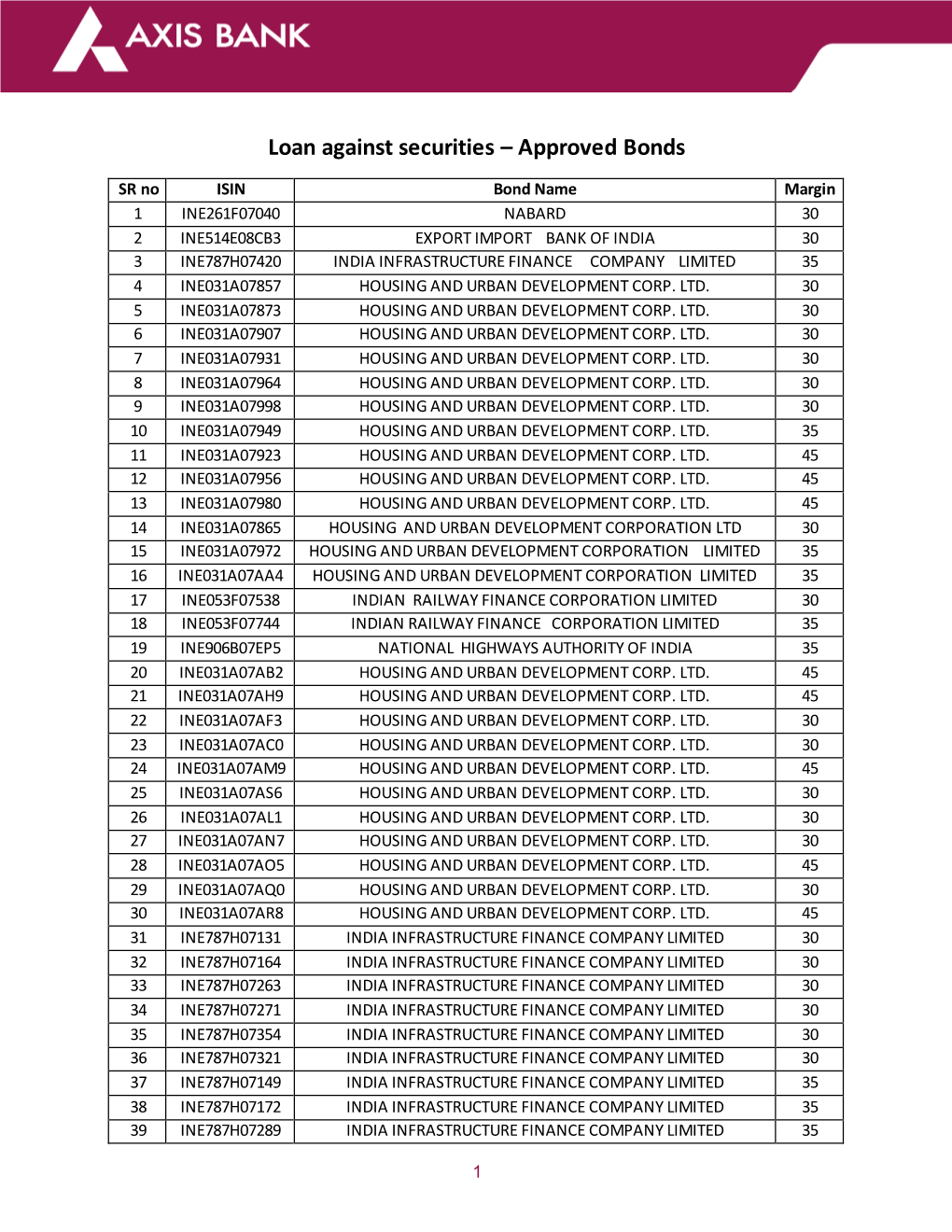

Loan Against Securities – Approved Bonds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

