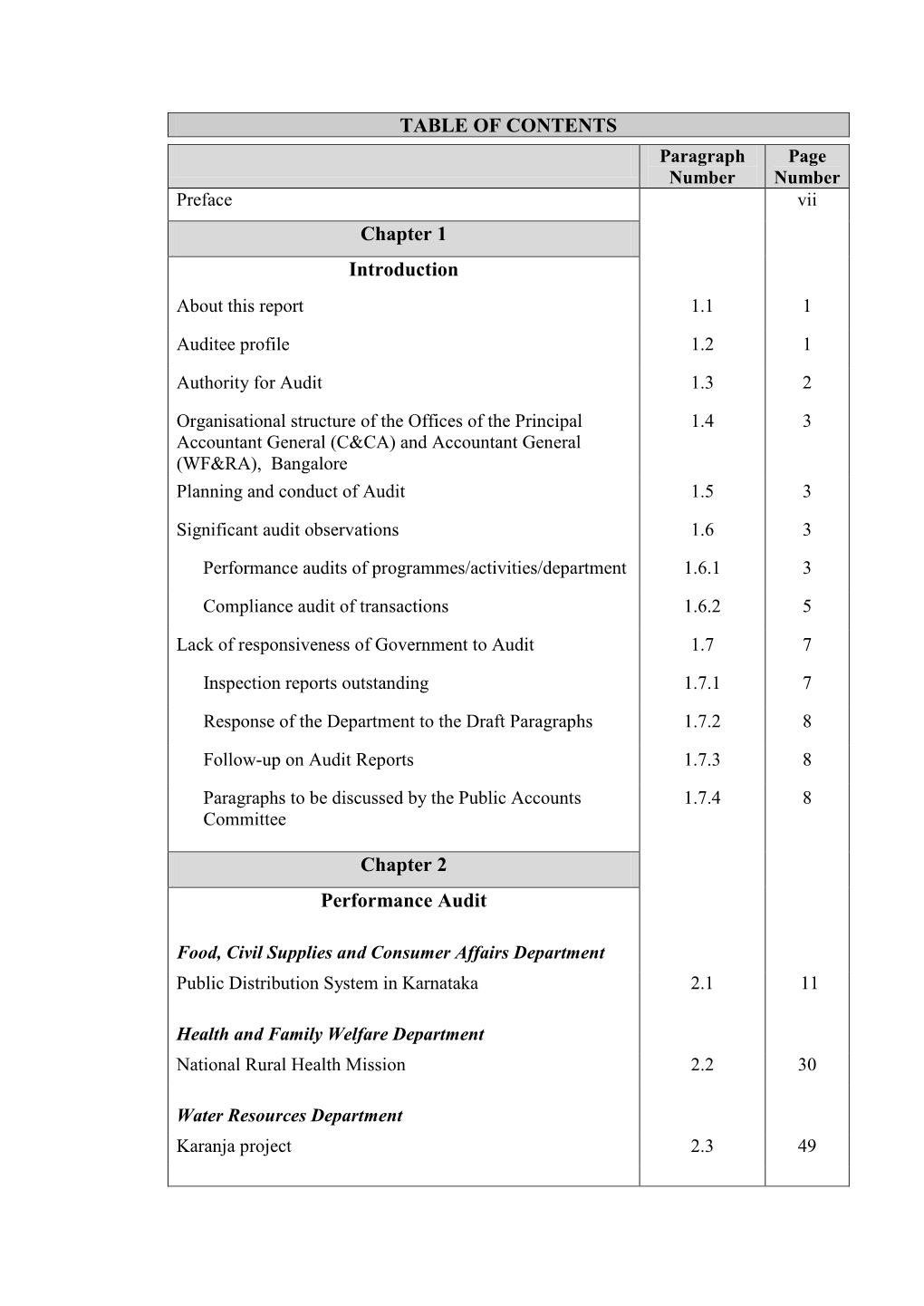

TABLE of CONTENTS Chapter 1 Introduction Chapter 2 Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Post Offices

