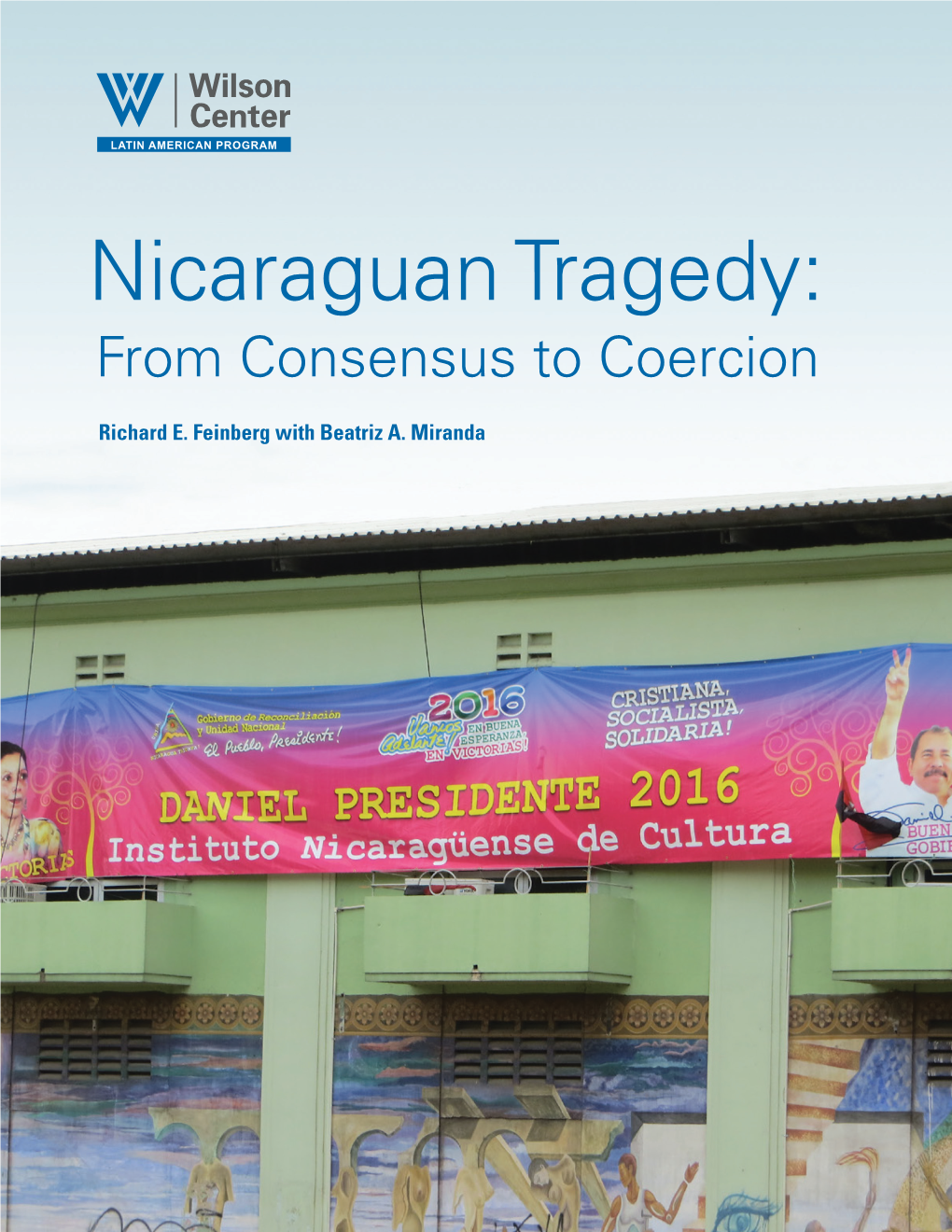

Nicaraguan Tragedy: from Consensus to Coercion

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Declaration by the Heads of States and Governments of Belize, Costa Rica, Guatemala, Honduras, Nicaragua, Panama and Dominican R

