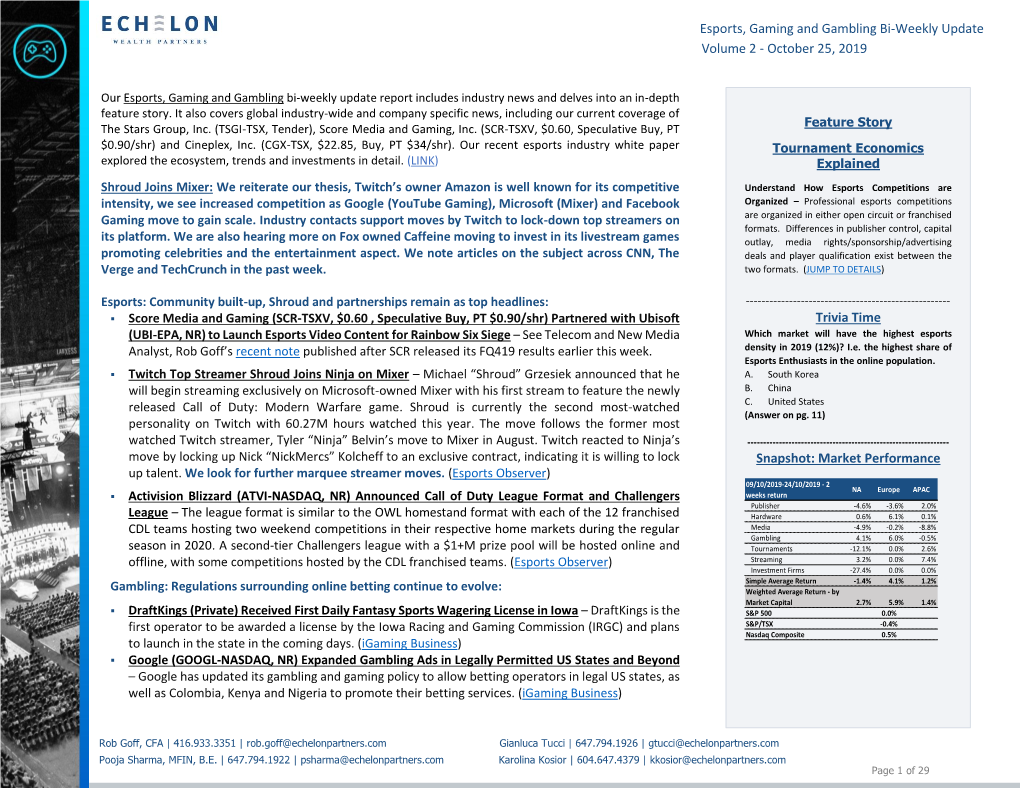

Esports, Gaming and Gambling Bi-Weekly Update Volume 2 - October 25, 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

„Kolíska“ Šťastia Sagan Skončil!

Piatok 9. 7. 2021 75. ročník • číslo 156 cena 0,90 pre predplatiteľov 0,70 App Store pre iPad a iPhone / Google Play pre Android Sagan skončil! Černák píše Hokejista Tampy Bay je prvý Slovák, históriu ktorý obhájil Stanleyho pohár Strana 22 Strany 20 a 21 Peter Sagan odstúpil z Tour de France. Cyklista tímu Bora-hansgrohe skončil pre zhoršujúce sa zranenie kolena, ktoré utrpel po páde v závere 3. etapy. Neustále musel byť pod dohľadom lekára. FOTO BORA-HANSGROHE Strany 3 – 7 „Kolíska“ šťastia Anglicko zdolalo v semifinále ME Dánsko 2:1 po predĺžení. Hráči z kolísky futbalu si prvý raz zahrajú o cennú trofej na kontinentálnom šampionáte. V nedeľu nastúpia proti Taliansku. FOTO TASR/AP FOTO INSTAGRM (eč) Prvý zápas 1. predkola Konferenčnej ligy: MŠK Žilina – FC Dila Gori 5:1 (2:0) 2 NÁZORY piatok 9. 7. 2021 PRIAMA REČ MARTINA PETRÁŠA Zaslúžené finálové obsadenie Finále európskeho šampionátu obsta- futbalistom, ktorí sa stotožnili s jeho filo- „ O trofej zabojujú dva tímy, ktoré že palce držím Taliansku, kde som nielen rajú Taliansko a Anglicko. Absolútne za- zofiou. Mužstvo predvádza fantastický hrával, ale stále tam trávim veľkú časť slúžene. O trofej zabojujú dva tímy, ktoré futbal v duchu moderných trendov. Hráči na turnaji predvádzajú najlepší futbal. svojho života. V krajine vládla podobná na turnaji predvádzajú najlepší futbal. Ve- majú okrem fyzického fondu aj kvalitu eufória naposledy v roku 2006, keď sa dú ich tréneri, ktorí dokázali zmeniť dl- a pritom Taliansko nič nestratilo zo svojej na tých istých postoch ako v národnom tí- reth Southgate rovnako ako jeho náproti- stali majstrami sveta. -