Circle Name Po Name Pincode ANDHRA PRADESH Chittoor ho 517001 ANDHRA PRADESH Madanapalle 517325 ANDHRA PRADESH Palamaner mdg 517408 ANDHRA PRADESH Ctr collectorate 517002 ANDHRA PRADESH Beerangi kothakota 517370 ANDHRA PRADESH Chowdepalle 517257 ANDHRA PRADESH Punganur 517247 ANDHRA PRADESH Kuppam 517425 ANDHRA PRADESH Karimnagar ho 505001 ANDHRA PRADESH Jagtial 505327 ANDHRA PRADESH Koratla 505326 ANDHRA PRADESH Sirsilla 505301 ANDHRA PRADESH Vemulawada 505302 ANDHRA PRADESH Amalapuram 533201 ANDHRA PRADESH Razole ho 533242 ANDHRA PRADESH Mummidivaram lsg so 533216 ANDHRA PRADESH Ravulapalem hsg ii so 533238 ANDHRA PRADESH Antarvedipalem so 533252 ANDHRA PRADESH Kothapeta mdg so 533223 ANDHRA PRADESH Peddapalli ho 505172 ANDHRA PRADESH Huzurabad ho 505468 ANDHRA PRADESH Fertilizercity so 505210 ANDHRA PRADESH Godavarikhani hsgso 505209 ANDHRA PRADESH Jyothinagar lsgso 505215 ANDHRA PRADESH Manthani lsgso 505184 ANDHRA PRADESH Ramagundam lsgso 505208 ANDHRA PRADESH Jammikunta 505122 ANDHRA PRADESH Guntur ho 522002 ANDHRA PRADESH Mangalagiri ho 522503 ANDHRA PRADESH Prathipadu 522019 ANDHRA PRADESH Kothapeta(guntur) 522001 ANDHRA PRADESH Guntur bazar so 522003 ANDHRA PRADESH Guntur collectorate so 522004 ANDHRA PRADESH Pattabhipuram(guntur) 522006 ANDHRA PRADESH Chandramoulinagar 522007 ANDHRA PRADESH Amaravathi 522020 ANDHRA PRADESH Tadepalle 522501 ANDHRA PRADESH Tadikonda 522236 ANDHRA PRADESH Kd-collectorate 533001 ANDHRA PRADESH Kakinada 533001 ANDHRA PRADESH Samalkot 533440 ANDHRA PRADESH Indrapalem 533006 ANDHRA PRADESH Jagannaickpur -

Table of Content Page No's 1-5 6 6 7 8 9 10-12 13-50 51-52 53-82 83-93

Table of Content Executive summary Page No’s i. Introduction 1-5 ii. Background 6 iii. Vision 6 iv. Objective 7 V. Strategy /approach 8 VI. Rationale/ Justification Statement 9 Chapter-I: General Information of the District 1.1 District Profile 10-12 1.2 Demography 13-50 1.3 Biomass and Livestock 51-52 1.4 Agro-Ecology, Climate, Hydrology and Topography 53-82 1.5 Soil Profile 83-93 1.6 Soil Erosion and Runoff Status 94 1.7 Land Use Pattern 95-139 Chapter II: District Water Profile: 2.1 Area Wise, Crop Wise irrigation Status 140-150 2.2 Production and Productivity of Major Crops 151-158 2.3 Irrigation based classification: gross irrigated area, net irrigated area, area under protective 159-160 irrigation, un irrigated or totally rain fed area Chapter III: Water Availability: 3.1: Status of Water Availability 161-163 3.2: Status of Ground Water Availability 164-169 3.3: Status of Command Area 170-194 3.4: Existing Type of Irrigation 195-198 Chapter IV: Water Requirement /Demand 4.1: Domestic Water Demand 199-200 4.2: Crop Water Demand 201-210 4.3: Livestock Water Demand 211-212 4.4: Industrial Water Demand 213-215 4.5: Water Demand for Power Generation 216 4.6: Total Water Demand of the District for Various sectors 217-218 4.7: Water Budget 219-220 Chapter V: Strategic Action Plan for Irrigation in District under PMKSY 221-338 List of Tables Table 1.1: District Profile Table 1.2: Demography Table 1.3: Biomass and Live stocks Table 1.4: Agro-Ecology, Climate, Hydrology and Topography Table 1.5: Soil Profile Table 1.7: Land Use Pattern Table -

