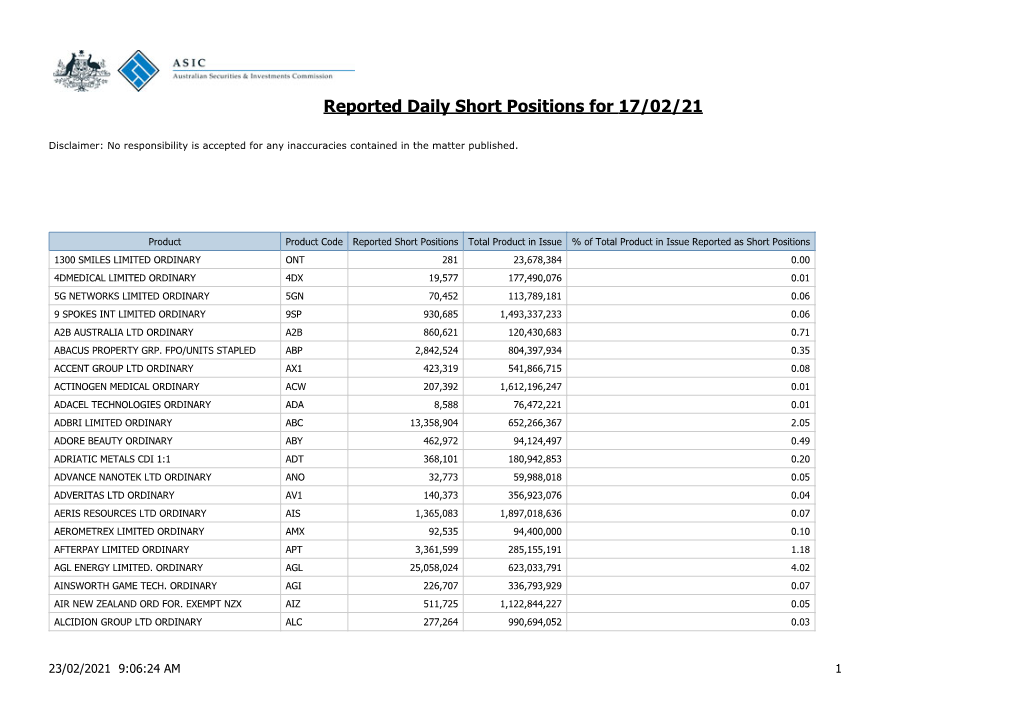

Reported Daily Short Positions for 17/02/21

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

The Mineral Industry of Australia in 2008

2008 Minerals Yearbook AUSTRALIA U.S. Department of the Interior August 2010 U.S. Geological Survey THE MINERAL INDUS T RY OF AUS T RALIA By Pui-Kwan Tse Australia was one of the world’s leading mineral producing and the Brockman iron project in the Pilbara region of Western countries and ranked among the top 10 countries in the world Australia (Australian Bureau of Agricultural and Resource in the production of bauxite, coal, cobalt, copper, gem and Economics, 2009a). near-gem diamond, gold, iron ore, lithium, manganese ore, tantalum, and uranium. Since mid-2008, the global financial Minerals in the National Economy crisis had sharply weakened world economic activities, and the slowdown had been particularly pronounced in the developed Australia’s mining sector contributed more than $105 billion countries in the West. Emerging Asian economies were also to the country’s gross domestic product (GDP), or 7.7% of the adversely affected by the sharply weaker demand for exports GDP during fiscal year 2007-08. In 2008, the mining sector and tighter credit conditions. After a period of strong expansion, employed 173,900 people who worked directly in mining and an Australia’s economic growth decreased by 0.5% in the final additional 200,000 who were involved in supporting the mining quarter of 2008. Overall, Australia’s economy grew at a rate activities. Expectations of sustained levels of global demand for of 2.4% during 2008. During the past several years, owing to minerals led to increased production of minerals and metals in anticipated higher prices of mineral commodities in the world Australia, and the mineral industry was expected to continue markets, Australia’s mineral commodity output capacities to be a major contributor to the Australian economy in the next expanded rapidly. -

