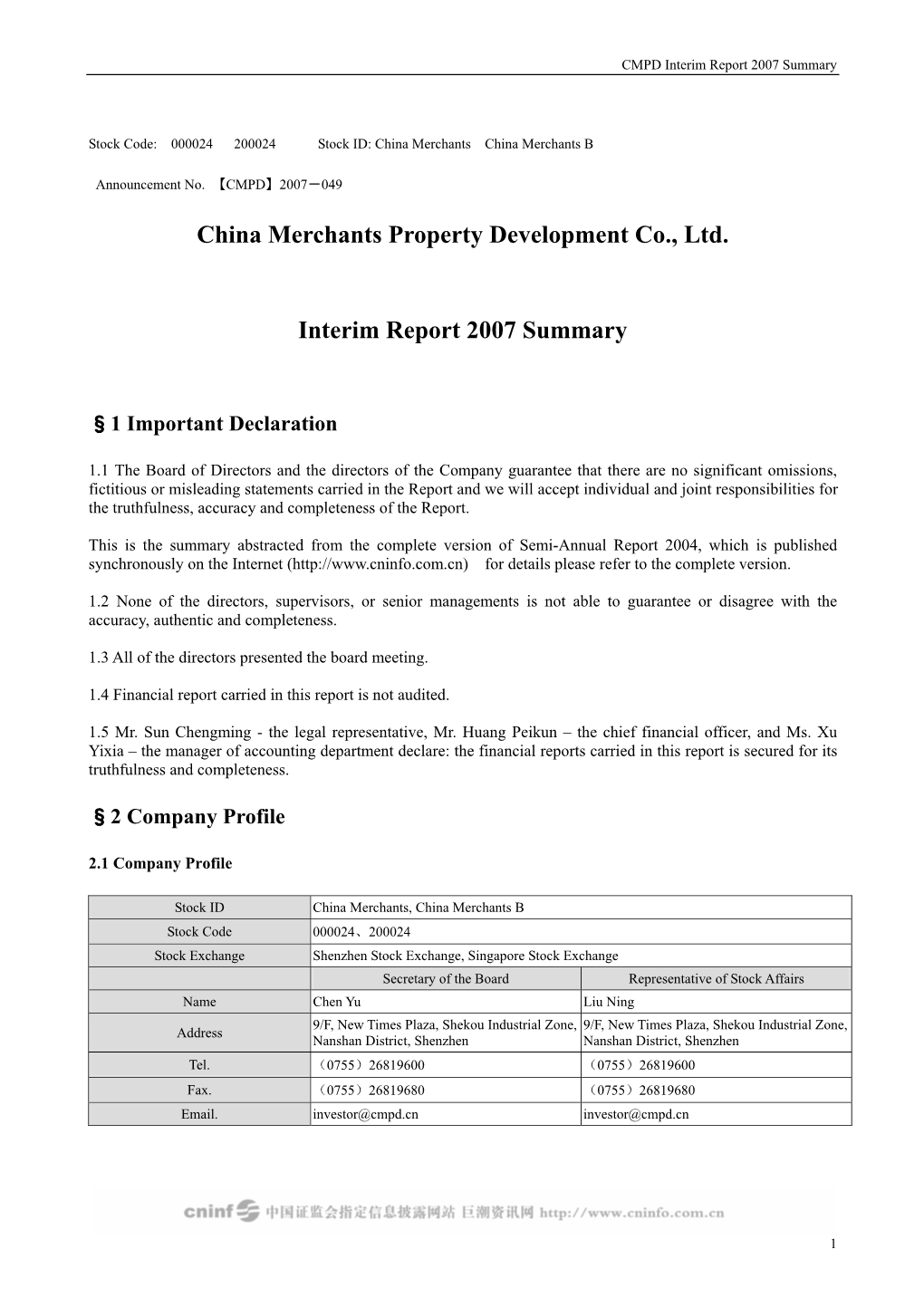

China Merchants Property Development Co., Ltd. Interim Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Summary of Semi-Annual Report 2006

