industry. Hypotheses regarding the offering size, EBITDA multiple and the percentage of primary shares were testified true and so not having an effect on underpricing.