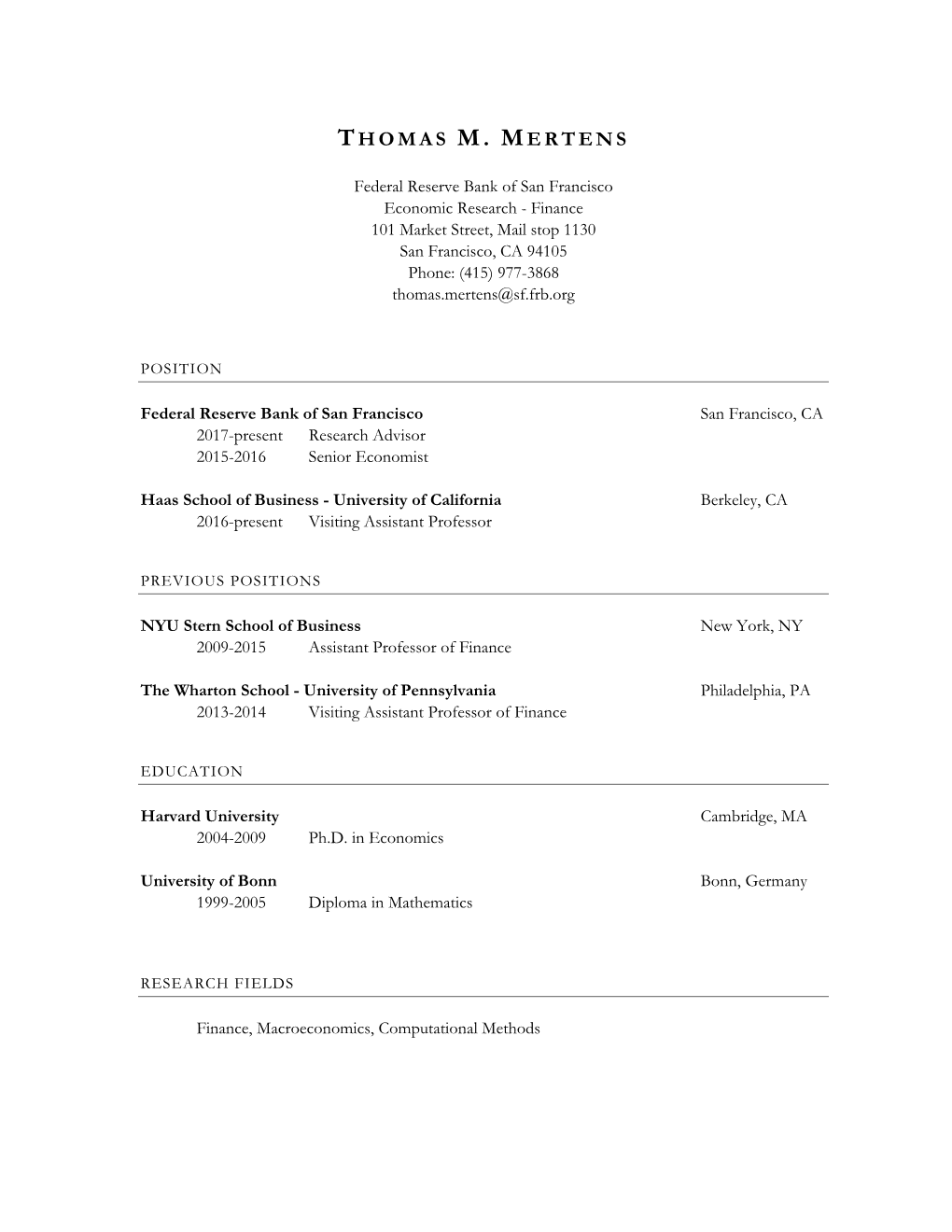

Thomas M. Mertens Curriculum Vitae

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Johannes Brumm, Chair of Macroeconomics Karlsruhe Institute of Technology (KIT), Institute of Economics (ECON) Waldhornstr

