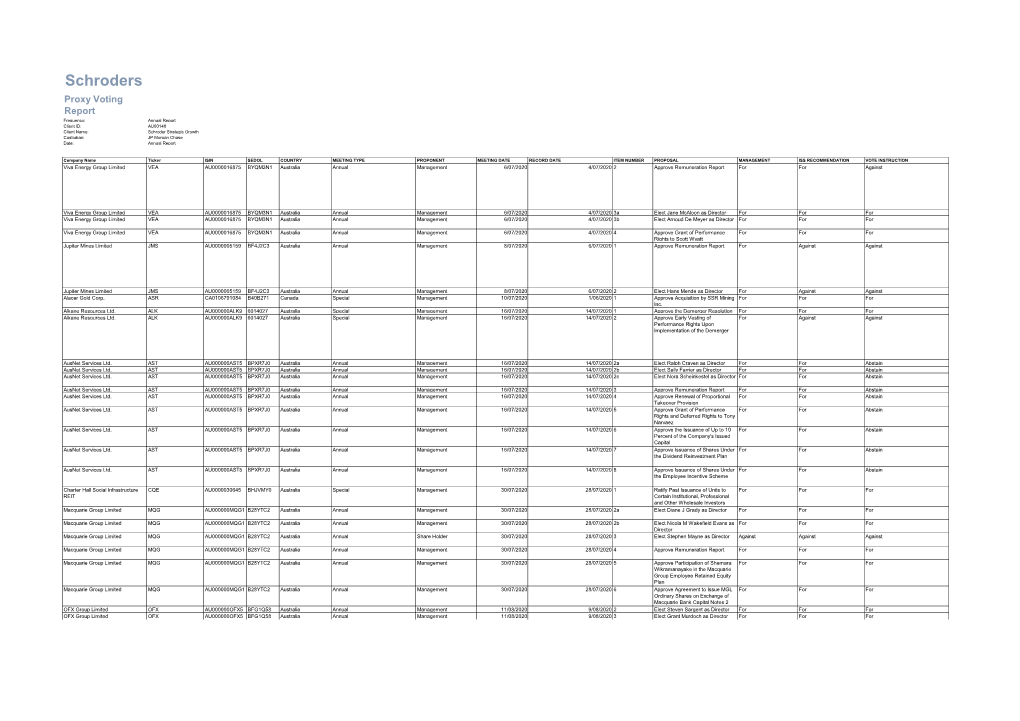

Proxy Voting Report Frequency: Annual Report Client ID: AU00148 Client Name: Schroder Strategic Growth Custodian: Jpfund Morgan Chase Date: Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fund Profile

Janus Henderson Tactical Income Fund With a focus on delivering a stable return profile and capital preservation, Janus Henderson’s highly experienced Australian Fixed Interest Team have the flexibility to actively change asset allocations in order to take full advantage of the interest rate cycle and credit environments. FUND Objective Stage 3: Implementation Implement the strategy by investing in a range of The Janus Henderson Tactical Income Fund cash, fixed interest and higher yielding securities. (“Fund”) seeks to achieve a total return By investing in the Fund, the following key after fees that exceeds the total return of the investment decisions are managed by the Team: Bloomberg AusBond Bank Bill Index and PROFILE Bloomberg AusBond Composite 0+ Yr Index • Interest rates: Determine when to hold longer (equally weighted) (“Benchmark”), by investing dated fixed rate assets (e.g. government bonds in a diversified portfolio of predominantly are typically cheap when interest rates peak in Australian income producing assets. an economic cycle) and when to hold shorter dated floating rate exposure. About the Fund • Sectors: Consider the right proportion of The Fund is an integrated and diversified fixed government securities versus non- interest solution, designed to make tactical government securities, dependent on the investment decisions between cash, longer adequacy of compensation to investors for duration fixed interest securities and higher the additional risk. yielding securities, throughout every step of the investment cycle. • Securities: Determine which non-government securities have stable to improving credit Investment philosophy quality. Of these securities, understand which offer an appropriate return for the The Fund is designed to leverage the considerable underlying risk. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

June 2017 Investment Update

Investment update As at 30 June 2017 Snapshot Pre-tax net tangible assets Gross assets $1.06 $42.0m Fully franked Performance dividend yield (p.a. since January 2008) wilsonassetmanagement.com.au 5.0% 12.6% ABN 49 126 420 719 WAM Active Limited Market overview ASX code WAA The S&P/ASX All Ordinaries Accumulation Index closed up 0.3% for the Listed Jan 2008 month, to finish the financial year up 13.1%, the best year for the market Gross assets $42.0m since 2014. The sectors that drove the advance during FY2017 were Market cap $42.7m materials (+20.6%), utilities (+14.7%), banks (+11.9%) and healthcare Share price (WAA) $1.10 (+11.8%). Option price (WAAO) $0.015 NTA before tax $1.06 Global equity markets ended the month down as central banks Shares on issue 38,802,828 foreshadowed the end of easy monetary policy. The US Federal Reserve Options on issue 31,680,247 raised interest rates for the third consecutive time to between 1% to 1.25% Annualised fully franked 5.5c in response to improving confidence in the US economy. interim dividend (FY2017) Fully franked dividend yield 5.0% In Australia, the unemployment rate fell to a lower than expected 5.5% from 5.7% the previous month, the lowest level since February 2013. The political Investment objectives attack on banks continued with the South Australian Government • Deliver shareholders a regular income announcing it would introduce a bank tax in addition to the Federal stream via fully franked dividends Government’s levy. -

