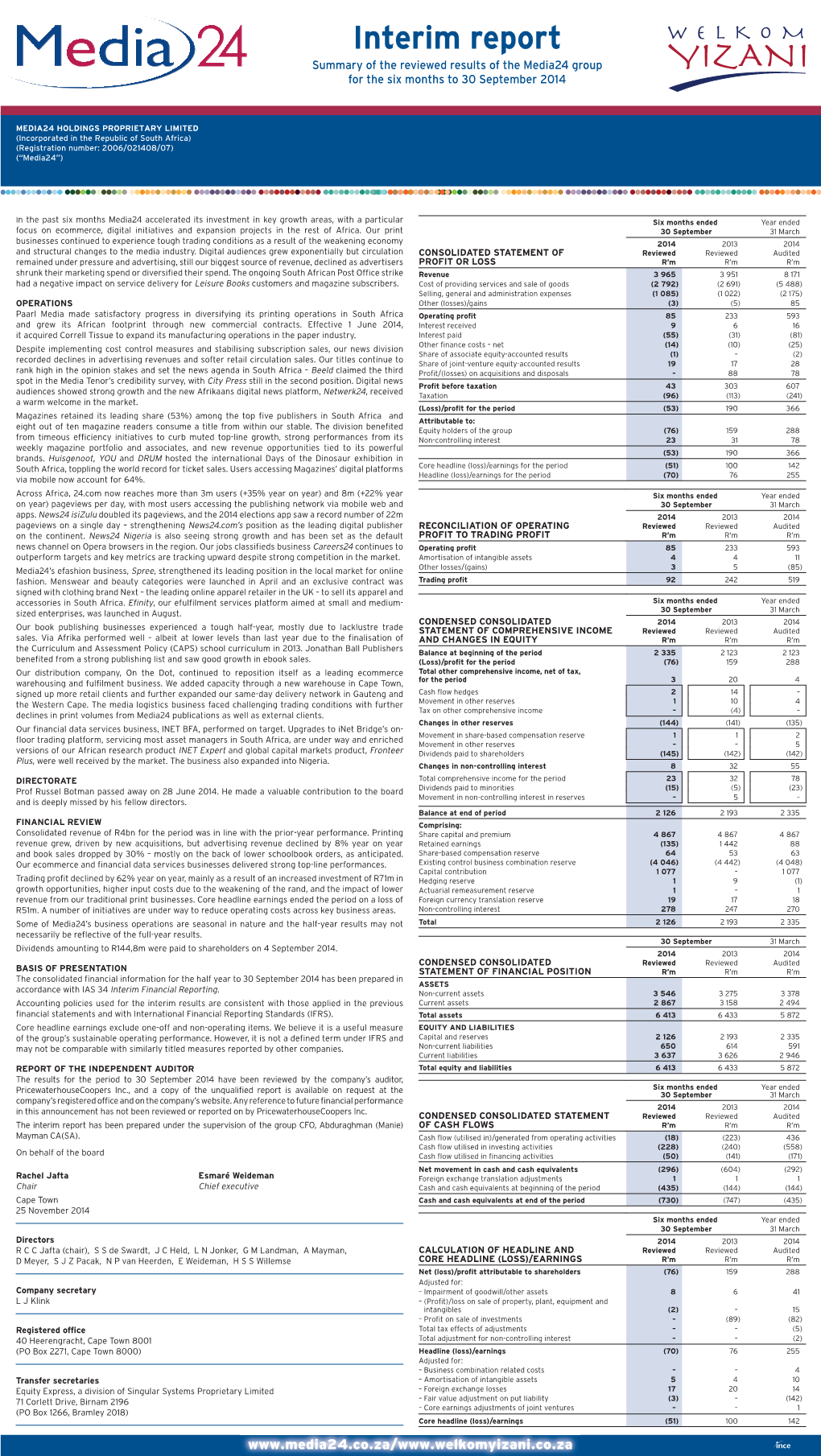

Interim Report Summary of the Reviewed Results of the Media24 Group for the Six Months to 30 September 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Blurred Lines

