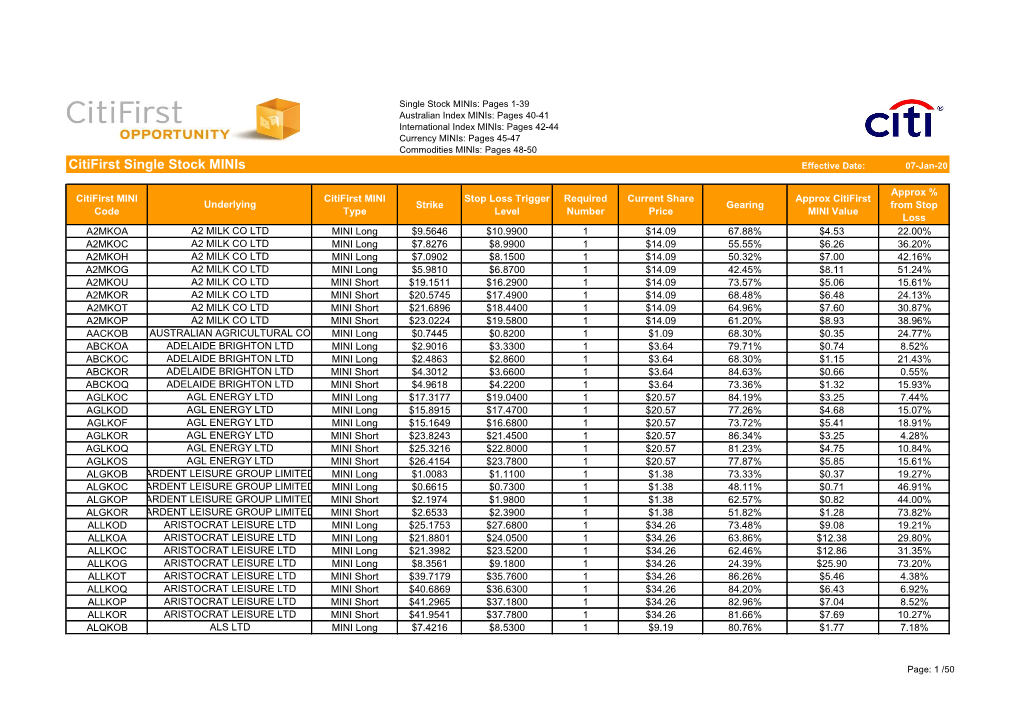

Citifirst Single Stock Minis Effective Date: 07-Jan-20

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ASX Announcement (All Currency Figures Are in Australian Dollars Unless Otherwise Stated)

Afterpay Limited ASX: APT ASX Announcement (all currency figures are in Australian dollars unless otherwise stated) 7 July 2020 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES TRADING UPDATE, CAPITAL RAISING AND CO-FOUNDER SELL-DOWN1 Afterpay Limited (Afterpay or the Company) is pleased to provide a trading update for the three month period ended 30 June 2020 (Q4 FY20) and the financial year ended 30 June 2020 (FY20). Afterpay also announces a capital raising of approximately $800m that includes a fully underwritten institutional Placement to raise $650m, followed by a non-underwritten Share Purchase Plan that aims to raise approximately $150m. KEY HIGHLIGHTS ● Strong performance across the business has delivered underlying sales of $11.1b in FY20, more than doubling the prior corresponding period (pcp) (up 112%). ● Underlying sales in Q4 FY20 was $3.8b, 127% above Q4 FY19. ● Q4 FY20 sales performance represented the highest quarterly performance ever, reflecting the accelerating shift to e-commerce spending since the impacts of COVID-19 emerged globally. ● Merchant revenue margins for FY20 are expected to be in line with or better than H1 FY20 and FY19. ● Net Transaction Loss (NTL) for FY20 is expected to be up to 55 basis points. ANZ NTL has remained at historically low levels and NTL within the US and UK regions has improved in 2H FY20 compared to 1H FY20 as a result of improving risk performance and historically high payment recovery rates. ● Net Transaction Margin (NTM) for FY20 is expected to be approximately 2%, underpinning a pathway to longer term profitability for the overall business. -

