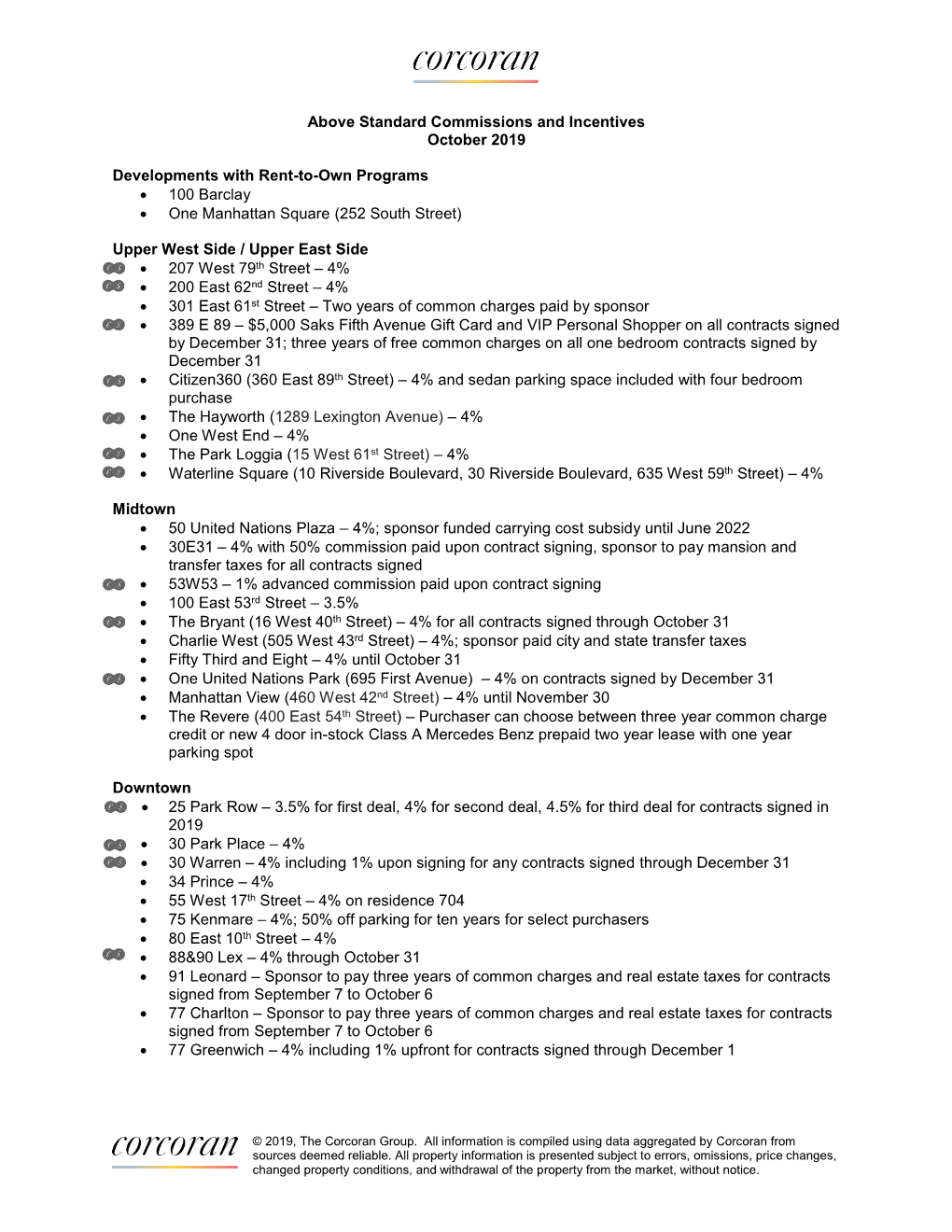

Above Standard Commissions and Incentives October 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Monthly Market Report

