There's More Energy in The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Do Crude Oil Prices Drive the Relationship Between Stock Markets of Oil-Importing and Oil-Exporting Countries?

economies Article Do Crude Oil Prices Drive the Relationship between Stock Markets of Oil-Importing and Oil-Exporting Countries? Manel Youssef 1 and Khaled Mokni 1,2,* 1 Department of Statistics and Quantitative methods, College of Business Administration, Northern Border University, Arar 91431, P.O. Box 1321, Kingdom of Saudi Arabia 2 Department of Quantitative methods, Institut Supérieur de Gestion de Gabès, University of Gabès, Street Jilani Habib, Gabès 6002, Tunisia * Correspondence: [email protected] or [email protected]; Tel.: +966-553-981-566 Received: 12 March 2019; Accepted: 13 May 2019; Published: 10 July 2019 Abstract: The impact that oil market shocks have on stock markets of oil-related economies has several implications for both domestic and foreign investors. Thus, we investigate the role of the oil market in deriving the dynamic linkage between stock markets of oil-exporting and oil-importing countries. We employed a DCC-FIGARCH model to assess the dynamic relationship between these markets over the period between 2000 and 2018. Our findings report the following regularities: First, the oil-stock markets’ relationship and that between oil-importing and oil-exporting countries’ stock markets themselves is time-varying. Moreover, we note that the response of stock market returns to oil price changes in oil-importing countries changes is more pronounced than for oil-exporting countries during periods of turmoil. Second, the oil-stock dynamic correlations tend to change as a result of the origin of oil prices shocks stemming from the period of global turmoil or changes in the global business cycle. Third, oil prices significantly drive the relationship between oil-importing and oil-exporting countries’ stock markets in both high and low oil-stock correlation regimes. -

Trading Fee Guide for Derivatives Market Members Issue Date: 12 July 2021

EURONEXT DERIVATIVES MARKETS TRADING FEE GUIDE FOR DERIVATIVES MARKET MEMBERS ISSUE DATE: 12 JULY 2021 EFFECTIVE DATE: 01 AUGUST 2021 INTERNAL USE ONLY TRADING FEE GUIDE FOR EURONEXT DERIVATIVES MARKET MEMBERS CONTENTS 1. INTRODUCTION ............................................................................................................................ 3 1.1 Standard Fees and Charges .................................................................................................................... 3 1.2 Clearing Fees and Charges ..................................................................................................................... 3 1.3 Wholesale trade facility ......................................................................................................................... 3 1.4 Maximum fee ......................................................................................................................................... 3 2. COMMODITY AND CURRENCY DERIVATIVES .................................................................................. 4 2.1 Commodity Futures and Options Contracts .......................................................................................... 4 2.2 Ceres incentive programme on Paris Commodity Contracts ................................................................. 5 2.3 Commodity Option strategy fee ............................................................................................................ 5 2.4 Artemis liquidity provider fee rebate.................................................................................................... -

