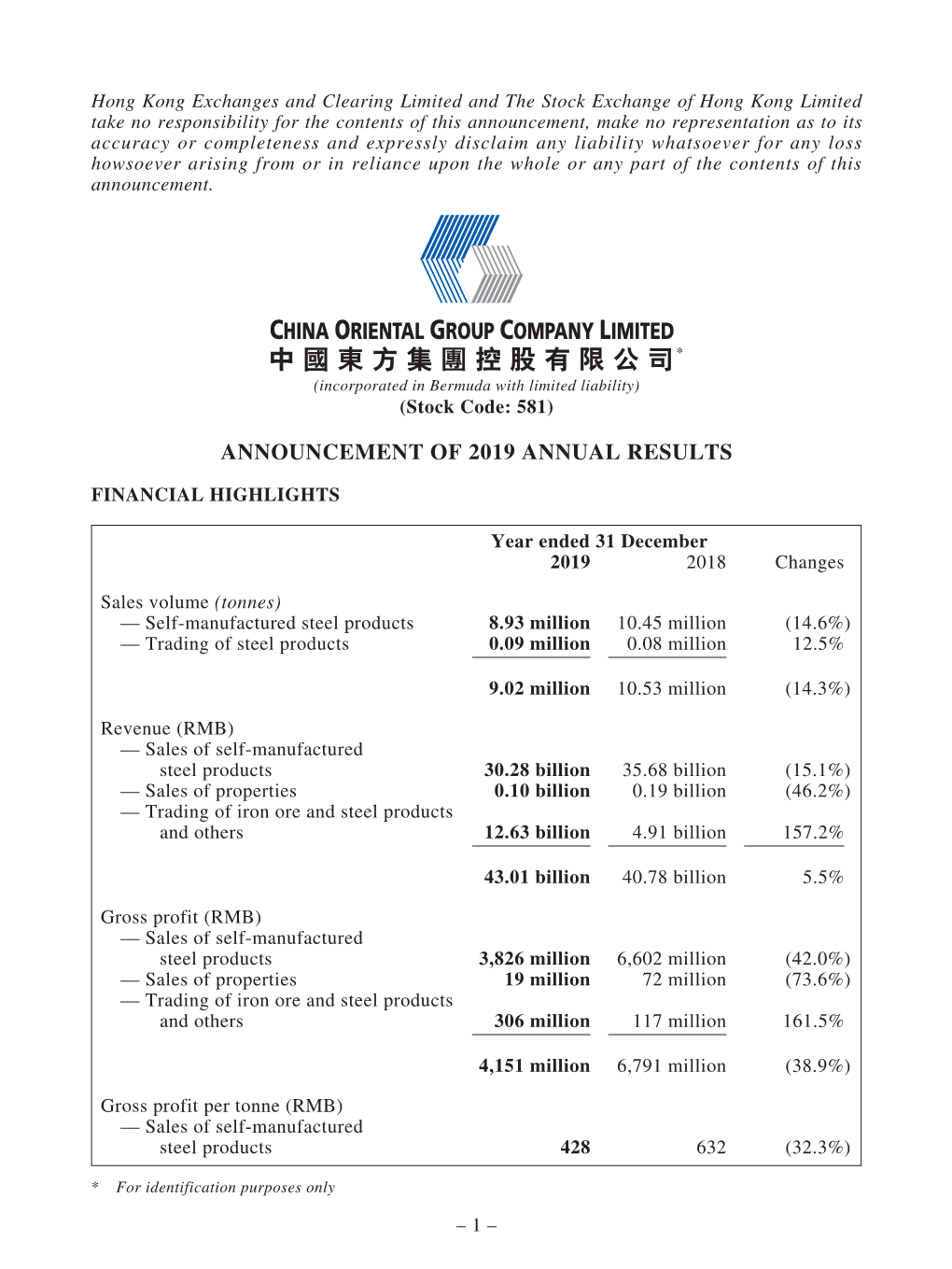

Announcement of 2019 Annual Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China's 2020 Vision for Global Fund Managers