FEBRUARY 2016 MONTHLY MARKET REPORT SALES SUMMARY .......................... 2 HISTORIAL PERFORMANCE ......... 4 NOTABLE NEW LISTINGS ............. 7 SNAPSHOT ...................................... 8 CityRealty is the website for NYC real estate, providing high-quality listings and tailored agent matching for prospective apartment buyers, as well as in-depth analysis of the New York real estate market. MONTHLY MARKET REPORT FEBRUARY 2016 Summary MOST EXPENSIVE SALES The average sale price for Manhattan apartments dipped in the four weeks leading up to January 1, while the number of sales rose. The average price for an apartment—taking into account both condo and co-op sales—was $2.1 million, down from $2.2 million in the preceding month. The number of recorded sales, 1,020, rose a great deal from the 862 recorded in the preceding month. AVERAGE SALES PRICE CONDOS AND CO-OPS $30.5M 834 Fifth Avenue, #10B $2.1 Million 2 beds, 4 baths The average price of a condo was $2.7 million and the average price of a co-op was $1.4 million. There were 542 condo sales and 478 co-op sales. RESIDENTIAL SALES 1,020 $2.1B UNITS GROSS SALES One of the most expensive sales this month was in a grand, prewar co-op on the Upper East Side, while the other two were in the large new downtown condo development The Greenwich Lane. $26.0M The most expensive sale of the month was unit 10B in 834 Fifth Avenue, a two-bedroom, The Greenwich Lane, #PH8 four-bathroom apartment that closed for $30.5 million. The Rosario Candela-designed building 140 West 12th Street is considered one of the most desirable prewar co-ops in Manhattan. -

Luxuryletter April 2018.Key

a 72 Mercer St, PENTHOUSE W SOHO WWW.THELEONARDSTEINBERGTEAM.COM NEW: TROPHY FIFTH AVENUE DUPLEX LUXURYLETTER APRIL 2018 Irrational Luxuberance There is really no great explanation why the wealthiest people in the world - much wealthier now than at any other time in history - are not buying more luxury real estate than ever before. Interest rates, while rising, are low, many prices are down off their (asking) highs, sellers are more inclined to negotiate on price and there are more options to choose from……although in some areas there are shortages. But yes, there are some reasons to explain why the luxury market is not faring as well as it ought to be: • Pricing escalated too far too fast. Buyer fatigue caused markets to pause and when they did, some sellers blinked causing more downward price adjustments. • Sellers were spoiled by the speed of sales: now that has normalized, yet it still feels very slow compared to the Studio-54-style pace of 2014-2016. • Most buyers between 2012 and 2015 saw an almost certain upside in buying…..these same people don’t want to take a loss buying now in case they can buy later for less. • Many buyers between 2010 and 2015 were buying purely for investment purposes: who wants to buy an investment apartment in a market where there are many price drops? Which investor likes buying in a market where rental returns are a bit depressed, especially if they can wait? The few smart, non-herd-mentality investors though are buying now because they have better choices and can negotiate. -

Draft EIS ECF 80 Flatbush Avenue Part 4

WILLOUGHBY STFLEET PL 2/5/2018 FLEET ST Fort Greene University Park Place FLATBUSH AVE EXTENSION DE KALB AVE HUDSON AVE Albee Square SOUTH PORTLAND AVE ASHLAND PL BOND ST SOUTH ELLIOTT PL HANOVER PL GROVE PL 230 Ashland Place POPS FULTON ST LIVINGSTON ST ST FELIX ST ROCKWELL PL Theatre for a New Audience Fowler Square VE TTE A FAYE Rockwell Place Bears LA SCHERMERHORN ST Community Garden Seating Sixteen Sycamores Area 2 Playground 300 Ashland Place Plaza FT GREENE PL STATE ST NEVINS ST FLATBUSH AVE HANSON PL North Pacific Plgd ATLANTIC AVE 3 AVE Atlantic PACIFIC ST Terminal Mall Plaza Barclay's Center DEAN ST Plaza 4 AVE E V A 5 BERGEN ST WYCKOFF ST Greenstreet Wykoff ST MARK'S PL Gardens Open Space Project Site 0 400 FEET Traffic Analysis Location Traffic Analysis Locations ECF 80 FLATBUSH AVENUE Figure 11-4 Chapter 11: Transportation Table 11-8 Traffic Level 2 Screening Analysis Results—Analysis Locations Incremental Vehicle Trips (Weekday) Intersection AM Midday PM Analysis Locations Fulton Street and DeKalb Avenue 0 0 0 Livingston Street and Bond Street 4 1 4 Schermerhorn Street and Bond Street 35 9 23 Flatbush Avenue and DeKalb Avenue 57 14 57 ✓ Flatbush Avenue and Fulton Street 72 19 92 ✓ Flatbush Avenue and Nevins Street 37 9 52 Livingston Street and Nevins Street 30 6 32 Schermerhorn Street and Nevins Street 61 13 51 ✓ State Street and Nevins Street 51 8 49 ✓ Atlantic Avenue and Nevins Street 32 7 36 Pacific Street and Nevins Street 10 0 7 DeKalb Avenue and Hudson Avenue 6 0 1 Hudson Avenue and Fulton Street 35 13 58 Flatbush -

