North Country Comprehensive Economic Development Strategy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

House Actions

Committee Report CONSENT CALENDAR February 27, 2018 HOUSE OF REPRESENTATIVES REPORT OF COMMITTEE The Committee on Election Law to which was referred HB 1666, AN ACT relative to redistricting. Having considered the same, report the same with the following resolution: RESOLVED, that it is INEXPEDIENT TO LEGISLATE. R p Michael Harrington FOR THE COMMITTEE Original: House Clerk Cc: Committee Bill File COMMITTEE REPORT Committee: Election Law Bill Numbdr: HB 1666 Title: relative to redistricting. Date: February 27 Consent Calendar: CONSENT Recommendation: INEXPEDIENT TO LEGISLATE STATEMENT OF INTENT The bill would create a new metric for evaluating redistricting proposals based on a computer model that attempts to measure the "efficiency gap" in votes cast. There are many unresolved issues with this bill. It establishes a commission made up of only Democrats and Republicans and does not include the third party with ballot status in NH. There is also confusion over how the results of an election determined to have an efficiency gap exceeding the allowed limit are to be handled. Would the loser have solid grounds to challenge the results in court? This bill would completely change the way we redistrict and needs more work before it should be considered for passage. Vote 20-0. Rep. Michael Harrington FOR THE COMMITTEE Original: House Clerk Cc: Committee Bill File CONSENT CALENDAR Election Law HB 1666, relative to redistricting. INEXPEDIENT TO LEGISLATE. Rep. Michael Harrington for Election Law. The bill would create a new metric for evaluating redistricting proposals based on a computer model that attempts to measure the "efficiency gap" in votes cast. -

2014 Families First Voter Guide

2014 Families First Voter Guide About the 2014 guide to the New Hampshire primary Contents: election: Find your legislator………….............. 2-6 Cornerstone Action provides this information to help you NH Executive Council Pledge…………7 select the candidates most supportive of family-friendly NH State Senate Scores……...............7,8 policies including the right to life, strong marriages, and choice in education, sound fiscal management, and NH Representative’s Scores…….….8-29 keeping New Hampshire casino-free. NH Delegate Pledge Signers……...29, 30 What's in the guide and how we calculated the ratings : Where a candidate is a former state representative who left Cornerstone invited all candidates to sign the Families First office after the 2012 election, we provide their Cornerstone Pledge. We have indicated on this guide who has signed the voter guide score for 2012. Likewise, if an incumbent had pledge without candidate having modified it in any way. insufficient data from this year's votes, we have provided the 2012 score if available. Voting records are drawn from the 2014 legislative session, for incumbent state legislators running for re-election. We We encourage you to look beyond the scores and consider a include results from three Senate votes and eight House candidate's particular votes. You can contact candidates to votes. thank them for past votes, or to ask about disappointing ones or gaps in the record. Let them know what matters to you as A candidate's percentage mark is for votes cast in 2014. you consider your options at the polls. There is no penalty for an excused absence from a vote; however, an unexcused absence or “not voting" is penalized This guide will be updated as more candidate replies are by being included as a "no" vote. -

Annual Report of the Town of Lincoln, New Hampshire

TownjiNcoLNof ^NEW HAMPSHIRE A Year ofProgreM Annual Report for the Year Ending December 31, 2004 TELEPHONE/E-MAIL DIRECTORY www.lincolnnh.org FIRE EMERGENCY 911 AMBULANCE EMERGENCY 911 POLICE EMERGENCY 911 NH POISON CONTROL CENTER 1-800-562-8236 Selectmen lincolntownhall@eaqle1 st.com 745-2757 Town Manager suttoninlincoln(a)eaqle1 st.com 745-2757 Town Hall Fax No 745-6743 Town Clerk /Tax Collector susan(5)eaqle1 st.com 745-8971 Planning/Zoning Department stacey(5)eaqle1 st.com 745-8527 Communications Center (Dispatch) 745-2238 Police Department (Business Line) tpsmith(g)adelphia.net 745-2238 Police Department Admin. Asst. [email protected] 745-2238 Police Department Fax No 745-8694 Fire Department (Business Line) 745-2757 Solid Waste Facility 745-6626 Public Works Garage 745-6250 Water Treatment Plant 745-9306 Wastewater Treatment Plant 745-3829 Lincoln Public Library libra ry(a)eaqle1 st.com 745-8159 Recreation Director's Office tattown(5)eaqle1 st.com 745-8673 Kancamagus Recreation Area 745-2831 HOURS OPEN TO THE PUBLIC Town Manager & Selectmen's Office Mon. - Fri. 8:00 a.m. - 4:30 p.m. Planning & Zoning Office Mon. - Fri. 8:00 a.m. - 4:30 p.m. Town Clerk/Tax Collector Mon. - Fri. 8:00 a.m. - 4:00 p.m. Solid Waste Facility Every day but Wed. 8:30 a.m. - 5 p.m. Recreation Department Mon. - Thurs. 8.00 a.m. - 4:00 p.m. Lincoln Public Library Mon. - Fri. noon - 8 p.m. and Sat. 10 a.m. -2 p.m. FRONT COVER: In 2004 two major projects preparation for the SEWER LAGOON in Lincoln were completed, and a third was CLEANING, a project that involved removal nearly finished by year-end. -