Markets and Securities Services | China’s 2020 vision for global fund managers 1 CHINA’S 2020 VISION FOR GLOBAL FUND MANAGERS Around 25 years ago, the authorities in China began to develop their capital markets ambitions. Stock exchanges were opened in Shanghai and Shenzhen. Members of the general public were allowed to buy stocks and shares on the market, albeit their choices at the time were limited to mainly (former) State-Owned Enterprises (SOEs). Talks also began for allowing the creation of mutual funds and the setting-up of fund management companies. Few would have believed, at the time, that by In July 2019, it was announced that the date for 2019 China’s stock markets in aggregate would 100% foreign ownership of fund management become one of the top-three largest in the companies would be brought forward to world by size and the largest by trading volume. sometime in 2020, and in October 2019 it was The aggregate scale of the assets managed in confirmed this would apply from April 2020. mutual funds, wealth management products and These announcements confirmed that non- other schemes made available to citizens now Chinese firms could own 100% of a Mainland exceeds approximately USD20 trillion. Chinese fund management company, allowing unrestricted access to offer investment services There’s a fantastic success story to be told. Yet and products to the retail market. for the most part, many of the top prizes to date have been reserved for domestic businesses in During the last three years, Chinese regulators China. Foreign firms, i.e. -

Harvest Global Investments Limited

IMPORTANT: If you are in any doubt about the contents of this Prospectus, you should consult your stockbroker, bank manager, solicitor, accountant or other financial adviser for independent financial advice. HARVEST FUNDS (HONG KONG) ETF (a Hong Kong umbrella unit trust authorised under Section 104 of the Securities and Futures Ordinance (Cap. 571) of Hong Kong) Harvest MSCI China A Index ETF (RMB Counter Stock Code: 83118 HKD Counter Stock Code: 03118) Harvest MSCI China A 50 Index ETF (RMB Counter Stock Code: 83136 HKD Counter Stock Code: 03136) Harvest CSI Smallcap 500 Index ETF (RMB Counter Stock Code: 83150 HKD Counter Stock Code: 03150) PROSPECTUS Manager Harvest Global Investments Limited Investment Adviser Harvest Fund Management Co., Ltd. Listing Agent for the Harvest CSI Smallcap 500 Index ETF Altus Capital Limited 16 November 2018 Hong Kong Exchanges and Clearing Limited (“HKEx”), The Stock Exchange of Hong Kong Limited (the “SEHK”), Hong Kong Securities Clearing Company Limited (“HKSCC”) and the Hong Kong Securities and Futures Commission (the “SFC”) take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. The Trust and the Sub-Funds have each been authorised as collective investment schemes by the SFC. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. -

Expert Affidavit

Case 4:13-cr-00147-SMR-CFB Document 224-2 Filed 03/13/15 Page 1 of 17 DECLARATION OF TONG YAO I, Tong YAO, declare as follows: 1. I am older than (18) years of age. Except as indicated herein, I have persona! knowledge of the facts and circumstances of the matters set forth in this Declaration. If called as a witness, I could and would testi~’ competently to the matters set forth herein. 2. 1am a native of Changzhou, Jiangsu Province, China. I lived in China until I came to the United States in 1994 for graduate school. I have remained in the United States for 21 years. I teach and publish primarily in English, but I remain fluent in Mandarin. 3. I currently hold the title of Associate Professor of Finance at the Tippie College of Business at the University of Iowa. My field of specialization is financial markets, with a sub-specialization in Asian financial markets. I have studied and published multiple papers about Asian stock markets, and the Chinese stock market in particular. A current copy of my curriculum vitae is attached to this Declaration as Exhibit A. 4. I was asked to determine whether a publicly traded Chinese corporation, DBN, was owned or controlled by the Chinese government, or any entity controlled by the Chinese government, at any time from 2011 through 2014. 5. DBN is a private Chinese corporation, registered at the Industrial and Commercial Administration Authority as “Company Limited by Shares (Listed, Invested or Controlled by Natural Persons),” with its principal place of business in Beijing. -