Code Security Description AAD ARDENT LEISURE GROUP ABC ADELAIDE BRIGHTON AGL AGL ENERGY LTD AHG AUTOMOTIVE HOLDINGS G AMP AMP LI

15-Jun-16 Australian Dividend Index Trust NTA & Allotment Notice The manager of the Australian Dividend Index Trust advises that as at close of business on 14 June 2016 a total of Nil units has been redeemed or allotted since 13 June 2016. The total number of units on issue on that day was 39,290,493. The asset backing for each ASD unit at close of business (Sydney) on 14 June 2016 was $1.49373 (NTA is net of applicable tax liability). The tracking difference was 2.35% Please note Basket applications and redemptions will be unavailable from Wednesday 15 June to Wednesday 29 June. Basket applications and redemptions will resume on Thursday 30 June. The following companies are currently in the Fund: Code Security description AAD ARDENT LEISURE GROUP ABC ADELAIDE BRIGHTON AGL AGL ENERGY LTD AHG AUTOMOTIVE HOLDINGS G AMP AMP LIMITED ANZ AUSTRALIA AND NEW ZEA APA APA GROUP AST AUSNET SERVICES ASX ASX LIMITED BEN BENDIGO AND ADELAIDE BOQ BANK OF QUEENSLAND CBA COMMONWEALTH BANK OF CGF CHALLENGER LIMITED CIM CIMIC GROUP LIMITED O CSR CSR LIMITED DOW DOWNER EDI LIMITED DUE DUET GROUP FLT FLIGHT CENTRE TRAVEL FXJ FAIRFAX MEDIA LTD FXL FLEXIGROUP LIMITED GEM G8 EDUCATION ORD GMA GENWORTH MORTGAGE INS HVN HARVEY NORMAN HOLDING IAG INSURANCE AUSTRALIA G IFL IOOF HOLDINGS LTD JBH JB HI-FI LIMITED LLC LENDLEASE CORPORATION MMS MCMILLAN SHAKESPEARE MQG MACQUARIE GROUP LTD NAB NATIONAL AUSTRALIA BA NVT NAVITAS LIMITED ORI ORICA LIMITED PPT PERPETUAL TRUSTEES AU PTM PLATINUM ASSET MANAGE RFG RETAIL FOOD GROUP RIO RIO TINTO LIMITED SHL SONIC HEALTHCARE LTD SKI SPARK INFRASTRUCTURE SPK SPARK NEW ZEALAND LIM SPO SPOTLESS GROUP HOLDIN SUL SUPER RETAIL GROUP LI SUN SUNCORP GROUP LTD SVW SEVEN GROUP HOLDINGS SYD SYDNEY AIRPORT UNITS TCL TRANSURBAN GROUP (ORD TLS TELSTRA CORPORATION L WBC WESTPAC BANKING CORP WES WESFARMERS LIMITED WOW WOOLWORTHS LIMITED WPL WOODSIDE PETROLEUM LT For further information please contact: Smartshares Limited 0800 80 87 80 [email protected]. -

