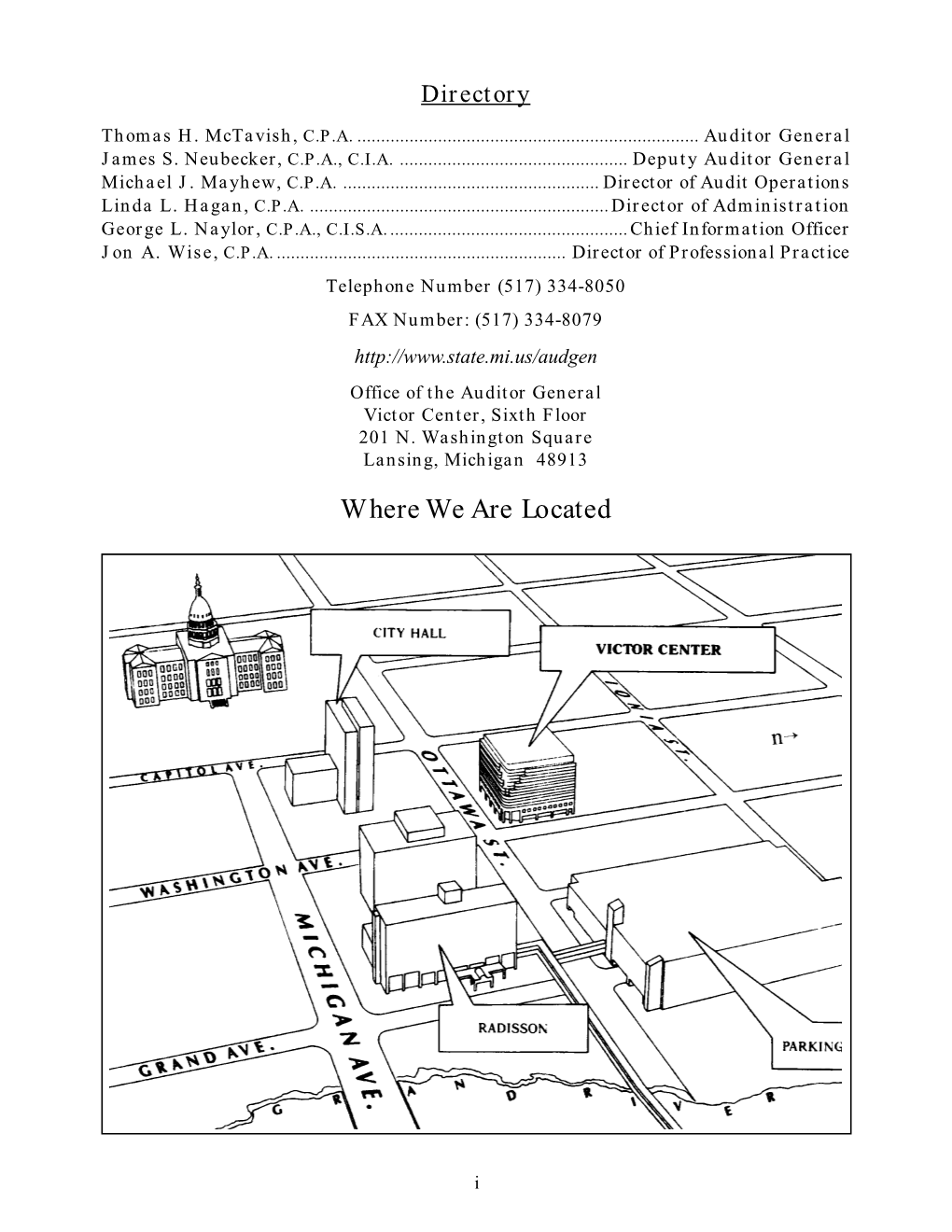

Where We Are Located

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OAG Annual Report 2006

Directory Thomas H. McTavish, C.P.A. ........................................................................ Auditor General Scott M. Strong, C.P.A., C.I.A. ........................................................ Deputy Auditor General Craig M. Murray, C.P.A., C.I.A. ....................................... Director of Professional Practice Kimberly E. Jacobs, C.P.A., C.I.S.A., C.N.E. ...................................Chief Information Officer Paul J. Green, C.P.A., C.I.A., C.I.S.A. ........................................... Director of Administration Robert T. Ortwein, P.C...................................................................... State Relations Officer Telephone Number: (517) 334-8050 FAX Number: (517) 334-8079 http://audgen.michigan.gov Office of the Auditor General Victor Center, Sixth Floor 201 N. Washington Square Lansing, Michigan 48913 Where We Are Located i STATE OF MICHIGAN OFFICE OF THE AUDITOR GENERAL 201 N. WASHINGTON SQUARE LANSING, MICHIGAN 48913 (517) 334-8050 THOMAS H. MCTAVISH, C.P.A. FAX (517) 334-8079 AUDITOR GENERAL September 30, 2006 The Honorable Jennifer M. Granholm, Governor of Michigan The Honorable Kenneth R. Sikkema, Senate Majority Leader The Honorable Craig M. DeRoche, Speaker of the House The Honorable Robert L. Emerson, Senate Minority Leader The Honorable Dianne Y. Byrum, House Minority Leader and Members of the 93rd Legislature Ladies and Gentlemen: This annual report on the operations of the Michigan Office of the Auditor General covers the fiscal year ended September 30, 2006 and is submitted in accordance with Article IV, Section 53 of the State Constitution. The Office of the Auditor General has the responsibility, as stated in Article IV, Section 53 of the State Constitution, to conduct post financial and performance audits of State government operations. In addition, certain sections of the Michigan Compiled Laws contain specific audit requirements in conformance with the constitutional mandate. -

Speakers, Speakers Pro Tempore, Clerks of the House Of

SPEAKERS OF THE HOUSE OF REPRESENTATIVES, 1835-20091 Representative County of Residence District Session Years Ezra Convis ............. Calhoun ............ Calhoun . 1835-1836 Charles W. Whipple ....... Wayne ............. Wayne .................. 1837 Kinsley S. Bingham ....... Livingston ........... Livingston................ 1838-1839 Henry Acker............. Jackson ............ Jackson ................. 1840 Philo C. Fuller2 ........... Lenawee ............ Lenawee ................ 1841 John Biddle ............. Wayne ............. Wayne .................. 1841 Kinsley S. Bingham ....... Livingston ........... Livingston ............... 1842 Robert McClelland ........ Monroe............. Monroe ................. 