TENET HEALTHCARE CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Advisory Board Members University of Michigan Cardiovascular Center 2005 National Advisory Board

National Advisory Board Members University of Michigan Cardiovascular Center 2005 National Advisory Board Noreen M. Clark, PhD Director, Center for Managing Chronic Diseases Marshall H. Becker Professor of Public Health School of Public Health University of Michigan Noreen M. Clark is dean of the University of Michigan School of Public Health and the Marshall H. Becker professor of Public Health. Dr. Clark also serves as national program director for the Robert Wood Johnson Foundation Allies Against Asthma Program. Dr. Clark earned her undergraduate degree from the University of Utah, and her master of arts, master of philosophy and doctoral degrees from Columbia University. She began her academic career at Columbia as assistant professor in 1974. She was named director of Columbia’s Program in Public Health Education in 1977, and promoted to associate professor in 1980. She joined U-M in 1981 as associate professor of Health Behavior and Education. Dr. Clark was promoted to professor in 1985, and named to the Becker chair in 1995. From 1999-2002, she was a member of the Advisory Council of the National Institute of Environmental Health Sciences. She is currently a member of the Institute of Medicine of the National Academy of Sciences. Dr. Clark has been president of the Society for Public Health Education and chair of the Public Health Education Section of the American Public Health Association. Among other honors, she is the recipient of the Distinguished Fellow Award, the highest honor bestowed by the Society for Public Health Education; the Derryberry Award for outstanding contribution to health education in behavioral science given by the American Public Health Association (APHA); the Health Education Research Award conferred by the National Asthma Education Program for leadership and research contributions; the Distinguished Career Award in Health Education and Promotion given by the APHA; the Behavioral Science Lifetime Achievement Award of the American Thoracic Society; and the Healthtrac Education Prize. -

Case 20-31840-Sgj11 Doc 256 Filed 08/12/20

Case 20-31840-sgj11 Doc 256 Filed 08/12/20 Entered 08/12/20 16:26:07 Page 1 of 56 Case 20-31840-sgj11 Doc 256 Filed 08/12/20 Entered 08/12/20 16:26:07 Page 2 of 56 EXHIBIT A Case 20-31840-sgj11 Doc 256 Filed 08/12/20 Entered 08/12/20 16:26:07 Page 3 of 56 Exhibit A Service List Served as set forth below Description Name Address Method of Service Customer MedLog Franken GmbH Address Redacted First Class Mail Customer % Colorificio della Bruna Address Redacted First Class Mail Customer ?l?skie Centrum Chor?b Serca Address Redacted First Class Mail Customer 1 Wojskowy Szpital Kliniczny z Address Redacted First Class Mail Customer 10 Wojskowy Szpital Kliniczny Address Redacted First Class Mail Customer 108 Szpital Wojskowy w Elu Address Redacted First Class Mail Customer A Care a.s. Address Redacted First Class Mail Customer Abbotsford Regional Hospital Address Redacted First Class Mail Customer Abbott Northwestern Address Redacted First Class Mail Customer Abbott Northwestern IDE Address Redacted First Class Mail Customer Abington Memorial Hospital Address Redacted First Class Mail Customer Abrazo Arizona Heart Hospital Address Redacted First Class Mail Customer Abrazo Arizona Heart Institute IDE Address Redacted First Class Mail Customer Abrazo Arrowhead Campus Address Redacted First Class Mail Customer Abrazo Scottsdale Campus Address Redacted First Class Mail Customer Abrazo West Campus Address Redacted First Class Mail Customer Academisch Medisch Centrum Address Redacted First Class Mail Customer Academisch Medisch Centrum AMC Address -

Bright, H.,1 Hitt, E.,2 Scales, R.1 1Mayo Clinic-Arizona, 2Arizona State University