Annual Report 2014 Contents

#LOVEBOQ ANNUAL REPORT 2014 CONTENTS DIRECTORS’ REPORT 2 DIRECTORS’ DETAILS 2 OPERATING AND FINANCIAL REVIEW 5 PERFORMANCE REMUNERATION REPORT 12 INTRODUCTORY MESSAGE 12 REMUNERATION REPORT 12 LEAD AUDITOR’S INDEPENDENCE DECLARATION 36 CORPORATE GOVERNANCE 37 SNAPSHOT FINANCIAL REPORT 47 INCOME STATEMENTS 47 STATEMENTS OF COMPREHENSIVE INCOME 48 BALANCE SHEETS 49 STATEMENTS OF CHANGES IN EQUITY 50 STATEMENTS OF CASH FLOWS 54 NOTES TO THE FINANCIAL STATEMENTS 55 OTHER INFORMATION 113 DIRECTORS’ DECLARATION 113 INDEPENDENT AUDITOR’S REPORT TO THE MEMBERS 114 SHAREHOLDING DETAILS 116 SHAREHOLDER INFORMATION 119 PERFORMANCE SNAPSHOT STATUTORY NETafter PROFITtax EARNINGS PER SHARE cash basic up up 5m to . to $260 89.5c CASH EARNINGS after tax DIVIDEND PERfull SHAREyear ordinary up up to $301.2m to 66c 1 Bank of Queensland Limited and its Controlled Entities A.B.N. 32 009 656 740. DIRECTORS’ REPORT Year Ended 31 August 2014 The Directors’ present their report together with the financial report of Bank of Queensland Limited (“the Bank”) and of the Consolidated Entity, being the Bank and its controlled entities for the year ended 31 August 2014 and the independent auditor’s report thereon. DIRECTORS’ DETAILS The Directors of the Bank at any time during or since the end of the financial year are: Name, qualifications and independence status Age Experience, special responsibilities and other Directorships Roger Davis 62 Mr Davis was appointed Chairman on 28 May 2013 and has been a Director since August B.Econ. (Hons), 2008. He has 32 years’ experience in banking and investment banking in Australia, the US and Master of Philosophy Japan. -

Takeovers + Schemes Review

TAKEOVERS + SCHEMES REVIEW 2018 GTLAW.COM.AU 1 THE GILBERT + TOBIN 2018 TAKEOVERS AND SCHEMES REVIEW 2017 demonstrated a distinct uptick in activity for Australian public company mergers and acquisitions. Some key themes were: + The number of transactions announced increased by 37% over 2016 and aggregate transaction values were among the highest in recent years. + The energy & resources sector staged a recovery in M&A activity, perhaps signalling an end to the downwards trend observed over the last six years. The real estate sector made the greatest contribution to overall transaction value, followed closely by utilities/infrastructure. + Despite perceived foreign investment headwinds, foreign interest in Australian assets remained strong, with Asian, North American and French acquirers featuring prominently. Four of the five largest transactions in 2017 (including two valued at over $5 billion) involved a foreign bidder. + There was a material decline in success rates, except for high value deals greater than $500 million. Cash transactions continued to be more successful than transactions offering scrip. Average premiums paid fell slightly. + Regulators continue to closely scrutinise public M&A transactions, with the attendant lengthening of deal timetables. This Review examines 2017’s public company transactions valued over $50 million and provides our perspective on the trends for Australian M&A in 2017 and what that might mean for 2018. We trust you will find this Review to be an interesting read and a useful resource for 2018. 2 -

