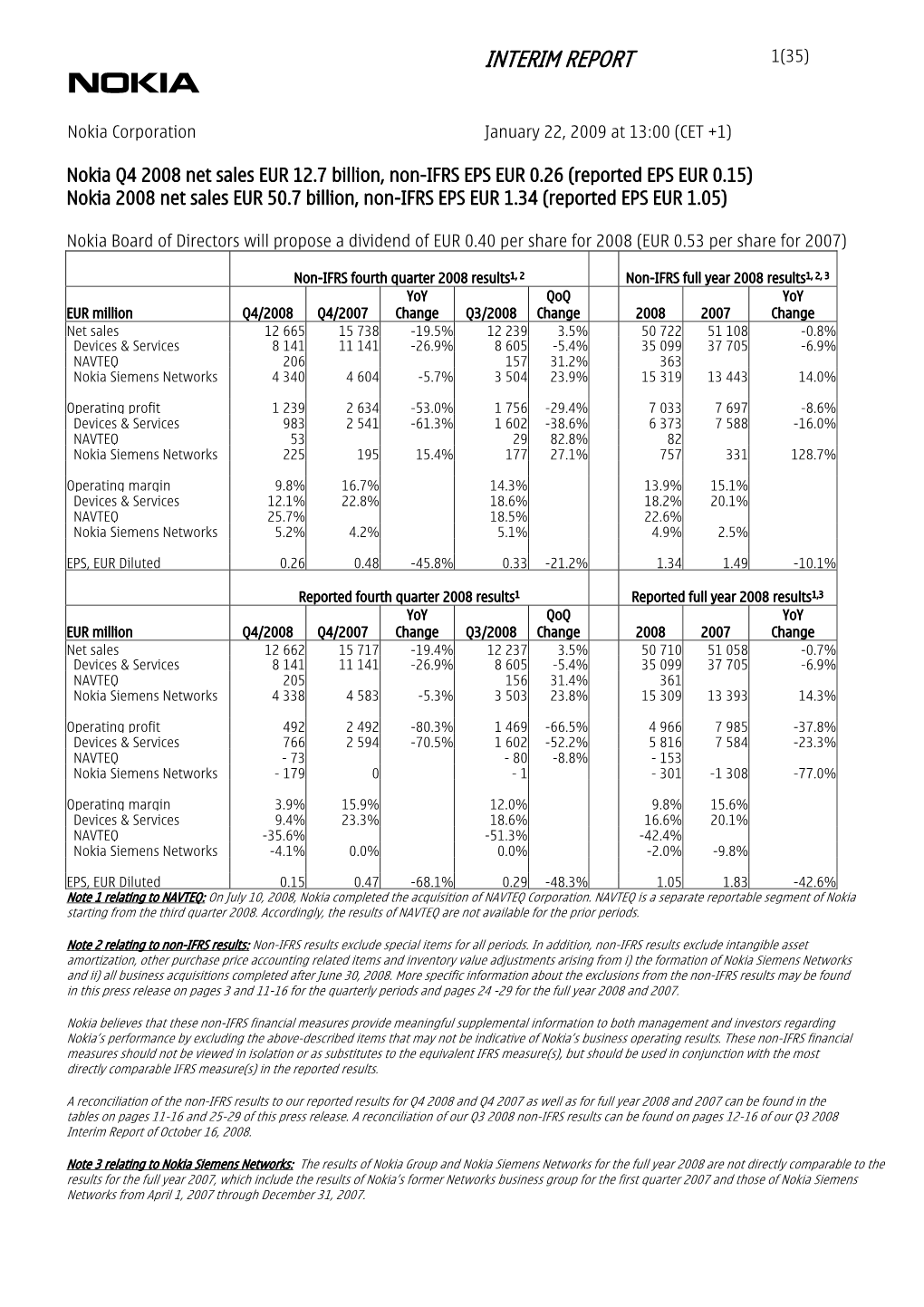

Interim Report 1(35)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Manuel D'utilisation Nokia N97 Mini