China Merchants Property Development Co., Ltd. Summary of Semi-Annual Report 2006 Stock Code: 000024,200024 Stock ID: G China Merchants, China Merchants B Announcement No. [CMPD]2006-023 China Merchants Property Development Co., Ltd. Summary of Semi-Annual Report 2006 §1 Important Declaration 1.1 The Board of Directors and the directors of the Company guarantee that there are no significant omissions, fictitious or misleading statements carried in the Report and we will accept individual and joint responsibilities for the truthfulness, accuracy and completeness of the Report. This summary is abstracted from the completed text of the Interim Report, which can be found at www.cninfo.com.cn , for details of the report please go to the complete text. 1.2 None of the directors, supervisors, or senior managements is not able to guarantee or disagree with the accuracy, authentic and completeness. 1.3 All directors presented the board meeting. 1.4 The financial statements carried in this report are not audited. 1.5 Mr. Sun Chengming - the legal representative, Mr. Huang Peikun – the chief financial officer, and Ms. Xu Yixia – the manager of accounting department declare: the financial reports carried in this report is secured for its truthfulness and completeness. 1 China Merchants Property Development Co., Ltd. Summary of Semi-Annual Report 2006 §2 Company Profile 2.1 Company Profile Stock ID G China Merchants, China Merchants B Stock Code 000024、 200024 Stock Exchange Shenzhen Stock Exchange, Singapore Stock Exchange Secretary of the Board Representative of Stock Affairs Name Chen Yu Liu Ning 9/F, New Times Plaza, Shekou Industrial Zone, 9/F, New Times Plaza, Shekou Industrial Zone, Address Nanshan District, Shenzhen Nanshan District, Shenzhen Tel. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Builing Energy Efficiency: Why Green Buildings Are Key to Asia's Future

ENDNOTES 1 Intergovernmental Panel on Climate Change, 2007, Climate Change 2007: Mitigation of Climate Change, Summary for Policymakers, p. 18. 2 The Institute of Energy Economics, Japan (IEEJ), 2006, “Asia/World Energy Outlook 2006”, see: http://eneken.ieej.or.jp/en/data/pdf/362.pdf 3 Architecture 2030, “The Building Sector”, See web site of Architecture 2030: http://www.architecture2030.org/building_sector/index.html 4 Dependency of Japan, China and South Korea on the Middle East for oil supply will increase from 72 percent in 2004 to 83 percent in 2030. 5 Ivo J.H. Bozon, Warren J. Campbell, and Mats Lindstrand, 2007, “Global Trends in Energy”, The McKinsey Quarterly, no. 1, pp.47-55. 6 Telephone interview with Barbara Finamore, Director, China Clean Energy Program, Natural Resources Defense Council, May 2006; Information Center of the Chinese Ministry of Land and Resources, 2007, “Energy Situation in China and Energy Development Strategy”, see: http://big5. lrn.cn/stratage/resposition/200704/t20070410_49075.htm 7 Xu Binglan, 2006, “Energy standards set for buildings”, China Daily, February 17, see: http://www.chinadaily.com.cn/english/doc/2006-02/17/ content_521206.htm 8 India Construction Industry Development Council, 2006, Country Report 2005-2006. 9 The Institute of Energy Economics, Japan (IEEJ), 2006, “Asia/World Energy Outlook 2006”, see: http://eneken.ieej.or.jp/en/data/pdf/362.pdf 10 The Institute of Energy Economics, Japan (IEEJ), 2006, “Asia/World Energy Outlook 2006”, see: http://eneken.ieej.or.jp/en/data/pdf/362.pdf www.AsiaBusinessCouncil.org -

U.S. Investors Are Funding Malign PRC Companies on Major Indices

U.S. DEPARTMENT OF STATE Office of the Spokesperson For Immediate Release FACT SHEET December 8, 2020 U.S. Investors Are Funding Malign PRC Companies on Major Indices “Under Xi Jinping, the CCP has prioritized something called ‘military-civil fusion.’ … Chinese companies and researchers must… under penalty of law – share technology with the Chinese military. The goal is to ensure that the People’s Liberation Army has military dominance. And the PLA’s core mission is to sustain the Chinese Communist Party’s grip on power.” – Secretary of State Michael R. Pompeo, January 13, 2020 The Chinese Communist Party’s (CCP) threat to American national security extends into our financial markets and impacts American investors. Many major stock and bond indices developed by index providers like MSCI and FTSE include malign People’s Republic of China (PRC) companies that are listed on the Department of Commerce’s Entity List and/or the Department of Defense’s List of “Communist Chinese military companies” (CCMCs). The money flowing into these index funds – often passively, from U.S. retail investors – supports Chinese companies involved in both civilian and military production. Some of these companies produce technologies for the surveillance of civilians and repression of human rights, as is the case with Uyghurs and other Muslim minority groups in Xinjiang, China, as well as in other repressive regimes, such as Iran and Venezuela. As of December 2020, at least 24 of the 35 parent-level CCMCs had affiliates’ securities included on a major securities index. This includes at least 71 distinct affiliate-level securities issuers. -

