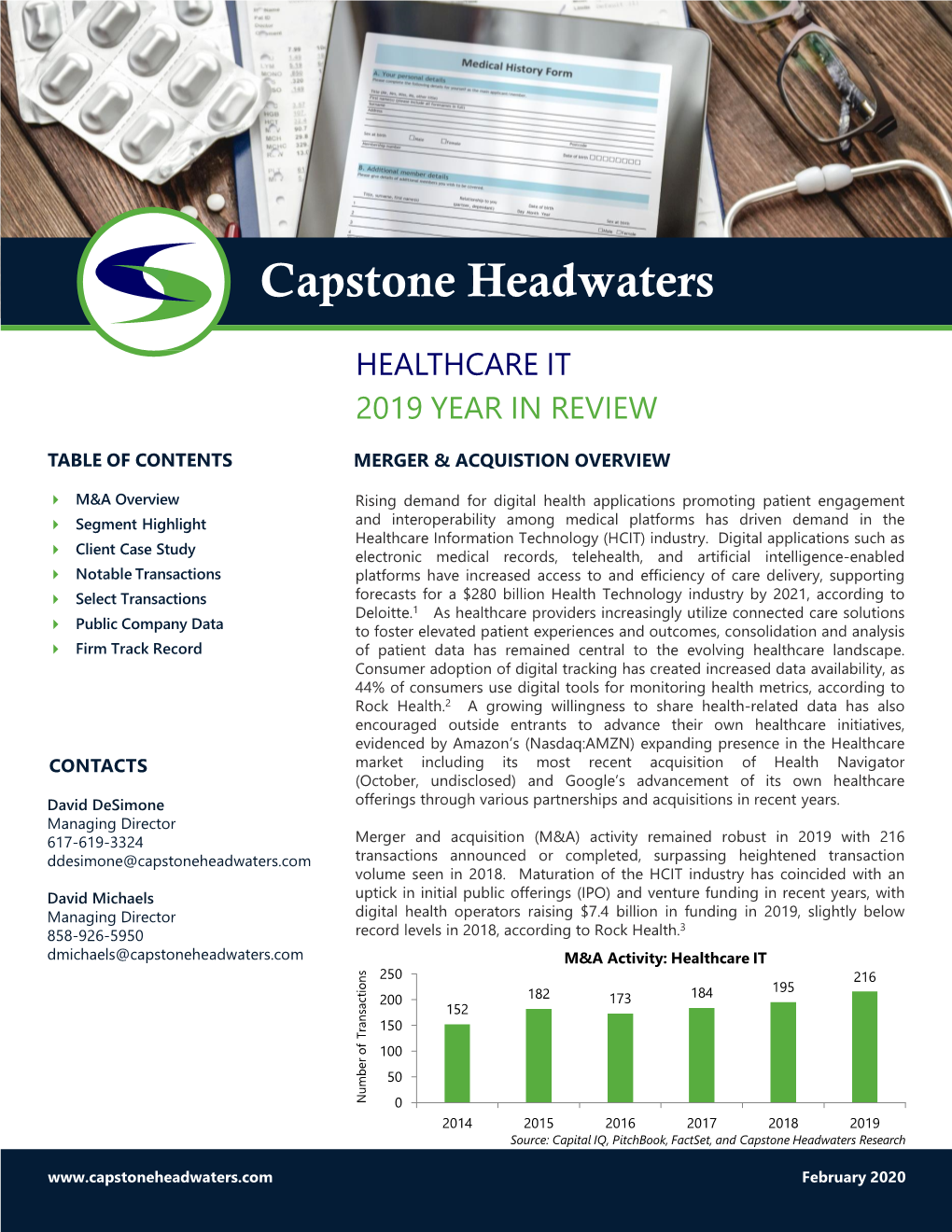

Capstone Headwaters Healthcare IT 2019 Year in Review M&A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

American Well Corporation (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q (Mark One) ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 30, 2020 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-39515 American Well Corporation (Exact name of registrant as specified in its charter) Delaware 20-5009396 (State of incorporation) (I.R.S. Employer Identification Number) 75 State Street, 26th Floor Boston, MA 02109 (Address of registrant’s principal executive offices) (617) 204-3500 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. -

