Glitre Energi AS Norway, Utilities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Konsernregnskap-2017-Engelsk.Pdf

Vardar in 2017 The energy group Vardar aims to create value through long-term investments in renewable energy. The Buskerud County Administration is the class A shareholder with influence over the company, while the municipalities in Buskerud county own the class B shares. Upon a restructuring of the county administrative level effective as of 1 January 2020, the class B shareholders will most likely become owners with full management rights. Vardar’s core operations were defined by the Buskerud County Administration in the autumn of 2016 as hydropower production and ownership of Glitre Energi AS. Vardar has worked with solutions for adaptation to the new ownership strategy throughout 2017. The Group has the following reporting structure as of 31 December 2017: Vardar AS Hydropower Wind Power Wind/Bio Abroad Bioenergy Vardar Vannkraft AS Norway/Sweden Vardar Eurus AS Vardar Varme AS Glitre Energi AS Vardar Boras AS Based on the earnings and balance sheet of the Hydropower segment back in the early 2000s, Vardar has had the opportunity to become a substantial wind power actor in the Baltic States and a well-known wind power actor in Norway and Sweden, as well as an established district heating operator in parts of Buskerud. The financing of investments and entering into hedging instruments to reduce risk related to the operations have been combined in Vardar AS. In the financial reporting, this is defined as unallocated activities. Vardar has had a strategy to invest in wind power power in Sweden and parts of the Norwegian wind through partnerships with local actors. If full power production, electricity certificates are also production in our various investments is assumed, traded for portions of the power production. -

Høring Om Forslag Til Endringer I Forskrift Om Kraftomsetning Og Nettjenester for Innføring Av Én Pris Og Én Regulerkraftbal

Flere mottakere. Se mottakerliste Vår dato: 23.04.2021 Vår ref.: 202103835-3 Arkiv: 623 Saksbehandler: Deres dato: Jørund Krogsrud Deres ref.: Høring om forslag til endringer i forskrift om kraftomsetning og nettjenester for innføring av én pris og én regulerkraftbalanse i regulerkraftavregningen Reguleringsmyndigheten for energi (RME) sender på høring forslag til ny modell for prising av regulerkraftubalanser i kraftmarkedet som innebærer at det innføres én pris og én regulerkraftbalanse i balanseavregningen, også omtalt som enpris-modellen. Som del av forslaget foreslås endringer i forskrift om kraftomsetning og nettjenester (avregningsforskriften)1 § 5-2. Forslaget sendes på høring på vegne av Olje- og energidepartementet (OED), som skal vedta forslaget. Høringsfristen er 23. juni 2021. RME foreslår at én pris og én regulerkraftbalanse i regulerkraftavregningen innføres fra 1. november 2021 Det europeiske og nordiske kraftsystemet er i endring med mer variabel kraftproduksjon som vind og sol, i tillegg til økt kraftutveksling over landegrensene. Denne utviklingen gjør det vanskeligere for systemansvarlig å balansere og opprettholde driftssikkerheten i det nordiske kraftsystemet. Enpris- modellen vil bidra til å sikre likebehandling av markedsaktørene siden ubalansene vil bli avregnet til en pris som i større grad reflekterer kostnaden av ubalansen, uavhengig av om den stammer fra kraftproduksjon eller -forbruk. RME er av den oppfatning at en mer effektiv avregning av ubalanser på like vilkår, vil bidra til at kraftsystemet som helhet så langt som mulig planlegges i balanse. På bakgrunn av dette, foreslår RME på vegne av OED endringer i avregningsforskriften § 5-2 for innføring av én pris og én regulerkraftbalanse i regulerkraftavregningen. Forslaget innebærer at ubalanser avregnes etter samme pris uavhengig av om ubalansen gjelder forbruk eller produksjon, samt uavhengig av ubalansens retning. -

