Docket No. RP16-___-000 Exhibit No. ANR-003 UNITED STATES OF

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Development of Market Centers and Electronic Trading in Natural Gas Markets

Office of Economic Policy Discussion Paper 99-01 The Development of Market Centers and Electronic Trading in Natural Gas Markets Stewart Holmes Office of Economic Policy Federal Energy Regulatory Commission June 1999 Office of Economic Policy Discussion Papers are preliminary materials circulated to stimulate comment and criticism. The analyses and conclusions are those of the author and do not necessarily reflect the views of other members of the Federal Energy Regulatory Commission staff, any individual Commissioner, or the Commission itself. Introduction The decade of the 1990s has seen the significant development of market centers and the introduction of electronic gas trading in natural gas markets. The purpose of this paper is to discuss the growth and current status of market centers and electronic gas trading. Almost all market center development and all electronic trading activity has occurred since Order No 636. Market centers are important to natural gas markets for several reasons. They facilitate gas trading and transportation, and they help provide the liquidity needed to make electronic gas trading a growing force in current-day natural gas markets. Market centers also reduce transactions costs by making it easier for buyers and sellers to do business with one another. Thus, market centers have supported and can continue to promote the Commission's goal of improved short-term and long-term gas markets. For a recent discussion of this goal, see the Commission's Notice of Proposed Rulemaking and Notice of Inquiry in Dockets RM98-10-000 and RM98-12-000, respectively. The text of the paper is organized into separate sections on market centers and electronic gas trading. -

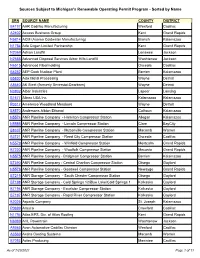

Sources Subject to Michigan's Renewable Operating Permit Program - Sorted by Name

Sources Subject to Michigan's Renewable Operating Permit Program - Sorted by Name SRN SOURCE NAME COUNTY DISTRICT B4197 AAR Cadillac Manufacturing Wexford Cadillac A2402 Access Business Group Kent Grand Rapids N5814 ACM (Asama Coldwater Manufacturing) Branch Kalamazoo N1784 Ada Cogen Limited Partnership Kent Grand Rapids N2369 Adrian Landfill Lenawee Jackson N2688 Advanced Disposal Services Arbor Hills Landfill Washtenaw Jackson N6515 Advanced Fibermolding Osceola Cadillac B4252 AEP Cook Nuclear Plant Berrien Kalamazoo B5830 Ajax Metal Processing Wayne Detroit A8640 AK Steel (formerly Severstal-Dearborn) Wayne Detroit N0802 Albar Industries Lapeer Lansing B1677 Allnex USA Inc. Kalamazoo Kalamazoo P0317 Ameresco Woodland Meadows Wayne Detroit B8570 Andersons Albion Ethanol Calhoun Kalamazoo N5574 ANR Pipeline Company - Hamilton Compressor Station Allegan Kalamazoo N5586 ANR Pipeline Company - Lincoln Compressor Station Clare BayCity B8337 ANR Pipeline Company - Muttonville Compressor Station Macomb Warren B3721 ANR Pipeline Company - Reed City Compressor Station Osceola Cadillac N5578 ANR Pipeline Company - Winfield Compressor Station Montcalm Grand Rapids B7220 ANR Pipeline Company - Woolfolk Compressor Station Mecosta Grand Rapids N5575 ANR Pipeline Company - Bridgman Compressor Station Berrien Kalamazoo B7390 ANR Pipeline Company - Central Charlton Compressor Station Otsego Gaylord N5576 ANR Pipeline Company - Goodwell Compressor Station Newaygo Grand Rapids B7219 ANR Storage Company - South Chester Compressor Station Otsego Gaylord -