The Status of Cardiac and Pulmonary Rehabilitation Programs in Arizona: 2019 Update Bright, H.,1 Hitt, E.,2 Scales, R.1 1Mayo Clinic-Arizona, 2Arizona State University Abstract Methods Results Cardiac Rehabilitation Patient Testimonial The American Association of Cardiovascular and Pulmonary Rehabilitation (AACVPR) recommend that every cardiac The ASCVPR is an affiliate organization of the AACVPR and represents cardiac and pulmonary professionals within the state. According to ASCVPR records, 33 programs offered early outpatient CR (Table 1). There were 21 AACVPR certified CR programs and pulmonary rehabilitation program becomes nationally certified to ensure strict standards of patient care and quality A delegated ASCVPR representative provided a record of programs that offered early outpatient CR and PR within the state. in AZ. This means that 64% of all early outpatient CR programs in AZ were certified, which was a 5% increase compared with programming. This investigation was conducted to update Arizona Society of Cardiovascular and Pulmonary Rehabilitation All programs were contacted to confirm they had an active program. Confirmation of national program certification and/or 2014. Twenty programs offered outpatient PR (Table 2), which was more double the number reported in 2014. There were 5 (ASCVPR) records of the number of cardiac rehabilitation (CR) and pulmonary rehabilitation (PR) programs that were registration was verified with the AACVPR online directory. An updated record through December, 2018 was then compiled. (25%) PR certified programs. In 2014, there were 19 (59%) certified CR programs out of 32 offering CR at that time. Three out AACVPR certified in Arizona (AZ). It also quantified the number of CR programs that offered billable Supervised Exercise All programs were invited to complete a structured telephone interview and there was a 97% compliance rate. -

