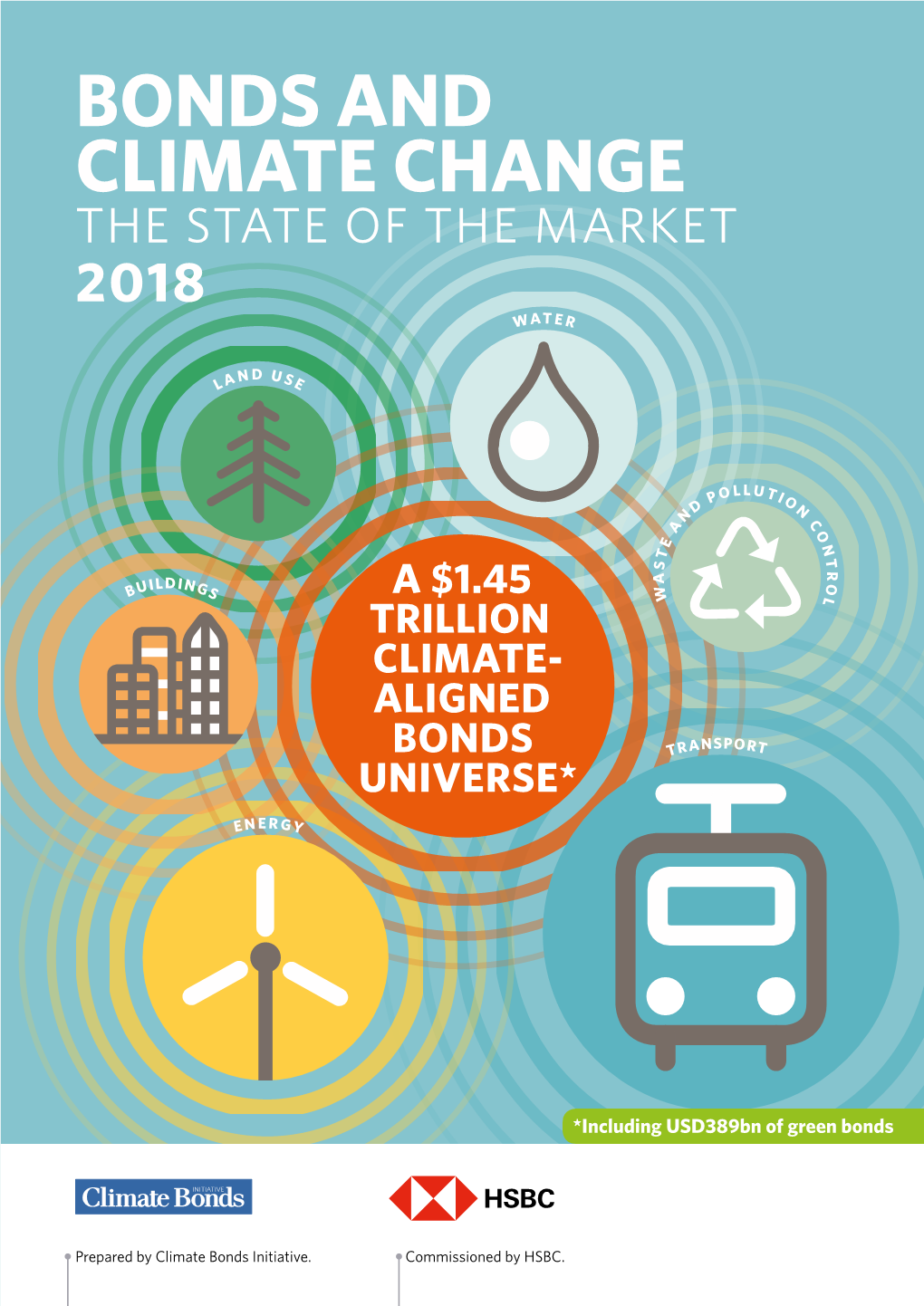

Bonds and Climate Change the State of the Market 2018 Wat E R

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pension Fund Service: Green Bonds (2017)