Chapter 1 Important Notice, Content and Paraphrases

招商局地产控股股份有限公司 2012 年度报告全文 Annual Report 2012 Announcement No.:【CMPD】2013-009 Chapter 1 Important Notice, Content and Paraphrases Important Notice: Board of Directors, Supervisory Committee of China Merchants Property Development Co., Ltd. (hereinafter referred to as the Company) and its directors, supervisors and senior executives hereby confirm that there are no any important omissions, fictitious statements or serious misleading information carried in this report, and shall take all responsibilities, individual and/or joint, for the authenticity, accuracy and integrality of the whole contents. The preplans for profit distribution and for increasing capital stock transferred from capital reserve during the report period examined by the Board of Directors of the Company are: Taking the report period end shareholding equity 1,717,300,503 shares as the cardinal number, for each ten shares, allot RMB 3.0 cash (including tax), and increasing capital stock transferred from capital reserve is not performed. Lin Shaobin—Legal Representative, Huang Peikun—Chief Financial Officer, and Xu Yixia—Manager of Accounting Department hereby confirm that the Financial Report enclosed in the Annual Report is true and complete. Zhang Wei - Independent Director of the Company did not attend the meeting due to business, and Chai Qiang -Independent Director was authorized to attend the meeting and exercised the right to vote on behalf of him. All the rest Directors attended the meeting of Board of Directors examining this report. This report has been prepared in Chinese and English version respectively. In the occurrence of differences due to interpretations of both versions, the Chinese report shall prevail. 0 招商局地产控股股份有限公司 2012 年度报告全文 Content Chapter 1. -

China Merchants Property Development Co., Ltd. Summary of Annual Report 2005

China Merchants Property Development Co., Ltd. Summary of Annual Report 2005 Stock Code: 000024, 200024 Stock ID: G China Merchants, China Merchants B Public Notice No: [CMPD] 2006-011 China Merchants Property Development Co., Ltd. Summary of Annual Report 2005 §1 Important Declaration 1.1 The Board of Directors and the directors of the Company guarantee that there are no significant omissions, fictitious or misleading statements carried in the Report and we will accept individual and joint responsibilities for the truthfulness, accuracy and completeness of the Report. This summary is abstracted from the completed text of Annual Report 2005, for details of the report please go to the complete text. 1.2 None of the directors, supervisors, nor senior executives is holding uncertain opinion or disagreement over the truthfulness, accuracy, and completeness over the Annual Report. 1.3 Director(s) absented the board meeting Name of the Reason of absent Consignee Director Liu Hongyu Business engagement Wu Yinong Shi Xinping Business engagement Wu Yinong Meng Yan Business engagement Wu Yinong 1.4 The financial reports were audited by Deloitte Touche Tohmatsu (Shanghai) CPA Ltd. and Deloitte Touche Tohmatsu (Hong Kong) CPA as domestic and overseas auditor respectively. Both of the CPAs issued standard auditing report without qualified opinion. 1.5 Mr. Sun Chengming - the legal representative, Mr. Huang Peikun – the chief financial officer, and Ms. Xu Yixia – the manager of accounting department declare: the financial reports carried in this annual report is secured for its truthfulness and completeness. §2 Company Profile 2.1 Company Profile Stock ID G China Merchants, China Merchants B Stock Code 000024、 200024 1 China Merchants Property Development Co., Ltd. -

CHINA MERCHANTS LAND LIMITED 招商局置地有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 978) LR 13.51A