Telehealth Research Analysts INDUSTRY PRIMER Jailendra Singh 212 325 8121 [email protected] a High-Growth and Cost-Saving Industry A.J

8 October 2018 Americas/United States Equity Research Managed Care & Healthcare Facilities Telehealth Research Analysts INDUSTRY PRIMER Jailendra Singh 212 325 8121 [email protected] A High-Growth and Cost-Saving Industry A.J. Rice 212 325 8134 Shaping the Future of Healthcare Delivery [email protected] ■ A Primer on the Global Telehealth Services Market. The global Eduardo Ron telehealth market is divided into three major components: hardware, 212 325 7491 [email protected] software, and services. This report primarily focuses on the services Caleb Harris, CPA segment of the market, which consists of the providers of telehealth as 212 325 7458 opposed to the makers of technology and devices. [email protected] ■ A High Growth Industry at a Very Early Stage. Telehealth is undoubtedly a disruptive trend in global healthcare. The telehealth market is forecasted to grow in every region in terms of components, applications, and stakeholders. While industry expert opinions vary regarding the shape that the industry will take and how quickly it will grow, experts agree that telehealth will alter how patients access healthcare and how providers administer care. ■ Key Growth Drivers. Several factors in the healthcare industry create the need for an alternative healthcare solution such as telehealth: physician shortages, increasing costs, and inefficiency. Additional growth drivers include an increase in chronic and long-term conditions, an increase in government telehealth initiatives, and advancements in mobile connectivity. ■ Key Challenges. Despite the strong cost-savings potential of the telehealth market, the widespread adoption of this technology still has a long way to go, with the key challenges including low consumer awareness, a lack of standardization in reimbursement policies by government and private health insurers, and uncertain patient and provider inertia with respect to telehealth. -

European Telemedicine

WWW.DRAKESTAR.COM APRIL 2021 6 Sector Report EUROPEAN TELEMEDICINE Christophe Morvan, Managing Partner Lawrence Giesen, Partner [email protected] [email protected] +33 170 087 610 +33 170 087 613 Grégoire Bizouerne, Analyst Antoine Pigneux, Analyst [email protected] [email protected] +33 170 087 615 +33 170 087 621 A MESSAGE FROM DRAKE STAR We are pleased to publish the inaugural 2021 Drake Star Telemedicine Sector Report presenting the European telemedicine market during an unprecedented year for the industry due to the ongoing Covid-19 outbreak. Our report will explore the uses of telemedicine, market trends, the impact of the Covid-19 crisis, interviews with leaders in the sector as well as an overview of the European landscape and its main players. We will include an extensive list of the recent private placement and M&A activity as well as an analysis of public markets valuations, including the launch of the Drake Star Telemedicine Index. We also provide 72 short profiles of European telemedicine companies, from startups to established firms, offering a diverse picture of the European market. The global telemedicine market recorded historic growth in 2020, reaching $52bn and is projected to triple by 2025 to over $150bn. Based on our estimations, the European market represents 20% of the global telemedicine market, but growing at a slower rate due to structural issues. Telemedicine adoption has been accompanied by a surge in fundraising, enabling platforms to scale quickly. We provide a mapping of the largest and most active financial and industrial investors in the space. -

