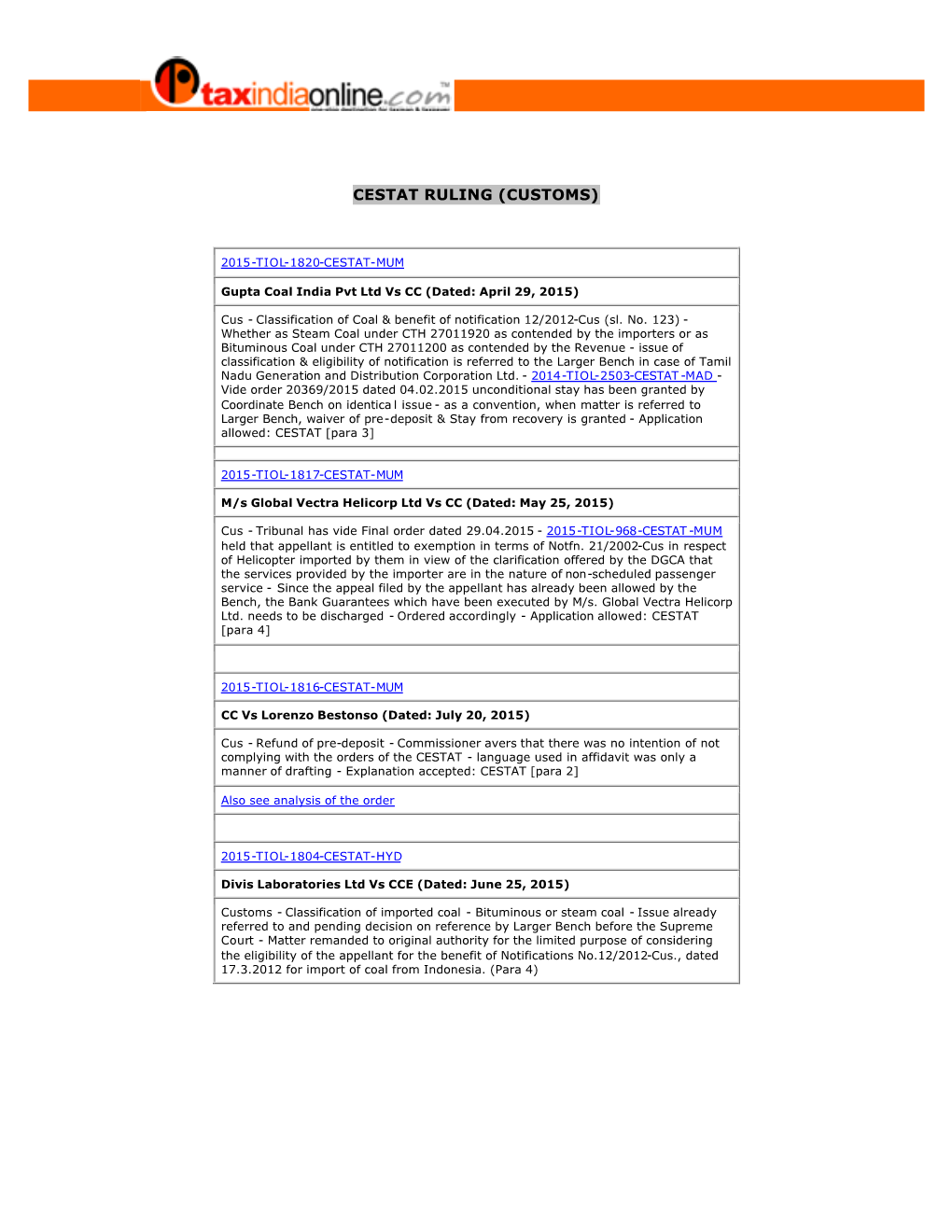

Cestat Ruling (Customs)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RESTRICTED WT/TPR/S/403 25 November 2020