FTSE World Asia Pacific

2 FTSE Russell Publications 19 August 2021 FTSE World Asia Pacific Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.04 NEW Asustek Computer Inc 0.1 TAIWAN Cheil Worldwide 0.02 KOREA ZEALAND ASX 0.12 AUSTRALIA Cheng Shin Rubber Industry 0.03 TAIWAN AAC Technologies Holdings 0.05 HONG KONG Atlas Arteria 0.05 AUSTRALIA Chiba Bank 0.04 JAPAN ABC-Mart 0.02 JAPAN AU Optronics 0.08 TAIWAN Chicony Electronics 0.02 TAIWAN Accton Technology 0.07 TAIWAN Auckland International Airport 0.06 NEW China Airlines 0.02 TAIWAN Acer 0.03 TAIWAN ZEALAND China Development Financial Holdings 0.07 TAIWAN Acom 0.02 JAPAN Aurizon Holdings 0.05 AUSTRALIA China Life Insurance 0.02 TAIWAN Activia Properties 0.03 JAPAN Ausnet Services 0.03 AUSTRALIA China Motor 0.01 TAIWAN ADBRI 0.01 AUSTRALIA Australia & New Zealand Banking Group 0.64 AUSTRALIA China Steel 0.19 TAIWAN Advance Residence Investment 0.05 JAPAN Axiata Group Bhd 0.04 MALAYSIA China Travel International Investment <0.005 HONG KONG ADVANCED INFO SERVICE 0.06 THAILAND Azbil Corp. 0.06 JAPAN Hong Kong Advantech 0.05 TAIWAN B.Grimm Power 0.01 THAILAND Chow Tai Fook Jewellery Group 0.04 HONG KONG Advantest Corp 0.19 JAPAN Bandai Namco Holdings 0.14 JAPAN Chubu Elec Power 0.09 JAPAN Aeon 0.2 JAPAN Bangkok Bank (F) 0.02 THAILAND Chugai Seiyaku 0.27 JAPAN AEON Financial Service 0.01 JAPAN Bangkok Bank PCL (NVDR) 0.01 THAILAND Chugoku Bank 0.01 JAPAN Aeon Mall 0.02 JAPAN Bangkok Dusit Medical Services PCL 0.07 THAILAND Chugoku Electric Power 0.03 JAPAN Afterpay Touch Group 0.21 AUSTRALIA Bangkok Expressway and Metro 0.02 THAILAND Chunghwa Telecom 0.17 TAIWAN AGC 0.08 JAPAN Bangkok Life Assurance PCL 0.01 THAILAND CIMB Group Holdings 0.08 MALAYSIA AGL Energy 0.04 AUSTRALIA Bank of East Asia 0.03 HONG KONG CIMIC Group 0.01 AUSTRALIA AIA Group Ltd. -

For Personal Use Only Use Personal For

ADDRESS CONTACT DETAILS UNIT REGISTRY Level 16 Telephone +61 2 9409 3670 c/- Link Market Services Limited 61 Lavender Street Investor Services 1800 ARDENT Level 12, 680 George Street Milsons Point NSW 2061 Fax +61 2 9409 3679 Sydney NSW 2000 AUSTRALIA www.ardentleisure.com Locked Bag A14 Sydney South NSW 1235 Telephone 1300 720 560 [email protected] ASX RELEASE 13 June 2012 The Manager Company Notices Section ASX Limited 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam MORGAN STANLEY CONFERENCE PRESENTATION Please find attached for release to the market a presentation to be given by Mr Greg Shaw today at the Morgan Stanley Emerging Companies Conference. Yours faithfully Alan Shedden Company Secretary Ardent Leisure Group is a specialist operator of leisure and entertainment assets across Australia, New Zealand and the United States. The Group operates Dreamworld, WhiteWater World, SkyPoint, d’Albora Marinas, AMF and Kingpin bowling centres and Goodlife fitness centres across Australia and New Zealand. The Group also operates the Main Event family entertainment centres in the United States. For further information on the Group’s activities please visit our website at www.ardentleisure.com.au For personal use only Ardent Leisure Group Comprising Ardent Leisure Trust ARSN 093 193 438 (Manager: Ardent Leisure Management Limited ABN 36 079 630 676, AFS Licence No. 247010) and Ardent Leisure Limited ABN 22 104 529 106 Morgan Stanley 2012 Emerging Companies Conference For personal use only Ardent Leisure Profile ― Ardent Leisure is one of Australia’s largest specialist operators of leisure and entertainment assets. ― Occupies dominant positions in a range of affordable leisure sectors: Sector Businesses Number Theme parks Dreamworld, WhiteWater World, and SkyPoint 3 Bowling AMF and Kingpin 49 Health Clubs Goodlife Health Clubs 45 Family Entertainment Centres Main Event USA 10 Marinas D’Albora Marinas 7 ― Resilient earning streams from diverse affordable leisure product range which For personal use only appeals to price conscious consumer. -