IPO Candy Presentation Transcript

IPO Candy Presentation Transcript Amwell (American Well Company) IPO Roadshow September 2020 Ido Schoenberg, MD, Chairman & CEO I am Ido Schoenberg, the CEO of Amwell. Together with me, today, is Keith Anderson, our chief financial officer and head of M&A. Together we are thrilled to tell you the story of Amwell. When Roy and I started the company 15 years ago, the very notion that digital care delivery would transform healthcare was a novelty. Today, it's very much a reality. The mission of Amwell is simple. We aim to connect and enable the key players in healthcare (providers, insurers, patients, and innovators) to deliver greater access to more affordable, higher- quality care. Our main focus is on improving financial and clinical outcomes and if you could do that with less visits, that's perfectly fine. At the high level we are a technology company. We take great strength from the huge number of key players (providers, payers, consumer aggregators, and innovators) that are already using our platform and rely on it day by day. In 2019 we had $149 million in revenue. Eighty-nine percent of it was recurring in the first half of this year. In the first half of this year 38% of the operating income came from platform subscriptions; 11% from software, hardware, and services; and 51% was related to visits that went up in an unusual way because of COVID. We have done more than 5.6 million visits, but our number one KPI is not revenue or visits; it is active providers. We have 57,000 active providers on our platform today. -

2020 – a Year Like No Other

AN AFFILIATE OF 2020 – A Year Like No Other February 1, 2020 Friends and Colleagues: With a year like no other now in the rearview mirror, we’re pleased to Turning to the capital markets, 2020 was characterized by volatility, where provide you with our review of a year filled with unfathomable sacrifice, despite a 34% decline between Feb. 19 and March 23, the sector finished courage and resolve, as well as historic transformation across our the year near all-time highs led by bellwether names including Livongo, healthcare industry, where 10-years of advancements were made in 10 One Medical, Oak Street, Teladoc and Accolade up 458%, 212%, 191%, short months! As the world watched, our industry embraced innovation like 139% and 98% respectively. In reviewing M&A activity, PJ SOLOMON saw never before in history to provide mission-critical technology and tech- 336 announced M&A transactions, including 24 with greater than $1 billion enabled infrastructure and services to meet the demands of our nation’s of announced deal values, bringing the total value of announced M&A consumer health – in the home, in the community, through virtual networks activity for the year to $92 billion. A few specific transactions to note and increased mobility and, of course, through the cloud. include: ▪ Teladoc’s merger with Livongo for $18 billion As the dust began to settle in 2Q20, we saw a dramatic pickup in sponsor ▪ MultiPlan’s SPAC merger with Churchill Capital III for $11.1 billion financings, IPOs and SPACs, with M&A back in full steam by 3Q20. -

Coker Capital's Healthcare Services Newsletter – 1St Quarter 2021

Healthcare Services M&A Coker Capital’s Healthcare Services Newsletter – 1st Quarter 2021 In this issue of the Coker Capital Healthcare Services Newsletter, we provide an April 2021 update on Healthcare Services activity through the 1st Quarter of 2021. Coker Capital provides mergers and Market Performance acquisitions advisory services to middle market healthcare companies throughout the United (1) ▪ The S&P Healthcare Services Select Index outperformed the broader States. Coker Capital operates from offices in market in Q1 2021, increasing +9.8% versus +5.8% and +2.8% increases for Atlanta, Austin, Charlotte, and New York. the S&P 500 and NASDAQ, respectively Coker Capital operates as a division of Fifth Third Securities, Inc. (“Fifth Third”) – Sub-sectors that experienced the largest increase in Q1 2021 include Specialty Pharmacy Services (+17.9%), Assisted Living and Long-Term For more information, please visit www.cokercapital.com Care (+16.1%), and Distribution and Supplies (+14.0%) If you are considering an M&A transaction, or – Other Outsourced Services (8.6%), Hospice and Home Care (5.6%), and would like to discuss other strategic HCIT (5.3%) have declined the most 2021 YTD alternatives, please contact one of the Refer to Pages 3 – 4 for additional detail professionals below. Valuation Update Steve Aguiar Managing Director ▪ The median Firm Value (FV) / 2021P EBITDA multiple for the 103 617-872-7611 companies in Coker Capital’s healthcare services comp set was 12.3x as of [email protected] space 03/31/2021 James Heidbreder -