1843 Edwin H. Lothrop ......... Kalamazoo .......... Kalamazoo . 1844 Alfred H. Hanscom ........ Oakland ............ Oakland ................. 1845 Isaac E. Crary ............ Calhoun ............ Calhoun . 1846 George W. Peck .......... Livingston ........... Livingston ............... 1847 Alexander W. Buel ........ Wayne ............. Wayne .................. 1848 Leander Chapman ........ Jackson ............ Jackson ................. 1849 Silas G. Harris ........... Ottawa ............. Ottawa/Kent ............. 1850 Jefferson G. Thurber ....... Monroe............. Monroe ................. 1851 Daniel G. Quackenboss .... Lenawee ............ 1st Lenawee .............. 1853 Cyrus Lovell ............. Ionia .............. Ionia ................... 1855 Byron G. Stout ........... Oakland ............ 1st Oakland ............. -

Where We Are Located

Directory Thomas H. McTavish, C.P.A. ........................................................................ Auditor General James S. Neubecker, C.P.A. ........................................ Executive Deputy Auditor General Michael J. Mayhew, C.P.A. .......................................... Deputy Auditor General for Audits Linda L. Hagan, C.P.A. .............................................................. Director of Administration George L. Naylor, C.P.A., C.I.S.A. ..................................................Chief Information Officer Jon A. Wise, C.P.A. ............................................................. Director of Professional Practice Robert T. Ortwein, L.P.C. ................................................................. State Relations Officer Telephone Number: (517) 334-8050 FAX Number: (517) 334-8079 http://÷.state.mi.us/audgen Office of the Auditor General Victor Center, Sixth Floor 201 N. Washington Square Lansing, Michigan 48913 Where We Are Located i STATE OF MICHIGAN OFFICE OF THE AUDITOR GENERAL 201 N. WASHINGTON SQUARE LANSING, MICHIGAN 48913 (517) 334-8050 THOMAS H. MCTAVISH, C.P.A. FAX (517) 334-8079 AUDITOR GENERAL September 30, 2002 The Honorable John M. Engler, Governor of Michigan The Honorable Dan L. DeGrow, Senate Majority Leader The Honorable Rick V. Johnson, Speaker of the House The Honorable John D. Cherry, Jr., Senate Minority Leader The Honorable Samuel Buzz Thomas, III, House Minority Leader and Members of the 91st Legislature Ladies and Gentlemen: This annual report on the operations of the Michigan Office of the Auditor General covers the fiscal year ended September 30, 2002 and is submitted in accordance with Article IV, Section 53 of the State Constitution. The Office of the Auditor General has the responsibility, as stated in Article IV, Section 53 of the State Constitution, to conduct post financial and performance audits of State government operations. In addition, certain sections of the Michigan Compiled Laws contain specific audit requirements in conformance with the constitutional mandate. -