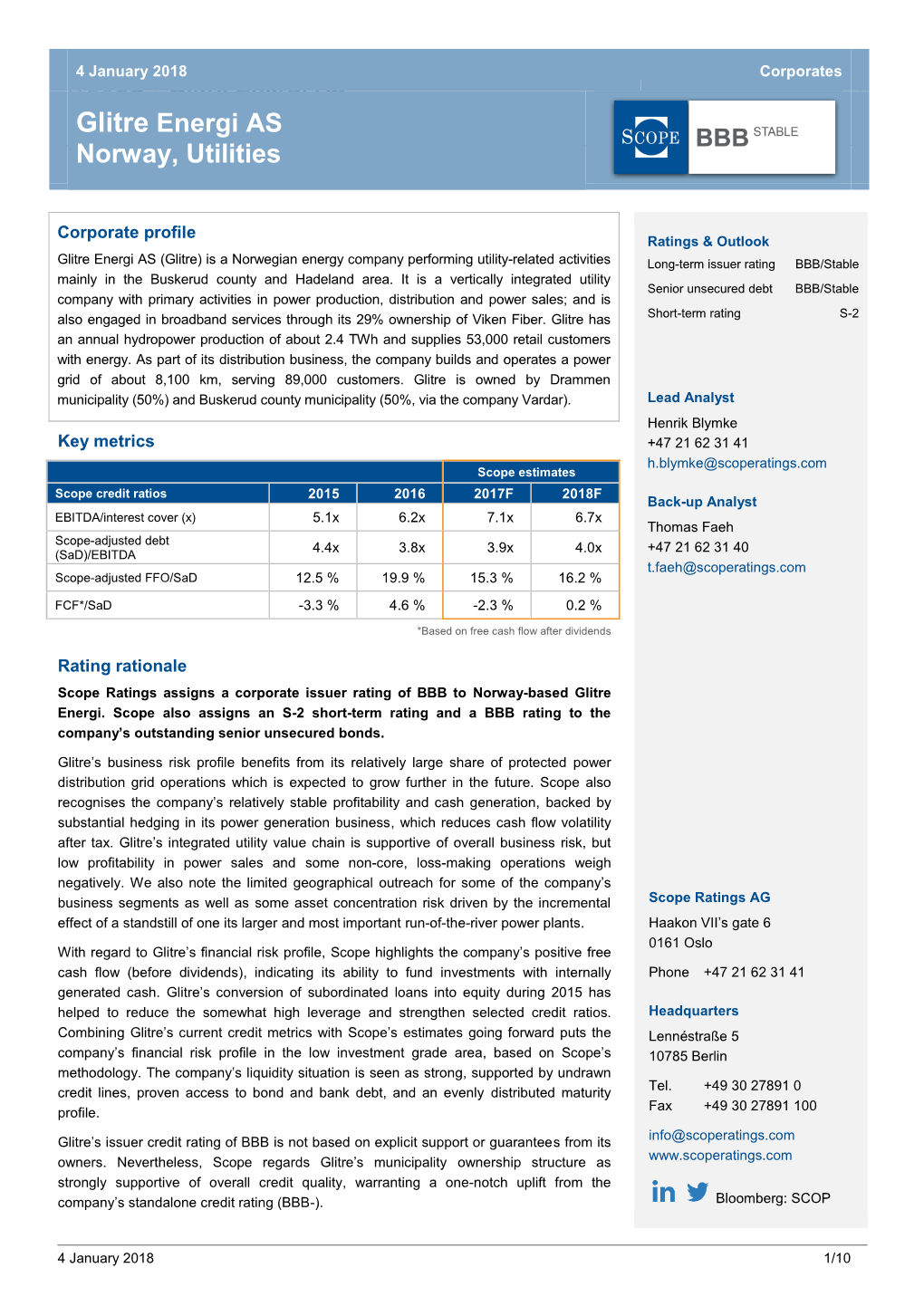

Glitre Energi AS

+ 4 January 2018 Corporates Glitre Energi AS Glitre EnergiNorway, UtilitiesAS Norway, Utilities Corporate profile Ratings & Outlook Glitre Energi AS (Glitre) is a Norwegian energy company performing utility-related activities Long-term issuer rating BBB/Stable mainly in the Buskerud county and Hadeland area. It is a vertically integrated utility Senior unsecured debt BBB/Stable company with primary activities in power production, distribution and power sales; and is also engaged in broadband services through its 29% ownership of Viken Fiber. Glitre has Short-term rating S-2 an annual hydropower production of about 2.4 TWh and supplies 53,000 retail customers with energy. As part of its distribution business, the company builds and operates a power grid of about 8,100 km, serving 89,000 customers. Glitre is owned by Drammen municipality (50%) and Buskerud county municipality (50%, via the company Vardar). Lead Analyst Henrik Blymke Key metrics +47 21 62 31 41 [email protected] Scope estimates Scope credit ratios 2015 2016 2017F 2018F Back-up Analyst EBITDA/interest cover (x) 5.1x 6.2x 7.1x 6.7x Thomas Faeh Scope-adjusted debt 4.4x 3.8x 3.9x 4.0x +47 21 62 31 40 (SaD)/EBITDA [email protected] Scope-adjusted FFO/SaD 12.5 % 19.9 % 15.3 % 16.2 % FCF*/SaD -3.3 % 4.6 % -2.3 % 0.2 % *Based on free cash flow after dividends Rating rationale Scope Ratings assigns a corporate issuer rating of BBB to Norway-based Glitre Energi. Scope also assigns an S-2 short-term rating and a BBB rating to the company’s outstanding senior unsecured bonds. -