The Bloom Is on the Roses

20100426-NEWS--0001-NAT-CCI-CN_-- 4/23/2010 7:53 PM Page 1 INSIDE IT’S HAMMERED TOP STORIES TIME Journal v. Times: Story NY’s last great Page 3 Editorial newspaper war ® Page 10 PAGE 2 With prices down and confidence up, VOL. XXVI, NO. 17 WWW.CRAINSNEWYORK.COM APRIL 26-MAY 2, 2010 PRICE: $3.00 condo buyers pull out their wallets PAGE 2 The bloom is on the Roses Not bad for an 82-year-old, Adam Rose painted a picture of a Fabled real estate family getting tapped third-generation-led firm that is company that has come a surpris- for toughest property-management jobs known primarily as a residential de- ingly long way from its roots as a veloper. builder and owner of upscale apart- 1,230-unit project.That move came In a brutal real estate market, ment houses. BY AMANDA FUNG just weeks after Rose was brought in some of New York’s fabled real es- Today, Rose Associates derives as a consultant—and likely future tate families are surviving and some the bulk of its revenues from a broad just a month after Harlem’s River- manager—for another distressed are floundering, but few are blos- menu of offerings. It provides con- A tale of 2 eateries: ton Houses apartment complex was residential property, the vast soming like the Roses.In one of the sulting for other developers—in- taken over, owners officially tapped Stuyvesant Town/Peter Cooper Vil- few interviews they’ve granted,first cluding overseeing distressed prop- similar starts, very Rose Associates to manage the lage complex in lower Manhattan. -

USA | Canada Reference Projects

USA | Canada Reference Projects One Vanderbilt. New York. KPF Architects 1 Tvitec in the USA & Canada | Projects 2020 Contents United States & Canada MIDTOWN CENTER. 4 BROOKFIELD PLACE CALGARY 34 Reference Projects 2020 ONE MANHATTAN WEST 8 ONE SOUTH FIRST 37 VIRGIN HOTEL NEW YORK 12 ROCKEFELLER UNIVERSITY 38 Tvitec System Glass is an international glass manufacturer which after ten years of activity has become the first Spanish architectural glass HUNTER’S POINT 13 SURF CLUB. MIAMI FOUR SEASONS 40 transformer. The company and its 500 employees have developed into the world’s technology an innovation leader for insulating, safety and digital RESTON STATION 14 55 BLOOR. MANULIFE CENTER 41 printed glass. ONE MANHATTAN SQUARE 16 ONE DALTON ST. FOUR SEASONS 42 Tvitec was founded in 2008. Its main manufacturing center is located in Cubillos del Sil - León (Spain). Its organizational structure an investment 2000 ROSS STRET DALLAS 18 CAPITOL ONE. BLOCK C 45 plans are focused on turning Tvitec into one of the world’s largest hi- gh-performance architectural glass manufacturers for projects specia- 160 LEROY STREET 20 NATIONAL AIR MUSEUM . 45 lized in façade and building envelope on a global scale. Tvitec invoiced in 2017 over 100 Million Euros with an important increase in its turnover 2000 K STREET 22 LCBO TOWER. 46 with respect to the pevious year. The major part of these sales were generated in the international market. 50 WEST STREET 24 1441 L STREET 47 The Spanish high-performance glass manufacturer supplies its products CAPITOL CROSSING & OTHERS 26 NORSTROM FLAGSHIP NYC 48 for a large number of singular constructions in the United States and Canada. -