CURRICULUMVITAE JOHANNESBRUMM contact information Address Prof. Dr. Johannes Brumm, Chair of Macroeconomics Karlsruhe Institute of Technology (KIT), Institute of Economics (ECON) Waldhornstr. 27, D-76131 Karlsruhe Email [email protected] Websites johannesbrumm.com, macro.econ.kit.edu academic positions since 2016 Full Professor, Chair of Macroeconomics Institute of Economics (ECON), Karlsruhe Institute of Technology (KIT) On parental leave since October 2018 2011 – 16 Senior Research Associate in Financial Economics, Department of Banking and Finance, University of Zurich visiting positions 2021 Department of Economics, Harvard University (scheduled) 2018 – 20 Department of Economics, Boston University education 2011 Doctorate in Economics (Dr. rer. pol.), summa cum laude, University of Mannheim Advisors: Tom Krebs, Felix Kubler 2010 Visiting Researcher, University of Zurich (4 months) 2009 ENTER Exchange Student, Stockholm School of Economics (6 months) 2007 Diploma in Mathematics (Dipl.-Math.), with Distinction, LMU Munich Advisor: Damir Filipovic 2004 – 05 Exchange Student, Balliol College,Oxford University (one academic year) 2003 Intermediate Diploma in Philosophy, LMU Munich 2001 – 07 Scholarships by Stiftung Maximilianeum and Studienstiftung des dt.Volkes 2000 A-levels (Abitur) at Friedrich-Koenig-Gymnasium Würzburg, Grade: 1.0 research fields Primary Macroeconomics, Computational Economics Secondary Financial Economics, General Equilibrium Theory 2 journal publications 2019 Global Value Chain Participation and Current Account -

Advanced Courses in Economics for Doctoral Students and Faculty Members 2019

www.szgerzensee.ch Foundation of the Swiss National Bank ADVANCED COURSES IN ECONOMICS FOR DOCTORAL STUDENTS AND FACULTY MEMBERS 2019 TABLE OF CONTENTS Program Description 3 Courses 3-8 Admission 8 Program Fees 8 Other Information 9 Advanced Courses in Economics 2019 PROGRAM DESCRIPTION Each year, the Study Center Gerzensee offers Advanced Courses in Economics for Doctoral Students and Faculty Members. In each of these week-long courses, a leading international academic teaches material at the frontier of economic research. While the courses are primarily designed for students preparing their thesis, they are also open to faculty members and other interested individuals with a solid back- ground in economics. Courses consist of formal lectures of 3 hours each day, usually starting at 10.30h on Monday and finishing at 12h on Friday. The remaining time is available for reading, discussions and group work. Courses may require preparatory readings. At the end of the course participants obtain a Certificate of Participation. Optionally, participants can take an exam. Upon request, the Study Center reports the grade to the participant's institution. However, it is the responsibility of participants to obtain ECTS equivalence with their institutions. COURSES 29.04. - 03.05.2019 Behavioral Finance, joint with Swiss Finance Institute Kent Daniel, Columbia Business School 11.06. - 14.06.2019 Recent Advances in Bayesian Macroeconometrics Frank Schorfheide, University of Pennsylvania 05.08. - 09.08.2019 HAM: Heterogenous Agents Models. Crafting, Mariacristina de Nardi, Federal Reserve Calibration and Estimation Bank of Minneapolis 12.08. - 16.08.2019 Optimal Fiscal and Monetary Policy Mikhail Golosov, University of Chicago 09.09. -

Three Essays on Quantitative Asset Pricing

Zurich Open Repository and Archive University of Zurich Main Library Strickhofstrasse 39 CH-8057 Zurich www.zora.uzh.ch Year: 2012 Three essays on quantitative asset pricing Scheuring, Simon Abstract: This thesis consists of three separate papers. The first paper, “International Diversification and the Forward Premium” reproduces the slope of the uncovered interest rate parity (UIP) regression for ten country pairs within one standard deviation under rational expectations. We propose an infinite horizon dy- namic stochastic general equilibrium model with incomplete markets. The underlying mechanism of the model relies on varying international diversification in the investors’ portfolio choice decision. This leads to adjustments in interest rates, which are negatively correlated with movements in the exchange rate, as implied by a negative UIP slope. The second paper, “Asset Pricing with Idiosyncratic Risk: The Impact of Job Loss” studies the impact of unemployment risk on risk premia in an incomplete markets economy with many infinitely-lived heterogeneous agents. Job loss is modeled as large, but rare, persis- tent idiosyncratic shocks with heteroskedastic countercyclical volatility. Within an otherwise standard model and despite conservative assumptions on preferences, we simul- taneously generate a sizeable eq- uity premium and a low risk-free rate. The third paper, “Multivariate Markov Chain Approximations” discusses the problem of discretizing vector autoregressive processes (VAR) into a finite number of states which is a necessary step to solve equilibrium models numerically. Univariate Markov chain approx- imations are well studied, however, few papers address the multivariate case. This paper presents and compares three approaches to the problem: quadrature, moment matching and bin estimation Posted at the Zurich Open Repository and Archive, University of Zurich ZORA URL: https://doi.org/10.5167/uzh-164164 Dissertation Published Version Originally published at: Scheuring, Simon. -