DECLARATION BY THE HEADS OF STATES AND GOVERNMENTS OF BELIZE, COSTA RICA, GUATEMALA, HONDURAS, NICARAGUA, PANAMA AND DOMINICAN REPUBLIC FACING THE PANDEMIC OF COVID-19 CENTRO AMERICA ALLIED AGAINST CORONA VIRUS 12th, March, 2020 The Heads of States and Governments of Belize, Costa Rica, Guatemala, Honduras, Nicaragua, Panama and Dominican Republic having a extraordinary virtual session under the pro tempore Presidency of SICA, with Honduras in the charge. Considering That the World Health Organization, with globally alarming levels of spread and severity of cases by COVID-19, has declared this disease to be a pandemic. This implies the necessity of regional agreements on containment against its spread for the safety of our inhabitants. The Resolution COMISCA 01-2020 adopted during the Extraordinary Meeting of the Council of Ministers of Health of Central America and the Dominican Republic (COMISCA), held on 3rd of March, 2020, relative to the situation of threats of COVID-19, and the regional reaction in public health against the pandemic, where joint actions are established. That faced of the threats of COVID-19, the General Secretariat of SICA and the Executive Secretariat of COMISCA have made efforts to establish regional, intersectoral approach in response to the pandemic DECLARE 1. The importance given by the Governments of the member states of SICA for the tutelage and protection of the human security, public health and common good for population in th e region, mainly in view of the expansion of COVID-19, which requires adopting joint meas ures and coordination to face it. 2. To the nations of the region, that our national health systems attend to the pandemic acco rding to the protocols guided by the World Health Organization / Pan American Health Org anization (WHO / PAHO), taking national measures through the Ministries and Secretaries of Health, including binational and cross-border collaboration of health services for compre hensive care of suspected and confirmed cases of COVID-19 and other public health probl ems. -

Measuring Farmers' Agroecological

Agriculture, Ecosystems and Environment 93 (2002) 87–105 Measuring farmers’ agroecological resistance after Hurricane Mitch in Nicaragua: a case study in participatory, sustainable land management impact monitoring Eric Holt-Giménez∗ Department of Environmental Studies, 321 Natural Sciences 2, University of California, Santa Cruz, 1156 High Street, Santa Cruz, CA 95064, USA Received 23 February 2001; received in revised form 15 October 2001; accepted 15 December 2001 Abstract A study using a participatory research approach and simple field techniques found significant differences in agroecological resistance between plots on “conventional” and “sustainable” farms in Nicaragua after Hurricane Mitch. On average, agroeco- logical plots on sustainable farms had more topsoil, higher field moisture, more vegetation, less erosion and lower economic losses after the hurricane than control plots on conventional farms. The differences in favor of agroecological plots tended to increase with increasing levels of storm intensity, increasing slope and years under agroecological practices, though the patterns of resistance suggested complex interactions and thresholds. For some indicators agroecological resistance collapsed under extreme stress. With the help of 19 non-governmental organizations (NGOs) and 45 farmer–technician teams, 833 farmers measured key agroecological indicators on 880 plots paired under the same topographical conditions. These paired observations covered 181 communities of smallholders from southern to northern Nicaragua. The broad geographical coverage took into account the diversity of ecological conditions, a variety of practices common to sustainable agriculture in Nicaragua, and moderate, high and extreme levels of hurricane impact. This coverage, and the massive mobilization of farmer–technician field research teams, was made possible by the existence of the Movimiento Campesino a Campesino (MCAC) (farmer-to-farmer movement), a widespread smallholders’ network for sustainable land management. -