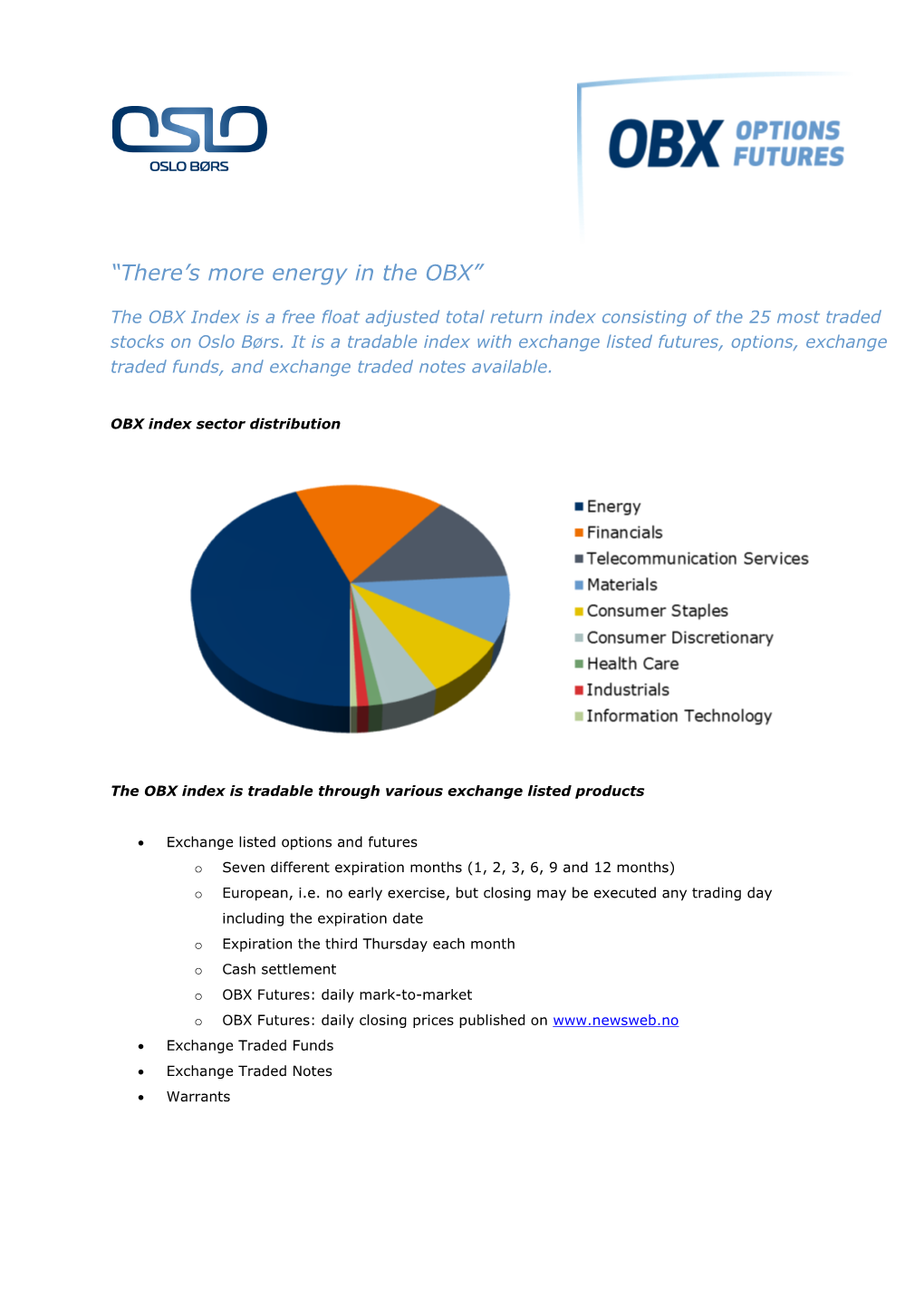

OBX Index Is a Tradable Index with Exchange Traded Futures and Options Available

OBXP Factsheet 1/3 OBX® Objective The OBX® Index consists of the 25 most traded securities on Oslo Børs, based on six months turnover rating. OBX is a semi-annually revised free float adjusted total return index (dividend adjusted) with composition changes and capping implemented after the market close of the third Friday of March and September. The index is capped to comply with UCITS III, and the total weighting of non- EEA companies is limited to a maximum of 10%. In the period between the composition review dates the number of shares for each constituent is fixed, with the exception of special capping and continuous adjustments for various corporate actions. The OBX Index is a tradable index with exchange traded futures and options available. The index serves as an underlying for structured products, funds, exchange traded funds and futures. Investability Stocks are screened to ensure liquidity and selected and free float weighted to ensure that the index is investable. Transparency The index rules are available on our website. All our rulebooks can be found on the following webpage: https://live.euronext.com/en/products-indices/index-rules. Statistics Mar-21 Market Capitalization EUR Bil OBXPerformance (%) Fundamentals Full 225,9 Q1 2021 9,62% P/E Incl. Neg LTM 2,45 Free float 122,3 YTD 9,62% P/E Incl. Neg FY1 1,91 % Oslo Bors All-share Index GI 7,5% 2020 1,84% P/E excl. Neg LTM 3,16 2019 14,06% P/E excl. Neg FY1 2,19 Components (full) EUR Bil 2018 -0,46% Price/Book 3,48 Average 9,04 Price/Sales 5,04 Median 4,85 Annualized (%) Price/Cash Flow - Largest 54,32 2 Year 8,94% Dividend Yield (%) 2,65% Smallest 0,71 3 Years 8,55% 5 Years 12,74% Risk Component Weights (%) Since Base Date 02-Jan-1987 -0,18% Sharpe Ratio 1 Year not calc. -