2011-08-09 Qon Exploration Expenditure

LEGISLATIVE COUNCIL C 'lff"\ 1"'.( "''1 ---------~~-~Question- on"notice ----------- ..'-?ibt;-:s::'.;"--- --_.- Thursday, 26 May 2011 4189. Hon Robin Chapple to the Minister for Mines and Petroleum. I refer to the Fourth Annual Kimberley Energy and Resources Development, 9 - 10 May 2011, Cable Beach Club Resort, Broome at which Dr Ivor Roberts, Executive Director - Mineral Titles Division, Department of Mines and Petroleum, spoke next on 'Government initiatives and mineral project approvals in the Kimberley', in which according to Mr Roberts, data from the Federal Government indicated that four billion had been expended last year on exploration, and 1 ask - (1) Does form five expenditure support this figure? (2) If yes to (1), what were the expenditure figures for 201O? (3) Ifno to (1), why not? (4) What were the expenditure figures for 2010? (5) Can the Minister also advise what the total amount of expenditure exemptions for 2010 was? (6) Which leaseholders sought and received expenditure exemptions for 2010? Answer (1) No. (2) Not applicable. (3) The exploration figure of four billion dollars quoted by Dr Ivor Roberts during his presentation at the Fourth Annual Kimberley Energy and Resources Development conference was for both minerals ($1.4017 billion) and petroleum ($2.4953 billion) and sourced from the Australian Bureau of Statistics' website at http://www.abs.gov.au/AUSST ATS/[email protected]/DetailsPage/8412.0Dec%20201 O?Open Document (4) $1,600,511,395 (the combined total expenditure as reported from Form 5 submissions). (5) Yes, $130,412,112. -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

Australian Capital Territory Listed Company Shareholdings As at 31 March 2021

? i Australian Capital Territory Listed Company Shareholdings at 31 March 2021 Publication Date: April 2021 Page | 1 10X Genomics Inc Airbus SE 3i Group PLC Aisin Corp 3M Co Ajinomoto Co Inc A O Smith Corp Akamai Technologies Inc a2 Milk Co Ltd/The Akzo Nobel NV ABB Ltd Albemarle Corp Abbott Laboratories Alcon Inc AbbVie Inc Alexandria Real Estate Equities Inc ABC-Mart Inc Alexion Pharmaceuticals Inc ABIOMED Inc Alfa Laval AB Accent Group Ltd Algonquin Power & Utilities Corp Accenture PLC Align Technology Inc Accor SA Alimentation Couche-Tard Inc Acom Co Ltd Alkane Resources Ltd ACS Actividades de Construccion y Servic Alleghany Corp Activision Blizzard Inc Allegion plc Adbri Ltd Allianz SE Adecco Group AG Allstate Corp/The adidas AG Ally Financial Inc Admiral Group PLC Alnylam Pharmaceuticals Inc Adobe Inc Alphabet Inc Advance Auto Parts Inc ALS Ltd Advanced Micro Devices Inc Alstom SA Advantest Corp AltaGas Ltd Adyen NV Altice USA Inc Aegon NV Altium Ltd Aeon Co Ltd Alumina Ltd Aflac Inc Amada Co Ltd Afterpay Ltd Amadeus IT Group SA AGC Inc Amazon.com Inc Ageas SA/NV Ambu A/S Agilent Technologies Inc Amcor PLC Agnaten SE AMERCO AGNC Investment Corp American Express Co Agnico Eagle Mines Ltd American Financial Group Inc/OH AIA Group Ltd American International Group Inc Air Canada American Tower Corp Air Liquide SA American Water Works Co Inc Air Products and Chemicals Inc Ameriprise Financial Inc Air Water Inc AmerisourceBergen Corp Airbnb Inc AMETEK Inc Page | 2 Amgen Inc Assicurazioni Generali SpA AMP Ltd Assurant Inc Amphenol Corp -

STOXX Pacific 100 Last Updated: 01.08.2017

STOXX Pacific 100 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 98.1 1 1 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 72.3 2 2 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 58.9 3 3 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Y 56.2 4 5 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 54.3 5 4 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 38.8 6 6 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 33.0 7 7 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 31.3 8 8 AU000000WOW2 6981239 WOW.AX 698123 Woolworths Ltd. AU AUD Y 23.4 9 9 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 18.9 10 11 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 18.6 11 10 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 15.9 12 12 AU000000SCG8 BLZH0Z7 SCG.AX AU01Z4 SCENTRE GROUP AU AUD Y 14.9 13 14 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 14.4 14 13 AU000000SUN6 6585084 SUN.AX 658508 SUNCORP GROUP LTD. AU AUD Y 12.5 15 15 AU000000AMC4 6066608 AMC.AX 606660 Amcor Ltd. AU AUD Y 12.0 16 16 AU000000QBE9 6715740 QBE.AX 671574 QBE Insurance Group Ltd. -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only. -