RESTRICTED WT/TPR/S/403 25 November 2020 (20-8526) Page: 1/175 Trade Policy Review Body TRADE POLICY REVIEW REPORT BY THE SECRETARIAT INDIA This report, prepared for the seventh Trade Policy Review of India, has been drawn up by the WTO Secretariat on its own responsibility. The Secretariat has, as required by the Agreement establishing the Trade Policy Review Mechanism (Annex 3 of the Marrakesh Agreement Establishing the World Trade Organization), sought clarification from India on its trade policies and practices. Any technical questions arising from this report may be addressed to Ms Eugenia Lizano (tel.: 022 739 6578), Ms Rohini Acharya (tel.: 022 739 5874), Ms Stéphanie Dorange-Patoret (tel.: 022 739 5497). Document WT/TPR/G/403 contains the policy statement submitted by India. Note: This report is subject to restricted circulation and press embargo until the end of the first session of the meeting of the Trade Policy Review Body on India. This report was drafted in English. WT/TPR/S/403 • India - 2 - CONTENTS SUMMARY ........................................................................................................................ 8 1 ECONOMIC ENVIRONMENT ........................................................................................ 14 1.1 Main Features of the Economy .................................................................................... 14 1.2 Recent Economic Developments.................................................................................. 14 1.3 Fiscal Policy ............................................................................................................ -

Elixir Journal

50958 Garima saxena and Rajeshwari kakkar / Elixir Inter. Law 119 (2018) 50958-50966 Available online at www.elixirpublishers.com (Elixir International Journal) International Law Elixir Inter. Law 119 (2018) 50958-50966 Performance of Stock Markets in the Last Three Decades and its Analysis Garima saxena and Rajeshwari kakkar Amity University, Noida. ARTICLE INFO ABSTRACT Article history: Stock market refers to the market where companies stocks are traded with both listed Received: 6 April 2018; and unlisted securities. Indian stock market is also called Indian equity market. Indian Received in revised form: equity market was not organized before independence due to the agricultural conditions, 25 May 2018; undeveloped industries and hampering by foreign business enterprises. It is one of the Accepted: 5 June 2018; oldest markets in India and started in 18th century when east India Company started trading in loan securities. During post-independence the capital market became more Keywords organized and RBI was nationalized. As we analyze the performance of stock markets Regulatory framework, in the last three decades, it comes near enough to a perfectly aggressive marketplace Reforms undertaken, permitting the forces of demand and delivers an inexpensive degree of freedom to Commodity, perform in comparison to other markets in particular the commodity markets. list of Deposit structure, reforms undertaken seeing the early nineteen nineties include control over problem of Net worth, investors. capital, status quo of regulator, screen primarily based buying and selling and threat management. Latest projects include the t+2 rolling settlement and the NSDL was given the obligation to assemble and preserve an important registry of securities marketplace participants and experts. -

PRACTICE PAPER, 2020-21 (5) Class: XII SUBJECT: ECONOMICS

PRACTICE PAPER, 2020-21 (5) Class: XII SUBJECT: ECONOMICS (030) Time Allowed: 3 Hrs. Maximum Marks: 80 General Instructions: 1 This question paper contains two parts: Part A – Macro Economics (40 marks) Part B – Indian Economics Development (40 marks) 2 Marks for questions are indicated against each question. 3 Question No. 1-10 and Question No. 18-27 (including two Case Based Questions) are 1-mark questions and are to be answered in one word/sentence. 4 Case Based Questions (CBQ’s) are Question No. 7-10 and Question No. 25-27. 5 Question No. 11-12 and Question No. 28-29 are 3 marks questions and are to be answered 60-80 words each. 6 Question No. 13-15 and Question No. 30-32 are 4 marks questions and are to be answered 80-100 words each. 7 Question No. 16-17 and Question No. 33-34 are 6 marks questions and are to be answered 100-150 words each. 8 Answer should be in brief and to the point and the above word limit be adhered to as far as possible. Q. QUESTIONS Marks No. PART A – INTRODUCTORY MACRO ECONOMICS 1. Which one is not included in the estimation of national income? 1 a) Imputed rent of owner-occupied houses. b) Pension on retirement c) Change in stock d) Remittances by NRIs 2. Money which is accepted as a medium of exchange because of the trust between 1 the payer and the payee. a) Fiat money b) Credit money c) Full bodied money d) Fiduciary money 3. In India, Coins are issued by: 1 a) State Bank of India b) Reserve Bank of India c) Ministry of Urban Development d) Ministry of Finance 4. -