View Annual Report

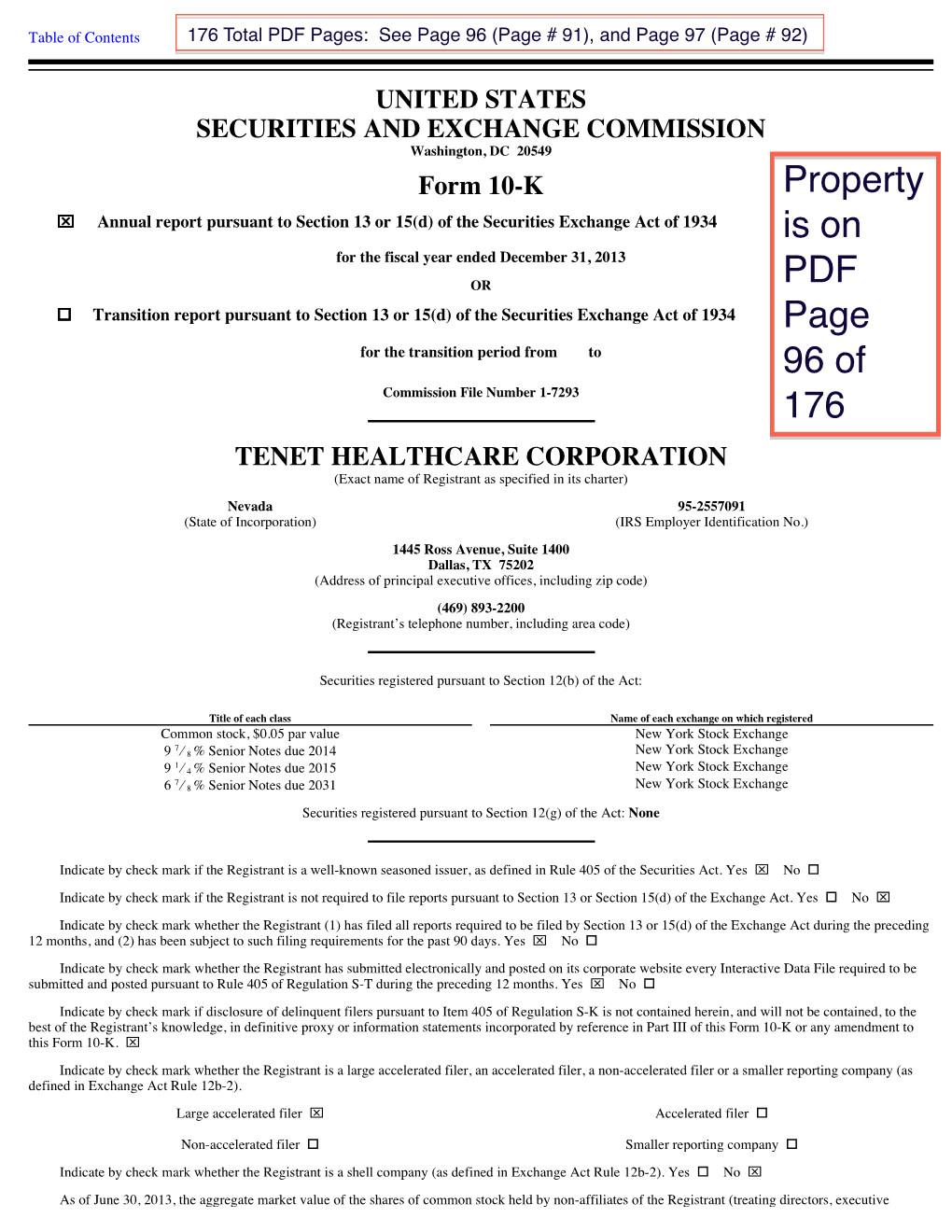

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 Form 10-K ☒ Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2019 OR ☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to Commission File Number 1-7293 ________________________________________ TENET HEALTHCARE CORPORATION (Exact name of Registrant as specified in its charter) Nevada 95-2557091 (State of Incorporation) (IRS Employer Identification No.) 14201 Dallas Parkway Dallas, TX 75254 (Address of principal executive offices, including zip code) (469) 893-2200 (Registrant’s telephone number, including area code) ________________________________________________________ Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol Name of each exchange on which registered Common stock, $0.05 par value THC New York Stock Exchange 6.875% Senior Notes due 2031 THC31 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None ________________________________________________________ Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Form 10-K TENET HEALTHCARE CORPORATION

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 Form 10-K ☒ Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2016 OR ☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to Commission File Number 1-7293 TENET HEALTHCARE CORPORATION ( Exact name of Registrant as specified in its charter) Nevada 95-2557091 (State of Incorporation) (IRS Employer Identification No.) 1445 Ross Avenue, Suite 1400 Dallas, TX 75202 (Address of principal executive offices, including zip code) (469) 893-2200 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common stock, $0.05 par value New York Stock Exchange 6⅞% Senior Notes due 2031 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. -

Mike Cox Attorney General

Mike Cox Attorney General Report on the Proposed Sale of the Detroit Medical Center Hospital Businesses to Vanguard Health Systems, Inc. November 13, 2010 EXHIBITS Exhibit 1 Amendment No. 2 to Purchase and Sale Agreement Exhibit 2 Enforcement Agreement between the Attorney General, DMC, Legacy DMC, Buyer, and Vanguard Exhibit 3 Monitoring and Compliance Agreement between the Attorney General, DMC, Legacy DMC, Buyer, and Vanguard Exhibit 4 Protection of Charitable Assets Agreement between the Attorney General and Legacy DMC Exhibit 5 AlixPartners, LLP Report November 11, 2010 November 11, 2010 Tracy Sonneborn, Esq. Assistant Attorney General Michigan Attorney General Consumer Protection Division and Charitable Trust Section P.O. Box 30213 Lansing, MI 48909 Dear Mr. Sonneborn: Healthcare Valuation and Financial Advisory Services in Connection with the Proposed Sale of the Detroit Medical Center This report presents our conclusions with respect to our assistance to the Michigan Office of the Attorney General (the “AG”) in connection with your review of the proposed sale of the Detroit Medical Center (“DMC” or the “System”) to Vanguard Health Systems, Inc. and its affiliates (“VHS”) (hereafter referred to as the “Proposed Transaction”). ALIXPARTNERS QUALIFICATIONS We have more than 25 years of healthcare valuation experience including significant experience valuing hospitals and hospital systems for a variety of purposes. We have significant experience with respect to providing reviews of transactions involving the conversion of not-for-profit hospitals, managed care and other health care entities on behalf of a number of states Attorneys General. We have reviewed the specific terms of these transactions and have also analyzed the financial condition of the parties involved. -

