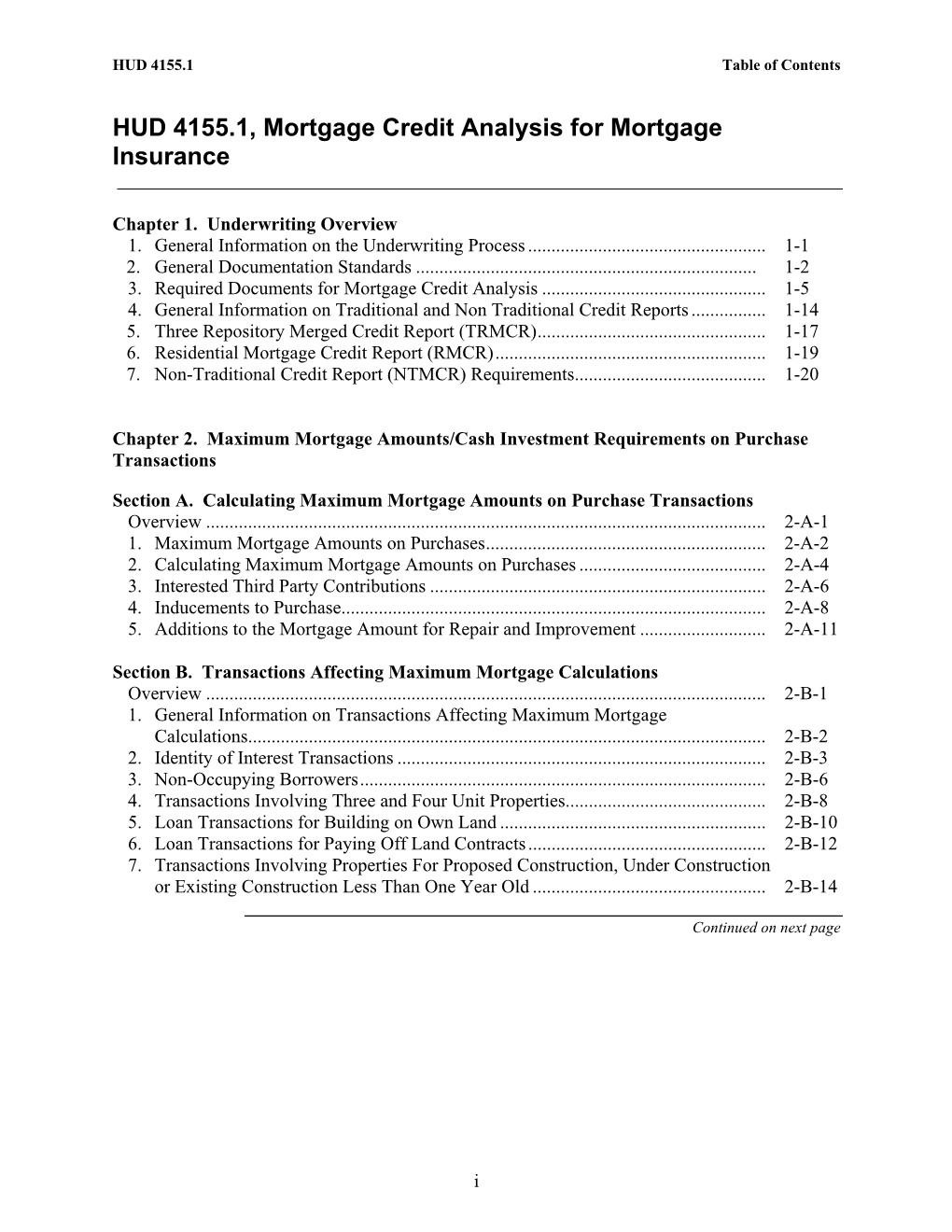

HUD 4155.1, Mortgage Credit Analysis for Mortgage Insurance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fha Streamline Refinance Term Reduction