ANR Pipeline Company Houston, Texas 77002

App # 202000097 TransCanada US Pipelines USGO Integrity Services Department 700 Louisiana St. ANR Pipeline Company Houston, Texas 77002 May 27, 2020 Michigan Department of Environment, Great Lakes, and Energy – Air Quality Division Cadillac District – Cadillac Office (Northwest Lower Peninsula) 120 W Chapin Street Cadillac, MI 49601-2158 Re: Rule 215(3) Notification of Off-Permit Change ANR Pipeline Company – Reed City Compressor Station Reed City, MI State Registration Number (SRN): B3721 Dear Sir or Madam, Enclosed is the R 336.1215(3) (Rule 215) Notification of Off-Permit Change for ANR Pipeline Company for the Reed City Compressor Station. The Renewable Operating Permit (ROP) No. MI-ROP-B3721-2014a for the Reed City Compressor Station expired February 6, 2019. As required under Section A.35 of the Reed City Station ROP, ANR has submitted a permit renewal application 6 months prior to expiration of the permit or August 6, 2018; therefore, the station continues to operate under this ROP. This change, anticipated to take place in June 2020, is for replacement of the two (2) existing emergency generators, EURC019 rated at 355 hp and EURC020 rated at 475 hp with one (1) new emergency generator, EURC064, rated at 1,114 hp. The new emergency generator, EURC064 is exempt from the requirement to obtain a Permit-to- Install (PTI) under R 336.1278 and R 336.1285(2)(9), which exempts internal combustion engines with heat input less than 10 MMBtu/hr from obtaining a PTI. The facility is currently subject to Prevention of Significant Deterioration (PSD) rules incorporated under R 336.1119, however this change does not trigger major modification applicability. -

Certificate Application

UNITED STATES OF AMERICA BEFORE THE FEDERAL ENERGY REGULATORY COMMISSION ) ANR PIPELINE COMPANY ) Docket No. CP20-1-000 ABBREVIATED APPLICATION OF ANR PIPELINE COMPANY FOR AMENDMENT TO CERTIFICATES OF PUBLIC CONVENIENCE AND NECESSITY AND FOR ABANDONMENT AUTHORITY Pursuant to sections 7(b) and 7(c) of the Natural Gas Act (“NGA”), 15 U.S.C. §§ 717f(b) and 717f(c), as amended, and Subpart A of the regulations of the Federal Energy Regulatory Commission (“Commission”), 18 C.F.R. Sections 157.5 et seq., ANR Pipeline Company (“ANR”) hereby submits this abbreviated application (“Application”) for the authority necessary to implement the acquisition and transition of ownership to ANR of certain natural gas storage assets currently leased by ANR from its affiliate, Mid Michigan Gas Storage Company (“Mid Michigan” or “MM”) at the Austin, Goodwell, Lincoln- Freeman, Loreed, and Reed City storage fields (“Leased Fields”), all located in central Michigan (“Transition”).1 The Transition is the result of Mid Michigan’s intent to divest itself of the storage assets it owns and currently leases to ANR at the Leased Fields. 1 Incidental to the leased storage assets at the Leased Fields, the proposed Transition also includes two minor laterals currently leased by ANR from Mid Michigan. These laterals are identified and described in Exhibit T, attached hereto. Specifically, ANR requests authority pursuant to section 7(b) and section 7(c) of the NGA as applicable to 1) amend the applicable certificates of public convenience and necessity to a) abandon the existing lease arrangements with Mid Michigan to remove Mid Michigan as owner and lessor, and b) change ANR from lessee to owner of the subject assets acquired from Mid Michigan, and 2) establish a new interim lease arrangement with Mid Michigan, specific to the Mid Michigan-owned base gas in the Leased Fields. -