Manuel d'utilisation Nokia N97 mini Édition 2 Sommaire Charger la batterie 20 Oreillette 20 Fixer la dragonne 21 Sécurité 7 Actions de l'écran tactile 21 À propos de votre appareil 7 Ecrire du texte 23 Applications de bureau 8 Verrouiller les touches et l'écran tactile 27 Services réseau 8 Echange Nokia 27 Mémoire partagée 9 Modes 29 ActiveSync 9 Aimants et champs magnétiques 9 Votre appareil 29 Ecran d'accueil 29 Obtenir de l'aide 10 Témoins d'affichage 31 Support 10 Raccourcis 32 Aide de l'appareil 10 Rechercher 33 Profiter davantage de votre appareil 11 Contrôle du volume et du haut-parleur 34 Mettre à jour le logiciel de l'appareil 11 Mode hors connexion 34 Paramètres 12 Téléchargement rapide 35 Codes d'accès 12 Ovi (service réseau) 35 Verrou distant 13 Prolonger la durée de vie de la batterie 13 Passer des appels 37 Libérer de la mémoire 14 Capteur de proximité 37 Appels vocaux 38 Prise en main 14 Pendant un appel 38 Pièces et composants (avant) 15 Boîtes vocales et vidéo 39 Touches et composants (arrière) 15 Répondre à un appel ou rejeter un appel 39 Pièces et composants (côtés) 16 Effectuer un appel en conférence 39 Touches et composants (haut) 16 Composition abrégée d'un numéro de téléphone 40 Insérer la carte SIM et la batterie 16 Mise en attente 40 Carte mémoire 17 Numérotation vocale 41 Emplacements des antennes 18 Effectuer un appel vidéo 41 Allumer et éteindre l'appareil 19 2 © 2009 Nokia. Tous droits réservés. Pendant un appel vidéo 42 Param. -

CMD Presentations

Extending the lead in devices Kai Öistämö Executive Vice President, Devices 31 © 2008 Nokia . Mobile Phone becomes Mobile Computer . Focus on solution not product . New organization has reduced overlaps . Focus back on hero products 32 © 2008 Nokia Capital Markets Day 2008 Hold home field advantage . Defend in markets where we are strong . Value for money . Highest perceived value . Nokia brand strength . Portfolio is king 34 © 2008 Nokia Capital Markets Day 2008 Exploit growth opportunities . Starts with the consumer . Strategic collaboration with US carriers . Shipments to Korea scheduled to begin in 2009 35 © 2008 Nokia Capital Markets Day 2008 Grow in emerging markets through value add 36 © 2008 Nokia Capital Markets Day 2008 Key drivers for 2009 . User Experience . Innovation . Scale and Cost Efficiency 37 © 2008 Nokia Capital Markets Day 2008 Gain user experience leadership . Across platforms, geographies, price points . One size does NOT fit all . User experience defines form factor . Tailored solutions 38 © 2008 Nokia Capital Markets Day 2008 Nokia 6210 Navigator Nokia E63 Nokia Entry and Life Tools 39 © 2008 Nokia Capital Markets Day 2008 Nokia Nseries . Over 80% of N95 owners access the web . Estimate over 100 million Nseries sold by Q1 2009 40 © 2008 Nokia Capital Markets Day 2008 Nokia N97 . Touch and physical QWERTY . Customizable Homescreen – your favorite contacts & services at a glance . 32 GB of on-board memory + 16 GB card slot = 48 GB of memory . 3.5” widescreen with 640x360 resolution . 5 Mpx camera with Carl Zeiss optics 41 © 2008 Nokia Capital Markets Day 2008 42 © 2008 Nokia Capital Markets Day 2008 43 © 2008 Nokia Capital Markets Day 2008 Drive innovation through platforms . -

56404DT-1738088.Pdf

(PLEASE READ BEFORE USE) Thank you for purchasing our product, we will provide you the best service. The specification maybe concludes the insufficient point on technology or the function is not the same with its operation, the wrong spelling word. We sincerely hope you can reflect your advice or opinion to us, we will make the improvement on the product according to your valued advices. The contents of this Manual are subject to change without notice. CAUTION! RISK OF ELECTRIC SHOCK. PLEASE DO NOT REMOVE COVER WHEN POWER CONNECTED. NO USER SERVICEABLE PARTS INSIDE. WARNING TO PREVENT FIRE OR ELECTRIC SHOCK HAZARD, DO NOT EXPOSE THIS APPLIANCE TO RAIN OR MOISTURE. FCC STATEMENT: This device complies with Part 15 of the FCC Rules. Operation is subject to the following two conditions: (1) this device may not cause harmful interference, and (2) this device must accept any interference received, including interference that may cause undesired operation. Changes or modifications not expressly approved by the party responsible for compliance could void the user's authority to operate the equipment.. NOTE: This equipment has been tested and found to comply with the limits for a Class B digital device, pursuant to Part 15 of the FCC Rules. These limits are designed to provide reasonable protection against harmful interference in a residential installation. This equipment generates, uses and can radiate radio frequency energy and, if not installed and used in accordance with the instructions, may cause harmful interference to radio communications. However, there is no guarantee that interference will not occur in a particular installation. -