MWP Booklet of Fellows & Team 2010-2011

Max Weber Fellows & Team 2010-2011 Table of contents List of All Max Weber Fellows (MWF) 2 Department of Economics ECO Max Weber Fellows Biosketches 3 Department of History and Civilization HEC Max Weber Fellows Biosketches 13 Department of Law LAW Max Weber Fellows Biosketches 27 Department of Political and Social Sciences SPS Max Weber Fellows Biosketches 39 Max Weber Programme (MWP) Team 55 MAX WEBER FELLOWS List of All Max Weber Fellows (in alphabetical order) ¾ AFONSO, Alexandre (SPS) ¾ KÜHNER, Christian (HEC) ¾ ANDRIGHETTO, Giulia (SPS) ¾ LARISE, Dunja (SPS) ¾ BESSUDNOV, Alexey (SPS) ¾ MARCUS, Nathan (HEC) ¾ CONTISSA, Giuseppe (LAW) ¾ MARTINICO, Giuseppe (LAW) ¾ D’ALBIS, Cécile (HEC) ¾ NANOU, Kyriaki (SPS) ¾ DEKKER, Willem Martijn (SPS) ¾ NOVAK, Stéphanie Julie (SPS) ¾ DERMINEUR, Elise (HEC) ¾ PACCAGNINI, Alessia (ECO) ¾ DIECKHOFF, Martina (SPS) ¾ RICHARD, Anne-Isabelle (HEC) ¾ DOSEMECI, Mehmet (HEC) ¾ RITTER, Daniel (SPS) ¾ EASTERBY-SMITH, Sarah C. (HEC) ¾ SCHAEFER, Tali (LAW) ¾ FLETCHER, Catherine (HEC) ¾ SEN, Uditi (HEC) ¾ FOROWICZ, Magdalena (LAW) ¾ SEVEL, Michael (LAW) ¾ GABALLO, Gaetano (ECO) ¾ SHNAYDERMAN, Ronen (SPS) ¾ GATTA, Giunia (SPS) ¾ STAUDIGL, Mathias (ECO) ¾ GAZZINI, Claudia Anna (HEC) ¾ SURAK, Kristin (SPS) ¾ GOBBATO, Marco (LAW) ¾ SVETIEV, Yane (LAW) ¾ HOELLE, Matthew (ECO) ¾ TASKIN, Temel (ECO) ¾ HOSNE, Ana Carolina (HEC) ¾ VAN WEELDEN, Richard (ECO) ¾ JURSKA-GAWRYSIAK, Aneta K. (LAW) ¾ VULETIC, Dean (HEC) ¾ KASHIWAGI, Masanori (ECO) ¾ WANG, Heng (LAW) ¾ KLINE, Reuben (SPS) ¾ ZAHN, Rebecca Lisa (LAW) ¾ KLINGELHÖFER, -

Inequality, Debt, and Financial Fragility in America, 1950-2016

Modigliani Meets Minsky: Inequality, Debt, and Financial Fragility in America, 1950-2016 Alina K. Bartscher†, Moritz Kuhn‡, Moritz Schularick§ and Ulrike I. Steins¶ Working Paper No. 124 April 28, 2020 ABSTRACT This paper studies the secular increase in U.S. household debt and its relation to growing income inequality and financial fragility. We exploit a new household-level dataset that covers the joint distributions of debt, income, and wealth in the United States over the past seven decades. The data show that increased borrowing by middle-class families with low income growth played a central role in rising indebtedness. Debt-to-income ratios have risen most dramatically for households between the 50th and 90th percentiles of the income distribution. While their income growth was low, middle-class families borrowed against the sizable housing wealth gains from rising home prices. Home equity borrowing accounts for about half of the increase in U.S. household debt between the 1970s and 2007. The resulting debt increase made balance sheets more sensitive to income and house price fluctuations and turned the American middle class into the epicenter of growing financial fragility. † University of Bonn, Adenauerallee 24-42, 53113 Bonn, Germany, [email protected] ‡ University of Bonn, CEPR, and IZA, Adenauerallee 24-42, 53113 Bonn, Germany, mokuhn@uni- bonn.de § Federal Reserve Bank of New York and University of Bonn, CEPR, Adenauerallee 24-42, 53113 Bonn, Germany, [email protected] ¶ University of Bonn, Adenauerallee 24-42, 53113 Bonn, Germany, [email protected] JEL Codes: E21, E44, D14, D31 Keywords: household debt, inequality, household portfolios, financial fragility https://doi.org/10.36687/inetwp124 Acknowledgements: We thank participants of seminars at the University of Chicago Booth School of Business, Cambridge University, SciencesPo, the Wharton School at the University of Pennsylvania, and the Bundesbank, as well as Stefania Albanesi, Luis Bauluz, Christian Bayer, Tobias Berg, David Berger, Douglas W. -