Pipeline Transportation and Underground

Docket No. RP16-___-000 Exhibit No. ANR-012 Page 1 of 17 Additions to Capacity on the U.S. Natural Gas Pipeline Network: 2005 This report examines the amount of new natural gas pipeline capacity added to the U.S. natural gas pipeline system during 2005 and the areas of the country where those additions were concentrated. In addition, it discusses and analyzes proposed natural gas pipeline projects that may be developed between 2006 and 2008 and the market factors supporting these initiatives. Questions or comments on the contents of this article should be directed to James Tobin at [email protected] or (202) 586-4835. The addition to natural gas pipeline capacity in 2005 It appears, however, that 2004 and 2005 may be the bottom exceeded that of 2004 (Figure 1) although fewer miles of of a temporary trough in the natural gas pipeline development pipeline were installed (Figure 2). Miles of new natural gas activity cycle. The current inventory of announced or pipeline (1,152) were 21 percent less than in 2004, even approved natural gas pipeline projects indicates that natural though pipeline capacity grew by 8.2 billion cubic feet per gas pipeline capacity additions could increase significantly day (Bcf/d), a 7-percent increase in capacity additions (see between 2006 and 2008 (Figure 1). Several factors are Box, “Capacity Measures,” p. 4). Indeed, less new natural driving this anticipated growth, particularly the expanding gas pipeline mileage was added in 2005 than in any year development of natural gas production in the Fort Worth during the past decade.1 Basin of east Texas and the Piceance/Unita Basins of western Colorado and eastern Utah, and the need for natural gas Figure 1. -

Table of Contents

ANR Pipeline Company Third Revised Volume No. 1 Tariff Table of Contents Tariff - Third Revised Volume No. 1 PART 1 - TABLE OF CONTENTS PART 2 - PRELIMINARY STATEMENT PART 3 - MAPS PART 4 - STATEMENT OF RATES 4.1 - Statement of Rates - Rate Schedule ETS 4.2 - Statement of Rates - Rate Schedule STS; Small Shipper ETS & FTS- 1 4.3 - Statement of Rates - Rate Schedules FTS-1, FTS-4 & FTS-4L 4.4 - Statement of Rates - Reserved for Future Use 4.5 - Statement of Rates - Rate Schedule FTS-2 4.6 - Statement of Rates - Rate Schedule FTS-3 4.7 - Statement of Rates - Rate Schedule ITS 4.8 - Statement of Rates - Rate Schedules ITS-3, IPLS & IWS 4.9 - Statement of Rates - Rate Schedules FSS & DDS 4.10 - Statement of Rates - Rate Schedules FSS & DDS (Cold Springs 1) 4.11 - Statement of Rates - Rate Schedules NNS & MBS 4.12 - Statement of Rates - Base Rates: FTS-1, FTS-4, FTS-4L, ETS, PTS-2 & FTS-2 4.13 - Statement of Rates - Base Rate Components: FTS-3 ANR Pipeline Company Third Revised Volume No. 1 Tariff 4.14 - Statement of Rates - Base Rate Components: ITS & PTS-3 4.15 - Statement of Rates - Negotiated Rate Agreements - PTS-3 4.16 - Statement of Rates - Statement of Surcharges 4.17 - Statement of Rates - Reserved for Future Use 4.18 - Statement of Rates - Transporter's Use (%) 4.19 - Statement of Rates - EPC Charge 4.20 - Statement of Rates - Reserved for Future Use PART 5 - RATE SCHEDULES 5.1 - Rate Schedules - Rate Schedule ETS 5.2 - Rate Schedules - Rate Schedule STS 5.3 - Rate Schedules - Rate Schedule FTS-1 5.4 - Rate Schedules - Rate Schedule FTS-2 5.5 - Rate Schedules - Rate Schedule FTS-3 5.6 - Rate Schedules - Rate Schedule FTS-4 5.7 - Rate Schedules - Rate Schedule FTS-4L 5.8 - Rate Schedules - Rate Schedule ITS 5.9 - Rate Schedules - Rate Schedule IPLS 5.10 - Rate Schedules - Rate Schedule IWS 5.11 - Rate Schedules - Rate Schedule ITS-3 5.12 - Rate Schedules - Rate Schedule FSS 5.13 - Rate Schedules - Rate Schedule DDS 5.14 - Rate Schedules - Rate Schedule MBS 5.15 - Rate Schedules - Rate Schedule NNS ANR Pipeline Company Third Revised Volume No. -

