Stone & Youngberg

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Community Survey #1 Summary

April 2019 – August 2019 The City of Palmdale hosted an online “icebreaker” survey to inform residents of the ongoing General Plan Update, collect feedback related to daily life in Palmdale, and demographics information. The survey was available in English and Spanish on the Palmdale General Plan Update website (Palmdale2045.org) from April 2019 to August 2019. The survey had a total of 762 responses (nearly all in English). Note that not all respondents answered every question in the survey. Key themes are summarized below. Detailed responses can be found in Appendix A. The survey asked participants to rate their agreement with different quality of life statements. Top responses to these questions are highlighted below. • Nearly 62% of respondents agree or strongly agree that Palmdale is a great place to live. • Approximately 56% of respondents agree or strongly agree that they feel safe in the Palmdale community. • Approximately 63% of respondents agree or strongly agree that they and their family have access to a healthy lifestyle (i.e., adequate health services, access to an active lifestyle such as walking or biking, access to fresh foods). • Approximately 39% of respondents disagree or strongly disagree that Palmdale is attracting quality jobs that pay well and offer benefits. • 71% of respondents agree or strongly agree that they can travel by car within Palmdale with minimal delays. • 30% of respondents neither agree nor disagree that they can access multi-modal transportation and infrastructure without driving in a car. Other responses are split across varying degrees of agreement and disagreement. • Approximately 51% of respondents agree or strongly agree that they know where to access information on City services. -

Season's Greetings

Season's Greetings TM & ©2018 Amusement Today, Inc. December 2018 | Vol. 22 • Issue 9 www.amusementtoday.com Focus on immersion and storytelling brings guests back RWS Entertainment unveils new Experiences department AT: Tim Baldwin assembled team of experts. [email protected] Tasked with supporting RWS’ ambitious Experiences NEW YORK, N.Y. — RWS program is award-winning Entertainment Group, a full- entertainment producer, direc- service production company tor and production manage- that creates award-winning ment professional Kevin custom entertainment, live Kreczko. Kreczko, formerly events and brand experienc- vice president of creative at es worldwide, announced a Lionstone Development, new Experiences department joined the RWS team in 2017 added to the company’s grow- as its senior director of busi- ing list of services. The new ness development for events department offers full concep- and attractions. At Lionstone, tual design and installation of a he oversaw the development wide range of experiential ser- of innovative hotel brands and vices, including theme design, activations. decor, attractions, seasonal “We feel the next wave of Christmas and winter-themed experiences consisting of light shows and LED-lit trees was activations and light shows entertainment in the indus- activated at Kettering Hospitals. COURTESY RWS ENTERTAINMENT GROUP year round, led by the newly 4See RWS, page 7 Two different show options close out season Showboat Branson Belle sets sail with holiday-themed shows AT: Tim Baldwin fun opportunity for families. Showboat Branson [email protected] “Santa’s Pancakes & PJs” Belle has entered enters its fourth year. The idea, its 24th year of BRANSON, Mo. — Since introduced by Guevel, wel- providing holiday the Showboat Branson Belle set comes families decked out in entertainment. -

Tammy Van Splinter 4Ugraphix Printing Company AV Auto Care

31-Bags – Tammy Van Splinter Antelope Valley Airport Express, Inc. 4ugraphix Printing Company Antelope Valley Auto Care Inc, Dan Broderius A V Auto Care, Inc., Dan Broderius Antelope Valley Chevrolet A V Pediatrics & Family Medicine Antelope Valley Ford Lincoln Ms. Renee Acevedo (Lee) ’80 Antelope Valley Ford Lincoln Mazda Mr. David Adams ’73 Antelope Valley Harley Davidson Ms. Cynthia Adams ’80 Antelope Valley Mall Jean and Reyes Aguila Antelope Valley Mall Vision Center Optometry Nadine Ahearn Antelope Valley Nissan Maiko Ainzua Antelope Valley Press Mr. & Mrs. Peter & Rita Albrech Mr. John Anthony A. and M. Alforque, Andre ’96 Antique Asylum Mr. Andrew Allen Ms. Annaliza Apilado AMC Theatres Aqua Dulce Winery Mr. & Mrs. John and Barbara Ament Arrow Transit Mix, Inc. American Eagle Art Around Studios Santos and Julieta Amorsolo Ms. Mary Asapokhai Ms. Carol Anderus Amy Atkerson Susan (Malone) and Don Andres ’67 Mr. & Mrs. Tim and Amy Atkerson, Mackenzie ’19 Patricia and Merwyn Anesetti, Elizabeth ’15 AV Bingo Supply Anthony and Jennifer Anesetti, Elizabeth ’15 AV Eye Care Mr. & Mrs. John and Theresa Anson AV Florist Ms. Catherine Anson ’06 Ms. Betty Ann Avery Johna Avila Balbina and Guillermo Bermudez Mr. Manuel Avila ’70 Dennis and Julie Berry ’89 AVTA Ms. Donna Berry-Ufert ’75 Mr. Timothy Baal ’71 Marcia and Joseph Bessacini, Christina ’08, Anne ’09 Col. and Mrs. Larry (ret.) and Bonnie Bagley Mr. David Bianchi, Nicholas ’03 Tana (Talbot) and William Bailey ’85 Ms. Martha Billeter, Sarah ’13 Mr. & Mrs. David and Linda (Carlson) Baker ’77 Mr. & Mrs. Bob and Claudette Black, Tylare ’20 Mrs. -