Annual Report 2012 Swiss Finance Institute @ Epfl Table of Contents

ANNUAL REPORT 2012 SWISS FINANCE INSTITUTE @ EPFL TABLE OF CONTENTS PART A: SELF-EVALUatION REPORT 1. OVERVIEW p.6 2. BRIEF HistorY p.7 3. GENERAL structure & governance p.9 4. FACULTY p.10 4.1 Composition p.10 4.2 Mentoring and promotion of assistant professors p.10 5. AREAS OF COMPETENCE p.11 6. Integration into THE Swiss FINANCE INSTITUTE networK p.12 7. MAJOR collaborations p.14 7.1 University Finance Centre of Lausanne (CULF) p.14 7.2 Collaboration in macroeconomics p.16 7.3 NCCR FINRISK p.17 7.4 Collaboration with Princeton University p.18 7.5 Swissquote p.18 8. OrganiZation AND manpower p.19 8.1 Promotion of gender equity p.20 9. BIBLIOMETRIC ANALYSIS p.21 10. MASTER PROGRAM IN FINANCIAL ENGINEERING p.26 10.1 Study program p.26 10.2 Student admission procedures and statistics p.28 10.3 Program structure p.28 10.4 MFE versus the Master specialization “Statistics and financial mathematics” offered by the Mathematics Section of the EPFL School of Basic Sciences p.30 10.5 Initiatives to recruit more EPFL students for the MFE program p.30 11. Doctoral PROGRAM IN FINANCE p.32 11.1 First phase: foundation courses p.32 11.2 Second phase: PhD research p.32 11.3 Student support p.33 11.4 Student placement record p.33 11.5 Program structure p.34 12 Strategic PRIORITIES P.34 13 OutreacH p.35 14 BUDGET p.38 15 ANNEX p.39 Annex 1. Finance research seminars at SFI@EPFL, schedule for 2012 - 2013 (sponsored by Unigestion) p.39 Annex 2. -

Bankruptcy and Transaction Costs in General Financial Models

University of Pennsylvania ScholarlyCommons Publicly Accessible Penn Dissertations Spring 2010 Bankruptcy and Transaction Costs in General Financial Models Matthew Hoelle University of Pennsylvania, [email protected] Follow this and additional works at: https://repository.upenn.edu/edissertations Part of the Economic Theory Commons, and the Finance Commons Recommended Citation Hoelle, Matthew, "Bankruptcy and Transaction Costs in General Financial Models" (2010). Publicly Accessible Penn Dissertations. 119. https://repository.upenn.edu/edissertations/119 This paper is posted at ScholarlyCommons. https://repository.upenn.edu/edissertations/119 For more information, please contact [email protected]. Bankruptcy and Transaction Costs in General Financial Models Abstract General financial models have become workhorse models in the fields of macroeconomics and finance. These models have been developed and extensively studied by general equilibrium theorists. What makes them so applicable for macroeconomics and finance is the well accepted fact that models with a representative agent and without financial frictions yield equilibrium outcomes that are inconsistent with the empirical realities of financial markets. The general financial models are characterized by two main features: heterogeneous agents and financial frictions. The ability of these models ot be applied in the fields of macroeconomics and finance in the future depends upon the frontier research in general equilibrium today. Over the past 20 years, research in general -