As Available on BSE BOND EBP Platform

(Private & Confidential - Not for circulation) This is a Disclosure Document prepared in conformity with Securities and Exchange Board of India (Issue and Listing of Debt Securities) (Amendment) Regulations, 2015 (Statutory Body Under The Government of India) NATIONAL HOUSING BANK (Established on 9th July 1988 under an Act of the Parliament) Head Office: India Habitat Centre Core 5A, 3rd - 5th Floor, Lodhi Road, New Delhi -110003 Web Site: http://www.nhb.org.in E-mail: [email protected] Tel: 011-39187064/103 Fax: 011-2464 6988 Disclosure document for Private Placement of Unsecured, Redeemable and Non-Convertible Bonds in the nature of Debentures of Face value 10 lacs each for cash, aggregating 500 Crore with green shoe option of 1500 Crore. REGISTRAR TO THE ISSUE TRUSTEES TO THE ISSUE Beetal Financial & Computer Services (P) Ltd IDBI Trusteeship Services Ltd Beetal House, 3rd Floor, 99 Madangir Registered Office: Near Dada Harsukhdas Mandir Asian Building, Ground Floor, New Delhi – 110062 17, R, Kamani Marg, Phone No 011-29961281 Mumbai – 400 001 Fax No 011-29961284 Tel No 022 66311771-3 Website: www.beetalfinancial.com Fax No 022-66311776 Email: [email protected] E-mail: [email protected] Arrangers to the issue: As available on BSE BOND EBP Platform Dated: 15.01.2020 1 DISCLAIMER DISCLAIMER OF THE ISSUER This Disclosure Document is neither a Prospectus nor a Statement in Lieu of Prospectus and is prepared in accordance with Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008 issued vide Circular No LAD-NRO/GN/2008/13/127878 dated June 06, 2008, as amended and Securities and Exchange Board of India(SEBI) (Issue and Listing of Debt Securities) (Amendment) Regulations, 2012, further vide Circular No LAD-NRO/GN/2015-16/013 dated September 02, 2015, as amended. -

The Housing Finance Market in India

THE HOUSING FINANCE CONRAD D’SOUZA TREASURER: HOUSING DEVELOPMENT MARKET IN INDIA FINANCE CORPORATION LIMITED - INDIA Workshop on Housing Finance in South Asia - World Bank & IFC Jakarta, Indonesia May 27, 2009 AGENDA • INDIAN HOUSING FINANCE SYSTEM • CURRENT MARKET SCENARIO • IMPACT OF THE GLOBAL CRISIS • REGULATORY ENVIRONMENT • HDFC SNAPSHOT • AFFORDABLE HOUSING • PROSPECTS & CHALLENGES 2 South Asia: Regional Overview • South Asia is the second fastest growing economic region • Average annual growth rate: 6.3% in 2008, 8.4% in 2007 • Majority of the population is still dependent on agriculture • Region is home to 50% of the world’s poor • Risks include high oil and food prices and political uncertainty • The global financial crisis has resulted in a slowdown in capital inflows and investments • Low penetration of housing finance 3 India Highlights Strong GDP IMPORTANCE OF HOUSING growth: 9% Rapid urbanisation, between rising middle class 2003-08 Engine of economic growth Second largest employment generator after agriculture Strong backward and forward linkages with ancillary industries Estimated investment for meeting housing needs up to Political stability 2012: US$ 108 bn Services sector Forex reserves accounts for at over $250 60% of GDP billion Second fastest growing economy in 4 the world after China Source: European Mortgage Federati LOW PENETRATION IMPLIES ROOM FORGROWTH LOW PENETRATION IMPLIES 100 20 40 60 80 0 1% Pakistan Mortgage MarketinIndia Indonesia 2% MORTGAGES AS A%OFGDP MORTGAGES 7% India 12% China on, 2007 & Asian Development Bank, on, 2007 & 2007 17% Thailand 26% Korea 29% Malaysia 32% Singapore 39% Taiwan 41% HongKong 80% USA 86% UK 5 Housing in India • Central Government formulates broad policy framework • Housing – state level activity • National Housing and Habitat Policy - last reviewed in 2007 • Acute housing shortage estimated at over 24.7 million units – Rural: 14.1 million units – Urban: 10.6 million units • Eleventh Five Year Plan (2007-2012): Investment requirements for housing estimated at INR 5. -