Index of North Castle History, Volume 26, 1999

INDEX FOR NORTH CASTLE HISTORY Volumes 1 (1974) through 30 (2003) by Sharon Tomback Letters L - Z (The volume year and page number, if available, appear as the last entry on each line) =============================================================== L L. Cundy & Co., Rubber Dealer, 1989:16 L.E. Preston & Co., Philadelphia, 1985:22 La Cremaillere French Restaurant, 2000:29 La Cremaillere Restaurant, 1990:23 La Cremaillere, 2000:23 La Rochelle, France, 1998:5 Labels, 1998:10 labor of love, 1993:5 Labor unions, 1987:20 laborer, 1989:20, 21 Labriola, Lawrence, 1978:10 Lacko, Frank, 1995:9 LaCremaillere Restaurant, 1981:3 Lada Mocarski, Valerin, 1995:9 Ladies' Aid Society, 1983:11 Ladies Aid Society, 1992:5 Ladies Guild, 1992: 9 Ladies Sewing Society, 1992:4 Ladies’ Shoes, 1997:12 Laet, John de, 1979:27 Lafayette Avenue, 1976:10 Lafayette, 1975:13 LaGuardia, Mayor Fiorello, 1976:7 Lafayette, General, 1991:23 LaFever, Miss Anna, 1984:14 Lake Champlain, 1980:31 Lake Champlain, 1985:23 Lake Champlain, 1987:11 Lake Mahopac, 1990:16, 17, 21 Lake Street, White Plains, 1988:10 Lake Street, White Plains, 2000:25 Lake View Hotel, Kensico, 1983:27 Lake View Hotel, Raven's, 1983:8 Lake Waccabuc, 1976:16 Lake, Old Kensico, 1983:17 Lakes, 2002:12, 18 Lakes, four artificial, 1998:21 Lakes, interconnected, 1998:21 Lambelet, Clarence A., 1992:3 Lambert, 1983:18 Lamont, Reverend Thomas, 1987:5 Lamp burning out, 1987:23 lamplight, 1994:10 Land Records and Wills, 1980:25 Land Records Office, Westchester County, 1975:9 Land Records, County Clerk's Office, 1989:27 Land Records, Deeds and Mortgages, Westchester Co. -

New Hampshire Environmental Education Planning Office Of

DOCUMENT RESUME BD 103 226 95 SE 018 129 AUTHOR Evert, William B.; Merriam, DeVolf TITLE, Environmental Education Resources and Programs. INSTITUTION New Hampshire Environmental Education Planning Council, Concord. SPONS AGENCY Office of Education (DREW), Washington, D.C. Office of Environmental Education.; Spaulding-Potter Trust, Concord, N.H. PUB DATE Sep 73 GRANT 0EG-0-72-5609 NOTE 45p.; Addendum Number Two to SE 018 127. See SE 016 128 for Addendum Number One EDRS PRICE MF-$0.76 HC-$1.95 PLUS POSTAGE DBSCPIPTORS Annotated Bibliographies; College Programs; Conservation Education; *Educaticnal Programs; Elementary Grades; *Environmental Education; Outdoor Education; Periodicals; Reading Materials; *Resource Materials; Secondary Grades; *State Programs IDENTIFIERS *New Hampshivh ABSTRACT This document, developed for the State of Nev Hampshire, is designed to help individuals, schools, and communities get started in the development and implementation ofenvironmental education programs by providing lists of New Hampshireenvironmental education programs and resource materials. The following arelisted in this publication: the publications of the EnvironmentalEducation Planning Council; elementary and secondary environmentaleducation prograns; resource teachers andpeople; college programs; places for field trips; school camping; summer youth programs;curriculum materials; environmental education bibliographies andfilm lists; New Hampshire film sources; periodicals; a selected reading list; and agencies and organizations on the state, privute, and nationallevel which offer training, assistance and information. (BT) BEST COPY AVAILABLE ENVIRONMENTAL EDUCATION RESOURCES AND US DEPARTMENT OA HEALTH. mamma aWELFARE MAMMAL INSTITUTE OP PROGRAMS IDUCATtOti THISDOCUMENT HAS SEEN REPRC DuC E 0 E xACIL v AS RUINEDFROM THE PERSON OR OPGANIZATiONOP MIN sy POINTS os vit W Du 4tA1 OPINIONS DO NOT NECESSARILY PEPRE %Flo? Of f ICIAL NATIONAL INSTITUTEOf OuCATtON POji MINI OR AOLICY daa. -