KARNATAKA 33 AFZALPUR Afzalpur C.D

KARNATAKA 33 AFZALPUR Afzalpur C.D. Block lies in the western part of Gulbarga kms. in Gulbarga south of Ghangapur railway station on the district.It is a part of Afzalpur taluka. The Block is located Chennai-Mumbai railway route. It is highly venerated by the at a distance of 46 kms. from district H.Q. (Gulbarga). Hindus of both Karnatakaand Maharashtra States. The There are 93 villages in the block with the total Pop. of sacred temple of Shri Narasimha Saraswathi Datta Maharaj 160,702 persons. Area of the C.D Block is 1301.73 sq. kms. is situated here. Pilgrims visit Ghangapurthroughout the It is bounded by taluk Aland on north, district Bijapur and year to worship at the temple and also to take holy bath at taluk Jevargi on south, taluk Gulbarga on east, district the confluence of the river Amerja and Bhima. There are Bijapur on west, and it has common boundary with the two large Dharmashalas for the use of pilgrims. It is state of Maharashtra on north. estimated that on an average 500 pilgrims visit this place Communications: daily to worship the Dattatraya Paduka. Around the Roadways : S.H-22: Direction- Akalkot to Gulbarga, Nearest month of February, a big jatra is held at this place at which Villages- Mannur, Karajagi, Ramnagar, Bhankalga, Shirwad, one lakh pilgrims congregate.Government road transport Gour (K), Gour (B), Afzalpur (Rural), Matoli, Mallabad, buses are run from Ghangapur railway station to this place Atnoor, Shivajinagar, Ingalgi (B), Chowdapur, Gobbur (B), every day. For the pilgrims, this place is known as Gobbur (K), Hawanur, Chinmmgera. -

HŒ臬 A„簧綟糜恥sµ, Vw笑n® 22.12.2019 Š U拳 W

||Om Shri Manjunathaya Namah || Shri Kshethra Dhamasthala Rural Development Project B.C. Trust ® Head Office Dharmasthala HŒ¯å A„®ãtÁS®¢Sµ, vw¯ºN® 22.12.2019 Š®0u®± w®lµu® îµ±°ªæX¯Š®N®/ N®Zµ°‹ š®œ¯‡®±N®/w®S®u®± š®œ¯‡®±N® œ®±uµÛ‡®± wµ°Š® wµ°î®±N¯r‡®± ªRq® y®‹°£µ‡®± y®ªq¯ºý® D Nµ¡®w®ºruµ. Cu®Š®ªå 50 î®±q®±Ù 50 Oʺq® œµX®±Ï AºN® y®lµu®î®Š®w®±Ý (¬šµ¶g¬w®ªå r¢›Š®±î®ºqµ N®Zµ°‹/w®S®u®± š®œ¯‡®±N® œ®±uµÛSµ N®xÇ®Õ ïu¯ãœ®Áqµ y®u®ï î®±q®±Ù ®±š®±é 01.12.2019 NµÊ Aw®æ‡®±î¯S®±î®ºqµ 25 î®Ç®Á ï±°Š®u®ºqµ î®±q®±Ù îµ±ªæX¯Š®N® œ®±uµÛSµ N®xÇ®Õ Hš¬.Hš¬.HŒ¬.› /z.‡®±±.› ïu¯ãœ®Áqµ‡µ²ºvSµ 3 î®Ç®Áu® Nµ©š®u® Aw®±„Â®î® î®±q®±Ù ®±š®±é 01.12.2019 NµÊ Aw®æ‡®±î¯S®±î®ºqµ 30 î®Ç®Á ï±°Š®u®ºqµ ) î®±±ºvw® œ®ºq®u® š®ºu®ý®Áw®NµÊ B‡µ±Ê ¯l®Œ¯S®±î®¼u®±. š®ºu®ý®Áw®u® š®Ú¡® î®±q®±Ù vw¯ºN®î®w®±Ý y®äqµã°N®î¯T Hš¬.Hº.Hš¬ î®±²©N® ¯Ÿr x°l®Œ¯S®±î®¼u®±. œ¯cŠ¯u® HŒ¯å A„®ãtÁS®¢Sµ A†Ãw®ºu®wµS®¡®±. Written test Sl No Name Address Taluk District mark Exam Centre out off 100 11 th ward near police station 1 A Ashwini Hospete Bellary 33 Bellary kampli 2 Abbana Durugappa Nanyapura HB hally Bellary 53 Bellary 'Sri Devi Krupa ' B.S.N.L 2nd 3 Abha Shrutee stage, Near RTO, Satyamangala, Hassan Hassan 42 Hassan Hassan. -