Performance of Option Trading Strategies Evidence for Individual Stocks and the OBX During 2005- 2015

Daniel Sand and Markus Borchgrevink-Persen ________________________________ Performance of Option Trading Strategies Evidence for Individual Stocks and the OBX During 2005- 2015 Masteroppgave i økonomi og administrasjon Handelshøyskolen ved HiOA 2017 1 ABSTRACT In this paper, we examine risk and return characteristics of some of the more popular option trading strategies such as: Covered calls, Covered combinations, Protective puts, Straddles, Strangles and Butterfly spreads. Long stocks are included as a benchmark. We contribute to a growing part of the literature that examines in detail risk and return characteristics of well- known trading strategies; see Eckbo and Ødegård (2015). We also contribute to Hemler and Miller (2015) by investigating a different market and a different time period. Our sample includes the largest stocks on the OSE together with the corresponding options. As implied volatility has been highlighted in prior literature as an important aspect of trading options, we have included this as a signal for a trading rule used for the last 3 of the said strategies. The results are presented in terms of risk-adjusted performance measures, namely: Sharpe ratio, Jensen’s alpha and Information ratio. We find that the Covered call is the only strategy the generally outperform the long stock strategy, which in turn outperform the rest of the 5 strategies, and that implied volatility fails to signal the strategies into outperforming the others. SAMMENDRAG Denne oppgaven evaluerer prestasjonen til noen av de mer populære opsjonsstrategiene ved hjelp av risikojustert avkastning. Nærmere bestemt - Covered calls, Covered combinations, Protective puts, Straddles, Strangles og Butterfly spreads. “Kjøp og hold” av aksjer er inkludert som en referanseportefølje. -

Contents Financial Calender

Financial calender 1996 13 May Annual General Meeting 1995 15 May 1. quarter 1996 22 August 2. quarter 1996 6 November 3. quarter 1996 medio March 1997 Annual results 1996 Contents This is UNI Storebrand 2 Key Figures 3 Report of the Board of Directors 1995 4 Profit and loss account and balance sheet of UNI Storebrand Group and UNI Storebrand ASA 8 Auditor’s report 12 From strategy to implementation 13 Business Areas 16 Interplay for welfare 22 Improvements in personal injury settlement 24 UNI Storebrand Group Analytical information 26 UNI Storebrand Life Insurance 27 UNI Storebrand Non-life Insurance 36 Shareholder matters 44 Terms and expressions 48 Directors and Officers 50 Notes UNI Storebrand 51 Contents Cashflow analysis 86 Reconciliation of differences in the income and equity between N GAAP and US GAAP 87 Companies in UNI Storebrand at 31.12.1995 91 Addresses 92 1 This is UNI Storebrand UNI Storebrand is Norway’s largest Key figures: insurance company in both life and Customers non-life insurance. The company ser- Non-life insurance: 1,000,000 ves around 40% of the Norwegian non- Life and pension insurance: 345,000 life insurance market and around 30% Man-years: 4,042 of the life insurance market. UNI Offices: 260 Storebrand is Norway’s largest mana- Shareholders: 77,872 ger of private savings in the securities Shares: 376,418,702 market. Customer base in non-life insurance: Snowmelting led to flood in The business • 896,000 individual customers the river Glomma May/June The insurance activities are organized • 110,000 business customers 1995. -