BLURRED LINES: HOW SOUTH AFRICA’S INVESTIGATIVE JOURNALISM HAS CHANGED WITH A NEW DEMOCRACY AND EVOLVING COMMUNICATION TOOLS Zoe Schaver The University of North Carolina at Chapel Hill School of Media and Journalism Advised by: __________________________ Chris Roush __________________________ Paul O’Connor __________________________ Jock Lauterer BLURRED LINES 1 ABSTRACT South Africa’s developing democracy, along with globalization and advances in technology, have created a confusing and chaotic environment for the country’s journalists. This research paper provides an overview of the history of the South African press, particularly the “alternative” press, since the early 1900s until 1994, when democracy came to South Africa. Through an in-depth analysis of the African National Congress’s relationship with the press, the commercialization of the press and new developments in technology and news accessibility over the past two decades, the paper goes on to argue that while journalists have been distracted by heated debates within the media and the government about press freedom, and while South African media companies have aggressively cut costs and focused on urban areas, the South African press has lost touch with ordinary South Africans — especially historically disadvantaged South Africans, who are still struggling and who most need representation in news coverage. BLURRED LINES 2 TABLE OF CONTENTS Chapter I: Introduction A. Background and Purpose B. Research Questions and Methodology C. Definitions Chapter II: Review of Literature A. History of the Alternative Press in South Africa B. Censorship of the Alternative Press under Apartheid Chapter III: Media-State Relations Post-1994 Chapter IV: Profits, the Press, and the Public Chapter V: Discussion and Conclusion BLURRED LINES 3 CHAPTER I: Introduction A. -

Psychological Responses to Coverage of Crime in the Beeld Newspaper

Psychological Responses to Coverage of Crime in the Beeld Newspaper Talia Thompson A thesis submitted to the Faculty of Arts, University of the Witwatersrand, Johannesburg, in partial fulfilment of the requirements for the Degree of Master of Arts (Clinical Psychology). Declaration I declare that this dissertation is my own, unaided work. It is being submitted for the Degree of Masters of Arts (Clinical Psychology) at the University of Witwatersrand, Johannesburg. It has not been submitted before for any degree or examination at any other University. _____________ Talia Thompson ______ day of _______ 2009. ii Acknowledgements I would like to thank my supervisor, Professor Gill Eagle, for her thoughtful input and patient guidance throughout the process of writing up this study. Her support, knowledge and commitment to encouraging excellence significantly contributed to making this research process challenging and meaningful. I would like to express sincere gratitude to my husband, Coenie, for his immeasurable generosity and support throughout all my studies. His patient encouragement is deeply appreciated and treasured. I would like to thank my parents and my brother for their support, encouragement and interest in this study. I had the privilege of studying with a very special group of people in the last couple of years and I would like to thank this group in particular for all their warm support and encouragement. Lastly, I would like to thank the participants who volunteered their time to reflect thoughtfully and honestly on the impact of coverage of crime in the Beeld newspaper. iii Abstract This research study aimed to explore the psychological impact of coverage of crime in the Beeld newspaper. -

How the City of Bloemfontein Did the Tango Alone in the Inner City Renewal Project