Gallery of Winning Photos Conservation Success in Deering and Sandwich

WHAT LANDOWNERS NEED TO KNOW ABOUT TODAY’S WOOD MARKETS Forest Notes NEW HAMPSHIRE’S CONSERVATION MAGAZINE Gallery of Winning Photos Conservation Success in Deering and Sandwich AUTUMN 2017 forestsociety.org RIVERMEAD . The Mead The Village 150 RiverMead Road Peterborough, NH RIVERMEAD (Coming Soon) A New Adventure... The Villas at Contact us today for an update on our New Villas, or Upcoming Events, and Cottage and Apartment Availability. [email protected] Call to schedule a personal visit: 1.800.200.5433 RiverMead is a Non-Prot LifeCare Community in the Monadnock Region of New Hampshire TABLE OF CONTENTS: AUTUMN 2017, No. 292 30 36 DEPARTMENTS 2 THE FORESTER’S PRISM Perpetuating the Ethic 6 5 THE WOODPILE Law Provides Tax Break for Conserving Small Properties. FEATURES 24 PEOPLE MAKING A DIFFERENCE Honoring our Conservationist of the Year. 6 Conservation Gallery 26 IN THE FIELD Winning photos from our 2017 Photo Contest. Upcoming events 16 Today’s Wood Markets 27 VOLUNTEER SPOTLIGHT Markets for low-grade timber are disappearing fast. Meet the 2017 Volunteer of the Year. What does that mean for family forest owners? 28 CONSERVATION SUCCESS STORIES 22 First to Meet the Forest — Skiing enthusiast’s latest conservation easement Reservations Challenge donation protects more trails in Sandwich. — Donations strengthen landscape-scale conservation Hikers share their notes after checking off in the Contoocook Valley. all 33 featured reservations. 30 THE FOREST CLASSROOM All ashore for kids’ camps at the Creek Farm Reservation in Portsmouth. 32 PUBLIC POLICY WHAT LANDOWNERS NEED TO KNOW ABOUT TODAY’S WOOD MARKETS N.H. legislators tell the SEC why Northern Pass’s Forest Notes proposal does not merit approval. -

Block Reports

MATRIX SITE: 1 RANK: MY NAME: Kezar River SUBSECTION: 221Al Sebago-Ossipee Hills and Plains STATE/S: ME collected during potential matrix site meetings, Summer 1999 COMMENTS: Aquatic features: kezar river watershed and gorgeassumption is good quality Old growth: unknown General comments/rank: maybe-yes, maybe (because of lack of eo’s) Logging history: yes, 3rd growth Landscape assessment: white mountian national forest bordering on north. East looks Other comments: seasonal roads and homes, good. Ownership/ management: 900 state land, small private holdings Road density: low, dirt with trees creating canopy Boundary: Unique features: gorge, Cover class review: 94% natural cover Ecological features, floating keetle hole bog.northern hard wood EO's, Expected Communities: SIZE: Total acreage of the matrix site: 35,645 LANDCOVER SUMMARY: 94 % Core acreage of the matrix site: 27,552 Natural Cover: Percent Total acreage of the matrix site: 35,645 Open Water: 2 Core acreage of the matrix site: 27,552 Transitional Barren: 0 % Core acreage of the matrix site: 77 Deciduous Forest: 41 % Core acreage in natural cover: 96 Evergreen Forest: 18 % Core acreage in non- natural cover: 4 Mixed Forest: 31 Forested Wetland: 1 (Core acreage = > 200m from major road or airport and >100m from local Emergent Herbaceous Wetland: 2 roads, railroads and utility lines) Deciduous shrubland: 0 Bare rock sand: 0 TOTAL: 94 INTERNAL LAND BLOCKS OVER 5k: 37 %Non-Natural Cover: 6 % Average acreage of land blocks within the matrix site: 1,024 Percent Maximum acreage of any -

