October 6, 1979

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3/1980 Report

MARCH 1980 SURVEY March 28, 1980 Surveyso fConsume rAttitude s Richard T.Curtin , Director §> CONSUMER SENTIMENT FALLS TO NEW RECORD LOW LEVEL **In the March 1980 survey, the Index of Consumer Sentiment was 56.5,dow n more than 10 Index-points from February 1980 (66.9) and March 1979 (68.4), and represents the lowest level recorded in more than a quarter-century. At no time have consumers been more pessimistic about their ownpersona l financial situation or about prospects for the economy as a whole. Importantly, the major portion of these declines were recorded prior to President Carter's latest inflation message just 10 percent of the interviews were conducted after Carter's speech. **Among families with incomes of $15,000 and over, the Index of Consumer Senti ment was 51.3 in March 1980,dow n from 60.2 in February 1980, and 65.2i n March 1979. TheMarc h 1980 Index figure of 51.3 is below the prior record low of 53.6 recorded in February 1975. **New record low levels recorded in March 1980include : *Near1y half (48 percent) of all families reported in March 1980 that they were worse off financially than a year earlier, twice the propor tion whoreporte d an improved financial situation (24 percent). *Three-in-four respondents (76 percent) expected bad times financially for the economy as a whole during the next 12 months, while just 14 percent expected improvement. ^Interest rates were expected to increase during the next 12 months by 71 percent of all families in March 1980an d the highest rates of expected inflation were recorded during early 1980, with consumers expecting inflation to average 12% during the next 12 months. -

What Have We Learned Since October 1979?

Panel Discussion I Moderation.” Recessions have become less fre- What Have We Learned Since quent and milder, and quarter-to-quarter volatility October 1979? in output and employment has declined signifi- cantly as well. The sources of the Great Moderation Ben S. Bernanke remain somewhat controversial, but, as I have argued elsewhere, there is evidence for the view he question asked of this panel is, that improved control of inflation has contributed “What have we learned since October in important measure to this welcome change in 1979?” The evidence suggests that we the economy (Bernanke, 2004). Paul Volcker and have learned quite a bit. Most notably, his colleagues on the Federal Open Market Com- Tmonetary policymakers, political leaders, and mittee deserve enormous credit both for recogniz- the public have been persuaded by two decades ing the crucial importance of achieving low and of experience that low and stable inflation has stable inflation and for the courage and persever- very substantial economic benefits. ance with which they tackled America’s critical This consensus marks a considerable change inflation problem. from the views held by many economists at the I could say much more about Volcker’s time that Paul Volcker became Fed Chairman. In achievement and its lasting benefits, but I am sure 1979, most economists would have agreed that, that many other speakers will cover that ground. in principle, low inflation promotes economic Instead, in my remaining time, I will focus on growth and efficiency in the long run. However, some lessons that economists have drawn from many also believed that, in the range of inflation the Volcker regime regarding the importance of rates typically experienced by industrial countries, credibility in central banking and how that credi- the benefits of low inflation are probably small— bility can be obtained. -

Development of Sirococcus Shoot Blight Following Thinning In

This file was created by scanning the printed publication. Text errors identified by the software have been corrected; however, some errors may remain. United States Department of Development of Sirococcus Agriculture Forest Service Shoot Blight Following Thinning in Pacific Northwest Forest and Range Western Hemlock Regeneration Experiment Station Research Note Charles G. Shaw III, Thomas H. Laurent, and PNW-387 May 1981 Spencer Israelson Abstract Shoot mortality from Sirococcus strobilinus Preuss. and other causes was recorded by crown position from April 1978 through October 1979 in young- growth western hemlock [Tsuga heterophylla (Raf.) Sarg.] crop trees released in a 1977 thinning at Thomas Bay, Alaska. All study trees contained some infected shoots, but no terminal leaders were killed by shoot blight. On individual trees, the number of shoots killed by S. strobilinus between April 1978 and October 1979 was significantly correlated with the level of shoot blight mortality present in April 1978. Disease occurrence was highest in the lower crown, but differences in the level of shoot mortality between lower, middle, and upper crown locations were not significant. Disease occurrence during 1978 and 1979 was markedly lower than that in 1976 and 1977. After thinning, shoot blight appears to be causing little damage to hemlock crop trees; suggesting that thinning operations can proceed at Thomas Bay with confidence that the selected crop trees will suffer little, if any, damage from the disease. Keywords: Shoot blight, diseases (plant), western hemlock, Tsuga heterophylla Alaska (Thomas Bay). Introduction Western hemlock [Tsuga heterophylla (Raf.) Sarg.] regeneration in southeast Alaska is commonly attacked by the shoot blight fungus, Sirococcus strobilinus Preuss. -