Making Connections September 2008 Nicaragua and Heifer Int'l's WILD

Making Connections September 2008 Nicaragua and Heifer Int’l’s WILD Program “Before, I did not understand things. The men were the breadwinners and said everything. But now the women are a part of the community. We are happy and more active with much more confidence.” “As women, we no longer feel alone… Now we help each other the best we can.” “It’s not just a project for each us. It’s a project for all of us.” Rosa Carmen Medina, Bernadina Maria Salgado, and Felicitas Diaz Lopez Nicaraguan Poultry Farmers and Heifer Project Participants Chickens, Piggies and Cows, Oh My! And Sheep too! Okay, even a cynic like me can’t resist all those cute smiling kids with equally cute animals on Heifer International’s website. (See little Racquel and her hen on our homepage—too adorable!) We’ve tackled some tough subjects in the last few months—mass rape in the Congo, AIDS in Uganda; sexual enslavement of girls in Cambodia. Not that Heifer’s mission to end hunger isn’t equally serious. Remember that hunger is very much related to all those other tragedies and chronic malnutrition causes more deaths of women and children in the world than any other factor. But those kids and animals, and the hope and joy in the stories you’ll “hear” from women like the ones quoted above whose lives have been changed by some chickens or a cow— well, this is going to be the most upbeat meeting that we’ve had in awhile. So play along and enjoy it. -

A Nicaraguan Exceptionalism? Debating the Legacy of the Sandinista Revolution

A Nicaraguan Exceptionalism? Debating the Legacy of the Sandinista Revolution edited by Hilary Francis INSTITUTE OF LATIN AMERICAN STUDIES A Nicaraguan Exceptionalism? Debating the Legacy of the Sandinista Revolution edited by Hilary Francis Institute of Latin American Studies, School of Advanced Study, University of London, 2020 British Library Cataloguing-in-Publication Data A catalogue record for this book is available from the British Library This book is published under a Creative Commons Attribution-NonCommercial- NoDerivatives 4.0 International (CC BY-NC-ND 4.0) license. More information regarding CC licenses is available at https://creativecommons.org/licenses/. This book is also available online at http://humanities-digital-library.org. ISBN: 978-1-908857-57-6 (paperback edition) 978-1-908857-78-1 (.epub edition) 978-1-908857-79-8 (.mobi edition) 978-1-908857-77-4 (PDF edition) DOI: 10.14296/220.9781908857774 (PDF edition) Institute of Latin American Studies School of Advanced Study University of London Senate House London WC1E 7HU Telephone: 020 7862 8844 Email: [email protected] Web: http://ilas.sas.ac.uk Typesetting by Thomas Bohm, User Design, Illustration and Typesetting. Cover image © Franklin Villavicencio. Contents List of illustrations v Notes on contributors vii Introduction: exceptionalism and agency in Nicaragua’s revolutionary heritage 1 Hilary Francis 1. ‘We didn’t want to be like Somoza’s Guardia’: policing, crime and Nicaraguan exceptionalism 21 Robert Sierakowski 2. ‘The revolution was so many things’ 45 Fernanda Soto 3. Nicaraguan food policy: between self-sufficiency and dependency 61 Christiane Berth 4. On Sandinista ideas of past connections to the Soviet Union and Nicaraguan exceptionalism 87 Johannes Wilm 5. -

Nicaragua | Freedom House

Nicaragua | Freedom House https://freedomhouse.org/report/freedom-world/2019/nicaragua A. ELECTORAL PROCESS: 3 / 12 A1. Was the current head of government or other chief national authority elected through free and fair elections? 1 / 4 The constitution provides for a directly elected president, and elections are held every five years. Constitutional reforms in 2014 eliminated term limits and required the winner of the presidential ballot to secure a simple plurality of votes. President Ortega was reelected in 2016 with over 72 percent of the vote in a severely flawed election that was preceded by the Supreme Court’s move to expel the main opposition candidate, Eduardo Montealegre, from his Independent Liberal Party (PLI). The decision crippled the PLI, and Montealegre withdrew from the election. Ortega’s closest competitor, Maximino Rodríguez of the Constitutionalist Liberal Party (PLC), received just 15 percent of the vote, with no other candidate reaching 5 percent. Ortega’s wife, Rosario Murillo, ran as Ortega’s vice presidential candidate. Ortega’s Sandinista National Liberation Front (FSLN) won 135 of 153 mayorships contested in 2017 municipal elections. There were reports ahead of the polls that the FSLN had ignored local primary surveys in order to put its preferred candidates up for election. Seven people were killed in postelection clashes between government and opposition supporters, according to the Nicaraguan Center of Human Rights (CENIDH). A2. Were the current national legislative representatives elected through free and fair elections? 1 / 4 The constitution provides for a 92-member unicameral National Assembly. Two seats in the legislature are reserved for the previous president and the runner-up in the most recent presidential election. -