Abyrosen.LO .Pdf

The New York real estate mogul is building his legacy THE and doesn’t care what anyone has RISE, to say about it. FALL, AND RISE OF 73 BYABY MICHAEL GROSS ROSEN SCREEN PRINT BY CHAD SILVER It’s October and the chairman of one of New York’s top real estate brokerages has slipped out of a cock- tail party at the Four Seasons, the Philip Johnson–designed restaurant in Ludwig Mies van der Rohe’s Seagram Building, in Midtown Manhattan, to study the travertine-marble wall of what was long called Picasso Alley, connecting its two dining rooms. “But there’s no damage,” she says quizzically, after looking closely at a surface that, last year, was said to be threatened by leaks from the kitchen behind it. There’s more than damage missing from this wall. Also absent is Pablo Picasso, or rather, Le Tricorne, the huge stage curtain he painted in 1919. It hung there from 1959 until 2014, when the building’s owner insisted on removing it, alleging those leaks required immediate repairs. More than a year later, no repairs have been done. But the Four Seasons has been damaged. The owners of the fabled restau- rant will leave next year, and what had been their space—a landmark within a landmark—will be re- furbished. They’ll then be replaced by trendy downtown New York restaurateurs. The Four Seasons name will go elsewhere, too, but its clientele—one of the greatest concentrations of plutocrats and power brokers anywhere—will likely scatter to the four winds. -

Monthly Accident Details: January - October 2019

Monthly Accident Details: January - October 2019 Incident Date Borough Address Number Street Fatalities Injuries EOC Final Description DOB Action ECB Violation Numbers DOB Violation Numbers Permit Permit No Incident Type Owner's Name Contractor Name 1/2/2019 Bronx 4215 PARK AVENUE 0 1 A DOB inspector reported that a worker in the cellar fell ECB Violation 35367408M 010319CE06WG01 Other Construction Related Incidents NOT ON FILE JOY CONSTRUCTION CORP approximately five feet from a ladder. The worker was sent to a hospital. An ECB Violation was issued for the improper use of a ladder. 1/2/2019 Queens 147-40 ARCHER AVENUE 0 1 The Site Safety Manager reported that an electrician No Dispatch NEW BUILDING 420654508 Other Construction Related Incidents HP JAMSTA HOUSING DEV. FUND CO CNY CONSTRUCTION LLC was preparing to pull wires through a pipe when he stepped backwards on the same floor and lost his balance. The electrician cut his left hand while trying to reach for something to grab to prevent himself from falling. The worker went to an urgent care center on his own to receive treatment. 1/3/2019 Brooklyn 1797 BROADWAY 0 1 A DOB inspector reported that a worker was guiding ECB Violation 35374959Y 010318CNEGS01 NB 32156883 Excavation/Soil Work 1797 REALTY ASSOCIATES W Developers Corp piles into place when a pile shifted and the worker suffered an injury to his right leg. The worker was in stable condition and was taken to an area hospital. The extent and severity of the worker's injuries were not known as of the time of inspection. -

The Cityrealty 100 Report 2020

THE CITYREALTY 100 REPORT 2020 DECEMBER 2020 THE CityRealty is the website for NYC real estate, providing high-quality listings and tailored agent matching for pro- spective apartment buyers, as well as in-depth analysis of the New York real estate market. 1100 THE CITYREALTY 100 REPORT 2020 About The CityRealty 100 The CityRealty 100 is an index comprising the top 100 condominium buildings in Manhattan. Several factors—including a building’s sales history, prominence, and CityRealty’s rating for the property—are used to determine which buildings are included in the index. This report tracks the performance of those buildings for the one-year period ending September 30, 2020. CityRealty releases regular reports on the CityRealty 100 to track the change in prices of the top 100 Manhattan condo buildings. After falling in 2018 from all-time highs achieved in 2016 and 2017, the index’s average price / foot and total sales volumes were roughly flat in 2020 as compared to 2019, with the average price per square foot increasing 2% to $2,649. For the 12 months ending Sep 30, there were 846 sales which accounted for $4.94B in sales volume. Manhattan real estate, as viewed through the lens of this report, focuses on the city's top tier of buildings, which are seen as a relatively stable and good investment. The stagnation in prices and volume, especially in buildings not new to the market, reflects a market that has been saturated with high-end product, and prices in the 3rd quarter of 2020 reflect an overall downward trend. -