Directors' Reports & Financial Reports

DIRECTORS’ REPORTS & FINANCIAL REPORTS for the year ended 31 December 2019 This report comprises: Atlas Arteria International Limited and its controlled entities Atlas Arteria Limited and its controlled entities Atlas Arteria (‘ALX’) comprises Atlas Arteria International Limited (Registration No. 43828) (‘ATLIX’) and Atlas Arteria Limited (ACN 141 075 201) (‘ATLAX’). ATLIX is an exempted mutual fund company incorporated and domiciled in Bermuda with limited liability and the registered office is 4th Floor, Cedar House, 41 Cedar Avenue, Hamilton, HM12, Bermuda. ATLAX is a company limited by shares incorporated and domiciled in Australia and the registered office is Level 5, 141 Flinders Lane, Melbourne, VIC 3000, Australia. Directors’ Reports & Financial Reports for the year ended 31 December 2019 Atlas Arteria International Limited Atlas Arteria Limited DIRECTORS’ REPORTS The directors of Atlas Arteria International Limited (‘ATLIX’) and the directors of Atlas Arteria Limited (‘ATLAX’) submit the following reports, together with the Financial Report for Atlas Arteria and the Financial Report for ATLAX and its controlled entities (‘ATLAX Group’), for the year ended 31 December 2019. An Atlas Arteria stapled security comprises one ATLIX share ‘stapled’ to one ATLAX share to create a single listed security traded on the Australian Securities Exchange (‘ASX’). The stapled securities cannot be traded or dealt with separately. AASB 3 Business Combinations and AASB 10 Consolidated Financial Statements require one of the stapled entities of a stapled structure to be identified as the parent entity for the purpose of preparing a consolidated Financial Report. In accordance with this requirement, and consistent with previous reporting periods, ATLIX has been identified as the parent entity of the consolidated group comprising ATLIX and its controlled entities (‘ATLIX Group’) and ATLAX Group, together comprising ‘Atlas Arteria’, ‘ALX’ or ‘the Groups’. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

JH Inv Funds Series I OEIC AR 05 2021.Indd

ANNUAL REPORT & ACCOUNTS For the year ended 31 May 2021 Janus Henderson Investment Funds Series I Janus Henderson Investment Funds Series I A Who are Janus Henderson Investors? Global Strength 14% 13% £309.6B 55% 45% 31% 42% Assets under Over 340 More than 2,000 25 Over 4,300 management Investment professionals employees Offi ces worldwide companies met by investment teams in 2020 North America EMEA & LatAm Asia Pacifi c Source: Janus Henderson Investors, Staff and assets under management (AUM) data as at 30 June 2021. AUM data excludes Exchange-Traded Note (ETN) assets. Who we are Janus Henderson Investors (‘Janus Henderson’) is a global asset manager off ering a full suite of actively managed investment products across asset classes. As a company, we believe the notion of ‘connecting’ is powerful – it has shaped our evolution and our world today. At Janus Henderson, we seek to benefi t clients through the connections we make. Connections enable strong relationships based on trust and insight aswell as the fl ow of ideas among our investment teams and our engagement with companies. These connections are central to our values, to what active management stands for and to the long-term outperformance we seek to deliver. Our commitment to active management off ers clients the opportunity to outperform passive strategies over the course of market cycles. Through times of both market calm and growing uncertainty, our managers apply their experience weighing risk versus reward potential – seeking to ensure clients are on the right side of change. Why Janus Henderson Investors At Janus Henderson, we believe in linking our world-class investment teams and experienced global distribution professionals with our clients around the world. -

Ausnet Services Greenfields Negotiated Electricity Connections Customer Service Standard

AusNet Services Greenfields Negotiated Electricity Connections Customer Service Standard AusNet Services Customer Service Standard Disclaimer This template is for generating internal and external document belonging to AusNet Services and may or may not contain all available information on the subject matter this document purports to address. The information contained in this document is subject to review and AusNet Services may amend this document at any time. Amendments will be indicated in the Amendment Table, but AusNet Services does not undertake to keep this document up to date. To the maximum extent permitted by law, AusNet Services makes no representation or warranty (express or implied) as to the accuracy, reliability, or completeness of the information contained in this document, or its suitability for any intended purpose. AusNet Services (which, for the purposes of this disclaimer, includes all of its related bodies corporate, its officers, employees, contractors, agents and consultants, and those of its related bodies corporate) shall have no liability for any loss or damage (be it direct or indirect, including liability by reason of negligence or negligent misstatement) for any statements, opinions, information or matter (expressed or implied) arising out of, contained in, or derived from, or for any omissions from, the information in this document. Contact This document is the responsibility of AusNet Services. Please contact the indicated owner of the document with any inquiries. AusNet Services Level 31, 2 Southbank Boulevard -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