Nicaragua: Revolution and Restoration

THE NEW GEOPOLITICS NOVEMBER 2018 LATIN AMERICA NICARAGUA: REVOLUTION AND RESTORATION RICHARD E. FEINBERG NICARAGUA: REVOLUTION AND RESTORATION RICHARD E. FEINBERG EXECUTIVE SUMMARY Since independence, Nicaragua has suffered periodic internecine warfare, deep distrust between contending factions dominated by powerful caudillos (strongmen), and interventions by foreign powers. While the United States was frequently a party to these conflicts, local Nicaraguan actors often outmaneuvered U.S. diplomats. At the end of the Cold War, internationally supervised elections yielded an interlude of relatively liberal democracy and alternation of power (1990-2006). To the consternation of the United States, Sandinista Party leader Daniel Ortega regained the presidency in 2007, and orchestrated a successful strategy of coalition-building with the organized private sector and the Catholic Church. Supported by the international financial institutions and the Venezuelan Chavista government, Nicaragua achieved strong economic performance with moderately inclusive growth. President Ortega used those economic resources to gradually capture or suppress—one by one—many of the nation’s political institutions, eroding institutional checks and balances. Ortega’s strategy of co-opting all centers of power extended to the military and national police. The restoration of traditional caudillo politics and the fusion of family-state-party-security forces were all too reminiscent of the Somoza family dynasty (1934-1979). Frustrated by Ortega’s narrowing of democratic -

UNIVERSITY of CALIFORNIA Santa Barbara Rosas Sin Pan: The

UNIVERSITY OF CALIFORNIA Santa Barbara Rosas Sin Pan: The Cultural Strategies of the Sandinista Devolution A Thesis submitted in partial satisfaction of the requirements for the degree Master of Arts in Sociology by Cristina Awadalla Committee in charge: Professor Denise Segura Chair Professor Jon Cruz Professor Kum-Kum Bhavnani June 2019 The thesis of Cristina Awadalla is approved. ___________________________________________________________ Kum-Kum Bhavnani ___________________________________________________________ Jon Cruz ___________________________________________________________ Denise Segura, Committee Chair April 2019 Acknowledgements Para mi mama, que me enseñó desde que era pequeña a amar, luchar, y alzar mi voz. A mi hermano mayor que ha estado a mi lado a lo largo de este viaje, alentándome incondicionalmente a confiar en mi trabajo. Para todas las valientes feministas Nicaragüenses, las que me brindaron su tiempo, historias y análisis profundos, las que siguen luchando y que siguen imaginando y creando nuevos mundos a pesar de toda la repression física y idiologica. Sin ellas, este proyecto no se podriá realizar. To my parents who came from different lands, whose endless hours at work have allowed me to dream and go places none of us could have imagined. To all my friends and family who support, motivate, and inspire me—thank you for letting me talk your ears off, engaging me and showing interest in my work. I would also like to thank the department of Sociology at UC, Santa Barbara, for the training and support provided to me that has helped me realize this work. Thank you to Denise Segura who has shown me what it is to be a bold woman of color in academia, who was the first here to show me my potential, giving me the support to cultivate it, and has provided endless feedback on an ever-evolving project. -

Bio-CLIMA Nicaragua: Integrated Climate Action for Reduced Deforestation and Strengthened Resilience in the BOSAWÁS and Rio San Juan Biosphere Reserves