Ovi Maps – Overview

Ovi Maps – Overview Global Reach • Ovi Maps offers free walk and drive navigation with turn-by-turn voice guidance in 77 countries and 46 languages, as well as maps for more than 180 countries • Latest countries/regions to have received free navigation are Iceland, Kenya, Malta and the Azores • In 3 months, Ovi Maps with free mobile navigation was downloaded over 10 million times: 1 download every second Ovi Maps (3.04) • New: Faster zooming and faster search • New: WiFi ppg,gpositioning, making Ovi Maps more accessible on-the-go, especially indoors and in low signal areas • The Own Voice for Ovi Maps app available through Ovi Store lets people personalize their navigators voice and share it with others • Hybrid technology plus intelligent combination of pre-loaded and online maps means navigation works when there is no data connection • Preload the latest map data from a computer to your Nokia phone with Nokia Ovi Suite and reduce roaming costs when travelling abroad • Vector maps are less data intensive and battery-draining than bulky bitmaps used by Google Maps • Ovi delivers unique mobile experiences that mix content with the best location, social networking and connectivity services and is the go to-place for discovering , sharing and enjoying lifestyle content and entertainment, all from a Nokia smartphone © 2010 Nokia. All rights reserved. Nokia, Nokia Connecting People and Ovi are trademarks or registered trademarks of Nokia Corporation. Other product and company names mentioned herein may be trademarks or trade names of their respective owners. Specifications are subject to change without notice. The availability of particular products and services may vary by region. -

Oracle® Beehive Registering and Configuring Mobile Devices Release 2 (2.0.1.7)

Oracle® Beehive Registering and Configuring Mobile Devices Release 2 (2.0.1.7) E20324-01 July 2012 Document updated July, 2012 Oracle Beehive provides wireless access to your e-mail, calendar events, tasks, and contacts allowing you to stay connected to your team directly from your phone wherever you go. The Oracle Beehive Mobile Communicator allows you to keep in touch using instant Messaging and search the directory for users directly from your iPhone, BlackBerry, or Windows Mobile phone. This help page provides information on how to register and configure your mobile device for use with Oracle Beehive. It lists the mobile platforms that are supported and the functionality available from each platform. Additional information about how to use your mobile device with Oracle Beehive is provided in the following Help documents: ■ Oracle Beehive Using Windows Mobile Device ■ Oracle Beehive Using iPhone or iPad ■ Oracle Beehive Using Blackberry 1 Supported Mobile Platforms ■ Apple iPhone and iPad ■ RIM Blackberry ■ Windows Mobile Professional (Pocket PC) and Standard (Smartphone) ■ Nokia Phones ■ SMS Enabled Devices Registering your Mobile Device Configuring your Apple iPhone or iPad ■ Auto-Configure your Device ■ Manually Configure your Device Configuring your BlackBerry ■ Activating your Blackberry ■ Avoiding access control issues ■ Configure your Device Configuring your Windows Mobile Professional (Pocket PC) and Standard (Smartphone) ■ Disable HTC TouchFlo Plug-in on your Pocket PC (HTC Fuze/Touch Only) ■ Configure your Device ■ Synchronize -

7. 3G/3.5G Mobile Phone/PDA Support

7. 3G/3.5G Mobile Phone/PDA Support To streaming from 3/3.5G mobile phone or PDA, you have to open the mobile port of DVR, the default setting is 7050, which may be changed, please refer to 5.5.5 PPPoE/DDNS(Net- Second Page] or IE 6.5 Device Parameters Settings ServerÆNetwork setting, video system For limited upload bandwidth of internet that DVRs connect, or limited streaming capability of some mobile phone/PDA, you have to adjust bandwidth of DVR to internet, please refer to 5.3.8 Dual Streaming for Network(Record- Advanced Setting) or 6.5 Device Parameters Settings - ChannelÆ Camera setting, Sub Bitstream, Subcode (from IE) for more details You may find the Windows Mobile 5.0/6.0/6.1 PDA(amplayersetup.CAB) and Symbian S60 3rd (P2P_S60_3rd_0113.sis) and S60 5th(P2P_S60_5Th_20090112.sis) softwares from the CD inside the DVR package or visit your DVR website to download by IE – http://xxx.xxxx.xxxx/download.html Note: User’s mobile phone must apply internet connection service at first, such as 3G or 3.5G service. Please contact mobile company for detail. 7. 1 Windows Mobile PDA Open accessory CD and find the “amplayersetup.CAB” for the surveillance software. Please refer to PDA user manual, copy *.cab into windows mobile pda Double click on *.cab can start install software into PDA. After install completed, user can find QQEYE in the application list. Execute QQEYE program and click to setup IP address of remote DVR. - 60 - Input user name 〖Admin〗and password. IP address of DVR and port:7050 for streaming data. -