Luxuryletter November UPDATED LAYOUT

a 72 Mercer St, PENTHOUSE W SOHO WWW.THELEONARDSTEINBERGTEAM.COM LUXURYLETTER NOVEMBER 2016 NEW: CHELSEA LOFT SUPREME New York Market Fall Awakening The past several months have been rife with fear and hesitation in the New York real estate markets. These were some of the major contributing factors: 1. The unprecedented US Presidential Election caused many to wonder what exact impact a Trump Presidency would have on the markets. A Clinton Presidency suggested a “more-of-the-same-market” although raising taxes on the wealthy could cause downward pricing pressure. Then again, there is a Congress and Senate…. 2. BREXIT may have veiled the root cause of the UK’s dramatic real estate activity plunge, down over 80% from the previous year. BREXIT highlighted the fears of isolationism, yet we believe its the raised fees and taxes that are the primary cause. 3. The fear of rising interest rates have caused some to believe real estate prices will drop. This remains to be seen: higher interest rates can indicate a strengthening economy. 4. All the above factors combined with a much stronger dollar minimized urgency: that extra group of all-cash foreign buyers the markets loved so dearly between 2010 and 2015 are highly diminished, although the Chinese buyers are still out in full force. 5. The volume of construction of high-priced properties may slow now that construction financing has become very scarce. 14 EAST 11TH STREET TROPHY LOWER FIFTH GREENWICH VILLAGE TOWNHOUSE NEW! 18 WEST 75TH ST FOR MORE INFORMATION OR TO SCHEDULE AN APPOINTMENT PLEASE CALL 646.780.7594 Selldorf Architects Bowery/Noho/Village 347 BOWERY OVER 40% IN CONTRACT PRICING STARTS AT $7.500,000 The 13-story tower will consist of four duplex stacked town homes, and one triplex penthouse With nearly 20 foot ceilings, each residence will feature a handcrafted staircase made of plaster and white oak. -

Manhattan New Development Report

JUNE 2016 Manhattan New Development Report MANHATTAN NEW DEVELOPMENT REPORT June 2016 New Buildings by Neighborhood Condominium development has largely centered on Midtown over the past several years, but there will be a wave of new construction and conversions in the Financial District in the near future, with large buildings such as 50 West Street, One Seaport and 125 Greenwich Street contributing to the roughly 1,250 new apartments slated for the neighborhood. NEW DEVELOPMENT KEY: UNITS: 10+ 50+ 100+ 150+ 200+ Unit Count NEIGHBORHOOD # OF UNITS NEIGHBORHOOD # OF UNITS Financial District 1,251 Broadway Corridor 264 Midtown West 1,229 Murray Hill 249 Lower East Side 912 East Village 207 Riverside Dr./West End Ave. 881 Chelsea 201 Flatiron/Union Square 499 SOHO 165 Gramercy Park 494 Central Park West 160 Tribeca 493 West Village 125 Midtown East 345 Beekman/Sutton Place 113 Yorkville 282 Carnegie Hill 105 2 June 2016 MANHATTAN NEW DEVELOPMENT REPORT Summary Condominium development is a multi-billion dollar business in Manhattan, and new apartment sales are poised to reach a level not seen since last decade’s boom cycle by 2018. While fewer developers in 2016 are signing on to build sky-grazing towers with penthouses that cost $100 million or more, condominium prices are still on an upward trajectory, with anticipated sales totaling roughly $30 billion through 2019. In total, 92 condominium projects with roughly 8,000 new apartments are under construction or proposed. Total New Development Sales (in Billions) $14B $12B $10.3B New development sales $10B totaled $5.4 billion last year, $8.4B up significantly from the $4.1 $8B billion in sales recorded in 2014. -