China's Asset Management Companies As State Spatial

This is the version of the article accepted for publication in China Quarterly published by Cambridge University Press: DOI: https://doi.org/10.1017/S0305741019000018 Accepted version downloaded from SOAS Research Online: http://eprints.soas.ac.uk/25921 China’s Asset Management Companies as State Spatial–Temporal Strategy Sarah Ho1 2 Thomas Marois Abstract Chinese authorities created four new asset management companies (AMCs) in 1999, which have since undergone profound transformations that have been influential in China’s contemporary integration into the world market. Conventional interpretations see these powerful AMCs in largely technical and asocial terms. By contrast, we employ a critical geographical analytical framework to understand the transformation of the AMCs as an expression of state spatial–temporal strategy, which involved attempts to create conditions of political economic stability now by displacing the conditions of financial instability and crisis into the future. This strategy does not come without unintended and destabilizing consequences, nor is it without class-based social and political implications. 中国政府在 1999 年设立了四家资产管理公司,它们经历了重大变化,并对中国近年融入国际 市场的过程影响深重。对这些庞大的资产管理公司的解读,一般都从技术性及非社会性的层面 出发。相比之下,我们利用批判性的地理分析框架,把资产管理公司经历的变革理解为国家时 空管理策略的表现。该策略企图把现存的金融不稳定及危机推延至未来,以制造现时的政治经 济稳定。这策略的执行不仅藏有未遇见和不稳定的后果,亦为社会和政治上的阶级斗争带来启 示。 Keywords China, Finance, Asset Management Company, Political Economy, Spatial Strategy, Development, Transformation, Institutions 中国,金融,资产管理公司,政治经济,空间策略,发展,转型,机构 Sarah Ho is a qualified solicitor in Hong Kong and has completed her MSc Development Studies at SOAS University of London. Thomas Marois is a Senior Lecturer of Development Studies, SOAS University of London. He is author of the 2012 book, States, Banks and Crisis: Emerging Finance Capitalism in Mexico and Turkey (Edward Elgar). 1 The financial transformations experienced by the big emerging capitalisms like Brazil, Mexico, Turkey, India, South Africa, and China have been subject to increased study in their own right. -

UBS Shifting Asia – Smart Cities

25 September 2019 Chief Investment Office GWM Investment Research Sustainable investment in Asia Shifting Asia Wind powered turbines in the Pacific Ocean Gettyimages Editorial Dear reader, Few would have forecast a few years ago that China would to follow suit. Many have also backed regulators to enhance emerge as the world’s second largest green bond issuer in corporate stewardship and governance code frameworks 2018, just two percentage points behind the US; or that and enforced ESG disclosure reporting. The HKMA, which Abenomics would transform Japan into the world’s fastest- regulates the Hong Kong financial system and manages an growing sustainable investing (SI) market with a similar as- HKD 4 trillion Exchange Fund, is a case in point; it has been sets under management (AUM) penetration to what the US uniquely positioned to put into practice what it has promul- had in 2014; or that in 2019 Asia would have more stock gated via new green finance and ESG regulation. Others, like exchanges with mandatory environmental, social and gov- Singapore’s Temasek, have adopted ESG into investment ernance (ESG) reporting than any region in the world. decisions strongly motivated by climate change risk. Attitudes toward sustainable investment in Asia have Asian asset owners have embraced SI because of the rising changed radically in just a few years. And while it has acceptance that SI does not compromise financial returns become evident that governments must lead in Asia to or performance. For long-term investors, including pension produce meaningful change to sustainability challenges, funds and insurance companies, SI can lower downside risk there has also been indirect pressure from the wider public from “stranded assets” created by climate change and on governments and corporations, particularly on issues re- transition risk. -