Evolve E-Gaming Index ETF MACROECONOMIC

MONTHLY COMMENTARY Evolve E-Gaming Index ETF HERO invests in equity securities of companies listed domestically and globally with business activities in the electronic gaming industry. As at September 30, 2019 TICKER: HERO (Hedged) MACROECONOMIC HIGHLIGHTS: Incidentally, Enthusiast Gaming has now become one of the largest gaming properties in the world, surpassing IGN Entertainment, GameSpot, and even Twitch.tv, according to a new Comscore evaluation. This follows a series of inter-related transactions, which saw Enthusiast entering into an M&A arrangement with J55 Capital Corporation and Aquilini GameCo way back in May. At the same time Aquilini was in the process of acquiring Luminosity Gaming, a global player in the esports industry. Once Aquilini acquired Luminosity, J55 acquired Aquilini and then subsequently merged with Enthusiast. The final result was the creation of one of the largest publicly traded esports and gaming organizations in the world.i Earlier in May, two console gaming heavyweights — Sony and Microsoft signed a memorandum of understanding to develop joint cloud gaming systems. The agreement was largely intended to offset the emergence of Google’s Stadia, a game-streaming service based on the cloud.ii According to SuperData Research, a subsidiary of Nielsen Holdings, global consumers spent US$8.9 billion on digital games worldwide across PC, console and mobile devices in August. This represents a 2% increase over the same period last year, driven in part by an uptick in mobile gaming spending. As of August, mobile gaming accounted for 67% of total worldwide spending in the gaming sector.iii SuperData also listed the highest-grossing games across each platform. -

Optic Gaming Wins Call of Duty® MLG Orlando Open

August 8, 2016 Optic Gaming Wins Call of Duty® MLG Orlando Open NEW YORK--(BUSINESS WIRE)-- The road to the 2016 Call of Duty® World League Championship, Presented by PlayStation® 4 finished its last live qualifying competition yesterday with an epic showdown in Orlando as Optic Gaming won the Call of Duty® MLG Orlando Open. Yesterday's finals completed a thrilling weekend of competition, as eager fans in attendance, online at MLG.tv and other livestreams, and those tuning-in directly through an in-game (BOIII PS4) Live Event Viewer, watched 72 hours of compelling action. Optic Gaming took home the top prize after besting Team Envyus to be the top of more than 100 teams from around the world. Yesterday's exciting tournament also served as the final CWL Pro Points event of the season, as competition now moves to the North American online qualifier as the final stop before the highly anticipated CWL Championship at Call of Duty® XP. At the CWL Championship, 32 teams will play for their share of the biggest single event prize pool in Call of Duty® history, $2 million. With the growth of the Call of Duty World League, Call of Duty esports viewership has increased by more than five times year-over-year to 33 million views of the Stage 1 events this year. The Call of Duty World League Championships at Call of Duty XP is expected to be our most viewed Call of Duty esports event in history by a wide margin. After the dust settled, over 1.4 million cumulative viewers across distribution platforms, including MLG.tv, generated over 8 million video views during the event, consuming over 2 million hours of content throughout the weekend, and peaking at 164,000 concurrent viewers during the thrilling finals match.1 Here are the top eight teams from the Call of Duty MLG Orlando Open: Optic Gaming Team Envyus Team Elevate Faze Clan Rise Nation Luminosity Gaming Cloud9 Complexity Gaming On August 15, 2016, a live broadcast on youtube.com/callofduty will determine the grouping for all the qualified teams. -