Congressional Record—Senate S5260

S5260 CONGRESSIONAL RECORD — SENATE June 26, 2013 to those who are here today, it has a and built the foundation on which it On July 1, 1963, the 90th Strategic bright future. stands today. He built the white clap- Wing came into existence amid grow- f board house that the family still calls ing tensions with the Soviet Union. home. He and his son, Armand, Protecting our national security RECOGNIZING WESTVIEW transitioned the farm from using work- throughout the Cold War and into ORCHARDS horses to using tractors. Harvey sold present day, the 90th Missile Wing pro- Ms. STABENOW. Mr. President, I the hog and dairy operations, focusing vides our Nation’s best, most reliable, rise today to congratulate Westview the business on growing fruits and most accurate strategic deterrent. Orchards of Romeo, MI on its 200th an- vegetables. He also added a grading Tasked with deterring an attack, the niversary. room and built a custom peach grader missile wing has worked extensively Since its founding in 1813, the or- and de-fuzzer machine to improve effi- with the Minuteman I and Minuteman chard has been a part of Michigan’s ciency. His greatest innovation, III systems, as well as encompassing way of life. It is where families go to though, was forced upon him in August the full lifecycle of the Peacekeeper pick their own peaches and straw- of 1930. Missile. Today, these men and women berries in the summer, and where they It was a typical August day in an un- maintain and protect our Minuteman go to pick apples, take wagon rides and usually good harvest year, and Harvey III resources 24 hours a day, 7 days a enjoy the cider mill in the fall. -

John Lanier Is Among the 10,000 Members Who Helped the Forest Society Protect More Than One Million Acres in New Hampshire

Why We Oppose Northern Pass Black Mountain Protected SPRING 2011 US $4.95 11> 074470 25172 9 forestsociety.org Anyone can give advice about investing. We suggest investing in advice. Like many of our friends in the Granite State, Cambridge Trust Company of New Hampshire values preservation and growth. Since 1890, Cambridge Trust has provided its clients with thoughtful, comprehensive investment management services. At Cambridge Trust, we understand that managing your wealth means more than simply managing your assets. Todd D. Mayo, President sTODDMAYO CAMBRIDGETRUSTCOM TABLE OF CONTENTS: WINTER/SPRING 2011, N o. 266 13 15 DEPARTMENTS 2 THE FORESTER’S PRISM 8 Why we oppose Northern Pass 12 IN THE FIELD Art exhibits, wildflower festivals, and more FEATURES 14 CONSERVATION SUCCESS STORIES Black Mountain victory; farmland in Warner and Nashua conserved; 4 Better Forestry for Better Forests North Country lands safeguarded through conservation easements; By Roger Amsden critical corner of Great Bay protected; and conserved acreage around Updated guidelines for Good Forestry in the Granite State Ashuelot River Headwaters Forest grows aim to improve management of forestlands 22 PUBLIC POLICY UPDATE 8 John Brooks: A Collaboration with Nature Forest Society calls for withdrawl of Northern Pass proposal; offending foresters pay the price of violations By Michelle Pennington A retrospective study of a native New Hampshire artist. 26 NATURE’S VIEW BY DAVE ANDERSON AND ESTHER COWLES Barking up the wrong tree; my brief romance with a porcupine 28 PROJECTS IN PROGRESS Help the Forest Society fight Northern Pass On our cover: One of the many streams and cascades on the recently protected Black Mountain. -