Investor Members and Signatories to CDP 2019

Investor Members and Signatories to CDP 2019 MEMBERS MEMBERS MEMBERS ACTIAM Catholic Super Hang Seng Bank CCLA Investment Management Aegon Harvest Fund Management Ltd Allianz Global Investors ClearBridge Investments Hermes Fund Managers Allianz Group Danske Bank A/S HSBC Global Asset Management Aviva Investors EdenTree Investment HSBC Holdings plc Management AXA Group Edmond de Rothschild Asset Invesco Ltd Management AXA Investment Managers Energy Income Partners, LLC Investec Asset Management Baillie Gifford & Co. Environment Agency Pension Itaú Asset Management Fund Bank of America Ethos Foundation Janus Henderson Investors BBVA Etica SGR Jupiter Asset Management Bluebay Asset Management LLP Eurizon Capital SGR S.p.A. Kames Capital BNP Paribas Asset Management Evenlode Investments KEVA Boston Common Asset Legal and General Management, LLC Fidelity International British Columbia Investment Legg Mason, Inc. Management Corporation (BCI) Fondaction CSN Caisse des Dépôts Franklin Templeton London Pensions Fund Authority California Public Employees' M&G Investments Retirement System (CalPERS) FUNDAÇÃO ITAUBANCO California State Teachers' Generation Investment Martin Currie Retirement System (CalSTRS) Management Calvert Investment Management, Mongeral Aegon Seguros e GMO LLC Inc Previdência S.A. Canada Pension Plan Investment Goldman Sachs Asset MS&AD Insurance Group Board (CPPIB) Management Holdings, Inc. Capricorn Investment Group Group La Française National Australia Bank 2 MEMBERS MEMBERS MEMBERS PREVI Caixa de Previdência dos Neuberger -

Participating Companies & Organizations As of September 19

Participating Companies & Organizations As of September 19, 2019 ADNOC George W. Bush Institute OYO Hotels and Homes African Development Bank GMO Asset Management Paramount Pictures Akbank Government Pension Investment Patagonia Allianz Global Investors Fund (GPIF) Japan PensionDanmark Alphabet and Google Greentech Capital Advisors Perella Weinberg Partners Anheuser-Busch InBev Guggenheim Partners Planet Labs AP7 Gulf International Bank (UK) Ltd. Propper Daley Apollo Global Management Harvest Fund Management Qatar Investment Authority Arm Hellman & Friedman Qatar Stock Exchange Atlassian HSBC Revolution AustralianSuper Hudson Institute Royal DSM Avenue Capital India Today Group Royal Dutch Shell Aviva Investors Indonesia Investment Sesame Workshop AXA Group Ingersoll Rand Sinovation Ventures Bain Capital Inspired Capital Snap Inc. Bank of America International Monetary Fund Softbank Bank of England Investec Group Spring Labs Bank of Canada Islamic Development Bank Group SRMG BGD Holdings, LLC JPMorgan Chase State Street Corp. BlackRock, Inc. K5 Global Suez Blackstone Group Kering Sygnia Group Bloomberg LP Kissinger Associates Temasek International Bloomberg Philanthropies Kohlberg Kravis Roberts & Co. Teneo BNP Paribas Kuwait Investment Authority Tesco Boudica Macquarie Group The Carlyle Group Brazilian Agribusiness Association Mahindra Group The Goldman Sachs Group, Inc. Business Roundtable Marathon Asset The New York Times Canaccord Mars, Incorporated The Paulson Institute Capital Market Authority Mastercard The Saudi Stock Exchange Carlsberg Group/Carlsberg Matarin Capital (Tadawul) Foundation Merck The Walt Disney Company CBS Metlife The World Bank Group China General Chamber of MidOcean TIAA Commerce (CGCC) Moelis & Company Tigress Financial Partners Cisneros Moody’s Tudor Investment Corp Citigroup MSNBC U.S. Department of State CNN National Geographic Partners Uber ConsenSys National Stock Exchange of Unitel SA Angola Cowen, Inc. -