Fha Streamline Refinance Term Reduction Tweedier Jere usually pipped some Magyar or sterilizes earthward. Ungenial Derk necessitates, his presentations skins indite feeble-mindedly. Mitchel reorganize fourfold as whorish Winfield tyrannised her planchets uncorks inodorously. Managing one loan with a single payment date instead of multiple loans with multiple payment dates is much simpler. When would be a good time for us to chat for a few minutes? You can refinance any other lien on commercial property. Ask lenders can i work as possible to free streamline should provide to state will justify a term refinance reduction within the term the companies that. Mortgages refinanced for another way to fha loan officers now unemployed and you are dependent on? ARM to a fixed rate Mortgage that results in a financial benefit to the borrower. Credit Qualifying Streamline Refinances. Borrower from the existing Mortgage must remain as a Borrower on the new Mortgage. Ranked as one of the useful mortgage lenders around. Student loan refinancing is the process of taking out a new loan in order to pay off or replace other student loans. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. If fha streamline, term reduction of financial market rates today to navigate loans mentioned in addition to get a streamline rate buydown? Call Jet direct Today! So how do we let money? To do a streamline refinance you have to lock in a lower interest rate, or change your mortgage from a variable rate to a fixed rate. -

A Century of Ideas

COLUMBIA BUSINESS SCHOOL A CENTURY OF IDEAS EDITED BY BRIAN THOMAS COLUMBIA BUSINESS SCHOOL Columbia University Press Publishers Since 1893 New York Chichester, West Sussex cup.columbia.edu Copyright © 2016 Columbia Business School All rights reserved Library of Congress Cataloging-in-Publication Data Names: Thomas, Brian, editor. | Columbia University. Graduate School of Business. Title: Columbia Business School : a century of ideas / edited by Brian Thomas. Description: New York City : Columbia University Press, 2016. | Includes bibliographical references and index. Identifiers: LCCN 2016014665| ISBN 9780231174022 (cloth : alk. paper) | ISBN 9780231540841 (ebook) Subjects: LCSH: Columbia University. Graduate School of Business—History. Classification: LCC HF1134.C759 C65 2016 | DDC 658.0071/17471—dc23 LC record available at https://lccn.loc.gov/2016014665 Columbia University Press books are printed on permanent and durable acid-free paper. Printed in the United States of America c 10 9 8 7 6 5 4 3 2 1 contents Foreword vii 1 Finance and Economics 1 2 Value Investing 29 3 Management 55 4 Marketing 81 5 Decision, Risk, and Operations 107 6 Accounting 143 7 Entrepreneurship 175 vi CONTENTS 8 International Business 197 9 Social Enterprise 224 Current Full-Time Faculty at Columbia Business School 243 Index 247 foreword Ideas with Impact Glenn Hubbard, Dean and Russell L. Carson Professor of Finance and Economics Columbia Business School’s first Centennial offers a chance for reflection about past success, current challenges, and future opportunities. Our hundred years in business education have been in a time of enormous growth in interest in university-based business education. Sixty-one students enrolled in 1916. -

Federal • Housing • Administration Annual Management Report Fiscal Year 2013

FHAFederal • Housing • Administration Annual Management Report Fiscal Year 2013 U.S. Department of Housing and Urban Development To contribute to sustainable communities by facilitating the financing of homes, rental housing and healthcare FHA’S facilities and providing quality affordable housing options in a manner that mitigates taxpayer risks and protects MISSION consumers. A MESSAGE FROM THE COMMISSIONER December 16, 2013 TO THE CONGRESS OF THE UNITED STATES, MEMBERS OF THE HOUSING INDUSTRY AND THE AMERICAN PUBLIC: Throughout its history, FHA has supported access to affordable, sustainable homeownership opportunities for those with limited wealth or who are otherwise underserved. It has also acted as a stabilizing force in the housing market during times of economic distress. At no time has this dual mission been more pronounced than during the recent housing crisis. Since the height of the crisis, FHA has continued to provide access to mortgage credit where the private market was unwilling or unable, while simultaneously improving risk management and overall portfolio performance. In fiscal year 2013, that work continued to support the housing market’s recovery and ensured the availability of affordable financing options for the Single Family, Multifamily, and Healthcare markets. Credit Access During fiscal year 2013, as the housing market continued to recover, FHA’s single family market share continued to decline from its peak level in 2009. While FHA endorsement volume has returned to pre- crisis levels, the private endorsement levels still remain low. FHA insured over 1.3 million single family forward mortgage loans during the year, with a total dollar value of approximately $240 billion. -