It's Personal

SIMON PUGH & PETER WOODS QLM Label Makers BOQ Business Banking customers It’s personal LYNNE POWER BOQ Owner-Manager KATIE KOCHANSKI Daisy Hill branch BOQ customer since age 7 Shareholder Review 2010 BOQ SHR 2010 FA - PRINT.indd 2 21/10/10 11:30 AM JONAH & AMBER Community members SHIRLEY KOLPAK Shareholder It’s personal BOQ SHR 2010 FA - PRINT.indd 3 21/10/10 11:30 AM CONTENTS 1 Operational overview 3 Acquisitions 4 Financial highlights 7 Chairman’s report 11 Managing Director’s report 15 Community 17 Customers 17 Environment 18 Employees 19 Executive team 21 Your Board 25 Remuneration overview 26 Financial calender BOQ SHR 2010 FA - PRINT.indd 4 21/10/10 11:30 AM BRAND RELAUNCH In February 2010, BOQ launched At BOQ, most of our branches are run by local a new brand promise: Owner-Managers. This means they’re running your own personal bank a small business, so they get what it means to The new brand was the culmination of deliver personal service. So we really can deliver an 18 month “inside out” brand review, on our promise of being your own personal bank. where both staff and customers helped The brand relaunch also represented the to really define what makes BOQ different perfect moment in time to reintroduce ourselves to the other banks. The overwhelming as BOQ, rather than the state-centric name of response was that for us, it’s personal. Bank of Queensland. Over the past decade, we have expanded right across Australia. And it all started with this simple question. -

Betashares Portfolio Holdings ETF Name BETASHARES FTSE RAFI AUSTRALIA 200 ETF ETF ASX Code QOZ Date: 6/09/2016 Security

BetaShares Portfolio Holdings ETF Name BETASHARES FTSE RAFI AUSTRALIA 200 ETF ETF ASX Code QOZ Date: 6/09/2016 Security/Code Security Name Weighting # securities Market value BHP BHP BILLITON LTD 9.13% 385,882 $ 7,848,840 CBA COMMONWEALTH BANK OF AUSTRAL 7.49% 89,038 $ 6,438,338 ANZ AUST AND NZ BANKING GROUP 7.39% 233,137 $ 6,352,983 WBC WESTPAC BANKING CORP 7.13% 206,613 $ 6,130,208 NAB NATIONAL AUSTRALIA BANK LTD 6.63% 206,485 $ 5,703,116 WES WESFARMERS LTD 4.17% 84,121 $ 3,583,555 WOW WOOLWORTHS LTD 3.73% 133,217 $ 3,203,869 RIO RIO TINTO LTD 2.12% 37,909 $ 1,823,423 SUN SUNCORP-METWAY LTD 2.09% 139,200 $ 1,794,288 WPL WOODSIDE PETROLEUM LTD 1.76% 53,115 $ 1,514,309 ORG ORIGIN ENERGY LTD 1.69% 276,343 $ 1,450,801 MQG MACQUARIE GROUP LTD 1.66% 17,366 $ 1,426,443 TLS TELSTRA CORP LTD 1.61% 269,524 $ 1,388,049 AMP AMP LTD 1.50% 240,024 $ 1,286,529 QBE QBE INSURANCE GROUP LTD 1.46% 127,707 $ 1,259,191 FMG FORTESCUE METALS GROUP LTD 1.46% 249,258 $ 1,251,275 SCG SCENTRE GROUP 1.01% 176,862 $ 866,624 IAG INSURANCE AUSTRALIA GROUP 1.00% 152,729 $ 858,337 WOR WORLEYPARSONS LTD 0.91% 96,847 $ 785,429 STO SANTOS LTD 0.90% 175,609 $ 777,948 AMC AMCOR LIMITED 0.90% 47,631 $ 774,004 CTX CALTEX AUSTRALIA LTD 0.85% 21,632 $ 733,108 FBU FLETCHER BUILDING LTD 0.84% 70,092 $ 724,751 AGL AGL ENERGY LTD 0.80% 37,247 $ 690,932 SGP STOCKLAND 0.78% 138,071 $ 666,883 CSL CSL LTD 0.77% 6,338 $ 664,983 LLC LEND LEASE GROUP 0.74% 44,545 $ 633,875 NCM NEWCREST MINING LTD 0.72% 26,978 $ 622,382 ORI ORICA LTD 0.71% 42,615 $ 609,821 MTS METCASH LTD 0.65% 265,979 -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Factsheet Templates