S. No. Housing Finance Companies (Hfcs) Website PLI Co De 17

NAME OF PRIMARY LENDING INSTITUTIONS WHO HAVE SIGNED MoU WITH NATIONAL HOUSING BANK (UNDER PMAY-CLSS FOR MIG): STATUS AS ON 30.04.2018 S. No. Housing Finance Website Companies (HFCs) PLI co de Aadhar Housing www.aadharhousing.com AADR1101 1. Finance Ltd. 2. Aavas Financiers Ltd. www.aavas.in AUHF1101 Aditya Birla Housing 3. www.adityabirlahomeloans.com BRLA1101 Finance Ltd. Akme Star Housing 4. www.akmestarhousing.com Finance Ltd. AKME1101 Altum Credo Home 5. www.altumcredo.com ALTM1101 Finance Pvt. Ltd. Anand Housing Finance Not Available ANAD1101 6. Pvt. Ltd. 7. Aptus Value Housing www.aptusindia.com APTS1101 Finance India Ltd. 8. Art Affordable Housing RAAS1101 Finance (India) Ltd. www.arthfc.com Aspire Home Finance 9. www.ahfcl.com ASPR1101 Corporation Ltd. Bajaj Housing Finance www.bajajfinserv.in BJAJ1101 10. Ltd. Bee Secure Home 11. www.incred.com BSEC1101 Finance Pvt. Ltd. Canfin Homes Ltd. www.canfinhomes.com CANF1101 12. Capital First Home 13. www.capfirst.com CAPT1101 Finance Ltd. Capri Global Housing www.cgcl.co.in CPRI1101 14. Finance Pvt. Ltd. Cent Bank Home www.cbhfl.com CENT1101 15. Finance Ltd. Centrum Housing www.centrum.co.in CTRM1101 16. Finance Ltd. NAME OF PRIMARY LENDING INSTITUTIONS WHO HAVE SIGNED MoU WITH NATIONAL HOUSING BANK (UNDER PMAY-CLSS FOR MIG): STATUS AS ON 30.04.2018 S. No. Housing Finance Companies (HFCs) Website PLI co de 17. Dewan Housing Finance www.dhfl.com DHFL1101 Corporation Ltd. 18. DMI Housing Finance www.dmihousingfinance.in DMIH1101 Pvt. Ltd. 19. Edelweiss Housing www.edelweissfin.com EDEL1101 Finance Ltd. Essel finance Home www.esselfinance.com ESSL1101 20. -

Loan Against Securities – Approved Bonds

Loan against securities – Approved bonds ISIN Code Name of the issuer Margin% INE031A09FF8 HOUSING & URBAN DEVELOPMENT CORPORATION LIMITED 30 INE031A07832 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07857 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07873 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07907 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07931 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07964 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07998 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07840 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 35 INE031A07865 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 35 INE031A07881 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 40 INE031A07972 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 40 INE031A07915 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07949 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 35 INE031A07AA4 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 40 INE031A07923 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07956 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07980 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07AB2 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07AH9 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07AG1 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 40 INE031A07AF3 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07AC0 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07AD8 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 40 INE031A07AM9 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07AS6 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07AT4 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07AL1 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07AN7 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07AO5 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 45 INE031A07AQ0 HOUSING AND URBAN DEVELOPMENT CORP. LTD. 30 INE031A07AR8 HOUSING AND URBAN DEVELOPMENT CORP. -

Term Deposit Scheme

NATIONAL HOUSING BANK (Wholly owned by Reserve Bank of India) NHB SUVRIDDHI (TAX SAVING) TERM DEPOSIT SCHEME Registrar to the Scheme : Collecting Banker : RCMC Share Registry Pvt. Ltd. IDBI Bank Ltd. B – 106, Sector 2, Noida Nodal Branch: CMS KG Marg Uttar Pradesh - 201301 Surya Kiran Building Email Id: [email protected], New Delhi - 110001 Telephone No. 0120-4015852 ( List of Collecting Branches is Fax No. 0120 - 2444346 given in the Application Form) Objectives NHB has been established to achieve, inter alia, the following objectives: a. To promote a sound, healthy, viable and cost effective housing finance system to cater to all segments of the population and to integrate the housing finance system with the overall financial system. b. To promote a network of dedicated housing finance institutions to adequately serve various regions and different income groups. c. To augment resources for the sector and channelise them for housing. d. To make housing credit more affordable. e. To regulate the activities of housing finance companies based on regulatory and supervisory authority derived under the Act. f. To encourage augmentation of supply of buildable land and also building materials for housing and to upgrade the housing stock in the country. g. To encourage public agencies to emerge as facilitators and suppliers of serviced land, for housing. ________________________________________________________________________ Vision NHB ensures a sound and healthy Housing Finance System in India through effective regulation and supervision of housing finance institutions. As a financial institution NHB is known for its commitment, innovation and quality of service offering broad spectrum of financial product to address the needs of the housing sector with motivated employees working in a congenial and participative work environment. -