Governors of the State of Michigan, 1835-2009

GOVERNORS OF THE STATE OF MICHIGAN, 1835-2009 D — Stevens T. Mason ............. 1835-1840 R — Aaron T. Bliss . 1901-1904 W — William Woodbridge1 .......... 1840-1841 R — Fred M. Warner6.............. 1905-1910 W — James Wright Gordon2 . 1841-1842 R — Chase S. Osborn . 1911-1912 D — John S. Barry ................ 1842-1846 D — Woodbridge N. Ferris .......... 1913-1916 D — Alpheus Felch3............... 1846-1847 R — Albert E. Sleeper . 1917-1920 D — William L. Greenly2 . 1847-1848 R — Alexander J. Groesbeck . 1921-1926 D — Epaphroditus Ransom . 1848-1850 R — Fred W. Green............... 1927-1930 D — John S. Barry ................ 1850-1851 R — Wilber M. Brucker ............ 1931-1932 D — Robert McClelland4............ 1852-1853 D — William A. Comstock . 1933-1934 D — Andrew Parsons2 ............. 1853-1854 R — Frank D. Fitzgerald . 1935-1936 R — Kinsley S. Bingham . 1855-1858 D — Frank Murphy . 1937-1938 R — Moses Wisner . 1859-1860 R — Frank D. Fitzgerald7 ........... 1939-1990 R — Austin Blair ................. 1861-1864 R — Luren D. Dickinson8........... 1939-1940 R — Henry H. Crapo .............. 1865-1868 D — Murray D. Van Wagoner ........ 1941-1942 R — Henry P. Baldwin............. 1869-1872 R — Harry F. Kelly . 1943-1946 R — John J. Bagley . 1873-1876 R — Kim Sigler .................. 1947-1948 R — Charles M. Croswell ........... 1877-1880 D — G. Mennen Williams........... 1949-1960 R — David H. Jerome . 1881-1882 D — John B. Swainson............. 1961-1962 D — Josiah W. Begole5 . 1883-1884 R — George Romney9 . 1963-1969 R — Russell A. Alger .............. 1885-1886 R — William G. Milliken . 1969-1982 R — Cyrus G. Luce . 1887-1890 D — James J. Blanchard............ 1983-1990 D — Edwin B. Winans ............. 1891-1892 R — John M. -

Michigan Biographies, Including Members of Congress, Elective

Library of Congress Michigan biographies, including Members of Congress, elective state officers, Justices of the Supreme Court, Members of the Michigan Legislature, Board of Regents of the University of Michigan, State Board of Agriculture and State Board of Education.... a machine-readable transcription. 24-27007 Michigan. Historical commission Michigan Biographies INCLUDING MEMBERS OF CONGRESS, ELECTIVE STATE OFFICES JUSTICES OF THE SUPREME COURT, MEMBERS OF THE MICHIGAN LEGISLATURE, BOARD OF REGENTS OF THE UNIVERSITY OF MICHIGAN, STATE BOARD OF AGRICULTURE AND STATE BOARD OF EDUCATION THE GREAT SEAL OF THE STATE OF MICHIGAN A. D. MDCCCXXXV. VOL. I. A-K Published by The Michigan Historical Commission Lansing, 1924. F565 M62 LIBRARY OF CONGRESS RECEIVED JAN 31, 1924 DOCUMENTS DIVISION PREFACE. In 1888 a volume entitled Early of Michigan, with Biographies of state Officers, Members of Congress, Judges and Legislators was published by the State under the impulse of Michigan biographies, including Members of Congress, elective state officers, Justices of the Supreme Court, Members of the Michigan Legislature, Board of Regents of the University of Michigan, State Board of Agriculture and State Board of Education.... a machine- readable transcription. http://www.loc.gov/resource/lhbum.7004a Library of Congress the semi-centennial anniversary of Michigan's admission to the Union. Since that time the book has become somewhat rare. Much new material has come to light which was not then accessible, and many new names have been added to the list of Michigan's distinguished sons. It has seemed well to revise this earlier volume and bring it up to date. For this purpose much use has been made of the several editions of the Michigan Manual. -