000 Exhibit No. ANR-187 Statement O Page 1 of 11 ANR

Docket No. RP16-__-000 Exhibit No. ANR-187 Statement O Page 1 of 11 ANR PIPELINE COMPANY Description of Company Operations System Overview ANR Pipeline Company’s (“ANR”) 9,400-mile transmission system was originally designed to transport natural gas from producing fields located primarily in Texas and Oklahoma on its Southwest Mainline and in Louisiana on its Southeast Mainline. ANR’s system extends to markets located primarily in Wisconsin, Michigan, Illinois, Ohio, and Indiana. ANR’s natural gas pipeline now also interconnects with numerous other natural gas pipelines, providing customers with access to diverse sources of North American supply, including Western Canada, the Rocky Mountain region, and the Appalachian and other unconventional production areas and to a variety of end-user markets in the midwestern and northeastern United States. ANR also owns and operates regulated underground natural gas storage facilities in Michigan. ANR provides storage, transportation, and various capacity related services on an open access basis to qualifying shippers. ANR is a wholly owned direct subsidiary of American Natural Resources Company and a wholly owned indirect subsidiary of TransCanada American Investments Ltd., TransCanada Pipeline USA Ltd., TransCanada Pipelines Limited, and TransCanada Corporation. Docket No. RP16-__-000 Exhibit No. ANR-187 Statement O Page 2 of 11 System Map [18 C.F.R. § 154.312(u)(1)] No significant changes have occurred on ANR's system, shown below, since the filing of ANR’s last FERC Form No. 2. A system map is provided below for convenience. Docket No. RP16-__-000 Exhibit No. ANR-187 Statement O Page 3 of 11 ANR PIPELINE COMPANY Major Expansions and Abandonments 1 [18 C.F.R. -

Public Notice

PUBLIC NOTICE Federal Communications Commission News Media Information 202 / 418-0500 445 12th St., S.W. Internet: http://www.fcc.gov Washington, D.C. 20554 TTY: 1-888-835-5322 Report Number: 5362 Date of Report: 10/21/2009 Wireless Telecommunications Bureau Site-By-Site Action Below is a listing of applications that have been acted upon by the Commission. AA - Aviation Auxiliary Group File Number Action Date Call Sign Applicant Name Purpose Action 0003993613 10/14/2009 WQKW980 Mountain Wave Emergency Communications, Inc. NE G AF - Aeronautical and Fixed File Number Action Date Call Sign Applicant Name Purpose Action 0003905863 10/17/2009 Marco Island Executive Airport AM D 0003981438 10/13/2009 WQKW859 Science and Engineering Services AM G 0003994102 10/14/2009 WQHY600 CESSNA AIRCRAFT COMPANY CA G 0003994119 10/14/2009 WQHY602 CESSNA AIRCRAFT COMPANY CA G 0003994122 10/14/2009 WQHY609 CESSNA AIRCRAFT COMPANY CA G 0003996967 10/15/2009 KNO6 Aviation Spectrum Resources Inc CA G 0003827708 10/15/2009 WQKX366 City of Cochran NE G 0003873927 10/15/2009 WQKX344 Houston Executive Airport Services NE G 0003913070 10/17/2009 Village of Bluffton NE D 0003940605 10/15/2009 WQKX345 City of Moultrie NE G 0003948626 10/13/2009 WQKW861 ITT Corporation, Advanced Engineering and Science NE G 0003948642 10/13/2009 WQKW860 ITT Corporation, Advanced Engineering and Science NE G 0003995226 10/14/2009 WBD79 THE BOEING COMPANY RO G Page 1 AF - Aeronautical and Fixed File Number Action Date Call Sign Applicant Name Purpose Action 0003995245 10/14/2009 WDR3 THE BOEING COMPANY RO G 0003995507 10/14/2009 KA98562 THE BOEING COMPANY RO G AI - Aural Intercity Relay File Number Action Date Call Sign Applicant Name Purpose Action 0003995276 10/14/2009 WLO994 NORTHERN STAR BROADCASTING, L.L.C. -