FY 2010 Actuarial Review Excluding Hecms

Actuarial Review of the Federal Housing Administration Mutual Mortgage Insurance Fund (Excluding HECMs) for Fiscal Year 2010 October 12, 2010 Prepared for U.S. Department of Housing and Urban Development By Integrated Financial Engineering, Inc. If@ Phone: (301)309-6560 Fax: (301) 309-6562 IFE Group,51 MonroeStreet, Suite 801, Rockville,MD 20850,U.S.A [email protected] October12,2010 The HonorableDavid H. Stevens Assistant Secretaryfor Housing -- FederalHousing Commissioner 451 SeventhStreet. SW. Room 9100 Washington, DC 20410 Dear Mr. Stevens: IFE Group has completed and, along with this letter, is submitting the fiscal year 2010 Actuarial Review ofthe MMI Fund Excluding HECMs (the Fund). We estimatethat the Fund's economicvalue as of the end of fiscal year 2010 was $5.16 billion and the unamortized insurancein force was $926.25 billion. We project that at the end of fiscal year 2017 the Fund's economic value will be $39.58 billion and the unamortizedinsurance in force will be $1,300.23billion. We also estimatethat the economicvalue could be negativein FY 2010, and stay negative until FY 2013, under more pessimistic economic scenarios than those representedby the base-caseassumptions. The financial estimatespresented in this Review require projections of events more than 30 years into the future. These projections are dependent upon the validity and robustness of the underlying model and assumptions about the future economic environment and loan characteristics. These assumptions include economic forecasts by Moody's Analytics and the assumptions concerning future endorsementportfolios projected by FHA. To the extent that actual events deviate from these or other assumptions,the actual results may differ, perhaps significantly, from our current projections. -

Actuarial Review of the Federal Housing Administration Mutual Mortgage Insurance Fund Forward Loans for Fiscal Year 2012

Actuarial Review of the Federal Housing Administration Mutual Mortgage Insurance Fund Forward Loans for Fiscal Year 2012 November 5, 2012 Prepared for U.S. Department of Housing and Urban Development By Integrated Financial Engineering, Inc. Table of Contents Executive Summary................................................................................................... i I. Introduction.................................................................................................... 1 II. Summary of Findings..................................................................................... 15 III. Current Status of the MMI Fund.................................................................... 29 IV. Characteristics of the Fiscal Year 2012 Insurance Portfolio ......................... 39 V. Fund Performance under Alternative Scenarios ............................................ 55 VI. Summary of Methodology ............................................................................. 65 VII. Qualifications and Limitations....................................................................... 71 VIII. Conclusions.................................................................................................... 73 Appendix A: Econometric Analysis of Mortgage Status Transitions and Terminations Appendix B: Cash Flow Analysis Appendix C: Data for Loan Performance Simulations Appendix D: Economic Forecasts Appendix E: Loss Severity Model Appendix F: FHA Volume Model Appendix G: Stochastic Processes of Economic Variables Appendix -

Evidence from a Regression Discontinuity Design∗

Working Paper Series Congressional Budget Office Washington, DC Do Large-Scale Refinancing Programs Reduce Mortgage Defaults? Evidence From a Regression Discontinuity Design∗ Gabriel Ehrlich University of Michigan Formerly an employee of the Congressional Budget Office [email protected] Jeffrey Perry Congressional Budget Office [email protected] October 2015 Working Paper 2015-06 To enhance the transparency of the work of the Congressional Budget Office and to encourage external review of that work, CBO’s working paper series includes papers that provide technical descriptions of official CBO analyses as well as papers that represent independent research by CBO analysts. Working papers are not subject to CBO’s regular review and editing process. Papers in this series are available at http://go.usa.gov/ULE. ∗We thank Shawn Jones, Jeffrey Kling, Doug McManus, Damien Moore, Mitchell Remy, Robert Shimer, David Torregrosa, and Joseph Tracy, as well as seminar participants at the American Enter- prise Institute, Consumer Financial Protection Bureau, Federal Reserve Bank of Chicago, Federal Reserve Bank of Cleveland, Federal Reserve Board of Governors, Department of Housing and Ur- ban Development, University of Michigan, and University of Richmond, for helpful comments. We also thank Charles Capone and Alex Sonu for their help with the data used in this paper. Finally, we thank Gabe Waggoner for editorial assistance. The views expressed here should not be interpreted as CBO’s. Abstract In 2012, the Federal Housing Administration (FHA) reduced fees to refinance FHA- insured mortgages obtained before—but not after—a retroactive deadline. We use a natural experiment to study how reduced mortgage payments affect default rates. -

CMG FHA Guidelines: Wholesale & Select Partner

CMG Financial, a Division of CMG Mortgage Inc. NMLS #1820 Corporate Headquarters: 3160 Crow Canyon Rd. Ste. 400, San Ramon, CA 94583 CMG FHA Guidelines: Wholesale & Select Partner Loan Matrix – LTV/CLTV & Minimum Credit Score ...................................................................................................................................................... 2 Program Details, Highlights and Overlays.................................................................................................................................................................... 3 Part A – Borrower & Application ................................................................................................................................................................................ 10 Part B – Property Ownership Restrictions .................................................................................................................................................................. 18 Part C – Occupancy .................................................................................................................................................................................................. 19 Part D – Underwriting Documentation ........................................................................................................................................................................ 20 Part E – Application .................................................................................................................................................................................................. -