Efficient Market Hypothesis and Calendar Effects: Evidence from the Oslo Stock Exchange

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by NORA - Norwegian Open Research Archives Efficient Market Hypothesis and Calendar Effects: Evidence from the Oslo Stock Exchange Evgenia Yavrumyan Master of Philosophy in Economics Department of Economics University of Oslo May 2015 II Efficient Market Hypothesis and Calendar Effects: Evidence from the Oslo Stock Exchange III © Evgenia Yavrumyan 2015 Efficient Market Hypothesis and Calendar Effects: Evidence from the Oslo Stock Exchange Evgenia Yavrumyan http://www.duo.uio.no/ Trykk: Reprosentralen, Universitetet i Oslo IV Summary Stock market efficiency is an essential property of the market. It implies that rational, profit-maximazing investors are not able to consistently outperform the market since prices of stocks in the market are fair, that is, there are no undervalued stocks in the market. Market efficiency is divided into three forms: weak, semi-strong and strong. Weak form of market efficiency implies that technical analysis, utilizing historical data, cannot be used to predict future price movements, since all the historical information is impounded into the stock prices and price changes are random. Semi-strong form of market efficiency states that fundamental analysis does not create opportunity to earn abnormal returns, since all publicly available information is reflected in the stock prices. In market efficiency in its strong form, the price on stock reflects all the relevant information and knowledge of insider information will not create opportunity to earn abnormal returns. In practice, to have a perfectly efficient market is almost impossible. Investors do not always behave rationally, stocks can be priced «wrongly» due to presence of anomaly in price formation process or there can emerge a predictable pattern in stock price changes. -

Master (8.509Mb)

FACULTY OF SCIENCE AND TECHNOLOGY MASTER’S THESIS Study programme/specialization: Spring semester, 2019 Industrial Economics – Risk management Open Author: Torstein Magnussen ………………………………………… Bendik Horvei Skeide (signatur forfatter) Programme coordinator: Harald Haukås Supervisors: Harald Haukås Title of master’s thesis: The impact of changes in Brent oil price on OBX and other major Norwegian indexes and Brent’s impact on the USD/NOK pair. Credits: 30 Keywords: Oslo, Benchmark, Index, Stocks, Oil price, Number of pages: 67 + 7 Brent, USD/NOK, OBX Stavanger, 09.06.2019 i (blank page) ii The impact of changes in Brent oil price on OBX and other major Norwegian indexes and Brent’s impact on the USD/NOK pair. Master’s Thesis by Torstein Magnussen and Bendik Horvei Skeide Spring 2019 University of Stavanger The Faculty of Science and Technology Department of Industrial Economics iii (blank page) iv Abstract Norway is known for its oil and gas dominated industry and oil price dependency. Oil is also one of the most important commodities in the world and is often referred to as the lifeblood of the world economy. This has been a motivator for this thesis to investigate how the Norwegian stock market is affected by the world and the oil price movements. The method chosen to test this is a multiple regression analysis. OBX is used as the dependant variable and β1=Brent, β2=S&P 500 and β3=USD/NOK as independent variables. S&P 500 is added as a variable that to some degree accounts for the global stock market and USD/NOK was added to test for changes in NOK. -