Good, Less Bad and Nothing Ugly

Value February 2017 For Private Circulation only Guide www.sharekhan.com More good, less bad and nothing ugly Intelligent Investing Regular Features Products & Services Trader’s Edge Budget Special Report Card PMS Technical view Stock Updates Earnings Guide Top Picks Currencies Sharekhan Special Wealth Creator F&O Insights Viewpoints MF Picks Advisory CONTENTS From Sharekhan’s Desk EQUITY The first of the major FUNDAMENTALS domestic macro- Stock Update 20 REGULAR FEATURES economic events Viewpoints 30 Report Card 4 - the Union Budget Sharekhan Special 32 Earnings Guide I - is behind us. It TECHNICALS DERIVATIVES neither disappointed Nifty 33 View 34 nor delighted the markets. The finance ADVISORY DISK DERIVATIVES minister has stuck to basics with focus on increasing MID Trades 41 Derivatives Ideas 41 capital expenditure allocation while maintaining fiscal prudence. CURRENCY 06 RESEARCH BASED EQUITY PRODUCTS FUNDAMENTALS USD-INR 35 GBP-INR 35 Top Picks Basket 07 EUR-INR 35 JPY-INR 35 Union Budget 11 Wealth Creator Portfolio 19 TECHNICALS USD-INR 36 GBP-INR 36 PMS DESK EUR-INR 36 JPY-INR 36 WealthOptimizer PMS 37 ProPrime - Diversified Equity 38 MUTUAL FIND DESK ProTech - Index Futures Fund 39 Top MF Picks (equity) 42 ProTech - Trailing Stops 40 Top SIP Fund Picks 43 Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE: INB/INF011073351 / BSE- CD; NSE: INB/INF/INE231073330 ; MSEI: INB/INF261073333 / INE261073330 ; DP: NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-271-2004; PMS-INP000000662 ; Mutual Fund-ARN 20669 ; For any complaints email at [email protected] ; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T & C on www.sharekhan.com before investing. -

CDSL Non-Individual Version 20.1

Non Individual CDSL VERSION 20.1 INDEX Sr. No. Name of the Document Brief Significance of the Document Page No. MANDATORY DOCUMENTS AS PRESCRIBED BY SEBI, DEPOSITORY & EXCHANGES 1. Account Opening Form-Checklist & Instructions The Document provides Instructions & Checklist relevant to opening of 3-4 trading & demat account 2. Know Your Client (KYC) Application Form_ This Document captures the basic information about the client/ Legal Entity Joint Holders for Trading & Demat Account respectively 5-6 3. Know Your Client (KYC) Application Form_ This Document captures the basic information about the client/ Related Person Joint Holders for Trading & Demat Account respectively 7-16 4. Account Opening Form for Trading & Depository This Document captures the additional information about the client 17-21 relevant for opening Trading & Demat Account 5. Tariff Sheet This Document provides schedule of fee applicable for Depository Account 33 6. Other Documents This document describes significant policies and procedure A-1 VOLUNTARY DOCUMENTS AS PROVIDED BY THE STOCK BROKER 7. Mandate for maintaining the account on This Document enables you to maintain your account on a running running account basis account basis. 22 8. Power of Attorney This Document confers specific rights on Sharekhan for operating your Demat account and for transferring the shares for margin/ pay-in purpose 23-24 and also authorises Sharekhan to act based on the instructions given by you 9. SIP Mandate This Document authorises Sharekhan to place SIP request with 25-26 RTA / AMCs on behalf of the client 10. Profile Sheet This Document enables us to know your interest in the stock market so 28 that we can serve you better 11. -

Terms and Conditions of ICICI Bank Apply Anurag Thakur Interview Covid-19 Hits Insurance