2020 Annual Report

ASX Release / 18 September 2020 2020 Annual Report The 2020 Annual Report for St Barbara Limited is attached, as distributed to shareholders today. The Annual Report complements, and should be read in conjunction with, information contained in the Annual Report Company’s corresponding Sustainability Report and Corporate Governance Statement, both released today and available at www.stbarbara.com.au. Integrated suite of annual reporting Corporate Sustainability Governance Report Statement Investor Relations Mr David Cotterell Manager Investor Relations +61 3 8660 1900 ASX: SBM Media Relations Mr Ben Wilson GRACosway +61 407 966 083 ADR: STBMY Authorised by Mr Rowan Cole Company Secretary St Barbara Limited Level 10, 432 St Kilda Road, Melbourne VIC 3004 T +61 3 8660 1900 F +61 3 8660 1999 ACN 009 165 066 Locked Bag 9, Collins Street East, Melbourne VIC 8003 W www.stbarbara.com.au ANNUAL REPORT 2020 St Barbara Limited ABN 36 009 165 066 OUR BUSINESS We are St Barbara – a growing gold company with a global outlook. An ASX 200 company, our gold mining operations are located in Australia, Canada and Papua New Guinea. As we operate our business and care for our people, we are guided by our five commitments and values-led culture. At St Barbara, doing the right thing is important to all of us. Our commitments SAFETY EMPOWERED PEOPLE STRONGER RESPECTING THE GROWING ALWAYS DIVERSE TEAMS COMMUNITIES ENVIRONMENT SUSTAINABLY Zero harm is always We are an employer We strive to help our We are committed Growing our business our target. Zero harm of choice committed communities thrive, to caring for the sustainably, where it to all people as we to inclusion and grow and prosper. -

Australia & New Zealand Report 2018

DISCLOSURE INSIGHT ACTION Australia & New Zealand Report 2018 On behalf of over 650 investors with US$87 trillion in assets. CDP Report 2018 | Published February 2019 Contents 3 CEO foreword 14 Appendix I List of disclosing companies in Australia & 4 Disclosure in 2018 New Zealand 5 Climate Change: Australia & New 18 Appendix II Zealand insights Responding companies in Australia & New Zealand – supply chain program 9 Water Security: Driving water stewardship 19 Appendix III Non-responding companies in Australia & 10 Forests: Building sustainable New Zealand supply chains 12 CDP Australia & New Zealand Awards 2018 13 Investor Signatories & Members in Australia & New Zealand Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

ACXW Avantis International Small Cap Value

American Century Investments® Quarterly Portfolio Holdings Avantis® International Small Cap Value ETF (AVDV) May 28, 2021 Avantis International Small Cap Value ETF - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 99.4% Australia — 8.0% Adairs Ltd. 64,691 233,414 Adbri Ltd. 444,216 1,141,164 Aeris Resources Ltd.(1) 238,800 31,179 Alkane Resources Ltd.(1)(2) 152,741 103,278 Alliance Aviation Services Ltd.(1) 50,306 171,065 Asaleo Care Ltd. 212,115 229,790 Aurelia Metals Ltd. 716,008 245,064 Austal Ltd. 283,491 520,718 Australian Finance Group Ltd. 186,297 400,567 Australian Pharmaceutical Industries Ltd. 419,111 373,258 Bank of Queensland Ltd. 555,800 3,869,929 Beach Energy Ltd. 2,204,143 2,167,414 Bendigo & Adelaide Bank Ltd. 252,445 2,042,517 Boral Ltd.(1) 116,988 619,401 Calix Ltd.(1) 39,671 84,060 Cedar Woods Properties Ltd. 8,294 45,011 Champion Iron Ltd.(1) 492,380 2,502,893 Collins Foods Ltd. 16,697 160,894 Coronado Global Resources, Inc.(1) 453,537 242,887 CSR Ltd. 651,143 2,799,491 Dacian Gold Ltd.(1) 129,467 28,363 Deterra Royalties Ltd. 179,435 579,460 Eclipx Group Ltd.(1) 432,641 710,525 Emeco Holdings Ltd.(1) 476,645 332,757 EML Payments Ltd.(1) 327,130 862,970 Galaxy Resources Ltd.(1) 3,318 9,808 Genworth Mortgage Insurance Australia Ltd.(1) 442,504 945,096 Gold Road Resources Ltd. 660,222 763,347 GrainCorp Ltd., A Shares 347,275 1,343,019 Grange Resources Ltd. -