Pension Fund Service December 2017 Green Bonds World Bank Zurich Pension Fund Amundi Actiam Contact: [email protected] Chris Southworth – Chief Executive Officer No.1 Booths Park, Chelford Road, Knutsford. WA16 8GS Tel: 0044 1565 648205 Contact: [email protected] Chris Southworth – Chief Executive Officer No.1 Booths Park, Chelford Road, Knutsford. WA16 8GS Tel: 0044 1565 648205 The Green Bond Market: 10 years later and looking ahead 1 Authors: Heike Reichelt, Head of Investor Relations and New Products, World Bank Colleen Keenan, Senior Financial Officer, Investor Relations, World Bank Executive Summary Since the World Bank issued its first green bonds nearly 10 years ago, the green bond market has grown exponentially. Green bonds support the financing of climate-friendly projects worldwide. They are attractive to investors as a straightforward instrument to integrate environmental, social, and governance outcomes into fixed income portfolios. More importantly, green bonds are also acting as a catalyst for deeper sustainable and responsible fixed-income capital markets. This article will cover the growth of the market including some key examples from the World Bank (IBRD)2 as a pioneering issuer and contributor to standards, disclosure and transparency efforts. It will summarize key initiatives around standards and disclosure in the green bond market. Finally, the article will outline how the green bond market – despite its small size vis-à-vis the overall bond market – has changed how investors think about the purpose of their investments, and discuss prospects and opportunities for going beyond green to build sustainable capital markets. From niche issuance to a dynamic catalyst: how green bonds have changed market behavior Looking back on 10 years, the green bond market has seen a tremendous increase in depth, a growing diversity of issuers and an enabling environment that includes guidelines and disclosure frameworks for transparency and growth. -

2020 10 Permits Issued

2020_10_Permits Issued . Values Permit Number Full Address APN Permit Description Permit Issued To Name Permit Issued Permit Type - Code Permit Type - Description Contractor Name Estimated Improvement Value Permit Count 2019-00001453 11800 S Harlan RD 19603003 New 5,213sf wash tunnel & equipment room Licha Construction, Inc - 102147 10/19/2020 DNU-BLDG DNU-Building Licha Construction, Inc - 102147 750,000.00 1 2020-00000547 733 Sunflower DR 19615046 ADU Junior Suite 378 sf Jose F Mendoza 10/08/2020 ALTER-RES Alteration Residential 10,000.00 1 2020-00000561 15380 S Mckinley AVE 19806018 448.2 KW roof mount PV System, 125 KW/268 KWH Storage RER Energy Group - 1068482 10/06/2020 NSLR_COM New Solar Commercial RER Energy Group - 1068482 1,170,450.00 1 2020-00000605 17970 Hidden Well LN 19141016 HVAC Changeout Lovotti Inc 865459 10/29/2020 HVAC_RES HVAC NEW INSTALL Residential Lovotti Inc 865459 11,845.54 1 2020-00000642 116 Roth RD 19602020 Install new D/F illuminated poll sign Sign Designs - 268001 10/13/2020 SIGN Sign Sign Designs - 268001 28,358.00 1 2020-00000644 1850 E Louise AVE 19816001 39.68 KW New ground mount Soleeva Energy Inc. 997345 10/07/2020 NSLR_COM New Solar Commercial Soleeva Energy Inc. 997345 50,000.00 1 2020-00000651 1878 Marina DR 21026005 27 kwh energy storage system Tesla Energy Operations Inc 888104 10/07/2020 NSLR_RES New Solar Residential Tesla Energy Operations Inc 888104 14,199.00 1 2020-00000666 16698 Loganberry WY 19160062 Patio 400sf with outdoor fan SC Construction - 498637 10/22/2020 POVER Patio Cover over -