2019 NA American Well (48)

FROST & SULLIVAN BEST PRACTICES AWARD TELEHEALTH SERVICES - NORTH AMERICA Company of the Year 2019 BEST PRACTICES RESEARCH Contents Background and Company Performance ........................................................................ 3 Conclusion........................................................................................................... 8 Significance of Company of the Year ............................................................................. 9 Understanding Company of the Year ............................................................................. 9 Key Benchmarking Criteria .................................................................................. 10 Best Practices Recognition: 10 Steps to Researching, Identifying, and Recognizing Best Practices ................................................................................................................. 11 The Intersection between 360-Degree Research and Best Practices Awards ..................... 12 Research Methodology ........................................................................................ 12 About Frost & Sullivan .............................................................................................. 12 © Frost & Sullivan 2019 2 “We Accelerate Growth” BEST PRACTICES RESEARCH Background and Company Performance Industry Challenges According to the World Health Organization, global expenditure on healthcare reached $7.3 trillion in 2015, with the United States (US) far exceeding other high-income countries.1 Nevertheless, -

Deconstructing the Telehealth Industry: Part Iii Enabling Clinicians to Do More Good for More People

DECONSTRUCTING THE TELEHEALTH INDUSTRY: PART III ENABLING CLINICIANS TO DO MORE GOOD FOR MORE PEOPLE WINTER 2020 • INDUSTRY WHITE PAPER ABOUT THE AUTHORS Grant Chamberlain joined Ziegler in 2015 as a managing director in the Corporate Finance Healthcare Practice. With over 20 years of investment banking experience, Grant has advised some of the leading healthcare systems, including Sharp Healthcare, Cedars-Sinai and Baylor Health, along with several of the most innovative virtual care companies, including AirStrip, MDLive, Voalte, IRIS, Forefront Telecare and Regroup. Prior to Ziegler, Grant led the mHealth sector coverage at Raymond James – which included telehealth, remote monitoring and wireless healthcare solutions – after spending 15 years advising HCIT and tech-enabled outsourced services companies on a broad variety of M&A, joint ventures/partnerships and private financings. Additionally, Grant has completed dozens of transactions in the physician practice management space with a specific concentration in GRANT CHAMBERLAIN oncology, having closed over 15 deals in that sector in his career. MANAGING DIRECTOR Prior to Raymond James, Grant was a principal at Shattuck Hammond Partners, which was 312 596 1550 acquired by Morgan Keegan. He was also a part of the corporate finance group of General Electric [email protected] Capital Corporation and the financial services division of GE Medical Systems. In addition, Grant is an elected Director of the American Telemedicine Association (ATA), the leading international advocate for the use of advanced remote medical technologies. He is also on the Board of Directors for the MAVEN Project, which uses virtual care and a network of volunteer physicians affiliated with the nation’s foremost medical school alumni associations to improve healthcare access for underserved populations. -

October 2015 Edition – Full Issue (Pdf)

FEATURE REPORT: DEVELOPMENTS IN TELEHEALTH – SEE PAGE 10 Publications Mail Agreement #40018238 CANADA’S MAGAZINE FOR MANAGERS AND USERS OF INFORMATION SYSTEMS IN HEALTHCARE VOL. 20, NO. 7 OCTOBER 2015 INSIDE: APPS FOR HEALTHCARE PAGE 14 Real-time ED clock Patients are able to check how long they will be waiting to see a doctor in the Emergency Depart- ment at Markham Stouffville Hos- pital, in Markham, Ont. The system allows them to plan their visits, and to make arrangements for children, family and friends. Page 6 Remote pharmacy support Five small and mid-sized hospitals across Ontario have implemented a cloud-based system that includes quick and effective review of physi- PHOTO: DALE MACMILLAN Edmonton prepares for gamma knife centre cian medication orders by pharma- The ground has been broken on the site of a $17.5 million Gamma Knife and Clinical MRI Centre. Pictured with the augur operator are: cists, around the clock. The tech- Guy Scott, Brain Centre Campaign Co-Chair; Alberta Health Minister Sarah Hoffman; Vickie Kaminski, CEO of Alberta Health Services; Jim nology is supplied by Ricoh Canada Brown, Campaign Co-Chair; and Dr, Keith Aronyk, Director, Division of Neurosurgery, University of Alberta Hospital. SEE STORY ON PAGE 7. and North West Telepharmacy. Page 4 Super-nurses for homecare An innovative eShift system is en- Video-visits with doctors are taking off in U.S. abling remote nurses to supervise and care for up to six patients in BY HUGH MACKENZIE tool (by 57.8 percent) and the most widely of time it takes to get an appointment, and their own homes, assisted by care considered for future use (by 67.1 percent). -