DRAFT Final Report

Final Report Manteca Family Entertainment Zone (“FEZ”) Submitted to: City of Manteca Submitted by: Market & Feasibility Advisors October 3, 2011 MFA Project Number: 518 One South Dearborn, Sui t e 2 1 0 0 Chicago IL 60603 312.212.4451 www.marketfeasibilityllc.com Chicago Austin Los Angeles Table of Contents Table of Contents _____________________________________________________________________ 2 Introduction & Executive Summary _______________________________________________________ 3 Regional Market Characteristics _________________________________________________________ 6 Regional Attraction Characteristics ______________________________________________________ 20 Comparable Family Destinations ________________________________________________________ 33 Business Model _____________________________________________________________________ 49 Appendix __________________________________________________________________________ 54 General Limiting Conditions ___________________________________________________________ 55 Exhibit A __________________________________________________________________________ 56 Exhibit B __________________________________________________________________________ 57 Exhibit C __________________________________________________________________________ 58 Exhibit D __________________________________________________________________________ 59 Market & Feasibility Advisors LLC Page 2 Manteca Family Entertainment Zone I ntroduction & Executive Summary Introduction Market Feasibility Advisors (“MFA”) was commissioned -

TEA/ERA Theme Park Attendance Report

TETEA/EA/ERRAA TThemeheme PPararkk AAttttendendancancee ReRepporortt © 2007 TEA and ERA TEA/ERA Theme Park Attendance Report 2006 Executive Publisher: TEA Executive Editor: Gene Jeffers Introduction Research: Economics Research Associates Editor: Judith Rubin One of the goals of TEA from the very start of the Publishers: InPark Magazine, Park World association was to be an industry leader in terms © 2007 TEA/ERA. All Rights Reserved. of information, education and standards and practices. With the introduction of this report, TEA Headquarters TEA moves ever-closer to fulfilling that goal. 175 E. Olive, Suite 100 Burbank, CA 91502, USA Tel. +01-818-843-8497 www.teaconnect.org This report is, plain and simple, the industry About TEA standard for attendance data as compiled by The TEA (formerly Themed Entertainment Association) is Economics Research Associates (ERA). ERA’s an international nonprofit organization founded in 1991 annual theme park attendance report has always to represent the creators of compelling experiences and been a must-read for the industry—a tool for places worldwide—from architects to designers, techni- journalists; a resource for industry professionals cal specialists to master planners, scenic fabricators to artists, and builders to feasibility analysts—some 6,500 and others. TEA is proud to be working with ERA creative specialists working in nearly 500 firms in 39 dif- to release and distribute this report. We look ferent countries. forward to continuing the relationship and the production cycle, so that you can look forward to About ERA Economics Research Associates is an international con- a regular stream of these useful educational sulting firm focused on economic analysis for the enter- materials. -