Essays in Equilibrium Asset Pricing

Zurich Open Repository and Archive University of Zurich Main Library Strickhofstrasse 39 CH-8057 Zurich www.zora.uzh.ch Year: 2020 Essays in equilibrium asset pricing Geng, Runjie Posted at the Zurich Open Repository and Archive, University of Zurich ZORA URL: https://doi.org/10.5167/uzh-175934 Dissertation Published Version Originally published at: Geng, Runjie. Essays in equilibrium asset pricing. 2020, University of Zurich, Faculty of Economics. Essays in Equilibrium Asset Pricing Dissertation submitted to the Faculty of Business, Economics and Informatics of the University of Zurich to obtain the degree of Doktor der Wirtschaftswissenschaften, Dr. oec. (corresponds to Doctor of Philosophy, PhD) presented by Runjie Geng from China approved in February 2020 at the request of Prof. Dr. Felix K¨ubler Prof. Dr. Herakles Polemarchakis The Faculty of Business, Economics and Informatics of the University of Zurich hereby authorizes the printing of this dissertation, without indicating an opinion of the views expressed in the work. Zurich, 12.02.2020 The Chairman of the Doctoral Board: Prof. Dr. Steven Ongena i ii Acknowledgments I would like to extend my gratitude towards my supervisor Prof. Dr. Felix K¨ubler. Without his insightful ideas, helpful discussions, the completion of this thesis would not have been possible. I would also like to thank my committee members Prof. Dr. Herakles Polemarchakis and Prof. Dr. Per Ostberg¨ for their great advice and guidance. Last, I would like to thank my colleagues and staff of the department who helped and supported me all the time. And I would thank my family members for their understanding and support. -

Daniel Harenberg

Daniel Harenberg ETH Zurich Department of Management, Technology, and Economics [email protected] Z¨urichbergstrasse 18 Office phone: +41 44 632 9711 8092 Z¨urich, Switzerland http://sites.google.com/site/danharenberghome/ Current Positions and Affiliations Since 09/2012 Post-Doctoral Researcher, Chair of Integrative Risk Management and Economics, ETH Zurich Since 10/2015 Junior Fellow at the Research Center \Sustainable Architecture for Finance in Europe" (SAFE), Goethe University Frankfurt Education 10/2004 { 06/2012 Ph.D. in Economics (Dr. rer. pol., with distinction), University of Mannheim, Center for Doctoral Studies in Economics Dissertation Committee: Tom Krebs (chair), Felix Kubler 09/2006 { 08/2008 Visiting scholar, University of Pennsylvania 11/2002 { 10/2004 Ph.D. student, Chair for Asset Management, European Business School, and studies of economics, University of Mannheim 09/1998 { 11/2002 Diplom (master equivalent) with distinction, Business Administration, European Business School, Oestrich-Winkel 02/2001 { 06/2001 Visiting student, Business Administration, Libero Istituto Universi- tario Cattaneo, Castellanza, Italy 07/2000 { 12/2000 Visiting student, Business Administration, University of Queensland, Brisbane, Australia Previous Employment 09/2008 { 08/2012 Research assistant for Prof. Tom Krebs, University of Mannheim 11/2002 { 09/2003 Research assistant for Prof. Lutz Johanning, European Business School, Oestrich-Winkel 07/2001 { 09/2001 Summer analyst internship at Deutsche Bank, Investment and Corpo- rate Banking, Global Equities Division, London Research Fields Macroeconomics, Computational Economics, Financial Economics, Economic Demography Peer-Reviewed Publications \Social Security in an Analytically Tractable Overlapping Generations Model with Aggregate and Idiosyncratic Risk"(with A. Ludwig), International Tax and Public Finance, 22(4), 579{603, August 2015 Other Publications \Web Service Providing { Pricing Strategies for Application Service Providers"(with Susanne Strahringer), in: Krivulin, N. -

CV Moritz Kuhn

MORITZ KUHN November 2015 Office: Contact Information: University of Bonn Phone: +49 228 73 62096 Adenauerallee 24-42 [email protected] D-53113 Bonn, Germany http://www.wiwi.uni-bonn.de/kuhn/ Current Position: 2014–present: Associate Professor, University of Bonn 2010–2014: Assistant Professor, University of Bonn 2012–present: Research Fellow, IZA (Institute for the Study of Labor) Fields: Macroeconomics, Income and Wealth Inequality, Labor Markets Visits: Visiting Scholar, Department of Economics, University of Minnesota and Federal Reserve Bank of Minnesota 1/2014 - 6/2014 Visiting Scholar, Department of Economics, University of Pennsylvania, 2/2011 - 5/2011 European Central Bank, Fiscal Policy Division, 6/2009 to 9/2009 Education: PhD in Economics (summa cum laude), University of Mannheim, Germany, 2005 to 2010 Thesis Title: “Topics in Dynamic Macroeconomics” (advisor: Tom Krebs) Master in Economics, University of Mannheim, 2000 to 2005 (advisor: Felix Kubler) Visiting Scholar University of California, Los Angeles, 2003 to 2004 Publications: “Recursive equilibria in an Aiyagari style economy with permanent income shocks” International Economic Review, Vol. 54-3, August 2013 “Labor market institutions and worker flows: Comparing Germany and the U.S” with Philip Jung, The Economic Journal, Vol. 124, Issue 581, p. 1317-1342, December 2014 “Should Unemployment Insurance be asset-tested?” with Sebastian Koehne Review of Economic Dynamics, Vol. 18, Issue 3, January 2015 “Optimal taxation in a habit formation economy” with Sebastian Koehne, September 2014 Journal of Public Economics, Vol. 122, p. 31-39, February 2015 “Human Capital Risk, Contract Enforcement, and the Macroeconomy“ with Tom Krebs and Mark Wright American Economic Review, Vol. -