Nokia 6210 Navigator

Guía del usuario del Nokia 6210 Navigator 9207742 2ª edición ES DECLARACIÓN DE CONFORMIDAD 0434 Por medio de la presente, NOKIA CORPORATION declara que este RM-367 producto cumple con los requisitos esenciales y cualesquiera otras disposiciones aplicables o exigibles de la Directiva 1999/5/CE. Existe una copia de la Declaración de conformidad disponible en la dirección www.nokia.com/phones/declaration_of_conformity/. © 2008 Nokia. Reservados todos los derechos. Nokia, Nokia Connecting People, Navi, Visual Radio y Nokia Care son marcas comerciales o registradas de Nokia Corporation. Nokia tune es una melodía registrada por Nokia Corporation. El resto de los productos y nombres de compañías aquí mencionados pueden ser marcas comerciales o registradas de sus respectivos propietarios. Queda prohibida la reproducción, transferencia, distribución o almacenamiento de todo o parte del contenido de este documento bajo cualquier forma sin el consentimiento previo y por escrito de Nokia. This product includes software licensed from Symbian Software Ltd © 1998-2008. Symbian and Symbian OS are trademarks of Symbian Ltd. US Patent No 5818437 and other pending patents. T9 text input software Copyright © 1997-2008. Tegic Communications, Inc. All rights reserved. Java™ and all Java-based marks are trademarks or registered trademarks of Sun Microsystems, Inc. Portions of the Nokia Maps software are © 1996-2008 The FreeType Project. All rights reserved. This product is licensed under the MPEG-4 Visual Patent Portfolio License (i) for personal and noncommercial use in connection with information which has been encoded in compliance with the MPEG-4 Visual Standard by a consumer engaged in a personal and noncommercial activity and (ii) for use in connection with MPEG-4 video provided by a licensed video provider. -

Bedienungsanleitung Nokia 6210 Navigator

Nokia 6210 Navigator Bedienungsanleitung 9207739 Ausgabe 1 DE KONFORMITÄTSERKLÄRUNG 0434 Hiermit erklärt NOKIA CORPORATION, dass sich das Gerät RM-367 in Übereinstimmung mit den grundlegenden Anforderungen und den übrigen einschlägigen Bestimmungen der Richtlinie 1999/5/EG befinden. Den vollständigen Text der Konformitätserklärung finden Sie unter: http://www.nokia.com/phones/declaration_of_conformity/. © 2008 Nokia. All rights reserved. Nokia, Nokia Connecting People, Navi, Visual Radio und Nokia Care sind Marken oder eingetragene Marken der Nokia Corporation. Nokia tune ist eine Tonmarke der Nokia Corporation. Andere in diesem Handbuch erwähnte Produkt- und Firmennamen können Marken oder Handelsnamen ihrer jeweiligen Inhaber sein. Der Inhalt dieses Dokuments darf ohne vorherige schriftliche Genehmigung durch Nokia in keiner Form, weder ganz noch teilweise, vervielfältigt, weitergegeben, verbreitet oder gespeichert werden. This product includes software licensed from Symbian Software Ltd © 1998-2008. Symbian and Symbian OS are trademarks of Symbian Ltd. US Patent No 5818437 and other pending patents. T9 text input software Copyright © 1997-2008. Tegic Communications, Inc. All rights reserved. Java™ and all Java-based marks are trademarks or registered trademarks of Sun Microsystems, Inc. Portions of the Nokia Maps software are © 1996-2008 The FreeType Project. All rights reserved. This product is licensed under the MPEG-4 Visual Patent Portfolio License (i) for personal and noncommercial use in connection with information which has been encoded in compliance with the MPEG-4 Visual Standard by a consumer engaged in a personal and noncommercial activity and (ii) for use in connection with MPEG-4 video provided by a licensed video provider. No license is granted or shall be implied for any other use. -

Recycle Cartridges and Cell Phones for Your Fundraising Organization!