Terms and conditions of ICICI Bank apply Anurag thakur interview covid-19 Hits insurance SubScriber copy not for reSale July 2020, ` 50 outlookmoney.com Unlocking The Market Power Of SMEs Govt. stimulus may unleash hidden energies of small and medium enterprises and fuel their stock prices China Conflict Effect ESG Funds Up NRIs Gain In Property 8 904150 800027 0 7 Focused on the right selection. ICICI Prudential Focused Equity Fund To invest, consult your Financial Advisor Download Visit IPRUTOUCH App www.iciciprumf.com ICICI Prudential Focused Equity Fund (An open ended equity scheme investing in maximum 30 stocks across market capitalisation i.e. focus on multicap) is suitable for investor who are seeking*: • Long term wealth creation • An open ended equity scheme investing in maximum 30 stocks across market-capitalisation *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Investors understand that their principal will be at moderately high risk Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Focused on the right selection. Contents JULY 2020 VOLUME 19 ISSUE 7 Interviews: 26 Anurag Thakur on the stimulus package 30 How India-China conflict can hit stock market SME STOCKS READY TO 34 Is insurance sufficient in COVID times? Health insurance is proving to be insufficient to deal with the challenges and high cost of COVID-19 BOUNCE BACK? treatment Sops may give a push to small and 38 Environment funds set to rise mid-cap stocks -

Annual Report 2017-18 (July 2017 - June 2018)

jk"V™h; vkokl cSad NATIONAL HOUSING BANK Annual Report 2017-18 (July 2017 - June 2018) 149 151 152 153 CONTENTS Page No. ABBREVIATIONS 156 1. INTRODUCTION 161 1.1 About National Housing Bank 162 1.2 Governance Structure 163 1.3 Board of Directors 164 2. PERFORMANCE 169 2.1 Operational Highlights 170 2.2 Key Metrics 171 3. OVERVIEW OF HOUSING TRENDS 173 4. OPERATIONS 179 4.1 Resource Mobilization 180 4.2 Refinance 182 4.3 Project Finance 186 4.4 Regulation and Supervision 188 4.5 Promotion and Development 194 4.6 Risk Management 202 4.7 Information Technology 203 4.8 Human Resources 204 4.9 Rajbhasha 205 4.10 Knowledge Centre 206 4.11 Corporate Social Responsibility 207 4.12 Regional Office and Regional Representative Offices 207 4.13 Audit 207 ANNUAL ACCOUNTS 2017-18 208 APPENDICES 281 BOXES Box 3.1 : Economic Survey 2017-18 and Union Budget 2018-19 177 Box 4.1 : Appearances before Parliamentary Committees 207 THREE DECADES OF SERVICE 291 155 Annual Report 2017-18 ABBREVIATIONS ACB Audit Committee of the Board ACHFS Apex Cooperative Housing Finance Societies ADB Asian Development Bank AFS Available for Sale AHF Affordable Housing Fund ALCO Asset Liability Management Committee AML Anti-Money Laundering ARDBs Agriculture and Rural Development Banks BPL Below Poverty Line CAGR Compound Annual Growth Rate CBHFL Cent Bank Home Finance Limited CBLO Collateralized Borrowing and Lending Obligation CEO Chief Executive Officer CERSAI Central Registry of Securitization Asset Reconstruction and Security Interest of India CLO Chief Liaisoning Officer -

Scheme Information Document for HSBC Ultra Short Duration Fund

Scheme Information Document HSBC Ultra Short Duration Fund (An open ended ultra-short term debt scheme investing in instruments such that the Macaulay Duration of the portfolio is between 3 months to 6 months) (Please refer Page no. 9 for explanation on MacaulayÊs duration) Continuous Offer of Units at NAV based prices The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI), along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme Information Document. The Scheme Information Document sets forth concisely the information about the scheme that a prospective investor ought to know before investing. Before investing, investors should also ascertain about any further changes to this Scheme Information Document after the date of this Document from the Mutual Fund / Investor Service Centers / Website / Distributors or Brokers. Investors in the Scheme are not being offered any guaranteed / assured returns. Investors are advised to consult their Legal / Tax and other Professional Advisors in regard to tax/legal implications relating to their investments in the Scheme before making decision to invest in or redeem the Units. The investors are advised to refer to the Statement of Additional Information (SAI) for details of HSBC Mutual Fund, Tax and Legal issues and general information on www.assetmanagement.hsbc.co.in. SAI is incorporated by reference is legally a part of the Scheme Information Document. -