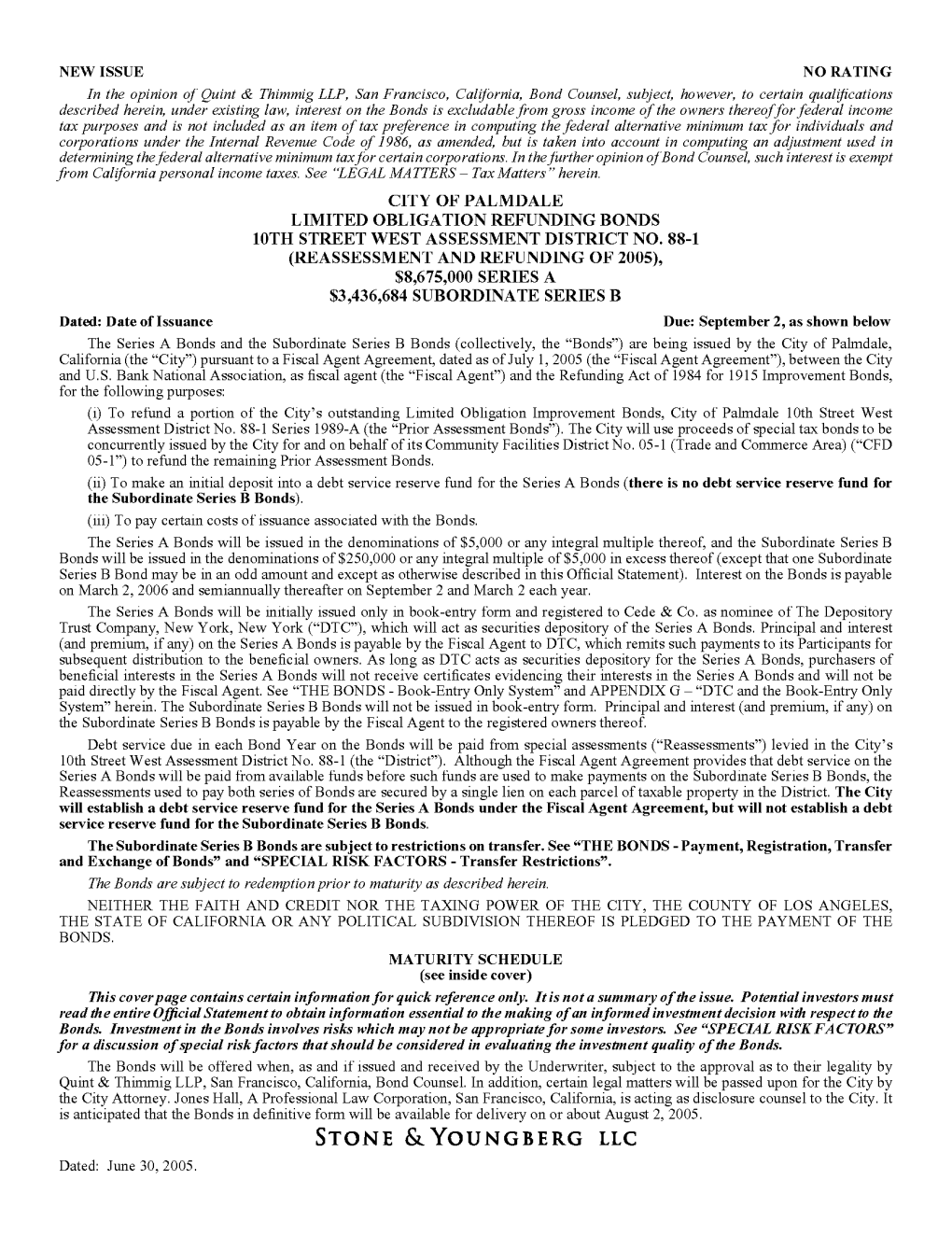

August 24, 2007 $2135000 CITY of PALMDALE LIMITED OBLIGATION

SUPPLEMENT TO OFFICIAL STATEMENT Dated: August 24, 2007 $2,135,000 $3,205,000 CITY OF PALMDALE CITY OF PALMDALE LIMITED OBLIGATION REFUNDING BONDS LIMITED OBLIGATION REFUNDING BONDS 7TH STREET WEST ASSESSMENT 7TH STREET WEST ASSESSMENT DISTRICT NO. 90-2 DISTRICT NO. 90-2 (REASSESSMENT AND REFUNDING OF (REASSESSMENT AND REFUNDING OF 2007-A), SERIES A 2007-C), SERIES C This Supplement to Official Statement (this "Supplement") supplements the Official Statement dated August 15, 2007 (the "Official Statement"} relating to the above-referenced bonds. The information set forth in this Supplement relates only to the captioned Series C Bonds, which have the maturity date, principal amount and CUSIP number set forth below: $3,205,000 5.000% Term Series C Bond due September 2, 2016, Yield: 5.000%, Price: 100.000 CUSIP No. 69672 H Purpose of Supplement This Supplement amends the Official Statement for two purposes: 1. To amend and restate the section entitled "Description of the Series C Reassessment Parcels" on pages 18-19 of the Official Statement. More specifically, the City wishes to amend the first paragraph of that section to reflect the terms under which the Series C Reassessment Parcels were sold to lntertex General Contractors, Inc. ("lntertex") by Palmdale T&C Partners LLC ("Palmdale T&C'') in July 2007. In addition, the second paragraph has been amended to reflect the fact that lntertex plans on beginning construction in early-2008 rather than late-2007. 2. With respect to the section entitled "Appraised Value of the Series C Reassessment Parcels" on page 21 of the Official Statement, to delete Footnote 1 to the summary of the appraised value of the Series C Reassessment Parcels. -