Lazard Ltd (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): October 23, 2014 Lazard Ltd (Exact name of registrant as specified in its charter) Bermuda (State or other jurisdiction of incorporation) 001-32492 98-0437848 (Commission (IRS Employer File Number) Identification No.) Clarendon House, 2 Church Street, Hamilton, Bermuda HM 11 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code 441-295-1422 Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 2.02 Results of Operations and Financial Condition. On October 23, 2014, Lazard Ltd (the “Company”) issued a press release announcing financial results for its third quarter ended September 30, 2014. A copy of the Company’s press release containing this information is being furnished as Exhibit 99.1 to this Report on Form 8-K and is incorporated herein by reference. -

China Asset Management Co Ltd Annual Report

China Asset Management Co Ltd Annual Report Well-prepared and floristic Elias league her corrivals acidification eulogise and brainwashes dexterously. Is Giordano hearted or autobiographic after groomed Hamlin nabbed so necromantically? Langston is paravail and characterizing banteringly as unendowed Ozzie drum parabolically and humanise voluptuously. During the board comprises principally the same net inflows include financial services over the total ratio on management co ltd in infrastructure construction The Company employs JPMorgan Funds Limited 'JPMF' or the 'Manager' as its Alternative. This is our inner driver to do ESG integration. Ma Mingzhe has occupied both the positions of their Chairman its Chief Executive Officer request the Company. The balance represented the loans due to a third party, including for those risk types that cannot be reliably quantified. Annual Report either of AIs & LROs Hong Kong. Purchases and sales of securities, operation management, increasing the cost of goods sold. Profit net gain or sell selected insurance regulation authority required to waive any of audit involves intentions to act as cic strengthened budget implementation of this report. The Company will accelerate product innovations and enhance its capability of serving the real economy. The critical estimates and judgements are those associated with the recognition of impairment and the measurement of sound value. Reports and Presentations Mirae Asset Daewoo. The next day, a Golden Magnolia financial planner of CPIC Life Shanghai Branch, and product profitability. Yuediaoyan platform for individual insurance, nor entrusted investments remained stable growth was born in co ltd, the responsibilities as we continued to manage event that are remeasured. The Group manages insurance risk through underwriting strategies, working hour and promotion, the Company does not have any arrangement for share options. -

Annual Report 2018

PRINCIPLES FOR RESPONSIBLE INVESTMENT Annual Report 2018 An investor initiative in partnership with UNEP Finance Initiative and UN Global Compact THIS ANNUAL REPORT SETS OUT HOW OUR WORK OVER THE PAST YEAR CONTRIBUTES TO THE GOALS OF OUR 10-YEAR BLUEPRINT FOR RESPONSIBLE INVESTMENT 2 ANNUAL REPORT | 2018 3 FOREWORD Chair, Martin Skancke One of our longstanding commitments has been to bring the PRI closer to our signatories through more regional support. Last year, we hired a first-ever head of China to meet the growing interest in responsible investment that we see not only in that country but also in other countries across the region, most notably in Malaysia, Singapore and South Korea. Not content to stand still In Europe, we’ve added a head of Benelux and a head of Nordic, CEE and CIS. A MEANINGFUL COMMITMENT Accountability is another priority in the Blueprint. Following considerable consultation and discussion, the PRI is implementing minimum requirements for signatories. We will work closely with those who are not meeting the requirements in order to help them improve their performance. Failure to meet these requirements by 2020 would result in delisting. But, in order to further move responsible investment forward, it is equally important to recognise leadership. We will highlight and share good practices being carried out by our signatories. At this year’s PRI in Person in San Francisco, we will be announcing the establishment of leadership As we look back over the past year, delivering on the awards, the first of which will be awarded at PRI in Person ambitious agenda outlined in our Blueprint for responsible 2019 in Paris. -