Potgieter, PJ & Steyn, JJ Bloemfontein CBD Masterplan Project 43rd ISOCARP Congress 2007 How the City of Bloemfontein did the tango alone in the Inner City Renewal Project 1. Introduction Since the founding of Bloemfontein in 1846 development has taken place around a market square area which later became known as the Central Business District (CBD). The study of the inner city was done on request by the Mangaung Local Municipality (MLM) and was based on data obtained for a previous study (1983). After a scientific delineation study which proved that due to changed circumstances in the inner city (CBD) the boundary was extended and a comprehensive land use plan for the area drawn up. Figure 1: New delineation for the CBD Masterplan Project Source: Potgieter & Steyn, 2005. This comprehensive land use plan was the culmination of the efforts of a number of people in various disciplines which made up a consortium. The aim of the study was to deliver a product which would enable the Council “to arrive at processes and projects with which the central business district of Bloemfontein can be upgraded to a semblance of its former splendour, is in fact a collection of a number of distinct deliverables.” (Potgieter & Steyn, 2005, 1) One of the main requirements for success of the study was stipulated in the second part of the study’s purpose which read as follows: “It is however important to note that all of the planning endeavours should be in total harmony with each other to ultimately arrive at a single vision for an upgraded CBD.” (Potgieter & Steyn, 2005, 1) However, this study will show to what extent public participation was manipulated by Council in order to get a quick plan before the election and how the planning profession lost against political power. -

The Impact of Supporter Experience at the Jonsson Kings Park Stadium on the Sharks Brand

The impact of supporter experience at the Jonsson Kings Park Stadium on The Sharks brand By Robyn Wheeler (15017776) Research Methodology Subject code: RESM8419 Supervisor: Gareth Gray Honours in the Bachelor of Arts in Strategic Brand Communications Word count: 11754 words I hereby declare that the Research Report submitter for the Honors in Strategic Brand Communication degree to The Independent Institute of Education is my own work and has not previously been submitted to another University or Higher Education Institution for degree purposes. Abstract 1 This small-scaled study reviewed supporters experiences within a sports stadium and their impact on a brand. The research specifically is centred around The Sharks brand and the Jonsson Kings Park Stadium, the home stadium of The Sharks rugby team. Rugby is a competitive sport that participates within South Africa’s heritage. This generated from the existence and the attendance to the home stadium of The Sharks. Attenders to the stadium have been declining due to supporters reducing their purchases of the stadium tickets. This study reviews themes that are common to sport stadiums that have suffered within similar scenarios. The information gathered in this study was accumulated through a qualitative approach. This would allow for flexibility of revealing deep insights during the entire primary research. The methodology of research performed involved focus groups and an online survey. The insights received from this, directed meaningful findings and recommendations that aspires to assist The Sharks by providing useful data to increase attenders to the stadium. It was concluded through the research that supporters do not value the stadium experience. -

STATE of the NEWSROOM SOUTH AFRICA2 013 Disruptions and Transitions

STATE OF THE NEWSROOM SOUTH AFRICA2 013 Disruptions and Transitions Glenda Daniels Lead Researcher and Project Co-ordinator: Dr Glenda Daniels For Wits Journalism: Prof Anton Harber and Prof Franz Krüger Wits Journalism student researchers: Kagiso Ledikwa, Taurai Maduna, Ebrahim Moolla, Mackson Muyambo and Camilla Bath Copy editor: Gill Moodie/Grubstreet Design and Layout: Hothouse South Africa Proof reader: Ruth Becker Photography: TJ Lemon, Pheladi Sethusa, Madelene Cronje, Liesl Frankson Special thanks: to Dr Julie Reid, Kelly Hawkins (both from Unisa), Joe Thloloe and Dr Johan Retief for information on the Press Council and Ombudsman rulings, to Jenny Tennant from Big Media for reading and commenting, and to Dinesh Balliah for general help. Publisher: Wits Journalism, University of the Witwatersrand Electronic copies can be accessed at: journalism.co.za/newsroom2013 CONTENTS PREFACE iii EXECUTIVE SUMMARY v 01 THE MEDIA LANDSCAPE 1 The Print Media Circulation Cutting Costs Ownership New Developments Transformation Community Media and Independent Publishing The Broadcast Landscape Television Audience Figures The Move to Digital Terrestrial Television (DTT) Radio The Internet, Paywalls, Apps and Mobis 02 THE LEGAL, POLITICAL AND REGULATORY LANDSCAPE 15 The Protection of State Information Bill/Secrecy Bill Amendments and Outstanding Problems Other Laws Impacting on Journalism From Self-regulation to Independent Co-regulation Freedom of Expression 03 RACE AND GENDER TRANSFORMATION 22 A Look Back in Time Employment Equity Policies Race and -