1995-96 and 1996- Postel Life Insurance Scheme 2988. SHRI

Written Answers 1 .DECEMBER 12. 1996 04 Written Answers (c) if not, the reasons therefor? (b) No, Sir. THE MINISTER OF STATE IN THE MINISTRY OF (c) and (d). Do not arise. RAILWAYS (SHRI SATPAL MAHARAJ) (a) No, Sir. [Translation] (b) Does not arise. (c) Due to operational and resource constraints. Microwave Towers [Translation] 2987 SHRI THAWAR CHAND GEHLOT Will the Minister of COMMUNICATIONS be pleased to state : Construction ofBridge over River Ganga (a) the number of Microwave Towers targated to be set-up in the country during the year 1995-96 and 1996- 2990. SHRI RAMENDRA KUMAR : Will the Minister 97 for providing telephone facilities, State-wise; of RAILWAYS be pleased to state (b) the details of progress achieved upto October, (a) whether there is any proposal to construct a 1906 against above target State-wise; and bridge over river Ganges with a view to link Khagaria and Munger towns; and (c) whether the Government are facing financial crisis in achieving the said target? (b) if so, the details thereof alongwith the time by which construction work is likely to be started and THE MINISTER OF COMMUNICATIONS (SHRI BENI completed? PRASAD VERMA) : (a) to (c). The information is being collected and will be laid on the Table of the House. THE MINISTER OF STATE IN THE MINISTRY OF RAILWAYS (SHRI SATPAL MAHARAJ) : (a) No, Sir. [E nglish] (b) Does not arise. Postel Life Insurance Scheme Railway Tracks between Virar and Dahanu 2988. SHRI VIJAY KUMAR KHANDELWAL : Will the Minister of COMMUNICATIONS be pleased to state: 2991. SHRI SURESH PRABHU -

Land Identified for Afforestation in the Forest Limits of Bidar District Μ

Land identified for afforestation in the forest limits of Bidar District µ Mukhed Nandijalgaon Bawalgaon Mailur Tanda Tanda Muttakhed Chikhli Hangarga Buzurg Hokarna Tanda Tanda Aknapur Sitalcha Tanda Sawargaon Ganganbid Dapka Kherda Buzurg Ganeshpur Bonti Lingi Talab Tanda Wagangiri Doparwadi Bada Tanda Handikheda Tanda Kurburwadi Hulyal Tanda Handikheda Murki Tanda Chemmigaon Shahpurwadi Wanbharpalli Malegaon Tanda Hulyal Manur Khurd Malegaon Donegaonwadi Dongargaon Badalgaon Hakyal Dhadaknal Bhopalgad Ekamba Sangnal Nandyal Nagmarpalli Karanji Kalan Karanji Khurd Madhur Sindyal Narayanpur Dongaon Belkoni Karkyal Jaknal Ganeshpur Khelgaon Aknapur Bijalgaon Jamalpur Aurad Sundal Itgyal Mamdapur Raipalli Indiranagar Tanda Kamalanagara Tegampur Kotgial Kindekere Yengundi Lingdhalli Rampur Khasimpur Tornawadi Mudhol Tanda Murug Khurd Kamalnagar Torna Hasikera Wadi Basavanna Tanda Balur Mudhol Buzurg Naganpalli Yeklara Chintaki Digi Tuljapur Gondgaon Kollur Munganal Bardapur Munanayak Tanda Boral Beldhal Mudhol Khurd Holsamandar Lingadahalli Ashoknagar Bhimra Mansingh Tanda Aurad Chandeshwar Mahadongaon Tanda Horandi Korial Basnal Eshwarnayak Tanda Jonnikeri Tapsal Korekal Mahadongaon Lingadahalli Lingadahalli Tanda Yelamwadi Sawali Lakshminagar Kappikeri Sunknal Chandpuri Medpalli Chandanawadi Ujni Bedkonda Gudpalli Hippalgaon Maskal Hulsur Sonali Gandhinagar Khed Belkuni Jojna Alwal Sangam Santpur Mankeshwar Kalgapur Nande Nagur Horiwadi Sompur Balad Khurd Kusnur Maskal Tanda M Nagura Chikli Janwada Atnur Balad Buzurg Gangaram Tanda Jirga -