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited LR 14.58(1) Note 5 to take no responsibility for the contents of this announcement, make no representation as to LR 13.52 its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA MERCHANTS LAND LIMITED 招商局置地有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 978) LR 13.51A MAJOR AND CONNECTED TRANSACTION RELATING TO THE ACQUISITION OF 49% EQUITY INTEREST IN MERCHANTS PROPERTY DEVELOPMENT (GUANGZHOU) Financial Adviser to the Company China Merchants Securities (HK) Co., Limited THE ACQUISITION On 3 August 2014, Sino Action (a wholly-owned subsidiary of the Company, as the purchaser), Shenzhen China Merchants (as the seller) and Merchants Property Development (Guangzhou) entered into the Agreement, pursuant to which Sino Action has conditionally agreed to acquire, and Shenzhen China Merchants has conditionally agreed to sell, the Sale Equity Interest. The Consideration for the sale and purchase of the Sale Equity Interest is approximately RMB1,212.77 million, which will be satisfied by way of cash. After the Sale Equity Interest is transferred to Sino Action, Merchants Property Development (Guangzhou) will become an indirect wholly-owned subsidiary of the Company. LISTING RULES IMPLICATIONS The Acquisition constitutes: (a) a major transaction of the Company under Rule 14.06(3) of the Listing Rules as one or more of the relevant percentage ratios under Rule 14.07 of the Listing Rules are over 25% but less than 100% for the Company in relation to the Acquisition; and (b) a non-exempt connected transaction of the Company as Shenzhen China Merchants is a connected person of the Company by virtue of being an associate of CMPD, which is the controlling shareholder of the Company. -

China Merchants Port Group Co., Ltd. Interim Report 2020

CHINA MERCHANTS PORT GROUP CO., LTD. INTERIM REPORT 2020 Date of Disclosure: 29 August 2020 1 China Merchants Port Group Co., Ltd. Interim Report 2020 Part I Important Notes, Table of Contents and Definitions The Board of Directors (or the “Board”), the Supervisory Committee as well as the directors, supervisors and senior management of China Merchants Port Group Co., Ltd. (hereinafter referred to as the “Company”) hereby guarantee the factuality, accuracy and completeness of the contents of this Report and its summary, and shall be jointly and severally liable for any misrepresentations, misleading statements or material omissions therein. Bai Jingtao, the Company’s legal representative, Lu Yongxin, the Company’s Acting Chief Financial Officer, and Sun Ligan, the person-in-charge of the accounting organ hereby guarantee that the financial statements carried in this Report are factual, accurate and complete. All the Company’s directors have attended the Board meeting for the review of this Report and its summary. Any forward-looking statements such as future plans or development strategies mentioned herein shall not be considered as the Company’s promises to investors. And investors are reminded to exercise caution when making investment decisions. Possible risks faced by the Company and countermeasures have been explained in “Part IV Operating Performance Discussion and Analysis” herein, which investors are kindly reminded to pay attention to. Securities Times, Shanghai Securities News, Ta Kung Pao (HK) and www.cninfo.com.cn have been designated by the Company for information disclosure. And all information about the Company shall be subject to what’s disclosed on the aforesaid media. -

2021 Semi-Annual Report (Unaudited)

FEBRUARY 28, 2021 2021 Semi-Annual Report (Unaudited) iShares, Inc. • iShares Core MSCI Emerging Markets ETF | IEMG | NYSE Arca • iShares MSCI BRIC ETF | BKF | NYSE Arca • iShares MSCI Emerging Markets Asia ETF | EEMA | NASDAQ • iShares MSCI Emerging Markets Small-Cap ETF | EEMS | NYSE Arca The Markets in Review Dear Shareholder, The 12-month reporting period as of February 28, 2021 reflected a remarkable period of disruption and adaptation, as the global economy dealt with the implications of the coronavirus (or “COVID-19”) pandemic. As the period began, the threat from the virus was becoming increasingly apparent, and countries around the world took economically disruptive countermeasures. Stay-at-home orders and closures of non-essential businesses became widespread, many workers were laid off, and unemploy- ment claims spiked, causing a global recession and a sharp fall in equity prices. After markets hit their lowest point of the reporting period in late March 2020, a steady recovery ensued, as businesses began to re-open and governments learned to adapt to life with the virus. Equity prices continued to rise throughout the summer, fed by strong fiscal and monetary support and improving Rob Kapito economic indicators. Many equity indices neared or surpassed all-time highs late in the reporting period President, BlackRock, Inc. following the implementation of mass vaccination campaigns and progress of additional stimulus through the U.S. Congress. In the United States, both large- and small-capitalization stocks posted a significant advance. International equities also gained, as both developed countries and emerging markets re- Total Returns as of February 28, 2021 bounded substantially from lows in late March 2020. -