Price, Volume and Liquidity Fluctuations Around OBX Revisions

Per Olav Collin Price, Volume and Liquidity Fluctuations Around OBX Revisions Evidence of Temporary Price Pressures and Index Effect Asymmetry Master’s thesis in Financial Economics Supervisor: Snorre Lindset Trondheim, June 2018 Norwegian University of Science and Technology Faculty of Economics and Management Department of Economics Preface This thesis concludes the two-year masters program in Financial Economics at the Norwegian University of Science and Technology (NTNU). My curiosity regarding index effects was awakened during the Norwegian Finance Initiative’s Summer School of 2017, where the topic was first introduced to me. It has since been an inspiring maneuver analyzing the phenomenon in further detail. I would like to thank my supervisor, Professor Snorre Lindset at the Department of Economics, for support and critique throughout the process. I would also like to thank my wife, Rut Kristine, for her tireless and never-ending encouragement, for which I am grateful. The results and analyses are entirely my own, and I take full responsibility of all content. Trondheim, May 2018 Per Olav Collin i ii Abstract This thesis seeks to isolate potential price, volume, and liquidity effects of revisions to the Oslo Børs Total Return Index (OBX). The research question is investigated using traditional event study methods. The market model is used to calculate normalized returns, whereas abnormal volume turnover is assessed using market-adjusted volume ratios. Additionally, bid- ask spreads are used to determine liquidity effects around index revisions. Through a comprehensive analysis of historical additions to and deletions from the OBX, findings point to significant temporary abnormal price pressures, most likely caused by index fund rebalancing, around the semi-annual revisions of the index. -

Euronext Financial Derivatives Markets Fees LCH SA - Effective from 6 May 2021

Euronext financial derivatives markets fees LCH SA - Effective from 6 May 2021 CONTENTS Clearing fees.................................................................................................. 3 Amsterdam clearing segment: “Dutch” products ..................................................... 3 Amsterdam clearing segment: others products ....................................................... 4 Brussels clearing segment ....................................................................................... 4 Lisbon clearing segment .......................................................................................... 5 Oslo clearing segment ............................................................................................. 5 Paris clearing segment ............................................................................................ 6 Exercise (Tender) / Assignment, Cash Settlement and Delivery fees ............. 7 Amsterdam clearing segment: “Dutch” products ..................................................... 8 Amsterdam clearing segment: others products ....................................................... 9 Brussels clearing segment ....................................................................................... 9 Lisbon clearing segment ........................................................................................ 10 Oslo clearing segment ........................................................................................... 10 Paris clearing segment ......................................................................................... -

Statistics Dec-20 Market Capitalization EUR Bil Obxperformance (%) Fundamentals Full 1130,6 Q4 2020 15,12% P/E Incl

OBXP Factsheet 1/3 OBX® Objective The OBX® Index consists of the 25 most traded securities on Oslo Børs, based on six months turnover rating. OBX is a semi- annually revised free float adjusted total return index (dividend adjusted) with composition changes and capping implemented after the market close of the third Friday of March and September. The index is capped to comply with UCITS III, and the total weighting of non-EEA companies is limited to a maximum of 10%. In the period between the composition review dates the number of shares for each constituent is fixed, with the exception of special capping and continuous adjustments for various corporate actions. The OBX Index is a tradable index with exchange traded futures and options available. Investability Stocks are screened to ensure liquidity and selected and free float weighted to ensure that the index is investable. Transparency The index rules are available on our website. All our rulebooks can be found on the following webpage: https://live.euronext.com/en/products-indices/index-rules. Statistics Dec-20 Market Capitalization EUR Bil OBXPerformance (%) Fundamentals Full 1130,6 Q4 2020 15,12% P/E Incl. Neg LTM 2,98 Free float 1130,6 YTD 1,84% P/E Incl. Neg FY1 3,27 % Oslo Bors All-share Index GI 41,5% 2019 14,06% P/E excl. Neg LTM 4,27 2018 -0,46% P/E excl. Neg FY1 4,09 Components (full) EUR Bil 2017 20,24% Price/Book 3,37 Average 7,55 Price/Sales 3,11 Median 3,96 Annualized (%) Price/Cash Flow 1,10 Largest 44,97 2 Year 7,77% Dividend Yield (%) 2,23% Smallest 0,64 3 Years 4,96% 5 Years 9,77% Risk Component Weights (%) Since Base Date 05-Jan-1987 6,53% Sharpe Ratio 1 Year not calc. -