Monthly Fact Sheet | 31 December 2019 ANZ Equity Capital Portfolio - Taxable Investment strategy and approach 3610 The Australian Equity Capital Portfolio (‘the Portfolio’) focuses on identifying and investing in Australian companies that willprovide capital growth to shareholders with the aim of outperforming the S&P/ASX 300 Accumulation Index, over rolling three year periods. - The Portfolio seeks to combine a passive exposure to the 20 companies that comprise the S&P/ASX 20 Index with two actively managed portfolios of 10-20 stocks each. The holdings in the Portfolio are generally comprised of between 40 and 50 securities, predominantly selected from the top 300 equities in the Australian equities market. However the Investment Manager many invest outside the top 300 companies if it is considered appropriate. -Theblending of the actively managed portfolios with the 20 passively held positions aims to reduce style bias and provide a diversified portfolio of Australian Equities. - The Portfolio is designed as a core investment offering with a focus on quality companies and long-term investment. #N/A Portfolio performance (before fees and taxes) 31/10/2008 31/10/2008 1 3 12 36 60 Since 1. Before 14 July 2017, Since the benchmark refers to 3 yrs 5 yrs S&P/ASX 100 1mth 3 mths 1 yr inception (p.a.) (p.a.) Accumulation Index . (p.a.)2 After 14 July 2017, benchmark refers to 1 Total return -1.7% 2.7% 22.6% 9.0% 8.0% 8.5% S&P/ ASX 300 1 1 Benchmark return -2.0% 0.7% 23.8% 10.4% 9.0% 9.6% Accumulation Index. -

Bennelong Kardinia Absolute Return Fund Monthly Performance Report As at 30 September 2020

Bennelong Kardinia Absolute Return Fund Monthly performance report As at 30 September 2020 Fund at a glance Fund facts Fund performance Strategy Long-short Australian equity $40,000 $35,000 Process Fundamental stock selection based on analysis of the macroeconomic $30,000 environment, company and $25,000 operating environment, quality of management and valuation $20,000 $15,000 Objective To achieve consistent positive returns through an investment cycle, $10,000 with an overarching philosophy of $5,000 capital protection $0 Strategy FUM AUD 127.4 million Fund Performance (Net returns) ASX 300 Accumulation Index RBA Cash Rate Inception date 1 May 2006 Source: Kardinia Capital Unit price: daily series 1.0454 RBA Cash Rate Unit price: monthly series 1.2290 Timeframe Fund return + 2% (Perf Fee hurdle)* Fund managers Kristiaan Rehder, CFA® Stuart Larke, CFA® 1 month (5.88%) 0.18% Investment Specialist Mark Burgess, CFA® 6 months 0.49% 1.13% Annualised return 8.31% 1 year (1.11%) 2.15% Total return since 215.98% 3 years p.a. (0.24%) 1.68% inception Annualised standard 7.48% 5 years p.a. 0.90% 1.68% deviation Since inception p.a. 8.31% 3.40% Sharpe ratio (RFR=RBA 0.66 Note: Performance results are presented net of all transaction costs, cash) investment management and performance fees and all other costs incurred by the Fund. Performance is the total return of the fund Percentage of positive 67.63% (assuming re-investment of distributions) and is quoted based on hard- months since inception close unit prices, without including the impact of buy/sell spreads.