Role of the Fiis in the Development of the Indian Stock Market: an Econometric Analysis

Journal of Economics, Management and Trade 20(1): 1-14, 2017; Article no.JEMT.38090 ISSN: 2456-9216 (Past name: British Journal of Economics, Management & Trade, Past ISSN: 2278-098X) Role of the FIIs in the Development of the Indian Stock Market: An Econometric Analysis Harshit Agarwal1* and Rashi Agarwal2 1Department of Economics and Finance, Portsmouth Business School, University of Portsmouth, University House, Winston Churchill Ave, Portsmouth PO1 2UP, United Kingdom. 2Department of Finance and Economics, Southampton Business School, University of Southampton, University Rd, Southampton SO17 1BJ, United Kingdom. Authors’ contributions This work was carried out in collaboration between both authors. Author HA designed the study, performed the statistical analysis, wrote the protocol and wrote the first draft of the manuscript. Author RA managed the analyses of the study and the literature searches. Both authors read and approved the final manuscript. Article Information DOI: 10.9734/JEMT/2017/38090 Editor(s): (1) Chiang-Ming Chen, Department of Economics, National Chi Nan University, Taiwan. Reviewers: (1) Jones Osasuyi Orumwense, University of Namibia, Namibia. (2) Sylvester Ohiomu, Edo University, Nigeria. Complete Peer review History: http://www.sciencedomain.org/review-history/22197 Received 10th November 2017 th Original Research Article Accepted 30 November 2017 Published 7th December 2017 ABSTRACT The stock market of a country operates in the economy of that country and the economic conditions of the country affect the stock prices of the stocks listed in the stock exchanges of the country. And it is believed that macroeconomic variables of a country and the stock prices of the stocks listed in the stock exchanges of the country are co-integrated. -

70 POLICIES THAT SHAPED INDIA 1947 to 2017, Independence to $2.5 Trillion

Gautam Chikermane POLICIES THAT SHAPED INDIA 70 POLICIES THAT SHAPED INDIA 1947 to 2017, Independence to $2.5 Trillion Gautam Chikermane Foreword by Rakesh Mohan © 2018 by Observer Research Foundation All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without permission in writing from ORF. ISBN: 978-81-937564-8-5 Printed by: Mohit Enterprises CONTENTS Foreword by Rakesh Mohan vii Introduction x The First Decade Chapter 1: Controller of Capital Issues, 1947 1 Chapter 2: Minimum Wages Act, 1948 3 Chapter 3: Factories Act, 1948 5 Chapter 4: Development Finance Institutions, 1948 7 Chapter 5: Banking Regulation Act, 1949 9 Chapter 6: Planning Commission, 1950 11 Chapter 7: Finance Commissions, 1951 13 Chapter 8: Industries (Development and Regulation) Act, 1951 15 Chapter 9: Indian Standards Institution (Certification Marks) Act, 1952 17 Chapter 10: Nationalisation of Air India, 1953 19 Chapter 11: State Bank of India Act, 1955 21 Chapter 12: Oil and Natural Gas Corporation, 1955 23 Chapter 13: Essential Commodities Act, 1955 25 Chapter 14: Industrial Policy Resolution, 1956 27 Chapter 15: Nationalisation of Life Insurance, 1956 29 The Second Decade Chapter 16: Institutes of Technology Act, 1961 33 Chapter 17: Food Corporation of India, 1965 35 Chapter 18: Agricultural Prices Commission, 1965 37 Chapter 19: Special Economic Zones, 1965 39 iv | 70 Policies that Shaped India The Third Decade Chapter 20: Public Provident Fund, 1968 43 Chapter 21: Nationalisation of Banks, 1969 45 Chapter -