OAG Annual Report 2004

Directory Thomas H. McTavish, C.P.A. .........................................................................Auditor General Scott M. Strong, C.P.A., C.I.A. .........................................................Deputy Auditor General Craig M. Murray, C.P.A., C.I.A. ........................................ Director of Professional Practice Kimberly E. Jacobs, C.P.A., C.I.S.A., C.N.E. .................................. Chief Information Officer Paul J. Green, C.P.A., C.I.A., C.I.S.A. .......................................... Director of Administration Robert T. Ortwein, P.C., C.S.W. ......................................................... State Relations Officer Telephone Number: (517) 334-8050 FAX Number: (517) 334-8079 http://audgen.michigan.gov Office of the Auditor General Victor Center, Sixth Floor 201 N. Washington Square Lansing, Michigan 48913 Where We Are Located i STATE OF MICHIGAN OFFICE OF THE AUDITOR GENERAL 201 N. WASHINGTON SQUARE LANSING, MICHIGAN 48913 (517) 334-8050 THOMAS H. MCTAVISH, C.P.A. FAX (517) 334-8079 AUDITOR GENERAL September 30, 2004 The Honorable Jennifer M. Granholm, Governor of Michigan The Honorable Kenneth R. Sikkema, Senate Majority Leader The Honorable Rick V. Johnson, Speaker of the House The Honorable Robert L. Emerson, Senate Minority Leader The Honorable Dianne Y. Byrum, House Minority Leader and Members of the 92nd Legislature Ladies and Gentlemen: This annual report on the operations of the Michigan Office of the Auditor General covers the fiscal year ended September 30, 2004 and is submitted in accordance with Article IV, Section 53 of the State Constitution. The Office of the Auditor General has the responsibility, as stated in Article IV, Section 53 of the State Constitution, to conduct post financial and performance audits of State government operations. -

Former Officials of Michigan French-Canadian Governors, 1603-1760

FORMER OFFICIALS OF MICHIGAN FRENCH-CANADIAN GOVERNORS, 1603-1760 No. Name Title Year 1 Aymar de Chastes, Sieur de Monts . 1603-12 2 Samuel de Champlain with Prince de Conde as acting governor . 1612-19 3 Henry, Duke of Montmorenci, acting governor . 1619-29 4 Samuel de Champlain1 . Lieut. Gen. and Viceroy . 1633 { 1635 5 Marc Antoine de Bras-de-Fer de Chateaufort . Lieut. Gen. and Viceroy . 1636 6Charles Hualt de Montmagny . Gov. and Lieut. Gen. 1636-47 7 Louis d’Ailleboust, Sieur de Coulonges . Governor . 1648-51 8 Jean de Lauson . Governor . 1651-55 9 Charles de Lauson-Charny2 . Governor . 1656-57 10 Louis d’Ailleboust, Sieur de Coulonges3 . Governor . 1657-58 11 Pierre de Voyer, Viscount d’Argenson . Governor . 1658-61 12 Baron Dubois d’Avaugour . Governor . 1661-63 13 Augustin de Saffray-Mezy . Governor . 1663-65 14 Alexandre de Prouville, Marquis de Tracy . Viceroy . 1663 15 Daniel Remy, Sieur de Courcelles . Gov. and Lieut. Gen. 1665-72 16 Louis de Buade, Count de Frontenac . Governor . 1672-82 17 Antoine Joseph Le Febvre de la Barre . Governor . 1682-85 18 Jacques Rene de Brisay, Marquis de Denonville . Governor . 1685-89 19 Louis de Buade, Count de Frontenac4 . Governor . 1689-98 20 Louis Hector de Callieres . Governor . 1698 { 1702 21 Philippe de Rigaud, Marquis de Vaudreuil . Governor . 1703 22 Charles LeMoyne, Baron de Longueuil . Governor . 1725 23 Charles de la Boische, Marquis de Beauharnois . Governor . 1726-47 24 Rolland Michel Barrin, Marquis de la Galissonniere . Governor . 1747-49 25 Jacques Pierre de Taffanel, Marquis de la Jonquiere . Governor . 1749-52 26 Charles LeMoyne, Baron de Longueuil5 . -

A History of the Office of the State Land Board H164 Michigan’S Present Capitol, the State’S Third, Opened on January 1, 1879, to Great Acclaim