What Have We Learned Since October 1979? by Alan S. Blinder Princeton

What Have We Learned since October 1979? by Alan S. Blinder Princeton University CEPS Working Paper No. 105 April 2005 “What Have We Learned since October 1979?” by Alan S. Blinder Princeton University∗ My good friend Ben Bernanke is always a hard act to follow. When I drafted these remarks, I was concerned that Ben would take all the best points and cover them extremely well, leaving only some crumbs for Ben McCallum and me to pick up. But his decision to concentrate on one issue—central bank credibility—leaves me plenty to talk about. Because Ben was so young in 1979, I’d like to begin by emphasizing that Paul Volcker re-taught the world something it seemed to have forgotten at the time: that tight monetary policy can bring inflation down at substantial, but not devastating, cost. It seems strange to harbor contrary thoughts today, but back then many people believed that 10% inflation was so deeply ingrained in the U.S. economy that we might to doomed to, say, 6-10% inflation for a very long time. For example, Otto Eckstein (1981, pp. 3-4) wrote in a well-known 1981 book that “To bring the core inflation rate down significantly through fiscal and monetary policies alone would require a prolonged deep recession bordering on depression, with the average unemployment rate held above 10%.” More concretely, he estimated that it would require 10 point-years of unemployment to bring the core inflation rate down a single percentage point,1 which is about five times more than called for by the “Brookings rule of thumb.”2 In the event, the Volcker disinflation followed the Brookings rule of thumb rather well. -

Day by Day Care Newsletter: October 1979 - June 1980 Center for Public Affairs Research (CPAR) University of Nebraska at Omaha

University of Nebraska at Omaha DigitalCommons@UNO Publications Archives, 1963-2000 Center for Public Affairs Research 1979 Day by Day Care Newsletter: October 1979 - June 1980 Center for Public Affairs Research (CPAR) University of Nebraska at Omaha Follow this and additional works at: https://digitalcommons.unomaha.edu/cparpubarchives Part of the Demography, Population, and Ecology Commons, and the Public Affairs Commons Recommended Citation (CPAR), Center for Public Affairs Research, "Day by Day Care Newsletter: October 1979 - June 1980" (1979). Publications Archives, 1963-2000. 75. https://digitalcommons.unomaha.edu/cparpubarchives/75 This Article is brought to you for free and open access by the Center for Public Affairs Research at DigitalCommons@UNO. It has been accepted for inclusion in Publications Archives, 1963-2000 by an authorized administrator of DigitalCommons@UNO. For more information, please contact [email protected]. VOLUME I, Number 1 October, 1979 LEAVES I like to rake the leaves Division of Continuing Education for Western Nebraska, Into a great big hump. part of the University of Nebraska system. Then I go. back a little way, Bend both knees, I don't have to introduce Marcia Nance and And jump! Jean Mellor to you because you know the good work that they have been doing. Marcia and Jean have agreed to continue on the team so you will see them at some of the workshops. They will be working with us through Kearney State which will represent us in the mid-state area. I'm Ginger Burch, coordinator of the Day Care Training and Service Program. We are really excited about the program this year. -

THE LUCAS CRITIQUE and the VOLCKER DEFLATION Olivier J

NBER WORKING PAPER SERIES THE LUCAS CRITIQUE AND THE VOLCKER DEFLATION Olivier J. Blanchard Working Paper No. 1326 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 April 19814 The research reported here is part of the NBER's research program in Economic Fluctuations. Any opinions expressed are those of the author and not those of the National Bureau of Economic Research. NBER Working Paper #1325 April 1984 The Lucas Critique and the Volcker Deflation ABSTRACT This paper examines, in light of the Lucas Critique, the behavior of the Phillips curve and of the term structure of interest rates after October 1 979. Itstarts with an informal account of the policy change and then discusses how we might expect these two relations to shift after such a change. It finds little evidence of a direct effect of the policy change on the Phillips curve, at least until 1982. It finds substantial evidence of a direct effect on term structure. Olivier J. Elanchard Department of Economics N. I. T. Cambridge, MA 02139 (617) 253—8891 The Lucas Critique and the Voicker Deflation by Olivjer J. Blanchard* Robert Lucas warned us in 1976 [1976] that our econometric modelswere, by their very design, likely to perform poorly in the face ofpolicy regime changes. The US econorny has in the last four years experiencedprecisely such a change, namely a change in monetary policy. Now is therefore a good time tostudy how two of the central macroeconometric equations, the Phillips curve and the term structure of interest rates, have fared during that period. -