Partial List Ex Conference 20

Artemis Health Institute Bharat Serums & Vaccines Carrier CP Milk & Food Products Discovery FCDO GlaxoSmithkline Henkel India Shelter Finance Corporation Kadtech Infraprojects LSEG MIND NIIT Paytm Money PT Bank BTPN RTI Shyam Spectra Stryker ThoughtWorks ValueMined Technologies Y-Axis Solutions Arth Group Bharti Axa Life Insurance Cars24 CP Plus Dksh FE fundinfo Glenmark Pharmaceuticals Herbalife Nutition IndiaMART Kaivalya Educatiion Foundation LTI MindTickle Nineleaps technology solutions PayU PT. Media Indra Buana Ruby Seven Studios Shyam Spectra STT Global Data Centres Thryve Digital Valuex Technologies Yamaha Motor Arvind Fashions Bhel Caterpillar CP Wholesale DLF Fedex GlobalEdge Here Technologies Indigo Kalpataru Luminous Power Technologies Mindtree Nippon Koei PCCPL PTC Network Rustomjee Sidel Successive Technologies Tierra Agrotech Varroc Engineering Yanbal Asahi India Glass BIC CDK Global CPI DMD ADVOCATES Ferns n Petals GlobalLogic Herman Miller Indmoney Kama Ayurveda Luthra Group MiQ Digital NISA Global PCS Publicis Media S P Setia Siemens Sulzer Pumps Tifc Varuna Group Yanmar TAKE A LOOK AT LIST OF Ashirvad Pipes Bidgely Technologies CEAT Creditas Solutions DP World Ferrero GMR Hero Indofil industries Kanishk Hospital Luxury Personified Mizuho Bank Nissan Peak Infrastructure Management PUMA Group S&P Global Sigma AVIT Infra Services Summit Digitel Infrastructure TIL Vastu Housing Finance Corpora- Yara COMPANIES WHO WILL JOIN Asian paints Bigtree Entertainment Celio Cremica Dr Reddy's Ferring Pharmaceuticals Godrej & Boyce -

Office of the Chief Commissioner of CGST& Central Excise (Chandigarh Zone), Central Revenue Building, Sector 17-C Chandigarh

/ Office of the Chief Commissioner of Department of Excise and Taxation CGST& Central Excise Additional Town hall Building (Chandigarh Zone), Sector-17-C, UT Chandigarh Central Revenue Building, Sector 17-C Chandigarh-160017 Order 03/2017 Dated 20.12.2017 Subject: Division of Taxpayers base between the Central Government and Union Territory of Chandigarh In accordance with the guidelines issued by the GST Council Secretariat vide Circular No. 01/2017, issued vide F. No. 166/Cross Empowerment/GSTC/2017 dated 20.09.2017, with respect to the division of taxpayer base between the Central Government and Union Territory of Chandigarh to ensure single interface under GST, the State Level Committee comprising Ms. Manoranjan Kaur Virk, Chief Commissioner, Central Tax and Central Excise, Chandigarh Zone and Shri Ajit Balaji Joshi, Commissioner, Excise and Taxation Department, UT Chandigarh has hereby decided to assign the taxpayers registered in Union Territory of Chandigarh in the following manner: 1. Taxpayers with turnover above Rs l.S Crores. a) Taxpayers falling under the jurisdiction of the Centre (List of 2166 Taxpayers enclosed as Annexure- 'lA') SI. NO. Trade Name GSTIN 1 BANK OF BARODA 04AAACB1534F1ZE 2 INDIAN OVERSEAS BANK 04AAACI1223J2Z3 ---------- 2166 DASHMESH TRADING COMPANY 04AAAFD7732Q1Z7 b) Taxpayers falling under the jurisdiction of Union Territory of Chandigarh (List of 2162 Taxpayers enclosed as Annexure- 'lB') SI. NO. Trade Name GSTIN 1 IBM INDIA PRIVATE LIMITED 04AAACI4403L1ZW 2 INTERGLOBE AVIATION LIMITED 04AABCI2726B1ZA ---------- 2162 HARJINDER SINGH 04ABXPS8524P1ZK Taxpayers with Turnover less than Rs. 1.5 Crores a) Taxpayers falling under the jurisdiction of the Centre (List of 1629 Taxpayers enclosed as Annexure- '2A') 51.