Vedtak Om Datamigrering Og Aktørgodkjenning Ved Innføring Av Elhub

Til omsetningskonsesjonærer Vår dato: 13.08.2018 Vår ref.: 201836732-2 Arkiv: Saksbehandler: Deres dato: Karl Magnus Ellinggard Deres ref.: 22959326/[email protected] Vedtak om datamigrering og aktørgodkjenning ved innføring av Elhub NVE vedtar at nettselskap og kraftleverandører må migrere data til Elhub, samt gjennomføre aktørgodkjenning i Elhub sitt testmiljø, jf. avregningsforskriften §§ 1-6 og 1-7. Vedtaket pålegger nettselskap og kraftleverandører å kvalitetssikre og migrere opplysninger til avregningsansvarlig i henhold til krav om datakvalitet ved milepæl 10. Det pålegger også nettselskap og kraftleverandører å gjennomføre aktørgodkjenning i Elhub testmiljø. Fristen for datamigrering og aktørgodkjenning settes til 1. september 2018. Bakgrunn NVE viser til varsel om vedtak av 9. juli 2018. Vi viser videre til vårt vedtak av 25. februar 2016 om kvalitetssikring og migrering av data til avregningsansvarlig i forbindelse med innføring av Elhub. Som ved oppfølging av tidligere milepæler i migreringsprosjektet for Elhub, vil NVE følge opp nettselskap og kraftleverandører ved milepæl 10 (M10) i migreringsprosjektet. Dette vedtaket angir krav til datakvalitet for migrerte data til Elhub som ved oppfølging av tidligere milepæler. Hensikten med migreringen er å verifisere at nettselskap og kraftleverandører har nødvendige data med tilfredsstillende datakvalitet før idriftsettelsen av Elhub 18. februar 2019. Aktørgodkjenningen skal verifisere at aktører kan kommunisere og gjennomføre forretningsprosesser i Elhub før den settes i drift. Krav om kvalitetssikring og migrering av data For å sikre at Elhub har nødvendig datakvalitet når den skal settes i drift 18. februar 2019 skal nettselskap og kraftleverandører overføre nødvendige og korrekte opplysninger til Elhub ved M10. Ved denne milepælen stilles krav til datakvalitet. -

Vardar-Konsernregnskap-2016-ENG

Vardar in 2016 Vardar is an energy group with the ambition to create value through long-term investments in renewable energy. The owners are Buskerud County Administration who owns the A-share, and the municipalities in Buskerud who own the B-shares. In case of a restructuring of the administrative level in Norway, the owners of the B-shares will be given the management of the company. Vardar’s core operations have been hydropower, wind power and bioenergy in Norway, Sweden and the Baltic countries. During 2016 Buskerud County Administration made a new strategy for Vardar and defined the core operations as hydropower and the ownership in Glitre Energi AS. During 2016 the power prices have risen compared to the low level in 2015, but is still on a low level. The graph shows the progress of the power prices in the areas Vardar produce energy. The graph show the achieved prices in Estonia (EE) and Lithuania (LV), including the received support. The production of wind power in Sweden and partly in Norway, are entitled to receive el certificates in addition to the power price. As a result of the low power prices, the power market is more challenged than earlier. The diversification between production based on different energy sources and geographic areas has given Vardar a strength. Totally Vardar contributed to the production of 2,6 TWh renewable energy in 2016. The year resulted in an all time high production both in Sweden and the Baltics, due to commissioning of new wind parks. Since Vardar calculate 50 % of the production in Gliltre Energi in this numbers, the segment Hydro Power stands for the highest share of the production. -