Active Operator Report 10-1-19.Xlsx

Active Meals and Rentals Tax Operators by Business Name as of October 1, 2019 Street Street License Business Entity Address Address Number Name Name Line 1 Line 2 City 47099 #6 RIVER & PINES CONDOMINIUMS WATTS WILLIAM 16 OLD RTE BARTLETT 65349 @RINCHA EKAPORN SAKTANASET 80 CONTINENTAL BLVD UNIT B MERRIMACK 64271 10 FRANCIS STREET 10 FRANCIS STREET LLC 10 FRANCIS ST HAMPTON 59441 10 RIDGEWOOD POINT RENTAL BOB AND SHANNON KRIEGER 10 RIDGEWOOD POINT RD SUNAPEE 46386 100 CLUB 100 CLUB CONCEPTS INC 100 MARKET ST STE 500 PORTSMOUTH 61097 100 MILE MARKET 100 MILE MARKET LLC 35 PLEASANT STREET CLAREMONT 63081 1025 LACONIA ROAD LAURA JOHNSON 1025 LACONIA RD TILTON 53640 104 DINER THE THE 104 DINER INC 752 ROUTE 104 NEW HAMPTON 60862 106 HAMEL RD SUNAPEE N.H. RENTAL MARK & HOLLY ADAMY 106 HAMEL RD SUNAPEE 58932 107 PIERCE RD WHITEFIELD NH MICHAEL & KRISTEN HARVEY 107 PIERCE ROAD WHITEFIELD 27480 107 PIZZERIA & RESTAURANT FREMONT HOUSE OF PIZZA INC 431 MAIN ST FREMONT 59204 108 EXPRESS MINI MART 108 EXPRESS MINI MART INC 21 SOUTH MAIN ST NEWTON 64309 110 GRILL 110 GRILL ES MANCHESTER LLC 875 ELM STREET MANCHESTER 59490 110 GRILL 110 GRILL TWO LLC 27 TRAFALGAR SQUARE NASHUA 61812 110 GRILL 110 GRILL RM ROCHESTER LLC 136 MARKETPLACE BLVD ROCHESTER 63344 110 GRILL 110 GRILL SL STRATHAM LLC 19 PORTSMOUTH AVE STRATHAM 64876 110 GRILL 110 GRILL WLNH, LLC 250 N PLAINFIELD ROAD WEST LEBANON 64113 12 LAKE STREET 12 LAKE STREET, LLC 144 LAKE ST UNIT #12 LACONIA 62017 12 OCEAN GRILL ELI SOKORELIS 12 OCEAN BLVD SEABROOK 38298 12% SOLUTION HAMEL MICHAEL 994 -

Philip A.Ll^Cfi^^ Sarah L. Stewart Director V Commissioner

MAR22'21 PM 1:02 RCUD ^(2. STATE OF NEW HAMPSHIRE DEPARTMENT of NATURAL and CULTURAL RESOURCES DIVISION of PARKS and RECREATION 172 Pembroke Road Concord^ New Hampshire 03301 Phone: (603)271-3556 Fax: (603)271-3553 Web: www.nhstateparks.org March 4,2021 His Excellency, Governor Christopher T. Sununu and the Honorable Executive Council State House Concord, NH 03301 REQUESTED ACTION Authorize the Department of Natural and Cultural Resources, Division of Parks and Recreation (Department) to enter into a Retroactive one-year Lease extension with the Society for the Protection of New Hampshire Forests (Forest Society) of Concord, NH for Forest Society property adjacent to Monadnock State Park known as Monadnock Reservation and Gap Mountain Reservation, for an annual payment equal to the gross proceeds from fees collected at the Old Toll Road trailhead in the previous fiscal year minus any direct expenses, effective lipon Governor and Executive Council approval fiom February 1,2021 through February 1,2022. The original lease was approved by the Governor and Executive Council on March 22, 2006, Late Item A. 100% Other Funds(Agency Income). EXPLANATION The original Lease was approved by the Governor and Executive Council on March 22, 2006 and expired on February 1, 2021, while the parties were still in negotiations for a new lease. This one- year lease extension will enable the parties to complete their negotiations. All other terms of the original Lease will remain in full force and effect The decision to seek a Lease extension so that negotiations -