PERSPECTIVE PLAN DPEP-II BIJAPUR DISTRICT D09551.Pdf

© PJKKSPJECTIVE PJLyllV - DPIilP - 11 BIJAPUK DISTRICT OFFICE OF IHE S l A IE PUOJEC I’ UIKECTOR DISI lUCT IMUMAUY EDUCA'I ION IMIOGHAMME Govl. Press Premises, Dr. Aiiibcdkar Veedlii, Haiignlore - 560 001 4 0 n l . 1 9 9 7 - S 4 - Z 7 i NIEPA DC ■ S 7 2 ' D09551 k flR -P p '< , utwiwi t bducatioA&I id ministration. t-.j, .j Aurobiudo Marg, ' ^ Ut>Ihi-1 1 0 0 1 6 o r ^ [ CONTENTS CHAPTER I Profile of Karnataka ... 1 CHAPTER II Education - A Historical Overview ... 6 CHAPTER Componentwise Progress Overview of State Interventions ... 15 CHAPTER IV DPEP I I : Approach and Strategies ...26 CHAPTER V Programme Undertakings ... 28 COSTING 60 a. For Project Period b. For 1997-98 Ci» ^ MfiP OF KflRlllflTflKfl SnOWiriQiPREP^RISTRICTS VyiTH FEMALE LIXERACY (,199.1) STATE : 44.^4 NATIONAL : 39.42 PR.OPOSEO DPEP-2 BANQALOnE(R) 38.15 BELiyXRY 31.97 9IDAR 30.55 GULBARGA 24.49 1 % MYSORE 37.95 BIJAPUR 4 0 . 0 6 ^ Vl^^lMYSORE] DHARWAD 4 5 , 2 0 Hi .u C.tI \ KARNATAKA ’ \ j r . DISTRICT BIJAPUR *m% • I #ovHOMv.«v**r . MA¥#*#0 900« A»OYf WIIM *• IAIU« • Aar A WtiM rO#V(*t*0M Iltl-CIA%) I.IMII.IT.W t Tl HC*0OU**tC«« OiYI*KV H*IW« « ; O P0\^ A**0 ftlfS"A»M OffKC MAtlOMAi HK>MWa1 _i™y— orcMif coiifcf am© ircnmc^i •UHCAIOW , •W«A10W , u(rA(.ic« no*o • AJiWAV W»t*« StAlK)M .M< IMf OM/Ci • tvin WIIM • ««4« W o --- - CHAPTER - I DISTRICT PROFILE Bijapur district is located in the northern most part of Karnataka. -

Department of Public Instruction - Karnataka List of Private Unaided (RTE) Schools - 2016 Sl.No

Department of Public Instruction - Karnataka List of Private Unaided (RTE) Schools - 2016 Sl.No. District Name Block Name DISE Code School Name Distirct :BIDAR Block :AURAD 1 BIDAR AURAD 29050100124 LITTLE STAR PUBLIK SCHOOL AURA 2 BIDAR AURAD 29050100137 SATYAM PUBLIC SCHOOL AURAD(B) 3 BIDAR AURAD 29050100159 SARASWATI PRIMARY SCHOOL AURAD (B) 4 BIDAR AURAD 29050100169 PATRISWAMY INTERNATIONAL P.S AURAD (B) 5 BIDAR AURAD 29050100401 SANGAMESHWAR HPS ALUR(B) 6 BIDAR AURAD 29050101212 SARASWATHI LPS SCHOOL BELKUNI (CH) CROSS 7 BIDAR AURAD 29050101501 VISHWACHETAN LPS SCHOOL BALAT(K) 8 BIDAR AURAD 29050102004 BALAJI GURUKUL LPS BELKUNI(B) AURAD 9 BIDAR AURAD 29050102707 OM SARASWATI LPS CHINTAKI 10 BIDAR AURAD 29050102709 BASAVA CHETAN LPS CHINTAKI 11 BIDAR AURAD 29050103701 JIJAMATA LPS SCHOOL DHABKA(C) 12 BIDAR AURAD 29050103805 SRI SWAMY VIVEKANAND LPS 13 BIDAR AURAD 29050103902 SRI SANT SEVALAL PRY DONGARGAON 14 BIDAR AURAD 29050104104 POOJYA NAGLING SWAMY D K GURUKUL DONGAON 15 BIDAR AURAD 29050105409 PRANALI LPS HOKRANA 16 BIDAR AURAD 29050105804 SHIVALINGESHWARA LPS SCHOOL HEDGAPUR 17 BIDAR AURAD 29050107102 BHUVANESHWARI GURUKUL HPS JAMB 18 BIDAR AURAD 29050107502 BHUVANESHWARI LPS SCHOOL KARANJI(B) 19 BIDAR AURAD 29050107906 MANIKRAO PATIL LPS KUSHNOOR T 20 BIDAR AURAD 29050107913 SRI KANTEPPA GEERGA LPS KUSHNOOR(T) 21 BIDAR AURAD 29050107914 S.B.BHARATI PUBLIC SCHOOL KUSHNOOR(T) 22 BIDAR AURAD 29050107915 SARSAWATI VIDYA MANDIR LPS KUSHNOOR(T) 23 BIDAR AURAD 29050107916 ORCHID CONCEPT SCHOOL KUSHNOOR (T) 24 BIDAR AURAD 29050108009 -