Appendix 10E

Appendix 10E Calpuff Modeling, Q/D And Visibility For Seney For Seney, Illinois, Indiana, Iowa, Michigan, Missouri and Wisconsin have the majority of the 20% worst day; same as indicated by the PSAT analysis (see Figure 10.2.c). Figure 10.2.c: Composite back trajectories for Seney for the 20% worst days. Orange is where the air is most likely to come from and green is where it is least like to come from. 1 2 Table 1. Calpuff modeling for Seney, includes only facilities located in the state of Michigan. SENEY CLASS I AREA FACILITY SRN 1/(M-m) WISCONSIN ELECTRIC POWER COMPANY B4261 0.565 EMPIRE IRON MINING PARTNERSHIP B1827 0.494 J. H. Campbell Plant B2835 0.493 ESCANABA PAPER COMPANY A0884 0.316 Karn - Weadock Facility B2840 0.311 ST MARYS CEMENT INC B1559 0.187 B. C. Cobb Plant B2836 0.182 Tilden Mining Company L.C. B4885 0.148 ESCANABA POWER PLANT B1573 0.128 MANISTIQUE PAPERS INC A6475 0.120 Neenah Paper - Michigan, Inc. B1470 0.077 Eckert & Moores Park Station B2647 0.075 Lafarge North America - Alpena Plant B1477 0.068 ANR Pipeline Company - Bridgman Compressor Station N5575 0.067 DETROIT EDISON/MONROE POWER B2816 0.063 INTERNATIONAL PAPER CO B7192 0.047 TES FILER CITY STATION N1685 0.038 Packaging Corporation of America - Filer City Mill B3692 0.038 Lansing Board of Water & Light, Erickson Station B4001 0.037 Marquette Board of Light & Power B1833 0.037 Holland BPW, Generating Station & WWTP B2357 0.036 Martin Marietta Magnesia Specialties, LLC A3900 0.035 Michigan State University K3249 0.034 S. -

Natural Gas Transmission Pipelines Receive Natural Gas from Producers

Natural gas transmission pipelines receive natural gas from producers, other mainline transmission pipelines, shippers and gathering systems through system interconnects and redeliver the natural gas to processing facilities, local gas distribution companies, industrial end-users, utilities and other pipelines. Generally natural gas transmission agreements generate revenue for these systems based on a fee per unit of volume transported. Our Mid-Continent Operations We own and operate a 565-mile interstate natural gas pipeline, approximately 2,700 miles of intrastate natural gas gathering systems, including approximately 800 miles of inactive pipeline, located in Oklahoma, Arkansas, southeastern Missouri, northern Texas and the Texas panhandle, and three processing plants and one stand-alone treating facility in Oklahoma. Our Mid-Continent operations were formed through our acquisition of Spectrum Field Services, Inc. (“Spectrum”), also referred to as our Velma system, in July 2004 and expanded through our acquisition of ETC Oklahoma Pipeline, Ltd. (“Elk City”) in April 2005 and the NOARK acquisition, which was consummated in two separate transactions in October 2005 and May 2006. Ozark Gas Transmission transports natural gas from receipt points in eastern Oklahoma, including major intrastate pipelines, and western Arkansas, where the Arkoma Basin is located, to local distribution companies in Arkansas and Missouri and to interstate pipelines in northeastern and central Arkansas. Our gathering and processing assets service long-lived natural gas regions that continue to experience an increase in drilling activity, including the Anadarko Basin, the Arkoma Basin and the Golden Trend area of Oklahoma. Our systems gather natural gas from oil and natural gas wells and process the raw natural gas into merchantable, or residue gas, by extracting NGLs and removing impurities. -