Appnirbhar Bharat Report

The Made in India App Landscape Report APPNIRBHAR BHARAT 1 2 APPNIRBHAR BHARAT Message from Shri Ravi Shankar Prasad Union Minister for Law & Justice, Communications and Electronics & Information Technology, Government of India APPNIRBHAR BHARAT 3 Foreword Over the past few years, India has undergone a rapid transformation into a digitally empowered society. With a digital population of over 600 million, India is today ranked the world’s second-largest online market. The country’s startup ecosystem has also grown to become the third- largest globally, with its entrepreneurs and tech innovators Shradha Sharma building lasting solutions to solve for not only India, but also Founder & CEO, for the world. YourStory India is also the top country in the world in terms of the number of apps installed and used per month. India’s app ecosystem has, in fact, never been in a greater position of strength, thanks to the renewed enthusiasm and vigour among Indian techies, innovators, and entrepreneurs to build from India, for India and the world. When Prime Minister Narendra Modi recently raised the clarion call for India to become ‘vocal for local’ and Aatmanirbhar, or self-reliant, he also put the spotlight on the need for an ‘Aatmanirbhar App Ecosystem’ when he launched the Government of India’s Aatmanirbhar Bharat App Innovation Challenge. “Today, when the entire nation is working towards creating an Aatmanirbhar Bharat, it is a good opportunity to give direction to their efforts, momentum to their hard work, and mentorship to their talent to evolve Apps which can satisfy our market as well as compete with the world,” PM Modi said. -

Demonetisation- a Historical Perspective

European Journal of Molecular & Clinical Medicine ISSN 2551-8260 Volume 07 , Issue 11 , 2020 DEMONETISATION- A HISTORICAL PERSPECTIVE SyedSalehaJaved Assistant Professor, H.R. College of Commerce and Economics, HSNC University, Mumbai, Maharashtra Abstract Demonetisation has become a much discussed and debated term post 8thNovember2016. Prime Minister NarendraModi took to national television on 20;00 hours IST, in an unscheduled address to the nation to announce the demonetization of the Rupees 500 and Rupees 1000 currency notes of the Mahatma Gandhi series with almost immediate effect. The ban on the two currencies which together accounted for almost 15.44 lakhcrore or 86 % of the total currency in circulation in India was to be enforced from midnight onwards ie roughly 4 hours from the time of announcement leaving almost no time to the citizens to respond. More than a year after the event and almost 99% of demonetized currency legally converted opinions continue to remain divided and as extreme as on day one. But the concept of demonetisation seemed to have gained traction globally as three countries namely Australia, Pakistan and Venezuela have announced plans for demonetisation of their currency post November,2016 albeit in varying degrees .The current paper is an attempt to study the concept of demonetisation and investigate the history of demonetisation with its resultant impact on the economy with special reference to India.The study is based entirely on secondary data obtained from website publications and reports of reputed institutions. Key Words: Currency, Demonetisation, History, Impact Introduction 8th of November, 2016 resembled any other day in November in India till Prime Minister NarendraModi took to national television on 20;00 hours IST, in an unscheduled address to the nation to announce the demonetisation of the Rupees 500 and Rupees 1000 currency notes of the Mahatma Gandhi series with almost immediate effect. -