EG Presentation

The Largest Gaming Media Platform in North America Investor Presentation October 2020 TSX: EGLX OTC: ENGMF FSE: 2AV Disclaimer CAUTIONARY STATEMENTS This presentation is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. The information contained herein has been prepared for the purpose of providing interested parties with general information to assist them in their evaluation of Enthusiast Gaming Holdings Inc. (“Enthusiast Gaming”) and this presentation should not be used for any other purpose. Under no circumstances may the contents of this presentation be reproduced, in whole or in part, in any form or forwarded or further redistributed to any other person. Any forwarding, distribution or reproduction of this document in whole or in part is unauthorized. By accepting and reviewing this document, you acknowledge and agree (i) to maintain the confidentiality of this document and the information contained herein, and (ii) to protect such information in the same manner you protect your own confidential information, which shall be at least a reasonable standard of care. Enthusiast Gaming has not authorized anyone to provide additional or different information. In this presentation all amounts are in Canadian dollars unless stated otherwise. The delivery of this presentation, at any time, will not imply that the information contained herein is correct as of any time subsequent to the date set forth on the cover page hereof or the date at which such information is expressed to be stated, as applicable, and, except as may be required by applicable law, Enthusiast Gaming is under no obligation to update any of the information contained herein (including forward looking statements and forward looking information) or to inform the recipient of any matters of which it becomes aware that may affect any matter referred to in this presentation (including, but not limited to, any error or omission which may become apparent after this presentation has been prepared). -

19 Overwatch Checklist Poster NEW 20 Teams ROOKIE and Base

EXCLUSIVELY LICENSED OVERWATCH LEAGUE™ TRADING CARDS CARD# PLAYER CARD# PLAYER CARD# PLAYER CARD# PLAYER CARD# PLAYER CARD# PLAYER CARD# PLAYER CARD# PLAYER CARD# PLAYER 1 SNOW 26 MANNETEN 51 HYDRATION 76 MEKO 101 DANTEH CHECKLIST ROOKIES STAR 201 ERSTER 226 SWON 251 FL0W3R 276 AID 2 NOTE 27 ZEBBOSAI 52 ASHER 77 PINE 102 IDDQD 202 MASAA 227 BQB 252 NENNE 277 ENVY 3 AVAST 28 CWOOSH 53 FISSURE 78 MANO 103 ARCHITECT 203 DAFRAN 228 KRIS 253 GREYY 278 BUMPER (OVERWATCH LEAGUE HIGH SERIES SET) HIGH SERIES LEAGUE (OVERWATCH BASE SET CHECKLIST SET BASE 4 KALIOS 29 AWESOMEGUY 54 IREMIIX 79 LIBERO 104 MIRO 204 NLAAER 229 XEPHER 254 LHCLOUDY 279 STITCH 5 AIMGOD 30 MUMA 55 SHAZ 80 JOEMEISTER 105 GIDO 205 KODAK 230 APPLY 255 KRUISE 280 SEOMINSOO 6 GAMSU 31 CLOCKWORK 56 BIGGOOSE 81 CARPE 106 ZUNBA 206 GATOR 231 RIO 256 HYP 281 SLIME 7 NEKO 32 BOINK 57 SUREFOUR 82 FRAGI 107 KUKI 207 DACO 232 HAPPY 257 BENBEST 282 JJANU 8 STRIKER 33 LINKZR 58 VOID 83 SHADOWBURN 108 RYUJEHONG 208 POKPO 233 ONLYWISH 258 NICOGDH 283 HOOREG 9 MISTAKES 34 ARHAN 59 KARIV 84 DAYFLY 109 FLETA 209 DOGMAN 234 EILEEN 259 ELK 284 TWILIGHT 10 KELLEX 35 JAKE 60 FATE 85 POKO 110 XEPHER 210 BLASÉ 235 SHU 260 SMURF 285 HAKSAL 11 HARRYHOOK 36 BANI 61 CUSTA 86 BOOMBOX 111 WEKEED 211 COLOURHEX 236 KYB 261 RASCAL 286 SANSAM 12 UNKOE 37 MENDOKUSAII 62 FINNSI 87 SNILLO 112 MUNCHKIN 212 ALEMAO 237 CHARA 262 VIOL2T 287 STRATUS 13 TAIMOU 38 FCTFCTN 63 NUMLOCKED 88 EQO 113 TOBI 213 -