Arizona Primary Care Clinics

Arizona Primary Care Clinics CITYSite ID FACILITY PARENTORG ADDRESS ZIP PHONE FAX Ajo84 Desert Senita Community Health Desert Senita Community Health Center 410 N Malacate St Bldg B 85321 520-387-5651 520-387-5347 Alpharetta981 24 ON Physicians, PC 24 ON Physicians, PC 318 Maxwell Rd Suite 500 30004 770-740-0895 Amado774 Amado Clinic United Community Health Center 28720 S Nogales Hwy 85645 520-407-5510 520-407-5990 Anthem1849 Anthem - Gavilan Peak Pkwy & Sonora Quest Laboratories 3624 W Anthem Way #C114 85086 623-551-2539 602-744-8921 Anthem1802 Anthem Office Arizona Kidney Disease and Hypertensio 42104 N Venture Dr Ste D118 85086 602-943-1231 602-395-9574 Apache Junction1856 Apache Junction - Ironwood & So Sonora Quest Laboratories 2080 W Southern Ave #B6 85120 480-474-1001 602-744-8921 Apache Junction597 Apache Junction Clinic Pinal County Health Department 575 N Idaho Rd Ste 301 85119 866-960-0633 Apache Junction1992 Apache Junction Office La Frontera Arizona 11518 E Apache Trl Ste 129 85120 480-317-2214 Apache Junction1094 Arizona's Children Association - Arizona's Children Association 2066 W Apache Trail Rd, Stes 101 85120 480-503-8530 Apache Junction1381 AZ-Tech Radiology - Apache Jun AZ-Tech Radiology 1840 Apache Trail 85120 480 288-6400 480 288-4079 Apache Junction1262 Banner Children's - Banner Healt Banner Health 1075 S Idaho Rd Ste 206 85119 480-827-5005 Apache Junction965 Banner Goldfield Medical Center Banner Health 2050 W Southern Ave 85120 480-733-3300 Apache Junction825 Horizon Health and Wellness - A Horizon Health and -

Fifth Amended Tenet Healthcare Corporation Annual Incentive Plan

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 Form 10-K ☒ Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2020 OR ☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to Commission File Number 1-7293 ________________________________________ TENET HEALTHCARE CORPORATION (Exact name of Registrant as specified in its charter) Nevada 95-2557091 (State of Incorporation) (IRS Employer Identification No.) 14201 Dallas Parkway Dallas, TX 75254 (Address of principal executive offices, including zip code) (469) 893-2200 (Registrant’s telephone number, including area code) ________________________________________________________ Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol Name of each exchange on which registered Common stock, $0.05 par value THC New York Stock Exchange 6.875% Senior Notes due 2031 THC31 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None ________________________________________________________ Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. -

3Shealth Guide to Health Care Gpos 3Shealth 1

Guide to Health Care GPOs 3sHealth 1 3sHealth Bethany Pioneer Village....................................... Middle Lake 700-2002 Victoria Avenue 777 Regional Park Road Regina, SK S4P 0R7 Middle Lake, SK S0K 2XO Phone(s): 306-347-5500 Sinikka Purmonen 306-367-2033 Fax(es): 306-525-1960 Central Haven Special Care Home...........................Saskatoon e-mail: [email protected] 1020 Avenue D N www.3shealth.ca Saskatoon, SK S7L 1N6 Year Founded: 1993 Dorothy Koseruba 306-665-6180 Circle Drive Special Care Home ..............................Saskatoon General Description 3055 Preston Avenue S 3sHealth provides services in support of Saskatchewan’s Saskatoon, SK S7T 1C3 healthcare system, as well as offering workplace benefits Clint Kinchen 306-955-4800 programs for employees of the healthcare system. The Cupar & District Nursing Home .....................................Cupar association offers Provincial contracting, linen services, 213 Mills Street business development, clinical services and a disability Cupar, SK S0G 0YO income program. Cheryl Heisler 306-723-4666 Organization Information Extendicare Moose Jaw .......................................... Moose Jaw 1151 Coteau Street W Type: Group Purchasing Organization Moose Jaw, SK S6H 5G5 Purchasing Alliance Institutions: 30 Rhonda Farley 306-693-5191 Proprietary Member Institutions: 140 Extendicare Parkside ..................................................... Regina Type(s) of Member Institutions: SG 4540 Rae Street Total Member Beds Represented: 7,000 Regina, SK S4S 3B4 Products/Categories Negotiated Jason Carson 306-586-0220 Business Forms; Capital Equipment (furniture); Capital Extendicare Preston.................................................. Saskatoon Equipment (medical); Diagnostic Reagents/Kits; Dietary 2225 Preston Avenue Equipment/Supplies; Patient Monitoring Equipment; Saskatoon, SK S7J 2E7 Food/Beverage; Housekeeping/Equipment Supplies; Tanya Mitzel 306-374-2242 Laboratory Equipment; Linens; Medical Gases; Respiratory Extendicare Regina ......................................................