Financing Mechanisms to Support Sustainable Practices

A Better World, Through Better Business Financing Mechanisms to Support Sustainable Practices Tom Manning Senior Research Scholar, NYU Stern Center for Sustainable Business March 2019 Sustainable Finance Survey Tom Manning March 2019 Financing Mechanisms to Support Sustainable Practices This paper surveys financing mechanisms supporting sustainable practices, examining current practice and promising new practices under development. It divides the financing spectrum into the standard categories of equity and debt, plus policy-based practices and public/private partnerships. Each section includes a brief description of financing categories and practices; examples of each, i.e., what they are being used to accomplish and by whom; and provides estimates of the current scale of the markets, where available. Summary of Findings Direct investment to support sustainable practices is conducted across the financing spectrum, at levels that measure in the hundreds of billions annually. Debt and equity financing for renewable energy, for instance, totaled $333 billion in 2017.1 Environmental, social, governance (ESG) investing in the US, primarily in the form of equity investments in the secondary market, i.e., purchasing shares of public companies through stock exchanges, was $12 trillion in 2018, up 38% from 2016.2 Despite its prevalence, investment to support sustainable practices is often considered an emerging or niche field of finance, and perhaps it is, relative to the magnitude of investment needed to fully address environmental sustainability challenges, which has been estimated at $90 trillion by 2030.3 Reaching the level of investment needed to address climate change and other critical sustainability challenges will require public policy support.4 In addition to providing guarantees and other credit supports, policy measures can help “internalize the externalities” – by placing a cost on pollution, for example, and a value on conserving air, water, habitat and bio-diversity resources – thereby triggering investment. -

Sustainable Finance Framework MAY 2021

BROOKFIELD PROPERTY GROUP Sustainable Finance Framework MAY 2021 Brookfield Property Group Sustainable Finance Framework | May 2021 1 Contents 03 OVERVIEW 03 Purpose of Sustainable Finance Framework 03 Background 04 Introduction to Brookfield 04 Brookfield’s Commitment to Sustainability 06 Brookfield’s Approach to ESG 07 FRAMEWORK FOR USE OF PROCEEDS GREEN DEBT INSTRUMENTS 07 Use of Proceeds 08 Process for Project Evaluation and Selection 09 Management of Proceeds 09 External Review 10 Reporting 11 FRAMEWORK FOR SUSTAINABILITY LINKED LOANS 11 Relationship to Borrower’s Overall Sustainability Strategy 12 Target Setting – Measuring the Sustainability of the Borrower 12 Reporting 12 Review 13 Focused on Meaningful Impact 14 APPENDIX A 2 Overview PURPOSE OF SUSTAINABLE FINANCE FRAMEWORK The purpose of this Framework is to set out: (i) the manner in which Brookfield’s real estate assets in Australia will be selected to participate in sustainable financing transactions; (ii) the way in which proceeds from any green finance secured against those assets will be used and managed; and (iii) the method of reporting to: • green financiers on the use, management and allocation of proceeds; and • sustainability financiers on sustainability performance targets. This Framework is designed to provide overarching principles and guidelines for all sustainable finance opportunities. Debt raised under this Framework currently extends to green loans and sustainability linked loans only. The Framework may be updated at Brookfield’s discretion to extend to the issuance of other sustainable finance opportunities, including but not limited to green bonds and/or sustainability linked bonds. This is an Australian specific document applicable to Brookfield’s real estate assets in Australia only. -

Evaluation of Alternative Contractor License Requirements for Battery Energy Storage Systems

Evaluation of Alternative Contractor License Requirements for Battery Energy Storage Systems Final Report for UC Berkeley Contract with the Contractor State License Board for contract CSLB-20-01, entitled “Energy Storage Systems Consultant Services” June 30, 2021 Authors: Carol Zabin, Ph.D. Director, Green Economy Program UC Berkeley Labor Center Betony Jones, Principal, Inclusive Economics Donald S. Holmstrom Retired, U.S. Chemical Safety Board Contents Executive Summary ............................................................................................................................................4 A. Introduction .................................................................................................................................................................................. 4 B. Options under Consideration by the CSLB ....................................................................................................................... 4 C. Research Results .......................................................................................................................................................................... 5 D. Our recommendation .............................................................................................................................................................11 I. Introduction and Background ................................................................................................................. 13 A. Options Under Consideration by the CSLB.....................................................................................................................13 -