About Us Support a School or Nonprofit Recycling Fundraising FAQs Blog Contact Us LOGIN Qualifying Items Cell Phones APPLE Part Number Points Cash Part Number Points Cash APPLE IPHONE 15.00 $6.00 APPLE IPHONE 3G 16GB 75.00 $30.00 APPLE IPHONE 3G 8GB 82.50 $33.00 APPLE IPHONE 3GS 16GB 150.00 $60.00 APPLE IPHONE 3GS 32GB 165.00 $66.00 APPLE IPHONE 4 16GB 225.00 $90.00 APPLE IPHONE 4 32GB 262.50 $105.00 APPLE IPHONE 4 8GB 172.50 $69.00 APPLE IPHONE 4S 16GB 322.50 $129.00 APPLE IPHONE 4S 32GB 412.50 $165.00 APPLE IPHONE 4S 64GB 525.00 $210.00 BLACKBERRY Part Number Points Cash Part Number Points Cash BLACKBERRY 8100 PEARL 7.50 $3.00 BLACKBERRY 8110 PEARL 7.50 $3.00 BLACKBERRY 8120 PEARL 7.50 $3.00 BLACKBERRY 8220 PEARL FLIP 7.50 $3.00 BLACKBERRY 8300 CURVE 15.00 $6.00 BLACKBERRY 8310 CURVE 15.00 $6.00 BLACKBERRY 8320 CURVE 15.00 $6.00 BLACKBERRY 8350I CURVE 7.50 $3.00 BLACKBERRY 8520 CURVE 60.00 $24.00 BLACKBERRY 8530 CURVE 7.50 $3.00 BLACKBERRY 8800 7.50 $3.00 BLACKBERRY 8820 7.50 $3.00 BLACKBERRY 8900 CURVE 40.00 $16.00 BLACKBERRY 9000 BOLD 40.00 $16.00 BLACKBERRY 9100 PEARL 3G 35.00 $14.00 BLACKBERRY 9105 PEARL 3G 75.00 $30.00 BLACKBERRY 9300 CURVE 3G 40.00 $16.00 BLACKBERRY 9330 CURVE 3G 7.50 $3.00 BLACKBERRY 9350 CURVE 15.00 $6.00 BLACKBERRY 9360 CURVE 3G 90.00 $36.00 BLACKBERRY 9370 CURVE 100.00 $40.00 BLACKBERRY 9380 CURVE 262.50 $105.00 BLACKBERRY 9500 STORM 22.50 $9.00 BLACKBERRY 9520 STORM 2 52.50 $21.00 BLACKBERRY 9530 STORM 20.00 $8.00 BLACKBERRY 9550 STORM 2 50.00 $20.00 BLACKBERRY 9630 TOUR 25.00 $10.00 BLACKBERRY 9650 BOLD -

Form 20-F 2008 Form 20-F Nokia Form 20-F 2008 Copyright © 2009

Nokia 20-F Form 2008 Form 20-F 2008 Copyright © 2009. Nokia Corporation. All rights reserved. Copyright © 2009. Nokia Corporation. of Nokia Corporation. trademarks registered Nokia and Connecting People are As filed with the Securities and Exchange Commission on March 5, 2009. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 Commission file number 113202 Nokia Corporation (Exact name of Registrant as specified in its charter) Republic of Finland (Jurisdiction of incorporation) Keilalahdentie 4, P.O. Box 226, FI00045 NOKIA GROUP, Espoo, Finland (Address of principal executive offices) Kaarina Sta˚hlberg, Vice President, Assistant General Counsel Telephone: +358 (0) 7 18008000, Facsimile: +358 (0) 7 18038503 Keilalahdentie 4, P.O. Box 226, FI00045 NOKIA GROUP, Espoo, Finland (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”): Name of each exchange Title of each class on which registered American Depositary Shares New York Stock Exchange Shares New York Stock Exchange(1) (1) Not for trading, but only in connection with the registration of American Depositary Shares representing these shares, pursuant to the requirements of the Securities and Exchange Commission. Securities registered pursuant to Section 12(g) of the Exchange Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Exchange Act: None Indicate the number of outstanding shares of each of the registrant’s classes of capital or common stock as of the close of the period covered by the annual report. -