Coins | Medals | Tokens | Paper Money

Front Cover Lot: 122 Back Cover Lot: 553 Inside Front Cover Lot: 122 Inside Last Cover Lot: 232 classical numismatic gallery Coins | Medals | Tokens | Paper Money auction 14 on Saturday, 21st December 2013, 5:30pm onwards. Venue Sonal Hall, Karve Road, Pune - 411004 (MH) in conjunction with Coinex Pune 2013 : conducted by : classical numismatic gallery A Proprietary Concern established by Shatrughan Saravagi 105, 3rd Eye Complex, C. G. Road, Panchvati, Ahmedabad - 380 006. Gujarat. India. Tel: +91 (0) 79 2646 4850 / 51 | Fax: +91 (0) 79 2646 4852 Email: [email protected] | Web: www.classicalnumismaticgallery.com Date of Auction: Saturday, 21st December 2013, 5:30pm onwards Order of Sale Ancient India .................................................................... Lots 1 - 109 Ancient World ................................................................. Lots 110 - 112 Hindu Coins of Medieval India ....................................... Lots 113 - 135 Sultanates ......................................................................... Lots 136 - 172 Mughals ............................................................................ Lots 173 - 316 Independent Kingdoms ..................................................... Lots 317 - 331 Princely States .................................................................. Lots 332 - 407 Indo Danish....................................................................... Lots 408 - 415 Indo French ....................................................................... Lots -

Stock Market Reactions to India's 2016 Demonetization: Implications for Tax Evasion, Corruption, and Financial Constraints

University of Michigan Law School University of Michigan Law School Scholarship Repository Law & Economics Working Papers 6-29-2017 Stock Market Reactions to India's 2016 Demonetization: Implications for Tax Evasion, Corruption, and Financial Constraints Dhammika Dharmapala University of Chicago Law School, [email protected] Vikramaditya Khanna University of Michigan Law School, [email protected] Follow this and additional works at: https://repository.law.umich.edu/law_econ_current Part of the Law and Economics Commons Working Paper Citation Dharmapala, Dhammika and Khanna, Vikramaditya, "Stock Market Reactions to India's 2016 Demonetization: Implications for Tax Evasion, Corruption, and Financial Constraints" (2017). Law & Economics Working Papers. 136. https://repository.law.umich.edu/law_econ_current/136 This Article is brought to you for free and open access by University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in Law & Economics Working Papers by an authorized administrator of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. Dharmapala and Khanna: STOCK MARKET REACTIONS TO INDIA’S 2016 DEMONETIZATION: IMPLICATIONS FOR TAX EVASION, CORRUPTION, AND FINANCIAL CONSTRAINTS Dhammika Dharmapala University of Chicago Law School [email protected] Vikramaditya S. Khanna University of Michigan Law School [email protected] June 2017 Abstract On November 8, 2016, the Indian government made a surprise announcement that certain currency notes (representing 86% of the currency then in circulation) would no longer be legal tender (although they could be deposited in banks over a limited period). The stated reason for this sudden “demonetization” was to combat tax evasion and corruption associated with “unaccounted-for” cash. -

Foreign Investment

REPORT O THE STEERING GROUP ON OREIGN DIRECT INVESTMENT Planning Commission Government of India New Delhi August 2002 © 2002 Planning Commission, New Delhi Published for Planning Commission by Shipra Publications, Delhi e-mail: [email protected] Contents 1. PREFACE . 9 1.1 Committee Members ...9 1.2 Terms of Reference ...10 1.3 Acknowledgements ...10 2. INTRODUCTION . 11 2.1 Background ...11 2.2 Meetings ...11 2.3 Presentations ...12 2.4 Material Collected ...12 3. FDI TRENDS . 13 3.1 Global Trends ...13 3.2 India’s Share ...13 3.3 Comparability of Data ...16 3.4 FDI in Privatisation ...17 3.5 Direction of FDI into India ...18 4. CAUSES AND REASONS FOR LOW FDI . 21 4.1 Image and Attitude ...21 4.2 Policy Framework ...22 4.2.1 FDI Policy ...22 4.2.2 Domestic Policy ...23 4.3 Procedures ...26 4.3.1 FIPB ...27 4.4 Quality of Infrastructure ...28 4.5 State Obstacles ...28 4.6 Legal Delays ...29 5. RECOMMENDATIONS . 31 5.1 Regulatory Reforms ...31 5.1.1 Foreign Investment Law ...31 5.1.2 State Laws on Infrastructure ...32 5.2 Institutional Changes ...32 5.2.1 Industry Department ...32 5.2.2 Planning and FDI Sector Targets ...34 5.2.3 Fund for Assistance to States ...34 5.2.4 Non-governmental Facilitation Services ...35 5.3 Raising FDI Sectoral CAPS ...35 5.3.1 National Security ...36 5.3.2 Culture and Media ...36 5.3.3 Natural Monopolies ...37 5.3.4 Monopoly Power ...38 5.3.5 Natural Resources ...38 5.3.6 Transition Costs ...39 5.3.7 Recommendations ...39 5.3.7.1 Manufacturing ...40 5.3.7.2 Mining ...41 5.3.7.3 Infrastructure ...42 5.3.7.4 -