Curriculum Vitae

CURRICULUM VITAE Felix Kubler 2020 Date and Place of Birth: December 13, 1969; Bochum, Germany. Personal Information Address: University of Zurich and Swiss Finance Institute Plattenstrasse 32 CH-8032 Zurich E-mail: [email protected] Telephone: +41 44 634 41 06 Education Universit¨atBonn, Germany, Diplom, 1994 Yale University, M.A. in Economics, 1995 Yale University, Ph.D. in Economics, 1999 Employment Assistant Professor, Stanford University, 1999-2004 Professor of Economics, University of Mannheim, 2004{2006 Associate Professor of Economics, University of Pennsylvania, 2006{2008 Professor of Economics, University of Pennsylvania, 2008-2009 (on leave) Professor of Financial Economics, University of Zurich, 2008 { Swiss Finance Institute Senior Chair, 2008 { FELIX KUBLER 2 Honors and Grants Carl Anderson Dissertation Fellowship, 1997 Stanford Institute for Economic Policy Research, Junior Faculty Grant, 1999 National Science Foundation, Research Grant, 2001-2004 NCCR-FINRISK, Research Grant, 2009-2012 Fellow of the Econometric Society ERC Starting Grant 2011-2016 Gossen Prize (Verein f¨urSocialpolitik), 2012 Economic Theory Fellow PASC exploratory grant 2015-2017 Alexander von Humboldt Professorship, 2015 (declined) PASC co-design project 2017-2020 SNF Sinergia project 2019-2023 PASC co-design project 2020-2021 Service Econometrica: Associate Editor International Economic Review: Associate Editor Journal of Mathematical Economics: Advisory Editor Quantitative Economics: Associate Editor Theoretical Economics: Associate Editor FELIX KUBLER 3 Main Publications 1. Judd, K., F. Kubler and K. Schmedders, \Computing Equilibria in Infinite Horizon Finance Economies: The Case of One Asset", (2000), Journal of Economic Dynamics and Control, 24, 1047-1078. 2. Kubler, F. and K. Schmedders, \Computing Equilibria in a Stochastic Finance Economy", (2000), Computational Economics, 15, 145-172. -

Preliminary Program

15th International Conference | 21-24 March 2019 | Keio University, Tokyo, Japan PRELIMINARY PROGRAM This is a searchable PDF document. To locate a particular participant, type Ctrl F and enter a portion of the individual’s name for whom you are searching. Participating Allied Societies MONETARY POLICY EFFECTS Chair: Kristin A. Van Gaasbeck, California State University, Sacramento AFEA .......... African Finance and Economics Association Papers: Central Bank Losses and Monetary Policy Rules: A DSGE APF ............ Athenian Policy Form Application with US Data EAAERE ..... East Asian Association of Environmental and Resource Economics *André Fourcans, ESSEC Business School, and Jonathan ESA ............ Economics Science Association Benchimol, Bank of Israel FICA ........... Finance ICT Convergence Association Shock Size Matters for US Monetary Policy IBEFA ......... International Banking, Economics and Finance Association *Toyoichiro Shirota, Hokkaido University ICA CCR ..... International Co-operative Alliance Committee on Co- Monetary Policy and Household Balance Sheet Heterogeneity operative Research *Xu Zhang, University of California, San Diego IEFS ........... International Economics and Finance Society Is Timing Everything?: Ordered Probit Estimation of Monetary Policy KAEA ......... The Korea-America Economic Association Reaction Functions Using Real-Time Data NAASE ....... North American Association of Sports Economists *Kristin A. Van Gaasbeck, California State University, Sacramento PES ............ Philippine Economic Society