Sports & Esports the Competitive Dream Team

SPORTS & ESPORTS THE COMPETITIVE DREAM TEAM JULIANA KORANTENG Editor-in-Chief/Founder MediaTainment Finance (UK) SPORTS & ESPORTS: THE COMPETITIVE DREAM TEAM 1.THE CROSSOVER: WHAT TRADITIONAL SPORTS CAN BRING TO ESPORTS Professional football, soccer, baseball and motor racing have endless decades worth of experience in professionalising, commercialising and monetising sporting activities. In fact, professional-services powerhouse KPMG estimates that the business of traditional sports, including commercial and amateur events, related media as well as education, academic, grassroots and other ancillary activities, is a US$700bn international juggernaut. Furthermore, the potential crossover with esports makes sense. A host of popular video games have traditional sports for themes. Soccer-centric games include EA’s FIFA series and Konami’s Pro Evolution Soccer. NBA 2K, a series of basketball simulation games published by a subsidiary of Take-Two Interactive, influenced the formation of the groundbreaking NBA 2K League in professional esports. EA is also behind the Madden NFL series plus the NHL, NBA, FIFA and UFC (Ultimate Fighting Championship) games franchises. Motor racing has influenced the narratives in Rockstar Games’ Grand Theft Auto, Gran Turismo from Sony Interactive Entertainment, while Psyonix’s Rocket League melds soccer and motor racing. SPORTS & ESPORTS THE COMPETITIVE DREAM TEAM SPORTS & ESPORTS: THE COMPETITIVE DREAM TEAM In some ways, it isn’t too much of a stretch to see why traditional sports should appeal to the competitive streaks in gamers. Not all those games, several of which are enjoyed by solitary players, might necessarily translate well into the head-to-head combat formats associated with esports and its millions of live-venue and online spectators. -

Forthlane Fridays – Guest Bios Session 8: the Future of Sports

Forthlane Fridays – Guest Bios Session 8: The Future of Sports David Beeston EVP & CHIEF STRATEGY OFFICER, BOSTON RED SOX & FENWAY SPORTS MANAGEMENT Dave Beeston joined the Boston Red Sox & Fenway Sports Management in March of 2013 and was named Executive Vice President and Chief Strategy Officer in February 2018. In his role, Beeston has varied responsibilities. He acts as a senior advisor to Sam Kennedy and Fenway Sports Group (FSG) ownership on key matters, including internal and external communication. In addition to the Boston Red Sox, FSG owns Liverpool F.C. Additionally, Dave is responsible for the execution and oversight of many of the key relationships of the Club, including with its media, concessions and merchandise partners. Finally, in his strategy role, he is charged with creating and executing new business initiatives and new lines of revenue for the Club and FSG, evaluating external opportunities presented to the Company, and acting as an internal resource for all Club departments, with a focus on long-term organizational objectives. Beeston spent the seven years prior to joining the Red Sox as an associate at Skadden, Arps, Slate, Meagher & Flom LLP, with a focus on securities transactions. A Toronto, Ontario native, Beeston completed his undergraduate and law degrees at the University of Western Ontario, graduating from the latter "with distinction." He formerly served on the Board of "Youth Without Shelter", a Toronto based teen homeless shelter, and currently serves on the Boston Medical Center's Exceptional Care Without Exception Trust Board. The son of former long-time Toronto Blue Jays and Major League Baseball executive Paul Beeston, he currently resides in Boston with his wife, Katie, and sons, Bobby and Jack. -

2020 Upper Deck Overwatch League Ultimate Fan (#Owlultimatefan) Program Contest Official Rules

2020 UPPER DECK OVERWATCH LEAGUE ULTIMATE FAN (#OWLULTIMATEFAN) PROGRAM CONTEST OFFICIAL RULES NO PURCHASE NECESSARY TO ENTER OR WIN. A PURCHASE WILL NOT INCREASE YOUR ODDS OF WINNING. WINNERS WILL BE REQUIRED TO RESPOND TO THE WINNER NOTIFICATION AND/OR COMPLETE AND EXECUTE A RELEASE AND PRIZE ACCEPTANCE AGREEMENT AND ANY OTHER LEGAL DOCUMENTS WITHIN THE TIMEFRAME REQUIRED BY SPONSOR OR PRIZES MAY BE FORFEITED (IN SPONSOR’S SOLE DISCRETION). ANY TERMS DEFINED IN THE RELEASE SHALL BE THE SAME AS THOSE DEFINED IN THE RULES. BY ENTERING THIS CONTEST DEFINED BELOW, YOU AGREE TO THESE OFFICIAL RULES, WHICH ARE A CONTRACT, SO READ THEM CAREFULLY BEFORE ENTERING THIS CONTEST. THIS CONTEST EXPRESSLY EXCLUDES QUEBEC, FLORIDA, RHODE ISLAND AND PUERTO RICO. WITHOUT LIMITATION, THIS CONTRACT INCLUDES INDEMNITIES TO THE SPONSOR FROM YOU AND A LIMITATION OF YOUR RIGHTS AND REMEDIES. 1. NAME OF CONTEST: 2020 Upper Deck Overwatch League Ultimate Fan Program Contest (“Contest”). 2. SPONSOR: This Contest is sponsored by The Upper Deck Company located at 5830 El Camino Real, Carlsbad, California 92008 (“UDC” or “Sponsor”). 3. CONTEST PERIOD: August 27, 2020 at 9 a.m. Pacific Standard Time (“PST”) to October 5, 2020 at 9 p.m. PST (“Contest Period”). For more information please see the Contest details located at www.upperdeck.com/OWLUltimateFan (the “Website”). 4. ELIGIBILITY: The Contest is open and offered only to natural persons Entrants who are legal residents of (a) the fifty (50) United States of America (“USA”), including Washington D.C., but excluding Florida, Rhode Island and Puerto Rico who are at least eighteen (18) years old or the age required in the state in which he or she resides at the time of Entry in the USA, and/or (b) the provinces and territories of Canada, excluding Quebec, who have reached the age of majority in their jurisdiction of residence. -