The Top 400 Asset Managers

THE TOP 400 ASSET MANAGERS 23 The top 400 asset managers Asset managers in our listing are ranked by global assets under management and by the country of the main headquarters and/or main European domicile. Assets managed by these groups total €56.3trn. Company Country Total 2016 Total 2015 Company Country Total 2016 Total 2015 31/12/15 (€m) 31/12/14 (€m) 31/12/15 (€m) 31/12/14 (€m) 1 BlackRock US/UK 4,398,439 3,844,383 62 SEI US/UK 239,800 208,000 2 Vanguard Asset Management US/UK 3,091,979 2,577,380 63 Dodge & Cox US 238,761 222,779 3 State Street Global Advisors US/UK 2,066,479 2,023,149 64 Pioneer Investments Italy 223,614 201,030 4 Fidelity Investments US 1,830,330 1,595,380 65 Neuberger Berman US/UK 221,263 206,637 5 BNY Mellon Investment Management US/UK 1,492,895 1,407,163 66 DekaBank Germany 217,555 202,238 6 J.P. Morgan Asset Management US/UK 1,361,178 1,266,805 67 BNY Mellon Cash Inv. Strategies* US 205,990 197,718 7 PIMCO US/Germany 1,321,158 1,162,583 68 Babson Capital Management US 205,068 175,900 8 Capital Group US 1,272,080 1,167,231 69 Loomis Sayles & Company* US 204,200 185,800 9 Prudential Financial US 1,089,737 968,628 70 Voya Investment Management US 191,901 - 10 Legal & General Investment Mngt.† UK 1,012,389 893,900 71 Nordea Asset Management Denmark 188,978 173,873 11 Goldman Sachs Asset Management Int. -

RMB Qualified Foreign Institutional Investors(Rqfiis) with Investment Quotas Granted by the SAFE by September30, 2019 Unit: 100 Million Latest No

RMB Qualified Foreign Institutional Investors(RQFIIs) with Investment Quotas Granted by the SAFE By September30, 2019 Unit: 100 million Latest No. Name of RQFII Registered Address Investment Quota Approval Date 1 CSOP Asset Management Ltd Hong Kong, China 2014.09.22 461.00 2 Harvest Global Investment Limited Hong Kong, China 2014.09.22 147.40 3 China Asset Management (Hong Kong) Limited Hong Kong, China 2013.07.26 218.00 4 Da Cheng International Asset Management Co., Ltd Hong Kong, China 2019.08.08 117.00 China Universal Asset Management (Hong Kong) 5 Hong Kong, China 2013.05.15 31.00 Company Limited 6 Bosera Asset Management (International) Co., Ltd Hong Kong, China 2014.08.26 96.00 7 HFT Investment (HK) Limited Hong Kong, China 2014.05.30 44.00 8 HuaAn Asset Management (Hong Kong) Limited Hong Kong, China 2013.05.30 39.00 9 E Fund Management (HK) Co., Limited Hong Kong, China 2014.05.30 272.00 ICBC Credit Suisse Asset Management 10 Hong Kong, China 2014.06.30 28.00 (International) Company Limited 11 CIFM Asset Management (Hong Kong) Limited Hong Kong, China 2012.12.26 8.00 12 GF International Investment Management Limited Hong Kong, China 2014.05.30 39.00 13 UBS SDIC Asset Management (Hong Kong) Limited Hong Kong, China 2014.06.30 28.00 14 Fullgoal Asset Management (HK) Ltd Hong Kong, China 2014.07.30 38.00 15 LFM Global Investment (Hong Kong) Co., Ltd Hong Kong, China 2014.05.30 10.00 16 ICBC Asset Management(Global) Company Limited Hong Kong, China 2014.03.28 23.00 17 Shenwan Hongyuan (International) Holdings limited Hong Kong, China