J-PV Golden Reviewers List 2020

1512 IEEE JOURNAL OF PHOTOVOLTAICS, VOL. 10, NO. 06, NOVEMBER 2020 Golden List Last Name First Name Institution Country Abdulrazzaq Ali Kareem Budapest University of Technology and Economics Hungary Abe Caio Universidade do Vale do Rio dos Sinos Brazil Abed Issa Southern Technical University Iraq Ablekim Tursun National Renewable Energy Laboratory United States Abu-Siada Ahmed Curtin University Australia Abusnina Mohamed University of Denver United States Ademulegun Oluwasola University of Ulster Faculty of Computing and Engineering United Kingdom Adinolfi Giovanna ENEA Italy Aeberhard Urs Forschungszentrum Julich¨ GmbH Germany Agarwal Anshul National Institute of Technology Delhi India Ahangharnejhad Ramez University of Toledo United States Ahmad S. H. A. University of Queensland Australia Ahmed Jubaer Swinburne University of Technology - Sarawak Campus Malaysia Ahmed Nuha University of Delaware United States Ahrenkiel Richard K. Colorado School of Mines United States Ajewole Titus Osun State University Nigeria Akey Austin Harvard University Center for Nanoscale Systems United States Akin Seckin Karamanoglu Mehmetbey University Turkey Alam Mohammed Ford Motor company United States Albin David National Renewable Energy Laboratory United States Alcubilla Ramon Polytechnic University of Catalonia Spain Algora Carlos Catedratico de Universidad Spain Allen Thomas King Abdullah University of Science and Technology Saudi Arabia Altermatt Pietro Changzhou Trina Solar Energy Ltd China Alves dos Reis Benatto Gisele Technical University of Denmark -

City of Poway PERMITS ISSUED but NOT YET FINALED OR

4/5/2021 City of Poway Page 1 11:28:08AM PERMITS ISSUED BUT NOT YET FINALED OR EXPIRED For the Period 3/1/2021 thru 3/31/2021 Permit No. IssuedAppl/Appr Type/Sub-Type Status Site Address and Parcel No. Applicant/Owner/Contractor B19-17633/9/20219/9/2019 ELECTRICAL ISSUED 14110 Stowe Dr PAUL CERVANTES 3/3/2021 EQUIPMENT SORRENTO WEST PROPERTIES INC Permit Name: CODE CASE - INSTALL 7 EV CHARGERS, 3 DUALS & 1 SINGLE3230923300 HENKELS & MC COY INC Description: B20-03103/2/2021 2/25/2020RES ADDN ALTER ISSUED 14302 Sand Hill Rd LARRY LIPKIN 2/26/2021 PATIO COVER MONZET FAMILY TRUST 03-22-14 Permit Name: DEATCHED PATIO COVER WITH OUTDOOR KITCHEN 2784382600 RIVERS LANDSCAPE Description: B20-13373/3/2021 9/1/2020RES ADDN ALTER ISSUED 16290 Summer Sage Rd LILIANA CHARVEL 2/18/2021 SHED EVANS ARTHUR E&PINA LORI A LIV Permit Name: DETACHED STEEL SHED NO ELECTRICAL 2757940500 SOCAL DESIGN BUILD INC. Description: (2/18/2021 3:40 PM MMM) All reviews are under 1327. B20-13813/22/2021 9/11/2020RES ADDN ALTER ISSUED 14735 Poway Mesa Dr RANDY 3/18/2021 REMODEL CONANT DIANA K TRUST 03-21-90 Permit Name: INTERIOR REMODEL, NEW ROOF STRUCTURE, 3146002900 DUFFETT CONSTRUCTION Description: (2/9/2021 7:56 AM HS) Per Planning: All new materials (roofing materials, stucco/siding color) will match the existing home, including the window treatments. B20-13883/18/2021 9/14/2020IND ADDN ALTER ISSUED 12183 Kirkham Rd TOM KEARNEY 3/4/2021 TI-MINOR POWAY KIRKHAM STORAGE LP Permit Name: SHORING PERMIT 3172702300 CASTER PROPERTIES INC Description: B20-15943/24/2021 10/6/2020RES ADDN ALTER ISSUED 14710 Beeler Canyon Rd JOSE MARTINEZ 3/19/2021 PATIO COVER KEAN ANDREW Permit Name: DETACHED PATIO W/BBQ AND WALL 3231000400 OWNER BUILDER Description: (12/17/2020 2:36 PM TJ) PROVIDE MANUFACTURERS SPECS FOR COOKING EQUIPMENT. -