Download Viber Software for Nokia C5-03

1 / 2 Download Viber Software For Nokia C5-03 Whats App messenger at nokia N9 open sourceFor Download :- http://openwhatsapp.org .... Follow the procedure to download Viber app for Nokia with Android OS support. ... These include Nokia 5228, Nokia 5233, Nokia C5-03, Nokia E7, Nokia 5800, .... 311 or 501, download viber app for nokia x2 01 nokia c3 and nokia asha 200 ... For Nokia C5 00.2 - DOWNLOAD (Mirror #1) Zero Hour A Royal Massacre Man 3 .... Free Nokia C5-03 WhatsApp Messenger Software Download - It can be seen as ... nokia c5 03的相关搜索, viber free download for nokia, viber for nokia c5 03, .... Download Viber Voice Call Download In Nokiac5 - best software for Windows. Viber: Viber for ... Nokia C5-00 RM-645_Gr.RUS_sw-071.005, версия. 2,998. 2 .... Results 1 - 20 of 142 — Do you want to download viber for nokia 5233 mobile9 for free? ... Apps Free Download Pdf reader mobile nokia c2 03 Whatsapp - mobile9 .... If you have necessity to download and install appendix Viber immediately on phone Nokia C5-03, follow the link under this message and then downloading .... Mar 22, 2021 — Find out if your phone supports whatsapp. ... Just head over Blackberry World and download the App. ... Nokia S40 and Nokia S60 ... on the ... nokia c5 03 software applications apps free download, nokia c503 user guide nds1 webapps microsoft com, viber for nokia c5 03 on nokia ovi ecliphecil,.. Viber for Nokia Lumia 710 2018 – Free download Viber For Nokia Symbian ... Nokia C5-03 software applications free download thousand of java apps program.. 3 days ago — You can then turn off notifications or uninstall the app. -

Buku Petunjuk Nokia 6210 Navigator

Buku Petunjuk Nokia 6210 Navigator Hak cipta © 2008 Nokia. Semua hak dilindungi undang-undang. PERNYATAAN KESESUAIAN Nokia menerapkan kebijakan pengembangan yang berkelanjutan. Nokia berhak 0434 Dengan ini, NOKIA CORPORATION menyatakan melakukan perubahan dan penyempurnaan atas produk yang diuraikan dalam buku bahwa produk RM-367 ini telah memenuhi petunjuk ini tanpa pemberitahuan sebelumnya. persyaratan utama dan ketentuan yang terkait SELAMA DIIZINKAN OLEH UNDANG-UNDANG YANG BERLAKU, DALAM KEADAAN lainnya dari Petunjuk Dewan 1999/5/EC. APAPUN, NOKIA ATAU PEMBERI LISENSINYA TIDAK BERTANGGUNG JAWAB ATAS Salinan Pernyataan Kesesuaian ini dapat dilihat di HILANGNYA DATA, PENGHASILAN, ATAU KERUGIAN KHUSUS, INSIDENTAL, http://www.nokia.com/phones/ KONSEKUENSIAL, ATAU TIDAK LANGSUNG, APAPUN PENYEBABNYA. declaration_of_conformity/. ISI DOKUMEN INI DIBERIKAN “SEBAGAIMANA ADANYA“. KECUALI JIKA DITETAPKAN LAIN DALAM UNDANG-UNDANG YANG BERLAKU, TIDAK ADA © 2008 Nokia. Semua hak dilindungi undang-undang. JAMINAN APAPUN, BAIK TERSURAT MAUPUN TERSIRAT, TERMASUK NAMUN TIDAK Nokia, Nokia Connecting People, Navi, Visual Radio, dan Nokia Care adalah merek TERBATAS PADA, JAMINAN TERSIRAT TENTANG KEADAAN YANG DAPAT dagang atau merek dagang terdaftar dari Nokia Corporation. Nokia tune adalah DIPERJUALBELIKAN DAN KESESUAIAN UNTUK TUJUAN TERTENTU, YANG DIBUAT merek melodi dari Nokia Corporation. Produk dan nama perusahaan lain yang SEHUBUNGAN DENGAN KEAKURATAN, KEANDALAN, ATAU ISI DOKUMEN INI. disebutkan di sini mungkin merupakan merek dagang atau nama dagang dari NOKIA BERHAK MENGUBAH DOKUMEN INI ATAU MENARIKNYA SETIAP SAAT masing-masing pemilik. TANPA PEMBERITAHUAN SEBELUMNYA. Dilarang memperbanyak, mentransfer, menyebarluaskan, atau menyimpan Ketersediaan produk, aplikasi, dan layanan tertentu untuk produk ini dapat berbeda sebagian atau seluruh isi dokumen ini dalam bentuk apapun tanpa izin tertulis menurut wilayah. Untuk ketersediaan pilihan bahasa dan informasi lebih lanjut, sebelumnya dari Nokia.