1 Columbus Blue Jackets News Clips August 22 – September 3, 2019

Columbus Blue Jackets News Clips August 22 – September 3, 2019 Columbus Blue Jackets PAGE 02 Columbus Dispatch: Zach Werenski seeking three-year contract at $5 million-plus annually, source says PAGE 03 The Athletic: ‘God gives us only what we can handle’: Blue Jackets pay surprise visit to ailing fan PAGE 06 Columbus Dispatch: Michael Arace | Jarmo Kekalainen's confidence in Blue Jackets prospects not shared by all PAGE 08 Columbus Dispatch: How the Blue Jackets and their Metro opponents fared in the offseason PAGE 11 The Athletic: Analysis: Glass half empty — how the Blue Jackets season could unravel PAGE 14 The Athletic: Analysis: Glass half full — how the Blue Jackets can be better than most expect PAGE 17 ESPN.com: 'Let's have all the people write us off': Blue Jackets GM confident in his team PAGE 21 Columbus Dispatch: Emil Bemstrom to miss prospects tournament with facial injury; should be OK for Blue Jackets camp PAGE 22 The Athletic: Sergei Mozyakin: The Greatest Blue Jacket who never was PAGE 27 Columbus Dispatch: Opportunity knocks for Columbus Blue Jackets' prospects Cleveland Monsters/Prospects NHL/Websites PAGE 29 The Athletic: What would a World Cup of Hockey in 2021 look like? PAGE 33 The Athletic: In a league full of exceptional talents, which special skills make the NHL’s best jealous PAGE 40 The Athletic: DGB Grab Bag: About those unsigned RFAs, in defense of a bad stat and laughing at the 1993 Leafs PAGE 44 The Seattle Times: Seattle NHL team’s name? Uniform colors? Here’s where fans rant, vent and even chat over beers -

Esports: a Whole Different Ball Game

Esports A Whole Different Ball Game BY AARON D. LOVAAS, ESQ. Boston Uprising, London About Esports Shaquille O’Neal, Joe Montana and the 1 Spitfire, San Francisco Oversimplified, esports is competitive Wilpon family (think New York Mets). video game play. However, unlike going Clearly, this is serious sports business. Shock, Shanghai Dragons: for the high score on a game like PacMan, If there are any lingering doubts, One might guess these esports involves head-to-head, real-time consider further that the NBA is now the competition, in which players dedicate first of the “big four” sports leagues to were the doomed team themselves to one particular game and venture directly into esports. The NBA monikers of some now- one specific character or avatar, develop 2K League, a joint venture between proficiency in utilizing the skill set the NBA and Take-Two Interactive defunct, professional programmed specifically to that avatar, Software, commenced its first season in indoor soccer league. To assemble teams with complementary skill May 2018, following scouting, a player combine and a full-blown draft at Madison the contrary, these are sets and develop fan bases through online broadcasts of the gaming action. Of course, Square Garden, presided over by NBA four of the 12 franchised, esports is also about money. Commissioner Adam Silver. The NBA city-based teams of the To begin to appreciate the scope 2K League consists of 17 teams, each and popularity of esports today, consider representing and owned by a real-life NBA Overwatch League (OWL). the recent launch of the OWL. In 2016, counterpart (e.g. -