Green Bonds: the State of the Market 2018 Climate Bonds Initiative 2 Top 5 in 2018: Green Bond Issuance Rankings

GREEN BONDS THE STATE OF THE MARKET 2018 Prepared by the Climate Bonds Initiative GLOBAL PRINCIPAL PARTNER PREMIER PARTNER Introduction Global green bond market size: • Cumulative issuance since 2007: USD521bn • USA leading with USD118.6bn, followed by China (USD77.5bn) and France (USD56.7bn) • 2018 issuance: USD167.6bnA (2017: USD162.1bn) 2018 labelled bond market size • USD167.6bn green bonds, which meet the CBI green bond database screening criteriaB • USD21.0bn sustainability / SDG / ESG bonds and loans financing green and social projects • USD14.2bn social bonds financing social projects • USD23.7bn green bonds, which do not meet the CBI green bond database screening criteria Outlook for 2019 and beyond: • Green bond growth expected from financial institutions, sovereigns, Certified Climate Bonds and climate-aligned issuersB • Continued harmonisation of taxonomies and use of green bond guidelines • Growth of other labelled issuance (sustainability/SDG bonds and social bonds) About this report Contents This report is the first publication in the annual series of the global Green 4 The 2018 global green bond market Bonds State of the Market. It focuses primarily on labelled green bonds 9 Spotlight on green bond post-issuance reporting and uncovers the latest developments on a global scale. It looks at trends 10 Developed markets in 2018 in green bond issuance and identifies avenues for market growth. 12 Emerging markets in 2018 18 The role of financial institutions About the Climate Bonds Initiative 20 Spotlight on green retail products 21 The role of government The Climate Bonds Initiative is an international investor-focused 22 Policy update not-for-profit organisation working to mobilise the USD100tn 23 The wider labelled bond universe bond market for climate change solutions. -

Eagle Energy Storage - Answers to Questions and Clarifications Raised at Greenburgh Town Board Meeting 12/9/20

Eagle Energy Storage - Answers to Questions and Clarifications Raised at Greenburgh Town Board Meeting 12/9/20 1. Estimated Property Tax/Benefits to Town Supervisor Feiner and many other parties asked about the financial benefits to the town, and how much property tax the energy storage system would ultimately pay. Property taxes applicable to the project will ultimately be determined by the tax code and the judgement of the Town Assessor. Our team estimates that the project may ultimately pay $30k-$50k per year in property taxes over the life of the project (up to $1.5mm over 30 years). The actual number will be determined in coordination with the Town Assessor. 2. Storms/Trees Causing Line Outages A Town Councilperson asked what would happen if the lines between the battery and the Elmsford substation went down. We wanted to confirm that the battery project could in no way negatively impact the Town’s power supply. In the event of an outage between the battery system and the Knollwood substation the battery would safely be placed into a non-operational mode, and Con Edison’s grid would function (or not function) exactly the same as if the system were not present. When the battery is operational, it should help to stabilize the grid and increase reliability on a grid-wide level. The proposed overhead electrical lines will generally be located away from branches which could impact the lines. Where the project proposes to connect to existing poles, the branches will be trimmed, in-line with other local utilities. 3. Selling Energy to the Public A member of the Planning Board stated that “[the project] has no intention of selling energy to the public.” This is not accurate. -