Sl. No. IFSC Code NEFT Amount Benificiary Account Benificiary

Sl. NEFT Benificiary Benificiary Date of IFSC Code Benificiary Address No. Amount Account Name transfer GOVERNMENT HIGH HEAD 1 SBIN0011578 5000 31171511179 SCHOOL BADALGAON 04-09-2020 MASTER AURAD BIDAR 585326 GOVERNMENT HIGH HEAD 2 SBIN0011578 5000 31192539734 SCHOOL BELKUNI 04-09-2020 MASTER THANA KUSHNOOR GOVERNMENT HIGH HEAD 3 SBIN0011578 5000 31171510981 SCHOOL 04-09-2020 MASTER BHANDARKUMTA GOVERNMENT HIGH HEAD 4 SBIN0011578 5000 31171511328 SCHOOL 04-09-2020 MASTER CHAWARDABKA AURAD GOVERNMENT HIGH HEAD 5 SBIN0011578 5000 31193957875 SCHOOL CHINTAKI 04-09-2020 MASTER CHAWARDABKA AURAD GOVERNMENT HIGH HEAD 6 SBIN0011578 5000 31175058553 SCHOOL 04-09-2020 MASTER DHUPATHMAHAGAON GOVERNMENT HIGH HEAD 7 SBIN0011578 5000 31213849930 SCHOOL EKAMBA 04-09-2020 MASTER AURAD BIDAR 585326 GOVERNMENT HIGH HEAD 8 SBIN0011578 5000 31193957401 SCHOOL EKLAR 04-09-2020 MASTER SANTHPUR AURAD GOVERNMENT HIGH HEAD 9 SBIN0011578 5000 31171511373 SCHOOL HEDGAPUR 04-09-2020 MASTER SANTHPUR AURAD GOVERNMENT HIGH HEAD 10 SBIN0011578 5000 31171312072 SCHOOL HOLSAMUDRA 04-09-2020 MASTER KAMALNAGAR AURAD GOVERNMENT HIGH HEAD 11 SBIN0011578 5000 31175057537 SCHOOL JAMBGI 04-09-2020 MASTER SANTHPUR AURAD GOVERNMENT HIGH HEAD 12 SBIN0011578 5000 31193958711 SCHOOL KHATGAON 04-09-2020 MASTER KAMALNAGAR AURAD GOVERNMENT HIGH HEAD 13 SBIN0011578 5000 31192538720 SCHOOL KOLLUR 04-09-2020 MASTER CHINTAKI AURAD BIDAR GOVERNMENT HIGH HEAD 14 SBIN0006881 5000 31168847241 SCHOOL MUDHOL 04-09-2020 MASTER THANA KUSHNOOR GOVERNMENT HIGH HEAD 15 SBIN0011578 5000 31171511226 SCHOOL MURKI 04-09-2020 MASTER KAMALNAGAR AURAD GOVERNMENT HIGH HEAD 16 SBIN0011578 5000 31193956203 SCHOOL NAGMARPALLI 04-09-2020 MASTER CHINTAKI AURAD BIDAR GOVERNMENT HIGH HEAD 17 SBIN0011578 5000 31192539371 SCHOOL SANTHPUR 04-09-2020 MASTER SANTHPUR AURAD Page 1 Sl. -