Public Records Inc. Collection

TITLE: Public Records Inc. Collection DATE RANGE: 1962 - 1991 CALL NUMBER: Y-MS 63 PHYSICAL DESCRIPTION: 10 linear feet (20 boxes) PROVENANCE: Unknown COPYRIGHT: Unknown RESTRICTIONS: This collection is unrestricted. CREDIT LINE: Public Records Inc. Collection, Y-MS 63, Arizona Historical Society- Rio Colorado Division PROCESSED BY: Benjamin Findley, July 2014 HISTORICAL NOTE: Public Records Incorporated compiled a weekly information sheet containing public records created by the Yuma City and County governments. It began publication in 1962 at $5.00 per issue. In 1974 the name of the publication was changed from The Record Reporter to Public Records Inc and was incorporated under this name in 1976. The business continued publishing the sheets until the 1990s. The corporation was officially dissolved in 1997. SCOPE AND CONTENT NOTE: This collection documents the publications of a husband and wife team from 1968 to 1991 as well as the company’s client records. Their weekly publication contains a wide range of public information aggregated from the Yuma County Court House and the Yuma County Recorder’s Office. It includes a list and brief summary of court cases, marriage licenses, tax liens, mortgages, business licenses, and building permits. Arranged in two series: Series I – Client Cards: Contains client records in alphabetical order indicating who purchased a subscription, when, and for how long. Series II – Record Reports: This series contains copies of publications by the company. The periodicals are organized chronologically. Public Records Inc. Collection – 1 of 4 CONTAINER LIST: Box Folder Title Dates 1 1 Client Cards: A (1 of 2) 1965 – 1983, n.d. -