Media24 Holdings Proprietary Limited

Media24 Holdings Proprietary Limited REG. NO. 2006/021408/07 ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2013 MEDIA24 HOLDINGS PROPRIETARY LIMITED INDEX TO CONSOLIDATED ANNUAL FINANCIAL STATEMENTS for the year ended 31 March 2013 Page Statement of responsibility by the board of directors 2 Directors and official information 3 Audit committee report 4 - 5 Directors' report to shareholders 6 - 7 Independent auditors’ report 8 Consolidated statement of financial position 9 Consolidated income statements 10 Consolidated statement of comprehensive income 11 Consolidated statement of changes in equity 12 Consolidated statement of cash flows 13 Notes to the consolidated annual financial statements 14 - 85 Company statement of financial position 86 Company statement of comprehensive income 87 Company statement of changes in equity 88 Company statement of cash flows 89 Notes to the company annual financial statements 90-93 1 MEDIA24 HOLDINGS PROPRIETARY LIMITED DIRECTORS AND OFFICIAL INFORMATION BOARD OF DIRECTORS GJ Gerwel (chairman) (deceased 28/11/2012) RCC Jafta (chairperson) (appointed as chairperson 01/04/2013) JP Bekker HR Botman SS de Swardt GM Landman SJZ Pacak LP Retief JJM van Zyl T Vosloo J J Pieterse E Weideman D Meyer (appointed 01/04/2013) REGISTERED ADDRESS 40 Heerengracht Cape Town 8001 P O Box 2271, Cape Town 8000 SECRETARY LJ Klink 40 Heerengracht Cape Town 8001 P O Box 2271, Cape Town 8000 AUDITORS PricewaterhouseCoopers Inc. No.1 Waterhouse Place Century City 7441 P O Box 2799, Cape Town 8000 ATTORNEYS Werksmans Incorporating Jan S de Villiers 17th Floor 1 Thibault Square Cape Town 8001 P O Box 1474, Cape Town 8000 REGISTRATION NUMBER 2006/021408/07 3 MEDIA24 HOLDINGS PROPRIETARY LIMITED AUDIT COMMITTEE REPORT FOR THE YEAR ENDED 31 MARCH 2013 The audit committee has pleasure in submitting this report, as required by section 94 of the Companies Act No 71 of 2008. -

South African Government Media Directory: Community and Regional Newspapers 2021-09-23

South African Government Media Directory: Community and Regional Newspapers 2021-09-23 Table of Contents African Reporter .................................................................................................................................................... 3 Alberton Record .................................................................................................................................................... 3 Athlone News ......................................................................................................................................................... 3 Barkly East Reporter ............................................................................................................................................. 3 Bedfordview and Edenvale News ........................................................................................................................ 3 Benoni City Times ................................................................................................................................................. 3 Berea Mail ............................................................................................................................................................... 3 Bloemnuus ............................................................................................................................................................. 3 Boksburg Advertiser ............................................................................................................................................ -