Bhalki Bar Association : Bhalki Taluk : Bhalki District : Bidar

3/17/2018 KARNATAKA STATE BAR COUNCIL, OLD KGID BUILDING, BENGALURU VOTER LIST POLING BOOTH/PLACE OF VOTING : BHALKI BAR ASSOCIATION : BHALKI TALUK : BHALKI DISTRICT : BIDAR SL.NO. NAME SIGNATURE KESHAV TATYARAO NITTURKAR MYS/570/62 S/O TATYARAO 1 TOWN KESHAV RAO NITTURKAR ADVOCATE ASHIRVAD BHALKI BIDAR VEERENDRA TIWARI MYS/31-A/68 2 S/O SHRI GOPAL PRASAD TIWARI IH.NO 2-4-7/1 NEAR TMC OFFICE OLD TOWN BHALKI BIDAR ASTURE RAJSHEKHAR PRABHUSHETTAPPA MYS/178/72 3 S/O PRABHUSHETTAPPA ASTURE SANGMESH THETARE POST BHALKI BIDAR 585328 BHORALE VENKAT SIDDALINGAPPA MYS/17/74 4 S/O SIDDALINGAPPA PO: BHATAMRA BHALKI BIDAR 1/29 3/17/2018 VENKAT YADAV RAO KULKARNI KAR/337-A/76 S/O YADAV RAO KULKARNI 5 TEACHERS HOUSING COLONY, HUMNABAD ROAD BHALKI BIDAR PATIL NAGANATH BASWANTH RAO KAR/142/77 6 S/O BASWANTH RAO AT POST: DADGI(V) BHALKI BIDAR MANDAKNALE ABDUL JALIL KAR/26/78 7 S/O MD FAKHIRAMMAD R/O KHATEEBA GALLI OLD TOWN BHALKI BIDAR KULKARNI SUNIL RAMRAO KAR/301/79 8 S/O RAMRAO KULKARNI AT PO: LAKHANGAON BHALKI BIDAR KHANDALE BANDEPPA GURUPADAPPA KAR/106/80 S/O GURUPADAPPA 9 SAIKRUPA NILAYA, GUNJ NEAR TAHSIL OFFICE, KHANDRE GALLI BHALKI BIDAR 2/29 3/17/2018 SIRSGI VAIJINATH KAR/221/81 10 S/O SHANKARAPPA OPP: COURT , NEAR AMBEDKAR CHOWK , BHALKI BIDAR 585328 SWAMI NAGANATH NILKANTHAYYA KAR/490/82 11 S/O NILKANTHAYYA NEAR FIRE ,STATION GUNJ BHALKI BIDAR 585328 KHUBA BASWARAJ KASHAPPA KAR/536/83 12 S/O P BODGI TQ BHALKI POST: DADGI, BHALKI BIDAR MULGE VISHWANATH N KAR/643/83 13 S/O NAGSHETTEPPA POST: HALBARGA BHALKI BIDAR 585 413 SHASTRI SURENDRA VERUPAKSHA KAR/764/83 14 S/O VEERUPAKSHA SHASTRT AT PO: ALANDI BHALKI BIDAR 3/29 3/17/2018 PATIL NARAYAN BALASAHEB KAR/960/85 15 S/O BALASAHEB PATIL AT AND POST LAKSHNAGAON . -

Karnataka Circle Cycle III Vide Notification R&E/2-94/GDS ONLINE CYCLE-III/2020 DATED at BENGALURU-560001, the 21-12-2020

Selection list of Gramin Dak Sevak for Karnataka circle Cycle III vide Notification R&E/2-94/GDS ONLINE CYCLE-III/2020 DATED AT BENGALURU-560001, THE 21-12-2020 S.No Division HO Name SO Name BO Name Post Name Cate No Registration Selected Candidate gory of Number with Percentage Post s 1 Bangalore Bangalore ARABIC ARABIC GDS ABPM/ EWS 1 DR1786DA234B73 MONU KUMAR- East GPO COLLEGE COLLEGE Dak Sevak (95)-UR-EWS 2 Bangalore Bangalore ARABIC ARABIC GDS ABPM/ OBC 1 DR3F414F94DC77 MEGHANA M- East GPO COLLEGE COLLEGE Dak Sevak (95.84)-OBC 3 Bangalore Bangalore ARABIC ARABIC GDS ABPM/ ST 1 DR774D4834C4BA HARSHA H M- East GPO COLLEGE COLLEGE Dak Sevak (93.12)-ST 4 Bangalore Bangalore Dr. Dr. GDS ABPM/ ST 1 DR8DDF4C1EB635 PRABHU- (95.84)- East GPO Shivarama Shivarama Dak Sevak ST Karanth Karanth Nagar S.O Nagar S.O 5 Bangalore Bangalore Dr. Dr. GDS ABPM/ UR 2 DR5E174CAFDDE SACHIN ADIVEPPA East GPO Shivarama Shivarama Dak Sevak F HAROGOPPA- Karanth Karanth (94.08)-UR Nagar S.O Nagar S.O 6 Bangalore Bangalore Dr. Dr. GDS ABPM/ UR 2 DR849944F54529 SHANTHKUMAR B- East GPO Shivarama Shivarama Dak Sevak (94.08)-UR Karanth Karanth Nagar S.O Nagar S.O 7 Bangalore Bangalore H.K.P. Road H.K.P. Road GDS ABPM/ SC 1 DR873E54C26615 AJAY- (95)-SC East GPO S.O S.O Dak Sevak 8 Bangalore Bangalore HORAMAVU HORAMAVU GDS ABPM/ SC 1 DR23DCD1262A44 KRISHNA POL- East GPO Dak Sevak (93.92)-SC 9 Bangalore Bangalore Kalyananagar Banaswadi GDS ABPM/ OBC 1 DR58C945D22D77 JAYANTH H S- East GPO S.O S.O Dak Sevak (97.6)-OBC 10 Bangalore Bangalore Kalyananagar Kalyananagar GDS ABPM/ OBC 1 DR83E4F8781D9A MAMATHA S- East GPO S.O S.O Dak Sevak (96.32)-OBC 11 Bangalore Bangalore Kalyananagar Kalyananagar GDS ABPM/ UR 1 DR26EE624216A1 DHANYATA S East GPO S.O S.O Dak Sevak NAYAK- (95.8)-UR 12 Bangalore Bangalore St. -