Asistent Greguš Na Tróne Holec

Piatok 24. 7. 2020 74. ročník • číslo 171 cena 0,80 pre predplatiteľov 0,70 App Store pre iPad a iPhone / Google Play pre Android Slovan „loví“ zvučné mená Strany 20 a 21 Do Bratislavy prichádza Buček, Rapáč i Bortňák, hovorí sa aj o Sukeľovi Asistent Greguš Chvály na Ružičku Na tróne Ján Greguš je v popredí poradia najlepších „prihrávačov“ americkej MLS. V kempe Calgary sa na reštart sezóny pripravuje aj Adam Ružička, ktorý Po odohratí piatich zápasov je so štyrmi asistenciami na delenej druhej zatiaľ čaká na premiéru v NHL. Kompetentní ho chvália, a tak sa môže priečke. Aj v remízovom stredajšom zápase proti Coloradu sa podieľal na stať, že ouvertúru v najprestížnejšej hokejovej súťaži na svete zažije urastený center už v play-off. FOTO INSTAGRAM (ar) Holec oboch góloch svojho mužstva. FOTO MLS Strana 4 Strany 20 a 21 Podľa vzoru mnohých zahranič- ných športových médií sme sa aj v našom denníku rozhodli vo futbalovej sezóne 2019/20 známkovať hráčov po každom zápase. Dlhodobú štatistiku ovládol Dominik Holec. Brankár Žiliny, ktorý v marci dostal pod Dubňom výpoveď, bude ako prvý „sedieť“ na našom pomyselnom tróne. FOTO TASR/LUKÁŠ GRINAJ Strany 8 a 9 Ďalšie číslo humoristického časopisu BUMerang POZOR! UŽ ZAJTRA 2 NÁZORY piatok 24. 7. 2020 PRIAMA REČ JINDŘICHA NOVOTNÉHO Stavjaňa nie je spasiteľ, záruka kvality áno Od sezóny 2012/13 boli fanúšikovia vať ofenzívnejší štýl. Nakoniec sa s muž- ďalšej kanadskej opory Judda Blackwa- hokejistov Nitry zvyknutí na medailovú stvom lúčil aj on a dvojica funkcionárov, „ Od skúseného trénera očakávajú tera, ktorý po nich už nenašiel obvyklý žatvu, v ktorej vynikal historický titul Miroslav Kováčik s Tomášom Chren- návrat na medailové pozície. -

Pasdecrisepourles Locauxd'entreprises

Big Caesar Chicken Salad Auch als Chicken McWrap® Chicken Caesar Ab 03.02.2020 /mcdlu 4Käsegipfel Riffelkartoffeln As long as stocks last. ©2020McDonald’s Coca-Cola ist eineeingetragene Schutzmarkeder TheCoca-ColaCompany. N°2832 MERCREDI Pas de crise pour les 29 JANVIER 2020 Europe 9 Le Portugal ne sera plus un eldorado pour les retraités locaux d'entreprises Le dynamisme sur le marché de l'immobi- cinq ans. Même constat pour les surfaces lier d'entreprise au Grand-Duché ne se dé- commerciales, portées par des projets tels ment pas. Selon des chiffres présentés hier le centre commercial Cloche d'Or ou le com- par JLL, la prise en occupation des bureaux plexe Royal-Hamilius. Là, la prise en occu- en 2019 a dépassé de 20 % la moyenne sur pation s'est carrément envolée. PAGE 12 Ruée sur les masques au Luxembourg Cinéma 15-26 Avant «#MeToo», scandale à la télévision américaine Sports 39 Danel Sinani attendra l'été pour rejoindre l'Angleterre Météo 40 La demande en masques de protection a largement augmenté au Luxembourg. Certaines pharmacies sont en rupture de stock. MATIN APRÈS-MIDI LUXEMBOURG Après des cas signalés 100 morts en Chine et ne cesse de cies ont été prises d'assaut pour en France et en Allemagne, la progresser, à tel point que le des demandes de masques de pro- 2° 5° crainte du coronavirus gagne le Grand-Duché a relevé son niveau tection. Des établissements sont Luxembourg. Ce virus a fait plus de d'alerte. Conséquence, les pharma- déjà en rupture de stock. PAGE 3 2 Actu MERCREDI 29 JANVIER 2020 / LESSENTIEL.LU «Igor le Russe» en box blindé Un espoir du cinéma français arrêté MADRID L'Espagne juge depuis MARSEILLE Révélé par hier dans un box blindé un son rôle dans le film «Shé- meurtrier présumé surnommé hérazade», Dylan Robert, «Igor le Russe», condamné 20 ans, dort en prison.