Leonis Healthcare Index 4Q 2020 Index Summary

4Q- 2020 LEONIS PARTNERS: 4 TH QUARTER 2020 HEALTHCARE ANALYSIS ANALYSIS OF HEALTHCARE VALUATIONS & KEY DRIVERS IN PUBLIC AND PRIVATE MARKETS. STRICTLY PRIVATE AND CONFIDENTIAL LEONIS PARTNERS EXPERIENCED HEALTHCARE ADVISORS. 2020 Award 2020 Award 2019 Award Winner Winner Winner LEONIS CREDENTIALS & SERVICES FIRM OVERVIEW ▪ Leonis provides M&A and Growth Capital advisory services ▪ Bankers with over 50 years of combined experience in bulge bracket to both high-growth and well-established technology and Wall Street firms and in the Middle Market technology services companies ▪ Team has executed over 130 M&A, restructuring and capital raising deals with cumulative transaction values over $180 billion Leonis core areas of focus: ▪ Deep knowledge of strategic and financial buyers with a proprietary database of more than 4,200 private equity investors and 1,800 ▪ Sell-side M&A: Represent companies looking to be acquired domestic and international strategic acquirers by a strategic or go through a fulsome liquidity event with a ▪ Team with experience advising, operating, and investing in businesses financial sponsor within the firm’s core areas provides an unbiased view of how “the other side will look at a deal” ▪ Capital Raises: ▪ Winner of M&A Atlas’ 2020 and 2019 Americas FinTech Deal of the – Majority Equity Raises: Recapitalizations from private Year, 2020 Americas Corporate Deal of the Year, and a 2020 Finalist for Boutique Technology Investment Bank of the Year equity & growth equity firms who understand the sector ▪ Winner of M&A Advisors’ -

American Well Corporation (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-k (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission File Number 001-39515 American Well Corporation (Exact name of Registrant as specified in its charter) Delaware 20-5009396 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 75 State Street, 26th Floor Boston, MA 02109 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (617) 204-3500 Securities registered pursuant to Section 12(b) of the Act: Trading Title of each class Symbol(s) Name of each exchange on which registered Class A common stock, par value of $0.01 per share AMWL The New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒ Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Coker Capital's Healthcare Services Newsletter – July 2020

Healthcare Services M&A Coker Capital’s Healthcare Services Newsletter – July 2020 In this issue of the Coker Capital Healthcare Services Newsletter, we provide an July, 2020 st update on Healthcare Services activity through the 1 Half of 2020. In addition, Coker Capital provides mergers and we spotlight Telehealth and review trends and activity across that sector. acquisitions advisory services to middle market healthcare companies throughout the United States. Coker Capital operates from offices in Atlanta, Austin, Charlotte, and New York. Coker Capital operates as a division of Fifth Market Performance Third Securities, Inc. (“Fifth Third”) (1) ▪ The S&P Healthcare Services Select Index underperformed the broader For more information, please visit market in Q2 2020, increasing +18.0% versus +20.0% and +30.6% www.cokercapital.com increases for the S&P 500 and NASDAQ, respectively If you are considering an M&A transaction, or – Sub-sectors that have experienced the largest increase in 2020 YTD would like to discuss other strategic alternatives, please contact one of the include HCIT (+25.3%), Physician Services and Alternate Site professionals below. (+13.2%), and Hospice and Home Health (+12.5%) Steve Aguiar – Hospitals (35.4%), Behavioral Health (33.2%), and Long-term Care Managing Director (28.7%) have declined the most 2020 YTD O: 617-872-7611 [email protected] space Refer to Pages 3 – 4 for additional detail Dan Davidson Valuation Update Managing Director 678.832.2003 ▪ The Firm Value (FV) / 2020P EBITDA multiple for the