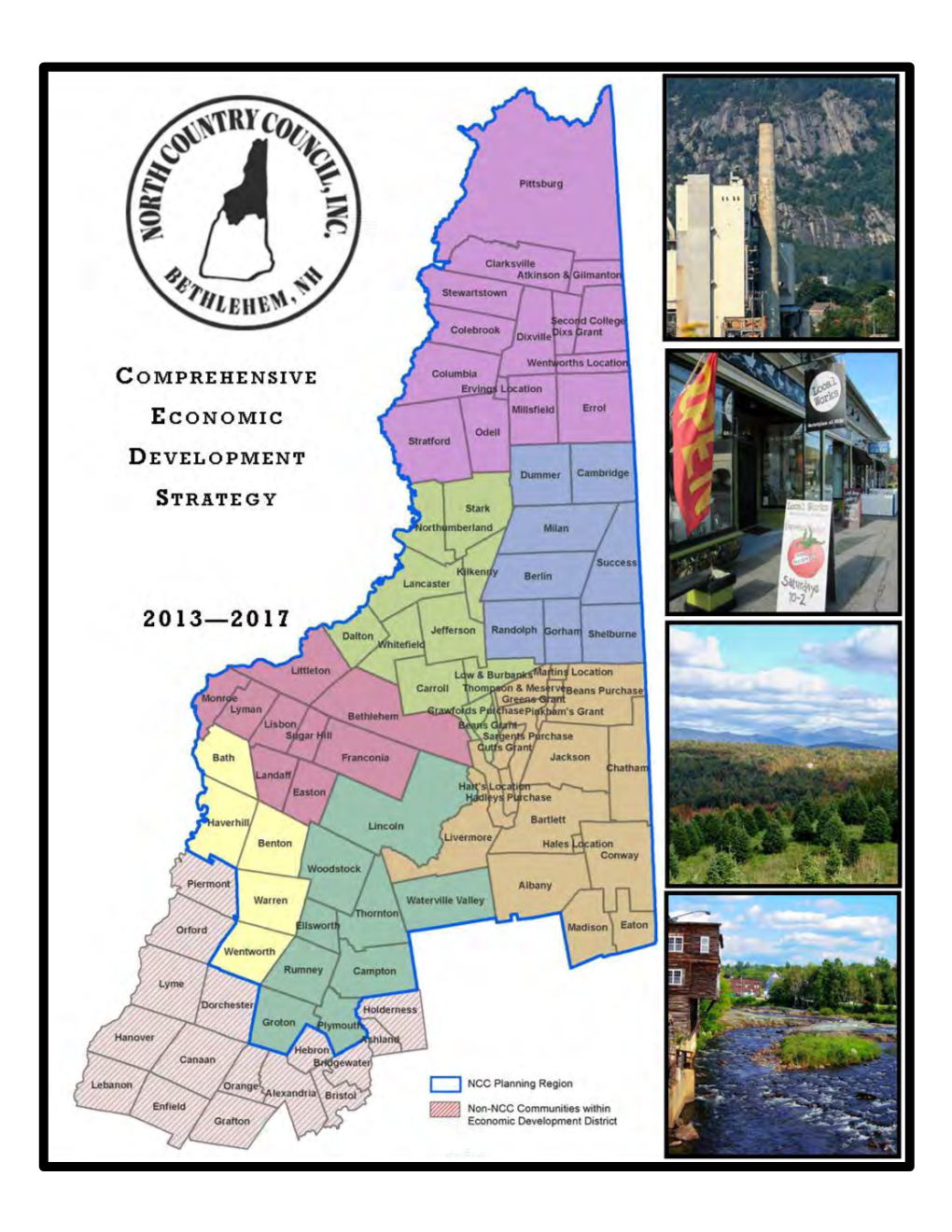

2015 Comprehensive Economic Development Strategy Update

2015 Comprehensive Economic Development Strategy Update For the North Country Council Economic Development District Produced with funds provided by: United States Department of Commerce— Economic Development Administration (EDA) December 2015 BACKGROUND It is now an accepted fact that region-states and not nations are the primary units of economic activity. The health of the North Country economy relies greatly on Early 2000’s employment decline also concentrat- the condition of New Hampshire’s and New England’s ed in establishments with employment of 100-999. economies and these are inextricably linked to the Smaller establishments (less than 100 employees) national and global economies. appeared to be relatively resilient as a group (NEEP). OUR REGIONAL ECONOMY 3. The North Country Economy Grafton County has developed as a service New Hampshire Growth Trends dependent county with a strong emphasis on tech- nology and the health care industry. Anchored by Mid 1970’s through the Mid 1990’s Dartmouth College, the Dartmouth Hitchcock The State of New Hampshire experienced a Medical Center, and the Dartmouth Regional higher level of growth outpacing the rest of New Eng- Technology Center, Grafton County has a large land and much of the rest of the country between 1975 cluster of health related research and service in- and 1995. dustries. Because of its ability to take part in the new economy, Grafton County is the most pros- 2. Late 1990’s and 2000’s perous county in NH’s North Country and one of This strong period of growth lasted until the the most prosperous counties in the -4 state north- late 1990’s when it was brought to an end by the sharp ern forest region.