2015Economic Roundtable Report

ECONOMIC ROUNDTABLE ANNIVERSARY 2015REPORT 15 IncorporatedYEAR December ’99 SoCalLeadingEdge.org REGIONAL BUSINESS/ INDUSTRIAL PARKS LANCASTER Fox Field Industrial Corridor North Valley Industrial Center Lancaster Business Park Enterprise Business Park Southern Amargosa Industrial Centerpoint Business Park The BLVD Antelope Valley Medical Main Street PALMDALE Challenger Business Park Fairway Business Park Freeway Business Center Palmdale Power Plant Industrial Park Palmdale Trade & Commerce Center Park One Industrial Park Sierra Business Park Sierra Gateway Park CALIFORNIA CITY Airport Business Park MOJAVE Mojave Air & Space Port RIDGECREST Ridgecrest Business Park Ridgecrest Industrial Park INYOKERN Inyokern Airport Industrial District TEHACHAPI Goodrick Business Park Capital Hills Business Park Bailey Avenue Industrial Park ECONOMIC ROUNDTABLE REPORT 2015 | 1 GREATER ANTELOPE VALLEY ECONOMIC ALLIANCE MEMBERS Officers Directors Norm Hickling County of Los Angeles Harvey Holloway Aaron Chang Supervisor Antonovich Coldwell Banker Commercial Palmdale Regional Medical Valley Realty Center Paulette Rush Chairman of Board MidAmerican Solar Carrie Rogers Chuck Hoey Los Angeles Economic Rob Duchow Charles Hoey and Associates Development Corp. The Gas Company Vice-Chair Cheri Bryant Steve Perez Tom Barnes Antelope Valley Press Rosamond Community Antelope Valley-East Kern Services District Water Agency Chris Perez Vice-Chair Wells Fargo Bank Steve Radford Antelope Valley Union High June Burcham David James School District Kaiser Permanente City -

State of California Adopted Annual Budget Fiscal Year 2009-10

STATE OF CALIFORNIA ADOPTED ANNUAL BUDGET FISCAL YEAR 2009-10 MAYOR JAMES C. LEDFORD, JR. MAYOR PRO TEM Steve Hofbauer COUNCILMEMBERS LAURA BETTENCOURT Mike Dispenza TOM LACKEY CITY MANAGER STEPHEN H. WILLIAMS TABLE OF CONTENTS BUDGET MESSAGE Budget Message................................................................................................................................i Budget Awards ...........................................................................................................................xxviii Public Notice - Budget Adoption.................................................................................................. xxix Joint Resolution CC 2009-103 Approving and Adopting the Fiscal Year 2009-10 Budget.......... xxx Public Notice - Appropriation Limit .............................................................................................xxxiv Resolution 2009-102 Establishing an Appropriations Limit........................................................ xxxv COMMUNITY PROFILE Location Map ....................................................................................................................................1 Population Profile .............................................................................................................................2 Population Growth ............................................................................................................................3 City Organization Chart….. ..............................................................................................................4 -

The Greater Antelope Valley Is Ready for Growth!

The Greater Antelope Valley is Ready For Growth! It has been a pleasure to have the opportunity to serve as Chairman of the GAVEA and AVEREF Boards of Directors this past year. 2017 saw a purposeful effort to both create new, and strengthen current, partnerships with regional workforce development practitioners, educators, Team California, the Industrial Asset Management Council (IAMC), CalEd, GoBis, the local Boards of Trade, Chambers of Commerce and Realtors. These partnerships will serve as the cornerstone of economic growth as we move into 2018. For nearly 20 years, GAVEA’s Economic Round Table Report has been the singular source for current data relevant to business in our region. This year the GAVEA staff has raised the bar to bring you the best Round Table Report to date. We are confident you will be able to use this report to grow your own business, as well as aide in the recruitment of new businesses to the region. The GAVEA board would like to thank our Investors and sponsors for their continued support. Your investment in this organization supports all of the work we do together to build a greater Antelope Valley. The board would also like to recognize the work of the GAVEA staff. The effort you put in to improve the economy of the Antelope Valley is second to none. We look forward to another great and prosperous year, Dr. Steve Radford, GAVEA Chairman Board Members OFFICERS Dr. Steve Radford Chairman Harvey Holloway Director at Large Antelope Valley Union High School District Coldwell Banker Commercial Valley Realty Rob Duchow Vice Chair George Atkinson Director at Large The Gas Company Atkinson and Associates Laurel Shockley Secretary Veronica Knudson Director at Large Southern California Edison Palmdale Regional Medical Center DIRECTORS Martha Molina-Aviles Ed Knudson LA County Workforce Development Board Antelope Valley College Tom Barnes Bernie Longjohn Antelope Valley East Kern Water Agency Learn 4 Life Chenin Dow Chris L.