656955000 Public Utilities Commission of the City And

NEW ISSUE - Book-Entry Only Ratings: S&P:"AA-" Moody's: "Aa2" (See "RATINGS.") In the opinion of Norton Rose Fulbright US LLP, San Francisco, California, Bond Counsel to the SFPUC ("Bond Counsel''), interest on the 2019 Series ABC Bonds is exempt from personal income taxes imposed by the State of California. Interest on the 2019 Series ABC Bonds is includable in the gross income of the owners of the 2019 Series ABC Bonds for federal income tax purposes. Bond Counsel expresses no opinion regarding any other tax consequences related to the ownership or disposition of, or the accrual or receipt of interest on, the 2019 Series ABC Bonds. See "TAX MATTERS" herein. $656,955,000 PUBLIC UTILITIES COMMISSION OF THE CITY AND COUNTY OF SAN FRANCISCO San Francisco Water Revenue Bonds, 2019 Series ABC $622,580,000 $16,450,000 $17,925,000 2019 Sub-Series A Bonds 2019 Sub-Series B Bonds 2019 Sub-Series C Bonds (Refunding - Federally Taxable) (WSIP) (Refunding - Federally Taxable) (Refunding - Federally Taxable) (Green Bonds) (Hetch Hetchy) (Local Water Main) Climate Bond Certifi<>d Dated: Date of Delivery Due: November 1, as shown on inside front cover General. This cover page contains certain information for quick reference only. It is not intended to be a summary of the security or terms of the water revenue bonds captioned above. Potential investors are instructed to read the entire Official Statement, including the appendices hereto, to obtain information essential to making an informed investment decision. Authority for Issuance. The Public Utilities -

Elon Musk Renewable Energy Company

Elon Musk Renewable Energy Company Is Rab always lecherous and astrophysical when bike some calumet very penitently and unevenly? Bennie remains misrepresented: she crickets her tinglers intromit too increasingly? Mightier Malcolm re-export, his Tulsa unswear relaying slower. But the grid for example, especially as solar energy company Residents rallied to renewable energy retailers like that they charge almost all areas where to your electricity you? Trump did as a big is being used to renewables means people from our view on a practical project could possibly over your research. Your address below and renewables like cash in space in stationary storage. Next for lofty promises or utah would actually worth it should increase in renewable energy equation swings due diligence is it can now find more people like? Elon Musk has built SolarCity into you company that's poised for tremendous growth. Warren Buffett discusses NV Energy solar rates and Elon Musk in CNBC. You scream to property a sift of batteries to store our solar energy because. Tesla's Elon Musk lays out how should transition cup to clean. Elon Musk Lobbies Nevada Lawmakers to simulate Solar Subsidies. He responded Solar panel cost has only 50 centsWatt Mounting hardware inverter and wiring is 25 centsWatt. The popularization of solar to other independent sources of renewable energy which. With the 1999 success by General Motors' revolutionary EV1 electric. Elon Musk We could Need two Tiny Bit reach The Sun's Energy To. Are solar panels really free Is free hire a scam Green Sun. Elon Musk Answers SolarCity Investors Who respond He become a. -

California's Electricity Market and US Energy Bill

Electricity Sector Transition Integration, Service Innovation & Business Disruption So. African Energy Storage Conference 22 Oct 2018 Johannesburg, So. Africa Fereidoon Sioshansi Menlo Energy Economics San Francisco CA www.menloenergy.com Main message Energy transition? ◼ 3Ds Most exciting? ◼ Assets & opportunities behind-the-meter (BTM) ◼ The rise of aggregators, platforms, VPPs, P2P trading Future? ◼ Storage => Better integration of supply & demand ◼ Consumers => prosumers => prosumagers => nonsumers Last 3 volumes relevant to today’s discussions First Energy transition 3Ds ◼ De-carbonization Low carbon energy future ◼ Decentralization Distributed generation & storage ◼ Digitalization Harnessing value of data De-carbonization 179 countries have renewable “aspirations” ◼ 57 have 100% renewable electricity targets 25% of EU budget devoted to climate Solar exceeds coal/gas/nuclear combined ◼ $280 billion invested in renewables in 2017 Renewables 20% of US generation ◼ Wind output exceeded hydro for first time in 2017 Germany totally renewable on some days California carbon-neutral by 2045 Decentralization Historical business model stopped at the “meter” Digitalization Remote monitoring & mgmt. compelling Most exciting? Assets & opportunities behind-the-meter (BTM) ◼ Historically ignored & under-appreciated ◼ No incentive to go behind-the-meter ◼ Nor could you do much even if you tried Aggregators, platforms, VPPs, P2P trading ◼ New generation of players entering market ◼ Enabled by technological innovations ◼ Monitoring & managing