Falling and Rising in the Wake of Cecil John Rhodes Tamar Garb

Falling and Rising In the Wake of Cecil John Rhodes Tamar Garb One spectacular event, many competing images. On the April 9, 2015, the University of Cape Town (UCT) enabled the removal of its most contentious public monument, the statue of Cecil John Rhodes, one-time prime minister of the Cape Colony (1890–96), arch imperialist, benefactor of the university’s estate, and protagonist of white supremacy.1 Both veteran documentary photographer David Goldblatt and emerging performance/visual artist Sethembile Msezane were there to witness the scene. As their images testify, they were not alone. Equipped with mobile phones and iPads, hundreds of onlookers attended the auspicious unseating, stretching their arms heavenward as if saluting or hailing history rather than merely capturing its symbolic passage. Figs 1, 2 Goldblatt’s and Msezane’s iconic photographs are particularly notable for capturing alternative views of an ongoing, sometimes bitter, argument. Despite the formal, aesthetic, and affective differences between these two photographs, the proliferation of handheld devices of recordkeeping and personal testimony that frame the scene are shared, providing the contemporary context for the newsworthy spectacle, democratized dissemination, and embodied experience that the scene of removal represents. Not only is it meaningful that the controversial, now visibly diminished, statue was taken down, but the public manner and individuated mediation/consumption of its removal makes the event significant at both a subjective and social level. -

“They Have Robbed Me of My Life” Xenophobic Violence Against Non-Nationals in South Africa WATCH

HUMAN RIGHTS “They Have Robbed Me of My Life” Xenophobic Violence Against Non-Nationals in South Africa WATCH “They Have Robbed Me of My Life” Xenophobic Violence Against Non-Nationals in South Africa Copyright © 2020 Human Rights Watch All rights reserved. Printed in the United States of America ISBN: 978-1-62313-8547 Cover design by Rafael Jimenez Human Rights Watch defends the rights of people worldwide. We scrupulously investigate abuses, expose the facts widely, and pressure those with power to respect rights and secure justice. Human Rights Watch is an independent, international organization that works as part of a vibrant movement to uphold human dignity and advance the cause of human rights for all. Human Rights Watch is an international organization with staff in more than 40 countries, and offices in Amsterdam, Beirut, Berlin, Brussels, Chicago, Geneva, Goma, Johannesburg, London, Los Angeles, Moscow, Nairobi, New York, Paris, San Francisco, Sydney, Tokyo, Toronto, Tunis, Washington DC, and Zurich. For more information, please visit our website: http://www.hrw.org SEPTEMBER 2020 ISBN: 978-1-62313-8547 “They Have Robbed Me of My Life” Xenophobic Violence Against Non-Nationals in South Africa Map .................................................................................................................................. i Summary ......................................................................................................................... 1 Recommendations .......................................................................................................... -

Winners List

WINNERS LIST Sub-category Entry Agency Brand Title Product Award Campaign category Content Strategy FoxP2 Ster-Kinekor The Van Der Merwe film launch The Van Der Merwe film Bronze Content Strategy King James Group Sanlam Ukshona Kwelanga MyChoice Funeral Plans Gold Content Strategy VML South Africa Edgars Fashion Emoji Catwalk Edgars Summer Range 2016 Silver Content Strategy VML South Africa The Huffington Post South Africa Stop The Cycle Bronze VML South Africa & Content Strategy Nedbank See Money Differently Nedbank Silver Joe Public Customer Engagement Data-driven Campaign Showmax Showmax Video On Demand Internet TV Gold Segmentation Digital Integrated Campaign Liquorice Distell Amarula #DontLetThemDisappear Amarula Bronze Digital Integrated Campaign Net#work BBDO SCA Vagina Varsity Libresse Panty Liners Bronze Digital Integrated Campaign Ogilvy DStv Halloween Sleep Over DStv Bronze Digital Integrated Campaign Wunderman Investec #MoreThanData Investec Private Bank Bronze Digital Strategy Net#work BBDO SCA Vagina Varsity Libresse Panty Liners Bronze Integrated Mixed Media Joe Public Pty Ltd Chicken Licken Afronaut Hotwings® Bronze Campaign Integrated Mixed Media King James Group Sanlam Ukshona Kwelanga MyChoice Funeral Plans Silver Campaign Integrated Mixed Media Mna Nam | National Savings King James Group Sanlam Silver Campaign Month Integrated Mixed Media M&C Saatchi Abel Nando’s Reconciliation Table Nando’s Silver Campaign Integrated Mixed Media Ogilvy & Mindshare Jhb KFC Soundbite The Soundbite Chart Silver Campaign Mobile Campaign -