Editors' Introduction

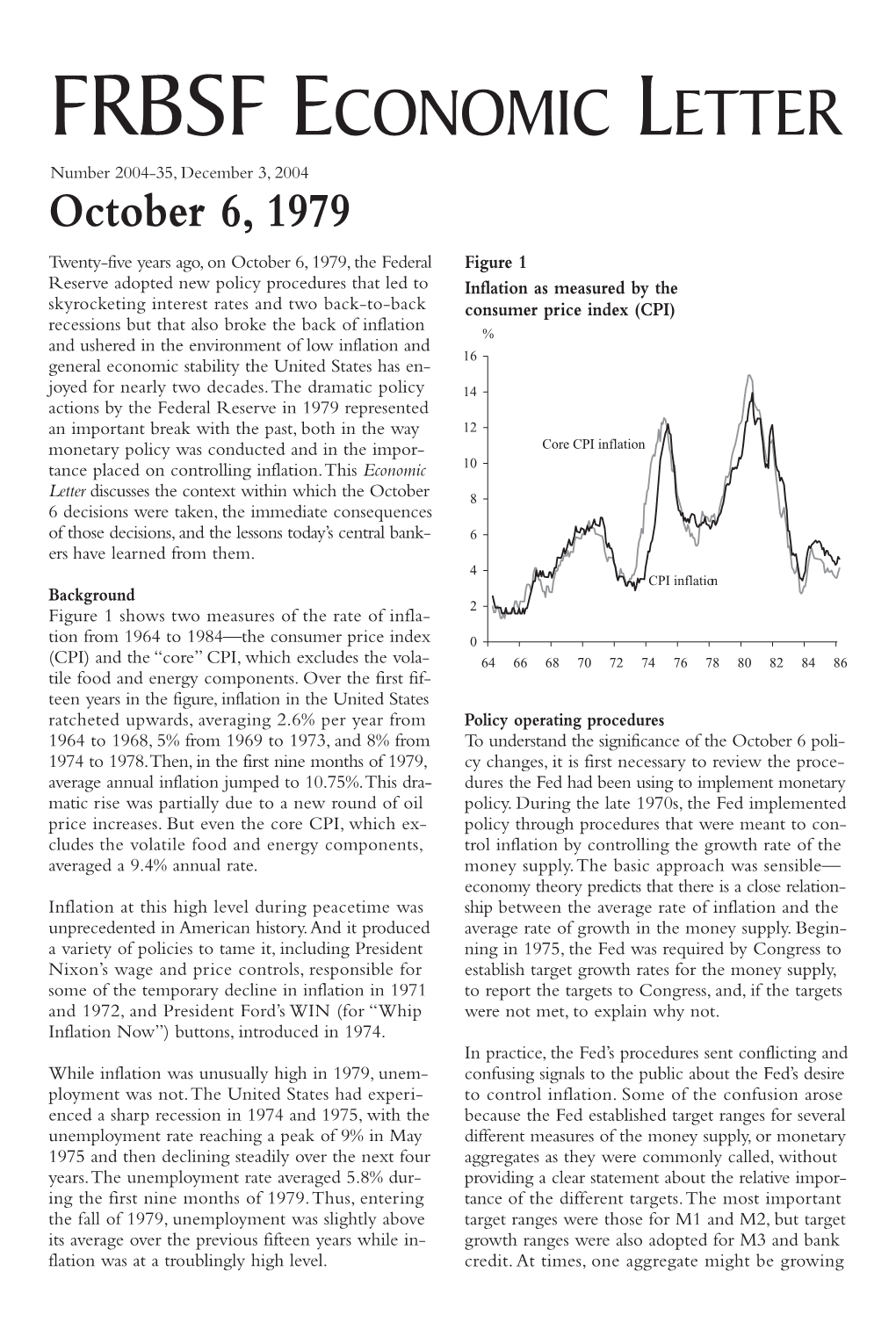

Editors’ Introduction Athanasios Orphanides and Daniel L. Thornton n October 6, 1979, the Federal ensuing lessons of that period. It may be the most Reserve implemented a monetary fruitful and proper way to commemorate the policy reform of profound signifi- events of October a quarter-century ago.” cance for the U.S. economy, mark- Oing the beginning of the end of the inflationary malaise that permeated the economy at the time. ORIGINS OF THE GREAT Starting with its policy actions that Saturday INFLATION afternoon, the Federal Reserve reaffirmed its In the first conference paper, Allan Meltzer responsibility to restore and maintain an environ- offers a historical analysis of the economic and ment of price stability in the economy, thereby political forces that generated and sustained the restoring confidence and setting the stage for a Great Inflation of the 1960s and 1970s and period of lasting economic prosperity. This pros- necessitated the forceful disinflationary actions perity has been interrupted only by two mild and of October 1979. Various explanations have been shallow recessions over the past two decades. advanced as possible causes of the policy errors A conference held in St. Louis on October 7 of that period. Some are based on the political and 8, 2004, provided the opportunity to reflect business cycle and dynamic consistency problems on the history of monetary policy in the United relating to the limited independence of the Federal States 25 years after the events of that October. Reserve at the time from the political process. Over the two-day period, three papers were pre- Other explanations stress the role of misinforma- sented and discussed, followed by two panel tion or misinterpretation of economic theories, discussions revisiting and distilling the policy models, and/or data. -

General Agreement on Tariffs and Trade

RESTRICTED L/5345 GENERAL AGREEMENT ON 8 July 1982 TARIFFS AND TRADE Limited Distribution APPLICATION OF THE GENERAL AGREEMENT TO NEWLY-INDEPENDENT STATES Report by the Director-General On 11 November 1967 the CONTRACTING PARTIES adopted a Recommendation (15S/64) that contracting parties should continue to apply de factor the General Agreement in their relations with each territory which acquired full autonomy in the conduct of its external commercial relations and in respect of which a contracting party had accepted the Agreement, provided such territories continued to apply de facto the Agreement to its trade with the contracting parties. The Recommendation does not have a time-limit. The Director-General is requested to submit a report on its application after three years. Earlier reports have been submitted to the Council in November 1970 (L/3457), in November 1973 (L/3948), in October 1976 (L/4427) and in October 1979 (L/4846 and Add.1). The Recommendation is at present applicable in respect of the following countries: Date of independence Mali 20 June 1960 Algeria 3 July 1962 Maldives 26 July 1965 Botswana 30 September 1966 Lesotho 4 October 1966 Yemen, Democratic 30 November 1967 Swaziland 6 September 1968 Equatorial Guinea 12 October 1968 Tonga 5 June 1970 Fiji 10 October 1970 Bahrain 16 August 1971 Qatar 3 September 1971 United Arab Emirates 1 December 1971 Bahamas 10 July 1973 Grenada 7 February 1974 Guinea-Bissau 10 September 1974 Mozambique 25 June 1975 Cape Verde 5 July 1975 Sao Tome and Principe 12 July 1975 Papua New Guinea 16 September 1975 Angola 11 November 1975 Seychelles 29 June 1976 Solomon Islands 7 July 1978 ./. -

Justice Expenditure and Employment in the U.S., 1979 II 1 T December 1980, BB-18A, NCJ-73288 R I I ~ I !