Margin Exceedences for European Stock Index Futures Using Extreme Value Theory

Munich Personal RePEc Archive Margin Exceedences for European Stock Index Futures using Extreme Value Theory Cotter, John University College Dublin 2000 Online at https://mpra.ub.uni-muenchen.de/3534/ MPRA Paper No. 3534, posted 13 Jun 2007 UTC Margin Exceedences for European Stock Index Futures using Extreme Value Theory JOHN COTTER1 University College Dublin Abstract Futures exchanges require a margin requirement that ensures their competitiveness and protects against default risk. This paper applies extreme value theory in computing unconditional optimal margin levels for a selection of stock index futures traded on European exchanges. The theoretical framework focuses explicitly on tail returns, thereby properly accounting for large levels of risk in measuring prudent margin levels. The paper finds that common margin requirements are sufficient for each contract, with the exception of the Norwegian OBX index, in providing equitable costs for traders. In addition, the paper shows the underestimation bias in margin levels that are calculated assuming normality. Differing margin requirements reflect the unconditional and conditional trading environments. JEL Classification: G15 Keywords: Stock Index Futures; Extreme Value Theory; Margin Levels. Acknowledgements: The author would like to thank Donal McKillop for his helpful comments on this paper. 1 Tel.: +353-1-7068900; fax: +353 1 283 5482; e-mail: [email protected] 1 Margin Exceedences for European Stock Index Futures using Extreme Value Theory 1. Introduction The commercial strength of Futures Exchanges necessitates that there be a trade-off between optimising liquidity and prudence. The imposition of margins is the mechanism by which these objectives are met. The margin requirement represents a deposit that brokers, and consequentially traders enter into prior to trading. -

SUMMARIZED GENERAL KEY FACTS' STATEMENT SECURITIES and FIDUCIARY ACCOUNTS GENERAL ACCOUNTS' INFORMATION Account Maintenance

GENERAL KFS FOR SECURITIES AND FIDUCIARY ACCOUNTS SUMMARIZED GENERAL KEY FACTS’ STATEMENT SECURITIES AND FIDUCIARY ACCOUNTS GENERAL ACCOUNTS’ INFORMATION Account Maintenance Fee 0.1% monthly applied on weighted average value of assets Minimum Investment USD 50,000.00 Check Deposit Fee USD 5 or equivalent (additional bank charges may apply) Check Withdrawal Fee USD 5 or Equivalent (additional bank charges may apply) Local Wire Transfer (Outward) USD 50 or equivalent (additional bank charges may apply) Fee International Wire Transfer USD 80 or equivalent (additional bank charges may apply) (Outward) Fee Statement of Account Fee Free GENERAL ACCOUNTS’ INFORMATION BONDS Commissions Up to 0.2% of investment value Min. commission of 80 EUR Min Trading Size Up to 200K of instrument’s currency BONDS CFDs Spread on Bond CFDs Up to 0.08 minimum spread Min. Trading Size 50 CFDs STOCKS, ETFs, AND CORRESPONDING CFDs Commissions Up to 0.8% of investment with Min. commission by market Min. Trading Size Up to 20K of instrument’s currency ETCs Commissions 0.14% of investment Min. commission of 16 Eur or 14 GBP INDEX CFDs Spreads Up to 84 minimum spread SPOT FOREX AND COMMODITIES - 1 - GENERAL KFS FOR SECURITIES AND FIDUCIARY ACCOUNTS Spreads Up to 52 minimum spread COMMODITY CFDs Spreads Up to 14 minimum spread Min. Trade size Depends on underlying FOREX CFDs Spreads Up to 0.04 min spread Min. Trade size Up to 5,000 OPTION CFDs Daily Holding Fee 2.2 Contract Size Up to 1 index OTHER FEES AND COMMISSIONS Custody Fee for ETFs/ETCs or 0.24% p.a.