Bio-CLIMA Nicaragua: Integrated climate action for reduced deforestation and strengthened resilience in the BOSAWÁS and Rio San Juan Biosphere Reserves | Nicaragua Central American Bank for Economic Integration (CABEI) 18 March 2019 Bio-CLIMA Nicaragua: Integrated climate action for reduced Project/Programme Title: deforestation and strengthened resilience in the BOSAWÁS and Rio San Juan Biosphere Reserves Country: Nicaragua National Designated Ministry of Finance and Public Credit (MHCP) Authority (NDA): Accredited Entity (AE): Central American Bank for Economic Integration (CABEI) Date of first submission/ [2019-03-15] [V.1] version number: Date of current submission/ [2019-03-15] [V.1] version number PROJECT / PROGRAMME CONCEPT NOTE Template V.2.0 GREEN CLIMATE FUND | PAGE 1 OF 4 A. Project / Programme Information (max. 1 page) ☒ Project A.2. Public or ☒ Public sector A.1. Project or programme ☐ Programme private sector ☐ Private sector Yes ☐ No ☒ A.3. Is the CN submitted in ☐ Confidential If yes, specify the RFP: A.4. Confidentiality response to an RFP? ☒ Not confidential ______________ Mitigation: Reduced emissions from: ☐ Energy access and power generation ☐ Low emission transport ☐ Buildings, cities and industries and appliances A.5. Indicate the result ☒ Forestry and land use areas for the Adaptation: Increased resilience of: project/programme ☐ Most vulnerable people and communities ☐ Health and well-being, and food and water security ☐ Infrastructure and built environment ☒ Ecosystem and ecosystem services A.7. Estimated 26,260 people A.6. Estimated mitigation adaptation impact (31% of rural impact (tCO2eq over 5,414,627 t CO (20 years) (number of direct 2eq households of the lifespan) beneficiaries and % of Project Region) population) A.8. -

Independent Final Evaluation of Combating the Worst Forst of Chils

This page intentionally left blank. Independent Final Evaluation of Combating the Worst Forms of Child Labor through Education in Nicaragua, ENTERATE USDOL Cooperative Agreement IL-17759-08-75-K 2011 This page intentionally left blank. ACKNOWLEDGEMENTS The evaluation of the ENTERATE Project in Nicaragua was conducted and documented by Michele González Arroyo, an independent evaluator in collaboration with USDOL/OCFT staff; the ENTERATE project team; and stakeholders in Nicaragua. ICF would like to express sincere thanks to all parties involved in this evaluation: the independent evaluator, the American Institutes of Research and its partners, and USDOL. Funding for this evaluation was provided by the United States Department of Labor under Task Order number DOLJ089K28130. Points of view or opinions in this evaluation report do not necessarily reflect the views or policies of the United States Department of Labor, nor does the mention of trade names, commercial products, or organizations imply endorsement by the United States Government. ~Page iii~ This page intentionally left blank. TABLE OF CONTENTS ACKNOWLEDGEMENTS iii LIST OF ACRONYMS vii EXECUTIVE SUMMARY ix I PROJECT BACKGROUND AND DESCRIPTION 1 1.1 USDOL’s Education Initiative Projects 1 1.2 Target Population 1 1.3 Project Strategies and Activities 2 II EVALUATION PURPOSE AND METHODOLOGY 5 2.1 Evaluation Purpose 5 2.2 Methodology 5 III RELEVANCE 11 3.1 Findings 11 3.2 Lessons Learned/Good Practices: Relevance 20 IV EFFECTIVENESS 23 4.1 Findings 23 4.2 Lessons Learned/Good Practices: -

Culture and Arts in Post Revolutionary Nicaragua: the Chamorro Years (1990-1996)

Culture and Arts in Post Revolutionary Nicaragua: The Chamorro Years (1990-1996) A thesis presented to the faculty of the Center for International Studies of Ohio University In partial fulfillment of the requirements for the degree Master of Arts Tatiana Argüello Vargas August 2010 © 2010 Tatiana Argüello Vargas. All Rights Reserved. 2 This thesis titled Culture and Arts in Post Revolutionary Nicaragua: The Chamorro Years (1990-1996) by TATIANA ARGÜELLO VARGAS has been approved for the Center for International Studies by Patrick Barr-Melej Associate Professor of History José A. Delgado Director, Latin American Studies Daniel Weiner Executive Director, Center for International Studies 3 ABSTRACT ARGÜELLO VARGAS, TATIANA, M.A., August 2010, Latin American Studies Culture and Arts in Post Revolutionary Nicaragua: The Chamorro Years (1990-1996) (100 pp.) Director of Thesis: Patrick Barr-Melej This thesis explores the role of culture in post-revolutionary Nicaragua during the administration of Violeta Barrios de Chamorro (1990-1996). In particular, this research analyzes the negotiation and redefinition of culture between Nicaragua’s revolutionary past and its neoliberal present. In order to expose what aspects of the cultural project survived and what new manifestations appear, this thesis examines the followings elements: 1) the cultural policy and institutional apparatus created by the government of President Chamorro; 2) the effects and consequences that this cultural policy produced in the country through the battle between revolutionary and post-revolutionary cultural symbols in Managua as a urban space; and 3), the role and evolution of Managua’s mayor and future president Arnoldo Alemán as an important actor redefining culture in the 1990s. -