FIYTA Precision Technology Co., Ltd. 2020 Semi-Annual Report July, 2020

FIYTA Precision Technology Co., Ltd. 2020 Semi-annual Report, Full Text FIYTA Precision Technology Co., Ltd. 2020 Semi-annual Report July, 2020 1 FIYTA Precision Technology Co., Ltd. 2020 Semi-annual Report, Full Text Section 1 Important Notice, Table of Contents and Definition The Board of Directors, the Supervisory Committee, directors, supervisors and senior executives hereby individually and collectively accept responsibility for the correctness, accuracy and completeness of the contents of this report and confirm that there are neither material omissions nor errors which would render any statement misleading. Huang Yongfeng, the Company leader, Chen Zhuo, chief financial officer, and Tian Hui, the manager of the accounting department (treasurer) hereby confirm the authenticity and completeness of the financial report enclosed in this Annual Report. All the directors attended the board meeting for reviewing the Annual Report. Any perspective description, such as future plan, development strategy, etc. involved in the Semi-annual Report shall not constitute the Company’s substantial commitment to the investors and the investors should please pay attention to their investment risks. In this report, the Company has described in detail the existing macro-economic risks as well as operation risks. Investors are advised to refer to the contents concerning risks possibly to be confronted with by the Company and the countermeasures to be taken in Section 4 Discussion and Analysis of the Operation The Company intends neither to distribute any -

Summary of 2014 Annual Report of China Merchants Property Development Co., Ltd

Summary of CMPD’s 2014 Annual Report Stock Code: 000024, 200024 Stock Short Names: China Merchants Property., China Merchants B Announcement No.: 【CMPD】2015-010 Summary of 2014 Annual Report of China Merchants Property Development Co., Ltd. I. Important Notice The Summary of Annual Report 2013 is originated from the full Annual Report 2013, so that investors who want to know the details should carefully read the full Annual Report 2013 simultaneously published in the websites such as Shenzhen stock exchange website and the like which are specified by China Securities Regulatory Commission (CSRC). Company Profile China Merchants Property, China Merchants Stock Short Name Stock Code 000024, 200024 B Listed Stock Exchange Shenzhen Stock Exchange Contact Person and Contact Way Secretary of the Board Securities Affair Representative Name Liu Ning Cheng Jiang No.3 Building, Nanhai E Cool Park, No.6 No.3 Building, Nanhai E Cool Park, No.6 Address Xinghua Road, Shekou Industrial Zone, Xinghua Road, Shekou Industrial Zone, Nanshan Nanshan District, Shenzhen District, Shenzhen Tel 0755-26819600 0755-26819600 Fax 0755-26818666 0755-26818666 Email [email protected] [email protected] II. Main accounting data and (I) Main accounting data Unit: RMB Yuan Increase or decrease of current year 2013 against Main Accounting Data 2014 2012 previous year After After adjustment Before adjustment adjustment Operating incomes 43,385,058,201.09 32,567,813,857.52 32,567,813,857.52 33.21 % 25,296,762,154.46 Net profits attributable to the listed company 4,263,636,555.36 -

Summary of Annual Report 2013 of China Merchants Property Development Co., Ltd

Summary of Annual Report 2013 of CMPD Stock Code: 000024, 200024 Stock Short Names: China Merchants Property., China Merchants B Announcement No.: 【CMPD】2014-013 Summary of Annual Report 2013 of China Merchants Property Development Co., Ltd. 1 Important Notice The Summary of Annual Report 2013 is originated from the full Annual Report 2013, so that investors who want to know the details should carefully read the full Annual Report 2013 simultaneously published in the websites such as Shenzhen stock exchange website and the like which are specified by China Securities Regulatory Commission (CSRC). Company Profile China Merchants Property, China Stock Short Name Stock Code 000024, 200024 Merchants B Listed Stock Exchange Shenzhen Stock Exchange Contact Person and Contact Way Secretary of the Board Securities Affair Representative Name Liu Ning Huang Rui No.3 Building, Nanhai E Cool Park, No.6 No.3 Building, Nanhai E Cool Park, No.6 Address Xinghua Road, Shekou Industrial Zone, Xinghua Road, Shekou Industrial Zone, Nanshan Nanshan District, Shenzhen District, Shenzhen Tel 0755-26819600 0755-26819600 Fax 0755-26818666 0755-26818666 Email [email protected] [email protected] 2 Main financial data and shareholder change The Company does not make retroactive adjustment or restatement for the previous year accounting data due to accounting policy alternative, correction of accounting error, etc. (Unit: RMB) Main Year-on-year accounting 2013 2012 2011 Change data Operating 32,567,813,857.52 25,296,762,154.46 28.74% 15,111,366,642.00 income (RMB) Net