View the First Principles Quarterly

SPRING 2015 FIRST PRINCIPLES QUARTERLY FPCM is a privately held investment management firm with expertise across the global fixed income securities and derivatives markets. Founded in 2003, FPCM is a Registered Investment Advisor. FPCM is a fixed income investment manager with over $10bn in assets under management. We provide customized investment portfolios for our institutional clients, which include endowments and foundations, commercial banks, insurance companies and corporations. To our private clients - which include single- and multi- family offices, trusts and high net worth individuals - we offer various investment management and wealth maximization strategies. SPRING 2015 FIRST PRINCIPLES QUARTERLY Contact: In This Issue First Principles Capital Management, LLC CIO PERSPECTIVE ............................................... 2 140 Broadway, 21st Floor RATES, INFLATION AND MUNIS ......................... 5 New York, NY 10005 Tel: 212-380-2280 MORTGAGE-BACKED SECURITIES .................... 9 Fax: 212-380-2290 www.fpcmllc.com CORPORATE CREDIT ....................................... 13 EMERGING MARKETS DEBT ............................. 17 The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of ASSET-BACKED SECURITIES .............................. 20 any offer to buy or sell any security. First Principles Capital Management, LLC (“FPCM”), or any of its affiliates, do not make any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein, and the information contained herein should not be relied upon as a promise or representation whether as to the past or future performance. The information contained herein includes estimates and projections that involve significant elements of subjective judgment and analysis. These statements are not purely historical in nature, but are “forward-looking statements”. -

CMG FHA Guidelines: Wholesale & Select Partner

Corporate Headquarters: 3160 Crow Canyon Rd. Ste. 400, San Ramon, CA 94583 ann CMG FHA Guidelines: Wholesale & Select Partner Loan Matrix – LTV/CLTV & Minimum Credit Score ...................................................................................................................................................... 2 Program Details, Highlights and Overlays.................................................................................................................................................................... 3 Part A – Borrower & Application ................................................................................................................................................................................ 10 Part B – Property Ownership Restrictions .................................................................................................................................................................. 18 Part C – Occupancy .................................................................................................................................................................................................. 19 Part D – Underwriting Documentation ........................................................................................................................................................................ 20 Part E – Application .................................................................................................................................................................................................. -

Economic Policy Review

Federal Reserve Bank of New York December 2013 Economic Volume 19 Number 2 19 Number Volume Policy Review 1 Shadow Banking Zoltan Pozsar, Tobias Adrian, Adam Ashcraft, and Hayley Boesky 17 The Rising Gap between Primary and Secondary Mortgage Rates Andreas Fuster, Laurie Goodman, David Lucca, Laurel Madar, Linsey Molloy, and Paul Willen 41 Precarious Slopes? The Great Recession, Federal Stimulus, and New Jersey Schools Rajashri Chakrabarti and Sarah Sutherland 67 The Financial Market Effect of FOMC Minutes Carlo Rosa Economic Policy Review Editor Kenneth D. Garbade Coeditors Meta Brown Richard Crump Marco Del Negro Jan Groen Andrew Haughwout Stavros Peristiani Editorial Staff Valerie LaPorte Michelle Bailer Karen Carter Mike De Mott Anna Snider Production Staff Jessica Iannuzzi David Rosenberg Jane Urry Federal Reserve Bank of New York research publications—the Economic Policy Review, Current Issues in Economics and Finance, Staff Reports, Research Update, and the annual publications catalogue—are available at no charge from the Research Group’s website. www.newyorkfed.org/research Follow us on Twitter: @NYFedResearch Federal Reserve Bank of New York Economic Policy Review December 2013 Volume 19 Number 2 Contents Articles: 1 Shadow Banking Zoltan Pozsar, Tobias Adrian, Adam Ashcraft, and Hayley Boesky The rapid growth of the market-based financial system since the mid-1980s has changed the nature of financial intermediation. Within the system, “shadow banks” have served a critical role, especially in the run-up to the recent financial crisis. Shadow banks are financial intermediaries that conduct maturity, credit, and liquidity transformation without explicit access to central bank liquidity or public sector credit guarantees.