A History of The Office of the State Land Board H164 Michigan’s present Capitol, the state’s third, opened on January 1, 1879, to great acclaim. Image Courtesy of the Archives of Michigan The Golden Age of Capitol Construction The Michigan State Capitol was built during the golden age of Capitol construction in the years follow- ing the American Civil War. From its inception, the building was designed to serve several functions and roles for the state. First, and most importantly, it is the official seat of government for the State of Michigan. It is a public forum where people can express their opinions, and a symbol of governmental traditions and the state itself. Yet the Capitol is also, at its very essence, an office building, where the day-to-day functions of government have played out for well over a century. When the Capitol first opened in 1879, it was state government’s only active office building, where all three branches of government were housed. The executive branch, including the Governor, State Treasurer, Secretary of State, State Librarian, Auditor General, the Superintendent of Public Instruction, and the Adjutant General, claimed most of the offices within it. The judicial branch was represented by the Supreme Court, which occupied offices and an elegant chamber in the east wing of the third floor. The legislative branch used the House and Senate Chambers, the largest and most impressive rooms in the Capitol, as well as offices for the Secretary of the Senate, the Clerk of the House, and a few committee rooms. -

2010 Annual Report

CHIGA MI N A U L D RA ITOR GENE office of the auditor general 201 n. washington square lansing, michigan 48913 tel 517.334.8050 fax 517.334.8079 http://audgen.michigan.gov 010 2 2010 annual report michigan office of the auditor general thomas h. mctavish, c.p.a. auditor general The auditor general shall conduct post audits of financial transactions and accounts of the state and of all branches, departments, offices, boards, commissions, agencies, authorities and institutions of the state established by this constitution or by law, and performance post audits thereof. - Article IV, Section 53 of the Michigan Constitution Directory (As of September 30, 2010) Thomas H. McTavish, C.P.A. ............................................................. Auditor General Scott M. Strong, C.P.A., C.I.A. .............................................. Deputy Auditor General Craig M. Murray, C.P.A., C.I.A. ............................... Director of Professional Practice Kimberly E. Jacobs, C.P.A., C.I.S.A., C.N.E. ...................... Chief Information Officer Paul J. Green, C.P.A., C.I.A., C.I.S.A. ............................... Director of Administration Robert T. Ortwein, L.M.S.W., L.P.C. ........................................ State Relations Officer Telephone Number: (517) 334-8050 FAX Number: (517) 334-8079 http://audgen.michigan.gov Office of the Auditor General Victor Center, Sixth Floor 201 N. Washington Square Lansing, Michigan 48913 Where We Are Located i STATE OF MICHIGAN OFFICE OF THE AUDITOR GENERAL 201 N. WASHINGTON SQUARE LANSING, MICHIGAN 48913 (517) 334-8050 THOMAS H. MCTAVISH, C.P.A. FAX (517) 334-8079 AUDITOR GENERAL January 28, 2011 The Honorable Rick Snyder, Governor of Michigan The Honorable Randy Richardville, Senate Majority Leader The Honorable Jase Bolger, Speaker of the House The Honorable Gretchen E. -

Where We Are Located

Directory Thomas H. McTavish, C.P.A. ........................................................................ Auditor General James S. Neubecker, C.P.A. ........................................ Executive Deputy Auditor General Michael J. Mayhew, C.P.A. .......................................... Deputy Auditor General for Audits Linda L. Hagan, C.P.A. .............................................................. Director of Administration George L. Naylor, C.P.A., C.I.S.A. ..................................................Chief Information Officer Jon A. Wise, C.P.A. ............................................................. Director of Professional Practice Robert T. Ortwein, L.P.C. ................................................................. State Relations Officer Telephone Number: (517) 334-8050 FAX Number: (517) 334-8079 http://÷.state.mi.us/audgen Office of the Auditor General Victor Center, Sixth Floor 201 N. Washington Square Lansing, Michigan 48913 Where We Are Located i STATE OF MICHIGAN OFFICE OF THE AUDITOR GENERAL 201 N. WASHINGTON SQUARE LANSING, MICHIGAN 48913 (517) 334-8050 THOMAS H. MCTAVISH, C.P.A. FAX (517) 334-8079 AUDITOR GENERAL September 30, 2000 The Honorable John M. Engler, Governor of Michigan The Honorable Dan L. DeGrow, Senate Majority Leader The Honorable Charles R. Perricone, Speaker of the House The Honorable John D. Cherry, Jr., Senate Minority Leader The Honorable Michael J. Hanley, House Minority Leader and Members of the 90th Legislature Ladies and Gentlemen: This annual report on the operations of the Michigan Office of the Auditor General covers the fiscal year ended September 30, 2000 and is submitted in accordance with Article 4, Section 53 of the State Constitution. The Office of the Auditor General has the responsibility, as stated in Article 4, Section 53 of the State Constitution, to conduct post financial and performance audits of State government operations. In addition, certain sections of the Michigan Compiled Laws contain specific audit requirements in conformance with the constitutional mandate.