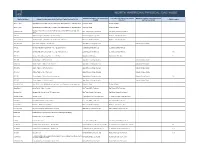

Physical Natural Gas Hub List

Gas Daily Index Reference for NG Firm Phys, Inside FERC Index Reference for NG Firm Natural Gas Intelligence Index Reference for Physical Hub Name Delivery Point Description for NG Firm Phys, FP & NG Firm Phys BS, LD1 ICE NGX Clearable? ID, GDD Phys, ID, IF NG Firm Phys, ID, NGI AB Pool (inter) Agua Blanca Pool (interstate gas only, contact White Water Midstream for applicable rates) Southwest, Waha Southwest, Waha AB Pool (intra) Agua Blanca Pool (intrastate gas only, contact White Water Midstream for applicable rates) Southwest, Waha Southwest, Waha Agua Dulce Hub (sellers' choice, intra-state gas only, contact NET Mexico for applicable Agua Dulce Hub East Texas, Houston Ship Channel East Texas, Houston Ship Channel rates) AGT-CG Algonquin Citygates (Excluding J-Lateral deliveries) Northeast, Algonquin, city-gates Northeast, Algonquin, city-gates AGT-CG (non-G) Algonquin Citygates (Excluding J-Lateral and G-Lateral deliveries) Northeast, Algonquin, city-gates Northeast, Algonquin, city-gates ANR-Joliet Hub ANR Pipeline Company - Joliet Hub CDP Upper Midwest, Chicago city-gates Midwest, Chicago Citygate ANR-SE American Natural Resources Pipeline Co. - SE Gathering Pool Louisiana/Southeast, ANR, La. Louisiana/Southeast, ANR, La. ANR-SE-T American Natural Resources Pipeline Co. - SE Transmission Pool Louisiana/Southeast, ANR, La. Louisiana/Southeast, ANR, La. Yes ANR-SW American Natural Resources Pipeline Co. - SW Pool Midcontinent, ANR, Okla. Midcontinent, ANR, Okla. Yes APC-ANR Alliance Pipeline - ANR Interconnect Upper Midwest, Chicago -

Phase III: Natural Gas-Fired Electric Power Generation Infrastructure Analysis an Analysis of Pipeline Capacity Availability

Phase III: Natural Gas-Fired Electric Power Generation Infrastructure Analysis An Analysis of Pipeline Capacity Availability Appendix Gregory L. Peters President, EnVision Energy Solutions [email protected] 804.378.0770 1 Disclaimer: This report was prepared by Gregory L. Peters, President and Principal Consultant of EnVision Energy Solutions, for the benefit of the Midcontinent Independent Transmission System Operator (MISO). This work involves detailed analyses of interstate pipeline daily flow and capacity data; data obtained and compiled by Bentek Energy; and available public information from independent third parties. The appropriate professional diligence has been applied in the preparation of this analysis, using what is believed to be reasonable assumptions. However, since the report also necessarily involves assumptions regarding the future and the accuracy of the data, no warranty is made, expressed or implied. EnVision Energy Solutions is the prime contractor and Bentek Energy is the subcontractor for this analysis. 2 Table of Contents A1 MBA Methodology Details………………………………………………………………………………….6 A1.1 Summary of Pipeline Capacity Availability for Additional Gas-fired Generation....14 A2 Specific Pipeline Overview and Analyses……………………………………………………………18 A2.1 Alliance Pipeline, LP (Segment 1)……..……………………………………………………….…..….18 A2.2 ANR Pipeline Co. (Segments 2, 3, 4) …………..……………………………………………………..21 A2.3 CenterPoint (Enable) MRT (Segment 5)………………………………………………..……………26 A2.4 Great Lakes Transmission (Segment 6)……………………………………………………………….29