If you have issues viewing or accessing this file contact us at NCJRS.gov. ~ I u.s. Department of Justice \ ! Bureau of Justice Statistics % --. Justice expenditure and employment in the U.S., 1979 II 1 t December 1980, BB-18a, NCJ-73288 r I I ~ I ! Preliminary report The 1979 survey of public expenditure In October 1979, there were 1,175,520 As in the past, local governments accounted and employmentfor civil and criminal justice justice employees on a full-time equivalent for more expenditure and employment in the activities in the United States showed that basis. As seen in table B, this was only 1.6 civil and criminal justice field than the expenditure in Fiscal Year 1979 amounted percent more than in October 1978, the Federal and State governments combined. to $26 billion, an increase of $1.8 billion smallest gain recorded injustice employment Of the Nation's $26 billion expenditure for (7.4 percent) over Fiscal Year 1978. for all governments since 1971. While State criminal justice purposes in 1979, 59 percent Increases in direct expenditure occurred at government full-time equivalent employment was expended by local governments. In all levels of government, with State increased by about 5 percent, the estimate of addition, 63 percent of total civil and governments registering a 9.8 percent full-time equivalent employment at the local criminal justice full-time equivalent employ increase over 1978, followed by local government level was onlyO.3 percent higher ment was in local justice activities. Reflecting governments (up 6.8 percent) and the Federal than the estimate for the previous year. -

A Costly Evolution: 1971 – 1991

Chapter 6 A Costly Evolution: 1971 – 1991 The economic environment affecting banks began to change during the 1970s and the pace of change accelerated during the 1980s. Also, the market for financial services became far more competitive as nonbanking companies began to encroach on traditional banking markets and banks sought to enter new product markets. As a result, banking became a riskier and more demanding business than ever before. The ramifications of unforeseen market developments or bad decisions were greatly magnified. This chapter documents some major changes in the banking environment that occurred from 1971 to 1991, a period that included record insured-bank failures and insurance losses and ended with the Bank Insurance Fund technically insolvent by $7 billion. Key Economic Variables Foreign exchange-rate volatility. The period of remarkable post-World War II stability came to an end in the 1970s. An important change resulted from the movement to a floating exchange-rate system from a fixed-rate system that occurred in 1973. As international trade expanded in the post-World War II era, the maintenance of fixed exchange rates required adjustments to trading relationships and domestic economic policies of trading nations that were not optimal. With the Smithsonian Agreement (Washington, DC, 1971), exchange rates among all of the major currencies of the world were realigned and permitted to float without upper and lower bounds. This development predictably gave rise to considerably greater exchange-rate volatility at a time when world trade was expanding rapidly. Since 1970, there have been periods of relative calm in the exchange rates – for example, 1976 and 1977 – interspersed with periods of substantial volatility, some considerably extended, and periods with volatility varying among currencies. -

Native American Women and Coerced Sterilization: on the Trail of Tears in the 1970S

AMERICAN IMIAN CULTURE AND RESEARCHJOURNAL24:2 (2000) 1-22 Native American Women and Coerced Sterilization: On the Trail of Tears in the 1970s SALLY J. TORPY During the 1970s, the majority of American protest efforts focused on the feminist, civil rights, and anti-government movements. On a smaller scale, Native Americans initiated their own campaign. Network television periodi- cally broadcast scenes of confrontation ranging from the Alcatraz Occupation in 1969 through the Wounded Knee Occupation of 1973. The consistent objective was to regain treaty rights that had been violated by the United States government and private corporations. Little publicity was given to another form of Native American civil rights vio- lations-the abuse of women’s reproductive freedom. Thousands of poor women and women of color, including Puerto Ricans, Blacks, and Chicanos, were sterilized in the 1970s, often without full knowledge of the surgical proce- dure performed on them or its physical and psychological ramifications. Native American women represented a unique class of victims among the larger popu- lation that faced sterilization and abuses of reproductive rights. These women were especially accessible victims due to several unique cultural and societal real- ities setting them apart from other minorities. Tribal dependence on the federal government through the Indian Health Service (IHS), the Department of Health, Education, and Welfare (HEW), and the Bureau of Indian Affairs (BIA) robbed them of their children andjeopardized their future as sovereign nations. Native women’s struggle to obtain control over reproductive rights has provided them with a sense of empowerment consistent with larger Native American efforts to be free of institutional control.