Draft Nicaragua Country Strategic Plan (2019–2023)

Executive Board First regular session Rome, 25 February–1 March 2019 Distribution: General Agenda item 6 Date: 12 December 2018 WFP/EB.1/2019/6-A/7/DRAFT Original: English Operational matters – Country strategic plans For approval Executive Board documents are available on WFP’s website (https://executiveboard.wfp.org). Draft Nicaragua country strategic plan (2019–2023) Duration 1 April 2019–31 December 2023 Total cost to WFP USD 66,815,944 Gender and age marker* 4 * http://gender.manuals.wfp.org/en/gender-toolkit/gender-in-programming/gender-and-age-marker/ Executive summary In the last decade, Nicaragua has achieved sustained economic growth and social development with improving nutrition indicators making it one of the countries that has reduced hunger the most in the region. However, natural disasters, climate change, poverty and social and economic fragility still threaten the food security of the most vulnerable people, particularly those in rural and remote areas. Targeted and coordinated efforts are therefore needed in order to reach Sustainable Development Goal 2 on zero hunger. Working in line with Nicaragua’s national human development plan for 2018–2021, WFP will help to accelerate action towards the achievement of zero hunger. The five-year country strategic plan for 2019–2023 has the aim of tackling the underpinning causes of food and nutrition insecurity by promoting long-term solutions to hunger. At the same time, considering the persistent levels of poverty and vulnerability to food insecurity in the country, WFP will continue to provide direct assistance with a view to ensuring that the most vulnerable people have access to nutritious and adequate food, including during emergencies. -

Stepdaughter Charges Nicaragua's Daniel Ortega with Sexual Abuse LADB Staff

University of New Mexico UNM Digital Repository NotiCen Latin America Digital Beat (LADB) 3-19-1998 Stepdaughter Charges Nicaragua's Daniel Ortega with Sexual Abuse LADB Staff Follow this and additional works at: https://digitalrepository.unm.edu/noticen Recommended Citation LADB Staff. "Stepdaughter Charges Nicaragua's Daniel Ortega with Sexual Abuse." (1998). https://digitalrepository.unm.edu/ noticen/8397 This Article is brought to you for free and open access by the Latin America Digital Beat (LADB) at UNM Digital Repository. It has been accepted for inclusion in NotiCen by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. LADB Article Id: 54819 ISSN: 1089-1560 Stepdaughter Charges Nicaragua's Daniel Ortega with Sexual Abuse by LADB Staff Category/Department: Nicaragua Published: 1998-03-19 Explosive allegations against Sandinista leader Daniel Ortega have rocked the Frente Sandinista de Liberacion Nacional (FSLN) just weeks before the party convention. In the aftermath, the FSLN is taking drastic measures to forge a united front and purge itself of dissidents. Former Nicaraguan president Daniel Ortega (1979-1990) called on supporters to unite following accusations by his stepdaughter that he had sexually molested her. In early March, Zoilamerica Narvaez Murillo, 30, faxed a letter to the media charging that Ortega started molesting her when she was 11 and continued "in a repeated manner, for many years." She also said she was the victim of aggression, threats, and blackmail. Ortega, 53, neither confirmed nor denied the allegations and said he was "saddened" by them. His wife, Rosario Murillo, who is Narvaez's mother, said the charges were lies.