480 Fulton Street Brooklyn, NY

480 Fulton Street Brooklyn, NY Confidential Offering Memorandum Champs Sports Financial summary 480 Fulton Street Brooklyn, NY Asset Summary Asking Price Cap Rate NOI Increases Term Remaining $16,980,220 5.01% $851,511 3% 12 years Investment Highlights Rent/Month $85,779 - Located on a prime retail corridor in Downtown Brooklyn Fulton Mall featuring hundreds of small and national businesses Gross Building SF 8,965 - Credit BB- tenant, subsidiary of Footlocker with long-term lease Rentable SF 6,740 - Proximity to three subway stations servicing all major subway lines First Floor 2,907 sf including 2 3 4 5 B D N Q R W Second Floor 926 sf - Champs is in the center of Citypoint surrounded by retailers such as Macy’s, Target, Express and Chase Bank Cellar Floor 3,067 sf Tenant Footlocker, Inc. Champs Sports Ownership Type Fee Simple Guarantor Parent Lease Commencement February 14, 2017 Rent Commencement June 14, 2017 Lease Expiration January 31, 2033 Avison Young | Confidential Offering Memorandum 2 Champs Sports Rent schedule 480 Fulton Street Brooklyn, NY Term Increases Annual Rent Monthly 7/1/2017 - 6/30/2018 - $942,000 $78,500 7/1/2018 - 6/30/2019 3.00% $970,260 $80,855 7/1/2019 - 6/30/2020 3.00% $999,368 $83,281 7/1/2020 - 6/30/2021 3.00% $1,029,349 $85,779 7/1/2021 - 6/30/2022 3.00% $1,060,229 $88,352 7/1/2022 - 6/30/2023 3.00% $1,092,036 $91,003 7/1/2023 - 6/30/2024 3.00% $1,124,797 $93,733 7/1/2024 - 6/30/2025 3.00% $1,158,541 $96,545 7/1/2025 - 6/30/2026 3.00% $1,193,297 $99,441 7/1/2026 -6/30/2027 3.00% $1,229,096 $102,425 7/1/2027 - 6/30/2028 3.00% $1,265,969 $105,497 7/1/2028 - 6/30/2029 3.00% $1,303,948 $108,662 7/1/2029 - 6/30/2030 3.00% $1,343,067 $111,922 7/1/2030 - 6/30/2031 3.00% $1,383,359 $115,280 7/1/2031 - 6/30/2032 3.00% $1,424,859 $118,738 7/1/2032 - 1/31/2033 3.00% $1,467,605 $122,300 Avison Young | Confidential Offering Memorandum 3 Champs Sports Tenant overview 480 Fulton Street Brooklyn, NY About Champs Sports Foot Locker, Inc. -

Manhattan Office Market

Manhattan Offi ce Market 2 ND QUARTER 2015 REPORT A NEWS RECAP AND MARKET SNAPSHOT Pictured: 1001 Avenue of the Americas Looking Ahead Partnership for New York City: New York’s Future as the World Financial Capital The report released in June concluded that while New York City remains the preferred location of global fi nancial companies to establish their headquarters, there is a growing trend to relocate jobs and business operations to lower cost, more business-friendly locations that are beyond the city’s border. A comprehensive survey was conducted in collaboration with Gerson Lehrman Group (GRG), intending to better understand how the fi nancial industry is evolving; and what measures are required to solidify New York’s competitive advantage as a global fi nancial center. Collected data represents an overview of the responses from 50-fi rm respondents that included large banks, insurance companies and asset managers, private equity fi rms, hedge funds, and fi nancial technology (FinTech) startups; and represent about 1/3rd of the total industry employment in the city. Additionally, observations were included from 8-real estate fi rms that were surveyed; along with interviews from other related experts in the fi eld. Financial Industry – an economic snapshot • Contributes 20% of the city’s economic output, representing twice that of the next top-grossing industry. • Accounts for nearly 1/3rd of the city’s private sector payroll, despite accounting for only 8%, or about 310,000 of the city’s private sector jobs in 2013; of which 23,000 jobs are high-technology in the areas of software, data processing and network management.