Kraftsystemutredning Region Buskerud Og Hadeland 2020 – 2040

KRAFTSYSTEMUTREDNING REGION BUSKERUD OG HADELAND 2020 – 2040 HOVEDRAPPORT Bilde på forsiden viser en av mastene etter ombygging av deler av 66 kV linja Gomsrud – Skollenborg på Kongsberg høsten 2019. Foto: Glitre Energi Nett KRAFTSYSTEMUTREDNING REGION BUSKERUD OG HADELAND Innhold INNHOLD: 0. FORORD ....................................................................................................................... 3 1. INNLEDNING .............................................................................................................. 5 2. UTREDNINGSPROSESSEN ...................................................................................... 7 2.1 Bakgrunn .............................................................................................................. 7 2.2 Organisering av utredningsprosessen ................................................................... 7 2.3 Samordning mot tilgrensende utredningsområder ............................................... 8 2.4 Behandling av utredningen .................................................................................. 8 2.5 Rullering av utredningen ...................................................................................... 8 3. FORUTSETNINGER I UTREDNINGSARBEIDET ............................................... 9 3.1 Utredningens ambisjonsnivå og tidshorisont ....................................................... 9 3.2 Mål for regionalnettet ........................................................................................... 9 3.3 Strategi for -

Konsernregnskap-2018-Engelsk.Pdf

Vardar in 2018 The starting point for Vardar AS was the Buskerud County Authority’s investment in hydropower development and power transmission in 1919. Today, the Group is a long-term investor in renewable energy, which is still owned by the founder, the Buskerud County Authority, as the A shareholder with full management rights, and the municipalities in Buskerud hold B shares without any management rights. After the establishment of the Viken County Authority on 1 January 2020, the municipalities in Buskerud will become owners with full management rights, and the county authority’s holding company will cease to exist. The Group has the following reporting structure as of 31 December 2018: Vardar AS Hydropower Wind Power Discontinued operations Bioenergy Vardar Vannkraft AS Norway/Sweden Wind/Bio Abroad Vardar Varme AS Glitre Energi AS Vardar Boras AS Vardar Eurus AS Based on the earnings and balance sheet of the Hydropower segment back to the early 2000s, Vardar has had the opportunity to help build up a substantial wind power actor in the Baltic States, become a well-known wind power actor in Norway and Sweden, and establish district heating operations in parts of Buskerud. The financing of investments and entering into hedging instruments to reduce risk related to the operations have been combined in Vardar AS. In financial reporting, this is defined as unallocated activities. The operations in the Baltic States have been sold throughout 2018, and fall under discontinued operations. There has been a boost in the power prices in 2018 relative to recent years, and this has had a positive impact on the consolidated financial statements. -

Mottakerliste: Agder Energi Nett AS Agder Energi Vannkraft AS Agva Kraft AS Akershus Energi Vannkraft AS Aktieselskabet Saudefal

Mottakerliste: Agder Energi Nett AS Agder Energi Vannkraft AS Agva Kraft AS Akershus Energi Vannkraft AS Aktieselskabet Saudefaldene Aktieselskabet Tyssefaldene Alta Kraftlag SA Andøy Energi AS Arctic Wind AS Arendals Fossekompani ASA Arna Kraftselskap AS AS Eidefoss AS Randsfjord Tremasse- & Papirfabrikk AS Vadheim Elektrochemiske Fabriker Askøy Energi Kraftsalg AS Askøy Nett AS Aurland Energiverk AS Austevoll Kraftlag SA Axpo Nordic AS Bagn Kraftverk Da Ballangen Energi AS BE Kraftsalg AS Bergen Energi Spot AS Bindal Kraftlag SA BIR Avfallsenergi AS BKK Nett AS BKK Produksjon AS BKK Varme AS Boliden Odda AS Brattvåg Kraftverk AS Dalane energi AS Dalane Kraft AS Dale Kraft AS Desconda AS Dragefossen Kraftanlegg AS Drangedal Everk KF Drangedal Kraft KF Driva Kraftverk e20 Smart Energi AS EB Strøm AS E-CO Energi AS Eidsdal Kraft AS Eidsiva Marked AS Eidsiva Bioenergi AS Eidsiva Nett AS Eidsiva Vannkraft AS Eiendomsspar AS Eiendomsspar Energi AS Elkem AS Elkraft AS Eneas Energy AS Energi Salg Norge AS ENERGI SYSTEM AS ENERGIPLAN AS Enfo Energy AS Engeset Kraft AS Eramet Norway Kvinesdal AS Etne Elektrisitetslag SA Evenes Kraftforsyning AS Finnfjord AS Finnås Kraftlag SA Firdakraft AS Firma Albert Collett Fitjar Kraftlag SA Fjelberg Kraftlag Fjord Energi AS Fjordkraft AS Flesberg Elektrisitetsverk AS Follo Energi AS Follo Nett AS Forsand Elverk KF Fortum Markets AS Forus Energigjenvinning 2 AS FosenKraft AS Fosstveit Kraft AS Fredrikstad Energisalg AS Fritzøe Skoger M M Treschow Fusa Kraftlag SA Gassco AS Gauldal Energi AS Gauldal Nett AS