Participating Organisations | June 2021 Aon Rewards Solutions Proprietary and Confidential

Aon Rewards Solutions Proprietary and Confidential Participating organisations | June 2021 Aon Rewards Solutions Proprietary and Confidential Participating organisations 1. .au Domain Administration 44. Alexion Pharmaceuticals Limited Australasia Pty Ltd 2. [24]7.ai 45. Alfa Financial Software 3. 10X Genomics* Limited 4. 4 Pines Brewing Company 46. Alibaba Group Inc 5. 8X8 47. Alida* 6. A.F. Gason Pty Ltd* 48. Align Technology Inc. 7. A10 Networks 49. Alkane Resources Limited 8. Abacus DX 50. Allianz Australia Ltd 9. AbbVie Pty Ltd 51. Allscripts 10. Ability Options Ltd 52. Alteryx 11. Abiomed* 53. Altium Ltd 12. AC3 54. Amazon.com 55. AMEC Foster Wheeler 13. ACCELA* Australia Pty Ltd 14. Accenture Australia Ltd 56. Amgen Australia Pty Ltd 15. AccorHotels 57. AMP Services Limited 16. Acer Computer Australia Pty Ltd* 58. AMSC 17. Achieve Australia Limited* 59. Analog Devices 18. Achmea Australia 60. Anaplan 19. ACI Worldwide 61. Ancestry.com 62. Anglo American Metallurgical 20. Acquia Coal Pty Ltd 21. Actian Corporation 63. AngloGold Ashanti Australia 22. Activision Blizzard Limited* 23. Adaman Resources 64. ANZ Banking Group Ltd 24. Adcolony 65. Aon Corporation Australia 25. A-dec Australia 66. APA Group 26. ADG Engineers* 67. Apollo Endosurgery Inc. 27. Adherium Limited 68. APPEN LTD 28. Administrative Services 69. Appian* 29. Adobe Systems Inc 70. Apple and Pear Australia Ltd* 30. ADP 71. Apple Pty Ltd 31. Adtran 72. Apptio 32. Advanced Micro Devices 73. APRA AMCOS 33. Advanced Sterlization 74. Aptean Products* 75. Aptos* 34. AECOM* 76. Apttus 35. AEMO 77. Aquila Resources 36. Aeris Resources Limited 78. Arcadis 37. -

Ausnet Services Holdings Pty Ltd ACN 603 317 559 Financial Report

AusNet Services Holdings Pty Ltd ACN 603 317 559 Financial Report For the financial year ended 31 March 2020 AusNet Services Holdings Pty Ltd Financial Statements Contents Directors' report 3 Lead auditor's independence declaration 34 Consolidated income statement 35 Consolidated statement of comprehensive income 36 Consolidated statement of financial position 37 Consolidated statement of changes in equity 38 Consolidated statement of cash flows 39 Notes to the consolidated financial statements 40 Directors' declaration 85 Independent auditor's report 86 This financial report covers the consolidated entity consisting of AusNet Services Holdings Pty Ltd and its subsidiaries. The financial report is presented in Australian dollars. AusNet Services Holdings Pty Ltd is a company limited by shares, incorporated and domiciled in Victoria, Australia. Its registered office and principal place of business is: Level 31, 2 Southbank Boulevard Southbank, Victoria 3006 Australia A description of the nature of AusNet Services Holdings Pty Ltd operations and its principal activities is included in the Directors’ report. The financial report was authorised for issue by the Directors on 11 May 2020. AusNet Services Holdings Pty Ltd Directors' report The Directors of AusNet Services Holdings Pty Ltd present their report on the general-purpose financial report of the consolidated entity for the financial year ended 31 March 2020 (FY2020). The financial report is for AusNet Services Holdings Pty Ltd and its controlled entities (we, us, our, or the Group). Our Board of Directors The persons listed below were Directors of the Company during the whole of the financial year and up to the date of this report unless otherwise noted. -

2017-2018 Annual Investment Report Retirement System Investment Commission Table of Contents Chair Report

South Carolina Retirement System Investment Commission 2017-2018 Annual Investment Report South Carolina Retirement System Investment Commission Annual Investment Report Fiscal Year Ended June 30, 2018 Capitol Center 1201 Main Street, Suite 1510 Columbia, SC 29201 Rebecca Gunnlaugsson, Ph.D. Chair for the period July 1, 2016 - June 30, 2018 Ronald Wilder, Ph.D. Chair for the period July 1, 2018 - Present 2017-2018 ANNUAL INVESTMENT REPORT RETIREMENT SYSTEM INVESTMENT COMMISSION TABLE OF CONTENTS CHAIR REPORT Chair Report ............................................................................................................................... 1 Consultant Letter ........................................................................................................................ 3 Overview ................................................................................................................................... 7 Commission ............................................................................................................................... 9 Policy Allocation ........................................................................................................................13 Manager Returns (Net of Fees) ..................................................................................................14 Securities Lending .....................................................................................................................18 Expenses ...................................................................................................................................19