Selection List of Gramin Dak Sevak for Karnataka Circle Vide Notification No.R&E/2-94/GDS ONLINE/CYCLE-II/2019 DATED at BENGALURU, the 05-08-2019

Selection list of Gramin Dak Sevak for Karnataka circle vide Notification No.R&E/2-94/GDS ONLINE/CYCLE-II/2019 DATED AT BENGALURU, THE 05-08-2019 S.No Division HO Name SO Name BO Name Post Name Cate No Registration Selected Candidate gory of Number with Percentage Post s 1 Bangalore Bangalore ARABIC ARABIC GDS ABPM/ UR 2 CR4FA844C73286 PRASAD BALIKAI- East GPO COLLEGE COLLEGE Dak Sevak (94.72)-UR 2 Bangalore Bangalore ARABIC ARABIC GDS ABPM/ UR 2 CR02E8EAA79A72 ARSHIYA G- East GPO COLLEGE COLLEGE Dak Sevak (94.08)-OBC 3 Bangalore Bangalore Dr. Dr. GDS ABPM/ UR 2 CR0C2A979D2A34 GIRISH SADASHIV East GPO Shivarama Shivarama Dak Sevak KADAKOL- (93.92)- Karanth Karanth UR Nagar S.O Nagar S.O 4 Bangalore Bangalore Dr. Dr. GDS ABPM/ UR 2 CR02E7C8A9E2A2 KAVERI V East GPO Shivarama Shivarama Dak Sevak CHAMAKERI- Karanth Karanth (93.44)-UR Nagar S.O Nagar S.O 5 Bangalore Bangalore Fraser Town Fraser Town GDS ABPM/ EWS 2 CR5F6C4297CCE5 SHEELAVATHI T S- East GPO S.O S.O Dak Sevak (83.68)-UR-EWS 6 Bangalore Bangalore Fraser Town Fraser Town GDS ABPM/ EWS 2 CR65143ED46114 SWAPNABAI R- East GPO S.O S.O Dak Sevak (80.96)-UR-EWS 7 Bangalore Bangalore H.K.P. Road H.K.P. Road GDS ABPM/ UR 1 CR2AD7718A2C4A AIMAN MUSKAN- East GPO S.O S.O Dak Sevak (93.92)-UR 8 Bangalore Bangalore HORAMAVU HORAMAVU GDS ABPM/ UR 1 CR248D61F6BE51 AKHILA D East GPO Dak Sevak NADIGAR- (95.2)- UR 9 Bangalore Bangalore KALYAN KALYAN GDS ABPM/ EWS 1 CR352C953CA17C SPOORTHI East GPO NAGAR NAGAR Dak Sevak SHETTY- (90.08)- UR-EWS 10 Bangalore Bangalore KALYAN KALYAN GDS ABPM/ SC 1 CR4F838CE269CE LANKESH- (95)-SC East GPO NAGAR NAGAR Dak Sevak 11 Bangalore Bangalore KALYAN KALYAN GDS ABPM/ ST 1 CR331D5793AB56 KRISHNAKUMAR- East GPO NAGAR NAGAR Dak Sevak (92)-ST 12 Bangalore Bangalore KALYAN KALYAN GDS ABPM/ UR 1 CR2942461B1C19 AMRUTHA R- East GPO NAGAR NAGAR Dak Sevak (95.04)-OBC 13 Bangalore Bangalore St.