ACZH Avantis International Small Cap Value

American Century Investments® Quarterly Portfolio Holdings Avantis® International Small Cap Value Fund May 28, 2021 Avantis International Small Cap Value Fund - Schedule of Investments MAY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 98.5% Australia — 8.0% Adairs Ltd. 10,087 36,395 Adbri Ltd. 41,613 106,901 Aeris Resources Ltd.(1) 194,638 25,413 Alkane Resources Ltd.(1)(2) 23,444 15,852 Alliance Aviation Services Ltd.(1) 9,551 32,478 Asaleo Care Ltd. 55,544 60,172 Aurelia Metals Ltd. 117,534 40,228 Austal Ltd. 40,665 74,694 Australian Finance Group Ltd. 27,184 58,450 Australian Pharmaceutical Industries Ltd. 57,039 50,799 Bank of Queensland Ltd. 50,470 351,413 Beach Energy Ltd. 256,312 252,041 Bega Cheese Ltd. 10,686 47,626 Bendigo & Adelaide Bank Ltd. 28,090 227,274 Boral Ltd.(1) 23,590 124,899 Brickworks Ltd. 3,303 53,477 Byron Energy Ltd.(1) 7,834 635 Calix Ltd.(1) 13,271 28,120 Champion Iron Ltd.(1) 59,052 300,176 Class Ltd. 1,392 1,856 Coronado Global Resources, Inc.(1) 116,275 62,270 CSR Ltd. 61,819 265,781 Dacian Gold Ltd.(1) 57,096 12,508 Eclipx Group Ltd.(1) 40,478 66,477 Emeco Holdings Ltd.(1) 64,744 45,199 EML Payments Ltd.(1) 32,108 84,701 Fleetwood Ltd. 1,403 2,649 Galaxy Resources Ltd.(1) 50,126 148,165 Genworth Mortgage Insurance Australia Ltd.(1) 23,355 49,881 Gold Road Resources Ltd. 119,473 138,134 GrainCorp Ltd., A Shares 46,105 178,302 Grange Resources Ltd. -

Premier Mining Industry Practice

Premier Mining Industry Practice “They go to great lengths to understand your industry, business and specific objectives . so the advice you get it is fit for purpose. It’s not cookie cutter, and as a client that is extremely valuable.” CLIENT QUOTED IN CHAMBERS UK, 2014 NATURAL RESOURCES “Sullivan is our firm of choice – they are terrific, time after time. The work is of a very high quality, and they understand our commercial intentions as well as the legal issues.” CLIENT QUOTED IN CHAMBERS USA, 2013 “The partners ‘are detail oriented, efficient and they think strategically’. ‘Their legal expertise is absolutely first rate but equally or more valuable is their general industry/business advice and suggestions on how to tackle issues.” LEGAL 500 LATIN AMERICA, 2013 Mining and Metals &C’s presence in the mining and metals sector is Sunrivaled. We continue to be the firm of choice for structurally complex, market-opening and precedent-setting deals. Our practice is not confined to working with major mining companies, and we frequently apply our expertise to benefit junior mining companies in their growth initiatives, as well as strategic and alternative investors and lenders and underwriters to the industry. We have particular expertise in challenging emerging markets. Our multi-disciplinary approach ensures that clients benefit from our industry experience in each of our core practice areas. OUR CORE Mergers & Acquisitions and Joint Ventures PRACTICE AREAS Project Development and Finance Capital Markets, Leveraged Finance & Lending Private Equity Restructuring Commodities, Futures & Derivatives Tax Sanctions and Trade Disputes and Investigations 2 The Firm’s standing in the industry is reflected in the number of major mining and metals companies and other active industry participants that it has represented, both directly and in consortia, including: Alumina Kinross Gold Corp.