Auction, 18 0Ctober 2014

ONS Auction, 18 0ctober 2014 References used: A Stephan Album, A checklist of popular Islamic Coins, 3rd edition, Santa Rosa 2011. Bop. Osmund Bopearachchi: Monnaies GrécoBactriennes et IndoGrecques, Paris 1991. Brotman Irwin F. Brotman: A Guide to the Temple Tokens of India, Los Angeles 1970. Codr H.W. Codrington: Ceylon Coins and Currency, Colombo 1924. Deyell John S. Deyell: Living without silver: The Monetary History of Early Medieval North India, New Delhi 1990. G/G Stan Goron & J.P. Goenka: The coins of the Indian Sultanates, New Delhi 2001 Göbl Sasanidische Numismatik, Braunschweig 1968 / Sasanian Numismatics, Braunschweig 1971 Göbl2 Münzprägung des Kushanreiches, Wien 1984 Gomes Alberto Gomes: Moedas Portuguesas, Lisboa, 5th ed., 2007. Van’t Haaff P.A. van’t Haaff: Catalogue of Elymaean Coinage, ca. 147BC – AD228. Lancaster 2007 HG T.R. Hardaker & P.L. Gupta: Ancient Indian Silver Punchmarked Coins, Nashik 1985. Herrli Hans Herrli: The Coins of the Sikhs, 2nd revised and augmented edition, New Delhi 2004. KG Karl Gabrish, Geld aus Tibet, Winterthur 1990. KM Krause/Mishler: Standard Catalog of World Coins, 23rd. ed. 1996, 18th and 17th cent. editions. Kulkarni Prashant P. Kulkarni: Coinage of the Bhonsla Rajas of Nagpur, Nagpur 1990. McClenaghan Tony McClenaghan: Indian Princely Medals, New Delhi 1996. Millies H.C. Millies: Recherches sur les monnaies des Indigènes de l'archipel Indien et de la péninsule Malaie, The Hague 1871. MWI M. Mitichiner: Oriental Coins and their Values: The World of Islam, London 1977. MAC do , The Ancient & Classical World, London 1978. MNI do , NonIslamic & Western Colonies, London 1979. -

Women on South Asian Coins Pankaj Tandon1

Women on South Asian Coins Pankaj Tandon1 Some years ago, I began to wonder how many women had appeared on the coins of South Asia, the area which today includes the countries of Afghanistan, Pakistan, India, Nepal, Bangladesh, and Sri Lanka. I started gathering images and ideas and started to compile a list. Along the way, I came across a paper by Jayanti Rath,2 which mentioned a total of 20 queens, although only 14 of them had demonstrably issued coins, and a small webpage3 celebrating International Women’s Week which mentioned 5 queens, of whom one had not been listed by Rath. However, I was discovering quite a few more, so I decided to continue my project, and this paper is the result. To be clear, my goal is to cover only human women who have appeared on coins, not goddesses. There are many goddesses who are depicted on coins, and the subject of deities being featured on Indian coins is one on which quite a bit has been written.4 These are not the subject of my census. I have discovered a total of 110 women who unquesionably could be said to have appeared in one way or another on coins of the sub-continent. Another three possibly appear on Gupta coins but it is debated whether the figures appearing on these coins are queens or goddesses. One more is supposed to be represented by one or two peacocks on certain Sikh coins, but this is hotly debated. Figure 1 presents a Table listing these 114 women. Finally, another six female names, serving as the gotra names of kings of the Satavahana and related dynasties, appear on coins.