The Defaunation Bulletin Quarterly Information and Analysis Report on Animal Poaching and Smuggling N°23. Events from the 1St O

The defaunation bulletin Quarterly information and analysis report on animal poaching and smuggling n°23. Events from the 1st October 2018 to the 31 of January 2019 Published on August 5, 2019 Original version in French 1 On the Trail #23. Robin des Bois Carried out by Robin des Bois (Robin Hood) with the support of the Brigitte Bardot Foundation, the Franz Weber Foundation and of the Ministry of Ecological and Solidarity Transition, France reconnue d’utilité publique 28, rue Vineuse - 75116 Paris Tél : 01 45 05 14 60 “On the Trail“, the defaunationwww.fondationbrigittebardot.fr magazine, aims to get out of the drip of daily news to draw up every three months an organized and analyzed survey of poaching, smuggling and worldwide market of animal species protected by national laws and international conventions. “ On the Trail “ highlights the new weapons of plunderers, the new modus operandi of smugglers, rumours intended to attract humans consumers of animals and their by-products.“ On the Trail “ gathers and disseminates feedback from institutions, individuals and NGOs that fight against poaching and smuggling. End to end, the “ On the Trail “ are the biological, social, ethnological, police, customs, legal and financial chronicle of poaching and other conflicts between humanity and animality. Previous issues in English http://www.robindesbois.org/en/a-la-trace-bulletin-dinformation-et-danalyses-sur-le-braconnage-et-la-contrebande/ Previous issues in French http://www.robindesbois.org/a-la-trace-bulletin-dinformation-et-danalyses-sur-le-braconnage-et-la-contrebande/ Non Governmental Organization for the Protection of Man and the Environment Since 1985 14 rue de l’Atlas 75019 Paris, France tel : 33 (1) 48.04.09.36 - fax : 33 (1) 48.04.56.41 www.robindesbois.org [email protected] Publication Director : Jacky Bonnemains Editor-in-Chief: Charlotte Nithart Art Directors : Charlotte Nithart et Jacky Bonnemains Coordination : Elodie Crépeau Writing: Jacky Bonnemains, Léna Mons and Jean-Pierre Edin. -

How Die Burger Newspaper Developed from Print to Digital Within a Century

How Die Burger Newspaper developed from print to digital within a century On the 18th of December 1914 in a Victorian style house named Heemstede, sixteen South African citizens established De Nationale Pers Beperkt better known as Naspers and Media24 today. This leads to the creating of the first edition of De Burger Newspaper on the 26th of July 1915. On the 12th of May 1915 De Nationale Pers Beperkt in Cape Town was registered under the Maatschappijenwet of 1892. The “Akte van Oprichting” were compiled at 22 Wale Street and Keeromstraat 30 became Naspers’ first address. Die Burger Newspaper was since its origin on 26 July 1915 a non profitable company. In 1928 the distribution of dividends became a reality. Willie Hofmeyr managed Naspers and established Santam and Sanlam in 1918 Today Media24 News publishes more than 90 titles and about 294,6 Million newspapers annually The weekly urban Newspapers have a strong market penetration and a circulation of about 974 000 per week, while the community newspapers’ circulation amounts to about 2 million a week. Naspers currently have 22031976 unique browsers over 90 newspapers and 60 magazines. Paul Jones, circulation manager confirms that Die Burger currently supply newspaper copies to 95 libraries in the WC and EC. We also working with the SBA we annually send 60,000 newspapers to 209 schools in the Western Cape. Our “ Leer en Presteer” appendix has recently ended in the Eastern Cape and we have distributed 24,000 newspapers to schools in the Eastern Cape . Preservation Each month the original copies of Die Burger were combined into bundles and covered with hard covers by the National Library of Southern Africa in Cape Town.